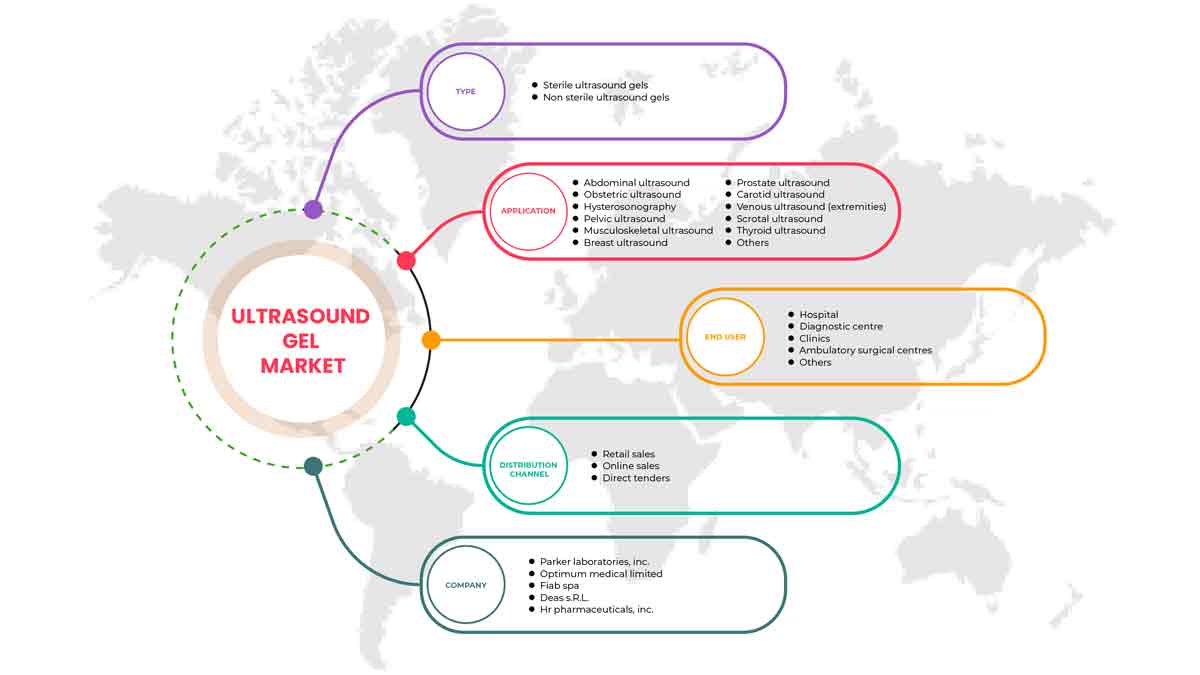

Marché européen des gels à ultrasons, par type (stérile et non stérile), application ( échographie abdominale , échographie obstétricale, hystérosonographie, échographie pelvienne, échographie musculo-squelettique , échographie mammaire, échographie de la prostate, échographie carotidienne, échographie veineuse (extrémités), échographie scrotale, échographie thyroïdienne et autres), utilisateur final (hôpitaux, cliniques, centres de diagnostic, centres de chirurgie ambulatoire et autres), canal de distribution (ventes au détail, ventes en ligne et appel d'offres direct) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des gels à ultrasons en Europe

Les gels à ultrasons sont l'un des gels les plus utilisés pour diverses procédures d'échographie impliquant l'hystérosonographie, l'échographie obstétricale, l'échographie abdominale, l'échographie mammaire, l'échographie carotidienne, l'échographie musculo-squelettique, l'échographie pelvienne, l'échographie de la prostate, l'échographie scrotale, l'échographie thyroïdienne, l'échographie veineuse, entre autres. Les gels à ultrasons sont un médicament anti-TNF indiqué pour le traitement des symptômes inflammatoires. Les professionnels de la santé utilisent des gels à ultrasons biologiques pour des diagnostics clairs et précis.

