Marché des fûts industriels de la région du CCG, par type ( fûts en plastique , fûts en acier, fûts en fibre et fûts de récupération), type de produit (tête ouverte et tête étanche), capacité (jusqu'à 100 litres, 100 à 250 litres, 250 à 500 litres et plus de 500 litres), utilisateur final (bâtiment et construction, produits chimiques et engrais, aliments et boissons, peintures, encres et colorants, pétrole brut et produits pétroliers, produits pharmaceutiques et autres) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des tambours industriels de la région du CCG

Le marché des tambours industriels de la région du CCG devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,8 % de 2023 à 2030 et devrait atteindre 996 275,86 milliers de dollars d'ici 2030. Le principal facteur à l'origine de la croissance du marché des tambours industriels est l'augmentation des échanges intercontinentaux entre les utilisateurs finaux.

Les fûts industriels transportent généralement des huiles, des carburants, des produits chimiques et de nombreuses marchandises sèches/liquides. La construction et les performances des fûts utilisés pour l'expédition de matières dangereuses. La demande croissante d'utilisation pour le stockage de produits chimiques , de pétrole et autres. La disponibilité de fûts industriels selon les spécifications des clients devrait stimuler le marché. L'augmentation des échanges transcontinentaux entre de nombreux utilisateurs finaux de pétrole, de produits chimiques, d'engrais et autres dans la région du CCG a eu un impact sur l'utilisation de fûts industriels pour le transcontinent, car l'industriel est utilisé pour stocker les produits chimiques dangereux et non dangereux et pour d'autres matériaux dans le transport des matériaux.

Le rapport sur le marché des tambours industriels de la région du CCG fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits et d'innovations technologiques sur le marché. Contactez-nous pour un briefing d'analyste afin de comprendre l'analyse et le scénario du marché. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par type (fûts en plastique, fûts en acier , fûts en fibre et fûts de récupération), type de produit (à tête ouverte et à tête étanche), capacité (jusqu'à 100 litres, de 100 à 250 litres, de 250 à 500 litres et plus de 500 litres), utilisateur final (bâtiment et construction, produits chimiques et engrais, aliments et boissons, peintures, encres et colorants, pétrole brut et produits pétroliers, produits pharmaceutiques et autres). |

|

Pays couverts |

Bahreïn, Koweït, Oman, Qatar, Arabie saoudite et Émirats arabes unis. |

|

Acteurs du marché couverts |

Français Greif, Time Technoplast Ltd., Groupe de sociétés DANA, Al Fujairah Steel Barrels and Drums LLC, Anglo American Steel LLC, Balmer Lawrie (UAE) LLC, Drum Express, Al Yamama Plastic Factory, Groupe PGTC, Al-Babtain Plastic & Insulation Materials Mfg. Co. ltd, Elan Incorporated FZE, VWR International, LLC., STARLINK Dubai LLC, INTC Steel Drums LLC, Emirates Plastic Industries Factory et Clouds Drums Dubai LLC, entre autres. |

Définition du marché

Un fût industriel est un récipient creux et circulaire utilisé pour le transport de marchandises volumineuses. Le plastique, l'acier et la fibre, entre autres matériaux, peuvent être utilisés pour fabriquer des fûts industriels. L'application détermine le matériau utilisé. Les fûts en acier sont utilisés pour le traitement chimique, tandis que les fûts en plastique sont utilisés pour les matières acides. Les fûts en fibre sont utilisés pour les matières solides. Les fûts industriels sont disponibles dans une variété de tailles. Le fût de 55 gallons, qui a une capacité de 55 gallons, est la taille de fût la plus souvent utilisée pour des raisons de transport. Le pétrole et le gaz, le pétrole, l'alimentation et les boissons, la construction, la fabrication, l'agriculture et d'autres secteurs utilisent des fûts industriels.

