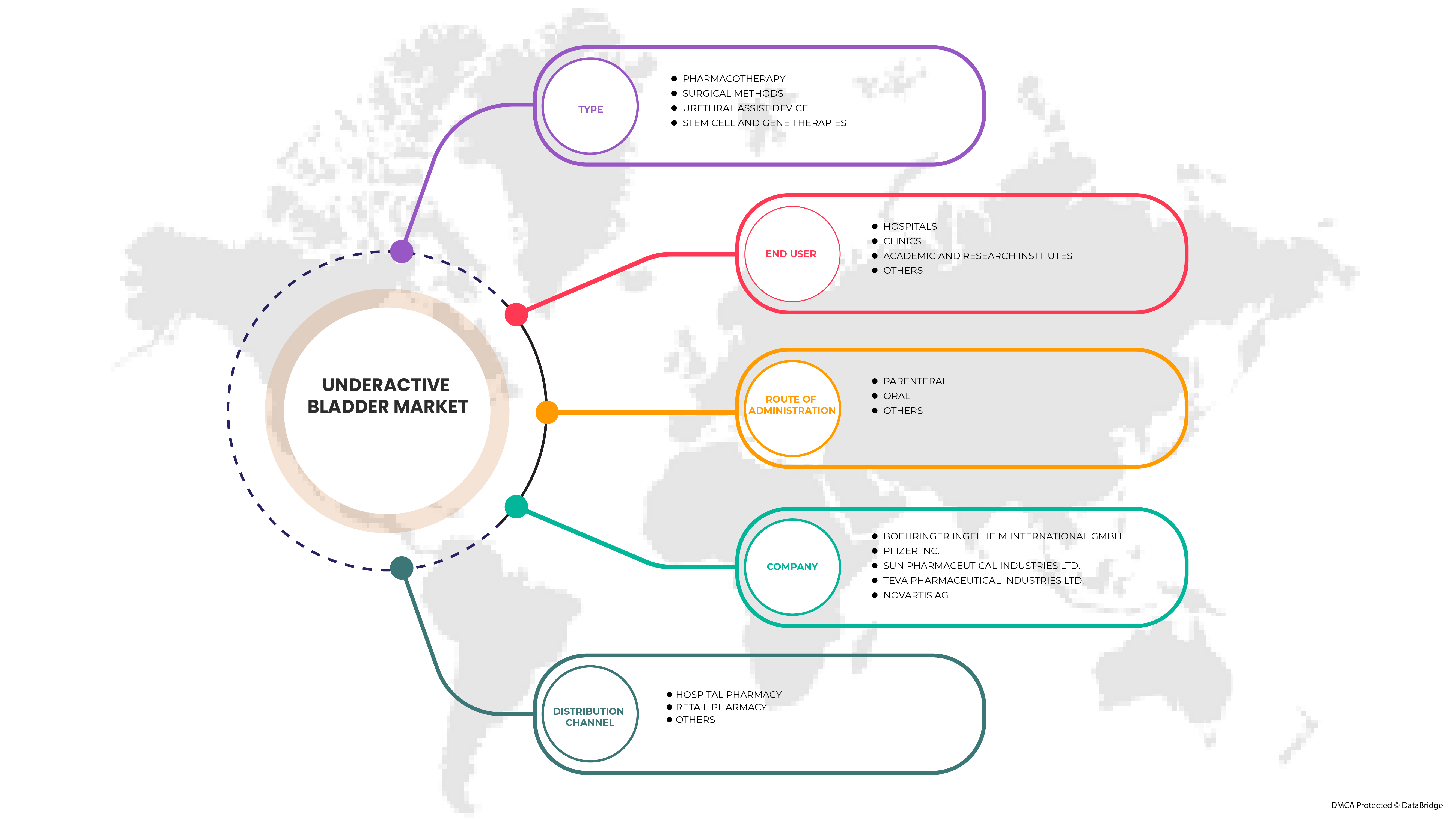

Marché européen de la vessie sous-active, par type (pharmacothérapie, méthodes chirurgicales, dispositif d'assistance urétrale et thérapies par cellules souches et gènes), voie d'administration (orale, parentérale et autres), utilisateur final (hôpitaux, cliniques, instituts universitaires et de recherche, et autres), canal de distribution (pharmacie hospitalière, pharmacie de détail et autres) Tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché européen de la vessie sous-active

Le marché européen de la vessie sous-active est stimulé par des facteurs tels que l'augmentation des cas d'infections vésicales neurogènes , l'augmentation du financement de la recherche, le développement de nouvelles thérapies pour la vessie sous-active (UAB) et les produits en cours de développement qui augmentent sa demande, ainsi que l'augmentation des investissements en R&D conduisant à la croissance du marché. Actuellement, les dépenses de santé ont augmenté dans les pays développés et émergents, ce qui devrait créer un avantage concurrentiel pour les fabricants qui souhaitent développer des produits nouveaux et innovants. En outre, l'augmentation des dépenses de santé et la prévalence croissante des troubles de la vessie ont un effet positif sur le marché.

Cependant, le coût élevé du traitement empêche les patients de recourir à des solutions efficaces et de haute qualité. Par conséquent, le coût élevé des procédures de traitement a un impact négatif sur le coût global du traitement. De plus, les médicaments actuellement utilisés pour le traitement de l'UAB ne sont pas cliniquement satisfaisants du point de vue de l'efficacité et de la sécurité, ce qui conduit à la nécessité de développer de nouveaux agents thérapeutiques.

Le marché européen de la vessie sous-active devrait croître au cours de la période de prévision en raison de l'augmentation du nombre d'acteurs sur le marché et de la présence de nouveaux médicaments en cours de développement. Parallèlement à cela, les fabricants sont engagés dans des activités de R&D pour lancer de nouveaux produits sur le marché.

Toutefois, le coût élevé associé à la recherche et aux études devrait freiner la croissance du marché, ce qui peut avoir un impact supplémentaire sur le lancement de nouveaux produits sur le marché.

