Global Adipic Acid Market

Taille du marché en milliards USD

TCAC :

%

USD

6.41 Billion

USD

9.40 Billion

2024

2032

USD

6.41 Billion

USD

9.40 Billion

2024

2032

| 2025 –2032 | |

| USD 6.41 Billion | |

| USD 9.40 Billion | |

|

|

|

|

Segmentation du marché mondial de l’acide adipique, par matière première (cyclohexanol, cyclohexanone), produit final (fibres de nylon 66, résines techniques de nylon 66, polyuréthanes, esters adipiques, autres produits finaux), application (plastifiants, résines de polyester insaturé, résines de papier humide, revêtements, lubrifiants synthétiques, additifs alimentaires, autres applications), industrie utilisatrice finale (automobile, électricité et électronique, textiles, alimentation et boissons, soins personnels, produits pharmaceutiques, autres industries utilisatrices finales) – Tendances et prévisions de l’industrie jusqu’en 2032

Analyse du marché de l'acide adipique

Ces dernières années, le marché de l'acide adipique et ses produits finis ont connu une croissance linéaire. Ce taux de croissance devrait s'accélérer dans les années à venir. La qualité, la durabilité, la légèreté, l'excellente capacité d'absorption d'énergie, l'augmentation de la demande de polyamide 66 durable, ainsi que les réglementations de sécurité à venir et les techniques innovantes pour son utilisation devraient être des facteurs d'influence clés pour le marché mondial, avec un accent accru sur ses différents types et applications.

Taille du marché de l'acide adipique

La taille du marché mondial de l'acide adipique a été évaluée à 6,41 milliards USD en 2024 et devrait atteindre 9,40 milliards USD d'ici 2032, avec un TCAC de 5,5 % au cours de la période de prévision de 2025 à 2032.

Portée du rapport et segmentation du marché

|

Attributs |

Informations clés sur le marché de l'acide adipique |

|

Segmentation |

|

|

Pays couverts |

États-Unis, Canada, Mexique, Brésil, Argentine, Reste de l'Amérique du Sud, Allemagne, France, Italie, Royaume-Uni, Belgique, Espagne, Russie, Turquie, Pays-Bas, Suisse, Reste de l'Europe, Japon, Chine, Inde, Corée du Sud, Australie, Singapour, Malaisie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique, Émirats arabes unis, Arabie saoudite, Égypte, Afrique du Sud, Israël, Reste du Moyen-Orient et de l'Afrique |

|

Principaux acteurs du marché |

INVISTA (États-Unis), Asahi Kasei Corporation (Japon), TCI Chemicals (Inde) Pvt. Ltd. (Inde), Rhodia Pads (France), Ascend Performance Materials (États-Unis), Tian Li High & New Tech. Co., Ltd. (Chine), Tangshan Zhonghao Chemical Co., Ltd. (Chine), BASF SE (Allemagne), LANXESS (Allemagne), Radici Partecipazioni SpA (Italie), Solvay SA (Belgique), Sumitomo Chemical Co., Ltd. (Japon), DSM (Pays-Bas), ARD (Canada), Hongye Chem (Chine), PetroChina Company Limited (Chine) et Shandong Haili Chemical Industry Company Ltd. (Chine) |

|

Opportunités de marché |

|

Définition du marché de l'acide adipique

L'acide adipique est un composé cristallin blanc généralement utilisé dans la production de nylon 6, 6. D'un point de vue commercial, il s'agit de l'un des acides essentiels disponibles sous forme d'acides dicarboxyliques aliphatiques. Il est également utilisé pour produire des polyuréthanes comme réactif pour former des plastifiants, des composants lubrifiants et des polyols de polyester. Dans la plupart des industries de fabrication de fibres synthétiques, l'acide adipique est généralement produit par oxydation du cyclohexane ou d'autres matières premières à base de pétrole. Selon les statistiques, le cyclohexane est responsable de la production de plus de la moitié de l'acide adipique. Le reste est dérivé du cyclohexène et du cyclohexanol/cyclohexanone non couplé (huile KA).

