Marché mondial de l'échantillonnage aseptique, par produit (échantillonnage aseptique manuel et système/instruments d'échantillonnage automatisé), type (échantillonnage aseptique manuel et échantillonnage aseptique automatisé), technique (technique d'échantillonnage hors ligne, technique d'échantillonnage en ligne et échantillonnage aseptique en ligne), application (processus en amont et processus en aval), utilisateur final (fabricants de biotechnologie et de produits pharmaceutiques, organisation de fabrication sous contrat, organisation de recherche sous contrat, départements universitaires et de R&D, et autres), canal de distribution (appel d'offres direct, distributeur tiers et autres) Tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et perspectives du marché de l'échantillonnage aseptique

Le marché des échantillons aseptiques fournit des produits et des services pour la collecte, le transport et le stockage d'échantillons stériles dans diverses industries, notamment les produits pharmaceutiques, la biotechnologie et l'alimentation et les boissons. L'échantillonnage aseptique fait référence à l'utilisation de techniques et de méthodes qui empêchent l'entrée de micro-organismes et d'autres contaminants pendant le processus d'échantillonnage et garantissent l'intégrité et la précision de l'échantillon.

Le marché de l'échantillonnage aseptique est influencé par la demande croissante de produits biologiques, de vaccins et d'autres médicaments complexes, les investissements dans les activités de R&D et les exigences de conformité réglementaire. Les produits biologiques et autres médicaments complexes nécessitent un contrôle strict de la stérilité et de la pureté des produits, ce qui augmente la demande de produits et de services d'échantillonnage aseptique. Les investissements dans la R&D pour développer des traitements avancés tels que la thérapie génique, la thérapie par cellules souches et la médecine personnalisée contribuent également à la croissance du marché. Les exigences croissantes de conformité réglementaire en matière de contrôle de la qualité et de sécurité augmentent également la demande de produits et de services d'échantillonnage aseptique.

Cependant, le marché est confronté à des défis tels que le coût élevé des produits et services d’échantillonnage aseptique, le manque de personnel qualifié et les exigences réglementaires complexes.

Le marché de l'échantillonnage aseptique a connu des avancées technologiques importantes ces dernières années visant à améliorer l'efficacité et la précision du processus d'échantillonnage. Les fabricants du marché mondial de l'échantillonnage aseptique se sont concentrés sur la collaboration avec des marques populaires pour attirer une plus grande base de consommateurs et proposer des instruments d'échantillonnage nouveaux et innovants.