L’augmentation du nombre de programmes de R&D et la montée des partenariats public-privé pour faciliter les développements novateurs en faveur de traitements innovants et efficaces influencent davantage le marché.

Le rapport sur le marché de la vessie sous-active en Europe fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité. L'évolutivité et l'expansion commerciale des unités de vente au détail dans les pays en développement de diverses régions et le partenariat avec les fournisseurs pour une distribution sûre de machines et de produits pharmaceutiques sont les principaux moteurs qui ont propulsé la demande du marché au cours de la période de prévision.

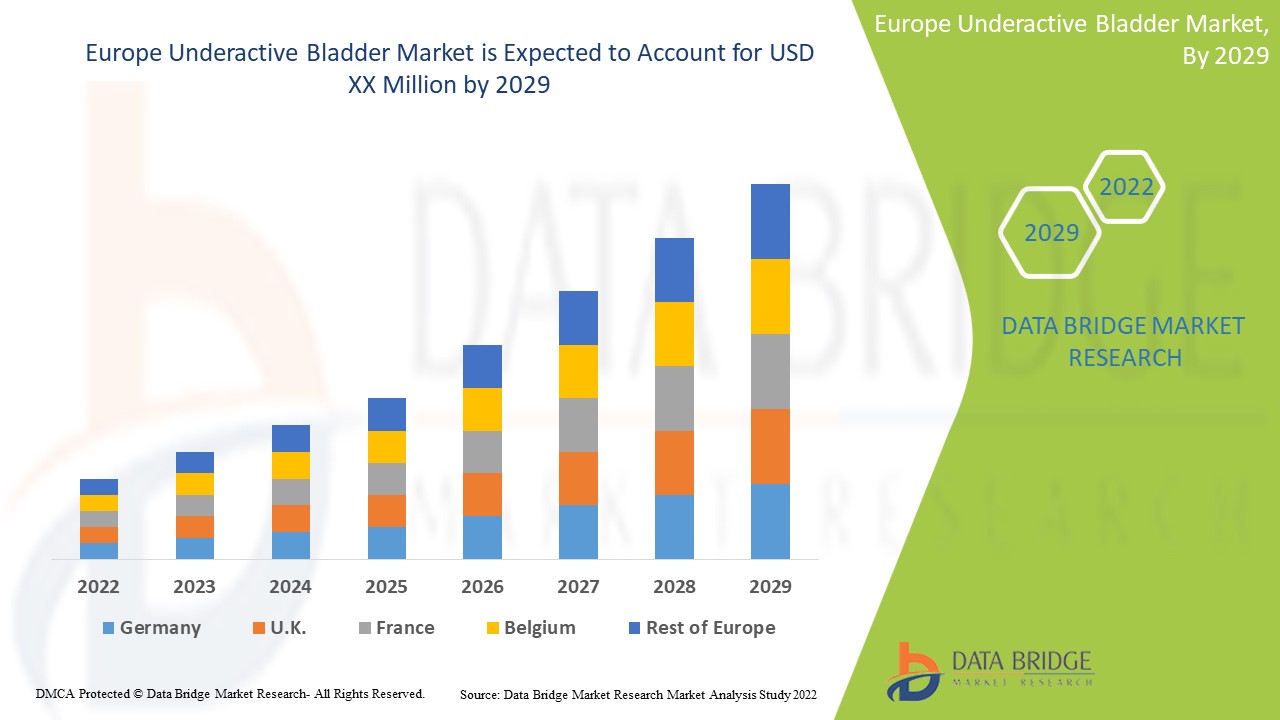

Le marché européen de la vessie sous-active est favorable et vise à réduire la progression de la maladie. Data Bridge Market Research analyse que le marché européen de la vessie sous-active connaîtra un TCAC de 4,5 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (pharmacothérapie, méthodes chirurgicales, dispositif d'assistance urétrale et thérapies par cellules souches et géniques), voie d'administration (orale, parentérale et autres), utilisateur final (hôpitaux, cliniques, instituts universitaires et de recherche et autres), canal de distribution (pharmacie hospitalière, pharmacie de détail et autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Russie, Espagne, Turquie, Pays-Bas, Suisse, Pologne, Turquie, Autriche, Hongrie, Norvège, Irlande, Luxembourg, Lituanie et reste de l'Europe |

|

Acteurs du marché couverts |

Astellas Pharma Inc., Aurobindo Pharma., Boehringer Ingelheim International GmbH, Macleods Pharmaceuticals Ltd., Orion Corporation, ONO PHARMACEUTICAL CO., LTD., Novartis AG, Pfizer Inc., Cipla Inc., Dr. Reddy's Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Almirall, SA, Glenwood, Vesiflo, Inc. et Alkem Labs. entre autres |

Définition du marché

L'hypoactivité vésicale (UAB) est un état clinique dans lequel un trouble de la miction se développe à la suite d'une réduction de la contraction du muscle détrusor (un muscle de la vessie) pendant la miction. Il est caractérisé par la sensation d'avoir besoin d'uriner immédiatement, et donc, cet état est différent de l' hyperactivité vésicale (OAB). La présente invention concerne une composition pharmaceutique utile pour la prévention ou le traitement de l'UAB qui a pour effet d'améliorer le débit urinaire, un effet d'amélioration de la surdistension de la vessie (un effet de réduction de la capacité de la vessie), et est donc utile pour la prévention ou le traitement de l'UAB.

De plus, il s'agit d'un état pathologique différent de l'HVV caractérisée par une urgence urinaire qui a attiré l'attention ces dernières années. Les causes de l'HVV comprennent la neuropathie autonome comme le diabète et l'alcoolisme, la chirurgie pelvienne comme l'hystérectomie radicale et le cancer rectal radical, les maladies de la moelle épinière comme le spina bifida et la hernie discale. Les patients souffrant de problèmes graves et légers associés à des troubles de la vessie ont besoin d'une pharmacothérapie souvent cyclique avec plusieurs thérapies et sans soulagement adéquat recevant des traitements continus, ce qui crée également un impact sur les dépenses de santé.