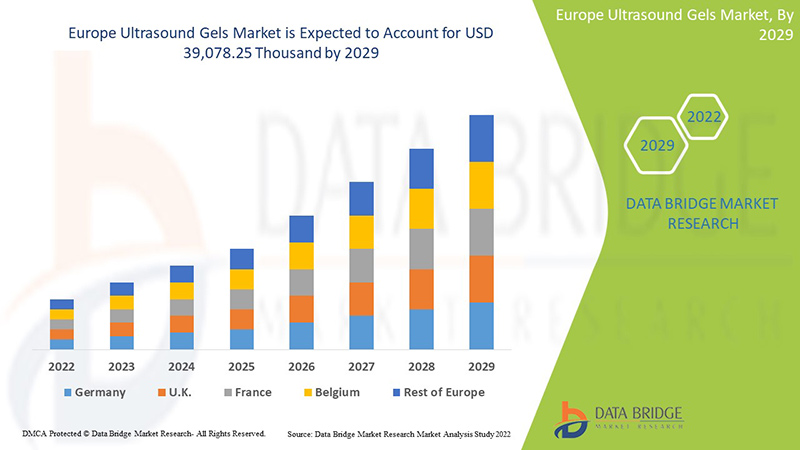

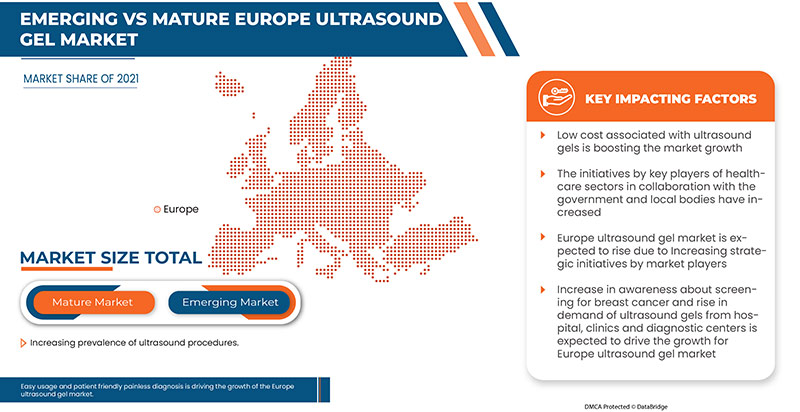

Le marché européen des gels à ultrasons devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,1 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 39 078,25 milliers USD d'ici 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (Personnalisable 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par type (stérile et non stérile), application (échographie abdominale, échographie obstétricale, hystérosonographie, échographie pelvienne, échographie musculo-squelettique, échographie mammaire, échographie de la prostate, échographie carotidienne, échographie veineuse (extrémités), échographie scrotale, échographie thyroïdienne et autres), utilisateur final (hôpitaux, cliniques, centres de diagnostic, centres de chirurgie ambulatoire et autres), canal de distribution (vente au détail, vente en ligne et appel d'offres direct) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Espagne, Pays-Bas, Suisse, Belgique, Turquie et le reste de l'Europe |

|

Acteurs du marché couverts |

Les principales entreprises opérant sur le marché sont Medline Industries LP, Deas srl, HR Pharmaceuticals Inc, FIAB SpA, Gima SpA, Parker Laboratories Inc, Primax Berlin GmbH, Optimum Medical Limited, Safersonic, Braun and Co. Limited, ProSys International Ltd, Turquoise Health, DJO LLC, Fannin, Lessa (filiale du groupe AB Medica), Rays SPA entre autres |

Définition du marché :

Les gels à ultrasons sont parmi les gels les plus couramment utilisés lors des procédures d'échographie. Les gels à ultrasons sont utilisés pour obtenir une imagerie claire et précise lors des diagnostics. Il s'agit du type de milieu conducteur appliqué sur la peau et qui agit comme un agent de couplage et contribue donc à former une liaison étroite entre la peau et la sonde. Ce gel permet également aux ondes ultrasonores d'atteindre directement les tissus et autres parties où l'imagerie est nécessaire.