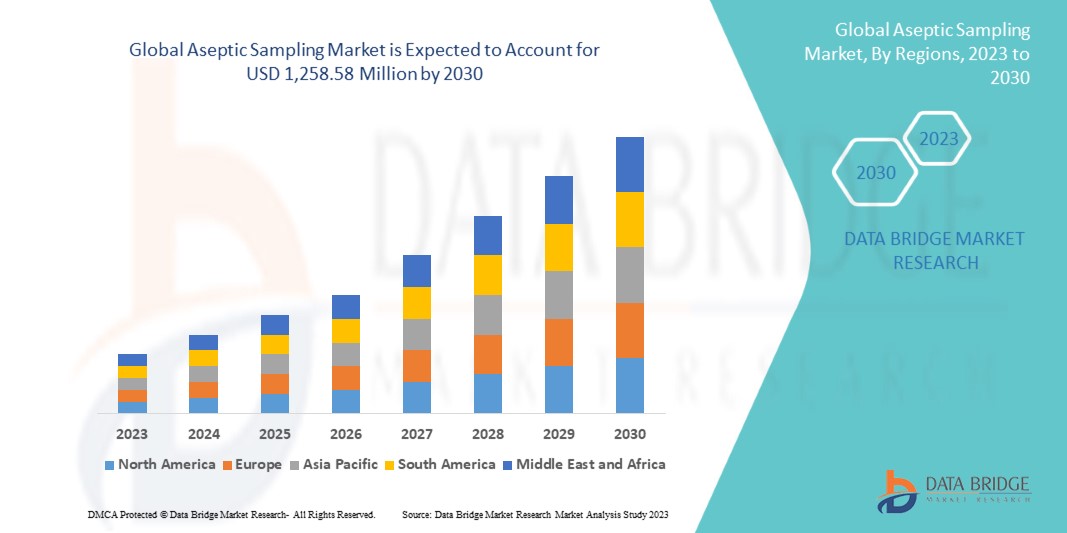

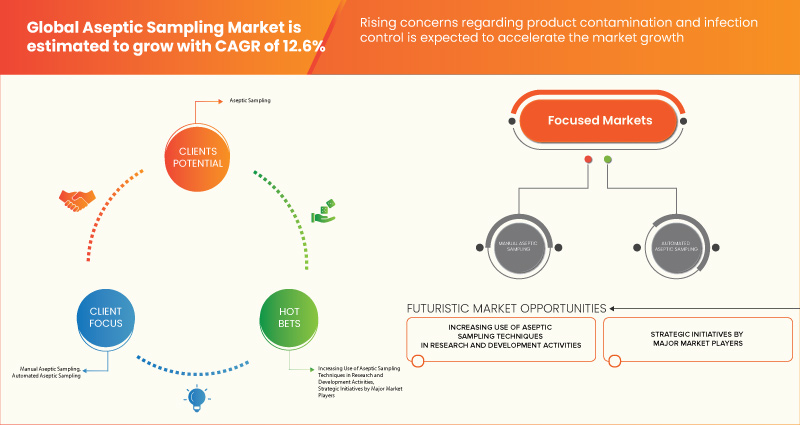

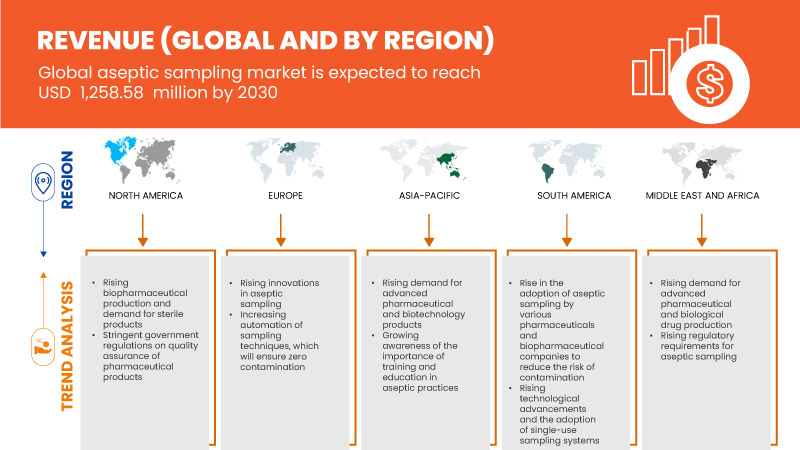

Data Bridge Market Research analyse que le marché mondial de l'échantillonnage aseptique devrait atteindre 1 258,58 millions USD d'ici 2030, à un TCAC de 12,6 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Produit (échantillonnage aseptique manuel et système/instruments d'échantillonnage automatisé), type (échantillonnage aseptique manuel et échantillonnage aseptique automatisé), technique (technique d'échantillonnage hors ligne, technique d'échantillonnage en ligne et échantillonnage aseptique en ligne), application (processus en amont et processus en aval), utilisateur final (fabricants de produits biotechnologiques et pharmaceutiques, organisation de fabrication sous contrat, organisation de recherche sous contrat, départements universitaires et de R&D, et autres), canal de distribution (appel d'offres direct, distributeur tiers et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, France, Italie, Russie, Espagne, Pays-Bas, Danemark, Suisse, Suède, Pologne, Norvège, Finlande, Belgique, Turquie, Reste de l'Europe, Chine, Japon, Inde, Nouvelle-Zélande, Australie, Corée du Sud, Indonésie, Philippines, Thaïlande, Malaisie, Singapour, Vietnam, Taïwan, Reste de l'Asie-Pacifique, Brésil, Argentine, Reste de l'Amérique du Sud, Arabie saoudite, Afrique du Sud, Bahreïn, Koweït, Oman, Qatar, Émirats arabes unis, Égypte, Israël et Reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Sartorius AG, KEOFITT A/S, KIESELMANN GmbH, THERMO FISHER SCIENTIFIC INC., GEMU Group, Flownamics, Merck KGaA, Advanced Microdevices Pvt. Ltd. Mdi, SAINT-GOBAIN,GEA Group Aktiengesellschaft, Avantor, Inc., ALFA LAVAL, WL Gore & Associates, Inc., QualiTru Sampling Systems, Aerre Inox Srl, Shanghai LePure Biotech Co., Ltd., JONENG VALVES CO., LIMITED, Burkle GmbH et Dietrich Engineering Consultants, entre autres |

Définition du marché mondial de l'échantillonnage aseptique

Le marché de l'échantillonnage aseptique désigne le marché des produits et services utilisés pour collecter et traiter des échantillons stériles à des fins de test, d'analyse et de contrôle qualité dans diverses industries, notamment les industries pharmaceutique, biotechnologique et agroalimentaire. L'échantillonnage aseptique implique des techniques et des procédures qui empêchent l'entrée de micro-organismes et d'autres contaminants pendant le processus d'échantillonnage et garantissent l'intégrité et la précision de l'échantillon.

