Marché de la vérification d'identité du CCG, par composant (solutions et services), type (non biométrique et biométrique ), mode de déploiement (sur site et cloud), taille de l'organisation (grandes entreprises et PME), vertical (BFSI, gouvernement et défense, énergie et services publics, vente au détail et commerce électronique, informatique et télécommunications, soins de santé, jeux et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché de la vérification d'identité du CCG

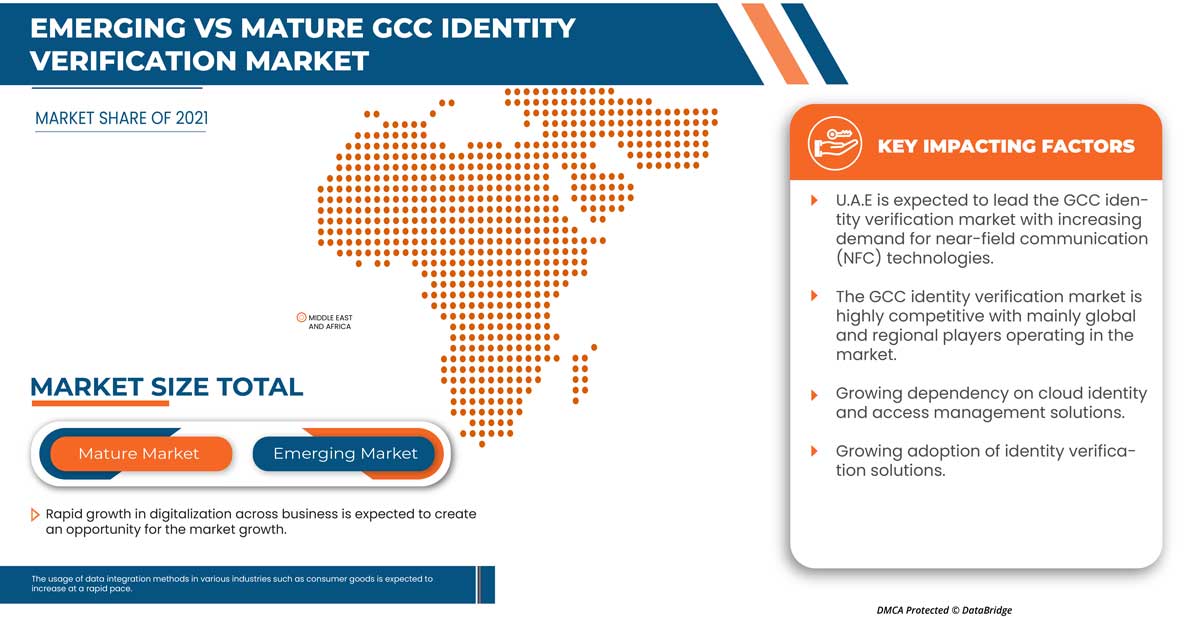

La croissance du marché de la vérification d'identité dans les pays du CCG a été considérablement stimulée par l'adoption croissante des paiements numériques par les clients. Les innovations technologiques croissantes dans les industries stimulent la croissance du marché. La vérification d'identité nécessite un capital initial élevé pour l'installation, la maintenance et d'autres coûts d'expertise technique, ce qui constitue un facteur de restriction majeur pour le marché.

Data Bridge Market Research analyse que le marché de la vérification d'identité du CCG devrait atteindre une valeur de 996 843,09 milliers USD d'ici 2029, à un TCAC de 11,9 % au cours de la période de prévision. Les solutions de vérification d'identité représentent le segment de mode de modules le plus important. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Année de base |

2021 |

|

Période de prévision |

2022 à 2029 |

|

Année historique |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Milliers de dollars américains |

|

Segments couverts |

Par composant (solutions et services), type (non biométrique et biométrique ), mode de déploiement (sur site et cloud), taille de l'organisation (grandes entreprises et PME), vertical (BFSI, gouvernement et défense, énergie et services publics, vente au détail et commerce électronique, informatique et télécommunications, soins de santé, jeux et autres). |

|

Pays couverts |

Émirats arabes unis, Royaume d'Arabie saoudite, Qatar, Koweït, Oman, Bahreïn |

|

Acteurs du marché couverts |

Experian Information Solutions, Inc. (une filiale d'Experian plc), LexisNexis Risk Solutions Group, Onfido, GB Group plc (« GBG »), Acuant, Inc., IDEMIA, Thales Group, Shufti Pro, Uqudo, Western Union Holdings, Inc., Plaid Inc., IDMERIT., AccuraTechnolabs, Ping Identity, IDnow., AML UAE., Stripe, Elm Company, Refinitiv, Trulioo., QlikTech International AB, entre autres. |