Dynamique du marché européen de la vessie sous-active

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tous ces éléments sont abordés en détail ci-dessous :

Conducteurs

- Prévalence croissante des troubles neurologiques

L'urticaire urinaire est une affection neurologique courante dans laquelle les nerfs et les muscles ne fonctionnent pas très bien ensemble, ce qui entraîne un temps d'urination prolongé avec ou sans sensation de vidange incomplète de la vessie. Dans cette affection, les muscles du détrusor ne fonctionnent pas correctement lors de leur activité de contraction, qui se caractérise par un jet urinaire lent, une hésitation et des efforts pour uriner, avec ou sans sensation de vidange incomplète de la vessie, parfois même avec des symptômes de stockage. Ainsi, la vessie ne se vide pas ou ne se vide que partiellement, ce qui est dû au fait que les muscles de la vessie sont incapables de libérer l'urine correctement.

En conséquence, les patients atteints d'UAB peuvent présenter divers symptômes de miction et peuvent être accompagnés d'une grande quantité d'urine résiduelle. Les complications de la rétention urinaire due à l'aggravation et les infections des voies urinaires (IVU) dues à l'urine résiduelle chronique sont souvent observées et sont devenues un problème. De plus, il s'agit d'un état pathologique différent de l'HVV caractérisée par une urgence urinaire qui a attiré l'attention ces dernières années. Ainsi, la prévalence croissante des troubles neurogènes de la vessie devrait stimuler la croissance du marché. Cela entraînera une demande accrue de traitements capables de détecter également les patients, ce qui devrait entraîner une croissance lucrative du marché.

- Augmentation des dépenses de santé

Les instruments, la main d'oeuvre et la gestion médicale en cas de préjudice pour les chercheurs, les assurances, le transport, les frais de comité d'éthique, le traitement des données et autres consommables entraînent des coûts importants pour les acteurs du marché. Les dépenses de santé comprennent tous les services de santé, les appareils de test, les activités de planification familiale et les secours d'urgence destinés à la santé. Les comptes nationaux de la santé fournissent de nombreux indicateurs basés sur les dépenses collectées dans un cadre internationalement reconnu. Les facteurs déterminant les dépenses de santé d'un pays sont le revenu (PIB par habitant), le progrès technologique et la variation des pratiques médicales, ainsi que les caractéristiques des systèmes de santé.

L'augmentation des dépenses de santé aide simultanément les organisations de santé et les organismes gouvernementaux à accroître les activités de recherche sur les médicaments contre la ménopause, leurs essais cliniques à venir et leurs activités de R&D. En outre, compte tenu du coût de la production et de la fabrication des nouveaux produits, les acteurs du marché ont besoin d'une allocation adéquate de fonds et de ressources, c'est pourquoi le gouvernement agit comme un coup de main dans ce scénario. L'augmentation des dépenses de santé est également bénéfique pour le développement économique et la croissance du secteur de la santé. En outre, l'augmentation du revenu disponible de la population est un facteur favorable. Par conséquent, l'augmentation des dépenses de santé devrait stimuler la croissance du marché à l'avenir.

Opportunité

- Augmentation des complications urologiques du diabète

L’une des causes connues de l’urètre urinaire est la neuropathie autonome comme le diabète. De plus, le diabète est associé à une apparition plus précoce et à une gravité accrue des maladies urologiques qui entraînent des complications urologiques coûteuses et invalidantes. Ces complications urologiques, notamment le dysfonctionnement de la vessie et les infections urinaires, ont un effet profond sur la qualité de vie des hommes et des femmes diabétiques. Le diabète et les maladies urologiques sont des problèmes de santé très courants dont la prévalence et l’incidence augmentent considérablement avec l’âge. Les complications urologiques du diabète en sont un effet immédiat. Le diabète est le trouble le plus répandu et sa prévalence est élevée à l’échelle mondiale.

Les complications de la vessie associées au diabète peuvent être dues à une alternance des muscles lisses du détrusor, à un dysfonctionnement neuronal et à un dysfonctionnement urothélial. Selon les nerfs impliqués, les effets de la neuropathie diabétique peuvent aller de l'inconfort et de l'engourdissement des jambes à des complications du système digestif, des voies urinaires, des vaisseaux sanguins et du tronc. L'augmentation des données sur le diabète augmentera considérablement le risque de complications urologiques du diabète dans le monde entier. Il est donc nécessaire de recommander des orientations futures pour la recherche et les soins cliniques pour un traitement approprié des complications urologiques du diabète. Le soutien d'autres organisations serait également nécessaire pour atteindre les régions sous-développées afin de s'attaquer aux complications négligées. Par conséquent, cela signifie que l'augmentation des complications urologiques du diabète devrait constituer une opportunité de croissance du marché.

Retenue/Défi

- Coût élevé de la recherche et du développement (R&D)

La recherche et le développement sont une condition préalable à la modification de la procédure destinée à traiter différents types de patients. Le coût plus élevé de la recherche et du développement pour les nouveaux produits exige des recherches approfondies et des études cliniques. Les différentes phases cliniques de la recherche et du développement nécessitent d'énormes investissements qui peuvent affecter la croissance du marché. Le coût de la recherche impliqué dans la planification et l'exécution des études, et la recherche nécessite une allocation adéquate de fonds et de ressources, ce qui peut affecter les nouveaux développements du marché. Le coût du produit joue un rôle majeur sur le marché. De nombreuses options de diagnostic sont disponibles sur le marché, mais en raison de leur coût élevé, la plupart des gens ont tendance à éviter de se faire diagnostiquer. Les approches diagnostiques sont devenues plus sensibles et plus spécifiques, le coût du test a également augmenté.

