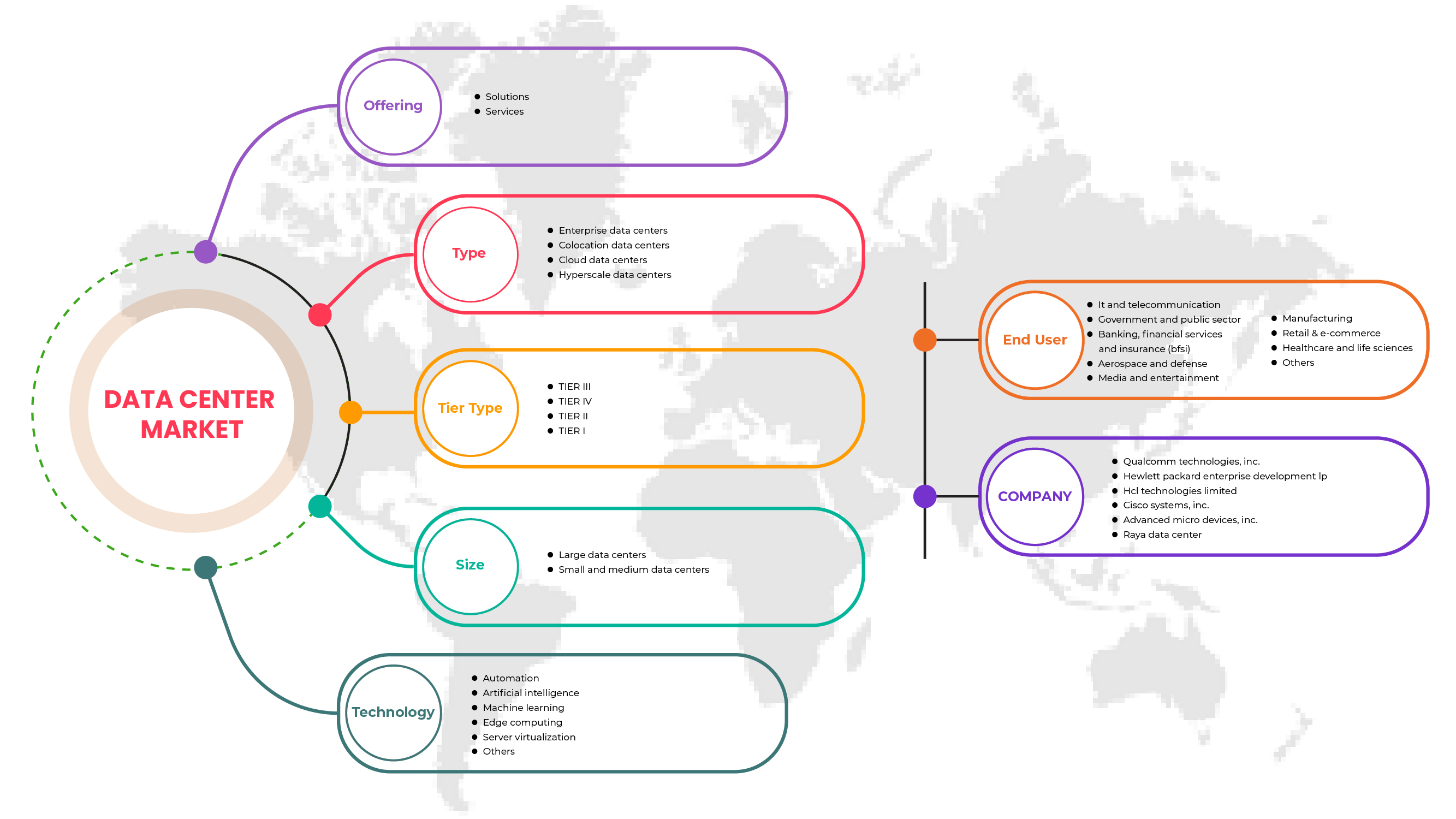

Marché des centres de données du CCG, par offre (solutions et services), type (centres de données d'entreprise, centres de données de colocation , centres de données cloud et centres de données hyperscale ), type de niveau (niveau III, niveau IV, niveau II et niveau I), taille (grands centres de données et petits et moyens centres de données), technologie ( automatisation , intelligence artificielle, apprentissage automatique, informatique de pointe, virtualisation de serveur et autres), utilisateur final (informatique et télécommunications, gouvernement et secteur public, banque, services financiers et assurances (BFSI), aérospatiale et défense, médias et divertissement, fabrication, vente au détail et commerce électronique, soins de santé et sciences de la vie et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des centres de données du CCG

Le centre de données est utilisé pour la gestion des données, la fluidité et la sécurité en garantissant que toutes les ressources travaillent au bon moment et au bon endroit. La prévision, la planification, la gestion des compétences, la gestion des ressources, le traitement, le calcul et la classification des données sont tous des aspects courants des centres de données.