Définition du marché

La vérification d'identité fait référence aux services et solutions utilisés pour vérifier l'authenticité de l'identité physique d'une personne ou de ses documents, tels qu'un permis de conduire, un passeport ou un document d'identité délivré par le pays, entre autres. La vérification d'identité est un processus important qui garantit que l'identité d'une personne correspond à celle qu'elle est censée être. Les solutions et services de vérification d'identité garantissent qu'une personne réelle opère derrière un processus et prouve qu'elle est bien celle qu'elle prétend être, empêchant ainsi les fausses identités ou les fraudes. La vérification d'identité est une exigence essentielle dans de nombreux processus et procédures d'entreprise.

Dynamique du marché de la vérification d'identité du CCG

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

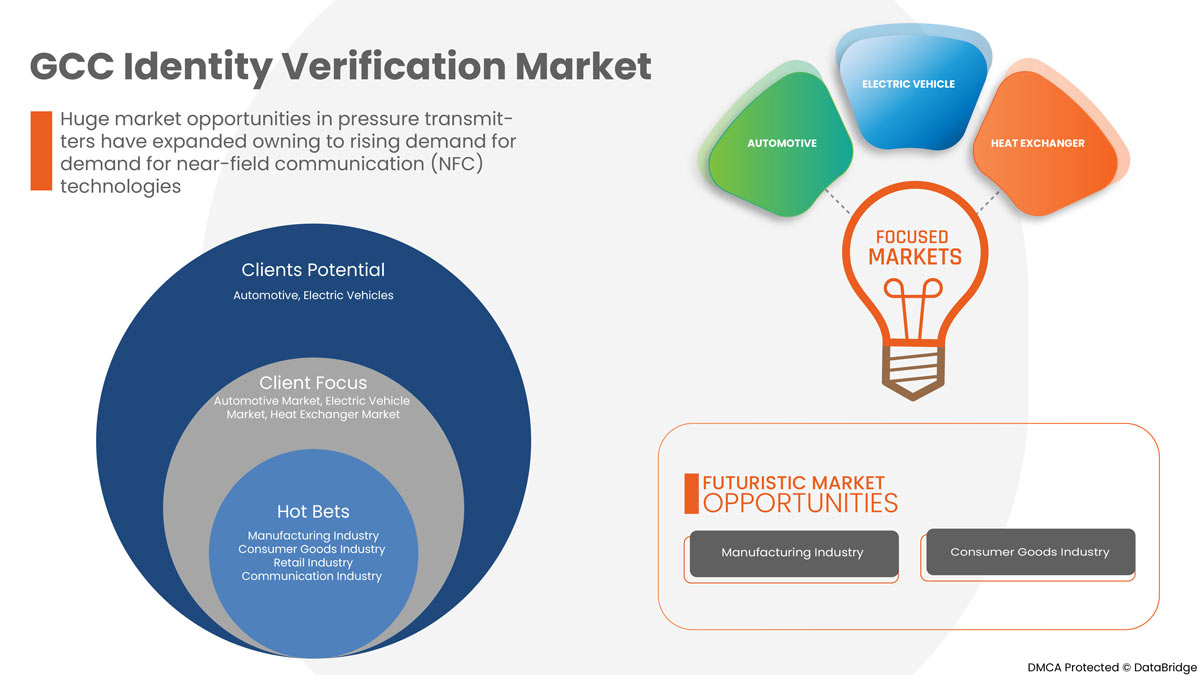

- Demande croissante de technologies de communication en champ proche (NFC)

La communication en champ proche (NFC) est une technologie de communication sans contact basée sur une radiofréquence (RF) avec une fréquence de travail de 13,56 MHz. La technologie NFC est conçue pour échanger des données entre deux appareils électroniques par un simple contact. Ces derniers temps, la technologie NFC a gagné en popularité en raison de facteurs tels que les cris de COVID à travers le monde et les services sans contact offerts par ces appareils pendant ces cris.