Le coût élevé de la procédure est dû aux différents points de contrôle des traitements ainsi qu'à l'utilisation de modalités de haute technologie pour effectuer ces procédures. Le coût de la recherche et du développement des traitements étant trop élevé, il limite la mise en place de solutions de haute qualité et efficaces. Par conséquent, le coût élevé a un impact négatif sur le coût du traitement global. Par conséquent, il limitera la demande future de traitement dans les pays à revenu faible et intermédiaire. Cela suggère que le coût élevé associé à la recherche et aux études devrait freiner la croissance du marché, ce qui peut avoir un impact supplémentaire sur le lancement de nouveaux produits sur le marché.

Impact post-COVID-19 sur le marché européen de la vessie hypoactive

La COVID-19 a eu un impact positif sur la croissance du marché, car la demande de produits a augmenté dans toute la région. Les gens sont devenus plus soucieux de leur santé, car la prévalence de diverses maladies de la vessie est en hausse dans la région. Des complications de rétention urinaire dues à une aggravation et des infections urinaires dues à une urine résiduelle chronique sont souvent observées et sont devenues un problème. Par conséquent, la COVID-19 a eu un impact positif sur ce marché.

Développements récents

- En juin 2020, Vesiflo, Inc. a annoncé la prise en charge par Medicare de la prothèse urinaire inFlow, un dispositif de pompe à valve intra-urétrale à couplage magnétique approuvé par la FDA qui peut être utilisé pendant 29 jours par les femmes adultes comme alternative au cathétérisme intermittent. Cela contribue à l'expansion rapide de l'activité du produit avec sa commercialisation sur le marché.

- En avril 2020, Astellas Pharma Europe Ltd. a achevé un essai clinique mené sur des sujets pour le traitement de l'hypoactivité vésicale. Actuellement, l'ASP8302 fait l'objet d'un essai clinique de phase 2 visant à étudier l'innocuité et la tolérance du médicament chez les patients souffrant d'hypoactivité vésicale.

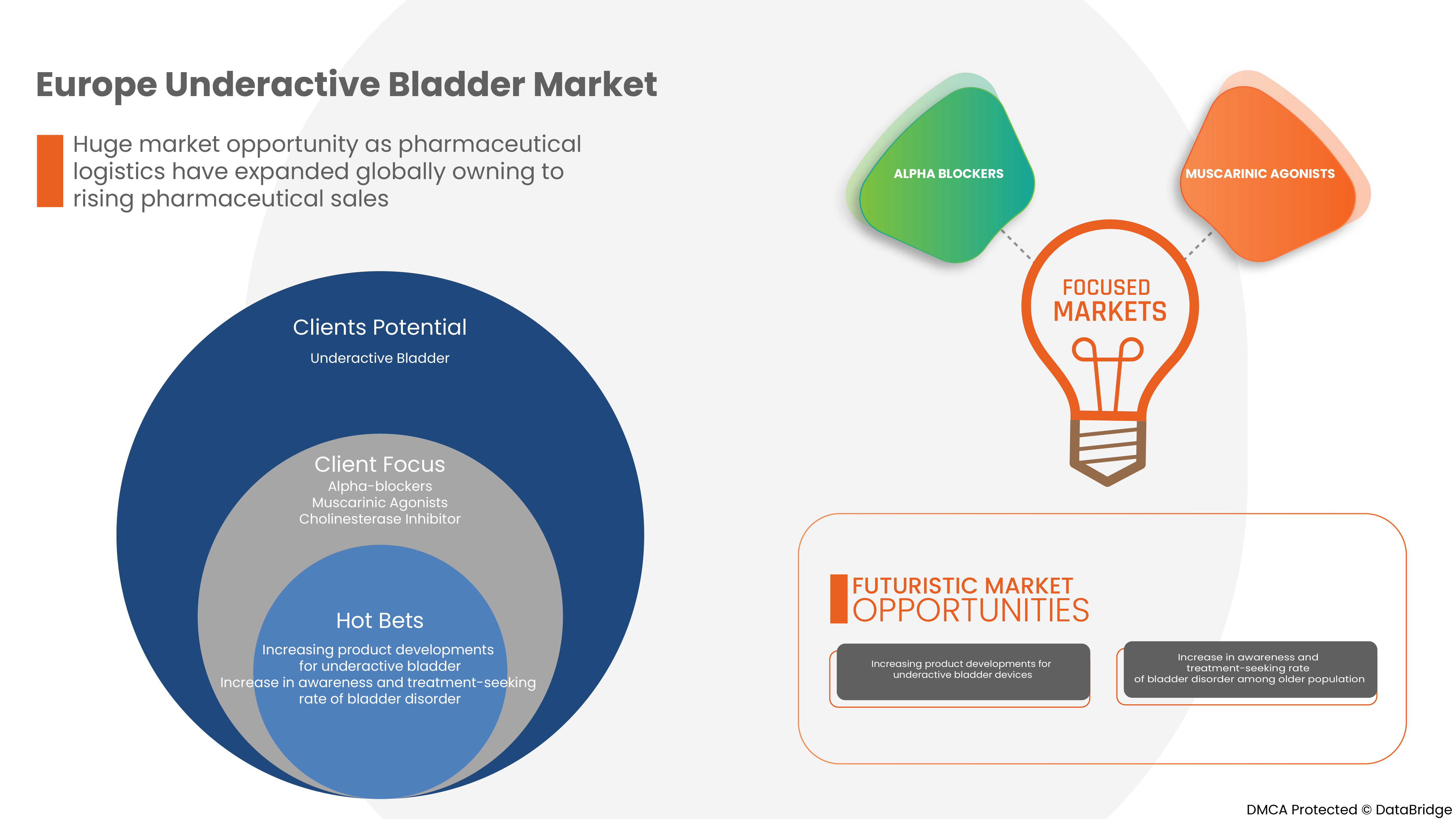

Portée du marché européen de la vessie sous-active

Le marché européen de la vessie sous-active est classé en quatre segments notables en fonction du type, de la voie d'administration, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Taper

- Pharmacothérapie

- Méthodes chirurgicales

- Dispositif d'assistance urétrale

- Thérapies à base de cellules souches et de gènes

En fonction du traitement, le marché est segmenté en pharmacothérapie, méthodes chirurgicales, dispositifs d’assistance urétrale et thérapies par cellules souches et gènes.