Les solutions et les centres de données d'entreprise stimulent la croissance du marché des centres de données dans tous les secteurs d'utilisation finale possibles dans le monde entier. Actuellement, les centres de données de niveau 3 sont très demandés dans un large éventail de secteurs tels que l'informatique et les télécommunications, le gouvernement et le secteur public, la banque, les services financiers et les assurances (BFSI) et d'autres. La concurrence de haut niveau sur le marché mondial exige le développement rapide de nouveaux produits afin de survivre sur le marché. La demande continue d'avancées technologiques telles que la technologie, l'automatisation, l'Internet des objets et autres contribue à accroître la demande de centres de données.

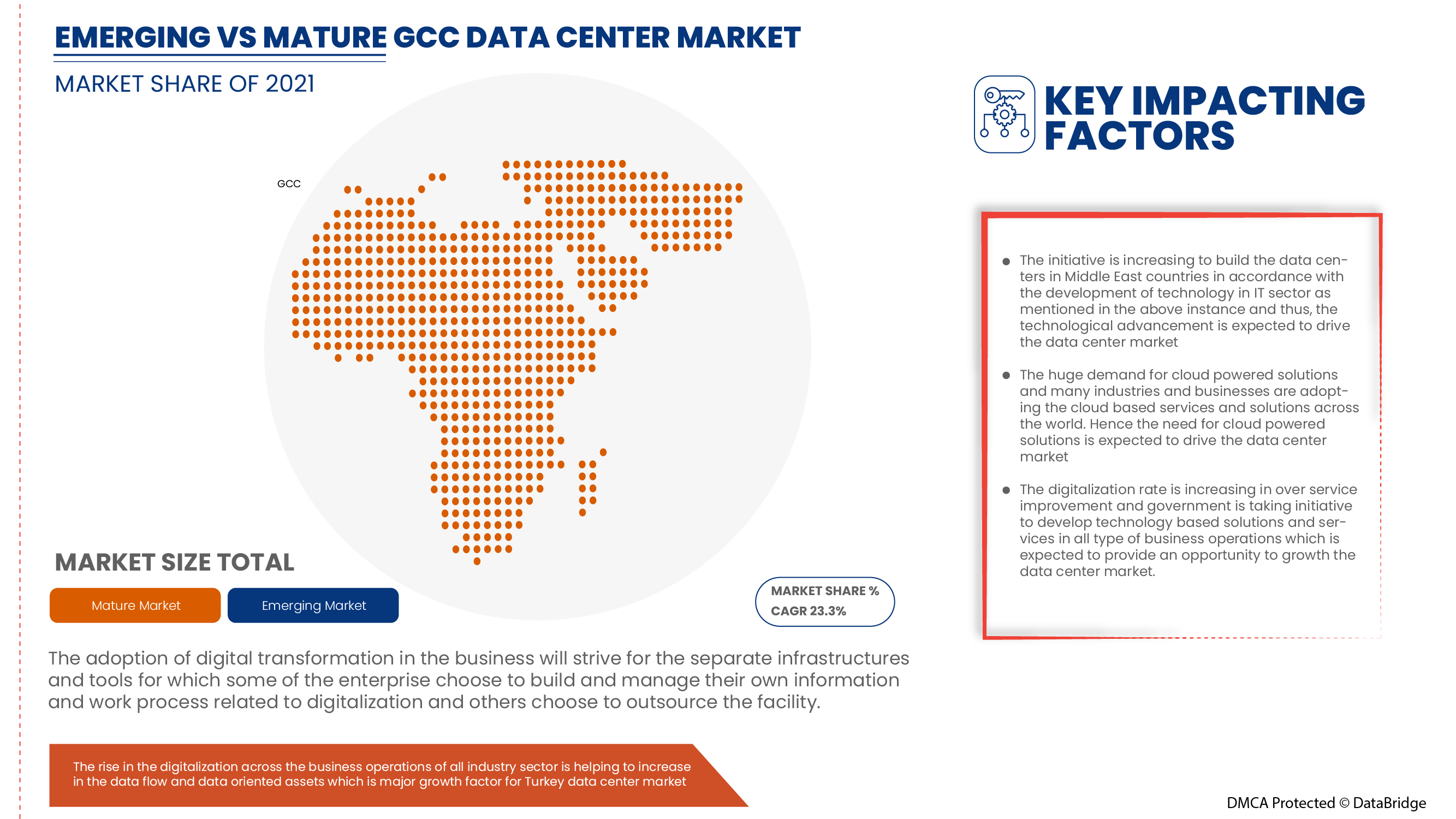

Selon les analyses de Data Bridge Market Research, le marché des centres de données du CCG, d'Irak, de Turquie et d'Égypte devrait atteindre la valeur de 6 608,33 millions USD d'ici 2029, à un TCAC de 23,3 % au cours de la période de prévision. Les « solutions » représentent le segment de composants le plus important du marché des centres de données, qui fournit des installations de base et une large gamme de fonctionnalités avec différentes plates-formes.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable jusqu'en 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par offre (solutions et services), type (centres de données d'entreprise, centres de données de colocation, centres de données cloud et centres de données hyperscale), type de niveau (niveau III, niveau IV, niveau II et niveau I), taille (grands centres de données et petits et moyens centres de données), technologie (automatisation, intelligence artificielle, apprentissage automatique, informatique de pointe, virtualisation de serveur et autres), utilisateur final (informatique et télécommunications, gouvernement et secteur public, banque, services financiers et assurances (BFSI), aérospatiale et défense, médias et divertissement, fabrication, vente au détail et commerce électronique, soins de santé et sciences de la vie et autres) |