- Accroître la dépendance aux solutions de gestion des identités et des accès dans le cloud

Les solutions de gestion des identités et des accès (IAM) sont un ensemble de disciplines de sécurité qui permettent aux bonnes personnes d'accéder au bon contenu pour la bonne intention. Les solutions de gestion des identités et des accès garantissent l'identité de l'utilisateur avant l'utilisation du contenu. Les solutions de gestion des identités et des accès (IAM) existent depuis un certain temps. Au départ, les entreprises et les sociétés déployaient des logiciels de gestion des identités et des accès (IAM) sur site pour gérer les stratégies d'identité et d'accès. Mais ces derniers temps, les progrès technologiques ont conduit à la croissance des solutions de gestion des identités et des accès (IAM) basées sur le cloud ou de l'identité en tant que service (IDaaS) basée sur le cloud. Les technologies cloud assistées par l'intelligence artificielle (IA), l'apprentissage automatique (ML) et l'apprentissage profond ont le dessus sur les technologies sur site.

- Adoption croissante des solutions de vérification d'identité

La vérification d'identité fait référence aux services et solutions utilisés pour vérifier et authentifier l'identité physique d'une personne ou des documents tels qu'un permis de conduire, un passeport ou un document d'identité délivré par le pays. La vérification d'identité est un processus important qui garantit que l'identité d'une personne correspond à celle qu'elle est censée être.

Contraintes/Défis

- Augmentation des activités frauduleuses

Les solutions et services de vérification d'identité garantissent qu'une personne réelle opère derrière un processus et prouvent que cette personne est bien celle qu'elle prétend être, empêchant ainsi les fausses identités de commettre des fraudes. La vérification et l'authentification d'identité sont une exigence essentielle dans de nombreuses entreprises.

- Manque de sensibilisation aux solutions de vérification d'identité

La demande de numérisation et de progrès technologique est très forte dans les différents secteurs d’activité de différents pays. Les solutions de vérification et d’authentification d’identité permettent aux organisations de vérifier rapidement l’identité numérique des clients nouveaux et existants.

- Coût initial élevé

La vérification d'identité implique des logiciels, des solutions et des services qui garantissent qu'une personne réelle opère derrière un processus. La vérification et l'authentification de l'identité d'une personne sont un processus crucial et important pour une entreprise et entraînent des coûts élevés.

Impact de la pandémie de COVID-19 sur le marché de la vérification d'identité dans les pays du CCG

La COVID-19 a eu un impact considérable sur le marché de la vérification d’identité des pays du CCG, car presque tous les pays ont choisi de fermer toutes les installations de production, à l’exception de celles qui produisent des biens essentiels. Le gouvernement a pris des mesures strictes, telles que l’arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d’autres pour empêcher la propagation de la COVID-19. Les seules entreprises en activité pendant cette pandémie étaient les services essentiels autorisés à ouvrir et à exécuter les processus.

La croissance du marché est en hausse en raison des politiques gouvernementales visant à stimuler le commerce international après la COVID-19. En outre, les avantages offerts par les tuyaux industriels pour optimiser les coûts et les itinéraires augmentent la demande pour le marché. Cependant, la congestion de certains pays liée aux routes commerciales et aux restrictions commerciales freine la croissance du marché. La fermeture des installations de production pendant la pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de R&D pour améliorer la technologie impliquée dans les tuyaux industriels. Les entreprises apporteront des solutions avancées et précises au marché. En outre, les initiatives gouvernementales visant à stimuler le commerce international ont entraîné une croissance du marché.

Développements récents

- En septembre 2022, Elm a participé à un sommet mondial sur l'IA à Riyad. Cette participation a aidé l'entreprise à rechercher les aspects futurs de l'intelligence artificielle et à résoudre des problèmes complexes. Cela contribuera à améliorer l'image de marque de l'entreprise.

