Global Cancer Diagnostics Market

Taille du marché en milliards USD

TCAC :

%

USD

110.11 Billion

USD

199.32 Billion

2024

2032

USD

110.11 Billion

USD

199.32 Billion

2024

2032

| 2025 –2032 | |

| USD 110.11 Billion | |

| USD 199.32 Billion | |

|

|

|

|

Segmentation du marché mondial du diagnostic du cancer, par produit (consommables et instruments), technologie (tests de diagnostic in vitro, imagerie et techniques de biopsie), type (tests d'imagerie, tests de biomarqueurs, tests de diagnostic in vitro, biopsie et autres), application (cancer du poumon, cancer du sein, cancer colorectal, mélanome, cancer de la prostate, cancer du foie et autres), utilisateur final (centres de diagnostic, hôpitaux et cliniques, instituts de recherche et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché du diagnostic du cancer

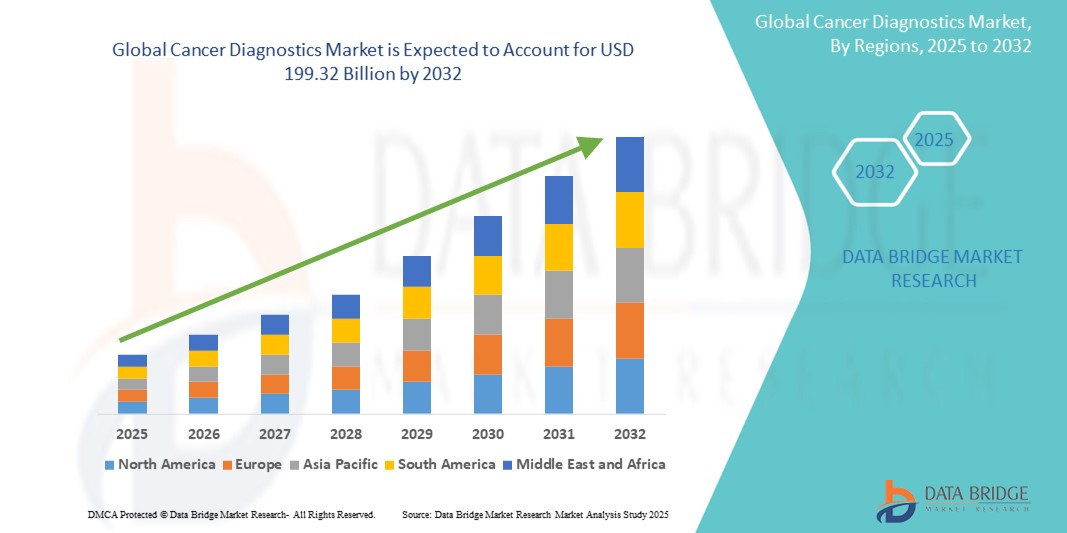

- La taille du marché mondial du diagnostic du cancer était évaluée à 110,11 milliards USD en 2024 et devrait atteindre 199,32 milliards USD d'ici 2032 , à un TCAC de 7,70 % au cours de la période de prévision.

- Cette croissance est due à des facteurs tels que l'augmentation du fardeau mondial du cancer, la sensibilisation croissante à la détection précoce du cancer et les progrès des technologies de diagnostic, notamment la biopsie liquide et l'imagerie assistée par l'IA.

Analyse du marché du diagnostic du cancer

- Les outils de diagnostic du cancer sont essentiels à la détection précoce, au diagnostic et à la surveillance de divers types de cancer, en utilisant des méthodes telles que l'imagerie, la biopsie, les marqueurs tumoraux et les diagnostics moléculaires.

- La demande de diagnostics du cancer est considérablement stimulée par l’augmentation de l’incidence mondiale du cancer, la sensibilisation croissante aux avantages de la détection précoce et les progrès technologiques dans les modalités de diagnostic.

- L'Amérique du Nord devrait dominer le marché du diagnostic du cancer avec une part de marché de 41,18 %, en raison d'une infrastructure de soins de santé bien établie, d'une prévalence élevée du cancer et d'investissements importants dans la recherche et le développement.

- L'Asie-Pacifique devrait être la région connaissant la croissance la plus rapide sur le marché du diagnostic du cancer au cours de la période de prévision en raison du vieillissement croissant de la population, de l'augmentation des dépenses de santé et de l'élargissement de l'accès aux services de diagnostic.

