Marché mondial du charbon de bois, par produit (charbon de bois en morceaux, briquettes de charbon de bois, charbon de bois japonais, charbon de bois de sucre et autres), application (activités de plein air, restauration, combustible métallurgique, combustible industriel, filtration et autres) Tendances de l'industrie et prévisions jusqu'en 2029.

Définition du marché

Le charbon de bois est un résidu de carbone noir artificiel produit à partir de matières végétales telles que le bois. Ce processus est réalisé en présence d'oxygène pour éliminer les composés volatils et l'eau qui constituent le charbon. En raison de la demande accrue pour ce produit dans la cuisine récréative et la fabrication de métaux, le bâtiment et la construction , les soins de santé, la filtration industrielle et les applications pharmaceutiques, le marché mondial du charbon de bois devrait se développer considérablement au cours de la période de prévision. Dans la cuisine récréative, le charbon de bois peut être utilisé comme substitut au charbon. En outre, la popularité croissante de la cuisine au barbecue dans les restaurants devrait stimuler la demande de charbon de bois.

Analyse et taille du marché

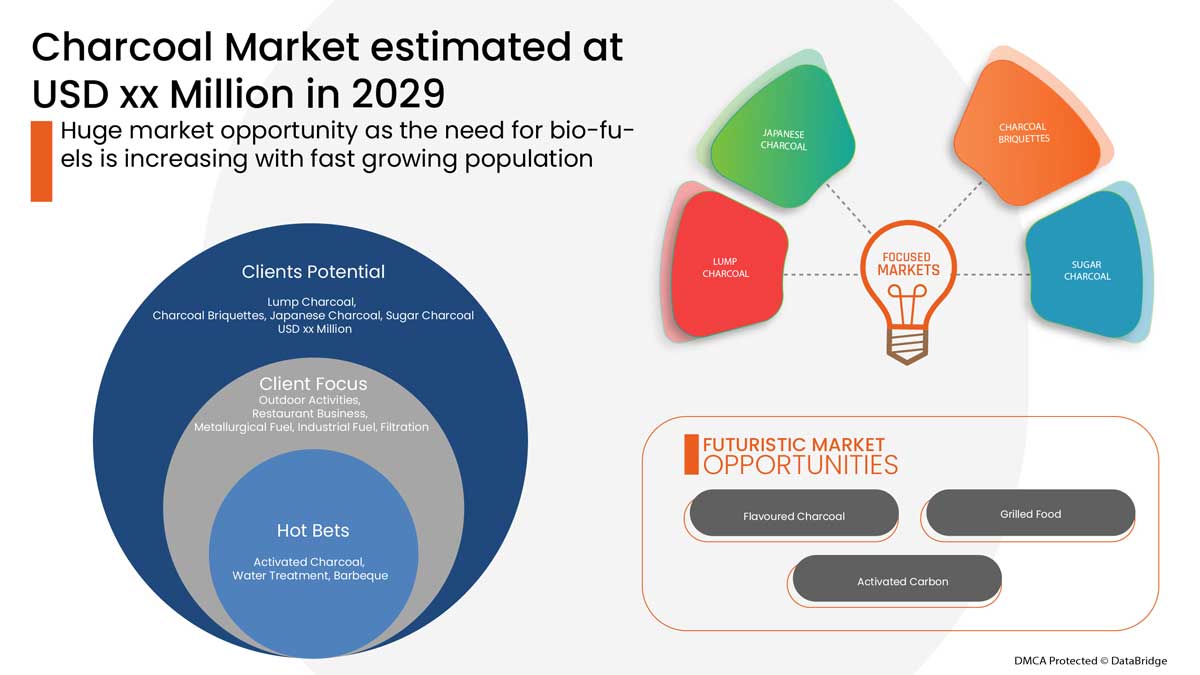

Data Bridge Market Research estime que le marché du charbon de bois devrait atteindre la valeur de 6 946,21 millions USD d'ici 2029, à un TCAC de 2,7 % au cours de la période de prévision. Le rapport sur le marché du charbon de bois couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Sous-produit (charbon de bois en morceaux, briquettes de charbon de bois, charbon de bois japonais, charbon de bois de sucre et autres), application (activités de plein air, restauration, combustible métallurgique, combustible industriel, filtration et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord, Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Reste de l'Europe en Europe, Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Hong Kong, Taïwan, Reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, Reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), Brésil, Argentine et Reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud. |

