Marché européen des appareils d'urologie, par type de produit (équipement de dialyse, appareils de traitement des calculs urinaires, appareils d'endoscopie, appareils de traitement de l'hyperplasie bénigne de la prostate, incontinence urinaire et prolapsus des organes pelviens et autres produits), type (instruments et consommables et accessoires), indication (maladies rénales, vessie hyperactive, hématurie, infection des voies urinaires, calculs rénaux, éjaculation précoce, hyperplasie bénigne de la prostate, cancer urologique, prolapsus des organes pelviens, urétrotomies, sténose urétrale et autres maladies), technologie (chirurgie mini-invasive, chirurgie robotique et autres), utilisateur final (hôpitaux et cliniques, centres de dialyse, laboratoires de recherche clinique, instituts universitaires et autres), canal de distribution (appels d'offres directs, distribution par des tiers et autres), pays (Allemagne, Royaume-Uni, France, Italie, Espagne, Pays-Bas, Russie, Turquie, Suisse et reste de l'Europe) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché : marché européen des dispositifs urologiques

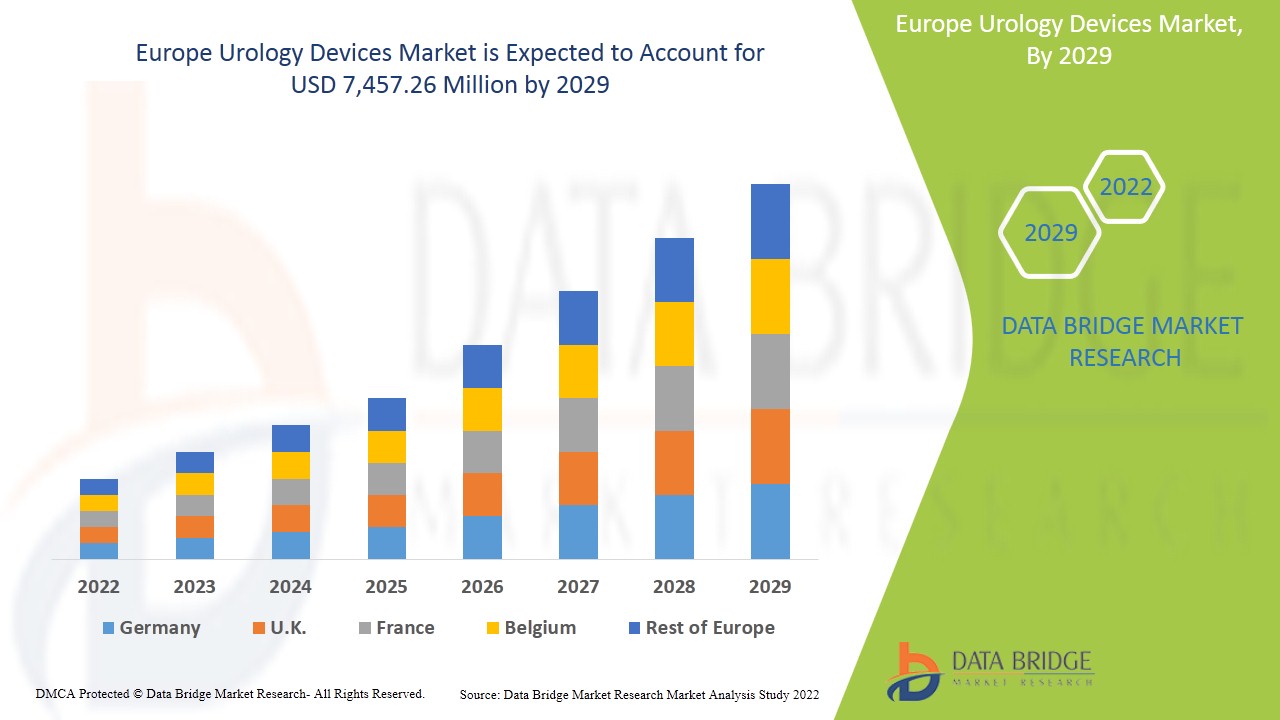

Le marché européen des dispositifs d'urologie devrait connaître une croissance de marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 7,8 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 7 457,26 millions USD d'ici 2029. L'augmentation des dépenses de santé et l'intérêt accru pour la chirurgie mini-invasive agissent comme moteurs de la croissance du marché des dispositifs d'urologie.