|

Pays couverts |

Émirats arabes unis, Arabie saoudite, Qatar, Oman, Koweït, Bahreïn |

|

Acteurs du marché couverts |

Parmi les autres sociétés figurent AL-NABAA, Equinix, Inc., FUTURE DIGITAL DATA SYSTEMS, Khazna, GIGA-BYTE Technology Co., Ltd., eHosting DataFort, Qualcomm Technologies, Inc., Advanced Micro Devices, Inc., Arista Networks, Inc., Quantum Switch, MEEZA, Delta Electronics, Inc., ABB, Siemens, Eaton, Schneider Electric, HCL Technologies Limited, Cisco Systems, Inc., Hewlett Packard Enterprise Development LP, Raya Data Center et Huawei Technologies Co., Ltd. |

Définition du marché

Un centre de données est une installation de pointe qui gère les systèmes et équipements informatiques liés à l'informatique. Les centres de données connectent les normes d'infrastructure aux exigences de l'environnement opérationnel de diverses industries d'utilisateurs finaux. Le centre de données est externalisé auprès de nombreuses entreprises à travers le monde qui fournissent l'installation en fonction des besoins de l'utilisateur final et du client. Ces types de solutions ou de services offerts aux clients dépendent des conditions de travail et des composants utilisés dans les centres de données, qui utilisent différents types de technologies et de composants électroniques en fonction de la taille des données gérées et stockées. Le marché des centres de données assure la gestion, le stockage, le traitement et le calcul des données, y compris l'inclusion et le temps de réponse pris par les composants pour répliquer le flux de données.

Dynamique du marché des centres de données

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- La demande croissante de numérisation dans les opérations commerciales

