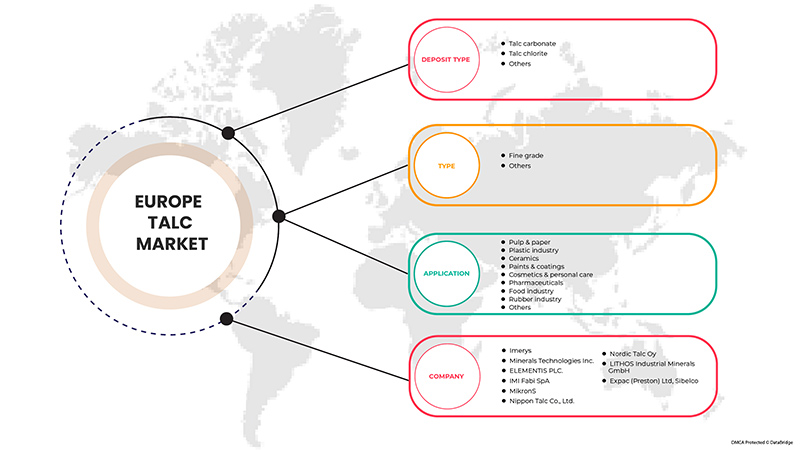

Marché européen du talc, par type de gisement (carbonate de talc, chlorite de talc et autres), type (qualité fine et autres), application (pâte et papier, industrie du plastique, céramique, peintures et revêtements, cosmétiques et soins personnels, produits pharmaceutiques, industrie alimentaire, industrie du caoutchouc et autres), pays (Allemagne, Royaume-Uni, Italie, France, Espagne, Russie, Suisse, Turquie, Belgique, Pays-Bas et reste de l'Europe) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché

Les applications étendues dans la production de plastiques légers pour les composants automobiles, l'industrialisation rapide et l'augmentation du revenu disponible de la classe moyenne des économies émergentes devraient stimuler la demande pour le marché européen du talc. Cependant, les directives régissant la production et l'utilisation du talc pourraient encore limiter la croissance du marché.

