Global Clinical Communication And Collaboration Software Market

Taille du marché en milliards USD

TCAC :

%

USD

2.34 Billion

USD

6.19 Billion

2024

2032

USD

2.34 Billion

USD

6.19 Billion

2024

2032

| 2025 –2032 | |

| USD 2.34 Billion | |

| USD 6.19 Billion | |

|

|

|

|

Segmentation du marché mondial des logiciels de communication et de collaboration cliniques, par composant (solutions et services), déploiement (cloud et sur site), utilisation finale (hôpitaux, laboratoires cliniques, établissements de soins de longue durée et autres prestataires de soins), application (communication de laboratoire et de radiologie, communication avec les infirmières, communication avec les patients et alertes d'urgence, et communication avec les médecins). Tendances et prévisions du secteur jusqu'en 2032.

Taille du marché des logiciels de communication et de collaboration cliniques

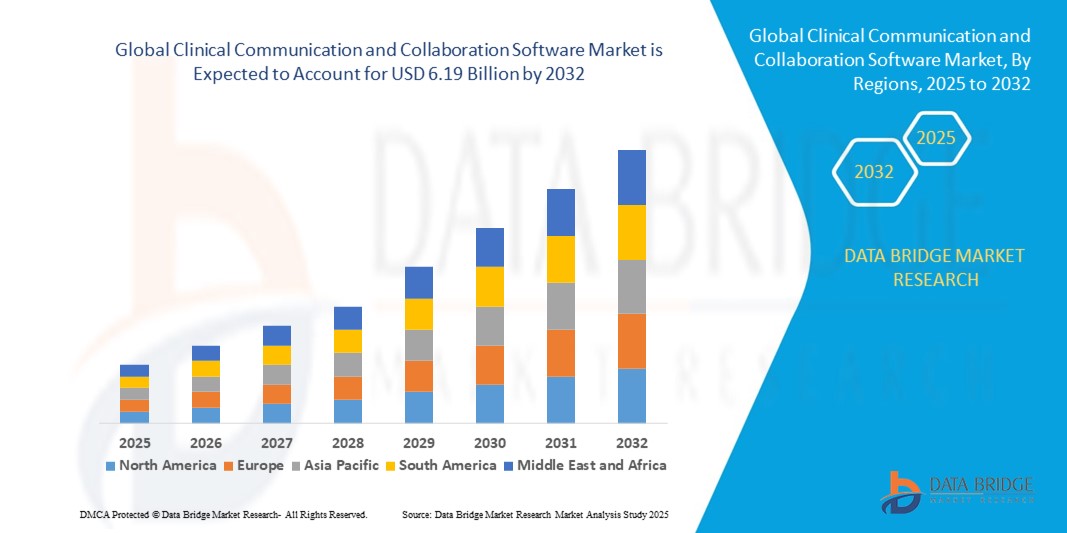

- La taille du marché mondial des logiciels de communication et de collaboration cliniques était évaluée à 2,34 milliards USD en 2024 et devrait atteindre 6,19 milliards USD d'ici 2032 , à un TCAC de 12,90 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par le besoin croissant d'une communication efficace entre les équipes de soins de santé, l'adoption croissante de solutions de santé numériques et la demande croissante de partage de données patients en temps réel pour améliorer les résultats cliniques.

- D'autres facteurs de croissance incluent l'intégration de technologies avancées telles que l'IA, le cloud computing et les plateformes mobiles, qui permettent une coordination transparente entre les prestataires de soins de santé dans de multiples contextes.

Analyse du marché des logiciels de communication et de collaboration cliniques

- Le marché connaît une forte adoption dans les hôpitaux, les centres de soins ambulatoires et les services de télésanté, où la messagerie en temps réel, les alertes et la coordination des soins sont essentielles.

- De plus, l'intégration croissante des applications mobiles et des appareils portables permet aux prestataires de soins de santé de surveiller les patients à distance et de réagir rapidement aux événements de santé critiques.

