Marché européen du vectoring de couple, par composant (matériel, services), technologie (système de vectoring de couple actif (ATVS), système de vectoring de couple passif (PTVS)), type d'actionnement d'embrayage (électrique, hydraulique), type de roue motrice (propulsion arrière (RWD), traction avant (FWD)), type de véhicule ( voitures particulièresvéhicules utilitaires , véhicule tout-terrain), type de propulsion (diesel/essence/GNC, véhicule électrique ) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché

Les solutions de vectorisation de couple sont des systèmes très importants et cruciaux qui garantissent la sécurité et contribuent à améliorer les performances du véhicule. Ces systèmes fournissent ou distribuent essentiellement le couple entre les roues, ce qui permet au véhicule de tourner efficacement dans un virage ou une courbe. La vectorisation de couple est une approche holistique et prédictive de la dynamique du véhicule utilisant une combinaison de matériel et de systèmes électroniques. Le marché mondial de la vectorisation de couple connaît une croissance rapide en raison de l'émergence d'EVS et de son système de vectorisation de couple. Les entreprises lancent même de nouveaux produits pour gagner une plus grande part de marché.

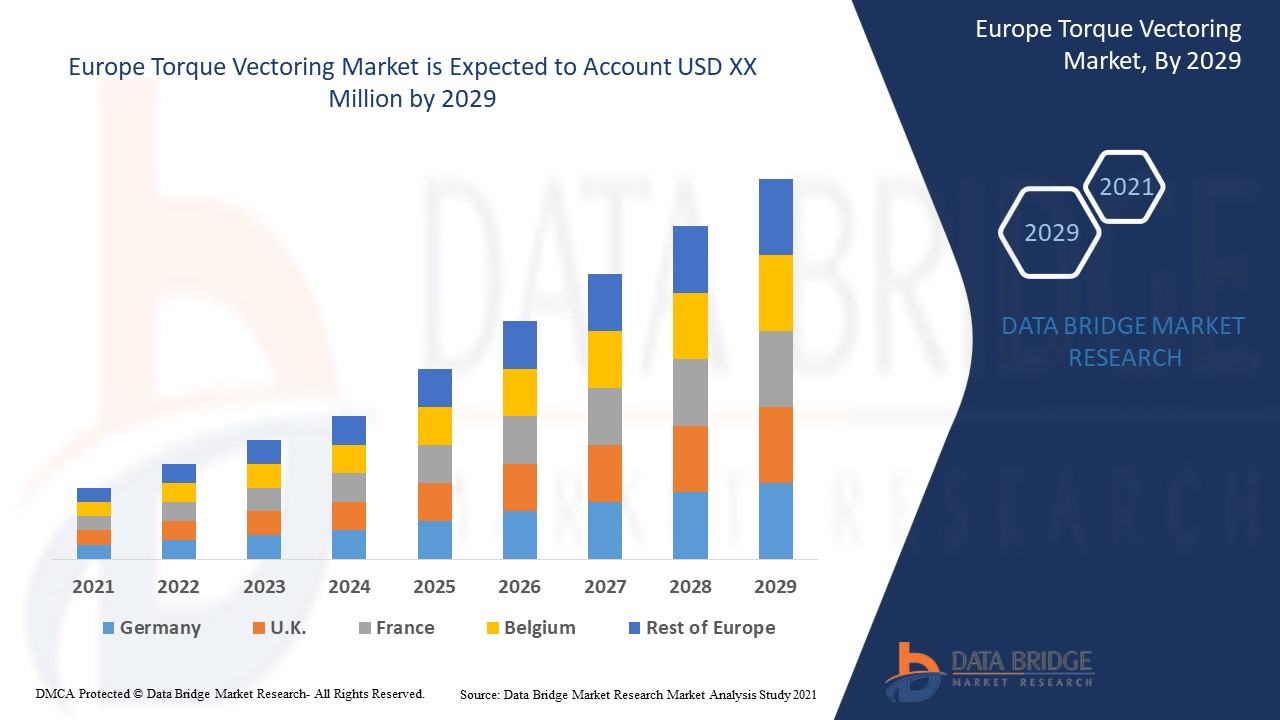

L'augmentation de la population, l'urbanisation rapide et l'industrialisation ont un impact propositionnel sur la croissance et l'adoption du vectoring de couple, car ces derniers temps, les systèmes de vectoring de couple sont largement utilisés pour améliorer la dynamique et les caractéristiques de sécurité des véhicules. Data Bridge Market Research analyse que le marché du vectoring de couple connaîtra une croissance de 17,4 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par composant (matériel, services), technologie (système de vectorisation de couple actif (ATVS), système de vectorisation de couple passif (PTVS)), type d'actionnement d'embrayage (électrique, hydraulique), type de roue motrice (propulsion arrière (RWD), traction avant (FWD)), type de véhicule (voitures particulières, véhicules utilitaires, véhicule tout-terrain), type de propulsion (diesel/essence/GNC, véhicule électrique) |

|

Pays couverts |

Allemagne, Espagne, France, Russie, Turquie, République tchèque, Royaume-Uni, Italie, Pologne, Roumanie, Hongrie, Belgique, Suède, Pays-Bas, Finlande, Biélorussie, Suisse et reste de l'Europe |

|

Acteurs du marché couverts |

Français BorgWarner Inc., Eaton, American Axle & Manufacturing, Inc., Dana Limited, JTEKT Corporation, Magna International Inc., Robert Bosch GmbH, Protean, Hewland Engineering Ltd, Continental AG, Modelon, GKN Automotive Limited, Inc., Prodrive Holdings Limited, MITSUBISHI MOTORS CORPORATION, Haldex, Schaeffler AG, THE TIMKEN COMPANY, Linamar Corporation, Ricardo, ZF Friedrichshafen AG entre autres. |

