Global Building Management System Market

Taille du marché en milliards USD

TCAC :

%

USD

88,841,536.28 Thousand

USD

200,517,985.93 Thousand

2023

2031

USD

88,841,536.28 Thousand

USD

200,517,985.93 Thousand

2023

2031

| 2024 –2031 | |

| USD 88,841,536.28 Thousand | |

| USD 200,517,985.93 Thousand | |

|

|

|

|

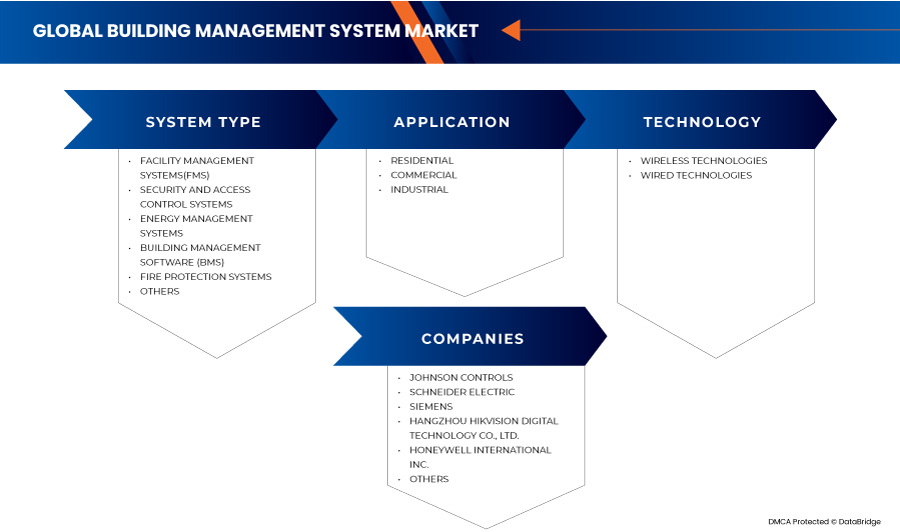

Marché mondial des systèmes de gestion des bâtiments, par type de système (systèmes de gestion des installations (FMS), systèmes de sécurité et de contrôle d'accès, systèmes de gestion de l'énergie, logiciels de gestion des bâtiments (BMS), systèmes de protection incendie et autres), technologie (technologies sans fil et technologies filaires), application (résidentielle, commerciale et industrielle) - Tendances et prévisions de l'industrie jusqu'en 2031.