- L'Amérique du Nord a dominé le marché des logiciels de communication et de collaboration cliniques avec la plus grande part de revenus de 42 % en 2024, grâce à l'adoption élevée des technologies de santé numériques, à une infrastructure informatique avancée et à une attention croissante portée à l'amélioration des soins aux patients grâce à la communication en temps réel.

- La région Asie-Pacifique devrait connaître le taux de croissance le plus élevé sur le marché mondial des logiciels de communication et de collaboration cliniques, grâce à l'augmentation des investissements dans les soins de santé, à l'adoption croissante de la télésanté et à la demande croissante de solutions de communication interopérables basées sur le cloud dans les hôpitaux, les cliniques et les établissements de soins à distance.

- Le segment des solutions a représenté la plus grande part de marché en 2024, grâce à l'adoption de plateformes logicielles avancées permettant la messagerie sécurisée, les alertes en temps réel et l'intégration des flux de travail dans tous les établissements de santé. Ces solutions contribuent à améliorer la prise en charge des patients, à rationaliser les opérations cliniques et à garantir la conformité réglementaire, ce qui en fait le choix privilégié des hôpitaux et des cliniques multispécialités.

Portée du rapport et segmentation du marché des logiciels de communication et de collaboration cliniques

|

Attributs |

Informations clés sur le marché des logiciels de communication et de collaboration cliniques |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande. |

Tendances du marché des logiciels de communication et de collaboration cliniques

L'essor de la communication numérique en temps réel dans le secteur de la santé

- L'évolution croissante vers la communication numérique en temps réel transforme les flux de travail des soins de santé en permettant une collaboration instantanée entre les équipes soignantes. La rapidité et l'accessibilité de ces plateformes permettent une prise de décisions cliniques immédiate, notamment dans les hôpitaux et les cliniques multispécialités où une coordination rapide est essentielle. Il en résulte une amélioration des résultats pour les patients et une réduction des erreurs médicales.

- La forte demande de communication intégrée dans les régions éloignées et défavorisées accélère l'adoption d'applications mobiles, de plateformes de messagerie sécurisées et d'outils de collaboration cloud. Ces solutions sont particulièrement efficaces lorsque les infrastructures hospitalières sont limitées, contribuant à réduire les délais de communication et à garantir des interventions rapides. Cette tendance est également soutenue par les initiatives informatiques gouvernementales et du secteur de la santé favorisant la transformation numérique.

- L'accessibilité et la facilité de déploiement des solutions logicielles modernes les rendent attractives pour la coordination clinique courante, améliorant ainsi l'efficacité des flux de travail. Les prestataires de soins bénéficient d'une communication simplifiée sans coûts opérationnels excessifs ni obstacles logistiques, ce qui améliore in fine la gestion globale des soins aux patients.

- Par exemple, en 2023, plusieurs réseaux hospitaliers régionaux en Inde ont signalé une baisse des taux de réadmission des patients après la mise en place de plateformes de messagerie clinique en nuage. Ces systèmes ont permis une communication plus rapide entre les infirmières, les médecins et les techniciens de laboratoire, améliorant ainsi la coordination des soins tout en réduisant les délais de traitement et la charge administrative.

- Si les outils de communication numérique accélèrent la collaboration en temps réel et favorisent l'efficacité opérationnelle, leur impact dépend de l'innovation continue, de la formation du personnel et des mesures de cybersécurité. Les fournisseurs doivent privilégier des interfaces conviviales, l'interopérabilité et des stratégies de déploiement évolutives pour tirer pleinement parti de cette demande croissante.

Dynamique du marché des logiciels de communication et de collaboration cliniques

Conducteur

Demande croissante de communication et de coordination efficaces des soins de santé

- Le besoin croissant de communication simplifiée dans les hôpitaux, les cliniques et les services de télésanté incite les prestataires de soins à adopter des solutions logicielles collaboratives. Des messages, des alertes et des données patients efficaces permettent une prise de décision clinique plus rapide et améliorent la qualité globale des soins.