Voie d'administration

- Oral

- Parentérale

- Autres

En fonction de la voie d’administration, le marché est segmenté en voie orale, parentérale et autres.

Utilisateur final

- Hôpitaux

- Cliniques

- Instituts universitaires et de recherche

- Autres

En fonction de l’utilisateur final, le marché est segmenté en hôpitaux, cliniques, instituts universitaires et de recherche, et autres.

Canal de distribution

- Pharmacie de l'hôpital

- Pharmacie de détail

- Autres

En fonction du canal de distribution, le marché est segmenté en pharmacie hospitalière, pharmacie de détail et autres.

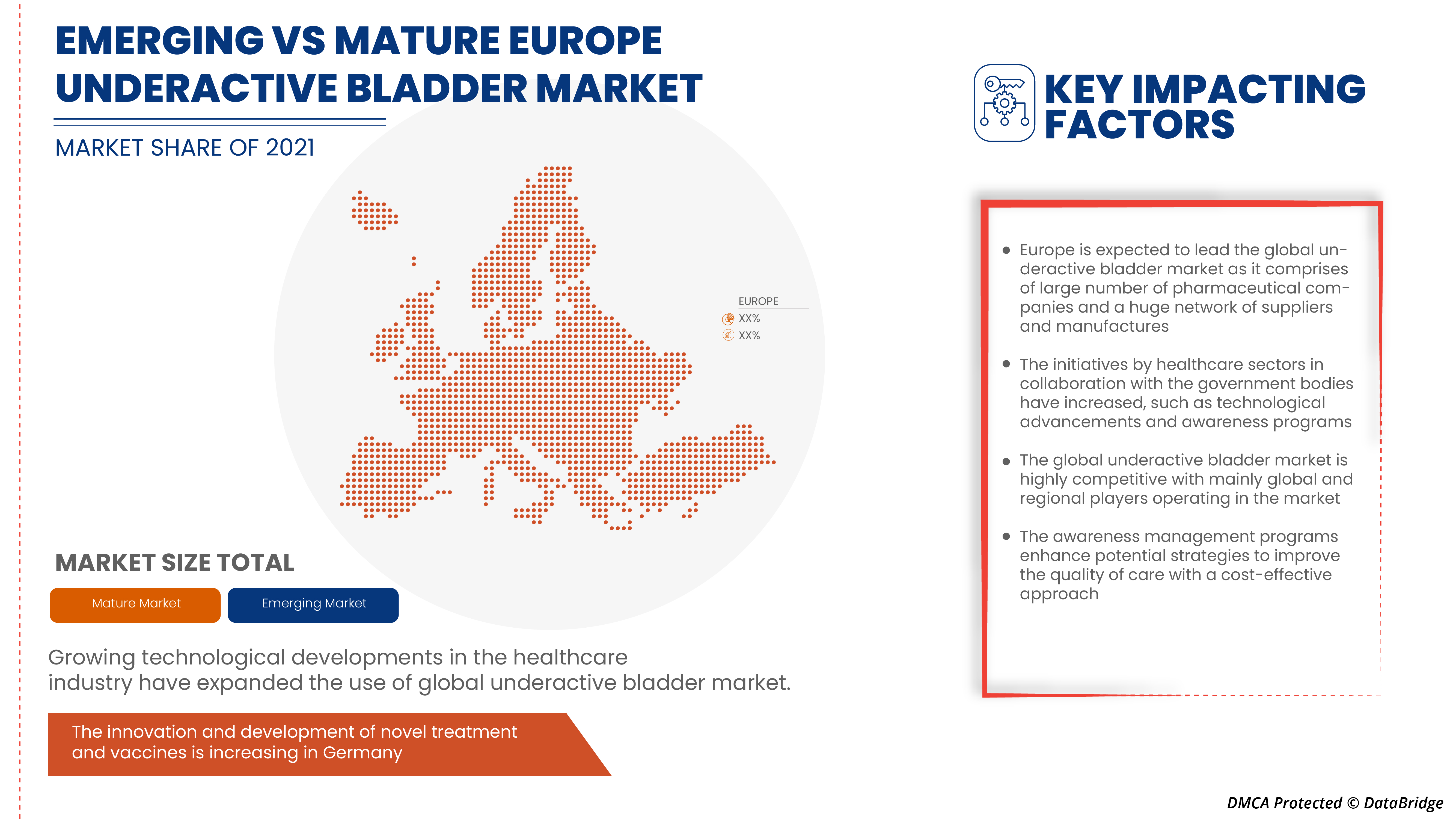

Analyse/perspectives régionales du marché de la vessie sous-active en Europe

Le marché européen de la vessie sous-active est analysé et des informations et tendances sur la taille du marché sont fournies par type, voie d’administration, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché européen de la vessie sous-active sont l'Allemagne, la France, le Royaume-Uni, l'Italie, la Russie, l'Espagne, la Turquie, les Pays-Bas, la Suisse, la Pologne, la Turquie, l'Autriche, la Hongrie, la Norvège, l'Irlande, la Lituanie et le reste de l'Europe.

- En 2022, le marché européen de la vessie sous-active devrait croître en raison de la prévalence croissante des troubles de la vessie et de la croissance de la population gériatrique. Les avancées technologiques dans le traitement des troubles de la vessie et l'augmentation des approbations de produits stimulent également la croissance du marché.

L’Allemagne devrait dominer le marché en raison de la présence de grands acteurs et d’un système de santé établi pour traiter les troubles de la vessie.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des tarifs nationaux et des routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du marché européen de la vessie sous-active

Le paysage concurrentiel du marché européen des vessies sous-actives fournit des détails par concurrents. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché européen des vessies sous-actives.