Analyse et taille du marché des systèmes de gestion des bâtiments

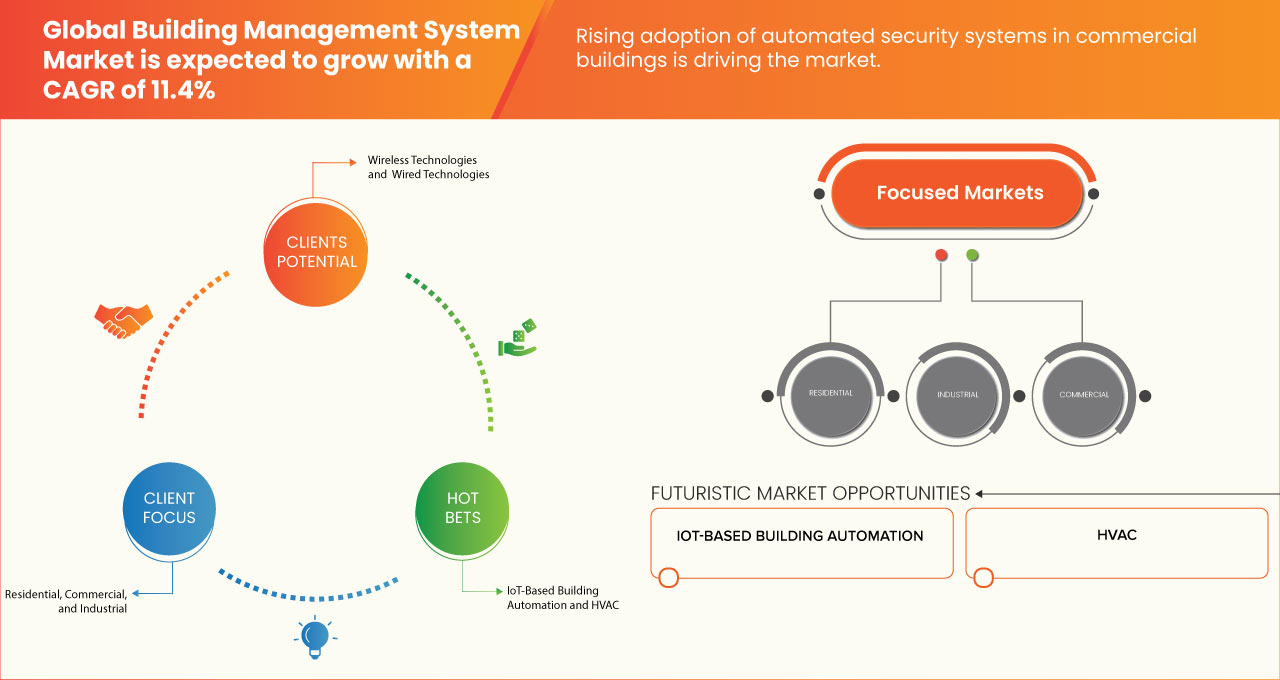

L'accent croissant mis sur la conception de bâtiments économes en énergie et respectueux de l'environnement, l'adoption croissante de systèmes de sécurité automatisés dans les bâtiments commerciaux et la popularité croissante des systèmes d'automatisation des bâtiments (BAS) basés sur l'IoT sont quelques-uns des principaux facteurs à l'origine de la croissance du marché.

Cependant, l'émergence de problèmes de sécurité et le coût élevé de maintenance des BAS en tant que problème pour les fabricants dans la fabrication de produits innovants, sont quelques-uns des principaux facteurs freinant la croissance du marché.

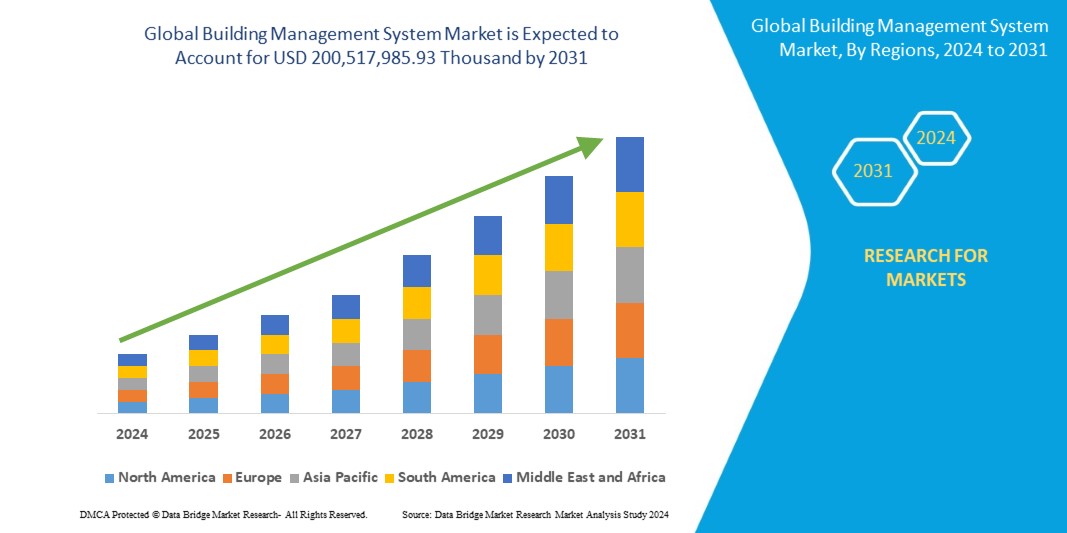

Data Bridge Market Research analyse que le marché mondial des systèmes de gestion des bâtiments devrait atteindre 200 517 985,93 milliers USD d'ici 2031, contre 88 841 536,28 milliers USD en 2023, avec un TCAC de 11,4 % au cours de la période de prévision de 2024 à 2031.

|

Rapport métrique |

Détails |

|

Période de prévision |

2024 à 2031 |

|

Année de base |

2023 |

|

Années historiques |

2022 (personnalisable pour 2016-2021) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Type de système (systèmes de gestion des installations (FMS), systèmes de sécurité et de contrôle d'accès, systèmes de gestion de l'énergie, logiciels de gestion des bâtiments (BMS), systèmes de protection contre les incendies et autres), technologie (technologies sans fil et technologies filaires), application (résidentielle, commerciale et industrielle) |

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, France, Royaume-Uni, Italie, Turquie, Espagne, Pays-Bas, Russie, Belgique, Suisse, Reste de l'Europe, Chine, Japon, Corée du Sud, Inde, Australie, Singapour, Malaisie, Thaïlande, Philippines, Indonésie, Reste de l'Asie-Pacifique, Arabie saoudite, Émirats arabes unis, Afrique du Sud, Israël, Égypte, Reste du Moyen-Orient et de l'Afrique, Brésil, Argentine et Reste de l'Amérique du Sud |

|

Acteurs du marché couverts |

Parmi les autres sociétés, citons Johnson Controls, Schneider Electric, Siemens, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Trane Technologies plc, IBM, Convergint Technologies LLC, Veolia, Delta Controls, ACUITY BRANDS, INC., Snap One, LLC, Virtusa Corp., Crestron Electronics, Beckhoff Automation GmbH & Co. KG, Bajaj Electricals Ltd, GridPoint, UNIPOWER, Novius Services, Elipse Software, BuildingIQ et Axonator Inc. |