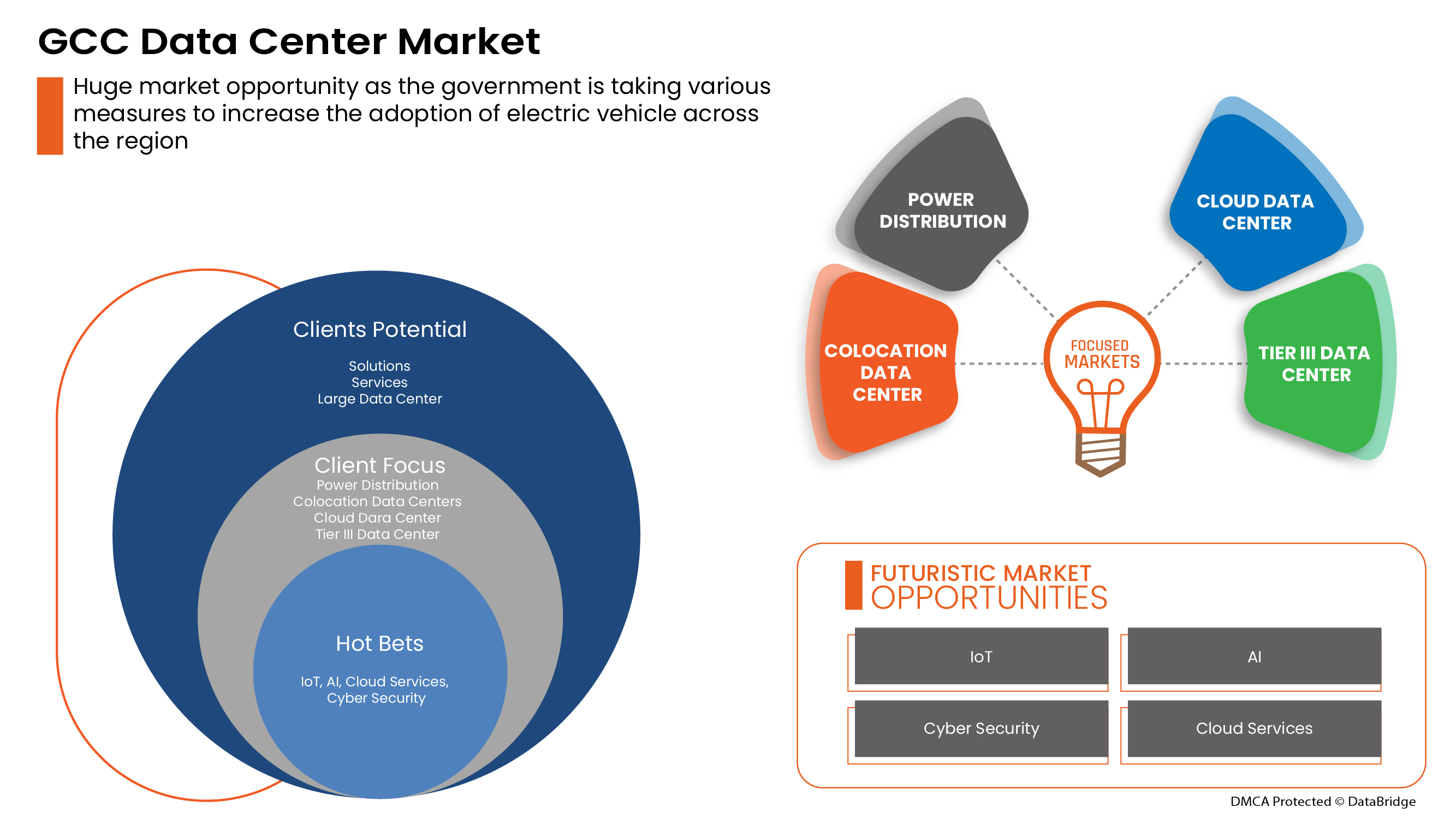

Le besoin de numérisation a augmenté dans toute la région au fil des ans, ce qui a profité aux habitants de la campagne et la demande va donc augmenter à l'avenir. L'adoption de la transformation numérique dans les entreprises s'efforcera de mettre en place des infrastructures et des outils distincts pour lesquels certaines entreprises choisiront de créer et de gérer leurs informations et leurs processus de travail liés à la numérisation et d'autres choisiront d'externaliser l'installation. Cela reproduit l'adoption et l'utilisation des centres de données dans toute la région et illustre les attentes quant au besoin de centres de données dans la région.

- Progrès technologiques dans le secteur informatique

Les progrès technologiques ont permis de créer des solutions et des produits innovants, ce qui a eu un impact sur la demande de connectivité facile et fluide et nécessite donc une quantité parfaite d'infrastructures appelées centres de données. De plus, l'initiative de construction de centres de données dans les pays du Moyen-Orient s'intensifie conformément au développement technologique dans le secteur informatique, comme mentionné dans l'exemple ci-dessus. Ainsi, les progrès technologiques devraient stimuler le marché des centres de données.

- La popularité croissante des solutions basées sur le cloud

Les gouvernements de nombreux pays du Moyen-Orient soutiennent de nombreuses initiatives pour permettre aux gens de démarrer une entreprise technologique, ce qui incite les petites et moyennes entreprises à se transformer numériquement. La demande de solutions basées sur le cloud est énorme et de nombreuses industries et entreprises adoptent des services et des solutions basés sur le cloud non seulement au Moyen-Orient et dans les pays du CCG, mais dans le monde entier. Par conséquent, le besoin de solutions basées sur le cloud devrait stimuler le marché des centres de données.

- Demande croissante de moyens de travail et d'apprentissage à distance

La pandémie a perturbé l’enseignement dans plus de 150 pays et a touché 1,6 milliard d’étudiants. En conséquence, de nombreux pays ont mis en place une forme d’apprentissage à distance. La réponse éducative au début de la COVID-19 s’est concentrée sur la mise en œuvre de modalités d’apprentissage à distance en réponse à la crise. Cependant, elles n’ont pas toujours été efficaces, mais à mesure que la pandémie s’est développée, les réponses éducatives ont également évolué.

Restrictions

- Infrastructures peu fiables dans les pays en développement

En particulier dans les pays émergents, les systèmes de base continuent de fournir des formes d'assistance problématiques et sont vulnérables aux chocs extérieurs, y compris aux dangers naturels. En outre, les inondations perturbent souvent l'ensemble de l'économie métropolitaine, même au-delà des zones directement touchées par les inondations. Lorsque les rues sont inondées, les transports publics et toute la circulation s'arrêtent. Les gens ne peuvent pas se rendre à leur travail, les chaînes d'approvisionnement sont perturbées, les livraisons sont manquées et les ventes sont perdues. L'alimentation électrique est également fréquemment affectée, ce qui entraîne des pannes de courant et l'arrêt de l'activité économique. Ainsi, le manque de fiabilité des infrastructures dans les pays en développement devrait freiner la croissance du marché des centres de données.