Les appareils et fournitures d'urologie sont des produits conçus pour les personnes souffrant de maladies urologiques, de rétention urinaire et qui ont besoin d'aide pour éliminer l'urine du corps. Les maladies ou affections urologiques comprennent les infections des voies urinaires, les calculs rénaux , les problèmes de contrôle de la vessie et les problèmes de prostate , etc. Les appareils d'urologie comprennent une large gamme de produits tels que des tables d'opération urologiques, des tables d'examen urologiques, des chaises, des systèmes d'imagerie par ultrasons urologiques, des scanners de vessie, des systèmes urodynamiques, des débitmètres urinaires, des lithotriteurs intracorporels, des lithotriteurs extracorporels, des lasers urologiques, des pinces urologiques, des aiguilles de biopsie de la prostate, des mailles, des stents , des cathéters, des ensembles et des sacs de drainage, des stimulateurs, des sondes, des kits de test du cancer et des implants. Ces appareils sont utilisés à la fois pour les procédures de diagnostic et de traitement urologiques. Les procédures urologiques courantes comprennent la vasectomie, l'inversion de vasectomie, la cystoscopie, la procédure de la prostate, la lithotritie et bien d'autres. Certaines affections urologiques ne durent que peu de temps tandis que d'autres durent longtemps. Les symptômes courants des problèmes urologiques sont la difficulté à uriner, des douleurs ou des brûlures en urinant, du sang ou d’autres écoulements dans l’urine, de la fièvre, des frissons, des douleurs dans le bas du dos et des douleurs dans les organes génitaux.

Le marché européen des dispositifs urologiques connaîtra une croissance au cours de l'année de prévision en raison de l'augmentation du nombre d'acteurs sur le marché et de la disponibilité de produits avancés en raison de l'incidence croissante des affections urologiques. Parallèlement à cela, les fabricants sont engagés dans des activités de R&D pour lancer de nouveaux produits sur le marché avec des approbations de produits réussies. Cependant, le coût élevé des dispositifs urologiques et le manque de sensibilisation au traitement urologique et aux dispositifs faisant l'objet de rappels de produits peuvent entraver la croissance du marché européen des dispositifs urologiques au cours de la période de prévision.

L'augmentation des dépenses de santé et l'intérêt croissant pour la chirurgie mini-invasive constituent des opportunités de croissance pour le marché. Les initiatives stratégiques des acteurs du marché offrent au marché de nouvelles opportunités d'améliorer le traitement. Cependant, le manque de professionnels qualifiés et le cadre réglementaire strict constituent un obstacle à la croissance du marché.

Le rapport sur le marché des dispositifs d'urologie fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché des dispositifs d'urologie, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des dispositifs d'urologie

Le marché européen des dispositifs d'urologie est classé en six segments notables en fonction du type de produit, du type, de l'indication, de la technologie, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du type de produit, le marché européen des appareils d'urologie est segmenté en équipements de dialyse, appareils de traitement des calculs urinaires, appareils d'endoscopie, appareils de traitement de l'hyperplasie bénigne de la prostate, incontinence urinaire et prolapsus des organes pelviens et autres produits. En 2022, le segment des équipements de dialyse devrait dominer le marché en raison de l'augmentation des maladies rénales et du nombre élevé de populations cibles.