Dynamique du marché des tambours industriels dans la région du CCG

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation des échanges transcontinentaux entre les utilisateurs finaux

L'augmentation des échanges transcontinentaux entre de nombreux utilisateurs finaux de pétrole, de produits chimiques, d'engrais et d'autres produits dans la région du CCG a eu un impact sur l'utilisation de fûts industriels pour le transport transcontinental, car les fûts industriels sont utilisés pour stocker les produits chimiques dangereux et non dangereux et pour d'autres matériaux dans le transport des matériaux.

Les fûts industriels permettent une plus grande efficacité opérationnelle et une plus grande efficience dans l'expédition de grandes quantités de marchandises, en particulier sous forme liquide. Les fûts industriels offrent également des solutions d'emballage de transport rentables pour l'expédition de matières dangereuses et non dangereuses, comme les produits chimiques, les vins, les jus de fruits et autres. Ils offrent également une résistance élevée, des propriétés de barrière aux gaz et des performances de traitement supérieures. La facilité de déplacement et les propriétés offertes par les différents fûts industriels sont la principale raison pour laquelle il faut envisager les fûts industriels pour le commerce intercontinental.

- Croissance de l'utilisation pour le stockage de produits chimiques, de pétrole et autres

Les fûts industriels sont très couramment utilisés pour le stockage et le transport de marchandises non dangereuses et dangereuses. Les fûts industriels sont le plus souvent utilisés dans les industries du pétrole, des huiles, des engrais et des produits chimiques.

Les fûts en acier sont largement utilisés pour emballer des semi-solides, des liquides et des poudres. Ils sont fabriqués en acier au carbone ou en acier inoxydable. De plus, ils peuvent résister à une gamme extrême de pressions, de températures et d'humidité, tout en conservant leur intégrité structurelle, indépendamment de la chaleur et des flammes, sans aucun déversement ni fuite. De plus, il est moins probable qu'ils implosent lorsque les conditions de travail appropriées ne sont pas affectées par les chocs thermiques. Ils sont disponibles en différentes tailles en fonction de l'application requise. De plus, tout aliment ou boisson doit être stocké dans des doublures de fût avant d'être placé dans un fût en acier pour éviter toute contamination croisée. Les fûts en acier sont utilisés dans les produits chimiques, l'agriculture, le pétrole et les lubrifiants, les peintures, les encres et les applications alimentaires et de boissons.

