Global Bundling Food Packaging Equipment Market

Taille du marché en milliards USD

TCAC :

%

USD

20.18 Billion

USD

36.26 Billion

2021

2029

USD

20.18 Billion

USD

36.26 Billion

2021

2029

| 2022 –2029 | |

| USD 20.18 Billion | |

| USD 36.26 Billion | |

|

|

|

|

Marché mondial des équipements d’emballage alimentaire, par technologie (contrôlée, active, intelligente, aseptique, biodégradable, autres), matériaux (métal, verre et bois, papier et carton et plastiques, autres), application (produits laitiers et laitiers, produits de boulangerie, produits de confiserie, volaille, fruits de mer et produits carnés, plats cuisinés, fruits et légumes, autres) – Tendances et prévisions de l’industrie jusqu’en 2029

Analyse et taille du marché des équipements d'emballage alimentaire groupés

Le secteur des aliments et des boissons a créé une demande immense pour les équipements d'emballage alimentaire à l'échelle mondiale. De plus, l'utilisation généralisée du plastique comme matériau d'emballage a suscité des préoccupations environnementales car il est difficile à décomposer. Par conséquent, la demande de technologie d'emballage biodégradable devrait augmenter rapidement, ce qui se traduit par une traction accrue pour le marché.

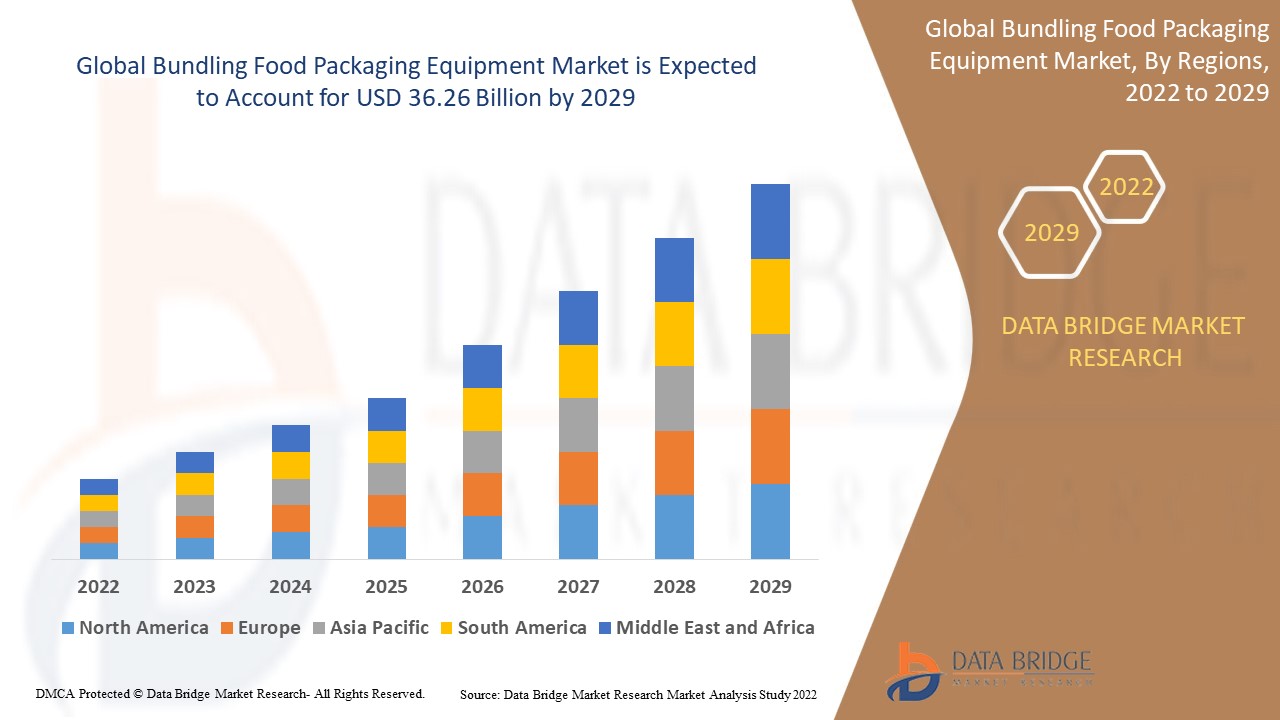

Le marché mondial des équipements d’emballage alimentaire en paquets était évalué à 20,18 milliards USD en 2021 et devrait atteindre 36,26 milliards USD d’ici 2029, enregistrant un TCAC de 7,6 % au cours de la période de prévision 2022-2029. En plus des informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l’équipe Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production, une analyse des brevets et des avancées technologiques.