- Les établissements de santé sont de plus en plus conscients des risques financiers et cliniques liés à une mauvaise communication, notamment les erreurs médicales, les retards de traitement et la baisse de satisfaction des patients. Cette prise de conscience a conduit à l'utilisation systématique de plateformes de communication intégrées dans les hôpitaux de toutes tailles.

- Les efforts du secteur public et les initiatives informatiques dans le secteur de la santé ont renforcé l'infrastructure numérique et les normes d'interopérabilité. Des programmes d'adoption subventionnés aux stratégies nationales de santé numérique, des cadres de soutien aident les prestataires à mettre en œuvre efficacement des outils de collaboration en temps réel.

- Par exemple, en 2022, le ministère américain de la Santé et des Services sociaux a encouragé l’intégration de plateformes de messagerie sécurisées dans les réseaux hospitaliers, stimulant ainsi l’adoption de logiciels de communication clinique à l’échelle nationale.

- Bien que la sensibilisation et le soutien institutionnel stimulent le marché, il est toujours nécessaire d'améliorer la cybersécurité, de garantir l'accessibilité financière des logiciels et d'intégrer les plateformes de manière transparente dans les systèmes de dossiers médicaux électroniques existants pour soutenir l'adoption.

Retenue/Défi

Coûts de mise en œuvre élevés et problèmes de sécurité des données

- Le prix élevé des logiciels de communication clinique avancés, notamment des plateformes cloud et d'IA, limite leur adoption par les petits prestataires de soins et les cliniques. Les grands systèmes hospitaliers absorbent généralement ces coûts, mais les établissements plus petits peuvent retarder leur mise en œuvre en raison de contraintes budgétaires. De plus, les frais de maintenance, les mises à jour logicielles et les coûts de licence alourdissent la charge financière, rendant difficile la mise en œuvre de solutions complètes pour les petites cliniques.

- Dans de nombreux établissements de santé, le personnel manque de formation sur les systèmes numériques complexes, ce qui peut réduire l'efficacité et retarder l'adoption. Les lacunes en matière d'infrastructure, comme une mauvaise connexion internet ou des systèmes informatiques obsolètes, entravent encore davantage le déploiement efficace. Cela entraîne souvent une sous-utilisation des fonctionnalités logicielles et augmente le risque d'erreurs, réduisant ainsi le retour sur investissement global des établissements de santé.

- La pénétration du marché est également affectée par la réglementation stricte en matière de confidentialité des données et les préoccupations relatives à la sécurité des informations des patients. Les prestataires doivent se conformer à la loi HIPAA, au RGPD et à d'autres normes, ce qui peut accroître la complexité et les coûts de mise en œuvre. Les audits fréquents, les exigences de chiffrement et les protocoles de gestion des accès sécurisés créent des défis opérationnels supplémentaires, en particulier pour les petites cliniques disposant de ressources informatiques limitées.

- Par exemple, en 2023, plusieurs petites cliniques d'Afrique subsaharienne ont signalé un accès limité aux plateformes de communication clinique sécurisées, citant les coûts élevés et l'insuffisance des infrastructures informatiques comme obstacles majeurs. Nombre de ces cliniques continuent de recourir à des processus manuels ou à des canaux de messagerie non sécurisés, ce qui augmente le risque de retards de communication et d'erreurs médicales.

- Alors que la technologie continue de progresser, il demeure crucial de relever les défis liés aux coûts, à la formation et à la sécurité. Les acteurs doivent privilégier des solutions évolutives, sécurisées et conviviales pour combler le fossé numérique et exploiter le potentiel du marché à long terme. Ne pas relever ces défis pourrait freiner l'adoption de solutions innovantes, notamment dans les marchés émergents et les milieux de soins ruraux.