Opportunités

- Collaboration stratégique entre entreprises pour fûts industriels

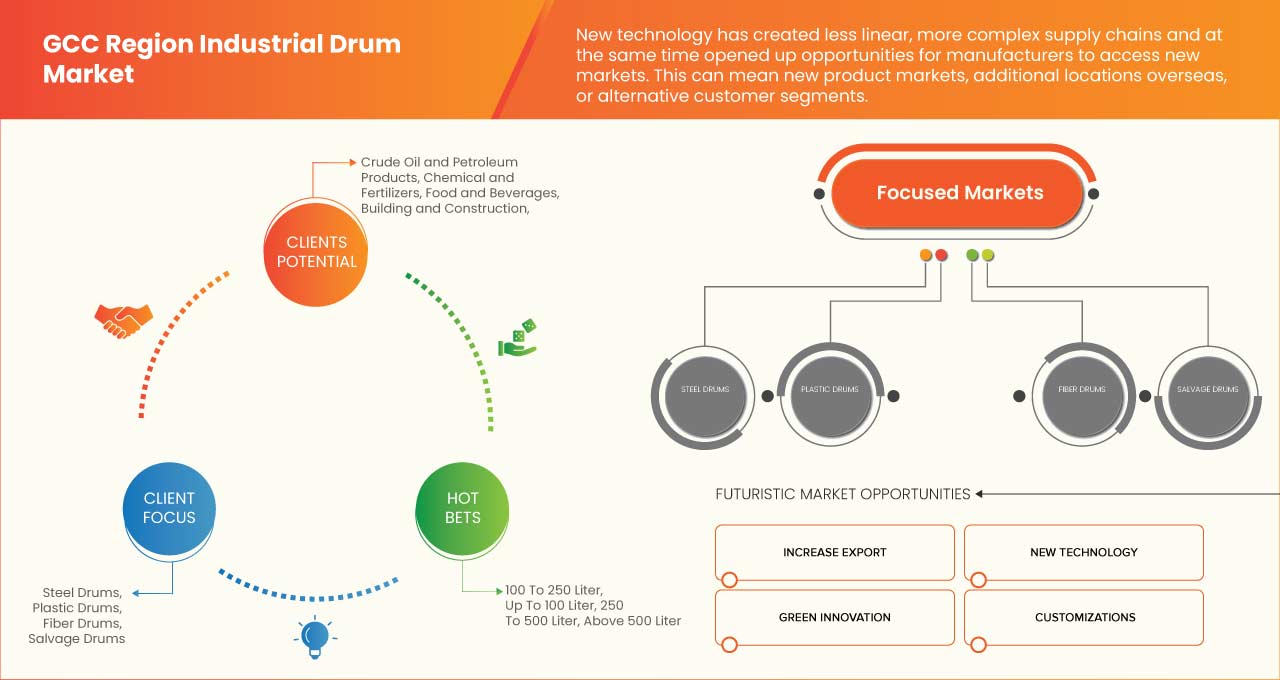

Les nouvelles technologies ont créé des chaînes d’approvisionnement moins linéaires et plus complexes, tout en offrant aux fabricants des opportunités d’accéder à de nouveaux marchés. Cela peut signifier de nouveaux marchés de produits, des sites supplémentaires à l’étranger ou des segments de clientèle alternatifs. La collaboration stratégique peut être un outil efficace pour accélérer le processus d’entrée sur un nouveau marché et le rendre plus fluide. Les collaborations stratégiques peuvent permettre d’améliorer les offres de produits et de services. Cela peut aider les entreprises à attirer de nouveaux clients et à fidéliser les clients existants.

Les alliances stratégiques sont un élément clé de la stratégie commerciale des entreprises de toutes tailles et de tous secteurs. Toute collaboration stratégique repose sur l'idée que chaque partenaire doit apporter de nouvelles connaissances à l'autre.

- Augmentation des exportations de pétrole et d’autres matières

Les projets d’exploration des EAU créeront des opportunités pour les projets Greenfield. Les producteurs émiriens continuent de tester et de mettre en œuvre de nouvelles technologies d’extraction pour augmenter les taux de récupération et prolonger la production. Les ressources pétrolières et gazières non conventionnelles intéressent beaucoup les EAU. L’un des moyens par lesquels les pays du Golfe prévoient de tirer le meilleur parti des hydrocarbures est de catalyser les investissements dans la production en aval et la capacité d’exportation de produits pétrochimiques et chimiques. Ainsi, l’augmentation des exportations de pétrole et d’autres produits chimiques devrait accroître la demande de fûts industriels pour la pénurie et le transport du pétrole et d’autres produits chimiques.

Contraintes/Défis

- Directives gouvernementales strictes pour les fûts industriels

Les réglementations strictes sont des normes nationales fondées sur la technologie, élaborées par secteur d'activité. Elles représentent les plus grandes réductions de polluants réalisables économiquement pour un secteur d'activité. Ces limites sont appliquées uniformément aux installations relevant du champ d'application de l'industrie défini par la réglementation, quel que soit l'état du plan d'eau recevant le rejet.

Si des substances dangereuses telles que des huiles de voiture ou du mazout sont stockées dans des fûts vides, elles doivent être éliminées conformément aux normes de santé et de sécurité. Après tout, ces règles protègent la santé de l'entreprise, de ses employés et de toute autre personne susceptible d'entrer en contact avec des déchets dangereux. Le propriétaire de l'entreprise doit s'assurer que les déchets dangereux sont manipulés correctement et en toute sécurité.