|

Acteurs du marché couverts |

Plantar, Rancher Charcoal, E & C Charcoal, Jumbo Charcoal (Pty) Ltd., Sagar Charcoal and Firewood Depot, Subur Tiasa Holdings Berhad, Etosha, The Clorox Company, Fire & Flavor, Timber Charcoal Company LLC, FogoCharcoal.com, NamCo Charcoal and Timber Products, Namchar, Mesjaya Sdn Bhd, Cook In Wood, maurobera.com, Royal Oak Enterprises, LLC., Duraflame, Inc. |

Dynamique du marché du charbon de bois

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

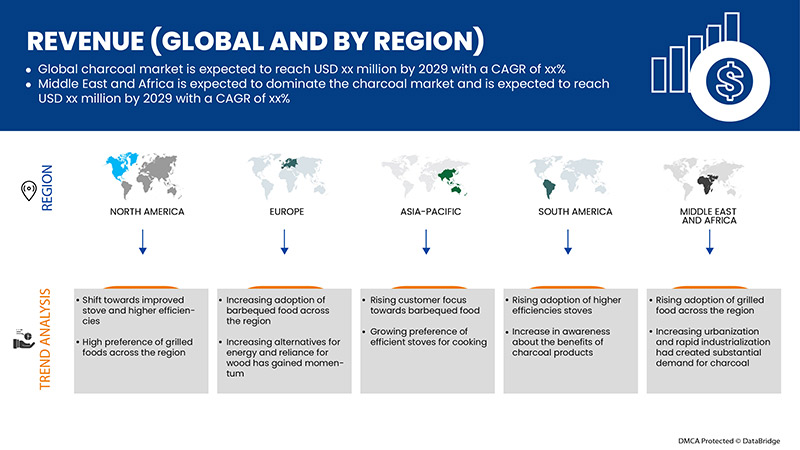

- L'augmentation de l'urbanisation et l'industrialisation rapide ont créé une demande substantielle de charbon de bois

La demande de charbon de bois augmente principalement en raison de la population urbaine dans les pays en développement. Plus de la moitié de la population mondiale vit désormais dans les villes et les citadins sont limités à l'utilisation du charbon de bois en raison de la facilité de production, d'accès, de transport et de tradition. L'urbanisation a influencé le type de combustibles utilisés ainsi que la consommation totale d'énergie pour différentes fonctions, ce qui a encore accru la demande de production de charbon de bois dans la région.

- Augmentation de la consommation d'aliments cuits au barbecue

Dans une grande partie du monde, le barbecue est une activité pratiquement très courante dans de nombreuses régions, en particulier en été. Et si certaines personnes grillent au gaz et à l'électricité, de nombreuses personnes préfèrent également griller au charbon de bois, ce qui donne à leurs aliments une saveur particulièrement fumée. En outre, le charbon de bois est principalement utilisé pour les barbecues récréatifs dans des pays comme l'Amérique du Nord et l'Europe, mais il est le principal combustible de cuisson dans la plupart des pays africains. En outre, il semblerait que le marché soit principalement stimulé par l'influence croissante des aliments grillés dans le monde entier et par l'adoption croissante des aliments grillés par la génération Y. En outre, les restrictions de confinement et la nécessité de maintenir une distance sociale en raison de la pandémie de COVID-19 en cours ont conduit un plus grand nombre de personnes à rester chez elles. Ainsi, un nombre croissant de personnes se sont lancées dans la cuisine à domicile et ont organisé de petits événements sociaux à la maison. Cette situation a entraîné une demande croissante d'équipements et de matériaux de cuisine à domicile.