- Le segment des tests de diagnostic in vitro devrait dominer le marché avec une part de marché de 52,1 %, grâce à l'adoption croissante des DIV, conséquence de la hausse des tests dans le contexte de la pandémie de COVID-19. Le développement de systèmes automatisés de DIV pour les hôpitaux et les laboratoires, offrant des diagnostics précis, efficaces et sans erreur, devrait stimuler la croissance du marché.

Portée du rapport et segmentation du marché du diagnostic du cancer

|

Attributs |

Informations clés sur le marché du diagnostic du cancer |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie par des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire. |

Tendances du marché du diagnostic du cancer

« L'émergence de l'IA, de la biopsie liquide et de la détection précoce de cancers multiples (DMP) : des tendances révolutionnaires »

- L'une des tendances marquantes du marché mondial du diagnostic du cancer est l'intégration rapide des technologies d'intelligence artificielle (IA), de biopsie liquide et de détection précoce de cancers multiples (MCED) dans les pratiques de diagnostic courantes.

- Ces innovations remodèlent le paysage diagnostique en permettant une détection plus précoce, plus précise et moins invasive de plusieurs types de cancer à partir d'un seul échantillon.

- Par exemple, les plateformes de biopsie liquide peuvent détecter l'ADN tumoral circulant (ADNct) dans le sang, offrant ainsi des informations en temps réel sur les mutations tumorales sans nécessiter de biopsie chirurgicale, tandis que les outils d'imagerie basés sur l'IA améliorent la précision du diagnostic en radiologie et en pathologie.

- Ces tendances entraînent une évolution vers la médecine personnalisée, améliorent la prise de décision clinique et élargissent le potentiel de dépistage du cancer à grande échelle, en particulier dans les populations asymptomatiques.

Dynamique du marché du diagnostic du cancer

Conducteur

« Fardeau croissant du cancer et nécessité d'une détection précoce »

- Le fardeau mondial croissant du cancer, dû au vieillissement de la population, aux changements de mode de vie et aux facteurs environnementaux, accroît considérablement la demande d'outils avancés de diagnostic du cancer.

- Le cancer restant l'une des principales causes de décès dans le monde, la détection précoce est devenue une priorité essentielle de santé publique, incitant les gouvernements et les prestataires de soins de santé à investir massivement dans les infrastructures de dépistage et de diagnostic.

- La disponibilité de diagnostics innovants, notamment les tests moléculaires, l’imagerie et le séquençage de nouvelle génération, permet une intervention plus précoce et améliore les taux de survie en identifiant les cancers à des stades traitables.

Par exemple,

- Selon l’Organisation mondiale de la santé (OMS), on estime à 20 millions le nombre de nouveaux cas de cancer et à 10 millions le nombre de décès liés au cancer dans le monde en 2022, les projections suggérant une forte augmentation de l’incidence au cours des prochaines décennies.

- En raison de la prévalence croissante du cancer et des avantages reconnus du diagnostic précoce, la demande mondiale de solutions de diagnostic du cancer précises, rapides et évolutives connaît une croissance significative.

Opportunité

« Expansion des programmes de dépistage du cancer dans les économies émergentes »

- L'urbanisation rapide, l'augmentation des investissements dans les soins de santé et une meilleure sensibilisation favorisent l'expansion des programmes organisés de dépistage du cancer dans les pays à revenu faible et intermédiaire.

- Les gouvernements et les organismes de santé lancent des initiatives visant à détecter précocement les cancers à forte prévalence tels que les cancers du sein, du col de l'utérus et colorectal, créant ainsi une demande importante de technologies de diagnostic abordables et évolutives.

- De plus, la disponibilité d'appareils de diagnostic portables et de solutions de télémédecine facilite la prestation de services de dépistage dans les zones rurales et mal desservies.

Par exemple,

- En octobre 2023, l'Organisation mondiale de la santé (OMS) a lancé l'Initiative mondiale contre le cancer du sein pour réduire la mortalité due au cancer du sein à l'échelle mondiale grâce à une meilleure détection précoce et un diagnostic rapide, en mettant fortement l'accent sur le soutien aux pays à revenu faible et intermédiaire.

- Alors que les efforts mondiaux visant à réduire les décès liés au cancer s'intensifient, les marchés émergents offrent des opportunités de croissance substantielles aux entreprises de diagnostic pour introduire des solutions de détection du cancer rentables, accessibles et innovantes.

Retenue/Défi

« Coût élevé et accessibilité limitée des technologies de diagnostic avancées »

- Le coût élevé des outils avancés de diagnostic du cancer, tels que les tests moléculaires, le séquençage de nouvelle génération (NGS) et l’imagerie TEP/CT, constitue un obstacle majeur à une adoption généralisée, en particulier dans les pays à revenu faible et intermédiaire.