Portée du marché des logiciels de communication et de collaboration cliniques

Le marché est segmenté en fonction du composant, du déploiement, de l’utilisation finale et de l’application.

- Par composant

Le marché des logiciels de communication et de collaboration cliniques est segmenté en solutions et services. Le segment des solutions a représenté la plus grande part de chiffre d'affaires en 2024, grâce à l'adoption de plateformes logicielles avancées permettant la messagerie sécurisée, les alertes en temps réel et l'intégration des flux de travail dans tous les établissements de santé. Ces solutions contribuent à améliorer la prise en charge des patients, à rationaliser les opérations cliniques et à garantir la conformité réglementaire, ce qui en fait le choix privilégié des hôpitaux et des cliniques multispécialités.

Le segment des services devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par la demande croissante de services gérés, de conseil et d'accompagnement à l'intégration. Des services tels que l'assistance au déploiement, la formation du personnel et le support technique aident les prestataires de soins à optimiser l'utilisation des logiciels de communication, garantissant ainsi une adoption fluide et de meilleurs résultats cliniques.

- Par déploiement

En fonction du déploiement, le marché est segmenté entre cloud et sur site. Le segment cloud a représenté la plus grande part de chiffre d'affaires en 2024, grâce à la flexibilité, l'évolutivité et la rentabilité des plateformes cloud. Le déploiement cloud permet aux établissements de santé d'accéder à des outils de communication sécurisés depuis plusieurs emplacements et appareils, améliorant ainsi la collaboration et l'efficacité opérationnelle.

Le segment sur site devrait connaître le taux de croissance le plus rapide entre 2025 et 2032 en raison des préoccupations concernant la sécurité des données, la conformité et le besoin de solutions personnalisées qui s'intègrent à l'infrastructure informatique existante dans les grands réseaux hospitaliers.

- Par utilisation finale

En fonction de l'utilisation finale, le marché est segmenté en hôpitaux, laboratoires cliniques, établissements de soins de longue durée et autres prestataires de soins de santé. Le segment hospitalier a représenté la plus grande part de chiffre d'affaires en 2024, grâce au besoin crucial de communication en temps réel, d'alertes d'urgence et de coordination efficace des soins entre équipes multidisciplinaires.

Le segment des laboratoires cliniques devrait connaître le taux de croissance le plus rapide entre 2025 et 2032 en raison de la demande croissante de partage sécurisé et rapide des résultats de laboratoire avec les médecins et les équipes de soins, contribuant ainsi à réduire les retards de diagnostic et à améliorer la gestion des patients.

- Par application

En fonction des applications, le marché est segmenté en communication de laboratoire et de radiologie, communication infirmière, communication patient et alertes d'urgence, et communication médecin. Le segment de la communication infirmière détenait la plus grande part de marché en 2024, stimulé par le besoin d'une coordination efficace entre infirmières et médecins pour les soins de routine aux patients et les interventions d'urgence.

Le segment de la communication avec les médecins devrait connaître le taux de croissance le plus rapide entre 2025 et 2032 en raison de l’adoption croissante de plateformes de messagerie sécurisées, d’applications mobiles et de solutions de télésanté qui facilitent la consultation et la prise de décision rapides dans tous les services et établissements.

Analyse régionale du marché des logiciels de communication et de collaboration cliniques

- L'Amérique du Nord a dominé le marché des logiciels de communication et de collaboration cliniques avec la plus grande part de revenus de 42 % en 2024, grâce à l'adoption élevée des technologies de santé numériques, à une infrastructure informatique avancée et à une attention croissante portée à l'amélioration des soins aux patients grâce à la communication en temps réel.

- Les prestataires de soins de santé de la région apprécient la messagerie sécurisée, les alertes automatisées et l'intégration des flux de travail qui rationalisent les opérations cliniques et réduisent les erreurs médicales

- Cette adoption généralisée est également soutenue par les dépenses élevées en informatique dans le secteur de la santé, les initiatives gouvernementales favorables et la préférence croissante pour les outils de collaboration basés sur le cloud et l'IA dans les hôpitaux, les cliniques et les établissements de soins de longue durée.

