Global Clinical Laboratory Services Market

Taille du marché en milliards USD

TCAC :

%

USD

319.13 Billion

USD

569.17 Billion

2024

2032

USD

319.13 Billion

USD

569.17 Billion

2024

2032

| 2025 –2032 | |

| USD 319.13 Billion | |

| USD 569.17 Billion | |

|

|

|

|

Segmentation du marché mondial des services de laboratoire clinique, par spécialité (tests de chimie clinique, tests d'hématologie, tests de microbiologie, tests d'immunologie, tests de dépistage de drogues, tests cytologiques et tests génétiques), fournisseur (laboratoires indépendants et de référence, laboratoires autonomes en milieu hospitalier et laboratoires de soins infirmiers et de cabinet médical), application (services liés à la découverte de médicaments, services liés au développement de médicaments, services de bioanalyse et de chimie de laboratoire, services de tests toxicologiques, services liés à la thérapie cellulaire et génique, services liés aux essais précliniques et cliniques et autres), type de service (services de tests de routine, services ésotériques et services d'anatomopathologie) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché mondial des services de laboratoire clinique

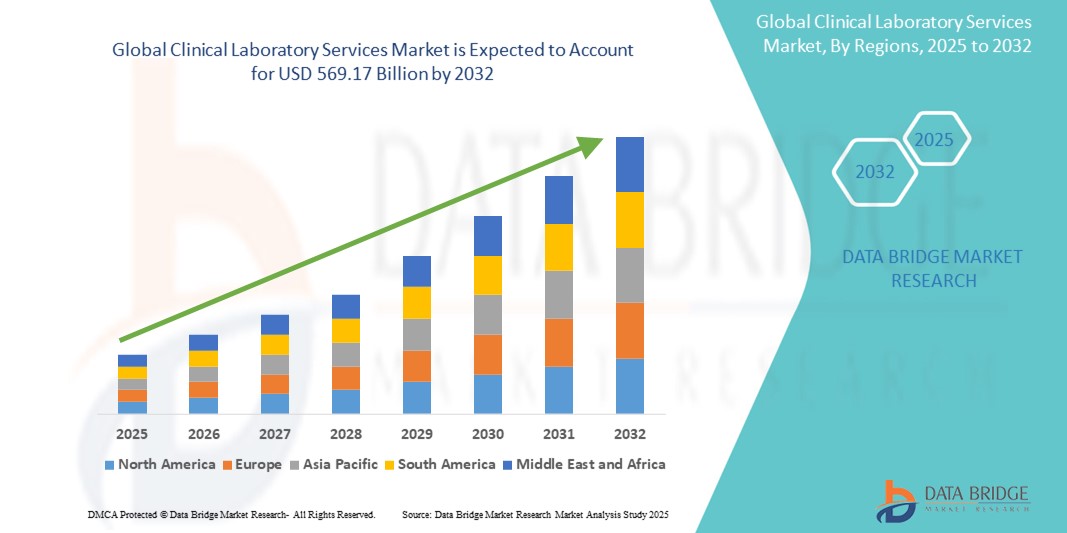

- La taille du marché mondial des services de laboratoire clinique était évaluée à 319,13 milliards USD en 2024 et devrait atteindre 569,17 milliards USD d'ici 2032 , à un TCAC de 7,5 % au cours de la période de prévision.

- Cette croissance est due à des facteurs tels que la prévalence croissante des maladies chroniques, le vieillissement de la population et les progrès technologiques.

Marché mondial des services de laboratoire clinique

- Les services de laboratoire clinique sont essentiels au dépistage, au diagnostic et au suivi des maladies, fournissant des résultats précis et rapides pour la prise en charge des patients. Ces services comprennent les analyses sanguines de routine, le diagnostic moléculaire, la microbiologie, la pathologie et les tests génétiques, jouant un rôle crucial dans la prise en charge des maladies et la planification des traitements.

- La demande de services de laboratoire clinique est considérablement stimulée par la prévalence croissante des maladies chroniques, le vieillissement de la population et l'importance croissante accordée aux soins de santé préventifs et à la détection précoce des maladies.

- L'Amérique du Nord devrait dominer le marché mondial des services de laboratoire clinique avec 44,5 % en raison de son infrastructure de soins de santé avancée, de ses dépenses de santé élevées et de l'adoption précoce de technologies de diagnostic avancées.