L'échantillonnage aseptique est essentiel pour maintenir la qualité et la sécurité des produits, en particulier dans les industries pharmaceutiques et biotechnologiques, où la stérilité et la pureté des produits sont essentielles. Le processus utilise divers produits et équipements pour collecter des échantillons, tels que des sacs de collecte stériles, des bouteilles, des échantillonneurs, des pelles et d'autres fournitures.

Dynamique du marché mondial de l'échantillonnage aseptique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Réglementations et directives strictes

Des lois et des directives strictes ont été un facteur majeur de l'expansion constante du marché des échantillons aseptiques. L'échantillonnage aseptique implique la collecte d'échantillons dans un environnement stérile pour éviter la contamination et protéger l'intégrité de l'échantillon. Des règles et des directives sont en place pour garantir que ces articles respectent des exigences strictes de qualité et de sécurité. Les secteurs pharmaceutique et biotechnologique ont des normes très strictes qui doivent être respectées pour garantir la sécurité et l'efficacité de leurs produits. L'échantillonnage aseptique est donc devenu une procédure cruciale dans diverses entreprises pour éviter la contamination et garantir la qualité de leur production.

L'échantillonnage aseptique est une procédure cruciale dans les secteurs pharmaceutique et biotechnologique pour garantir la sécurité et l'efficacité des médicaments et des produits biologiques. Les organismes de réglementation comme l'Agence européenne des médicaments (EMA) et la Food and Drug Administration (FDA) des États-Unis ont établi des règles strictes pour le traitement aseptique afin d'éviter toute contamination tout au long du processus de fabrication. Ces directives exigent l'utilisation de techniques d'échantillonnage aseptiques. Ces réglementations exigent l'utilisation de techniques d'échantillonnage aseptiques pour garantir que les échantillons sont exempts de contamination microbiologique, d'endotoxines et d'autres contaminants qui pourraient affecter la qualité du produit final.

La demande de produits et services d'échantillonnage aseptique a considérablement augmenté ces dernières années. Les entreprises du marché de l'échantillonnage aseptique investissent dans la R&D pour développer de nouveaux produits et services qui répondent à des exigences et directives réglementaires strictes.

Retenue

- Manque de normalisation

L'échantillonnage aseptique dans diverses industries, notamment les produits pharmaceutiques, les biotechnologies , l'alimentation et les boissons, implique la collecte d'échantillons dans un environnement stérile pour éviter toute contamination. Les méthodes d'échantillonnage aseptique utilisées dans diverses industries et applications ne sont cependant pas universelles, ce qui peut entraîner des résultats incohérents et limiter la comparabilité des données. L'absence de normes et de standards clairs de la part des organismes de réglementation entraîne un manque de normalisation dans l'échantillonnage aseptique. Bien que les organismes de réglementation proposent des recommandations générales sur l'échantillonnage aseptique, il n'existe aucune normalisation pour les procédures d'échantillonnage, les tailles d'échantillon, les outils ou les techniques de validation. Par conséquent, il peut être difficile de produire des résultats cohérents dans diverses applications et industries et entraîner une confusion commerciale.

Des données inexactes ou incohérentes peuvent conduire à des conclusions erronées et à de mauvaises décisions dans le développement de produits, le contrôle qualité et la conformité réglementaire. Cela peut avoir de graves conséquences sur la santé et la sécurité publiques, ainsi que sur la santé financière des entreprises.

Ainsi, le manque de normalisation devrait freiner la croissance du marché mondial de l’échantillonnage aseptique.

Opportunité

Croissance des progrès technologiques

Le développement de nouvelles technologies dans le domaine de l'échantillonnage aseptique est l'un des facteurs les plus importants contribuant à l'expansion du marché de l'échantillonnage aseptique à l'échelle mondiale. Les entreprises peuvent désormais améliorer la précision, l'efficacité et la fiabilité de leurs opérations grâce au développement d'équipements et de techniques d'échantillonnage avancés. Ces développements ouvrent de nouvelles opportunités de croissance pour le marché et, par conséquent, les entreprises réalisent des investissements importants dans la recherche et le développement pour maintenir leur position de leader du marché.