Aperçu du marché américain des logiciels de communication et de collaboration cliniques

En 2024, le marché américain a capté la plus grande part de chiffre d'affaires en Amérique du Nord, grâce à la transformation numérique rapide des hôpitaux et des réseaux de santé. Les prestataires privilégient de plus en plus l'intégration de messageries sécurisées, d'applications mobiles et d'alertes automatisées pour améliorer la prise en charge des patients et l'efficacité opérationnelle. L'utilisation croissante de plateformes basées sur l'IA, l'interopérabilité avec les dossiers médicaux électroniques (DME) et l'adoption de la télésanté stimulent également la croissance du marché. Le soutien gouvernemental aux solutions de santé numérique et l'adoption de logiciels conformes à la loi HIPAA contribuent significativement à l'expansion du marché.

Aperçu du marché européen des logiciels de communication et de collaboration cliniques

Le marché européen devrait connaître la croissance la plus rapide entre 2025 et 2032, portée par une réglementation sanitaire stricte et une demande croissante de soins centrés sur le patient. L'augmentation des investissements dans les infrastructures informatiques hospitalières, l'urbanisation et les initiatives de santé numérique favorisent l'adoption de ces technologies. La région connaît une croissance significative dans les hôpitaux, les cliniques et les établissements de soins de longue durée, grâce à des solutions permettant une coordination efficace entre infirmiers et médecins, des alertes patients et la communication des résultats d'analyse.

Aperçu du marché britannique des logiciels de communication et de collaboration cliniques

Le marché britannique devrait connaître sa croissance la plus rapide entre 2025 et 2032, grâce à l'adoption croissante des plateformes de santé numériques et à l'accent mis sur l'amélioration de l'efficacité clinique. Les préoccupations concernant la sécurité des patients, les retards dans les flux de travail et la nécessité d'une communication en temps réel incitent les prestataires de soins à adopter des logiciels collaboratifs. Le solide réseau hospitalier britannique, le développement de la télémédecine et les initiatives de e-santé continuent de stimuler la demande.

Analyse du marché allemand des logiciels de communication et de collaboration cliniques

Le marché allemand devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par une sensibilisation croissante aux solutions informatiques de santé et une demande croissante de plateformes de communication sécurisées et à la pointe de la technologie. Les hôpitaux et les cliniques adoptent des logiciels pour la coordination des infirmières et des médecins, les alertes d'urgence et le partage des résultats de laboratoire. La solide infrastructure informatique allemande, l'accent mis sur l'innovation et le respect de la réglementation européenne sur la confidentialité des données encouragent une adoption généralisée.

Analyse du marché des logiciels de communication et de collaboration cliniques en Asie-Pacifique

Le marché Asie-Pacifique devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce au développement des infrastructures de santé, à la hausse des investissements dans la santé numérique et à l'adoption croissante des plateformes de communication cloud dans des pays comme la Chine, le Japon et l'Inde. Les initiatives gouvernementales en faveur de la numérisation des soins de santé, combinées à la demande croissante de services de télésurveillance des patients et de télésanté, accélèrent la croissance du marché.

Aperçu du marché japonais des logiciels de communication et de collaboration cliniques

Le marché japonais devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à son système de santé axé sur la technologie, au vieillissement de la population et à l'accent mis sur l'efficacité opérationnelle des hôpitaux. L'adoption de plateformes de messagerie en temps réel, d'outils de communication entre infirmières et médecins et de systèmes d'alerte d'urgence est en hausse. L'intégration avec les objets connectés et les dossiers médicaux électroniques alimente également la croissance, tandis que le soutien gouvernemental aux initiatives d'hôpitaux intelligents favorise leur adoption dans les milieux cliniques.