- Volatilité du prix des matières premières

Les matières premières connaissent souvent une volatilité des marchés résultant de ruptures d'approvisionnement, d'une demande refoulée ou de pics et de creux de prix importants. Les prix des matières premières sont très volatils sur les marchés. On leur impute souvent ces variations, mais les fabricants de fûts constatent que les variations de l'offre et de la demande sont les principaux déterminants des prix des matières premières. Les prix élevés de l'acier continuent de poser des problèmes aux producteurs de fûts en acier.

La matière première pour les fûts industriels est exportée depuis différentes régions, car les raisons de la volatilité des prix sont nombreuses. Par exemple, la guerre actuelle entre la Russie et l'Ukraine peut affecter le prix de certaines matières premières utilisées pour la fabrication des fûts industriels en fonction du type de fût industriel fabriqué par l'entreprise. Ainsi, si le prix de la matière première a augmenté, le fabricant peut être amené à augmenter le prix du produit final.

Développements récents

- En mars 2022, le Comité des producteurs d'acier des Émirats arabes unis a tenu une réunion urgente pour discuter des développements actuels sur le marché local des barres d'armature, où il a affirmé l'engagement du membre à fournir au marché des Émirats arabes unis les besoins nécessaires en barres d'armature ainsi qu'à maintenir la stabilité du marché pour soutenir respectivement le secteur de la construction et l'économie.

- En mars 2022, selon PSU Connect Media Pvt. Ltd, l'Inde a lancé un appel à la collaboration avec le CCG dans le secteur de l'acier. Une session interactive sur « L'utilisation de l'acier aux EAU et les opportunités de collaboration pour le secteur sidérurgique indien » a été organisée entre les principales entreprises productrices d'acier de l'Inde et les entreprises utilisatrices d'acier des EAU.