Le développement de systèmes automatisés est l'une des avancées technologiques les plus importantes qui ont été réalisées dans le domaine de l'échantillonnage aseptique. Ces systèmes utilisent la robotique et l'intelligence artificielle pour améliorer la précision des procédures d'échantillonnage tout en augmentant leur vitesse. Ils améliorent la cohérence des résultats tout en réduisant simultanément le risque de contamination, ce qui conduit à une augmentation de l'efficacité globale des opérations. Les systèmes automatisés sont particulièrement utiles dans les opérations à grande échelle avec un débit d'échantillons élevé en raison de leur rapidité et de leur précision.

Les progrès des techniques d’échantillonnage stimulent également la croissance du marché mondial de l’échantillonnage aseptique. Par exemple, le développement de techniques d’échantillonnage en boucle fermée permet aux entreprises de prélever des échantillons représentatifs sans exposer le produit à l’environnement. Cette technique réduit le risque de contamination et améliore la précision des résultats. Ainsi, la croissance des avancées technologiques constitue une opportunité pour la croissance du marché mondial de l’échantillonnage aseptique.

Défi

Manque de main d'oeuvre qualifiée

Des équipements spécialisés et du personnel formé sont essentiels pour exploiter, entretenir et dépanner les systèmes d'échantillonnage aseptique. Cependant, une pénurie de personnel formé et qualifié pour exploiter ces systèmes pourrait freiner l'expansion du marché.

Le marché de l'échantillonnage aseptique est très avancé sur le plan technique et les employeurs recherchent des candidats ayant de l'expérience en microbiologie, en ingénierie et en automatisation. D'un autre côté, il se peut qu'il n'y ait pas suffisamment de travailleurs qualifiés dans ces régions pour soutenir la mise en œuvre de systèmes d'échantillonnage aseptique. Cela pourrait entraîner des délais de mise en œuvre du système plus longs, des coûts de formation plus élevés et une baisse de productivité en raison du manque d'expérience du personnel.

De plus, le taux de rotation élevé du personnel qualifié peut rendre le problème du manque de main-d'œuvre qualifiée encore plus difficile à résoudre. Lorsque des employés compétents quittent leur poste, ils emportent avec eux les connaissances et l'expérience nécessaires pour exploiter efficacement les systèmes d'échantillonnage aseptique. Par conséquent, cela peut réduire l'efficacité, la productivité, les temps d'arrêt et les coûts de maintenance.

En conclusion, le manque de main-d’œuvre qualifiée constitue un défi majeur dans l’expansion du marché mondial de l’échantillonnage aseptique.

Développements récents

- En juin 2022, Merck kGaA a annoncé une collaboration avec Agilent Technologies pour combler le manque de technologies d'analyse de processus pour le traitement en aval. Cette collaboration contribuera à une nouvelle augmentation des revenus.

- En novembre 2021, Sartorius AG, l'un des principaux partenaires internationaux de la recherche en sciences de la vie et de l'industrie biopharmaceutique, a annoncé avoir reçu le prix du « Meilleur fournisseur de bioprocédés » lors des Europe Bioprocessing Excellence Awards 2021. Ce prix a aidé l'entreprise à faire reconnaître son travail.