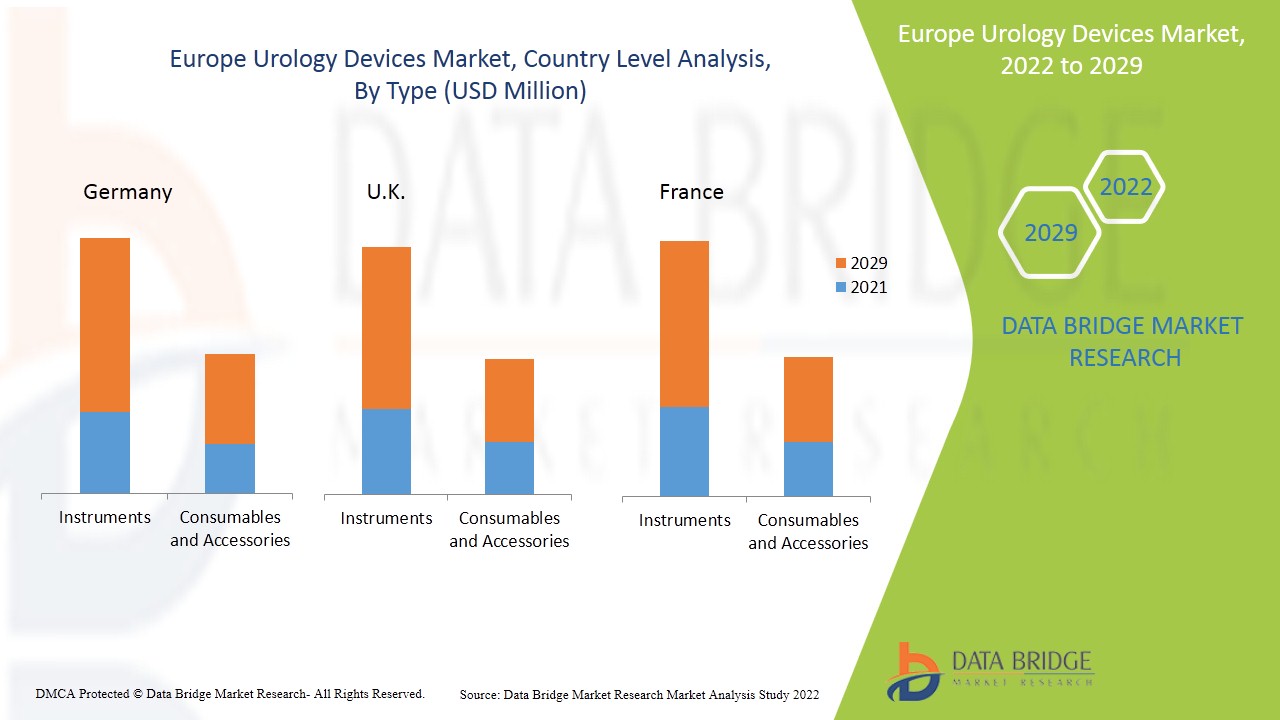

- Sur la base du type, le marché européen des dispositifs d'urologie est segmenté en instruments et en consommables et accessoires. En 2022, le segment des instruments devrait dominer le marché en raison du nombre élevé d'approbations de produits dans la région pour les acteurs du marché.

- Sur la base des indications, le marché européen des dispositifs d'urologie est segmenté en maladies rénales, vessie hyperactive, hématurie, infection des voies urinaires, calculs rénaux, éjaculation précoce, hyperplasie bénigne de la prostate, cancer urologique, prolapsus des organes pelviens, urétrotomies, sténose urétrale et autres maladies. En 2022, le segment des maladies rénales devrait dominer le marché en raison de mauvaises habitudes alimentaires et de l'augmentation des maladies liées au mode de vie.

- Sur la base de la technologie, le marché européen des dispositifs urologiques est segmenté en chirurgie mini-invasive, chirurgie robotique et autres. En 2022, le segment de la chirurgie mini-invasive devrait dominer le marché en raison des avancées technologiques importantes dans ce domaine pour un meilleur confort des patients.

- En fonction de l'utilisateur final, le marché européen des appareils d'urologie est segmenté en hôpitaux et cliniques, centres de dialyse, laboratoires de recherche clinique, instituts universitaires et autres. En 2022, le segment des hôpitaux et cliniques devrait dominer le marché en raison du financement gouvernemental important pour de meilleurs équipements dans les hôpitaux.

- Sur la base du canal de distribution, le marché européen des dispositifs urologiques est segmenté en appels d'offres directs, distribution par des tiers et autres. En 2022, le segment des appels d'offres directs devrait dominer le marché car il fournit de meilleurs produits de bonne qualité.