Définition du marché

Les solutions de vectorisation de couple sont des systèmes très importants et cruciaux qui garantissent la sécurité et contribuent à améliorer les performances du véhicule. Ces systèmes fournissent ou distribuent essentiellement le couple entre les roues, ce qui permet au véhicule de tourner efficacement dans un virage ou une courbe. La vectorisation de couple est une approche holistique et prédictive de la dynamique du véhicule utilisant une combinaison de systèmes matériels et électroniques. Elle fournit la distribution de couple la plus appropriée à une roue à tout moment en fonction des intentions du conducteur et des conditions de conduite. Il existe essentiellement deux types de techniques de vectorisation de couple qui sont principalement utilisées, l'une est la vectorisation de couple basée sur le freinage et l'autre est la vectorisation de couple basée sur l'électricité.

Dynamique du marché du vectoring de couple

Conducteurs

- Augmentation de la population et urbanisation rapide

L'urbanisation rapide, la population, l'émergence des technologies de mobilité en tant que service (MaaS) et le changement des comportements des consommateurs obligent les principaux acteurs à proposer des services par abonnement pour que les consommateurs obtiennent un avantage sur le marché.

- L'émergence des véhicules électriques et de leur système de vectorisation du couple

Ces derniers temps, l'industrie automobile a connu une croissance énorme au fil des ans en raison de la demande croissante de véhicules électriques de luxe. Les véhicules entièrement électriques (VE) sont appelés véhicules électriques à batterie qui utilisent une batterie pour stocker l'énergie électrique qui alimente les véhicules

- Approche intelligente de vectorisation du couple pour les véhicules ADAS

Les systèmes avancés d'aide à la conduite (ADAS) sont des systèmes électroniques implantés dans les automobiles pour aider à la conduite des véhicules ou des voitures autonomes. Ce système utilise des capteurs tels que des radars, des caméras pour l'analyse et prend des mesures automatiques en fonction de l'environnement du véhicule

- Hausse de la demande de véhicules de luxe et de performance

Le concept de véhicules connectés dotés de fonctions de sécurité avancées et de télématique est possible grâce aux progrès technologiques. Des technologies telles que l'IA, le big data, la connectivité réseau avancée et l'IoT. De plus, le vectoring de couple est un système de contrôle piloté par ordinateur qui contrôle la puissance que le ou les moteurs du véhicule peuvent générer et envoyer à chaque roue en fonction des données disponibles sur les performances.