- Complexités liées à l'intégration de différents outils de centre de données

L'intégration des centres de données et du Big Data implique un large éventail d'exigences et est associée à des stratégies de travail complexes qui ne peuvent pas être éliminées mais peuvent être simplifiées grâce à divers outils et solutions, qui nécessitent des coûts de configuration supplémentaires et une maintenance fréquente. L'intégration de différents outils de centres de données implique donc des complexités. On s'attend à ce que cela freine le marché des centres de données.

Impact post-COVID-19 sur le marché des centres de données

La COVID-19 a eu un impact majeur sur le marché des centres de données, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui ont dû faire face à cette situation de pandémie étaient les services essentiels qui ont été autorisés à ouvrir et à exécuter des processus.

La COVID-19 a eu un impact sur le marché des centres de données. Les coûts d'investissement limités et le manque d'employés ont entravé les ventes et la production du centre de données. Cependant, le gouvernement et les principaux acteurs du marché ont adopté de nouvelles mesures de sécurité pour développer les pratiques. Les progrès technologiques ont accéléré le taux de croissance du marché des centres de données, car ils ciblaient le bon public. Le marché de la construction de centres de données devrait reprendre son rythme après la pandémie en raison de l'assouplissement des restrictions.

Développements récents

- En juin 2022, Schneider Electric a annoncé une nouvelle étude sur les infrastructures informatiques innovantes pour des opérations à zéro émission nette pour le secteur de l'informatique et des centres de données. Ce développement aidera l'entreprise à mettre en évidence le manque d'action dans les centres de données et à innover de nouvelles solutions pour combler ce manque et améliorer l'efficacité des centres de données

- En décembre 2021, Equinix, Inc. a annoncé un partenariat pluriannuel avec Nasdaq, Inc. pour accroître l'utilisation du centre de données de l'entreprise. Ce partenariat aidera l'entreprise à renforcer sa position sur le marché et à attirer de nouveaux clients en gagnant la confiance grâce à un partenariat avec une entreprise réputée

Portée du marché des centres de données du CCG, de l'Irak, de la Turquie et de l'Égypte

Le marché des centres de données est segmenté en fonction des offres, du type, du type de niveau, de la taille, de la technologie et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Offre

- Solutions

- Services

Sur la base de l'offre, le marché des centres de données du CCG, de l'Irak, de la Turquie et de l'Égypte est segmenté en solutions et services .

Taper

- Centres de données d'entreprise

- Centres de données de colocation

- Centres de données Cloud

- Centres de données hyperscale

Sur la base du type, le marché des centres de données du CCG, de l'Irak, de la Turquie et de l'Égypte est segmenté en centres de données de collocation, centres de données d'entreprise, centres de données cloud et centres de données hyperscale.

Type de niveau

- Niveau I

- Niveau II

- Niveau III

- Niveau IV

Sur la base du type de niveau, le marché des centres de données du CCG, de l'Irak, de la Turquie et de l'Égypte est segmenté en niveau I, niveau II, niveau III et niveau IV.

Taille

- Grands centres de données

- Centres de données de petite et moyenne taille

Sur la base de la taille, le marché des centres de données du CCG, de l'Irak, de la Turquie et de l'Égypte est segmenté en grands centres de données et en petits et moyens centres de données.

Technologie

- Automation

- Intelligence artificielle

- Apprentissage automatique

- Informatique de pointe

- Virtualisation des serveurs

- Autres

Sur la base de la technologie, le marché des centres de données du CCG, de l'Irak, de la Turquie et de l'Égypte est segmenté en informatique de pointe, virtualisation des serveurs, automatisation, intelligence artificielle, apprentissage automatique et autres.

Utilisateur final

- Informatique et télécommunication

- Gouvernement et secteur public

- Banque, services financiers et assurances (BFSI)

- Aérospatiale et Défense

- Médias et divertissement

- Fabrication

- Commerce de détail et commerce électronique

- Santé et sciences de la vie

- Autres

Sur la base de l'utilisateur final, le marché des centres de données du CCG, de l'Irak, de la Turquie et de l'Égypte est segmenté en informatique et télécommunications, gouvernement et secteur public, banque, services financiers et assurances (BFSI), aérospatiale et défense, médias et divertissement, fabrication, vente au détail et commerce électronique, soins de santé et sciences de la vie et autres.

Analyse/perspectives régionales du marché des centres de données

Le marché des centres de données est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, offre, type, type de niveau, taille, technologie et utilisateur final, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des centres de données sont les Émirats arabes unis, l'Arabie saoudite, le Qatar, Oman, le Koweït et Bahreïn.

Le CCG domine la région du CCG, de l’Irak, de la Turquie et de l’Égypte en raison de la présence de grandes entreprises et du volume important de flux de données dans la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des centres de données

Le paysage concurrentiel du marché des centres de données fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence régionale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des centres de données.