Opportunité

- Passage à des fourneaux améliorés et à des rendements plus élevés

Les fourneaux traditionnels utilisés pour le chauffage et la cuisson des aliments dans les ménages sont généralement inefficaces et génèrent une pollution de l’air intérieur considérable, qui peut être nocive pour la santé humaine. Des fourneaux améliorés ont été déployés dans de nombreux pays pour tenter d’améliorer l’efficacité de la cuisson et du chauffage et de réduire la pollution intérieure dans les ménages. En outre, le charbon de bois peut être brûlé proprement et en toute sécurité s’il est préparé correctement et utilisé correctement dans des appareils efficaces. Les fourneaux améliorés sont de forme convexe et isolés sur tous les côtés. En raison de leur isolation, ils nécessitent moins de charbon de bois pour générer une quantité équivalente de chaleur utile et ils retiennent la chaleur plus longtemps. De plus, on a récemment introduit des fourneaux améliorés qui peuvent réduire les émissions de GES en améliorant l’efficacité énergétique et en réduisant ainsi la demande de charbon de bois pour la même quantité d’énergie de cuisson.

Contraintes/Défis

- Réglementation gouvernementale stricte pour la production de charbon de bois

Un certain nombre de politiques et de normes ont été mises en place pour la production de charbon de bois afin de garantir la qualité et la manipulation sécuritaire du produit. Par exemple, la Loi canadienne sur la sécurité des produits de consommation (LC 2010, ch. 21) traite des risques pour la santé et la sécurité humaines que posent les produits de consommation au Canada, y compris ceux qui circulent au Canada et ceux qui sont importés.

- Informations de base insuffisantes pour la formulation de politiques relatives au charbon de bois

La croissance démographique et le passage du bois de chauffage au charbon de bois ont été soulignés comme les principaux facteurs moteurs de la croissance du marché du charbon de bois . Cependant, l'exploitation du bois de chauffage à elle seule ne fournit clairement pas une explication sommaire de la déforestation en cours à l'échelle nationale. Les problèmes liés au bois de chauffage ont augmenté en raison d'informations de base non structurées liées aux diverses politiques de production de charbon de bois, ce qui a encore créé un écart entre l'offre et la demande de charbon de bois dans la région. Par conséquent, des données précises sur la chaîne de valeur du charbon de bois doivent être fournies pour un excellent point d'entrée pour l'élaboration de cadres politiques appropriés. Cela offrira également une opportunité aux différentes parties prenantes d'ajouter des connaissances, du capital d'innovation et de la technologie à chaque étape ou maillon de la chaîne de valeur de la production de charbon de bois. Par conséquent, l'insuffisance des informations de base pour la formulation des politiques crée un défi majeur pour la croissance du marché.

Impact post-COVID-19 sur le marché du charbon de bois

La COVID-19 a eu un impact majeur sur le marché du charbon de bois, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels.

La pandémie de COVID-19 a eu un impact négatif sur le marché du charbon de bois. Ainsi, le marché a enregistré un taux de croissance annuel estimé inférieur à celui de 2019 en raison de la diminution des activités des secteurs associés au marché du charbon de bois. Cependant, la croissance a été élevée après l'ouverture du marché après COVID-19, et on s'attend à ce qu'il y ait une croissance considérable dans le secteur en raison de la demande accrue d'aliments grillés. Et ce facteur devrait en outre stimuler la croissance globale du marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans le charbon de bois. Grâce à cela, les entreprises apporteront des technologies avancées au marché. En outre, les initiatives gouvernementales pour l'utilisation des véhicules électriques ont conduit à la croissance du marché