Analyse du marché des dispositifs d'urologie au niveau des pays

Le marché européen des dispositifs d’urologie est classé en six segments notables en fonction du type de produit, du type, de l’indication, de la technologie, de l’utilisateur final et du canal de distribution.

Les pays couverts dans le rapport sur le marché des dispositifs d’urologie sont l’Allemagne, le Royaume-Uni, l’Italie, la France, l’Espagne, la Suisse, la Russie, la Turquie, les Pays-Bas et le reste de l’Europe.

Le segment des instruments en Allemagne devrait connaître le taux de croissance le plus élevé au cours de la période de prévision de 2022 à 2029 en raison de la prévalence croissante des maladies urologiques. Le segment des instruments au Royaume-Uni est le deuxième marché dominant en Europe en raison de l'augmentation des cas de maladies rénales et des activités de recherche et développement intenses. La France est le troisième pays à la tête de la croissance du marché européen et le segment des instruments domine dans ce pays en raison du nombre croissant de centres de biotechnologie et d'activités de recherche.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Les activités stratégiques croissantes des principaux acteurs du marché pour accroître la sensibilisation au traitement des dispositifs d'urologie stimulent la croissance du marché des dispositifs d'urologie.

Le marché des dispositifs d'urologie vous fournit également une analyse de marché détaillée pour chaque pays en termes de croissance sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2011 à 2020.

Analyse du paysage concurrentiel et des parts de marché des dispositifs d'urologie

Le paysage concurrentiel du marché des appareils d'urologie fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché des appareils d'urologie.

Français Les principales entreprises qui commercialisent des appareils d'urologie sont Medtronic, Siemens, CooperSurgical, Inc., General Electric, BD, Stryker, Boston Scientific Corporation, Cardinal Health., Intuitive Surgical., Cook, Olympus Corporation, Med pro Medical BV, Fresenius Medical Care AG & Co. KGaA, Baxter., Richard Wolf GmbH., Dornier MedTech., KARL STORZ SE & Co. Kg, Dale Medical Products, Inc., Healthtronics, Inc., Medi Tech Devices Pvt. Ltd., Coloplast Corp., Remington MEDICAL, Medi-Globe GmbH, Nikkiso Co., Ltd., B. Braun Melsungen AG, Lumenis Be Ltd., Teleflex Incorporated, Urocare Products, Inc., Dynarex Corporation et parmi d'autres acteurs nationaux. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux contrats et accords sont également initiés par les entreprises du monde entier qui accélèrent également le marché des dispositifs urologiques.

Par exemple,

- En janvier 2022, Stryker (États-Unis) a acquis Vocera Communications (États-Unis), leader dans le domaine de la coordination et de la communication des soins numériques. Cette acquisition a aidé l'entreprise à élargir le portefeuille innovant de la division médicale de Stryker, propulsant ainsi la croissance du marché

- En octobre 2021, Medtronic a annoncé que la société avait reçu le marquage CE pour son produit urologique « Hugo robotic-assisted surgery (RAS) system » dont la vente est autorisée en Europe. L'approbation du marquage CE a amélioré la qualité des produits dans les procédures urologiques et gynécologiques qui représentent environ la moitié de toutes les procédures robotisées réalisées aujourd'hui. Cela a amélioré la position de l'entreprise sur le marché

- En novembre 2020, Coloplast Corp. a annoncé l'acquisition de Nine Continents Medical, Inc., une jeune entreprise pionnière dans le domaine du traitement implantable de stimulation du nerf tibial pour la vessie hyperactive. Cette acquisition a permis à l'entreprise d'améliorer ses opportunités dans le domaine de l'urologie interventionnelle afin d'apporter des solutions innovantes au marché.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché des pompes à perfusion vétérinaires, ce qui offre également l'avantage de la croissance des bénéfices de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE UROLOGY DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET INDICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GLOBAL MEDICAL DEVICES GROWTH TRENDS - OVERVIEW