Dynamique du marché des gels à ultrasons

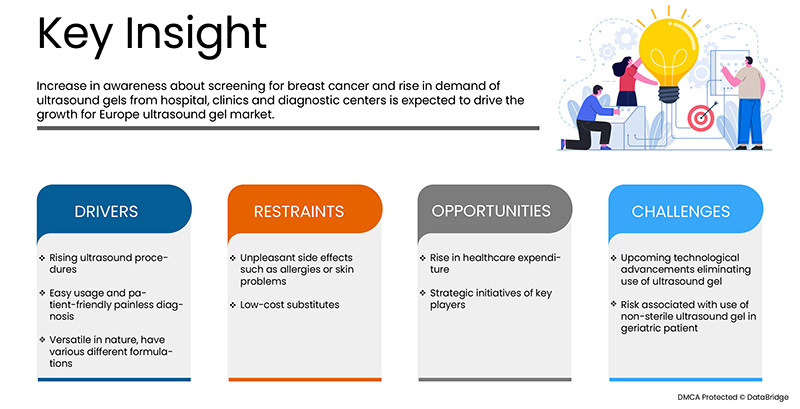

Conducteurs

- Procédures d'échographie en hausse

Les ondes sonores à haute fréquence permettent d'effectuer une échographie pour obtenir une image des structures internes du corps d'une personne. Les médecins ou les cliniciens appliquent des gels à ultrasons sur les parties du corps d'un patient pour une imagerie médicale profonde, précise et claire. Comme la technologie croissante permet des images à haute résolution dans l'échographie médicale, il devient plus facile de diagnostiquer correctement le corps interne. En raison de sa nature rentable et de la sensibilisation accrue aux contrôles périodiques pour des corps plus sains, le nombre d'échographies augmente. Les gels à ultrasons sont le produit le plus pratique et le plus fiable lors de ces examens. La dépendance des cliniciens et des médecins aux ultrasons augmente régulièrement. Ces procédures sont couramment utilisées pour examiner le foie, les reins et d'autres organes de l'estomac, du bassin et d'autres organes ou tissus qui peuvent être évalués à travers la peau. Augmentation de la population gériatrique

- Utilisation facile et diagnostic convivial pour le patient

Lors de l'échographie, les gels à ultrasons sont le plus souvent utilisés par les cliniciens, les médecins et le personnel médical, car ces gels aident à empêcher l'air entre les ondes ultrasonores du scanner et la partie du corps sur laquelle le gel est appliqué. La plupart des procédures d'échographie sont indolores car elles sont non invasives et sont effectuées en externe, seuls les gels sont appliqués sur le corps et le transducteur est placé à proximité du contact avec la peau lorsqu'il passe des ondes lumineuses, ce qui a un effet négligeable sur le corps de la personne. Les procédures d'échographie utilisent des ondes sonores à haute fréquence pour créer une image d'une partie de l'intérieur du corps, car les gels à ultrasons capturent au mieux ces images. Ces gels appliqués sur la peau sont faciles à utiliser et ne provoquent aucune douleur corporelle. Par conséquent, la procédure d'échographie facile et indolore contribuera à la croissance du marché au cours de la période de prévision

Opportunités

-

L'augmentation des dépenses de santé

Les dépenses de santé ont augmenté dans le monde entier à mesure que le revenu disponible des citoyens de divers pays augmente. De plus, pour répondre aux besoins de la population, les organismes gouvernementaux et les organisations de santé prennent l'initiative d'accélérer les dépenses de santé. En outre, l'augmentation des dépenses de santé du gouvernement dans la région assurera l'intégrité structurelle et les opportunités futures du marché des gels à ultrasons au cours de la période de prévision 2022-2029.

Contraintes/Défis

Il existe de nombreux problèmes de peau et allergies signalés en raison de l'utilisation de gels à ultrasons. Certains développent ces problèmes en raison de leur peau sensible. Une dermatite de contact est survenue chez une petite population de patients en raison de l'utilisation de gels à ultrasons. D'autres contaminations bactériennes peuvent également se développer parfois sur la peau du patient où les gels sont appliqués. Certaines formulations ou compositions différentes de gels chauffent lorsqu'elles sont traitées sous lumière UV en raison d'une réaction exothermique. Plus les gels sont épais, plus la chaleur produite est importante. Par conséquent, les effets secondaires associés à l'utilisation de gels à ultrasons peuvent entraver la croissance du marché au cours de la période de prévision.