- En septembre 2019, Refinitiv a annoncé le lancement de « QUAL-ID », qui intègre la technologie d'identité numérique à la vérification préalable KYC. La solution a été lancée pour éviter les activités frauduleuses et protéger les données. L'entreprise pourra ainsi pénétrer un nouveau marché de couverture et attirer davantage de clients.

Portée du marché de la vérification d'identité du CCG

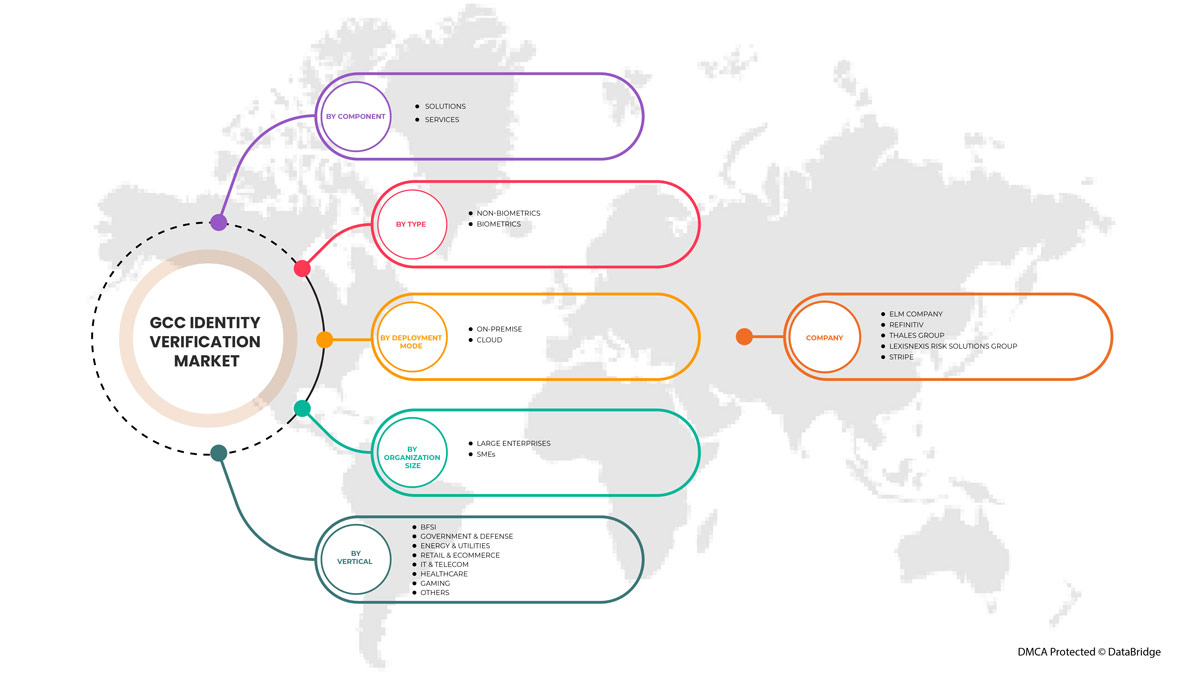

Le marché de la vérification d'identité du CCG est segmenté en cinq segments notables en fonction du composant, du type, du mode de déploiement, de la taille de l'organisation et du secteur vertical. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par composant

- Solutions

- Services

Sur la base des composants, le marché de la vérification d’identité du CCG a été segmenté en solutions et services.

Par type

- Données non biométriques

- Biométrie

Sur la base du type, le marché de la vérification d’identité du CCG a été segmenté en biométrie et non-biométrie.

Par mode de déploiement

- Sur site

- Nuage

Sur la base du mode de déploiement, le marché de la vérification d’identité du CCG a été segmenté en cloud et sur site.

Par taille d'organisation

- Grandes entreprises

- PME

Sur la base de la taille de l’organisation, le marché de la vérification d’identité du CCG a été segmenté en grandes entreprises et PME.

Par vertical

- BFSI

- Gouvernement et Défense

- Énergie et services publics

- Commerce de détail et e-commerce

- Informatique et Télécom

- Soins de santé

- Jeux

- Autres

Sur la base de la verticale, le marché de la vérification d'identité du CCG a été segmenté en BFSI, gouvernement et défense, énergie et services publics, vente au détail et commerce électronique, informatique et télécommunications, soins de santé, jeux et autres.