Opportunité

-

Adoption rapide du système de vectorisation du couple dans les véhicules tout-terrain

Un véhicule tout-terrain (VTT) est un type de véhicule conçu spécifiquement pour une utilisation hors route, essentiellement sur des terrains accidentés. Ces véhicules sont spécialement développés pour les consommateurs qui préfèrent les véhicules tout-terrain pour l'accessibilité dans leur zone de résidence ou à des fins récréatives.

Retenue/Défi

Cependant, l'empreinte carbone élevée du secteur automobile obligera les organismes gouvernementaux à prendre des mesures et des réglementations strictes pour contrôler le niveau d'émission, ce qui pourrait réduire l'adoption de solutions de vectorisation du couple. De plus, l'offre limitée de véhicules en raison de la pénurie de puces semi-conductrices et de contrôleurs a une corrélation directe avec les ventes et la disponibilité de nouveaux systèmes de vectorisation du couple.

Impact du Covid-19 sur le marché du Torque Vectoring

Le COVID-19 a eu un impact négatif sur le marché. Les systèmes de vectorisation de couple étant très demandés, des entreprises telles que JTEKT Corporation, Magna International Inc., Robert Bosch GmbH, Protean et d'autres en Europe ont du mal à fournir des systèmes avancés pour les véhicules neufs et anciens en raison de la pénurie de puces de contrôle et de contrôleurs à semi-conducteurs, en raison des réglementations strictes imposées par le gouvernement. De plus, l'offre limitée de puces et de gadgets à semi-conducteurs a considérablement affecté l'offre de véhicules sur le marché.

Développement récent

- En mars 2022, Prodrive Holdings Limited a lancé la première Hyper Car tout-terrain au monde. La principale caractéristique de ce lancement de voiture était son véhicule d'aventure tout-terrain à quatre roues motrices de 600 ch avec une capacité et des performances inégalées sur n'importe quel terrain. Grâce à cette société, elle a élargi son marché en proposant des solutions innovantes à ses consommateurs.

Portée du marché européen du vectoring de couple

Le marché du vectoring de couple est segmenté en fonction du composant, de la technologie, du type d'actionnement de l'embrayage, du type de roue motrice, du type de véhicule et du type de propulsion. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Composant

- Matériel

- Services

Sur la base des composants, le marché européen du vectoring de couple a été segmenté en matériel et en services.

Technologie

- Système de vectorisation de couple actif (ATVS)

- Système de vectorisation de couple passif (PTVS)

Sur la base de la technologie, le marché européen du vectoring de couple a été segmenté en système de vectoring de couple actif (ATVS) et système de vectoring de couple passif (PTVS).

Type d'actionnement de l'embrayage

- Électrique

- Hydraulique

Sur la base du type d'actionnement de l'embrayage, le marché européen du vectoring de couple a été segmenté en électrique et hydraulique.

Type de roue motrice

- Propulsion arrière (RWD)

- Traction avant (FWD)

- Transmission intégrale/à quatre roues motrices (AWD/4WD)

Sur la base du type de roue motrice, le marché européen du vectoring de couple a été segmenté en traction arrière (RWD), traction avant (FWD) et transmission intégrale/quatre roues motrices (AWD/4WD).

Type de véhicule

- Voitures de tourisme

- Véhicules commerciaux

- Véhicule tout terrain

Sur la base du type de véhicule, le marché européen du vectoring de couple a été segmenté en voitures particulières, véhicules utilitaires et véhicules tout-terrain.

Type de propulsion

- Diesel/Essence/GNC

- Véhicule électrique

Sur la base du type de propulsion, le marché européen du vectoring de couple a été segmenté en véhicules diesel/essence/GNC et véhicules électriques.

Analyse/perspectives régionales du marché du vectoring de couple en Europe

Le marché du vectoring de couple est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, composant, technologie, type d'actionnement d'embrayage, type de roue motrice, type de véhicule et type de propulsion comme référencé ci-dessus. Le marché européen est en outre segmenté en Allemagne, Espagne, France, Russie, Turquie, République tchèque, Royaume-Uni, Italie, Pologne, Roumanie, Hongrie, Belgique, Suède, Pays-Bas, Finlande, Biélorussie, Suisse, reste de l'Europe.