Développement récent

- En mars 2022, Kingsford Products Company, une filiale de The Clorox Company, a lancé une nouvelle gamme de produits de charbons de bois aromatisés et de granulés de bois dur. L'objectif principal de ce lancement de produit est d'améliorer l'expérience de grillade avec diverses saveurs et arômes. Cela améliorera le portefeuille de produits de l'entreprise

Portée du marché mondial du charbon de bois

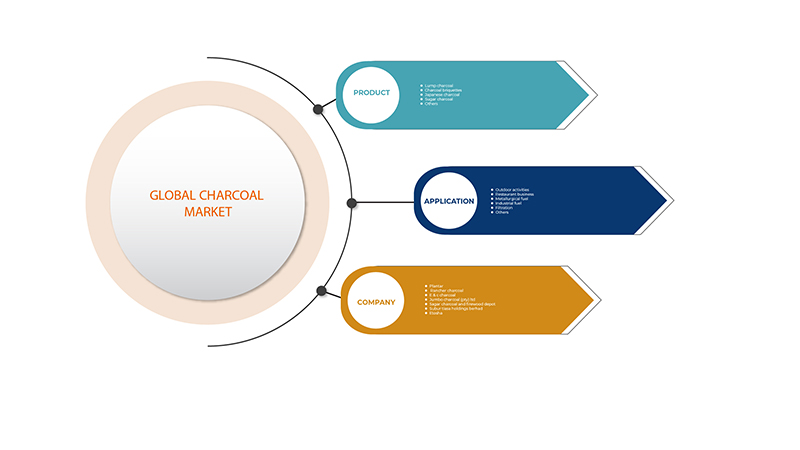

Le marché du charbon de bois est segmenté en fonction du produit et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Charbon de bois en morceaux

- Briquettes de charbon de bois

- Charbon de bois japonais

- Sucre au charbon

- Autres

Sur la base du produit, le marché mondial du charbon de bois est segmenté en charbon de bois en morceaux, briquettes de charbon de bois, charbon de bois japonais, charbon de bois de sucre et autres.

Application

- Activités de plein air

- Entreprise de restauration

- Combustible métallurgique

- Carburant industriel

- Filtration

- Autres

Sur la base des applications, le marché mondial du charbon de bois a été segmenté en activités de plein air, restauration, carburant métallurgique, carburant industriel, filtration et autres.

Analyse/perspectives régionales du marché du charbon de bois

Le marché du charbon de bois est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, produit et application comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché du charbon de bois sont les États-Unis, le Canada et le Mexique en Amérique du Nord, l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie, le reste de l'Europe en Europe, la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines, Hong Kong, Taïwan, le reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), l'Arabie saoudite, les Émirats arabes unis, l'Afrique du Sud, l'Égypte, Israël, le reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), le Brésil, l'Argentine et le reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud.

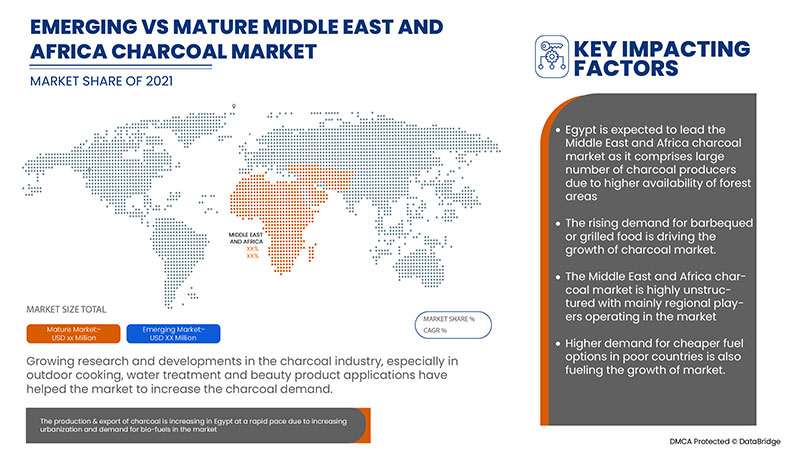

La région du Moyen-Orient et de l’Afrique domine le marché du charbon de bois car elle a démontré une forte demande de traitement des déchets industriels et de l’eau à l’aide de charbon actif.