Analyse/perspectives régionales du marché de la vérification d'identité du CCG

Le marché de la vérification d’identité du CCG est analysé et des informations et tendances sur la taille du marché sont fournies par pays, composant, type, mode de déploiement, taille de l’organisation et vertical, comme référencé ci-dessus.

Certains pays couverts par le marché de la vérification d’identité du CCG sont les Émirats arabes unis, le Royaume d’Arabie saoudite, le Qatar, le Koweït, Oman et Bahreïn, entre autres.

Les Émirats arabes unis devraient croître sur le marché car il s’agit d’une région technologiquement avancée avec une large présence d’acteurs majeurs du marché, ce qui augmente par la suite l’adoption de la vérification d’identité.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du CCG et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des tarifs nationaux et des routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la vérification d'identité dans le CCG

Le paysage concurrentiel du marché de la vérification d'identité du CCG fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de la vérification d'identité du CCG.

Français Certains des principaux acteurs opérant sur le marché de la vérification d'identité du CCG sont Experian Information Solutions, Inc. (une filiale d'Experian plc), LexisNexis Risk Solutions Group., Onfido, GB Group plc (« GBG »), Acuant, Inc., IDEMIA, Thales Group, Shufti Pro, Uqudo, Western Union Holdings, Inc., Plaid Inc., IDMERIT., AccuraTechnolabs, Ping Identity, IDnow., AML UAE., Stripe, Elm Company, Refinitiv, Trulioo., QlikTech International AB, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GCC IDENTITY VERIFICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1.1 AI