Définition du marché mondial des systèmes de gestion des bâtiments

Un système de gestion de bâtiment (BMS) est un système informatique qui gère et surveille divers systèmes de bâtiment, tels que le chauffage, la ventilation, la climatisation, l'éclairage, la sécurité, la prévention des incendies et l'approvisionnement en énergie. Il peut réduire la consommation d'énergie, les coûts de maintenance et l'impact environnemental en ajustant les paramètres des systèmes du bâtiment en fonction des données collectées par les capteurs et les compteurs. Un BMS peut également fournir des informations et des alertes en temps réel aux exploitants et aux gestionnaires du bâtiment, leur permettant de contrôler et d'optimiser les performances du bâtiment.

Dynamique du marché mondial des systèmes de gestion des bâtiments

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- L'attention portée à la conception de bâtiments économes en énergie et respectueux de l'environnement prend de l'ampleur

Les économies d'énergie par l'efficacité énergétique dans les bâtiments ont acquis une importance capitale dans le monde entier. Les principaux aspects de l'efficacité énergétique dans un bâtiment comprennent la conception d'un bâtiment passif avant la construction et l'utilisation de matériaux de construction à faible consommation d'énergie pendant la construction. L'accent principal de la construction de bâtiments écologiques est mis sur l'intégration de technologies d'énergie renouvelable et l'utilisation d'équipements efficaces ayant de faibles besoins énergétiques opérationnels.

La consommation d'énergie dans les bâtiments et les infrastructures augmente de manière exponentielle, ce qui suggère la nécessité de développer des alternatives pour économiser l'énergie et exploiter les bâtiments de manière durable. L'efficacité énergétique peut être obtenue grâce à l'isolation, à des techniques de construction améliorées et à des méthodes de construction modifiées pour les bâtiments, ce qui augmente la demande de systèmes d'automatisation durables. En conséquence, cela augmente la demande de systèmes de gestion des bâtiments, ce qui stimule la croissance du marché.

- Adoption croissante de systèmes de sécurité automatisés dans les bâtiments commerciaux

Les systèmes de sécurité sont essentiels pour tous les bâtiments, en particulier pour les bâtiments commerciaux. Ils garantissent la cohérence des opérations commerciales et la sécurité des biens physiques et intellectuels. Les propriétés commerciales telles que les entreprises industrielles, les institutions financières et gouvernementales, les écoles, les établissements médicaux et les sociétés pétrolières et gazières nécessitent un ensemble unique de mesures de sécurité et de sûreté, car chaque type de propriété est vulnérable à différents dangers.

Un système de sécurité pour bâtiments commerciaux présente une solution plus complète que les systèmes de sécurité classiques des immeubles d'appartements et comprend différents systèmes d'automatisation. Cela comprend un contrôle d'accès commercial multicouche, divers capteurs et détecteurs, tels que des capteurs infrarouges, micro-ondes ou laser , et une sécurité périmétrique (CCTV). Tous les systèmes de sécurité commerciaux peuvent être intégrés dans une solution de sécurité complexe avec une plus grande flexibilité et évolutivité, propulsant ainsi la croissance du marché.

Opportunité

- Initiatives et incitations gouvernementales favorables aux villes intelligentes émergentes

Les bâtiments intelligents comprennent une technologie avancée d'automatisation et de gestion des bâtiments qui améliore la manière dont les gouvernements surveillent et contrôlent les machines, les systèmes de chauffage, de refroidissement et d'éclairage dans les bâtiments fédéraux de tous les pays, augmentant ainsi l'efficacité de ces systèmes. La technologie des systèmes de gestion des bâtiments collecte des données brutes provenant de systèmes mécaniques ou électriques, les analyse et utilise les résultats pour identifier les inefficacités qui peuvent être corrigées immédiatement.

L'initiative des bâtiments intelligents permet aux gouvernements de faire une réelle différence en mettant en œuvre des technologies innovantes et en identifiant des possibilités d'économie d'énergie. Grâce à l'initiative des bâtiments intelligents, le gouvernement intensifie ses efforts pour améliorer la gestion de la performance énergétique dans les bâtiments fédéraux. Cela entraînera une réduction de l'empreinte environnementale et des coûts énergétiques grâce à la mise en œuvre de BMS intelligents. Grâce à l'initiative des bâtiments intelligents, le gouvernement de chaque pays améliore la gestion de la performance énergétique des bâtiments fédéraux, ce qui se traduit par une réduction des émissions de gaz à effet de serre et des coûts énergétiques. Ainsi, il est prévu de créer une opportunité significative de croissance du marché.