Portée du marché des tambours industriels de la région du CCG

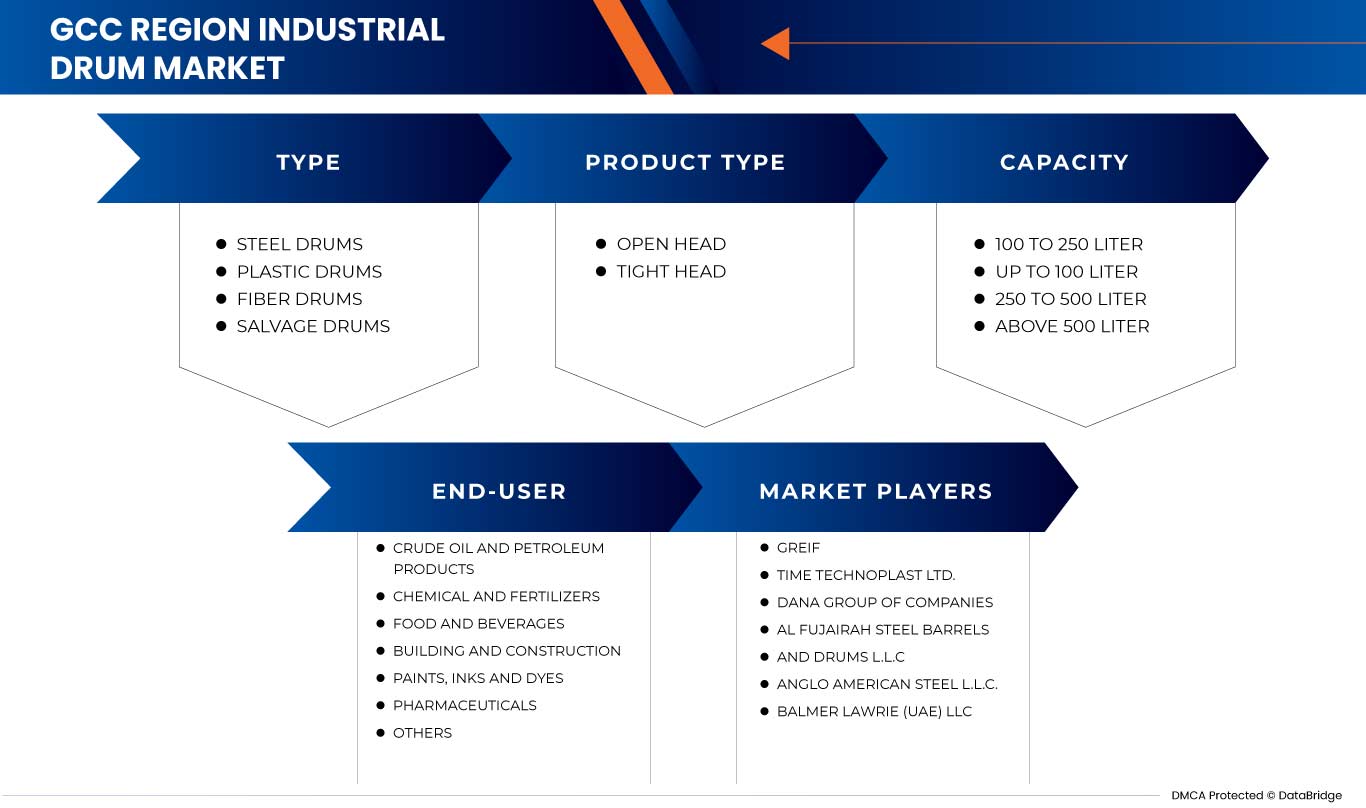

Le marché des tambours industriels de la région du CCG est classé en fonction du type, du type de produit, de la capacité et de l'utilisateur final. La croissance entre quatre segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

PAR TYPE

- FÛTS EN PLASTIQUE

- TAMBOURS EN ACIER

- FÛTS EN FIBRE

- FÛTS DE RÉCUPÉRATION

En fonction du type, le marché des tambours industriels de la région du CCG est classé en quatre segments : les tambours en plastique, les tambours en acier, les tambours en fibre et les tambours de récupération.

PAR TYPE DE PRODUIT

- TÊTE OUVERTE

- TÊTE SERRÉE

En fonction du type de produit, le marché des tambours industriels de la région du CCG est classé en deux segments : tête ouverte et tête serrée.

PAR CAPACITÉ

- JUSQU'À 100 LITRES

- 100 À 250 LITRES

- 250 À 500 LITRES

- PLUS DE 500 LITRES

En fonction de la capacité, le marché des tambours industriels de la région du CCG est classé en quatre segments : jusqu'à 100 litres, 100 à 250 litres, 250 à 500 litres et plus de 500 litres.

PAR UTILISATEUR FINAL

- BÂTIMENT ET CONSTRUCTION

- PRODUITS CHIMIQUES ET ENGRAIS

- ALIMENTS ET BOISSONS

- PEINTURES, ENCRES ET COLORANTS

- PÉTROLE BRUT ET PRODUITS PÉTROLIERS

- MÉDICAMENTS

- AUTRES

En fonction de l'utilisateur final, le marché des tambours industriels de la région du CCG est classé en six segments : bâtiment et construction, produits chimiques et engrais, aliments et boissons , peintures, encres et colorants, pétrole brut et produits pétroliers, produits pharmaceutiques et autres.

Analyse/perspectives régionales du marché des tambours industriels de la région du CCG

Le marché des tambours industriels de la région du CCG est segmenté en fonction du type, du type de produit, de la capacité et de l’utilisateur final.

Les pays du marché des fûts industriels de la région du CCG sont Bahreïn, le Koweït, Oman, le Qatar, l'Arabie saoudite et les Émirats arabes unis. L'Arabie saoudite domine le marché des fûts industriels de la région du CCG en termes de part de marché et de revenus du marché en raison d'une augmentation de la demande de fûts industriels pour le stockage et le transport.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques du CCG et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des tambours industriels dans la région du CCG

Le paysage concurrentiel du marché des tambours industriels de la région du CCG fournit des détails par concurrents. Les détails inclus sont l'aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des tambours industriels de la région du CCG.