4.1.2 INTERNET OF THINGS (IOT)

4.1.3 5G & LTE

4.1.4 NFC TECHNOLOGY

4.1.5 SMART BIOMETRIC TECHNOLOGIES

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 RAW MATERIAL PROCUREMENT

4.2.2 MANUFACTURING

4.2.3 MARKETING AND DISTRIBUTION

4.2.4 END USERS

4.3 USE CASE

4.3.1 FINANCIAL SERVICES

4.3.2 E-COMMERCE AND RETAIL

4.3.3 HEALTHCARE

4.3.4 GOVERNMENT

4.3.5 EDUCATION

4.4 REGULATION COVERAGE

4.5 KEY FEATURES OFFERED BY IDENTITY VERIFICATION SOLUTIONS

4.5.1 DIGITAL ONBOARDING

4.5.2 E KYC

4.5.3 REGTECH SOLUTIONS

4.6 PORTER'S MODEL

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR NEAR-FIELD COMMUNICATION (NFC) TECHNOLOGIES

5.1.2 HIGH DEPENDENCY ON CLOUD IDENTITY AND ACCESS MANAGEMENT SOLUTIONS

5.1.3 GROWING ADOPTION OF IDENTITY VERIFICATION SOLUTIONS

5.1.4 RAPID GROWTH IN DIGITALIZATION ACROSS BUSINESS

5.2 RESTRAINTS

5.2.1 SURGE IN FRAUDULENT ACTIVITIES

5.2.2 LACK OF AWARENESS REGARDING IDENTITY VERIFICATION SOLUTIONS

5.2.3 HIGH INITIAL COST

5.3 OPPORTUNITIES

5.3.1 HIGH ADOPTION OF RAZOR-SHARP BIOMETRICS IDENTITY VERIFICATION SOLUTIONS

5.3.2 INCREASING DEMAND FOR IDENTITY VERIFICATION SERVICES IN SMARTPHONES

5.3.3 WIDE RANGE ADOPTION OF IDENTITY VERIFICATION SOLUTIONS ACROSS BFSI

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS WHILE OFFERING SERVICE FOR IDENTITY VERIFICATION SOLUTIONS

5.4.2 STORAGE CHALLENGE FOR HUGE VARIANTS OF DATA/INFORMATION

6 GCC IDENTITY VERIFICATION MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 DOCUMENT/ID VERIFICATION

6.2.2 DIGITAL/ELECTRONIC IDENTITY VERIFICATION

6.2.3 AUTHENTICATION

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1 IMPLEMENTATION

6.3.2.2 TRAINING AND SUPPORT

6.3.2.3 CONSULTING

6.3.3 INTEGRATION SERVICES

7 GCC IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE

7.1 OVERVIEW

7.2 ON-PREMISE

7.3 CLOUD

8 GCC IDENTITY VERIFICATION MARKET, BY TYPE

8.1 OVERVIEW

8.2 BIOMETRICS

8.3 NON-BIOMETRICS

9 GCC IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMES

10 GCC IDENTITY VERIFICATION MARKET, BY VERTICAL

10.1 OVERVIEW

10.2 GOVERNMENT AND DEFENSE

10.2.1 SOFTWARE

10.2.2 SERVICES

10.3 BFSI

10.3.1 SOFTWARE

10.3.2 SERVICES

10.4 RETAIL AND ECOMMERCE

10.4.1 SOFTWARE

10.4.2 SERVICES

10.5 HEALTHCARE

10.5.1 SOFTWARE

10.5.2 SERVICES

10.6 IT AND TELECOM

10.6.1 SOFTWARE

10.6.2 SERVICES

10.7 ENERGY AND UTILITIES

10.7.1 SOFTWARE

10.7.2 SERVICES

10.8 GAMING

10.8.1 SOFTWARE

10.8.2 SERVICES

10.9 OTHERS

10.9.1 SOFTWARE

10.9.2 SERVICES

11 GCC IDENTITY VERIFICATION MARKET, BY COUNTRY

11.1 UAE

11.2 KINGDOM OF SAUDI ARABIA

11.3 QATAR

11.4 KUWAIT

11.5 OMAN

11.6 BAHRAIN

12 GCC IDENTITY VERIFICATION MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GCC

12.2 COMPANY SHARE ANALYSIS: UAE

12.3 COMPANY SHARE ANALYSIS: KSA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ELM COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 REFINITIV

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 THALES GROUP

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SOLUTION PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 LEXISNEXIS RISK SOLUTIONS GROUP.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 STRIPE

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 GB GROUP PLC

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SOLUTION PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AML UAE.

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICES PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ACCURATECHNOLABS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 ACUANT, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 SOLUTION PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 EXPERIAN INFORMATION SOLUTIONS, INC. (A SUBSIDIARY OF EXPERIAN PLC)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 SOLUTION PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 IDNOW.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 IDMERIT.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 IDEMIA

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 JUMIO

14.14.1 COMPANY SNAPSHOT

14.14.2 SOLUTION PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 NUANCE COMMUNICATIONS, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 ONESPAN.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 ONFIDO

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 PLAID INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 PING IDENTITY.

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 QLIKTECH INTERNATIONAL AB

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 SHUFTI PRO

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.22 TRULIOO.

14.22.1 COMPANY SNAPSHOT

14.22.2 SOLUTION PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 UQUDO

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENT

14.24 WESTERN HOLDING INC

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 PRODUCT PORTFOLIO

14.24.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 BELOW MENTIONED ARE A FEW REGULATORY LANDSCAPES FOLLOWED IN GCC:

TABLE 2 GCC IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 3 GCC SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 GCC SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 GCC PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 GCC IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 7 GCC IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 GCC IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 9 GCC IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 10 GCC GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 GCC BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 GCC RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 GCC HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 GCC IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 GCC ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 GCC GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 GCC OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 GCC IDENTITY VERIFICATION MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 19 U.A.E. IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 20 U.A.E. SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 U.A.E. SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 U.A.E. PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 U.A.E. IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 24 U.A.E IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 U.A.E. IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 26 U.A.E. IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 27 U.A.E. GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 U.A.E. BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 U.A.E. RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 30 U.A.E. HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 U.A.E. IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 32 U.A.E. ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 U.A.E. GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 U.A.E. OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 36 KINGDOM OF SAUDI ARABIA (KSA) SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 KINGDOM OF SAUDI ARABIA (KSA) SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 KINGDOM OF SAUDI ARABIA (KSA) PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 40 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 42 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 43 KINGDOM OF SAUDI ARABIA (KSA) GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 KINGDOM OF SAUDI ARABIA (KSA) BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 KINGDOM OF SAUDI ARABIA (KSA) RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 KINGDOM OF SAUDI ARABIA (KSA) HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 KINGDOM OF SAUDI ARABIA (KSA) IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 KINGDOM OF SAUDI ARABIA (KSA) ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 KINGDOM OF SAUDI ARABIA (KSA) GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 KINGDOM OF SAUDI ARABIA (KSA) OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 QATAR IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 52 QATAR SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 QATAR SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 QATAR PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 QATAR IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 56 QATAR IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 QATAR IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 QATAR IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 59 QATAR GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 QATAR BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 QATAR RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 QATAR HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 QATAR IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 QATAR ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 QATAR GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 QATAR OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 KUWAIT IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 68 KUWAIT SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 KUWAIT SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 KUWAIT PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 KUWAIT IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 72 KUWAIT IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 KUWAIT IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 74 KUWAIT IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 75 KUWAIT GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 KUWAIT BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 KUWAIT RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 KUWAIT HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 KUWAIT IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 KUWAIT ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 KUWAIT GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 KUWAIT OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 OMAN IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 84 OMAN SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 OMAN SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 OMAN PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 OMAN IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 88 OMAN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 OMAN IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 90 OMAN IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 91 OMAN GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 OMAN BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 OMAN RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 OMAN HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 OMAN IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 OMAN ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 OMAN GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 OMAN OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 BAHRAIN IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 100 BAHRAIN SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 BAHRAIN SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 BAHRAIN PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 BAHRAIN IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 104 BAHRAIN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 BAHRAIN IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 106 BAHRAIN IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 107 BAHRAIN GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 BAHRAIN BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 BAHRAIN RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 BAHRAIN HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 BAHRAIN IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 BAHRAIN ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 BAHRAIN GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 BAHRAIN OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 GCC IDENTITY VERIFICATION MARKET: SEGMENTATION

FIGURE 2 GCC IDENTITY VERIFICATION MARKET: DATA TRIANGULATION

FIGURE 3 GCC IDENTITY VERIFICATION MARKET: DROC ANALYSIS

FIGURE 4 GCC IDENTITY VERIFICATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 GCC IDENTITY VERIFICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GCC IDENTITY VERIFICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GCC IDENTITY VERIFICATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GCC IDENTITY VERIFICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GCC IDENTITY VERIFICATION MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR NEAR-FIELD COMMUNICATION (NFC) TECHNOLOGIES IS EXPECTED TO DRIVE GCC IDENTITY VERIFICATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GCC IDENTITY VERIFICATION MARKET IN 2022 & 2029

FIGURE 12 TECHNOLOGICAL TRENDS IN IDENTITY VERIFICATION SOLUTIONS

FIGURE 13 SUPPLY CHAIN OF GCC IDENTITY VERIFICATION MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GCC IDENTITY VERIFICATION MARKET

FIGURE 15 FIGURE 2 GROWTH IN NFC TECHNOLOGIES USAGE

FIGURE 16 GROWING PREVALENCE OF BIOMETRIC SOLUTIONS AMONG CONSUMERS

FIGURE 17 FIGURE 4 NUMBER OF SMARTPHONE USERS WORLDWIDE, FROM 2016 TO 2020

FIGURE 18 GCC IDENTITY VERIFICATION MARKET: BY COMPONENT, 2021

FIGURE 19 GCC IDENTITY VERIFICATION MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 20 GCC IDENTITY VERIFICATION MARKET: BY TYPE, 2021

FIGURE 21 GCC IDENTITY VERIFICATION MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 22 GCC IDENTITY VERIFICATION MARKET: BY VERTICAL, 2021

FIGURE 23 GCC IDENTITY VERIFICATION MARKET: SNAPSHOT (2021)

FIGURE 24 GCC IDENTITY VERIFICATION MARKET: BY COUNTRY (2021)

FIGURE 25 GCC IDENTITY VERIFICATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 GCC IDENTITY VERIFICATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 GCC IDENTITY VERIFICATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 28 GCC IDENTITY VERIFICATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 29 UAE GCC IDENTITY VERIFICATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 30 KSA GCC Identity Verification MARKET: company share 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.