L’Égypte domine la région du Moyen-Orient et de l’Afrique en raison de la demande massive de bois de chauffage moins cher et plus efficace dans ce pays.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du charbon de bois

Le paysage concurrentiel du marché du charbon de bois fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché du charbon de bois.

Certains des principaux acteurs opérant sur le marché du charbon de bois sont Plantar, Rancher Charcoal, E & C Charcoal, Jumbo Charcoal (Pty) Ltd., Sagar Charcoal and Firewood Depot, Subur Tiasa Holdings Berhad, Etosha, The Clorox Company, Fire & Flavor, Timber Charcoal Company LLC, FogoCharcoal.com, NamCo Charcoal and Timber Products, Namchar, Mesjaya Sdn Bhd, Cook In Wood, maurobera.com, Royal Oak Enterprises, LLC., Duraflame, Inc.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CHARCOAL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION CONSUMPTION ANALYSIS

4.2 IMPORT-EXPORT SCENARIO

4.3 RAW MATERIAL PRODUCTION COVERAGE

4.4 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.5 LIST OF KEY BUYERS BY REGION

4.5.1 NORTH AMERICA

4.5.2 EUROPE

4.5.3 ASIA-PACIFIC

4.5.4 SOUTH AMERICA

4.5.5 MIDDLE EAST AND AFRICA

4.6 PORTER'S FIVE FORCES

4.7 VENDOR SELECTION CRITERIA

4.8 PESTEL ANALYSIS

4.9 REGULATION COVERAGE

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 AN INCREASE IN URBANIZATION AND RAPID INDUSTRIALIZATION HAS CREATED SUBSTANTIAL DEMAND FOR CHARCOAL

7.1.2 RISE IN CONSUMPTION OF BARBEQUED FOOD

7.1.3 INCREASING ALTERNATIVES FOR ENERGY AND RELIANCE ON WOOD HAS GAINED MOMENTUM

7.1.4 GROWING DEMAND FOR INDUSTRIAL WASTE AND WATER TREATMENT USING ACTIVATED CARBON

7.2 RESTRAINTS

7.2.1 STRINGENT GOVERNMENT REGULATIONS FOR CHARCOAL PRODUCTION

7.2.2 HIGHER ENVIRONMENTAL IMPACTS OF CHARCOAL PRODUCTION IN TROPICAL ECOSYSTEM

7.3 OPPORTUNITIES

7.3.1 SHIFT TOWARDS IMPROVED STOVE AND HIGHER EFFICIENCIES

7.3.2 INCREASE IN SOURCE OF INCOME FOR RURAL DWELLERS WITH CHARCOAL PRODUCTION

7.3.3 HIGH PREFERENCE FOR GRILLED FOODS ACROSS THE REGION

7.4 CHALLENGES

7.4.1 INADEQUATE BASELINE INFORMATION FOR POLICY FORMULATION RELATED TO CHARCOAL

7.4.2 LACK OF AWARENESS OF THE ENVIRONMENTAL EFFECTS OF CHARCOAL PRODUCTION

8 IMPACT OF COVID-19 ON THE GLOBAL CHARCOAL MARKET

8.1 AFTERMATH AND GOVERNMENT INITIATIVES FOR THE CHARCOAL MARKET

8.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.3 IMPACT ON DEMAND AND PRICE