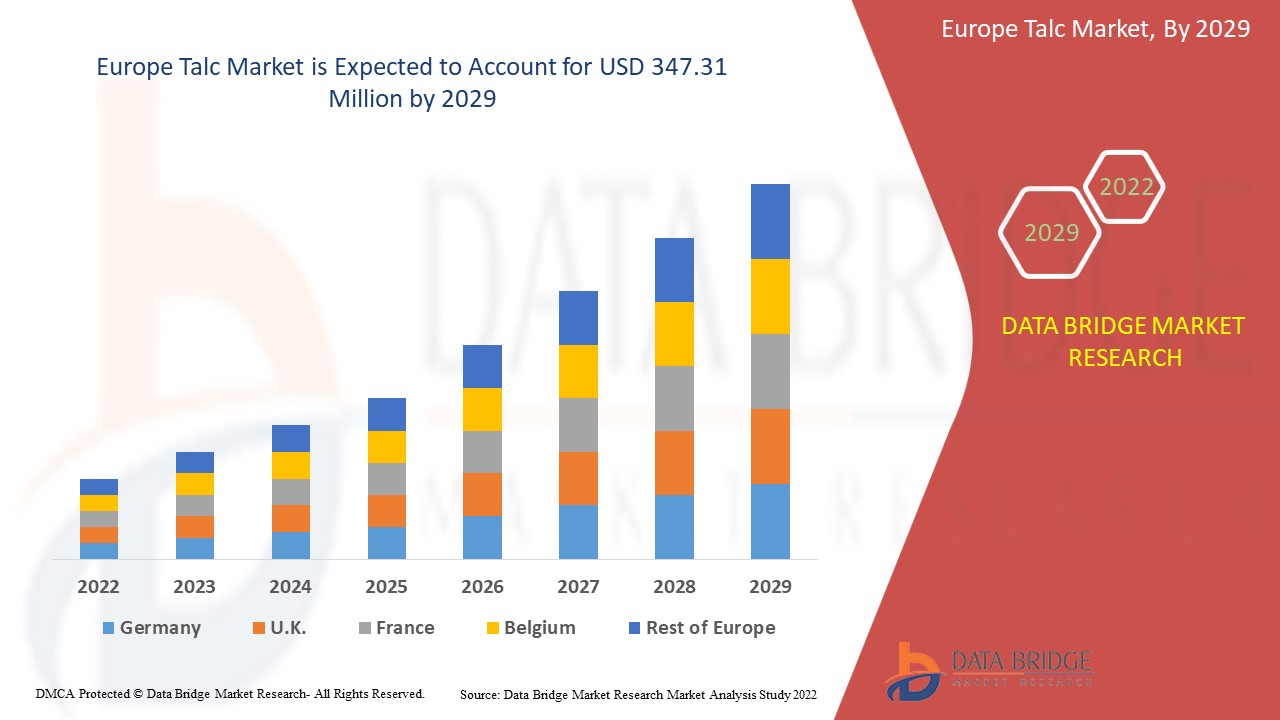

Ce talc est utilisé dans les plastiques légers pour l'industrie automobile. Data Bridge Market Research analyse que le marché européen du talc devrait atteindre la valeur de 347,31 millions USD d'ici 2029, à un TCAC de 3,2 % au cours de la période de prévision. « Pâte à papier et papier » représente le segment d'application le plus important. Le rapport de marché élaboré par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type de dépôt (carbonate de talc, chlorite de talc et autres), type (qualité fine et autres), application (pâte à papier et papier, industrie du plastique, céramique, peintures et revêtements, cosmétiques et soins personnels, produits pharmaceutiques, industrie alimentaire, industrie du caoutchouc et autres) |

|

Pays couverts |

Allemagne, Royaume-Uni, Italie, France, Espagne, Russie, Suisse, Turquie, Belgique, Pays-Bas et reste de l'Europe |

|

Acteurs du marché couverts |

Imerys, Minerals Technologies Inc., ELEMENTIS PLC., IMI Fabi SpA, MikronS, Nippon Talc Co., Ltd., Nordic Talc Oy, LITHOS Industrial Minerals GmbH, Expac (Preston) Ltd, Sibelco |

Définition du marché

Le talc est un type de roche minérale composée de silicate de magnésium hydraté. Il a une grande variété d'applications, la plus courante étant la poudre pour bébé. En raison de sa résistance à la chaleur, à l'électricité et à l'absorption des acides, de l'huile et de la graisse, il est très demandé par de nombreuses industries. Ses caractéristiques sont la douceur du minéral, la capacité de retenir les parfums, la pureté et la couleur blanche.

Le COVID-19 a eu un impact minime sur le marché du talc

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. En raison du confinement, le marché du talc a connu un impact significatif sur l'importation et l'exportation de produits à base de talc par rapport aux dernières années. Cependant, la demande croissante du produit de consommation augmentera la croissance du marché du talc.

Dynamique du marché :

Facteurs moteurs/opportunités

- Applications étendues dans la production de plastiques légers pour les composants automobiles

Les principales applications extérieures du talc sont les pare-chocs, les bas de caisse et les calandres. Une forte résistance aux chocs et une faible dilatation thermique sont nécessaires pour toutes ces applications afin de les assembler avec des pièces métalliques ayant une très faible variation dimensionnelle avec la température. La plupart de ces articles sont peints sur la carrosserie de la voiture pour améliorer l'attrait esthétique. Les composites chargés de talc sont également utilisés dans les applications sous le capot. Dans ce cas, de bonnes propriétés thermiques sont généralement requises. Par conséquent, avec la croissance de l'industrie automobile et la demande croissante de véhicules et de composants légers pour augmenter l'efficacité des véhicules, il y aura une énorme demande de talc, ce qui devrait stimuler le marché européen du talc.

- Industrialisation rapide et augmentation du revenu disponible de la classe moyenne des économies émergentes

Les principaux pays européens connaissent actuellement une transformation sociétale et économique. La région connaît un développement économique rapide, avec le soutien ferme de diverses politiques gouvernementales visant à réduire la pauvreté, à accroître les niveaux de qualification de la main-d'œuvre et à ouvrir la région à des activités économiques à plus forte valeur ajoutée telles que l'industrie manufacturière. En outre, les salaires augmentent rapidement en conséquence. Par conséquent, le marché européen a décollé avec l'augmentation du revenu disponible. Cela pourrait créer une plate-forme pour la croissance du marché européen du talc.

- Disponibilité facile des matières premières et main d'œuvre abordable

Les pays européens disposent d'une main d'œuvre importante, bon marché par rapport aux autres régions, qui est engagée dans le processus d'extraction et de fabrication de talc synthétique. De plus, la France est l'un des principaux centres d'extraction de talc, ce qui permet aux autres pays européens d'obtenir plus facilement la matière première talc à un prix inférieur et dans les quantités requises. De plus, les ressources de talc de la France comprennent non seulement son volume de réserve important, mais aussi la qualité supérieure de son talc blanc, et la France est le plus important fournisseur de talc, y compris tous les produits de qualité moyenne et supérieure. Par conséquent, la disponibilité facile des matières premières de talc dans cette région et aux alentours devrait favoriser la croissance du marché européen du talc.