Certains des principaux acteurs opérant sur le marché des centres de données sont AL-NABAA, Equinix, Inc., FUTURE DIGITAL DATA SYSTEMS, Khazna, GIGA-BYTE Technology Co., Ltd., eHosting DataFort, Qualcomm Technologies, Inc., Advanced Micro Devices, Inc., Arista Networks, Inc., Quantum Switch, MEEZA, Delta Electronics, Inc., ABB, Siemens, Eaton, Schneider Electric, HCL Technologies Limited, Cisco Systems, Inc., Hewlett Packard Enterprise Development LP, Raya Data Center et Huawei Technologies Co., Ltd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GCC DATA CENTER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 GCC OFFERING TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCE ANALYSIS

4.2 BENEFITS OF DATA CENTER SOLUTIONS FOR BUSINESSES

4.3 MACHINE LEARNING APPLICATIONS FOR DATA CENTER OPTIMIZATION

4.4 TRENDS TO SHAPE THE DATA CENTER INDUSTRY

4.4.1 GREEN DATA CENTERS

4.4.2 ENERGY STORAGE

4.4.3 AUTOMATION AND ROBOTICS

4.4.4 SUSTAINABILITY

4.5 VALUE CHAIN ANALYSIS

4.5.1 OVERVIEW OF VALUE CHAIN ANALYSIS OF GCC DATA CENTER MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR DIGITALIZATION IN BUSINESS OPERATIONS

5.1.2 TECHNOLOGICAL ADVANCEMENTS IN THE IT SECTOR

5.1.3 INCREASING POPULARITY OF CLOUD-POWERED SOLUTIONS

5.1.4 RISING DEMAND FOR REMOTE WORKING AND LEARNING FACILITIES

5.2 RESTRAINTS

5.2.1 UNRELIABLE INFRASTRUCTURE IN DEVELOPING COUNTRIES

5.2.2 COMPLEXITIES INVOLVED IN THE INTEGRATION OF DIFFERENT DATA CENTER TOOLS

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND FROM GOVERNMENT AND PRIVATE SECTOR FOR SERVICE IMPROVEMENT

5.3.2 SURGE IN THE ADOPTION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.3.3 RISE IN THE E-COMMERCE BUSINESS ACROSS THE REGION

5.4 CHALLENGES

5.4.1 HINDRANCE IN DATA CENTER SUPPLY CHAIN

5.4.2 CHALLENGES IN DATA CLASSIFICATION AND PROCESSING

6 GCC DATA CENTER MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.3 SERVICES

7 GCC DATA CENTER MARKET, BY TYPE

7.1 OVERVIEW

7.2 ENTERPRISE DATA CENTERS

7.3 COLOCATION DATA CENTERS

7.4 CLOUD DATA CENTERS

7.5 HYPERSCALE DATA CENTERS

8 GCC DATA CENTER MARKET, BY TIER TYPE

8.1 OVERVIEW

8.2 TIER III

8.3 TIER IV

8.4 TIER II

8.5 TIER I

9 GCC DATA CENTER MARKET, BY SIZE

9.1 OVERVIEW

9.2 LARGE DATA CENTERS

9.3 SMALL AND MEDIUM DATA CENTERS

10 GCC DATA CENTER MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 AUTOMATION

10.3 ARTIFICIAL INTELLIGENCE

10.4 MACHINE LEARNING

10.5 EDGE COMPUTING

10.6 SERVER VIRTUALIZATION

10.7 OTHERS

11 GCC DATA CENTER MARKET, BY END USER

11.1 OVERVIEW

11.2 IT AND TELECOMMUNICATION

11.3 GOVERNMENT AND PUBLIC SECTOR

11.4 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.5 AEROSPACE AND DEFENSE

11.6 MEDIA AND ENTERTAINMENT

11.7 MANUFACTURING

11.8 RETAIL & E-COMMERCE

11.9 HEALTHCARE AND LIFE SCIENCES

11.1 OTHERS

12 GCC DATA CENTER MARKET, BY COUNTRY

12.1 U.A.E.

12.2 SAUDI ARABIA

12.3 QATAR

12.4 OMAN

12.5 KUWAIT

12.6 BAHRAIN

13 GCC DATA CENTER MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GCC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ADVANCED MICRO DEVICES, INC

15.1.1 COMPANY SNAPSHOT

15.1.1 REVENUE ANALYSIS

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENTS

15.2 CISCO SYSTEMS, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 QUALCOMM TECHNOLOGIES, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 HCL TECHNOLOGIES LIMITED

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ABB

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 AL-NABAA

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTIONS PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 ARISTA NETWORKS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 DELTA ELECTRONICS, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 EATON