4.2 PESTEL

4.3 PORTER'S FIVE FORCES MODEL

5 EUROPE UROLOGY DEVICES MARKET: REGULATIONS

5.1 U.S.

5.2 EUROPE

5.3 GERMANY

5.4 ITALY

5.5 SPAIN

5.6 RUSSIA

5.7 NETHERLANDS

5.8 SWITZERLAND

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN RESEARCH AND DEVELOPMENT OF UROLOGY MEDICAL DEVICES

6.1.2 RISE IN INCIDENCE OF UROLOGY CONDITIONS IN EUROPE

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN UROLOGICAL DEVICES

6.1.4 RISE IN GERIATRIC POPULATION

6.1.5 RISE IN PRODUCT APPROVALS

6.2 RESTRAINTS

6.2.1 RISE IN COST OF UROLOGY DEVICES AND TREATMENT OF UROLOGICAL CONDITIONS

6.2.2 RISKS OBSERVED WHILE USING UROLOGICAL DEVICES

6.2.3 RISE IN PRODUCT RECALL

6.2.4 LACK OF AWARENESS ABOUT TREATMENT FOR UROLOGICAL CONDITIONS

6.3 OPPORTUNITIES/

6.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

6.3.2 RISE IN HEALTHCARE EXPENDITURE

6.3.3 INCREASED USE OF MINIMALLY INVASIVE SURGICAL DEVICES

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS REQUIRED FOR USE OF UROLOGY DEVICES

6.4.2 STRINGENT REGULATIONS

7 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

7.1 PRICE IMPACT

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS FOR MANUFACTURERS/ SERVICE PROVIDERS