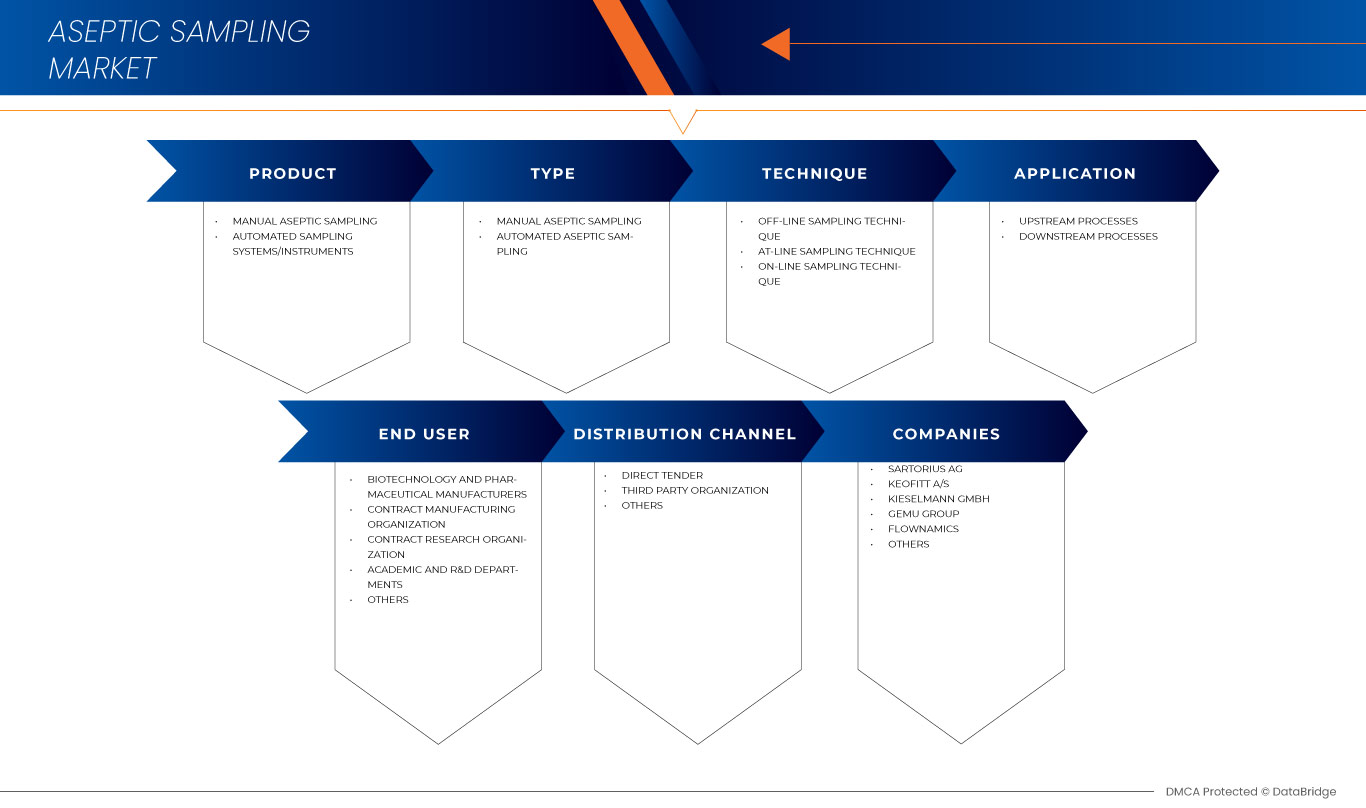

Portée du marché mondial de l'échantillonnage aseptique

Le marché mondial de l'échantillonnage aseptique est segmenté en six segments notables : produit, type, technique, application, utilisateur final et canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Produit

- Échantillonnage aseptique manuel

- Système/instruments d'échantillonnage automatisé

Sur la base du produit, le marché mondial de l’échantillonnage aseptique est segmenté en échantillonnage aseptique manuel et en systèmes/instruments d’échantillonnage automatisés.

Taper

- Échantillonnage aseptique manuel

- Échantillonnage aseptique automatisé

Sur la base du type, le marché mondial de l’échantillonnage aseptique est segmenté en échantillonnage aseptique manuel et échantillonnage aseptique automatisé.

Technique

- Technique d'échantillonnage hors ligne

- Technique d'échantillonnage en ligne

- Technique d'échantillonnage en ligne

Sur la base de la technique, le marché mondial de l’échantillonnage aseptique est segmenté en technique d’échantillonnage hors ligne, technique d’échantillonnage en ligne et technique d’échantillonnage en ligne.

Application

- Processus en amont

- Processus en aval

Sur la base de l’application, le marché mondial de l’échantillonnage aseptique est segmenté en processus en amont et en processus en aval.

Utilisateur final

- Fabricants de produits biotechnologiques et pharmaceutiques

- Organisation de fabrication sous contrat

- Organisation de recherche sous contrat

- Départements académiques et de recherche et développement

- Autres

Sur la base de l'utilisateur final, le marché mondial de l'échantillonnage aseptique est segmenté en fabricants de biotechnologie et de produits pharmaceutiques, organisations de fabrication sous contrat, organisations de recherche sous contrat, départements universitaires et de R&D, et autres.

Canal de distribution

- Appel d'offres direct

- Distributeur tiers

- Autres

Sur la base du canal de distribution, le marché mondial de l'échantillonnage aseptique est segmenté en appel d'offres direct, distributeur tiers et autres.

Analyse/perspectives régionales du marché mondial de l'échantillonnage aseptique

Le marché mondial de l’échantillonnage aseptique est classé en six segments et zones géographiques notables.