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 EHOSTING DATAFORT

15.11.1 COMPANY SNAPSHOT

15.11.2 SERVICE PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 EQUINIX, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 SOLUTION PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 FUTURE DIGITAL DATA SYSTEMS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 GIGA-BYTE TECHNOLOGY CO., LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 HUAWEI TECHNOLOGIES CO., LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 KHAZNA

15.16.1 COMPANY SNAPSHOT

15.16.2 SERVICE PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 MEEZA

15.17.1 COMPANY SNAPSHOT

15.17.2 SERVICE PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 QUANTUM SWITCH

15.18.1 COMPANY SNAPSHOT

15.18.2 SERVICE PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 RAYA DATA CENTER

15.19.1 COMPANY SNAPSHOT

15.19.2 SERVICE PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SCHNEIDR ELECTRIC

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

15.21 SIEMENS

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 GCC DATA CENTER MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 GCC SOLUTIONS IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 GCC SERVICES IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 GCC DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 GCC DATA CENTER MARKET, BY TIER TYPE, 2020-2029 (USD MILLION)

TABLE 6 GCC DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 7 GCC DATA CENTER MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 GCC DATA CENTER MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 9 GCC IT AND TELECOMMUNICATION IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 10 GCC GOVERNMENT AND PUBLIC SECTOR IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 11 GCC BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 12 GCC AEROSPACE AND DEFENSE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 13 GCC MEDIA AND ENTERTAINMENT IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 14 GCC MANUFACTURING IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 15 GCC RETAIL & E-COMMERCE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 16 GCC HEALTHCARE AND LIFE SCIENCES IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 17 GCC DATA CENTER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 U.A.E. DATA CENTER MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 19 U.A.E. SOLUTIONS IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.A.E. POWER DISTRIBUTION IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 U.A.E. SERVICES IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 U.A.E. DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 U.A.E. DATA CENTER MARKET, BY TIER TYPE, 2020-2029 (USD MILLION)

TABLE 24 U.A.E. DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 25 U.A.E. DATA CENTER MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 26 U.A.E. DATA CENTER MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 27 U.A.E. IT AND TELECOMMUNICATION IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 28 U.A.E. GOVERNMENT AND PUBLIC SECTOR IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 29 U.A.E. BANKING, FINANCIAL SERVICES, INSURANCE (BFSI) IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 30 U.A.E. AEROSPACE AND DEFENSE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 31 U.A.E. MEDIA AND ENTERTAINMENT IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 32 U.A.E. MANUFACTURING IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 33 U.A.E. RETAIL & E-COMMERCE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 34 U.A.E. HEALTHCARE AND LIFE SCIENCES IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 35 SAUDI ARABIA DATA CENTER MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 36 SAUDI ARABIA SOLUTIONS IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 SAUDI ARABIA POWER DISTRIBUTION IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 SAUDI ARABIA SERVICES IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 SAUDI ARABIA DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 SAUDI ARABIA DATA CENTER MARKET, BY TIER TYPE, 2020-2029 (USD MILLION)

TABLE 41 SAUDI ARABIA DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 42 SAUDI ARABIA DATA CENTER MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 SAUDI ARABIA DATA CENTER MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 SAUDI ARABIA IT AND TELECOMMUNICATION IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 45 SAUDI ARABIA GOVERNMENT AND PUBLIC SECTOR IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 46 SAUDI ARABIA BANKING, FINANCIAL SERVICES, INSURANCE (BFSI) IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 47 SAUDI ARABIA AEROSPACE AND DEFENSE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 48 SAUDI ARABIA MEDIA AND ENTERTAINMENT IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 49 SAUDI ARABIA MANUFACTURING IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA RETAIL & E-COMMERCE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA HEALTHCARE AND LIFE SCIENCES IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 52 QATAR DATA CENTER MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 53 QATAR SOLUTIONS IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 QATAR POWER DISTRIBUTION IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 QATAR SERVICES IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 QATAR DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 QATAR DATA CENTER MARKET, BY TIER TYPE, 2020-2029 (USD MILLION)

TABLE 58 QATAR DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 59 QATAR DATA CENTER MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 QATAR DATA CENTER MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 QATAR IT AND TELECOMMUNICATION IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 62 QATAR GOVERNMENT AND PUBLIC SECTOR IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 63 QATAR BANKING, FINANCIAL SERVICES, INSURANCE (BFSI) IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 64 QATAR AEROSPACE AND DEFENSE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 65 QATAR MEDIA AND ENTERTAINMENT IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 66 QATAR MANUFACTURING IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 67 QATAR RETAIL & E-COMMERCE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 68 QATAR HEALTHCARE AND LIFE SCIENCES IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 69 OMAN DATA CENTER MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 OMAN SOLUTIONS IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 OMAN POWER DISTRIBUTION IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 OMAN SERVICES IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 OMAN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 OMAN DATA CENTER MARKET, BY TIER TYPE, 2020-2029 (USD MILLION)