7.5 CONCLUSION

8 EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 DIALYSIS EQUIPMENT

8.3 URINARY STONE TREATMENT DEVICES

8.4 ENDOSCOPY DEVICES

8.5 URINARY INCONTINENCE & PELVIC ORGAN PROLAPSED

8.6 BENIGN PROSTATIC HYPERPLASIA TREATMENT DEVICES

8.7 OTHER PRODUCTS

9 EUROPE UROLOGY DEVICES MARKET, BY TYPE

9.1 OVERVIEW

9.2 INSTRUMENTS

9.2.1 DIALYSIS DEVICES

9.2.1.1 CENTER-USE HEMODIALYSIS MACHINES

9.2.1.2 HOME-USE HEMODIALYSIS MACHINES

9.2.2 LASERS AND LITHOTRIPSY DEVICES

9.2.2.1 UROLOGY LASERS

9.2.2.2 LITHOTRIPTERS

9.2.2.2.1 INTRACORPOREAL LITHOTRIPTERS

9.2.2.2.2 EXTRACORPOREAL LITHOTRIPTERS

9.2.3 ENDOSCOPES AND ENDOVISION SYSTEMS

9.2.4 OTHER INSTRUMENT

9.3 CONSUMABLES AND ACCESSORIES

9.3.1 DIALYSIS CONSUMABLES

9.3.1.1 DIALYZERS

9.3.1.2 HEMODIALYSIS CONCENTRATES

9.3.1.2.1 ACIDIC

9.3.1.2.2 ALKALINE

9.3.1.3 BLOODLINES

9.3.1.4 OTHERS

9.3.2 GUIDEWIRES AND CATHETERS

9.3.2.1 URETERAL CATHETERES

9.3.2.2 NEPHROSTOMY CATHETERES

9.3.2.3 VESICAL CATHETERES

9.3.2.4 CYSTOMETRY CATHETERES

9.3.2.5 RECTAL PRESSURE MONITORING CATHETERS

9.3.2.6 OTHER CATHETERS

9.3.3 STENTS

9.3.3.1 URETHRAL STENTS

9.3.3.2 URETERAL STENTS

9.3.3.3 PROSTATIC STENTS

9.3.4 ENDOSCOPIC BASKETS

9.3.5 BIOPSY DEVICES

9.3.5.1 PROSTATE BIOPSY NEEDLES

9.3.5.2 OTHERS

9.3.6 PELVIC IMPLANTS

9.3.7 MESHES

9.3.8 MORCELLATORS

9.3.9 OTHER CONSUMABLES AND ACCESSORIES

10 EUROPE UROLOGY DEVICES MARKET, BY INDICATION

10.1 OVERVIEW

10.2 KIDNEY DISEASES

10.3 KIDNEY STONES

10.4 UROLOGICAL CANCER

10.5 PELVIC ORGAN PROLAPSE

10.6 BENIGN PROSTATIC HYPERPLASIA

10.7 HEMATURIA

10.8 URINARY TRACT INFECTIONS

10.9 URETHROTOMIES

10.1 OVERACTIVE BLADDER

10.11 PREMATURE EJACULATION

10.12 URETHRAL STRICTURE

10.13 OTHER DISEASE

11 EUROPE UROLOGY DEVICES MARKET, BY TECHNOLOGY

11.1 OVERVIEW

11.2 MINIMALLY INVASIVE SURGERY

11.3 ROBOTIC SURGERY

11.4 OTHERS

12 EUROPE UROLOGY DEVICES MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS & CLINICS

12.3 DIALYSIS CENTERS

12.4 CLINICAL RESEARCH LABORATORIES

12.5 ACADEMIC INSTITUTES

12.6 OTHERS

13 EUROPE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 THIRD PARTY DISTRIBUTORS

13.4 OTHERS

14 EUROPE UROLOGY DEVICES MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 U.K.

14.1.3 FRANCE

14.1.4 ITALY

14.1.5 SPAIN

14.1.6 RUSSIA

14.1.7 SWITZERLAND

14.1.8 NETHERLANDS

14.1.9 TURKEY

14.1.10 REST OF EUROPE

15 EUROPE UROLOGY DEVICES MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 FRESENIUS SE & CO. KGAA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 BAXTER

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 BOSTON SCIENTIFIC CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 OLYMPUS CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 B. BRAUN MELSUNGEN AG

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 BD

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 MEDTRONIC

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 COOPERSURGICAL INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 COLOPLAST CORP

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.9.5 ACQUISITION

17.1 CARDINAL HEALTH

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 COOK

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 DORNIER MEDTECH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 DALE MEDICAL PRODUCTS, INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.13.4 DEVELOPMENT

17.14 DYNAREX CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 GENERAL ELECTRIC

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.15.5 ACQUISITION

17.16 HEALTHTRONICS, INC

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.16.4 ACQUISITION

17.17 INTUITIVE SURGICAL

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 KARL STORZ SE & CO KG,TUTTLINGEN

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 LUMENIS BE LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.19.4 PRODUCT LAUNCHES

17.2 MEDI GLOBE GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 MEDI TECH DEVICES PVT. LTD.

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 MED PRO MEDICAL B.V.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 NIKKISO CO., LTD.