Retenue/Défi

- Émergence des problèmes de sécurité

Ces dernières années, de nombreux bâtiments ont été équipés de systèmes de communication bidirectionnels pour la surveillance et le contrôle avancés des ressources du centre de données, ce qui favorise le besoin de systèmes d'automatisation. Par conséquent, la diffusion des BMS a également augmenté la prévalence des cyberattaques sur les entreprises, les institutions gouvernementales et d'autres bâtiments nouvellement construits, ce qui est susceptible de susciter de véritables inquiétudes concernant les systèmes de sécurité des bâtiments.

Les logiciels malveillants peuvent pénétrer dans un système de bâtiment via des réseaux non sécurisés et provoquer des perturbations. Les problèmes techniques et autres menaces virales peuvent souvent entraîner une perte de communication et d'accès à des données sensibles, affectant le fonctionnement d'appareils tels que la vidéosurveillance dans les bâtiments.

Alors que le marché continue de croître, l'émergence de problèmes de sécurité freine considérablement sa progression. Par conséquent, les vulnérabilités en matière de cybersécurité , si elles ne sont pas correctement traitées, peuvent compromettre la sécurité, la confidentialité et la fonctionnalité des bâtiments. Pour soutenir la croissance du marché et garantir la sécurité des infrastructures critiques, les parties prenantes doivent prioriser et investir dans des mesures de cybersécurité robustes. De plus, lorsqu'un bâtiment connecte tous les appareils du système à un seul réseau de contrôle, il existe un risque qu'un utilisateur malveillant ou un étranger puisse pirater efficacement le bâtiment, ce qui réduirait la demande de systèmes de gestion des bâtiments et freinerait la croissance du marché.

Développements récents

- En octobre 2023, Hangzhou Hikvision Digital Technology Co., Ltd. s'est associée à l'efficacité des bâtiments écologiques en utilisant des « jumeaux numériques ». Hikvision a développé une solution avancée de jumeaux numériques pour répondre à la demande croissante de constructions intelligentes et respectueuses de l'environnement. La solution crée une réplique numérique des bâtiments, permettant une surveillance en temps réel d'indicateurs clés tels que l'efficacité énergétique et la sécurité. Cela permet des interventions rapides en cas d'incidents ou de problèmes techniques, améliorant ainsi l'efficacité opérationnelle globale

- En juin 2023, Atrius, une division d'ACUITY BRANDS, INC., a dévoilé Atrius DataLab, sa dernière plateforme d'automatisation des bâtiments. Le produit, lancé hier, révolutionne les opérations dans les espaces bâtis en offrant un contrôle centralisé. Atrius DataLab facilite l'automatisation rapide des applications pour un contrôle évolutif. La plateforme, construite sur Microsoft Azure, fournit une architecture indépendante des données. Elle permet aux utilisateurs de créer des applications personnalisées, aidant les responsables des installations, de l'énergie et du développement durable à suivre et à signaler la consommation des ressources

- En mai 2023, ACUITY BRANDS, INC. a finalisé l'acquisition de KE2 Therm Solutions, Inc. La société de technologie industrielle a intégré KE2 Therm, connue pour ses solutions de contrôle de réfrigération intelligentes, dans Distech Controls au sein du segment d'activité Intelligent Spaces Group. Cette opération vise à améliorer l'efficacité du système et à réduire les coûts d'exploitation et de service, contribuant ainsi à une meilleure rentabilité. Cette acquisition a permis à l'entreprise d'augmenter son offre de produits et d'atteindre de nouveaux clients sur le marché commercial

- En mars 2022, GridPoint, un acteur clé dans le domaine des technologies de gestion de l'énergie, a conclu avec succès une levée de fonds de 75 millions de dollars. Le Sustainable Investing Group de Goldman Sachs Asset Management a été le fer de lance du financement stratégique, rejoint par Shell Ventures. L'investissement propulsera les efforts de GridPoint pour décarboner les bâtiments commerciaux et faire progresser la modernisation du réseau

- En décembre 2021, ACUITY BRANDS, INC. a lancé Atrius Building Manager, une solution cloud visant à réduire les coûts et à améliorer l'efficacité des bâtiments. La plateforme lancée aujourd'hui se concentre initialement sur le contrôle de l'éclairage pour réduire les dépenses opérationnelles et augmenter la satisfaction des occupants. Atrius Building Manager offre des fonctionnalités évolutives et intégrées pour une visibilité et une automatisation améliorées sur différents types de bâtiments commerciaux. Ce lancement a aidé l'entreprise à répondre à la demande des consommateurs en proposant des options comparativement moins chères pour gérer les systèmes d'éclairage et en réduisant les coûts de main-d'œuvre