Le marché mondial de l’échantillonnage aseptique est segmenté en six segments notables : produit, type, technique, application, utilisateur final et canal de distribution.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada, le Mexique, l'Allemagne, le Royaume-Uni, la France, l'Italie, la Russie, l'Espagne, les Pays-Bas, le Danemark, la Suisse, la Suède, la Pologne, la Norvège, la Finlande, la Belgique, la Turquie, le reste de l'Europe, la Chine, le Japon, l'Inde, la Nouvelle-Zélande, l'Australie, la Corée du Sud, l'Indonésie, les Philippines, la Thaïlande, la Malaisie, Singapour, le Vietnam, Taïwan, le reste de l'Asie-Pacifique, le Brésil, l'Argentine, le reste de l'Amérique du Sud, l'Arabie saoudite, l'Afrique du Sud, Bahreïn, le Koweït, Oman, le Qatar, les Émirats arabes unis, l'Égypte, Israël et le reste du Moyen-Orient et de l'Afrique.

L'Amérique du Nord domine le marché en raison de l'augmentation des investissements dans l'échantillonnage aseptique qui devrait stimuler la croissance du marché. Les États-Unis dominent l'Amérique du Nord en raison de la forte présence d'acteurs clés. L'Allemagne domine l'Europe en raison de la demande croissante d'échantillonnage aseptique dans les marchés émergents et de l'expansion. La Chine domine la région Asie-Pacifique en raison de la tendance croissante des clients à adopter des processus technologiques avancés.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et leurs défis en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché mondiales de l'échantillonnage aseptique

Le paysage concurrentiel du marché mondial de l'échantillonnage aseptique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et la portée du produit, la domination de l'application, la courbe de vie du type de produit. Les points de données ci-dessus ne concernent que l'orientation de l'entreprise vers le marché mondial de l'échantillonnage aseptique.

Français Certains des principaux acteurs opérant sur le marché de l'échantillonnage aseptique sont Sartorius AG, KEOFITT A/S, KIESELMANN GmbH, THERMO FISHER SCIENTIFIC INC., GEMU Group, Flownamics, Merck KGaA, Advanced Microdevices Pvt. Ltd. Mdi, SAINT-GOBAIN,GEA Group Aktiengesellschaft, Avantor, Inc., ALFA LAVAL, WL Gore & Associates, Inc., QualiTru Sampling Systems, Aerre Inox Srl, Shanghai LePure Biotech Co., Ltd., JONENG VALVES CO., LIMITED, Burkle GmbH et Dietrich Engineering Consultants, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL ASEPTIC SAMPLING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 STRATEGIC INITIATIVES