TABLE 75 OMAN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 76 OMAN DATA CENTER MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 OMAN DATA CENTER MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 OMAN IT AND TELECOMMUNICATION IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 79 OMAN GOVERNMENT AND PUBLIC SECTOR IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 80 OMAN BANKING, FINANCIAL SERVICES, INSURANCE (BFSI) IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 81 OMAN AEROSPACE AND DEFENSE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 82 OMAN MEDIA AND ENTERTAINMENT IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 83 OMAN MANUFACTURING IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 84 OMAN RETAIL & E-COMMERCE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 85 OMAN HEALTHCARE AND LIFE SCIENCES IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 86 KUWAIT DATA CENTER MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 87 KUWAIT SOLUTIONS IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 KUWAIT POWER DISTRIBUTION IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 KUWAIT SERVICES IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 KUWAIT DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 KUWAIT DATA CENTER MARKET, BY TIER TYPE, 2020-2029 (USD MILLION)

TABLE 92 KUWAIT DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 93 KUWAIT DATA CENTER MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 94 KUWAIT DATA CENTER MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 95 KUWAIT IT AND TELECOMMUNICATION IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 96 KUWAIT GOVERNMENT AND PUBLIC SECTOR IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 97 KUWAIT BANKING, FINANCIAL SERVICES, INSURANCE (BFSI) IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 98 KUWAIT AEROSPACE AND DEFENSE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 99 KUWAIT MEDIA AND ENTERTAINMENT IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 100 KUWAIT MANUFACTURING IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 101 KUWAIT RETAIL & E-COMMERCE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 102 KUWAIT HEALTHCARE AND LIFE SCIENCES IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 103 BAHRAIN DATA CENTER MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 104 BAHRAIN SOLUTIONS IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 BAHRAIN POWER DISTRIBUTION IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 BAHRAIN SERVICES IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 BAHRAIN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 BAHRAIN DATA CENTER MARKET, BY TIER TYPE, 2020-2029 (USD MILLION)

TABLE 109 BAHRAIN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 110 BAHRAIN DATA CENTER MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 111 BAHRAIN DATA CENTER MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 112 BAHRAIN IT AND TELECOMMUNICATION IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 113 BAHRAIN GOVERNMENT AND PUBLIC SECTOR IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 114 BAHRAIN BANKING, FINANCIAL SERVICES, INSURANCE (BFSI) IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 115 BAHRAIN AEROSPACE AND DEFENSE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 116 BAHRAIN MEDIA AND ENTERTAINMENT IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 117 BAHRAIN MANUFACTURING IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 118 BAHRAIN RETAIL & E-COMMERCE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 119 BAHRAIN HEALTHCARE AND LIFE SCIENCES IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 GCC DATA CENTER MARKET: SEGMENTATION

FIGURE 2 GCC DATA CENTER MARKET: DATA TRIANGULATION

FIGURE 3 GCC DATA CENTER MARKET: DROC ANALYSIS

FIGURE 4 GCC DATA CENTER MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GCC DATA CENTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GCC DATA CENTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GCC DATA CENTER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GCC DATA CENTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GCC DATA CENTER MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 GCC DATA CENTER MARKET: SEGMENTATION

FIGURE 11 RISE IN DEMAND FOR DIGITALIZATION IN BUSINESS IS EXPECTED TO DRIVE THE GCC DATA CENTER MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 THE SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GCC DATA CENTER MARKET IN 2022 & 2029

FIGURE 13 PORTER'S FIVE FORCE ANALYSIS

FIGURE 14 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GCC DATA CENTER MARKET

FIGURE 16 UNEMPLOYMENT RATE IN THE MIDDLE EAST & NORTH AFRICA REGION

FIGURE 17 PENETRATION OF 3G-OR-GREATER MOBILE INTERNET IN THE MIDDLE EAST

FIGURE 18 SIZING CLOUD SHIFT, WORLDWIDE, 2019 – 2025

FIGURE 19 GCC DATA CENTER MARKET, BY OFFERING, 2021

FIGURE 20 GCC DATA CENTER MARKET, BY TYPE, 2021

FIGURE 21 GCC DATA CENTER MARKET, BY TIER TYPE, 2021

FIGURE 22 GCC DATA CENTER MARKET, BY SIZE, 2021

FIGURE 23 GCC DATA CENTER MARKET, BY TECHNOLOGY, 2021

FIGURE 24 GCC DATA CENTER MARKET, BY END USER, 2021

FIGURE 25 GCC DATA CENTER MARKET: SNAPSHOT (2021)

FIGURE 26 GCC DATA CENTER MARKET: BY COUNTRY (2021)

FIGURE 27 GCC DATA CENTER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 GCC DATA CENTER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 GCC DATA CENTER MARKET: BY OFFERING (2022-2029)

FIGURE 30 GCC DATA CENTER MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.