L'Allemagne devrait dominer l'Europe, en raison du besoin du marché de la vectorisation de couple, car elle compte de grands fabricants et des demandes élevées.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du Torque Vectoring

Le paysage concurrentiel du marché du vectoring de couple fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché du vectoring de couple.

Certains des principaux acteurs opérant sur le marché du vectoring de couple sont Continental AG, Schaeffler AG, Robert Bosch GmbH, GKN Automotive Limited, ZF Friedrichshafen AG, BorgWarner Inc., Eaton, Magna International Inc., Dana Limited, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE TORQUE VECTORING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES ANALYSIS

4.2 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN POPULATION & RAPID URBANIZATION

5.1.2 EMERGENCE OF EVS & AND ITS TORQUE VECTORING SYSTEM

5.1.3 INTELLIGENT TORQUE VECTORING APPROACH FOR ADAS VEHICLES

5.1.4 UPSURGE IN DEMAND FOR LUXURY AND PERFORMANCE VEHICLES

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH IMPLEMENTING TORQUE VECTORING/AWD/4WD SYSTEMS

5.2.2 HIGH CARBON FOOTPRINT OF THE AUTOMOTIVE SECTOR

5.3 OPPORTUNITIES

5.3.1 HEAVING ADOPTION OF TORQUE VECTORING SYSTEM IN OFF-ROAD VEHICLES

5.3.2 GROWING AWARENESS ABOUT ENHANCED SAFETY AND VEHICLE DYNAMICS

5.4 CHALLENGES

5.4.1 HAMPERED SUPPLY OF SEMICONDUCTOR EQUIPMENT LIMITS TORQUE VECTORING SYSTEM

5.4.2 CHANGING AUTOMOTIVE PRODUCT LIFE CYCLE AND LONG PRODUCTION CYCLE OF AUTOMOTIVE VEHICLES

6 EUROPE TORQUE VECTORING MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 DRIVE CONTROL UNIT (DCU)

6.2.2 MOTOR CONTROLLERS

6.2.3 SENSORS

6.2.4 MOTOR

6.2.5 CAN BUS

6.2.6 OTHERS

6.3 SERVICES

7 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

7.3 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

8 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE

8.1 OVERVIEW

8.2 ELECTRIC

8.3 HYDRAULIC

9 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE

9.1 OVERVIEW

9.2 FRONT-WHEEL DRIVE (FWD)

9.3 ALL-WHEEL DRIVE/FOUR-WHEEL DRIVE (AWD/4WD)

9.4 REAR-WHEEL DRIVE (RWD)

10 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER CARS

10.2.1 BY TYPE

10.2.1.1 SEDAN

10.2.1.2 HATCHBACK

10.2.1.3 CROSSOVERS

10.2.1.4 SUV

10.2.1.5 OTHERS

10.2.2 BY TECHNOLOGY

10.2.2.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.2.2.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

10.3 COMMERCIAL VEHICLES

10.3.1 BY TYPE

10.3.1.1 LIGHT COMMERCIAL VEHICLE

10.3.1.2 HEAVY COMMERCIAL VEHICLE

10.3.1.2.1 BUS

10.3.1.2.2 TRUCKS

10.3.2 BY TECHNOLOGY

10.3.2.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.3.2.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

10.4 OFF ROAD VEHICLE

10.4.1 BY TECHNOLOGY

10.4.1.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.4.1.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

11 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE

11.1 OVERVIEW

11.2 DIESEL/PETROL/CNG

11.3 ELECTRIC VEHICLE

11.3.1 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2 HYBRID ELECTRIC VEHICLE (HEV)