Français Certains des principaux participants opérant sur le marché des tambours industriels de la région du CCG sont Greif, Time Technoplast Ltd., DANA Group of Companies, Al Fujairah Steel Barrels and Drums LLC, Anglo American Steel LLC, Balmer Lawrie (UAE) LLC, Drum Express, Al Yamama Plastic Factory, PGTC Group, Al-Babtain Plastic & Insulation Materials Mfg. Co. ltd, Elan Incorporated FZE, VWR International, LLC., STARLINK Dubai LLC, INTC Steel Drums LLC, Emirates Plastic Industries Factory et Clouds Drums Dubai LLC, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GCC REGION INDUSTRIAL DRUM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 PRODUCTION AND CONSUMPTION ANALYSIS

4.4 IMPORT-EXPORT SCENARIO

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

4.7 RAW MATERIAL COVERAGE

4.8 REGULATION COVERAGE

5 SUPPLY CHAIN ANALYSIS

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING AND PACKING

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWTH IN THE USE FOR THE STORAGE OF CHEMICALS, PETROLEUM, AND OTHERS

7.1.2 INCREASED CROSS-CONTINENT TRADING AMONG END-USERS

7.1.3 AVAILABILITY OF INDUSTRIAL DRUM ACCORDING TO CUSTOMER SPECIFICATION

7.2 RESTRAINTS

7.2.1 VOLATILITY OF RAW MATERIAL PRICE

7.2.2 COMPLEXITY IN THE SUPPLY CHAIN

7.3 OPPORTUNITIES

7.3.1 INCREASE IN THE EXPORT OF PETROLEUM AND OTHER MATERIAL

7.3.2 STRATEGIC COLLABORATION AMONG COMPANIES FOR INDUSTRIAL DRUM

7.4 CHALLENGES

7.4.1 STRINGENT GOVERNMENT GUIDELINES FOR INDUSTRIAL DRUM

7.4.2 ECOLOGICAL EFFECT BY RAW MATERIAL USED FOR MANUFACTURING THE INDUSTRIAL DRUM

8 GCC REGION INDUSTRIAL DRUM MARKET, BY TYPE

8.1 OVERVIEW

8.2 STEEL DRUMS

8.3 PLASTIC DRUMS

8.4 FIBER DRUMS

8.5 SALVAGE DRUMS

9 GCC REGION INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 OPEN HEAD

9.3 TIGHT HEAD

10 GCC REGION INDUSTRIAL DRUM MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 100 TO 250 LITER

10.3 UP TO 100 LITER

10.4 250 TO 500 LITER

10.5 ABOVE 500 LITER

11 GCC REGION INDUSTRIAL DRUM MARKET, BY END-USER

11.1 OVERVIEW

11.2 CRUDE OIL AND PETROLEUM PRODUCTS

11.2.1 STEEL DRUMS

11.2.2 PLASTIC DRUMS

11.2.3 SALVAGE DRUMS

11.2.4 FIBER DRUMS

11.3 CHEMICAL AND FERTILIZERS

11.3.1 STEEL DRUMS

11.3.2 PLASTIC DRUMS

11.3.3 SALVAGE DRUMS

11.3.4 FIBER DRUMS

11.4 FOOD AND BEVERAGES

11.4.1 STEEL DRUMS

11.4.2 PLASTIC DRUMS

11.4.3 FIBER DRUMS

11.4.4 SALVAGE DRUMS

11.5 BUILDING AND CONSTRUCTION

11.5.1 PLASTIC DRUMS

11.5.2 STEEL DRUMS

11.5.3 FIBER DRUMS

11.5.4 SALVAGE DRUMS

11.6 PAINTS, INKS AND DYES

11.6.1 PLASTIC DRUMS