Portée du marché mondial des systèmes de gestion des bâtiments

Le marché mondial des systèmes de gestion des bâtiments est divisé en trois segments notables en fonction du type de système, de la technologie et de l'application. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de système

- Systèmes de gestion des installations (FMS)

- Systèmes de sécurité et de contrôle d'accès

- Systèmes de gestion de l'énergie

- Logiciel de gestion de bâtiment (BMS)

- Systèmes de protection contre les incendies

- Autres

Sur la base du type de système, le marché mondial des systèmes de gestion des bâtiments est segmenté en systèmes de gestion des installations (FMS), systèmes de protection incendie, systèmes de sécurité et de contrôle d'accès, systèmes de gestion de l'énergie, logiciels de gestion des bâtiments (BMS) et autres.

Technologie

- Technologies sans fil

- Technologies câblées

Sur la base de la technologie, le marché mondial des systèmes de gestion des bâtiments est segmenté en technologies sans fil et technologies filaires.

Application

- Résidentiel

- Commercial

- Industriel

Sur la base des applications, le marché mondial des systèmes de gestion des bâtiments est segmenté en résidentiel, commercial et industriel.

Analyse/perspectives régionales du marché mondial des systèmes de gestion des bâtiments

Le marché mondial des systèmes de gestion des bâtiments est segmenté en trois segments notables en fonction du type de système, de la technologie et de l'application.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada, le Mexique, l'Allemagne, la France, le Royaume-Uni, l'Italie, la Turquie, l'Espagne, les Pays-Bas, la Russie, la Belgique, la Suisse, le reste de l'Europe, la Chine, le Japon, la Corée du Sud, l'Inde, l'Australie, Singapour, la Malaisie, la Thaïlande, les Philippines, l'Indonésie, le reste de l'Asie-Pacifique, l'Arabie saoudite, les Émirats arabes unis, l'Afrique du Sud, Israël, l'Égypte, le reste du Moyen-Orient et de l'Afrique, le Brésil, l'Argentine et le reste de l'Amérique du Sud.

L’Europe devrait dominer le marché mondial des systèmes de gestion des bâtiments, car elle dispose de grands fabricants et d’une forte demande de BMS. L’Allemagne devrait dominer la région Europe en raison de l’augmentation des incidents de sécurité et de la hausse du besoin de solutions de sécurité innovantes. Les États-Unis devraient dominer la région Amérique du Nord en raison de la capacité de dépense accrue des consommateurs pour numériser les installations de construction, ce qui accroît la demande du marché. La Chine devrait dominer la région Asie-Pacifique en raison de la demande croissante de bâtiments respectueux de l’environnement.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des tarifs nationaux et des routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du marché mondial des systèmes de gestion des bâtiments

Le paysage concurrentiel du marché mondial des systèmes de gestion des bâtiments fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché.

Certains des principaux acteurs du marché opérant sur ce marché mondial des systèmes de gestion des bâtiments sont Johnson Controls, Schneider Electric, Siemens, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Trane Technologies plc, IBM, Convergint Technologies LLC, Veolia, Delta Controls, ACUITY BRANDS, INC., Snap One, LLC, Virtusa Corp., Crestron Electronics, Beckhoff Automation GmbH & Co. KG, Bajaj Electricals Ltd, GridPoint, UNIPOWER, Novius Services, Elipse Software, BuildingIQ et Axonator Inc, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BUILDING MANAGEMENT SYSTEM MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 SYSTEM TYPE TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.2 REGULATIONS

4.3 BUILDING AUTOMATION SYSTEM REGULATIONS

4.4 TRADE AND TARIFF ANALYSIS

4.5 AVERAGE SELLING PRICE ANALYSIS

4.6 MARKET LANDSCAPE OF AUSTRALIAN MANUFACTURES AND THEIR COMPETENCIES

4.7 BUILDING AUTOMATION SYSTEM ECOSYSTEM

4.8 ATTRACTIVE OPPORTUNITIES IN THE BUILDING AUTOMATION SYSTEM MARKET

4.9 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 UPSURGE IN THE FOCUS ON DESIGNING ENERGY-EFFICIENT AND ECO-FRIENDLY BUILDINGS