- L'Asie-Pacifique devrait être la région à la croissance la plus rapide avec un CGR de 8,10 % sur le marché mondial des services de laboratoire clinique, grâce au développement rapide des infrastructures de santé, à la sensibilisation croissante aux soins de santé et à la demande croissante de tests de diagnostic dans les économies émergentes.

- Les services de tests de routine devraient dominer le marché, avec une part de marché de 57,6 %, en raison de leur rôle essentiel dans les soins de santé. Ces tests, notamment les analyses de sang, d'urine et les bilans métaboliques de base, constituent la base du diagnostic clinique, facilitant les bilans de santé de routine, la surveillance et le dépistage précoce des maladies.

Portée du rapport et segmentation du marché mondial des services de laboratoire clinique

|

Attributs |

Marché mondial des services de laboratoire clinique : informations clés |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché mondial des services de laboratoire clinique

« Progrès en matière d'automatisation et de technologies numériques pour les services de laboratoire clinique »

- L’une des tendances marquantes dans l’évolution des services de laboratoire clinique est l’intégration croissante de l’automatisation, de l’intelligence artificielle (IA) et des technologies numériques.

- Ces innovations améliorent l’efficacité, la précision et la rapidité des tests de diagnostic, réduisant ainsi les erreurs humaines et permettant des délais d’exécution plus rapides pour les décisions médicales critiques.

- Par exemple, les systèmes modernes d'automatisation des laboratoires peuvent traiter des volumes importants d'échantillons, automatiser les tests de routine et intégrer la gestion des données, réduisant ainsi considérablement la charge de travail manuelle et les coûts opérationnels. Les plateformes d'IA sont également utilisées pour analyser des ensembles de données complexes, fournissant des informations diagnostiques plus précises et favorisant la médecine personnalisée.

- Ces avancées transforment les diagnostics cliniques, améliorent les résultats des patients et stimulent la demande de services de laboratoire de nouvelle génération qui offrent une précision et une fiabilité accrues.

Dynamique du marché mondial des services de laboratoire clinique

Conducteur

« Demande croissante due à la prévalence croissante des maladies chroniques »

- La prévalence croissante des maladies chroniques telles que le cancer, les troubles cardiovasculaires, le diabète et les maladies infectieuses contribue de manière significative à la demande accrue de services de laboratoire clinique

- À mesure que la population mondiale vieillit, l’incidence de ces maladies continue d’augmenter, ce qui entraîne une demande accrue de tests de diagnostic pour la détection précoce, la planification du traitement et la surveillance des maladies.

- Alors que de plus en plus de personnes recherchent des examens de santé réguliers et des services de diagnostic, la demande de tests de laboratoire clinique, notamment des analyses de sang, des diagnostics moléculaires et des tests génétiques, continue de croître, favorisant de meilleurs résultats pour les patients.

Par exemple,

- En décembre 2021, selon l'Organisation mondiale de la Santé (OMS), les maladies non transmissibles (MNT) étaient responsables de près de 71 % des décès dans le monde, les maladies cardiovasculaires, les cancers, les maladies respiratoires et le diabète étant les principales causes. Cette tendance stimule la demande de services de laboratoire clinique avancés pour la détection et la prise en charge précoces des maladies.

- En raison de la prévalence croissante des maladies chroniques, on observe une augmentation significative de la demande de tests de laboratoire clinique, qui jouent un rôle crucial dans l’amélioration des résultats des soins de santé et la réduction de la charge globale des soins de santé.

Opportunité

« Intégration de l'intelligence artificielle et de l'automatisation dans les laboratoires cliniques »

- Les plateformes de diagnostic basées sur l'IA et les systèmes de laboratoire automatisés peuvent améliorer la vitesse, la précision et l'efficacité des tests de diagnostic, permettant aux laboratoires de traiter de grands volumes d'échantillons avec une intervention humaine minimale.

- Les algorithmes d'IA peuvent analyser des ensembles de données complexes, identifier des modèles et fournir des résultats de diagnostic plus rapides et plus précis, soutenant la médecine personnalisée et les diagnostics de précision.

- De plus, l'automatisation peut rationaliser les flux de travail des laboratoires, réduire les délais d'exécution et diminuer les coûts opérationnels, rendant les laboratoires plus efficaces et évolutifs.

Par exemple ,

- En janvier 2025, selon un article publié dans le JAMA Network, les systèmes de diagnostic basés sur l'IA ont démontré une grande précision dans la détection de maladies telles que le cancer, les maladies cardiovasculaires et les troubles neurologiques. Ces systèmes peuvent traiter rapidement de grands volumes de données patient, améliorant ainsi la précision du diagnostic et favorisant une intervention précoce.