Impact post-COVID-19 sur le marché européen des gels à ultrasons

La COVID-19 a affecté la croissance du marché en raison de l'augmentation des procédures d'échographie dans la région, telles que l'hystérosonographie, l'échographie obstétricale, l'échographie abdominale, l'échographie mammaire, l'échographie carotidienne, l'échographie musculo-squelettique, l'échographie pelvienne, l'échographie de la prostate, l'échographie scrotale, l'échographie thyroïdienne, l'échographie veineuse, etc. Par conséquent, le besoin de gels à ultrasons continue d'augmenter pendant la période COVID.

Développement récent

- En avril 2019, Civco Medical Solutions a lancé une nouvelle solution, Envision Viral Barrier, qui élimine l’utilisation de gels dans les procédures d’échographie. Ce produit se compose d’une housse de sonde à ultrasons et d’un tampon de numérisation avec un liquide stérile qui facilite les procédures 100 % sans gel. De telles avancées technologiques contribuent à réduire le risque de contamination et à faciliter les flux de travail des cliniciens dans les établissements de santé, ce qui peut entraver la croissance du marché

Portée du marché européen des gels à ultrasons

Le marché européen des gels à ultrasons est segmenté en type, application, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Application

- Échographie abdominale

- Echographie obstétricale

- Hystérosonographie

- Échographie pelvienne

- Echographie musculo-squelettique

- Échographie mammaire

- Échographie de la prostate

- Echographie carotidienne

- Echographie veineuse (extrémités)

- Échographie scrotale

- Échographie de la thyroïde

- Autres

Sur la base de l'application, le marché européen des gels à ultrasons est segmenté en échographie abdominale, échographie obstétricale, hystérosonographie, échographie pelvienne, échographie musculo-squelettique, échographie mammaire, échographie de la prostate, échographie carotidienne, échographie veineuse (extrémités), échographie scrotale, échographie thyroïdienne et autres.

Taper

- Gels stériles pour ultrasons

- Gels à ultrasons non stériles

Sur la base du type, le marché européen des gels à ultrasons est segmenté en gels à ultrasons stériles et non stériles.

Utilisateur final

- Hôpitaux

- Cliniques

- Centres de diagnostic

- Centres de chirurgie ambulatoire

- Autres

Sur la base des utilisateurs finaux, le marché européen des gels à ultrasons est segmenté en hôpitaux, cliniques, centres de diagnostic, centres de chirurgie ambulatoire et autres.

Canal de distribution

- Ventes au détail

- Ventes en ligne

- Appel d'offres direct

Sur la base du canal de distribution, le marché européen des gels à ultrasons est segmenté en ventes au détail, ventes en ligne et appels d'offres directs.

Définition du marché

Les gels à ultrasons sont l'un des gels les plus couramment utilisés et sont principalement utilisés lors des procédures d'échographie. Les gels à ultrasons sont utilisés pour obtenir une imagerie claire et précise lors des diagnostics. Il s'agit du type de milieu conducteur qui est appliqué sur la peau et agit comme un agent de couplage et aide donc à former une liaison étroite entre la peau et la sonde. Ce gel permet également aux ondes ultrasonores de se transmettre directement aux tissus et aux autres parties où l'imagerie est nécessaire.

Analyse/perspectives régionales du marché des gels à ultrasons en Europe

Le marché des gels à ultrasons est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, application, utilisateur final et canal de distribution, comme référencé ci-dessus.

Les pays composant le marché européen des gels à ultrasons sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, les Pays-Bas, la Suisse, la Belgique, la Turquie et le reste de l'Europe.

L'Allemagne domine le marché des gels à ultrasons en termes de part de marché et de chiffre d'affaires et continuera de renforcer sa domination au cours de la période de prévision. Cela est dû à l'augmentation de la prévalence de diverses maladies chroniques et à la recherche et au développement de médicaments en Allemagne qui améliorent encore la croissance de ce marché.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché

Le paysage concurrentiel du marché des gels à ultrasons fournit des détails sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché européen des gels à ultrasons.