- Ces technologies, bien que très précises, nécessitent souvent une infrastructure sophistiquée, un personnel qualifié et des coûts opérationnels permanents, qui peuvent mettre à rude épreuve les budgets de santé dans les contextes aux ressources limitées.

- Ce fardeau financier limite l’évolutivité des programmes complets de dépistage du cancer et contribue aux diagnostics à un stade tardif, en particulier dans les régions mal desservies.

Par exemple,

- Dans le rapport de 2023 du Centre international de recherche sur le cancer (CIRC), des disparités importantes ont été constatées dans l'accès aux services de diagnostic, les pays à faible revenu signalant une couverture diagnostique inférieure à 30 % pour des cancers comme le cancer du col de l'utérus et le cancer colorectal, contre plus de 80 % dans les pays à revenu élevé.

- En conséquence, l’accès limité aux diagnostics avancés continue d’entraver la détection précoce et la prestation équitable des soins de santé, ce qui constitue un défi majeur pour l’expansion mondiale des diagnostics du cancer.

Portée du marché du diagnostic du cancer

Le marché est segmenté en fonction du produit, de la technologie, du type, de l'application et de l'utilisateur final.

|

Segmentation |

Sous-segmentation |

|

Par produit |

|

|

Par technologie |

|

|

Par type |

|

|

Par application |

|

|

Par utilisateur final |

|

En 2025, les tests de diagnostic in vitro devraient dominer le marché avec une part de marché plus importante dans le segment de type

Le segment des tests de diagnostic in vitro devrait dominer le marché du diagnostic du cancer avec une part de marché de 52,1 %, grâce à l'adoption croissante des diagnostics in vitro (DIV) liée à l'augmentation des tests dans le contexte de la pandémie de COVID-19. Le développement de systèmes automatisés de DIV pour les hôpitaux et les laboratoires, offrant des diagnostics précis, efficaces et sans erreur, devrait stimuler la croissance du marché.

Les consommables devraient représenter la part la plus importante au cours de la période de prévision dans le segment de produits

En 2025, le segment des consommables devrait dominer le marché avec une part de marché de 58,5 %. Le développement de techniques d'imagerie diagnostique et de tests efficaces à base d'anticorps monoclonaux pour la détection d'antigènes et de petites molécules générées par les cellules malignes améliorerait considérablement la médecine diagnostique. Bien que la technologie des anticorps monoclonaux en soit encore à ses balbutiements, les nouveaux développements dans la synthèse d'antigènes recombinants et les techniques de création d'anticorps ont considérablement accru son potentiel diagnostique.

Analyse régionale du marché du diagnostic du cancer

« L'Amérique du Nord détient la plus grande part du marché du diagnostic du cancer »

- L'Amérique du Nord domine le marché mondial du diagnostic du cancer avec une part de marché de 41,18 %, grâce à une infrastructure de soins de santé avancée, une forte adoption de technologies de diagnostic de pointe et la présence d'institutions de recherche sur le cancer et de sociétés de diagnostic de premier plan.

- Les États-Unis détiennent une part importante de 36,4 %, en raison de la prévalence croissante du cancer, d'un système de remboursement bien établi et des progrès continus dans les technologies de diagnostic moléculaire et d'imagerie.

- Les initiatives gouvernementales fortes en matière de recherche sur le cancer, les dépenses de santé élevées et l'accent croissant mis sur la détection précoce du cancer sont des facteurs clés qui stimulent le marché dans cette région.

- De plus, la disponibilité croissante de la médecine personnalisée et de précision, ainsi que les taux élevés de dépistage du cancer, contribuent à la croissance du marché du diagnostic du cancer en Amérique du Nord.

« L'Asie-Pacifique devrait enregistrer le TCAC le plus élevé sur le marché du diagnostic du cancer »

- La région Asie-Pacifique devrait connaître le taux de croissance le plus élevé sur le marché du diagnostic du cancer, grâce aux progrès rapides des infrastructures de santé, à la sensibilisation croissante au cancer et à l'amélioration de l'accès aux technologies de diagnostic.

- Des pays comme la Chine, l’Inde et le Japon émergent comme des marchés clés en raison du vieillissement croissant de la population, de l’augmentation de l’incidence du cancer et de l’amélioration des établissements de santé.

- Le Japon, fort de son système de santé performant et de son engagement en faveur de solutions diagnostiques innovantes, demeure un marché majeur pour le diagnostic du cancer. Le pays continue d'adopter des technologies de pointe telles que l'imagerie par IA et la biopsie liquide pour la détection précoce du cancer.