12 EUROPE TORQUE VECTORING MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY (LEFT HAND DRIVE)

12.1.2 SPAIN (LEFT HAND DRIVE)

12.1.3 FRANCE (LEFT HAND DRIVE)

12.1.4 RUSSIA (LEFT HAND DRIVE)

12.1.5 TURKEY (LEFT HAND DRIVE)

12.1.6 CZECH REPUBLIC (LEFT HAND DRIVE)

12.1.7 U.K. (RIGHT HAND DRIVE)

12.1.8 ITALY (LEFT HAND DRIVE)

12.1.9 POLAND (LEFT HAND DRIVE)

12.1.10 ROMANIA (LEFT HAND DRIVE)

12.1.11 HUNGARY (LEFT HAND DRIVE)

12.1.12 BELGIUM (LEFT HAND DRIVE)

12.1.13 SWEDEN (LEFT HAND DRIVE)

12.1.14 NETHERLANDS (LEFT HAND DRIVE)

12.1.15 FINLAND (LEFT HAND DRIVE)

12.1.16 BELARUS (LEFT HAND DRIVE)

12.1.17 SWITZERLAND (LEFT HAND DRIVE)

12.1.18 REST OF EUROPE

13 EUROPE TORQUE VECTORING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 AMERICAN AXLE & MANUFACTURING, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY PROFILE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 CONTINENTAL AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 EATON

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 SCHAEFFLER AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 JTEKT CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 BORGWARNER INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 DANA LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 DRAKO MOTORS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCTS PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 GKN AUTOMOTIVE LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCTS PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 HALDEX

15.10.1 COMPANY SNPASHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 HEWLAND ENGINEERING LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LINAMAR CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 MAGNA INTERNATIONAL INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 MITSUBISHI MOTORS CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCTS PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 MODELON

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 PRODRIVE HOLDINGS LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCTS PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PROTEAN