Certains des principaux acteurs opérant sur le marché européen des gels à ultrasons sont Medline Industries LP, Deas srl, HR Pharmaceuticals Inc, FIAB SpA, Gima SpA, Parker Laboratories Inc, Primax Berlin GmbH, Optimum Medical Limited, Safersonic, Braun and Co. Limited, ProSys International Ltd, Turquoise Health, DJO LLC, Fannin, Lessa (filiale du groupe AB Medica), Rays SPA, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché Europe vs. Région et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE ULTRASOUND GELS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 NUMBER OF ULTRASOUND PROCEDURES, BY COUNTRY

4.3.1 NUMBER OF ABDOMINAL ULTRASOUND PROCEDURES, BY COUNTRY

4.3.2 NUMBER OF OBSTETRIC ULTRASOUND PROCEDURES, BY COUNTRY

4.3.3 NUMBER OF HYSTEROSONOGRAPHY ULTRASOUND PROCEDURES, BY COUNTRY

4.3.4 NUMBER OF BREAST ULTRASOUND PROCEDURES, BY COUNTRY

4.3.5 NUMBER OF CAROTID ULTRASOUND PROCEDURES, BY COUNTRY

4.3.6 NUMBER OF MUSCULOSKELETAL ULTRASOUND PROCEDURES, BY COUNTRY

4.3.7 NUMBER OF PELVIC ULTRASOUND PROCEDURES, BY COUNTRY

4.3.8 NUMBER OF PROSTATE ULTRASOUND PROCEDURES, BY COUNTRY

4.3.9 NUMBER OF SCROTAL ULTRASOUND PROCEDURES, BY COUNTRY

4.3.10 NUMBER OF THYROID ULTRASOUND PROCEDURES, BY COUNTRY

4.3.11 NUMBER OF VENOUS (EXTREMITIES) ULTRASOUND PROCEDURES, BY COUNTRY

5 EUROPE ULTRASOUND GELS MARKET: REGULATIONS

5.1 REGULATION IN EUROPE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING ULTRASOUND PROCEDURES

6.1.2 EASY USAGE AND PATIENT-FRIENDLY PAINLESS DIAGNOSIS

6.1.3 VERSATILE IN NATURE, HAVE VARIOUS DIFFERENT FORMULATIONS

6.2 RESTRAINTS

6.2.1 UNPLEASANT SIDE EFFECTS SUCH AS ALLERGIES OR SKIN PROBLEMS

6.2.2 LOW-COST SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES OF KEY PLAYERS

6.3.3 DEVELOPMENT OF INNOVATIVE IMAGING MODALITIES AND CONTRAST AGENTS

6.4 CHALLENGES

6.4.1 UPCOMING TECHNOLOGICAL ADVANCEMENTS ELIMINATING THE USE OF ULTRASOUND GEL

6.4.2 RISK ASSOCIATED WITH USE OF NON-STERILE ULTRASOUND GEL IN GERIATRIC PATIENTS

7 EUROPE ULTRASOUND GELS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-STERILE ULTRASOUND GELS

7.3 STERILE ULTRASOUND GELS

8 EUROPE ULTRASOUND GELS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ABDOMINAL ULTRASOUND

8.2.1 NON-STERILE ULTRASOUND GELS

8.2.2 STERILE ULTRASOUND GELS

8.3 OBSTETRIC ULTRASOUND

8.3.1 NON-STERILE ULTRASOUND GELS

8.3.2 STERILE ULTRASOUND GELS

8.4 HYSTEROSONOGRAPHY

8.4.1 NON-STERILE ULTRASOUND GELS

8.4.2 STERILE ULTRASOUND GELS

8.5 PELVIC ULTRASOUND

8.5.1 NON-STERILE ULTRASOUND GELS

8.5.2 STERILE ULTRASOUND GELS

8.6 MUSCULOSKELETAL ULTRASOUND

8.6.1 NON-STERILE ULTRASOUND GELS

8.6.2 STERILE ULTRASOUND GELS

8.7 BREAST ULTRASOUND

8.7.1 NON-STERILE ULTRASOUND GELS

8.7.2 STERILE ULTRASOUND GELS

8.8 PROSTATE ULTRASOUND

8.8.1 NON-STERILE ULTRASOUND GELS

8.8.2 STERILE ULTRASOUND GELS

8.9 CAROTID ULTRASOUND

8.9.1 NON-STERILE ULTRASOUND GELS

8.9.2 STERILE ULTRASOUND GELS

8.1 VENOUS ULTRASOUND (EXTERMITIS)

8.10.1 NON-STERILE ULTRASOUND GELS

8.10.2 STERILE ULTRASOUND GELS

8.11 SCROTAL ULTRASOUND

8.11.1 NON-STERILE ULTRASOUND GELS

8.11.2 STERILE ULTRASOUND GELS

8.12 THYROID ULTRASOUND

8.12.1 NON-STERILE ULTRASOUND GELS

8.12.2 STERILE ULTRASOUND GELS

8.13 OTHERS

9 EUROPE ULTRASOUND GELS MARKET, BY END USER

9.1 OVERVIEW

9.2 HOSPITALS

9.3 DIAGNOSTIC CENTERS

9.4 CLINICS

9.5 AMBULATORY SURGICAL CENTERS

9.6 OTHERS

10 EUROPE ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 RETAIL SALES

10.3 ONLINE SALES

10.4 DIRECT TENDER

11 EUROPE ULTRASOUND GELS MARKET, BY COUNTRY

11.1 GERMANY

11.2 FRANCE

11.3 U.K.

11.4 ITALY

11.5 TURKEY

11.6 SPAIN

11.7 NETHERLANDS

11.8 BELGIUM

11.9 SWITZERLAND

11.1 REST OF EUROPE

12 EUROPE ULTRASOUND GELS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 PARKER LABORATORIES, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENTS

14.2 OPTIMUM MEDICAL LIMITED

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENTS

14.3 FIAB SPA

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 DEAS S.R.L.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 HR PHARMACEUTICALS, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 BRAUN & CO. LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 DJO, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 FANNIN

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 GIMA S.P.A.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 LESSA (SUBSIDIARY OF AB MEDICA GROUP)

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 MEDLINE INDUSTRIES, LP.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 PRIMAX BERLIN GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 PROSYS INTERNATIONAL LTD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 RAYS S.P.A

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 SAFERSONIC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 TURQUOISE HEALTH

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 EUROPE ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (VOLUME, IN THOUSAND)

TABLE 3 EUROPE ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 4 EUROPE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE ABDOMINAL ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE OBSTETRIC ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE HYSTEROSONOGRAPHY IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE PELVIC ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE MUSCULOSKELETAL ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE BREAST ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE PROSTATE ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE CAROTID ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE VENOUS ULTRASOUND (EXTREMITIS) IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE SCROTAL ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE THYROID ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE ULTRASOUND GELS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 19 GERMANY ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 GERMANY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 GERMANY ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 22 GERMANY OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 GERMANY HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 GERMANY PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 GERMANY MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 ERMANY BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 27 GERMANY PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 28 GERMANY CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 GERMANY VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 30 GERMANY SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 31 GERMANY THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 GERMANY ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 33 GERMANY ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 34 FRANCE ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 FRANCE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 36 FRANCE ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 FRANCE OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 38 FRANCE HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 FRANCE PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 FRANCE MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 FRANCE BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 42 FRANCE PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 43 FRANCE CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 FRANCE VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 45 FRANCE SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 FRANCE THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 47 FRANCE ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 48 FRANCE ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 49 U.K. ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 U.K. ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 U.K. ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 U.K. OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 U.K. HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 U.K. PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 U.K. MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 U.K. BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 57 U.K. PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 58 U.K. CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 U.K. VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 U.K. SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 U.K. THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 U.K. ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 63 U.K. ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 64 ITALY ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 ITALY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 ITALY ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 67 ITALY OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 ITALY HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 ITALY PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 ITALY MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 ITALY BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 ITALY PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 ITALY CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 ITALY VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 ITALY SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 76 ITALY THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 ITALY ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 78 ITALY ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 79 TURKEY ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 TURKEY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 TURKEY ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 TURKEY OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 83 TURKEY HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 TURKEY PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 TURKEY MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 86 TURKEY BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 87 TURKEY PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 88 TURKEY CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 TURKEY VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 TURKEY SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 91 TURKEY THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 92 TURKEY ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 93 TURKEY ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 94 SPAIN ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 SPAIN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 SPAIN ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 SPAIN OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 SPAIN HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 99 SPAIN PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 100 SPAIN MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 SPAIN BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 SPAIN PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 SPAIN CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 104 SPAIN VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 105 SPAIN SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 SPAIN THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 SPAIN ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 108 SPAIN ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 109 NETHERLANDS ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 NETHERLANDS ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 NETHERLANDS ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 112 NETHERLANDS OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 NETHERLANDS HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 114 NETHERLANDS PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 115 NETHERLANDS MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 116 NETHERLANDS BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 117 NETHERLANDS PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 118 NETHERLANDS CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 NETHERLANDS VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 120 NETHERLANDS SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 121 NETHERLANDS THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 NETHERLANDS ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 123 NETHERLANDS ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 124 BELGIUM ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 BELGIUM ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 126 BELGIUM ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 127 BELGIUM OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 128 BELGIUM HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 BELGIUM PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 BELGIUM MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 131 BELGIUM BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 132 BELGIUM PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 BELGIUM CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 134 BELGIUM VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 135 BELGIUM SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 BELGIUM THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 137 BELGIUM ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 138 BELGIUM ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 139 SWITZERLAND ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 SWITZERLAND ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 141 SWITZERLAND ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 142 SWITZERLAND OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 143 SWITZERLAND HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 144 SWITZERLAND PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 145 SWITZERLAND MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 146 SWITZERLAND BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 SWITZERLAND PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 148 SWITZERLAND CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 SWITZERLAND VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 150 SWITZERLAND SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 SWITZERLAND THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 152 SWITZERLAND ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 153 SWITZERLAND ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 154 REST OF EUROPE ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 EUROPE ULTRASOUND GELS MARKET: SEGMENTATION