Aperçu du marché chinois des logiciels de communication et de collaboration cliniques

En 2024, le marché chinois a représenté la plus grande part de chiffre d'affaires de la région Asie-Pacifique, grâce au développement des réseaux hospitaliers, à l'augmentation des investissements dans la santé numérique et à l'adoption massive des solutions de communication mobile. Des plateformes de collaboration en temps réel sont déployées dans les hôpitaux, les cliniques et les établissements de soins de longue durée afin d'améliorer les résultats des patients. L'impulsion donnée par le gouvernement aux hôpitaux intelligents, combinée à la disponibilité de solutions cloud abordables, stimule la croissance du marché.

Part de marché des logiciels de communication et de collaboration cliniques

L'industrie des logiciels de communication et de collaboration cliniques est principalement dirigée par des entreprises bien établies, notamment :

- Epic Systems Corporation (États-Unis)

- Cerner Corporation (États-Unis)

- Allscripts Healthcare Solutions (États-Unis)

- Medtronic (Irlande)

- NantHealth (États-Unis)

- Teladoc Health (États-Unis)

- VSee (États-Unis)

- Qventus (États-Unis)

- Cisco Systems (États-Unis)

- Amwell (États-Unis)

- Microsoft (États-Unis)

- Siemens Healthineers (Allemagne)

- IBM Watson Health (États-Unis)

- Luma Health (États-Unis)

Derniers développements sur le marché mondial des logiciels de communication et de collaboration cliniques

- En novembre 2024, dans le cadre d'une initiative stratégique visant à révolutionner l'expérience client en matière d'évaluation de santé, Canara HSBC Life Insurance (CHLI) s'est associée à Fedo.ai, leader des solutions technologiques de santé basées sur l'IA. Cette collaboration associe la technologie avancée de numérisation faciale de Fedo à l'expertise en assurance de CHLI, offrant ainsi une approche de pointe et non invasive des évaluations de santé. Cette innovation permet aux clients d'effectuer des examens de santé essentiels en seulement 14 secondes, sans consultation à l'hôpital ni intervention invasive.

- En novembre 2024, WellSky, leader des technologies de santé, a dévoilé SkySense, une nouvelle suite d'outils d'intelligence artificielle conçue pour améliorer les opérations cliniques et l'efficacité des prestataires. SkySense vise à rationaliser les processus de documentation et à réduire les erreurs en automatisant l'extraction, la transcription et la synthèse des données, améliorant ainsi les interactions patient-professionnel et la prestation globale des soins.

- En juin 2024, Keragon, une plateforme d'automatisation des flux de travail pour la santé, basée sur l'IA et conforme à la loi HIPAA, a été officiellement lancée en catimini grâce à un financement de 3 millions de dollars. Première plateforme d'automatisation des flux de travail sans code spécialement conçue pour le secteur de la santé américain, Keragon accompagne déjà un large éventail d'utilisateurs, des petites cliniques aux grands hôpitaux, en passant par les startups de la santé numérique, dans les 50 États américains. Keragon s'intègre parfaitement à divers logiciels de santé courants, tels que les dossiers médicaux électroniques, les CRM et les systèmes de prise de rendez-vous, permettant ainsi aux professionnels de santé sans connaissances techniques particulières d'automatiser efficacement leurs flux de travail.

- En janvier 2023, CenTrak a lancé WorkflowRT, une plateforme cloud évolutive conçue pour automatiser les flux de travail et les communications cliniques, répondant ainsi au défi de la documentation manuelle dans les établissements de santé. La plateforme intègre une technologie de localisation en temps réel (RTLS) et des outils de reporting intégrés pour aider les équipes soignantes à suivre et optimiser le flux des patients. En exploitant les indicateurs historiques, WorkflowRT permet d'améliorer les processus, ce qui a permis de réduire les temps d'attente, d'augmenter la durée des soins et d'accroître la satisfaction des patients et du personnel.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.