- L'intégration de l'IA et de l'automatisation dans les laboratoires cliniques peut conduire à de meilleurs résultats diagnostiques, à une réduction des erreurs et à une amélioration des soins aux patients, positionnant ainsi les laboratoires pour une croissance future.

Retenue/Défi

« Les coûts élevés d'équipement et d'exploitation entravent la pénétration du marché »

- Le coût élevé des équipements de laboratoire avancés et des systèmes d'automatisation constitue un défi important pour le marché des services de laboratoire clinique, affectant particulièrement les petits laboratoires et les établissements de santé dans les régions en développement.

- Ces systèmes, essentiels pour des diagnostics précis et à haut débit, peuvent nécessiter un investissement initial substantiel et des coûts de maintenance continus, créant des barrières financières pour les petites installations.

- Ce fardeau financier substantiel peut dissuader les laboratoires d’adopter les dernières technologies, ce qui conduit à une dépendance à des équipements obsolètes et à des processus de diagnostic plus lents.

Par exemple,

- En novembre 2024, selon un article publié par Labcompare, le coût de mise en place d'un laboratoire clinique automatisé peut varier de plusieurs centaines de milliers à plusieurs millions de dollars, selon le niveau d'automatisation et les capacités de diagnostic. Cela peut limiter la compétitivité des petits laboratoires sur un marché en pleine évolution.

- Par conséquent, ces défis financiers peuvent entraîner des disparités dans la qualité et l’accès au diagnostic, ce qui entrave en fin de compte la croissance globale du marché des services de laboratoire clinique.

Portée du marché mondial des services de laboratoire clinique

Le marché est segmenté en fonction de la spécialité, du fournisseur, de l’application et du type de service.

|

Segmentation |

Sous-segmentation |

|

Par spécialité |

|

|

Par fournisseur |

|

|

Par application |

|

|

Par type de service

|

|

En 2025, les services de tests de routine devraient dominer le marché avec une part de marché plus importante dans le segment des types de services.

Le segment des services de tests de routine devrait dominer le marché mondial des services de laboratoire clinique avec une part de marché de 57,6 % en 2025, en raison de son rôle essentiel dans les soins de santé. Les tests de routine, notamment les analyses de sang, d'urine et les bilans métaboliques de base, constituent l'épine dorsale du diagnostic clinique et facilitent les bilans de santé de routine, la surveillance et la détection précoce des maladies. La forte demande pour ces tests, stimulée par une sensibilisation croissante aux soins de santé, les initiatives de soins préventifs et la charge croissante de morbidité mondiale, contribue largement à la domination de ce segment sur le marché.

Les tests de chimie clinique devraient représenter la part la plus importante au cours de la période de prévision sur le marché spécialisé.

En 2025, le segment des tests de chimie clinique devrait dominer le marché avec une part de marché de 31,35 %, en raison de son rôle essentiel dans le diagnostic et le suivi d'un large éventail de maladies, notamment le diabète, les maladies cardiovasculaires et les maladies rénales. Figurant parmi les plus importants du marché des tests spécialisés, la forte demande en tests métaboliques, électrolytiques et fonctionnels organiques, conjuguée aux avancées des technologies diagnostiques, conforte sa domination. La prévalence croissante des maladies chroniques renforce encore davantage le besoin de tests de chimie clinique précis et rapides, consolidant ainsi sa position de leader.

Analyse régionale du marché mondial des services de laboratoire clinique

« L'Amérique du Nord détient la plus grande part du marché mondial des services de laboratoire clinique »

- L'Amérique du Nord domine le marché mondial des services de laboratoire clinique, détenant la plus grande part de marché régionale d'environ 44,5 %, grâce à une infrastructure de soins de santé avancée, une forte adoption de technologies de diagnostic de pointe et une forte présence d'acteurs clés du marché.

- Les États-Unis représentent une part importante de cette part, avec environ 36,40 %, en raison du volume élevé de tests diagnostiques, de la prévalence croissante des maladies chroniques et de la présence de laboratoires cliniques bien établis. Le marché américain bénéficie également de politiques de remboursement avantageuses et d'investissements importants en recherche et développement, renforçant ainsi sa position.

- De plus, la demande croissante de dépistage précoce des maladies et de médecine personnalisée, conjuguée à un système de santé bien établi, contribue significativement à la domination du marché dans la région. L'adoption croissante des systèmes de diagnostic automatisés et l'utilisation généralisée des diagnostics moléculaires avancés stimulent également l'expansion du marché en Amérique du Nord.