FIGURE 2 EUROPE ULTRASOUND GELS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ULTRASOUND GELS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ULTRASOUND GELS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ULTRASOUND GELS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ULTRASOUND GELS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ULTRASOUND GELS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE ULTRASOUND GELS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 EUROPE ULTRASOUND GELS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE ULTRASOUND GELS MARKET: SEGMENTATION

FIGURE 11 THE INCREASING PREVALENCE OF ULTRASOUND PROCEDURES AND THE RISE IN THE GERIATRIC POPULATION ARE EXPECTED TO DRIVE THE EUROPE ULTRASOUND GELS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 THE NON-STERILE ULTRASOUND GELS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ULTRASOUND GELS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MRI COILS MARKET

FIGURE 14 EUROPE ULTRASOUND GELS MARKET: BY TYPE, 2021

FIGURE 15 EUROPE ULTRASOUND GELS MARKET: BY TYPE, 2022-2029 (USD THOUSAND)

FIGURE 16 EUROPE ULTRASOUND GELS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 EUROPE ULTRASOUND GELS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 EUROPE ULTRASOUND GELS MARKET: BY APPLICATION, 2021

FIGURE 19 EUROPE ULTRASOUND GELS MARKET: BY APPLICATION, 2022-2029 (USD THOUSAND)

FIGURE 20 EUROPE ULTRASOUND GELS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 21 EUROPE ULTRASOUND GELS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 22 EUROPE ULTRASOUND GELS MARKET: BY END USER, 2021

FIGURE 23 EUROPE ULTRASOUND GELS MARKET: BY END USER, 2022-2029 (USD THOUSAND)

FIGURE 24 EUROPE ULTRASOUND GELS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 25 EUROPE ULTRASOUND GELS MARKET: BY END USER, LIFELINE CURVE

FIGURE 26 EUROPE ULTRASOUND GELS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 EUROPE ULTRASOUND GELS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD THOUSAND)

FIGURE 28 EUROPE ULTRASOUND GELS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 29 EUROPE ULTRASOUND GELS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 30 EUROPE ULTRASOUND GELS MARKET: SNAPSHOT (2021)

FIGURE 31 EUROPE ULTRASOUND GELS MARKET: BY COUNTRY (2021)

FIGURE 32 EUROPE ULTRASOUND GELS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 EUROPE ULTRASOUND GELS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 EUROPE ULTRASOUND GELS MARKET: BY TYPE (2022 & 2029)

FIGURE 35 EUROPE ULTRASOUND GELS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.