11.6.2 STEEL DRUMS

11.6.3 FIBER DRUMS

11.6.4 SALVAGE DRUMS

11.7 PHARMACEUTICALS

11.7.1 PLASTIC DRUMS

11.7.2 FIBER DRUMS

11.7.3 STEEL DRUMS

11.7.4 SALVAGE DRUMS

11.8 OTHERS

11.8.1 PLASTIC DRUMS

11.8.2 FIBER DRUMS

11.8.3 STEEL DRUMS

11.8.4 SALVAGE DRUMS

12 GCC REGION INDUSTRIAL DRUM MARKET, BY COUNTRY

12.1 SAUDI ARABIA

12.2 UNITED ARAB EMIRATES

12.3 OMAN

12.4 KUWAIT

12.5 QATAR

12.6 BAHRAIN

13 GCC REGION INDUSTRIAL DRUM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GCC REGION

13.2 CERTIFICATION

13.3 ACQUISITION

13.4 AWARD

13.5 AGREEMENT

13.6 NEW WEBSITE

13.7 NEW PLANT

13.8 PARTNERSHIP

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 GREIF

15.1.1 COMPANY SNAPSHOT

15.1.2 SWOT ANALYSIS

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TIME TECHNOPLAST LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 SWOT ANALYSIS

15.2.3 REVENUE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 VWR INTERNATIONAL, LLC.

15.3.1 COMPANY SNAPSHOT

15.3.2 SWOT ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 STARLINK DUBAI LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 SWOT ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ELAN INCORPORATED FZE

15.5.1 COMPANY SNAPSHOT

15.5.2 SWOT ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AL FUJAIRAH STEEL BARRELS AND DRUMS L.L.C

15.6.1 COMPANY SNAPSHOT

15.6.2 SWOT ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 AL YAMAMA PLASTIC FACTORY

15.7.1 COMPANY SNAPSHOT

15.7.2 SWOT ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 AL-BABTAIN PLASTIC & INSULATION MATERIALS MFG, CO. LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 SWOT ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 ANGLO AMERICAN STEEL L.L.C.

15.9.1 COMPANY SNAPSHOT

15.9.2 SWOT ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 BALMER LAWRIE (UAE) LLC

15.10.1 COMPANY SNAPSHOT

15.10.2 SWOT ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 CLOUDS DRUMS DUBAI LLC

15.11.1 COMPANY SNAPSHOT

15.11.2 SWOT ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 DANA GROUP OF COMPANIES

15.12.1 COMPANY SNAPSHOT

15.12.2 SWOT ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 DRUM EXPRESS

15.13.1 COMPANY SNAPSHOT

15.13.2 SWOT ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMIRATES PLASTIC INDUSTRIES FACTORY

15.14.1 COMPANY SNAPSHOT

15.14.2 SWOT ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 INTC STEEL DRUMS LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 SWOT ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 PGTC GROUP