5 INDUSTRY INSIGHTS

6 REGULATORY FRAMEWORK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 STRINGENT REGULATIONS AND GUIDELINES

7.1.2 RISING DEMAND FOR ADVANCED PHARMACEUTICAL AND BIOTECHNOLOGY PRODUCTS

7.1.3 INCREASING FOCUS ON QUALITY ASSURANCE AND GROWING AWARENESS OF ASEPTIC PRACTICES

7.1.4 GROWING R&D ACTIVITIES AND NEW APPROVALS AND LAUNCHES OF ASEPTIC SAMPLING PRODUCTS

7.2 RESTRAINTS

7.2.1 LACK OF STANDARDISATION

7.2.2 ALTERNATIVE SAMPLING TECHNIQUES

7.3 OPPORTUNITIES

7.3.1 GROWTH IN TECHNOLOGICAL ADVANCEMENTS

7.3.2 INCREASING ADOPTION OF SINGLE-USE ASEPTIC SAMPLING SYSTEMS

7.3.3 INCREASING DEMAND FOR STERILE PHARMACEUTICAL FORMULATIONS

7.4 CHALLENGES

7.4.1 HIGH INSTALLATION AND OPERATIONAL COSTS

7.4.2 LACK OF SKILLED WORKFORCE

8 GLOBAL ASEPTIC SAMPLING MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 MANUAL ASEPTIC SAMPLING

8.3 AUTOMATED SAMPLING INSTRUMENTS/SYSTEMS

9 GLOBAL ASEPTIC SAMPLING MARKET, BY TYPE

9.1 OVERVIEW

9.2 MANUAL ASEPTIC SAMPLING

9.3 AUTOMATED ASEPTIC SAMPLING

10 GLOBAL ASEPTIC SAMPLING MARKET, BY TECHNIQUE

10.1 OVERVIEW

10.2 OFF-LINE SAMPLING TECHNIQUE

10.3 AT-LINE SAMPLING TECHNIQUE

10.4 ON-LINE SAMPLING TECHNIQUE

11 GLOBAL ASEPTIC SAMPLING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 UPSTREAM PROCESSES

11.3 DOWNSTREAM PROCESSES

12 GLOBAL ASEPTIC SAMPLING MARKET, BY END USER

12.1 OVERVIEW

12.2 BIOTECHNOLOGY AND PHARMACEUTICAL MANUFACTURERS

12.3 CONTRACT MANUFACTURING ORGANIZATION

12.4 CONTRACT RESEARCH ORGANIZATION

12.5 ACADEMIC AND R&D DEPARTMENTS

12.6 OTHERS

13 GLOBAL ASEPTIC SAMPLING MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 THIRD PARTY DISTRIBUTOR

13.4 OTHERS

14 GLOBAL ASEPTIC SAMPLING MARKET, BY REGION

14.1 OVERVIEW

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 GERMANY

14.3.2 FRANCE

14.3.3 U.K.

14.3.4 ITALY

14.3.5 SPAIN

14.3.6 RUSSIA

14.3.7 TURKEY

14.3.8 BELGIUM

14.3.9 DENMARK

14.3.10 NETHERLANDS

14.3.11 SWITZERLAND

14.3.12 SWEDEN

14.3.13 POLAND

14.3.14 NORWAY

14.3.15 FINLAND

14.3.16 REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1 CHINA

14.4.2 JAPAN

14.4.3 INDIA

14.4.4 SOUTH KOREA

14.4.5 AUSTRALIA

14.4.6 SINGAPORE

14.4.7 THAILAND

14.4.8 INDONESIA

14.4.9 PHILIPPINES

14.4.10 MALAYSIA

14.4.11 NEW ZEALAND

14.4.12 VIETNAM

14.4.13 TAIWAN

14.4.14 REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1 BRAZIL

14.5.2 ARGENTINA

14.5.3 REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1 SOUTH AFRICA

14.6.2 SAUDI ARABIA

14.6.3 BAHRAIN

14.6.4 U.A.E.

14.6.5 KUWAIT

14.6.6 OMAN

14.6.7 QATAR

14.6.8 EGYPT

14.6.9 ISRAEL

14.6.10 REST OF MIDDLE EAST AND AFRICA

15 GLOBAL ASEPTIC SAMPLING MARKET_: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16 COMPANY PROFILE

16.1 SARTORIUS AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 KIESELMANN GMBH

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 SAINT-GOBAIN

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 MERCK KGAA

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 ALFA LAVAL

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADVANCED MICRODEVICES PVT. LTD. MDI

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AVANTOR, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 COMPANY SHARE ANALYSIS

16.7.4 PRODUCT PORTFOLIO

16.7.5 RECENT DEVELOPMENT

16.8 AERRE INOX S.R.L.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BURKLE GMBH

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DIETRICH ENGINEERING CONSULTANTS

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 FLOWNAMICS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 GEMU GROUP

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 GEA GROUP AKTIENGESELLSCHAFT (2022)

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 COMPANY SHARE ANALYSIS

16.13.4 PRODUCT PORTFOLIO

16.13.5 RECENT DEVELOPMENTS

16.14 JONENG VALVES CO., LIMITED

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 KEOFITT A/S

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 QUALITRU SAMPLING SYSTEMS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SHANGHAI LEPURE BIOTECH CO., LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 THERMO FISHER SCIENTIFIC INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 COMPANY SHARE ANALYSIS

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENT

16.19 W.L. GORE & ASSOCIATES, INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 COMPANY SHARE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des figures

FIGURE 1 GLOBAL ASEPTIC SAMPLING MARKET: SEGMENTATION

FIGURE 2 GLOBAL ASEPTIC SAMPLING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL ASEPTIC SAMPLING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL ASEPTIC SAMPLING MARKET : GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL ASEPTIC SAMPLING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL ASEPTIC SAMPLING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL ASEPTIC SAMPLING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL ASEPTIC SAMPLING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 GLOBAL ASEPTIC SAMPLING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL ASEPTIC SAMPLING MARKET: SEGMENTATION

FIGURE 11 STRINGENT REGULATIONS AND GUIDELINES IN VARIOUS INDUSTRIES FOR QUALITY PRODUCTS ARE EXPECTED TO DRIVE THE GLOBAL ASEPTIC SAMPLING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 MANUAL ASEPTIC SAMPLING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL ASEPTIC SAMPLING MARKET IN THE FORECAST PERIOD OF 20213 & 2030