Certains des principaux acteurs opérant sur le marché sont

- Astellas Pharma Inc.

- Aurobindo Pharma.

- Boehringer Ingelheim International GmbH

- Macleods Pharmaceutiques Ltée.

- Société Orion

- ONO PHARMACEUTIQUE SOCIÉTÉ, LTD.

- Novartis SA

- Pfizer Inc.

- Cipla Inc.

- Laboratoires Dr. Reddy's Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltée.

- Almirall, SA

- Glenwood

- Laboratoires Alkem.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'Europe par rapport au pays et l'analyse des parts des fournisseurs. Veuillez demander un appel à l'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE UNDERACTIVE BLADDER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 EPIDEMIOLOGY

4.4 THE IMPORTANCE OF UNDERSTANDING PATENTS-

4.4.1 DOXAZOSIN

4.4.2 BETHANECHOL CHLORIDE

4.4.3 TAMSULOSIN HYDROCHLORIDE

4.5 CLINICAL TRIALS FOR UNDERACTIVE BLADDER

4.5.1 EU CLINICAL TRIALS REGISTER-

4.6 MERGER & ACQUISITION IN HEALTHCARE INDUSTRY

4.7 M&A DEALS IN 2021 BY TARGET COMPANY TERRITORY:

4.8 CROSS-BORDER DEALS:

4.9 OUTLOOK FOR 2022:

4.1 PATIENT ENROLMENT STRATEGIES

4.11 FACTORS AFFECTING PATIENT RECRUITMENT:

4.12 CHALLENGES:

4.13 PATIENT FUNNEL ANALYSIS:

4.14 RECOMMENDATIONS

4.14.1 USE OF TECHNOLOGY:

4.14.2 PARTICIPANT CHARACTERISTICS:

4.14.3 RECRUITER CHARACTERISTICS:

4.14.4 SYSTEMS & PROCEDURES:

4.14.5 LOCATION:

4.14.6 NATURE OF RESEARCH:

4.15 CONCLUSION:

4.16 UNDERACTIVE BLADDER PATIENT FLOW DIAGRAM

4.17 WHAT CAUSES UNDERACTIVE BLADDER?

4.17.1 CAUSES OF UNDERACTIVE BLADDER INCLUDE

4.17.2 TESTS TO EVALUATE UNDERACTIVE BLADDER

4.18 UNDERACTIVE BLADDER INVESTIGATIONAL PRODUCTS-

5 EUROPE UNDERACTIVE BLADDER MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF NEUROGENIC DISORDER

6.1.2 INCREASE IN RESEARCH AND DEVELOPMENT OF UNDERACTIVE BLADDER TREATMENT

6.1.3 FAVOURABLE REIMBURSEMENT SCENARIO

6.1.4 RISING HEALTHCARE EXPENDITURE

6.2 RESTRAINTS

6.2.1 HIGH COST OF RESEARCH AND DEVELOPMENT

6.2.2 STRINGENT GOVERNMENT REGULATIONS ON NEW PRODUCTS APPROVAL

6.3 OPPORTUNITIES

6.3.1 RISING UROLOGIC COMPLICATIONS OF DIABETES

6.3.2 PRESENCE OF NOVEL PIPELINE DRUGS

6.3.3 IMPROVING A BETTER HEALTHCARE SYSTEM

6.4 CHALLENGES

6.4.1 LACK OF PROPER TREATMENT

6.4.2 RISK INVOLVED DURING TREATMENT OF UNDERACTIVE BLADDER

7 EUROPE UNDERACTIVE BLADDER MARKET, BY TYPE

7.1 OVERVIEW

7.2 PHARMACOTHERAPY

7.2.1 ALPHA-BLOCKERS

7.2.2 MUSCARINIC AGONISTS

7.2.3 CHOLINESTERASE INHIBITOR

7.2.3.1 BY DRUGS

7.2.3.1.1 TAMSULOSIN

7.2.3.1.2 DOXAZOSIN

7.2.3.1.3 DISTIGMINE

7.2.3.1.4 BETHANECHOL

7.2.3.1.5 OTHERS

7.2.4 BY PRODUCT TYPES

7.2.4.1 GENERICS

7.2.4.2 BRANDED

7.2.4.2.1 FLOMAX

7.2.4.2.2 ALFADIL

7.2.4.2.3 GRAVITOR

7.2.4.2.4 URIVOID

7.2.4.2.5 OTHERS

7.3 SURGICAL METHODS

7.3.1 SURGICAL NERVE STIMULATION

7.3.2 REDUCTION CYSTOPLASTY

7.3.3 SURGERIES FOR BLADDER OBSTRUCTION

7.3.4 INJECTION INTO EXTERNAL SPHINCTER

7.3.5 OTHERS

7.4 URETHRAL ASSIS DEVICE

7.4.1 INFLOW INTRAURETHRAL VALVE PUMP

7.5 STEM CELL AND GENE THERAPIES

7.5.1 NERVE GROWTH FACTOR

7.5.2 GLIAL-CELL DERIVE NEUTOPHIC FACTORGLIAL

7.5.3 NEUTOPHIN-3 DERIVES FROM GLIALL CELLS

8 EUROPE UNDERACTIVE BLADDER MARKET,BY ROUTE OF ADMINISTRATION

8.1 OVERVIEW

8.2 PARENTERAL

8.3 ORAL

8.4 OTHERS

9 EUROPE UNDERACTIVE BLADDER MARKET , BY END USER

9.1 OVERVIEW

9.2 HOSPITALS

9.3 CLINICS

9.4 ACADEMIC AND RESEARCH

9.5 OTHERS

10 EUROPE UNDERACTIVE BLADDER MARKET , BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 HOSPITAL PHARMACY

10.3 RETAIL PHARMACY

10.4 OTHERS

11 EUROPE UNDERACTIVE BLADDER MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 FRANCE

11.1.3 U.K.

11.1.4 ITALY

11.1.5 RUSSIA

11.1.6 SPAIN

11.1.7 TURKEY

11.1.8 NETHERLANDS

11.1.9 SWITZERLAND

11.1.10 POLAND

11.1.11 AUSTRIA

11.1.12 HUNGARY

11.1.13 NORWAY

11.1.14 IRELAND

11.1.15 LITHUANIA

11.1.16 REST OF EUROPE

12 EUROPE UNDERACTIVE BLADDER MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 PFIZER INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 SUN PHARMACEUTICAL INDUSTRIES LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 TEVA PHARMACEUTICAL INDUSTRIES LTD