« L'Asie-Pacifique devrait enregistrer le TCAC le plus élevé du marché mondial des services de laboratoire clinique »

- L'Asie-Pacifique devrait connaître la plus forte croissance du marché mondial des services de laboratoire clinique, avec un TCAC prévu de 8,10 % sur la période de prévision. Cette croissance est portée par l'expansion rapide des infrastructures de santé, la sensibilisation croissante aux soins préventifs et la charge croissante des maladies chroniques.

- Des pays comme la Chine, l'Inde et le Japon émergent comme des marchés clés en raison de leur population nombreuse et vieillissante, plus vulnérable aux maladies telles que le diabète, les maladies cardiovasculaires et le cancer, ce qui stimule la demande de tests cliniques.

- Le Japon, réputé pour ses technologies médicales avancées et son système de santé hautement développé, demeure un marché crucial pour les services de laboratoire clinique. Le pays demeure un leader dans l'adoption de diagnostics de précision et de tests moléculaires pour améliorer les résultats des patients.

- L'Inde devrait enregistrer le TCAC le plus élevé de la région avec une part de marché de 3,3 %, grâce à l'expansion des infrastructures de santé, à l'augmentation des dépenses de santé et à une demande croissante de tests de diagnostic précis dans les zones rurales et urbaines.

Part de marché mondiale des services de laboratoire clinique

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- Abbott (États-Unis)

- Laboratoires ARUP (États-Unis)

- OPKO Health, Inc. (États-Unis)

- Bioscientia Healthcare GmbH (Allemagne)

- Charles River Laboratories (États-Unis)

- Laboratoires NeoGenomics (États-Unis)

- Healthscope (Australie)

- Labcorp (États-Unis)

- Quest Diagnostics Incorporated (États-Unis)

- Siemens Healthineers AG (Allemagne)

- Tulip Diagnostics (P) Ltd (Inde)

- Sonic Healthcare Limited (Australie)

- Agilent Technologies, Inc. (États-Unis)

- Thermo Fisher Scientific Inc. (États-Unis)

- IQVIA (États-Unis)

- SYNLAB International (Allemagne)

Derniers développements sur le marché mondial des services de laboratoire clinique

- En janvier 2025, Abbott a annoncé le lancement de son analyseur d'immunoessais de nouvelle génération, l'Alinity M, conçu pour améliorer l'efficacité et la rapidité des analyses en laboratoire. Doté de capacités d'automatisation avancées, d'un débit élevé et d'un vaste choix d'analyses, ce système prend en charge une large gamme de tests diagnostiques, notamment les maladies infectieuses, l'oncologie et les tests génétiques, ce qui en fait un outil essentiel pour les laboratoires cliniques modernes.

- En octobre 2024, les Laboratoires ARUP ont lancé leur plateforme de diagnostic moléculaire basée sur l'IA, conçue pour améliorer la précision et la rapidité des tests génétiques complexes. Cette plateforme intègre des algorithmes d'apprentissage profond et des techniques moléculaires avancées, offrant des délais d'exécution plus courts et des résultats diagnostiques très précis pour une médecine personnalisée.

- En septembre 2024, OPKO Health, Inc. a annoncé l'expansion de son réseau de laboratoires BioReference, renforçant ainsi ses capacités de diagnostic en mettant l'accent sur la génomique du cancer et les soins de santé personnalisés. Cette expansion comprend l'ajout de tests génétiques avancés et de services d'oncologie de précision, favorisant ainsi de meilleurs résultats pour les patients et des stratégies thérapeutiques ciblées.

- En septembre 2024, Bioscientia Healthcare GmbH, l'un des principaux fournisseurs de services de laboratoire clinique en Europe, a lancé sa plateforme innovante d'analyse du microbiome, conçue pour fournir des informations complètes sur la santé intestinale et la prévention des maladies. Cette plateforme utilise le séquençage de nouvelle génération (NGS) et la bioinformatique avancée pour fournir des analyses de santé personnalisées.

- En septembre 2024, Charles River Laboratories, acteur majeur des services de laboratoire précliniques et cliniques, a lancé ses nouveaux services de tests bioanalytiques pour les thérapies cellulaires et géniques, destinés à accompagner les entreprises biopharmaceutiques dans le développement de thérapies de nouvelle génération. Cette expansion devrait accélérer le développement de médicaments personnalisés et de produits biologiques avancés.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.