5.1.2 RISING ADOPTION OF AUTOMATED SECURITY SYSTEMS IN COMMERCIAL BUILDINGS

5.1.3 GROWING POPULARITY OF IOT BUILDING AUTOMATION SYSTEMS

5.1.4 INCREASING DEMAND FOR WIRELESS SENSOR NETWORK TECHNOLOGY

5.2 RESTRAINTS

5.2.1 EMERGENCE OF SECURITY ISSUES

5.2.2 HIGH MAINTENANCE COST OF BUILDING AUTOMATION SYSTEMS

5.3 OPPORTUNITIES

5.3.1 FAVORABLE GOVERNMENT INITIATIVES AND INCENTIVES FOR EMERGING SMART CITIES

5.3.2 SHIFTING CONSUMER’S PREFERENCE TOWARDS HVAC CONTROL SYSTEMS

5.3.3 INCREASING COLLABORATION AND PARTNERSHIPS FOR BUILDING MANAGEMENT SYSTEMS

5.4 CHALLENGES

5.4.1 INVOLVEMENT OF VARIOUS LENGTHY COMMUNICATION PROTOCOLS DURING THE INSTALLATION PROCESS

5.4.2 FALSE NOTION ABOUT HIGH INSTALLATION COSTS OF BUILDING MANAGEMENT SYSTEMS

6 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE

6.1 OVERVIEW

6.2 FACILITY MANAGEMENT SYSTEMS (FMS)

6.2.1 FACILITY MANAGEMENT SYSTEMS(FMS), BY TYPE

6.2.1.1 HVAC CONTROL SYSTEMS

6.2.1.1.1 HVAC CONTROL SYSTEMS, BY TYPE

6.2.1.1.1.1 SENSORS

6.2.1.1.1.2 ACTUATORS

6.2.1.1.1.3 ACTUATORS, BY TYPE

6.2.1.1.1.4 ELECTRIC

6.2.1.1.1.5 HYDRAULIC

6.2.1.1.1.6 PNEUMATIC

6.2.1.1.1.7 CONTROL VALVES

6.2.1.1.1.8 HEATING AND COOLING COILS

6.2.1.1.1.9 SMART THERMOSTATS

6.2.1.1.1.10 PUMPS AND FANS

6.2.1.1.1.11 DAMPERS

6.2.1.1.1.12 DAMPERS, BY TYPE

6.2.1.1.1.13 PARALLEL AND OPPOSED BLADE DAMPERS

6.2.1.1.1.14 LOW-LEAKAGE DAMPERS

6.2.1.1.1.15 ROUND DAMPERS

6.2.1.1.1.16 OTHERS

6.2.1.2 SMART DEVICES

6.2.1.2.1 SMART DEVICES, BY TYPE

6.2.1.2.1.1 SMART APPLIANCES

6.2.1.2.1.2 ENVIRONMENT AND AIR QUALITY MONITORING SYSTEMS

6.2.1.2.1.3 SMART METER

6.2.1.3 LIGHTING CONTROL SYSTEMS

6.2.1.3.1 LIGHTING CONTROL SYSTEMS, BY SYSTEM

6.2.1.3.1.1 HARDWARE

6.2.1.3.1.2 HARDWARE, BY TYPE

6.2.1.3.1.3 RECEIVERS

6.2.1.3.1.4 ACTUATORS

6.2.1.3.1.5 TRANSMITTERS

6.2.1.3.1.6 SENSORS

6.2.1.3.1.7 TIMERS

6.2.1.3.1.8 RELAY

6.2.1.3.1.9 SOFTWARE

6.2.1.3.1.10 SERVICES

6.2.1.3.1.11 SERVICES, BY TYPE

6.2.1.3.1.12 INSTALLATION

6.2.1.3.1.13 SUPPORT AND MAINTENANCE

6.3 SECURITY AND ACCESS CONTROL SYSTEMS

6.3.1 SECURITY AND ACCESS CONTROL SYSTEMS, BY TYPE

6.3.1.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

6.3.1.1.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEM, BY SYSTEM

6.3.1.1.1.1 HARDWARE

6.3.1.1.1.2 HARDWARE, BY TYPE

6.3.1.1.1.3 MULTI FACTOR AUTHENTICATION

6.3.1.1.1.4 SINGLE FACTOR AUTHENTICATION

6.3.1.1.1.5 SOFTWARE

6.3.1.1.1.6 SERVICES

6.3.1.1.1.7 SERVICES, BY TYPE

6.3.1.1.1.8 INSTALLATION

6.3.1.1.1.9 SUPPORT & MAINTENANCE

6.3.1.1.1.10 ACCESS CONTROL AS A SERVICE (ACAAS)

6.3.1.2 VIDEO SURVEILLANCE SYSTEMS

6.3.1.2.1 VIDEO SURVEILLANCE SYSTEMS, BY TYPE

6.3.1.2.1.1 HARDWARE

6.3.1.2.1.2 HARDWARE, BY TYPE

6.3.1.2.1.3 CAMERAS

6.3.1.2.1.4 STORAGE SYSTEMS

6.3.1.2.1.5 ACCESSORIES

6.3.1.2.1.6 MONITORS

6.3.1.2.1.7 SOFTWARE

6.3.1.2.1.8 SERVICES

6.3.1.2.1.9 SERVICES, BY TYPE

6.3.1.2.1.10 INSTALLATION

6.3.1.2.1.11 SUPPORT & MAINTENANCE

6.3.1.2.1.12 VIDEO SURVEILLANCE AS A SERVICE (VSAAS)