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 NOVARTIS AG

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 DR. REDDY’S LABORATORIES LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 ASTELLAS PHARMA INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 ORION CORPORATION.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 ALKEM LABS.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 ALMIRALL, S.A

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 AUROBINDO PHARMA.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 CIPLA INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 GLENWOOD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MACLEODS PHARMACEUTICALS LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 ONO PHARMACEUTICAL CO., LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 VESIFLO, INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 TOTAL 40 DOXAZOSIN DRUGS WERE DISCONTINUED FROM THE MARKET

TABLE 2 TOTAL 38 DOXAZOSIN DRUGS ARE STILL IN THE MARKET

TABLE 3 TOTAL PRESCRIPTION AND DISCONTINUED DRUGS (DOXAZOSIN) BY COMPANY

TABLE 4 TOTAL 58 DRUGS DISCONTINUED

TABLE 5 TOTAL PRESCRIPTION AND DISCONTINUED DRUGS (BETHANECHOL CHLORIDE) BY COMPANY

TABLE 6 OUT OF 3,128 STUDIES ON BLADDER DISORDER, ONLY 22 STUDIES ARE ONGOING FOR THE UAB-

TABLE 7 THESE CLINICAL TRIALS ARE MOSTLY RECRUITING/ONGOING IN DIFFERENT REGIONS OF THE WORLD-

TABLE 8 TOP ACQUISITIONS OF 2021 RANKED BY TOTAL DEAL VALUE:

TABLE 9 FDA REQUIRES THE FOLLOWING SCENARIO BEFORE A DRUG IS APPROVED

TABLE 10 EUROPE UNDERACTIVE BLADDER MARKET, TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 EUROPE STEM CELL AND GENE THERAPIES IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE UNDERACTIVE BLADDER MARKET , BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE PARENTERAL IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE ORAL IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE UNDERACTIVE BLADDER MARKET , BY END USER, 2020-2029 (USD MILLION)

TABLE 28 EUROPE HOSPITALS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE CLINICS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE ACADEMIC AND RESEARCH IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE UNDERACTIVE BLADDER MARKET , BY DISTRIBUTION CHANNEL , 2020-2029 (USD MILLION)