Portée et segmentation du marché des équipements d'emballage alimentaire groupé

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en milliards USD, volumes en unités, prix en USD |

|

Segments couverts |

Technologie (contrôlée, active, intelligente, aseptique, biodégradable, autres), matériaux (métal, verre et bois, papier et carton et plastiques, autres), application (produits laitiers, produits de boulangerie, produits de confiserie, volaille, fruits de mer et produits carnés, plats cuisinés, fruits et légumes, autres) |

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, Italie, Royaume-Uni, France, Espagne, Pays-Bas, Belgique, Suisse, Turquie, Russie, Reste de l'Europe, Japon, Chine, Inde, Corée du Sud, Australie, Singapour, Malaisie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique, Brésil, Argentine, Reste de l'Amérique du Sud, Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël, Reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Syntegon Technology GmbH (Allemagne), Coesia SPA (Italie), GEA Group Aktiengesellschaft (Allemagne), MULTIVAC (Allemagne), IMA INDUSTRIA MACCHINE AUTOMATICHE SPA (Italie), Krones AG (Allemagne), Tetra Laval (Suisse), OPTIMA Packaging Group GmbH (Allemagne), nVenia LLC (États-Unis), Ishida Co. Ltd (Japon), Omori Machinery Co. Ltd. (Japon), Robert Bosch GmbH (Allemagne), Omori Machinery Co. Ltd. (Japon), Nichrome Packaging Solutions (Inde), Adelphi Group (Royaume-Uni), Kaufman Engineered Systems (États-Unis) et Lindquist Machine Corporation (États-Unis) et TNA Australia Pty Limited. (Australie) |

|

Opportunités de marché |

|

Définition du marché

L'emballage alimentaire groupé est un procédé qui repose sur des équipements et des technologies et qui permet de conserver les produits et de les garder frais plus longtemps. L'emballage alimentaire groupé est utilisé par de nombreux fournisseurs de produits alimentaires pour stocker d'énormes quantités de produits avant qu'ils ne soient emballés ou regroupés en un seul paquet.

Dynamique du marché des équipements d'emballage alimentaire groupés

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Passage à des emballages alimentaires pratiques

La gestion des emballages et des équipements alimentaires s'est orientée vers des méthodes d'emballage alimentaire pratiques pour la consommation directe et de meilleure qualité en raison de la demande accrue de produits alimentaires frais et de haute qualité pour les consommateurs. Les avantages essentiels de l'emballage alimentaire qui conduisent à la demande croissante du marché sont la durée de conservation accrue, la qualité des aliments et la durabilité. La demande d'équipements d'emballage alimentaire groupés pour une variété de produits, y compris les collations, les produits à base de viande et de volaille , les barres chocolatées, les chocolats, les sauces , les fruits et légumes transformés et les produits laitiers, est stimulée par la popularité des caractéristiques d'emballage pratiques telles que l'ouverture facile, la portabilité, la refermabilité, la micro-perforation, la légèreté et la manipulation facile.

En outre, des facteurs tels que l'augmentation du pouvoir d'achat, la croissance du nombre de commandes d'épicerie en ligne et l'énorme base de consommateurs « en déplacement » vont encore accélérer le taux de croissance du marché des équipements d'emballage alimentaire groupé. L'augmentation de l'urbanisation et l'augmentation du nombre de supermarchés et d'hypermarchés vont également stimuler la croissance de la valeur marchande.

Opportunités

- Adoption d'équipements de pointe et augmentation des activités de recherche et développement

L'adoption d'équipements d'emballage alimentaire efficaces et avancés par les acteurs du marché étend encore les opportunités rentables aux acteurs du marché au cours de la période de prévision de 2022 à 2029. De plus, l'augmentation des activités de recherche et développement au sein des équipements d'emballage élargira encore la croissance future du marché des équipements d'emballage alimentaire en groupage.

Contraintes/Défis

- Des réglementations strictes

Les déchets d'emballage ont un impact considérable sur l'écologie, car ils mettent beaucoup de temps à se désintégrer. De nombreux gouvernements s'attaquent à ce problème en promulguant des réglementations strictes que le secteur de l'emballage alimentaire doit respecter. Par exemple, les gouvernements européens mettent en œuvre un certain nombre de mesures pour résoudre les problèmes de recyclage et de déchets d'emballage. Les matériaux recyclés ne peuvent pas être utilisés pour l'emballage alimentaire, car ils peuvent libérer des produits chimiques dangereux dans les aliments. Les pays en développement les imitent également en appliquant des directives strictes sur l'emballage alimentaire et en promouvant des options d'emballage écologiques ou biodégradables. L'ensemble des revenus du marché de l'emballage alimentaire sont affectés par la baisse des bénéfices, ce qui à son tour limiterait l'expansion du marché des équipements d'emballage alimentaire.