- La Chine et l'Inde, avec leurs populations importantes et leur fardeau croissant du cancer, connaissent des investissements accrus dans les services de dépistage et de diagnostic du cancer. La présence croissante d'entreprises mondiales de diagnostic et les initiatives gouvernementales visant à élargir l'accès aux soins de santé alimentent la croissance du marché dans la région.

Part de marché du diagnostic du cancer

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- F. Hoffmann-La Roche SA (Suisse)

- Thermo Fisher Scientific (États-Unis)

- Abbott (États-Unis)

- Siemens Healthineers (Allemagne)

- Koninklijke Philips NV (Pays-Bas)

- BD (États-Unis)

- GE Healthcare (États-Unis)

- Hologic, Inc. (États-Unis)

- Illumina, Inc. (États-Unis)

- Exact Sciences Corporation (États-Unis)

- Guardant Health (États-Unis)

- Myriad Genetics (États-Unis)

- Laboratoires NeoGenomics (États-Unis)

- BioMérieux SA (France)

- Qiagen NV (Allemagne)

- Leica Biosystems (Allemagne)

- Céphéide (États-Unis)

- Danaher Corporation (États-Unis)

- Agilent Technologies (États-Unis)

- F. Hoffmann-La Roche SA (Suisse)

Derniers développements sur le marché mondial du diagnostic du cancer

- En juillet 2024, DELFI Diagnostics a annoncé avoir obtenu une prise de participation du Fonds Merck Global Health Innovation. Ce financement stratégique accélérera le développement de la plateforme de fragmentomique basée sur l'IA de DELFI, conçue pour le dépistage avancé du cancer. Cette collaboration vise à améliorer les capacités diagnostiques et à faire progresser les méthodologies utilisées pour une détection plus précise du cancer. Ce partenariat s'inscrit dans la tendance croissante vers des solutions de diagnostic basées sur l'IA et l'oncologie de précision. Cet investissement soutiendra le développement de technologies de pointe qui révolutionneront la détection précoce du cancer, stimuleront l'innovation sur le marché et élargiront la disponibilité des outils de diagnostic avancés à l'échelle mondiale.

- En mai 2024, Quest Diagnostics a annoncé la scission du laboratoire de pathologie numérique de PathAI dans le cadre d'une initiative stratégique visant à approfondir l'intégration de l'intelligence artificielle (IA). Cette initiative vise à accélérer l'adoption des technologies d'IA au sein des opérations de l'entreprise, afin d'optimiser ses capacités de pathologie numérique et d'améliorer la précision des diagnostics. Cette évolution illustre la tendance croissante à l'intégration de solutions basées sur l'IA dans les flux de travail diagnostiques. En développant son offre de pathologie numérique, Quest Diagnostics se positionne à l'avant-garde de la transition vers une détection du cancer plus précise et plus efficace.

- En février 2023, F. Hoffmann-La Roche a annoncé l'élargissement de sa collaboration avec Janssen afin de faire progresser les initiatives de soins de santé personnalisés. Ce partenariat renforcé se concentrera sur le développement de diagnostics compagnons, avec pour objectif d'améliorer les résultats thérapeutiques des patients grâce à des approches thérapeutiques plus précises et plus personnalisées. Cette collaboration souligne l'évolution croissante vers l'oncologie de précision et l'importance croissante des diagnostics compagnons dans l'amélioration du traitement du cancer.

- En novembre 2023, Abbott a reçu l'approbation de la FDA pour son test HPV, développé pour être utilisé avec la plateforme Alinity m. Cet outil de diagnostic est conçu pour le dépistage primaire du HPV et la détection des types de HPV à haut risque liés au cancer, notamment celui du col de l'utérus. Cette approbation renforce considérablement le portefeuille d'Abbott en matière de prévention et de diagnostic du cancer du col de l'utérus, répondant ainsi à la demande croissante de solutions de dépistage avancées sur le marché mondial du diagnostic du cancer.

- En 2022, Precipio, Inc. a conclu un accord de distribution pour son produit HemeScreen avec un important partenaire de distribution aux États-Unis. L'entreprise poursuit un plan de croissance stratégique pour HemeScreen, ciblant les laboratoires médicaux, les réseaux hospitaliers nationaux et régionaux et les laboratoires de référence. Cette initiative souligne la demande croissante d'outils de diagnostic avancés permettant une détection plus précise et plus efficace des cancers hématologiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.