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL ASEPTIC SAMPLING MARKET, AND EUROPE IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 EUROPE IS THE FASTEST-GROWING MARKET FOR ASEPTIC SAMPLING MANUFACTURERS IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL ASEPTIC SAMPLING MARKET

FIGURE 16 GLOBAL ASEPTIC SAMPLING MARKET: BY PRODUCT, 2022

FIGURE 17 GLOBAL ASEPTIC SAMPLING MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 18 GLOBAL ASEPTIC SAMPLING MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 19 GLOBAL ASEPTIC SAMPLING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 GLOBAL ASEPTIC SAMPLING MARKET: BY TYPE, 2022

FIGURE 21 GLOBAL ASEPTIC SAMPLING MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 22 GLOBAL ASEPTIC SAMPLING MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 23 GLOBAL ASEPTIC SAMPLING MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 GLOBAL ASEPTIC SAMPLING MARKET: BY TECHNIQUE, 2022

FIGURE 25 GLOBAL ASEPTIC SAMPLING MARKET: BY TECHNIQUE, 2023-2030 (USD MILLION)

FIGURE 26 GLOBAL ASEPTIC SAMPLING MARKET: BY TECHNIQUE, CAGR (2023-2030)

FIGURE 27 GLOBAL ASEPTIC SAMPLING MARKET: BY TECHNIQUE, LIFELINE CURVE

FIGURE 28 GLOBAL ASEPTIC SAMPLING MARKET: BY APPLICATION, 2022

FIGURE 29 GLOBAL ASEPTIC SAMPLING MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 30 GLOBAL ASEPTIC SAMPLING MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 31 GLOBAL ASEPTIC SAMPLING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 32 GLOBAL ASEPTIC SAMPLING MARKET: BY END USER, 2022

FIGURE 33 GLOBAL ASEPTIC SAMPLING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 34 GLOBAL ASEPTIC SAMPLING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 35 GLOBAL ASEPTIC SAMPLING MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 GLOBAL ASEPTIC SAMPLING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 37 GLOBAL ASEPTIC SAMPLING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 38 GLOBAL ASEPTIC SAMPLING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 39 GLOBAL ASEPTIC SAMPLING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 40 GLOBAL ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 41 LOBAL ASEPTIC SAMPLING MARKET : BY REGION (2022)

FIGURE 42 GLOBAL ASEPTIC SAMPLING MARKET : BY REGION (2023 & 2030)

FIGURE 43 GLOBAL ASEPTIC SAMPLING MARKET : BY REGION (2022 & 2030)

FIGURE 44 GLOBAL ASEPTIC SAMPLING MARKET : BY PRODUCT (2023-2030)

FIGURE 45 NORTH AMERICA ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 46 NORTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022)

FIGURE 47 NORTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 48 NORTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 49 NORTH AMERICA ASEPTIC SAMPLING MARKET: BY PRODUCT (2023-2030)

FIGURE 50 EUROPE ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 51 EUROPE ASEPTIC SAMPLING MARKET: BY COUNTRY (2022)

FIGURE 52 EUROPE ASEPTIC SAMPLING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 53 EUROPE ASEPTIC SAMPLING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 54 EUROPE ASEPTIC SAMPLING MARKET: BY PRODUCT (2023-2030)

FIGURE 55 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 56 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: BY COUNTRY (2022)

FIGURE 57 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 58 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 59 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: BY PRODUCT (2023-2030)

FIGURE 60 SOUTH AMERICA ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 61 SOUTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022)

FIGURE 62 SOUTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 63 SOUTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 64 SOUTH AMERICA ASEPTIC SAMPLING MARKET: BY PRODUCT (2023-2030)

FIGURE 65 MIDDLE EAST AND AFRICA ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 66 MIDDLE EAST AND AFRICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022)

FIGURE 67 MIDDLE EAST AND AFRICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 68 MIDDLE EAST AND AFRICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 69 MIDDLE EAST AND AFRICA ASEPTIC SAMPLING MARKET: BY PRODUCT (2023-2030)

FIGURE 70 GLOBAL ASEPTIC SAMPLING MARKET: COMPANY SHARE 2022 (%)

FIGURE 71 NORTH AMERICA ASEPTIC SAMPLING MARKET: COMPANY SHARE 2022 (%)

FIGURE 72 EUROPE ASEPTIC SAMPLING MARKET: COMPANY SHARE 2022 (%)

FIGURE 73 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.