Dynamique du marché de l'acide adipique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Utilisation accrue auprès des utilisateurs finaux

La préférence croissante pour les produits durables et légers dans les secteurs de la construction, de l'automobile et de l'électronique, l'expansion de l'industrie de la construction pour la production de matériaux isolants, d'électronique de logement et de panneaux extérieurs, la commercialisation de l'acide bio-adipique et la demande croissante en raison de procédés chimiques respectueux de l'environnement sont autant de facteurs qui accéléreront probablement la croissance du marché de l'acide adipique au cours de la période de prévision.

L'industrialisation rapide et la croissance continue de l'industrie de l'emballage et des biens de consommation propulseront davantage le taux de croissance du marché de l'acide adipique. En outre, la demande croissante de plastique de haute qualité et d'un mode de vie amélioré ainsi que la demande croissante de meubles confortables et durables stimuleront également la croissance de la valeur marchande. La pression croissante pour un air et une eau propres et la nécessité d'améliorer le niveau de traitement et de fabrication des produits finis devraient soutenir la croissance du marché.

Opportunités

Réglementation, Innovation et Recherche et Développement

En outre, diverses réglementations gouvernementales strictes en matière de sécurité ainsi que les techniques innovantes pour son utilisation étendent les opportunités rentables aux acteurs du marché au cours de la période de prévision de 2025 à 2032. De plus, les activités croissantes d'innovation et de recherche et développement pour développer du plastique biosourcé élargiront encore la croissance future du marché de l'acide adipique.

Contraintes/Défis

- Problèmes liés aux prix

Le coût de fabrication élevé de l'acide adipique synthétique, combiné à la fluctuation des prix des matières premières, devrait créer des obstacles à la croissance du marché de l'acide adipique.

- Réglementations environnementales strictes

En outre, les réglementations environnementales strictes s’avéreront un inconvénient pour le marché de l’acide adipique, ce qui devrait constituer un défi pour le taux de croissance du marché de l’acide adipique.

Ce rapport sur le marché de l'acide adipique fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de l'acide adipique, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Portée du marché de l'acide adipique

Le marché de l'acide adipique est segmenté en fonction de la matière première, du produit final, de l'application et de l'industrie utilisatrice finale. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Matière première