- Augmentation du nombre de cas de contrefaçon d'emballages

La disponibilité des équipements d'emballage alimentaire a permis à de nombreux producteurs d'emballages illégaux de pénétrer le marché et de produire des produits contrefaits. L'expansion des emballages alimentaires contrefaits a un impact sur le marché des équipements d'emballage alimentaire. Ces produits contrefaits nuisent aux résultats financiers des entreprises et à leur réputation de marques leaders. Par conséquent, les emballages contrefaits ont un impact négatif sur le marché des équipements d'emballage alimentaire groupé, compromettant ainsi la croissance globale du marché.

Ce rapport sur le marché des équipements d'emballage alimentaire groupés fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des équipements d'emballage alimentaire groupés, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché des équipements d'emballage alimentaire groupé

La récente épidémie de coronavirus a eu une influence significative sur le marché des équipements d'emballage alimentaire. Les secteurs qui contribuent à répondre aux besoins fondamentaux, tels que la livraison sécurisée de nourriture et de fournitures aux clients, sont progressivement touchés à mesure que la pandémie se développe et que son impact humanitaire augmente. L'industrie de l'emballage est en première ligne puisque l'emballage alimentaire est le segment le plus actif du marché. La pandémie a provoqué certaines des plus fortes baisses de l'histoire récente de la demande pour certains types d'emballages tout en accélérant la croissance pour d'autres, comme l'emballage pour les expéditions de commerce électronique, qui est devenu essentiel dans ce nouvel environnement. Cependant, le secteur des équipements d'emballage alimentaire est susceptible de croître, ce qui devrait augmenter les ventes d'équipements d'emballage alimentaire tout au long de la période de prévision en raison de l'assouplissement des restrictions de confinement et de l'amélioration de la logistique à la lumière des mesures préventives du COVID-19.

L’épidémie de COVID-19 a provoqué une panique des consommateurs, ce qui a fait augmenter la demande de biens essentiels, notamment de produits alimentaires. La disponibilité des produits d’épicerie dans les points de vente au détail a considérablement diminué à mesure que la consommation alimentaire a augmenté. L’industrie alimentaire a également été confrontée à des difficultés supplémentaires en raison de la rupture des chaînes d’approvisionnement, d’une pénurie de main-d’œuvre et du besoin croissant de grandes quantités de matières premières. Cependant, la situation a commencé à s’améliorer en 2021. De plus, les entreprises qui produisent des équipements d’emballage alimentaire et des installations de transformation des aliments ont commencé à se concentrer sur l’automatisation des procédures d’emballage.

Portée du marché mondial des équipements d'emballage alimentaire groupé

Le marché des équipements d'emballage alimentaire groupé est segmenté en fonction de la technologie, des matériaux et des applications. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Technologie

- Contrôlé

- Actif

- Intelligent

- Aseptique

- Biodégradable

- Autres

Matériels

- Métal

- Verre et Bois

- Papier et carton et plastiques

- Autres

Application

- Produits laitiers et produits laitiers

- Produits de boulangerie

- Produits de confiserie

- Volaille

- Produits de la mer et de la viande

- Plats préparés

- Fruits et légumes

- Autres

Analyse/perspectives régionales du marché des équipements d'emballage alimentaire groupé

Le marché des équipements d’emballage alimentaire groupé est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, technologie, matériaux et application comme référencé ci-dessus.

The countries covered in the bundling food packaging equipment market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the bundling food packaging equipment market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2022-2029. The market growth over this region is attributed to the growth in demand for processed food in developing countries and the rise in infrastructural development within the region.

Asia-Pacific, on the other hand, is estimated to show lucrative growth over the forecast period of 2022-2029, due to the favorable government policies, the increasing investment in research and development of food processing equipment and technology, and rising consumption of healthy food within the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Bundling Food Packaging Equipment Market Share Analysis

The bundling food packaging equipment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to bundling food packaging equipment market.

Some of the major players operating in the bundling food packaging equipment market are

- Syntegon Technology GmbH (Germany)

- Coesia S.P.A (Italy)

- GEA Group Aktiengesellschaft (Germany)

- MULTIVAC (Germany)

- I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A. (Italy)

- Krones AG (Germany)

- Tetra Laval (Switzerland)

- OPTIMA Packaging Group GmbH (Germany)

- nVenia LLC (U.S.)

- Ishida Co. Ltd (Japan)

- Omori Machinery Co. Ltd. (Japan)

- Robert Bosch GmbH (Allemagne)

- Omori Machinery Co. Ltd., (Japon)

- Solutions d'emballage Nichrome (Inde)

- Groupe Adelphi (Royaume-Uni)

- Systèmes d'ingénierie Kaufman (États-Unis)

- Lindquist Machine Corporation (États-Unis)

- TNA Australia Pty Limited. (Australie)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.