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RICARDO

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 ROBERT BOSCH GMBH

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 THE TIMKEN COMPANY

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 UNIVANCE CORPORATION

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 ZF FRIEDRICHSHAFEN AG

15.22.1 COMPANY SNAPSHOT

15.22.2 SOLUTION PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 PERFORMANCE TABLE

TABLE 2 CARBON EMISSION LEVEL OF VARIOUS TYPES OF CARS & SUVS

TABLE 3 EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 4 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE SERVICES IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 EUROPE ACTIVE TORQUE VECTORING SYSTEMS (ATVS) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE PASSIVE TORQUE VECTORING SYSTEMS (PTVS) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ELECTRIC IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE HYDRAULIC IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE FRONT-WHEEL DRIVE (FWD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ALL-WHEEL DRIVE/FOUR-WHEEL DRIVE (AWD/4WD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE REAR-WHEEL DRIVE (RWD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 EUROPE COMMERCIAL VEHICLES IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 25 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 27 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE DIESEL/PETROL/CNG IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 EUROPE (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 35 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 37 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 45 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 46 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 49 GERMANY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 51 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 52 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 53 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 54 GERMANY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 GERMANY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 56 GERMANY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 GERMANY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 59 GERMANY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 63 SPAIN (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 65 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 66 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 67 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 68 SPAIN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SPAIN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 SPAIN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SPAIN (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SPAIN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 SPAIN (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 75 SPAIN (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 77 FRANCE (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 80 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 81 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 82 FRANCE (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 FRANCE (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 84 FRANCE (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 FRANCE (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 FRANCE (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 FRANCE (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 89 FRANCE (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 91 RUSSIA (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 94 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 95 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 96 RUSSIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 RUSSIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 98 RUSSIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 RUSSIA (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 RUSSIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 101 RUSSIA (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 103 RUSSIA (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 104 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 105 TURKEY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 107 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 108 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 109 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 110 TURKEY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 TURKEY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 TURKEY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 TURKEY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 TURKEY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 115 TURKEY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 116 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 117 TURKEY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 118 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 119 CZECH REPUBLIC (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 121 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 122 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 123 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 124 CZECH REPUBLIC (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CZECH REPUBLIC (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 126 CZECH REPUBLIC (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 CZECH REPUBLIC (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 CZECH REPUBLIC (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 129 CZECH REPUBLIC (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 130 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 131 CZECH REPUBLIC (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 133 U.K. (RIGHT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 135 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 137 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 138 U.K. (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 U.K. (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 140 U.K. (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 U.K. (RIGHT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 U.K. (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 U.K. (RIGHT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 144 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.K. (RIGHT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 146 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 147 ITALY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 149 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 150 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 151 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 152 ITALY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 ITALY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 ITALY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 ITALY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 ITALY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 157 ITALY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 158 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 159 ITALY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 161 POLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 163 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 164 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 165 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 166 POLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 POLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 168 POLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 POLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 POLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 171 POLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 172 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 173 POLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 174 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 175 ROMANIA (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 177 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 178 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 179 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 180 ROMANIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 ROMANIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 182 ROMANIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 ROMANIA (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 ROMANIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 185 ROMANIA (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 186 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 187 ROMANIA (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 188 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 189 HUNGARY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 191 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 192 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 193 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 194 HUNGARY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 HUNGARY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 196 HUNGARY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 HUNGARY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 HUNGARY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 199 HUNGARY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 200 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 201 HUNGARY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 202 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 203 BELGIUM (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 205 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 206 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 208 BELGIUM (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 210 BELGIUM (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 216 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 217 SWEDEN (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 219 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 220 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 221 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 222 SWEDEN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SWEDEN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 224 SWEDEN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 SWEDEN (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 SWEDEN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 227 SWEDEN (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 228 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 229 SWEDEN (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 230 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 231 NETHERLANDS (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 233 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 234 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 235 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 236 NETHERLANDS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 NETHERLANDS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 238 NETHERLANDS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 NETHERLANDS (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 NETHERLANDS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 241 NETHERLANDS (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 242 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 243 NETHERLANDS (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 244 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 245 FINLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 247 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 248 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 249 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 250 FINLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 FINLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 252 FINLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 FINLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 FINLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 255 FINLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 256 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 257 FINLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 258 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 259 BELARUS (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 261 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 262 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 263 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 264 BELARUS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 BELARUS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 266 BELARUS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 BELARUS (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 BELARUS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 269 BELARUS (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 270 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 271 BELARUS (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 272 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 273 SWITZERLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 275 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 276 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 277 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 278 SWITZERLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 SWITZERLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 280 SWITZERLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 SWITZERLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 SWITZERLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 283 SWITZERLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 284 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 285 SWITZERLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 286 REST OF EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE TORQUE VECTORING MARKET: SEGMENTATION

FIGURE 2 EUROPE TORQUE VECTORING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE TORQUE VECTORING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE TORQUE VECTORING MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE TORQUE VECTORING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE TORQUE VECTORING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE TORQUE VECTORING MARKET: DBMRMARKET POSITION GRID

FIGURE 8 EUROPE TORQUE VECTORING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE TORQUE VECTORING MARKET: SEGMENTATION

FIGURE 10 INTELLIGENT TORQUE VECTORING APPROACH FOR ADAS VEHICLES IS EXPECTED TO DRIVE EUROPE TORQUE VECTORING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE TORQUE VECTORING MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE EUROPE TORQUE VECTORING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE TORQUE VECTORING MARKET

FIGURE 14 PERCENTAGE OF URABANIZATION ACROSS THE GLOBE

FIGURE 15 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 16 ROAD TRANSPORT EMISSIONS

FIGURE 17 EUROPE TORQUE VECTORING MARKET: BY COMPONENT, 2021

FIGURE 18 EUROPE TORQUE VECTORING MARKET: BY TECHNOLOGY, 2021

FIGURE 19 EUROPE TORQUE VECTORING MARKET: BY CLUTCH ACTUATION TYPE, 2021

FIGURE 20 EUROPE TORQUE VECTORING MARKET: BY DRIVING WHEEL TYPE, 2021

FIGURE 21 EUROPE TORQUE VECTORING MARKET: BY VEHICLE TYPE, 2021

FIGURE 22 EUROPE TORQUE VECTORING MARKET: BY PROPULSION TYPE, 2021

FIGURE 23 EUROPE TORQUE VECTORING MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE TORQUE VECTORING MARKET: BY COMPONENT (2022-2029)

FIGURE 28 EUROPE TORQUE VECTORING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.