6.4 ENERGY MANAGEMENT SYSTEMS

6.5 BUILDING MANAGEMENT SOFTWARE (BMS)

6.6 FIRE PROTECTION SYSTEMS

6.6.1 FIRE PROTECTION SYSTEMS BY TYPE

6.6.1.1 SENSORS AND DETECTORS

6.6.1.1.1 SENSORS AND DETECTORS, BY TYPE

6.6.1.1.1.1 SMOKE DETECTORS

6.6.1.1.1.2 SMOKE DETECTORS, BY TYPE

6.6.1.1.1.3 DUAL-SENSOR SMOKE DETECTORS

6.6.1.1.1.4 IONIZATION

6.6.1.1.1.5 PHOTOELECTRIC

6.6.1.1.1.6 FLAME DETECTORS

6.6.1.1.1.7 FLAME DETECTORS, BY TYPE

6.6.1.1.1.8 SINGLE IR /SINGLE UV

6.6.1.1.1.9 DUAL IR /SINGLE UV

6.6.1.1.1.10 MULTI IR /SINGLE UV

6.7 OTHERS

7 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 WIRELESS TECHNOLOGIES

7.2.1 ZIGBEE

7.2.2 Z–WAVE

7.2.3 ENOCEAN

7.2.4 WI-FI

7.2.5 THREAD

7.2.6 BLUETOOTH

7.2.7 INFRARED

7.3 WIRED TECHNOLOGIES

7.3.1 KNX

7.3.2 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

7.3.3 BUILDING AUTOMATION AND CONTROL NETWORK (BACNET)

7.3.4 LONWORKS

7.3.5 MODBUS

8 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 RESIDENTIAL

8.2.1 FACILITY MANAGEMENT SYSTEMS (FMS)

8.2.1.1 HVAC CONTROL SYSTEMS

8.2.1.2 SMART DEVICES

8.2.1.3 LIGHTING CONTROL SYSTEMS

8.2.2 SECURITY AND ACCESS CONTROL SYSTEMS

8.2.2.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

8.2.2.2 VIDEO SURVEILLANCE SYSTEMS

8.2.3 ENERGY MANAGEMENT SYSTEMS

8.2.4 BUILDING MANAGEMENT SOFTWARE (BMS)

8.2.5 FIRE PROTECTION SYSTEMS

8.2.6 OTHERS

8.3 COMMERCIAL

8.3.1.1 AIRPORTS AND RAILWAY STATIONS

8.3.1.2 GOVERNMENT

8.3.1.3 HOSPITALS AND HEALTHCARE FACILITIES

8.3.1.4 HOSPITALITY

8.3.1.5 OFFICE BUILDINGS

8.3.1.6 RETAIL AND PUBLIC ASSEMBLY BUILDINGS

8.3.1.7 EDUCATION

8.3.1.8 OTHERS

8.3.1.9 FACILITY MANAGEMENT SYSTEMS (FMS)

8.3.1.9.1 HVAC CONTROL SYSTEMS

8.3.1.9.2 SMART DEVICES

8.3.1.9.3 LIGHTING CONTROL SYSTEMS

8.3.1.10 SECURITY AND ACCESS CONTROL SYSTEMS

8.3.1.10.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

8.3.1.10.2 VIDEO SURVEILLANCE SYSTEMS

8.3.1.11 ENERGY MANAGEMENT SYSTEMS

8.3.1.12 BUILDING MANAGEMENT SOFTWARE (BMS)

8.3.1.13 FIRE PROTECTION SYSTEMS

8.3.1.14 OTHERS

8.4 INDUSTRIAL

8.4.1 FACILITY MANAGEMENT SYSTEMS (FMS)

8.4.1.1 HVAC CONTROL SYSTEMS

8.4.1.2 SMART DEVICES

8.4.1.3 LIGHTING CONTROL SYSTEMS

8.4.2 SECURITY AND ACCESS CONTROL SYSTEMS

8.4.2.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

8.4.2.2 VIDEO SURVEILLANCE SYSTEMS

8.4.3 ENERGY MANAGEMENT SYSTEMS

8.4.4 BUILDING MANAGEMENT SOFTWARE (BMS)

8.4.5 FIRE PROTECTION SYSTEMS

8.4.6 OTHERS

9 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY REGION

9.1 OVERVIEW

10 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

10.6 COMPANY SHARE ANALYSIS: SOUTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 JOHNSON CONTROLS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 SCHNEIDER ELECTRIC

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 SIEMENS

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 HONEYWELL INTERNATIONAL INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ACUITY BRANDS, INC.