8.4 IMPACT ON SUPPLY CHAIN

8.5 CONCLUSION

9 GLOBAL CHARCOAL MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 LUMP CHARCOAL

9.3 CHARCOAL BRIQUETTES

9.4 JAPANESE CHARCOAL

9.5 SUGAR CHARCOAL

9.6 OTHERS

10 GLOBAL CHARCOAL MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 OUTDOOR ACTIVITIES

10.3 RESTAURANT BUSINESS

10.4 METALLURGICAL FUEL

10.5 INDUSTRIAL FUEL

10.6 FILTRATION

10.7 OTHERS

11 GLOBAL CHARCOAL MARKET, BY REGION

11.1 OVERVIEW

11.2 MIDDLE EAST & AFRICA

11.2.1 EGYPT

11.2.2 SOUTH AFRICA

11.2.3 SAUDI ARABIA

11.2.4 U.A.E.

11.2.5 ISRAEL

11.2.6 REST OF MIDDLE EAST & AFRICA

11.3 ASIA-PACIFIC

11.3.1 CHINA

11.3.2 INDIA

11.3.3 JAPAN

11.3.4 SOUTH KOREA

11.3.5 THAILAND

11.3.6 INDONESIA

11.3.7 AUSTRALIA

11.3.8 MALAYSIA

11.3.9 SINGAPORE

11.3.10 PHILIPPINES

11.3.11 HONG KONG

11.3.12 TAIWAN

11.3.13 REST OF ASIA-PACIFIC

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 NORTH AMERICA

11.5.1 U.S.

11.5.2 CANADA

11.5.3 MEXICO

11.6 EUROPE

11.6.1 GERMANY

11.6.2 FRANCE

11.6.3 U.K.

11.6.4 ITALY

11.6.5 NETHERLANDS

11.6.6 SPAIN

11.6.7 RUSSIA

11.6.8 BELGIUM

11.6.9 SWITZERLAND

11.6.10 TURKEY

11.6.11 REST OF EUROPE

12 GLOBAL CHARCOAL MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.4 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THE CLOROX COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 ROYAL OAK ENTERPRISES, LLC.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 DURAFLAME, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 SUBUR TIASA HOLDINGS BERHAD

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 NAMCO CHARCOAL AND TIMBER PRODUCTS

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 COOK IN WOOD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 E&C CHARCOAL

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ETOSHA

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 FIRE & FLAVOR

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 FOGOCHARCOAL.COM

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 JUMBO CHARCOAL (PTY) LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MAUROBERA.COM

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MESJAYA SDN BHD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NAMCHAR

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 RANCHER CHARCOAL

14.15.1 COMPANY SNPASHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SAGAR CHARCOAL AND FIREWOOD DEPOT

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 TIMBER CHARCOAL CO. LLC

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 PLANTAR

14.18.1 COMPANY SNAPSHOT

14.18.2 SOLUTION PORTFOLIO

14.18.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 VALUES OF CERTAIN CHARCOAL CHARACTERISTICS PURSUANT TO THE EUROPEAN EN 1860-2 AND GERMAN DIN 51749 STANDARD

TABLE 2 CHARCOAL TRANSPORTATION COSTS WITH DISTANCE TRAVELED THROUGH DIFFERENT DISTRICTS OF THAILAND ARE BELOW:

TABLE 3 GLOBAL CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL LUMP CHARCOAL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL CHARCOAL BRIQUETTES IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL JAPANESE CHARCOAL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL SUGAR CHARCOAL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL OTHERS IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL OUTDOOR ACTIVITIES IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL RESTAURANT BUSINESS IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL METALLURGICAL FUEL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL INDUSTRIAL FUEL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 14 GLOBAL FILTRATION IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL OTHERS IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 EGYPT CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 21 EGYPT CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 SOUTH AFRICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 23 SOUTH AFRICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 SAUDI ARABIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 SAUDI ARABIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 U.A.E. CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 U.A.E. CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 ISRAEL CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 29 ISRAEL CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 REST OF MIDDLE EAST & AFRICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 CHINA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 35 CHINA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 INDIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 37 INDIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 JAPAN CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 39 JAPAN CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 SOUTH KOREA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 SOUTH KOREA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 THAILAND CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 THAILAND CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 INDONESIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 INDONESIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 AUSTRALIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 47 AUSTRALIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 MALAYSIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 49 MALAYSIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 SINGAPORE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 SINGAPORE CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 PHILIPPINES CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 PHILIPPINES CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 HONG KONG CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 HONG KONG CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 TAIWAN CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 57 TAIWAN CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 REST OF ASIA-PACIFIC CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AMERICA CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AMERICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AMERICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 BRAZIL CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 BRAZIL CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 ARGENTINA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 ARGENTINA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 REST OF SOUTH AMERICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.S. CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 U.S. CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 CANADA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 CANADA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 MEXICO CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 MEXICO CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 EUROPE CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 77 EUROPE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 78 EUROPE CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 GERMANY CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 80 GERMANY CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 FRANCE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 FRANCE CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 U.K. CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 U.K. CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 ITALY CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 ITALY CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 NETHERLANDS CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 NETHERLANDS CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 SPAIN CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 SPAIN CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 RUSSIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 RUSSIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 BELGIUM CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 BELGIUM CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 SWITZERLAND CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 96 SWITZERLAND CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 TURKEY CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 TURKEY CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 REST OF EUROPE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 GLOBAL CHARCOAL MARKET: SEGMENTATION

FIGURE 2 GLOBAL CHARCOAL MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL CHARCOAL MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL CHARCOAL MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL CHARCOAL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL CHARCOAL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL CHARCOAL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL CHARCOAL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL CHARCOAL MARKET: SEGMENTATION

FIGURE 10 RISING CONSUMPTION OF BARBEQUED FOOD IS EXPECTED TO DRIVE THE GLOBAL CHARCOAL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 LUMP CHARCOAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL CHARCOAL MARKET IN 2022 & 2029

FIGURE 12 MIDDLE EAST & AFRICA IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE GLOBAL CHARCOAL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 MIDDLE EAST & AFRICA IS THE FASTEST GROWING MARKET FOR CHARCOAL MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 WOOD CHARCOAL PRODUCTION QUANTITY SHARE BY REGION (2020)

FIGURE 15 TOP IMPORTERS OF WOOD CHARCOAL 2020

FIGURE 16 TOP EXPORTERS OF WOOD CHARCOAL 2020

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF GLOBAL CHARCOAL MARKET

FIGURE 18 AVERAGE WOOD CHARCOAL PRODUCTION QUANTITY SHARE BY REGION (2019-2020)

FIGURE 19 GLOBAL CHARCOAL MARKET: BY PRODUCT, 2021

FIGURE 20 GLOBAL CHARCOAL MARKET: BY APPLICATION, 2021

FIGURE 21 GLOBAL CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 22 GLOBAL CHARCOAL MARKET: BY REGION (2021)

FIGURE 23 GLOBAL CHARCOAL MARKET: BY REGION (2022 & 2029)

FIGURE 24 GLOBAL CHARCOAL MARKET: BY REGION (2021 & 2029)

FIGURE 25 GLOBAL CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 27 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 28 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 31 ASIA-PACIFIC CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 32 ASIA-PACIFIC CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 33 ASIA-PACIFIC CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 ASIA-PACIFIC CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 ASIA-PACIFIC CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 36 SOUTH AMERICA CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 37 SOUTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 38 SOUTH AMERICA CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 SOUTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 SOUTH AMERICA CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 41 NORTH AMERICA CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 42 NORTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 43 NORTH AMERICA CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 NORTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 NORTH AMERICA CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 46 EUROPE CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 47 EUROPE CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 48 EUROPE CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 EUROPE CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 EUROPE CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 51 GLOBAL CHARCOAL MARKET: COMPANY SHARE 2021 (%)

FIGURE 52 ASIA-PACIFIC CHARCOAL MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 NORTH AMERICA CHARCOAL MARKET: COMPANY SHARE 2021 (%)

FIGURE 54 EUROPE CHARCOAL MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.