15.16.1 COMPANY SNAPSHOT

15.16.2 SWOT ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 GCC REGION INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 GCC REGION INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 4 GCC REGION INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 GCC REGION INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 6 GCC REGION INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 7 GCC REGION CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 GCC REGION CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 GCC REGION FOOD AND BEVERAGE IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 GCC REGION BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 GCC REGION PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 GCC REGION PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 GCC REGION OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 GCC REGION INDUSTRIAL DRUM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 15 GCC REGION INDUSTRIAL DRUM MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 16 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 18 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 20 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 21 SAUDI ARABIA CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 SAUDI ARABIA CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 SAUDI ARABIA FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 SAUDI ARABIA BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 SAUDI ARABIA PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 SAUDI ARABIA PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 SAUDI ARABIA OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 30 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 32 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 33 UNITED ARAB EMIRATES CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 UNITED ARAB EMIRATES CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 UNITED ARAB EMIRATES FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 UNITED ARAB EMIRATES PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 UNITED ARAB EMIRATES PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 UNITED ARAB EMIRATES OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 OMAN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 OMAN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 42 OMAN INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 OMAN INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 44 OMAN INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 45 OMAN CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 OMAN CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 OMAN FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 OMAN BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 OMAN PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 OMAN PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 OMAN OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 KUWAIT INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 KUWAIT INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 54 KUWAIT INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 KUWAIT INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 56 KUWAIT INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 57 KUWAIT CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 KUWAIT CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 KUWAIT FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 KUWAIT BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 KUWAIT PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 KUWAIT PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 KUWAIT OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 QATAR INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 QATAR INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 66 QATAR INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 QATAR INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 68 QATAR INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 69 QATAR CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 QATAR CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 QATAR FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 QATAR BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 QATAR PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 QATAR PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 QATAR OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 BAHRAIN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 BAHRAIN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 78 BAHRAIN INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 BAHRAIN INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 80 BAHRAIN INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 81 BAHRAIN CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 BAHRAIN CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 BAHRAIN FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 BAHRAIN BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 BAHRAIN PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 BAHRAIN PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 BAHRAIN OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 GCC REGION INDUSTRIAL DRUM MARKET: SEGMENTATION

FIGURE 2 GCC REGION INDUSTRIAL DRUM MARKET: DATA TRIANGULATION

FIGURE 3 GCC REGION INDUSTRIAL DRUM MARKET: DROC ANALYSIS

FIGURE 4 GCC REGION INDUSTRIAL DRUM MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 GCC REGION INDUSTRIAL DRUM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GCC REGION INDUSTRIAL DRUM MARKET: TYPE LIFE LINE CURVE

FIGURE 7 GCC REGION INDUSTRIAL DRUM MARKET: MULTIVARIATE MODELLING

FIGURE 8 GCC REGION INDUSTRIAL DRUM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GCC REGION INDUSTRIAL DRUM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GCC REGION INDUSTRIAL DRUM MARKET: APPLICATION COVERAGE GRID

FIGURE 11 GCC REGION INDUSTRIAL DRUM MARKET: CHALLENGE MATRIX

FIGURE 12 GCC REGION INDUSTRIAL DRUM MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GCC REGION INDUSTRIAL DRUM MARKET: SEGMENTATION

FIGURE 14 AVAILABILITY OF INDUSTRIAL DRUMS ACCORDING TO CUSTOMER SPECIFICATION IS EXPECTED TO DRIVE THE GCC REGION INDUSTRIAL DRUM MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 STEEL DRUMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GCC REGION INDUSTRIAL DRUM MARKET IN 2023 & 2030

FIGURE 16 GCC REGION INDUSTRIAL DRUM MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2021-2023 (THOUSAND UNITS)

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 SUPPLY CHAIN ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GCC REGION INDUSTRIAL DRUM MARKET

FIGURE 20 GCC REGION INDUSTRIAL DRUM MARKET: BY TYPE, 2022

FIGURE 21 GCC REGION INDUSTRIAL DRUM MARKET: BY PRODUCT TYPE, 2022

FIGURE 22 GCC REGION INDUSTRIAL DRUM MARKET: BY CAPACITY, 2022

FIGURE 23 GCC REGION INDUSTRIAL DRUM MARKET: BY END-USER, 2022

FIGURE 24 GCC REGION INDUSTRIAL DRUM MARKET: SNAPSHOT (2022)

FIGURE 25 GCC REGION INDUSTRIAL DRUM MARKET: BY COUNTRY (2022)

FIGURE 26 GCC REGION INDUSTRIAL DRUM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 GCC REGION INDUSTRIAL DRUM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 GCC REGION INDUSTRIAL DRUM MARKET: BY TYPE (2023-2030)

FIGURE 29 GCC REGION INDUSTRIAL DRUM MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.