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 AXONATOR INC

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BECKHOFF AUTOMATION GMBH & CO. KG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 BAJAJ ELECTRICALS LTD

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 BUILDINGIQ

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 CONVERGINT TECHNOLOGIES LLC

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 CRESTON ELECTRONICS

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 DELTA CONTROLS

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 ELIPSE SOFTWARE

12.14.1 COMPANY SNAPSHOT

12.14.2 SOLUTION PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 GRIDPOINT

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 IBM

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENT

12.17 NOVIUS SERVICES

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 SNAP ONE, LLC

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 SOLUTION PORTFOLIO

12.18.4 RECENT DEVELOPMENT

12.19 TRANE TECHNOLOGIES PLC

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENT

12.2 UNIPOWER

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENT

12.21 VEOLIA

12.21.1 COMPANY SNAPSHOT

12.21.2 REVENUE ANALYSIS

12.21.3 SOLUTION PORTFOLIO

12.21.4 RECENT DEVELOPMENTS

12.22 VIRTUSA CORP.

12.22.1 COMPANY SNAPSHOT

12.22.2 SERVICE PORTFOLIO

12.22.3 RECENT DEVELOPMENT

13 QUESTIONNAIRES

14 RELATED REPORTS

Liste des tableaux

TABLE 1 BUILDING AUTOMATION SYSTEM REGULATIONS

TABLE 2 VIDEO SURVEILLANCE PRIVACY AND WIRETAPPING REGULATIONS

TABLE 3 GOVERNMENT REGULATIONS FOR BIOMETRIC SYSTEM

TABLE 4 COMPREHENSIVE IMPORT DATA OF THE BUILDING MANAGEMENT SYSTEM

TABLE 5 COMPREHENSIVE EXPORT DATA OF THE BUILDING MANAGEMENT SYSTEM

TABLE 6 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 GLOBAL FACILITY MANAGEMENT SYSTEMS(FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 GLOBAL HVAC CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 10 GLOBAL ACTUATORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 GLOBAL DAMPERS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 GLOBAL SMART DEVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 GLOBAL LIGHTING CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 14 GLOBAL HARDWARE IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 15 GLOBAL SERVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 17 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 GLOBAL BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 19 GLOBAL HARDWARE IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 GLOBAL SERVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 21 GLOBAL VIDEO SURVEILLANCE SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 GLOBAL HARDWARE IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 GLOBAL SERVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 GLOBAL ENERGY MANAGEMENT SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 GLOBAL BUILDING MANAGEMENT SOFTWARE (BMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 26 GLOBAL FIRE PROTECTION SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 GLOBAL FIRE PROTECTION SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 28 GLOBAL SENSORS AND DETECTORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 29 GOBAL SMOKE DETECTORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 GLOBAL FLAME DETECTORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 31 GLOBAL OTHERS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 33 GLOBAL WIRELESS TECHNOLOGIES IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 GLOBAL WIRELESS TECHNOLOGIES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 35 GLOBAL WIRED TECHNOLOGIES IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 GLOBAL MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 37 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 38 GLOBAL RESIDENTIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 GLOBAL RESIDENTIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 40 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 41 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 42 GLOBAL COMMERCIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 GLOBAL COMMERCIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 44 GLOBAL COMMERCIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 45 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 46 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 GLOBAL INDUSTRIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 48 GLOBAL INDUSTRIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

Liste des figures

FIGURE 1 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: GLOBAL VS. REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SYSTEM TYPE TIMELINE CURVE

FIGURE 8 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 12 EUROPE IS EXPECTED TO DOMINATE THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 13 UPSURGE IN THE FOCUS ON DESIGNING ENERGY-EFFICIENT AND ECO-FRIENDLY BUILDINGS IS DRIVING THE GROWTH OF THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 14 FACILITY MANAGEMENT SYSTEMS (FMS) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET IN 2024 AND 2031

FIGURE 15 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR BUILDING MANAGEMENT SYSTEM MARKET MANUFACTURERS IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 16 AUSTRALIAN MANUFACTURES AND THEIR COMPETENCIES

FIGURE 17 VALUE CHAIN ANALYSIS FOR GLOBAL BUILDING MANAGEMENT SYSTEM MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET

FIGURE 19 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: BY SYSTEM TYPE, 2023

FIGURE 20 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: BY TECHNOLOGY, 2023

FIGURE 21 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: BY APPLICATION, 2023

FIGURE 22 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SNAPSHOT (2023)

FIGURE 23 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 24 NORTH AMERICA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 25 EUROPE BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 26 ASIA-PACIFIC BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 27 MIDDLE EAST AND AFRICA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 28 SOUTH AMERICA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.