- Cyclohexanol

- Cyclohexanone

Produit fini

- Fibres de nylon 66

- Résines techniques en nylon 66

- Polyuréthanes, esters adipiques

- Autres produits finis

Application

- Plastifiants

- Résines de polyester insaturées

- Résines pour papier humide

- Revêtements

- Lubrifiants synthétiques

- Additifs alimentaires

- Autres applications

Secteur d'utilisation finale

- Automobile

- Électricité et électronique

- Textiles

- Alimentation et boissons

- Soins personnels

- Pharmaceutique

- Autres industries utilisatrices finales

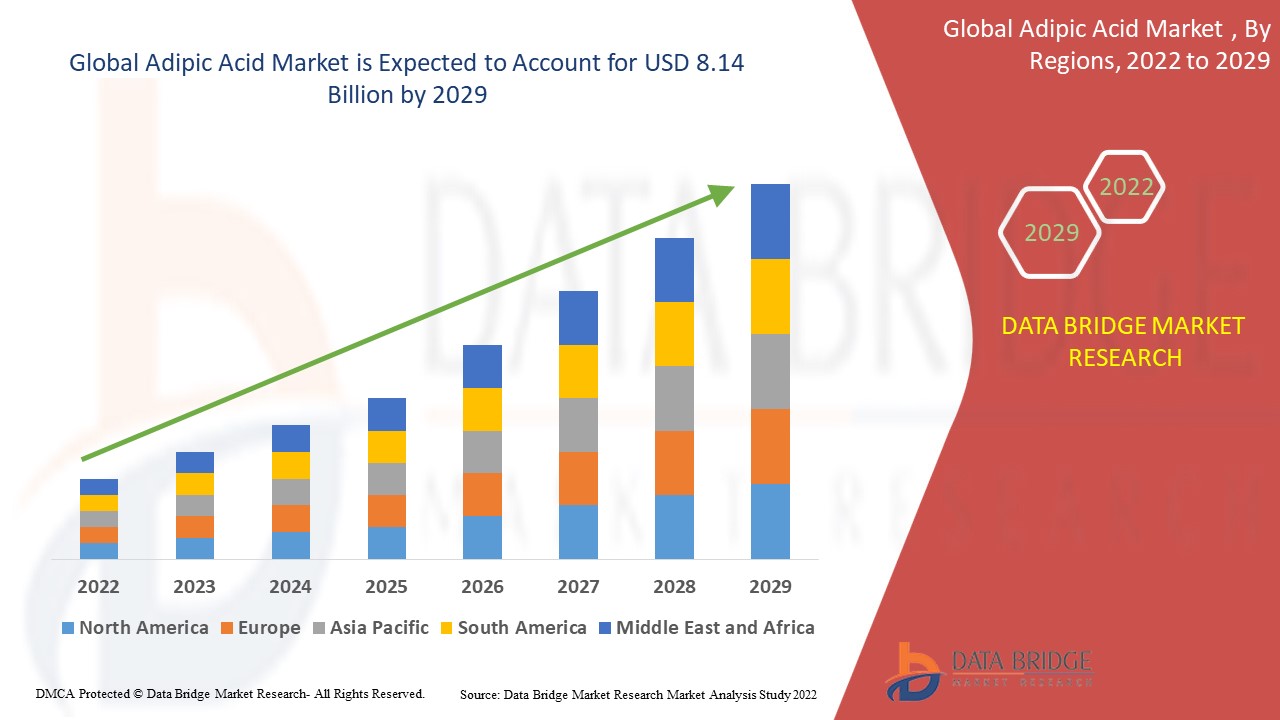

Analyse régionale du marché de l'acide adipique

Le marché de l’acide adipique est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, matière première, produit final, application et industrie de l’utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de l'acide adipique sont les États-Unis, le Canada et le Mexique en Amérique du Nord, l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie, le reste de l'Europe en Europe, la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), l'Arabie saoudite, les Émirats arabes unis, Israël, l'Égypte, l'Afrique du Sud, le reste du Moyen-Orient et de l'Afrique (MEA) dans le cadre du Moyen-Orient et de l'Afrique (MEA), le Brésil, l'Argentine et le reste de l'Amérique du Sud dans le cadre de l'Amérique du Sud.

L’Amérique du Nord domine le marché de l’acide adipique en raison de la croissance croissante de l’industrie automobile ainsi que de la prévalence du centre d’approvisionnement en polymères techniques dans la région.

D’autre part, l’Asie-Pacifique devrait afficher une croissance lucrative au cours de la période de prévision de 2025 à 2032 en raison de la prévalence d’un climat favorable aux affaires dans la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Part de marché de l'acide adipique

Le paysage concurrentiel du marché de l'acide adipique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de l'acide adipique.

Les leaders du marché de l'acide adipique opérant sur le marché sont :

- INVISTA (États-Unis)

- Asahi Kasei Corporation (Japon)

- TCI Chemicals (Inde) Pvt. Ltd., (Inde)

- Tampons Rhodia (France)

- Matériaux de performance Ascend (États-Unis)

- Tian Li High & New Tech. Co., Ltd., (Chine)

- Tangshan Zhonghao Chemical Co., Ltd. (Chine)

- BASF SE (Allemagne)

- LANXESS (Allemagne)

- Radici Partecipazioni SpA (Italie)

- Solvay SA (Belgique)

- Sumitomo Chemical Co., Ltd. (Japon)

- DSM (Pays-Bas)

- ARD (Canada)

- Hongye Chem (Chine)

- PetroChina Company Limited (Chine)

- Shandong Haili Chemical Industry Company Ltd. (Chine)

Derniers développements sur le marché de l'acide adipique

- En janvier 2020, BASF SE a annoncé l'acquisition de l'activité polyamide de Solvay afin d'étendre les capacités de BASF dans le domaine des polyamides avec des produits innovants et reconnus tels que Technyl. Cette acquisition a également permis à BASF de fournir à ses clients des solutions de plastiques techniques encore plus performantes, telles que la conduite autonome et la mobilité électrique.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.