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 REMINGTON MEDICAL

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 RICHARD WOLF GMBH

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 STRYKER

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT DEVELOPMENTS

17.26.5 ACQUISITION

17.27 SIEMENS HEALTHCARE GMBH

17.27.1 COMPANY SNAPSHOT

17.27.2 REVENUE ANALYSIS

17.27.3 PRODUCT PORTFOLIO

17.27.4 RECENT DEVELOPMENTS

17.27.5 ACQUISITION

17.28 TELEFLEX INCORPORATED.

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENTS

17.28.5 PRODUCT LAUNCH

17.29 UROCARE PRODUCTS, INC.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 EUROPE LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE GUIDEWIRES AND CATHETERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 16 EUROPE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 17 EUROPE UROLOGY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 EUROPE DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 EUROPE UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 33 EUROPE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 GERMANY UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 GERMANY UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 GERMANY INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 GERMANY DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 GERMANY LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 GERMANY LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 GERMANY CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 GERMANY DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 GERMANY HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 GERMANY GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 GERMANY STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 GERMANY BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 GERMANY UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 47 GERMANY UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 GERMANY UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 GERMANY UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 U.K. UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.K. UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.K. INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.K. LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.K. LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.K. CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.K. DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.K. HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.K. UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 63 U.K. UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 64 U.K. UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 U.K. UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 FRANCE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 FRANCE UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 FRANCE DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 FRANCE LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 FRANCE CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 FRANCE HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 FRANCE STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 FRANCE BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 FRANCE UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 79 FRANCE UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 80 FRANCE UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 FRANCE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 ITALY UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 ITALY UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 ITALY INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 ITALY DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 ITALY LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 ITALY LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 ITALY DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 ITALY HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ITALY GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 ITALY STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 ITALY BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 ITALY UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 95 ITALY UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 96 ITALY UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 97 ITALY UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 SPAIN UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 SPAIN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SPAIN DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SPAIN LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SPAIN LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SPAIN CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SPAIN DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SPAIN HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SPAIN GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SPAIN STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 SPAIN BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SPAIN UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 111 SPAIN UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 SPAIN UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 113 SPAIN UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 RUSSIA INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 RUSSIA LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 RUSSIA CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 RUSSIA DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 RUSSIA HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 RUSSIA GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 RUSSIA STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 RUSSIA BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 RUSSIA UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 127 RUSSIA UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 128 RUSSIA UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 RUSSIA UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SWITZERLAND LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 SWITZERLAND LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 SWITZERLAND CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 SWITZERLAND DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 SWITZERLAND HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 SWITZERLAND GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 SWITZERLAND STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 SWITZERLAND BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 SWITZERLAND UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 143 SWITZERLAND UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 144 SWITZERLAND UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 145 SWITZERLAND UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 146 NETHERLANDS UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 NETHERLANDS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 NETHERLANDS INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 NETHERLANDS DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 NETHERLANDS LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 NETHERLANDS LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 NETHERLANDS CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 NETHERLANDS DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 NETHERLANDS HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 NETHERLANDS GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 NETHERLANDS STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 NETHERLANDS BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 NETHERLANDS UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 159 NETHERLANDS UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 NETHERLANDS UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 161 NETHERLANDS UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 162 TURKEY UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 TURKEY UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 TURKEY INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 TURKEY DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 TURKEY LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 TURKEY LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 TURKEY CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 TURKEY DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 TURKEY HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 TURKEY GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 TURKEY STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 TURKEY BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 TURKEY UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 175 TURKEY UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 176 TURKEY UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 177 TURKEY UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 178 REST OF EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE UROLOGY DEVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE UROLOGY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE UROLOGY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE UROLOGY DEVICES MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE UROLOGY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE UROLOGY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE UROLOGY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE UROLOGY DEVICES MARKET: INDICATION COVERAGE GRID

FIGURE 9 EUROPE UROLOGY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE UROLOGY DEVICES MARKET: SEGMENTATION

FIGURE 11 RISING PREVALENCE OF UROLOGICAL DISORDERS IS EXPECTED TO DRIVE THE EUROPE UROLOGY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 DIALYSIS EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE UROLOGY DEVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE UROLOGY DEVICES MARKET

FIGURE 14 ESTIMATED COUNT OF WOMEN SUFFERING FROM URINARY INCONTINENCE IN 2021 IN THE U.S.

FIGURE 15 PROSTATE CANCER INCIDENCE IN EUROPEAN REGION IN 2021

FIGURE 16 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 18 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 19 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 EUROPE UROLOGY DEVICES MARKET: BY TYPE, 2021

FIGURE 21 EUROPE UROLOGY DEVICES MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 22 EUROPE UROLOGY DEVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 23 EUROPE UROLOGY DEVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, 2021

FIGURE 25 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, 2020-2029 (USD MILLION)

FIGURE 26 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 27 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 28 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, 2021

FIGURE 29 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, 2020-2029 (USD MILLION)

FIGURE 30 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 31 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 32 EUROPE UROLOGY DEVICES MARKET: BY END USER, 2021

FIGURE 33 EUROPE UROLOGY DEVICES MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 34 EUROPE UROLOGY DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 35 EUROPE UROLOGY DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 37 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 38 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 39 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 40 EUROPE UROLOGY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 41 EUROPE UROLOGY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 42 EUROPE UROLOGY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 43 EUROPE UROLOGY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 44 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 45 EUROPE UROLOGY DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.