TABLE 33 EUROPE HOSPITAL PHARMACY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE RETAIL PHARMACY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE UNDERACTIVE BLADDER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 EUROPE UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 39 EUROPE PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 40 EUROPE BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 41 EUROPE BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 42 EUROPE BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 43 EUROPE BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 44 EUROPE BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 45 EUROPE BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 46 EUROPE BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 47 EUROPE SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 48 EUROPE URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 49 EUROPE STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 50 EUROPE UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 51 EUROPE UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 52 EUROPE UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 53 GERMANY UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 GERMANY PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 55 GERMANY PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 56 GERMANY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 57 GERMANY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 58 GERMANY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 59 GERMANY BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 60 GERMANY BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 61 GERMANY BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 62 GERMANY BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 63 GERMANY SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 64 GERMANY URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 65 GERMANY STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 66 GERMANY UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 67 GERMANY UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 68 GERMANY UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 69 FRANCE UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 71 FRANCE PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 72 FRANCE BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 73 FRANCE BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 74 FRANCE BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 75 FRANCE BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 76 FRANCE BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 77 FRANCE BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 78 FRANCE BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 79 FRANCE SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 80 FRANCE URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 81 FRANCE STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 82 FRANCE UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 83 FRANCE UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 84 FRANCE UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 85 U.K. UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.K. PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 87 U.K. PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 88 U.K. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 89 U.K. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 90 U.K. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 91 U.K. BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 92 U.K. BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 93 U.K. BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 94 U.K. BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 95 U.K. SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 96 U.K. URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 97 U.K. STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 98 U.K. UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 99 U.K. UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 100 U.K. UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 101 ITALY UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 ITALY PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 103 ITALY PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 104 ITALY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 105 ITALY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 106 ITALY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 107 ITALY BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 108 ITALY BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 109 ITALY BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 110 ITALY BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 111 ITALY SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 112 ITALY URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 113 ITALY STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 114 ITALY UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 115 ITALY UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 116 ITALY UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 117 RUSSIA UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 119 RUSSIA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 120 RUSSIA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 121 RUSSIA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 122 RUSSIA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 123 RUSSIA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 124 RUSSIA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 125 RUSSIA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 126 RUSSIA BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 127 RUSSIA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 128 RUSSIA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 129 RUSSIA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 130 RUSSIA UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 131 RUSSIA UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 132 RUSSIA UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 133 SPAIN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SPAIN PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 135 SPAIN PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 136 SPAIN BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 137 SPAIN BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 138 SPAIN BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 139 SPAIN BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 140 SPAIN BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 141 SPAIN BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 142 SPAIN BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 143 SPAIN SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 144 SPAIN URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 145 SPAIN STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 146 SPAIN UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 147 SPAIN UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 148 SPAIN UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 149 TURKEY UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 TURKEY PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 151 TURKEY PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 152 TURKEY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 153 TURKEY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 154 TURKEY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 155 TURKEY BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 156 TURKEY BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 157 TURKEY BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 158 TURKEY BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 159 TURKEY SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 160 TURKEY URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 161 TURKEY STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 162 TURKEY UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 163 TURKEY UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 164 TURKEY UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 165 NETHERLANDS UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 NETHERLANDS PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 167 NETHERLANDS PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 168 NETHERLANDS BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 169 NETHERLANDS BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 170 NETHERLANDS BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 171 NETHERLANDS BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 172 NETHERLANDS BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 173 NETHERLANDS BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 174 NETHERLANDS BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 175 NETHERLANDS SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 176 NETHERLANDS URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 177 NETHERLANDS STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 178 NETHERLANDS UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 179 NETHERLANDS UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 180 NETHERLANDS UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 181 SWITZERLAND UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 SWITZERLAND PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 183 SWITZERLAND PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 184 SWITZERLAND BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 185 SWITZERLAND BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 186 SWITZERLAND BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 187 SWITZERLAND BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 188 SWITZERLAND BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 189 SWITZERLAND BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 190 SWITZERLAND BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 191 SWITZERLAND SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 192 SWITZERLAND URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 193 SWITZERLAND STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 194 SWITZERLAND UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 195 SWITZERLAND UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 196 SWITZERLAND UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 197 POLAND UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 POLAND PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 199 POLAND PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 200 POLAND BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 201 POLAND BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 202 POLAND BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 203 POLAND BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 204 POLAND BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 205 POLAND BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 206 POLAND BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 207 POLAND SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 208 POLAND URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 209 POLAND STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 210 POLAND UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 211 POLAND UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 212 POLAND UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 213 AUSTRIA UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 AUSTRIA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 215 AUSTRIA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 216 AUSTRIA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 217 AUSTRIA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 218 AUSTRIA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 219 AUSTRIA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 220 AUSTRIA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 221 AUSTRIA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 222 AUSTRIA BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 223 AUSTRIA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 224 AUSTRIA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 225 AUSTRIA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 226 AUSTRIA UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 227 AUSTRIA UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 228 AUSTRIA UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 229 HUNGARY UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 HUNGARY PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 231 HUNGARY PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 232 HUNGARY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 233 HUNGARY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 234 HUNGARY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 235 HUNGARY BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 236 HUNGARY BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 237 HUNGARY BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 238 HUNGARY BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 239 HUNGARY SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 240 HUNGARY URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 241 HUNGARY STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 242 HUNGARY UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 243 HUNGARY UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 244 HUNGARY UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 245 NORWAY UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 NORWAY PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 247 NORWAY PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 248 NORWAY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 249 NORWAY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 250 NORWAY BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 251 NORWAY BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 252 NORWAY BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 253 NORWAY BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 254 NORWAY BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 255 NORWAY SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 256 NORWAY URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 257 NORWAY STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 258 NORWAY UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 259 NORWAY UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 260 NORWAY UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 261 IRELAND UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 IRELAND PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 263 IRELAND PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 264 IRELAND BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 265 IRELAND BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 266 IRELAND BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 267 IRELAND BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 268 IRELAND BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 269 IRELAND BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 270 IRELAND BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 271 IRELAND SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 272 IRELAND URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 273 IRELAND STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 274 IRELAND UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 275 IRELAND UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 276 IRELAND UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 277 LITHUANIA UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 LITHUANIA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 279 LITHUANIA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 280 LITHUANIA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 281 LITHUANIA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 282 LITHUANIA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 283 LITHUANIA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 284 LITHUANIA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 285 LITHUANIA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 286 LITHUANIA BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 287 LITHUANIA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 288 LITHUANIA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 289 LITHUANIA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 290 LITHUANIA UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 291 LITHUANIA UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 292 LITHUANIA UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 293 REST OF EUROPE UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE UNDERACTIVE BLADDER MARKET: SEGMENTATION

FIGURE 2 EUROPE UNDERACTIVE BLADDER MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE UNDERACTIVE BLADDER MARKET: DROC ANALYSIS

FIGURE 4 EUROPE UNDERACTIVE BLADDER MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE UNDERACTIVE BLADDER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE UNDERACTIVE BLADDER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE UNDERACTIVE BLADDER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE UNDERACTIVE BLADDER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE UNDERACTIVE BLADDER MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE UNDERACTIVE BLADDER MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF NEUROGENIC BLADDER INFECTIONS IS EXPECTED TO DRIVE THE EUROPE UNDERACTIVE BLADDER MARKET IN THE FORECAST PERIOD

FIGURE 12 TREATMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE UNDERACTIVE BLADDER MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE UNDERACTIVE BLADDER MARKET

FIGURE 14 EUROPE UNDERACTIVE BLADDER MARKET : TYPE, 2021

FIGURE 15 EUROPE UNDERACTIVE BLADDER MARKET : TYPE, 2022-2029 (USD MILLION)

FIGURE 16 EUROPE UNDERACTIVE BLADDER MARKET : TYPE, CAGR (2022-2029)

FIGURE 17 EUROPE UNDERACTIVE BLADDER MARKET : TYPE, LIFELINE CURVE

FIGURE 18 EUROPE UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, 2021

FIGURE 19 EUROPE UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 20 EUROPE UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 21 EUROPE UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 22 EUROPE UNDERACTIVE BLADDER MARKET : BY END USER, 2021

FIGURE 23 EUROPE UNDERACTIVE BLADDER MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 24 EUROPE UNDERACTIVE BLADDER MARKET : BY END USER, CAGR (2022-2029)

FIGURE 25 EUROPE UNDERACTIVE BLADDER MARKET : BY END USER, LIFELINE CURVE

FIGURE 26 EUROPE UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 EUROPE UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 28 EUROPE UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 29 EUROPE UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 30 EUROPE UNDERACTIVE BLADDER MARKET: SNAPSHOT (2021)

FIGURE 31 EUROPE UNDERACTIVE BLADDER MARKET: BY COUNTRY (2021)

FIGURE 32 EUROPE UNDERACTIVE BLADDER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 EUROPE UNDERACTIVE BLADDER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 EUROPE UNDERACTIVE BLADDER MARKET: BY TYPE (2022-2029)

FIGURE 35 EUROPE UNDERACTIVE BLADDER MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.