- Des activités de recherche en plein essor pour l'avancement de nouvelles qualités de talc

L'accent a été mis sur l'exploration du talc comme retardateur de dissolution dans les produits à libération contrôlée et comme nouveau substrat pour la conception de granulés en raison de sa nature physicochimique, physiologiquement inerte et peu coûteuse. En raison de ces caractéristiques attrayantes, les agglomérats sphériques humides de talc ont été utilisés comme substrat pour l'enrobage et comme diluant dans la cristallo-co-agglomération (CCA). L'utilisation d'un tel excipient à haute fonctionnalité permet d'obtenir de meilleurs produits à moindre coût, un délai de mise sur le marché plus court et un cycle de vie du produit prolongé. La croissance des industries de la pâte à papier, du papier, de l'automobile, des plastiques, des peintures, des revêtements, des cosmétiques, des soins personnels, de la céramique, de l'agriculture et de l'alimentation compte parmi les principaux consommateurs de talc dans la région et devrait offrir des opportunités de croissance au marché européen du talc.

Contraintes/Défis

- Lignes directrices régissant la production et l'utilisation du talc

Selon l'International Journal of Gynecological Cancer, il a été prouvé que l'utilisation fréquente de talc sous différentes formes par les femmes peut provoquer un cancer des ovaires . De plus, l'utilisation de poudre de talc est associée à des problèmes respiratoires chez les nourrissons, et une exposition à long terme à celle-ci peut provoquer une pneumonie et des symptômes d'asthme. De plus, une exposition prolongée au talc a de graves effets néfastes sur les fonctions corporelles, comme par exemple la formation de croûtes, une éventuelle infection et des granulomes à corps étrangers dans le derme. Par conséquent, en raison de ces effets nocifs créés lors de la production et de l'utilisation du talc, des règles et réglementations strictes ont été appliquées. Cela devrait entraver la croissance du marché européen du talc.

- Développement modéré de l'industrie des pâtes et papiers grâce à la numérisation

La croissance de l'industrie de la pâte à papier et du papier en Europe a été très lente par rapport aux années précédentes, ce qui devrait freiner la croissance du marché européen du talc. De plus, le talc est largement remplacé par des solutions biotechnologiques dans diverses applications, telles que le contrôle de la poix dans la fabrication de pâte à papier et de papier. Ces solutions biotechnologiques utilisent des enzymes ou des champignons pour contrôler la poix dans le papier. Par conséquent, l'utilisation du talc dans l'industrie de la pâte à papier et du papier diminue rapidement, ce qui entraîne une baisse de la demande de talc.

- Accessibilité facile aux substituts

La silice est présente dans les produits de maquillage minéraux qui ne contiennent pas de talc. Elle est utilisée pour sa capacité à absorber l'huile et à empêcher l'agglomération. La silice synthétique amorphe utilisée dans les cosmétiques et autres produits de soins personnels ne contient pas de silice cristalline et est généralement considérée comme sûre à l'usage. Ainsi, la disponibilité facile d'une large gamme de substituts au talc sur le marché devrait considérablement remettre en cause le développement du marché européen du talc.

Ce rapport sur le marché européen du talc fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché du talc, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision éclairée sur le marché pour atteindre la croissance du marché.

Développements récents

- En septembre 2020, Imerys a reçu la note Platinum d'EcoVadis en matière de développement durable. Cette récompense a renforcé l'image de l'entreprise sur le marché et a placé Imerys dans le top 1% des entreprises évaluées dans le monde.

- En octobre 2018, ELEMENTIS PLC a acquis Mondo Minerals, un important producteur d'additifs à base de talc. Cette acquisition a permis à l'entreprise de bénéficier d'une activité complémentaire et structurellement avantageuse

Portée du marché européen du talc

Le marché européen du talc est segmenté en fonction du type de gisement, du type et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de dépôt

- Carbonate de talc

- Chlorite de talc

- Autres

Sur la base du type de gisement, le marché est segmenté en carbonate de talc, chlorite de talc et autres.

Taper

- Qualité fine

- Autres

Sur la base du type, le marché est segmenté en qualité fine et autres.

Application

- Pâte à papier et papier

- Industrie du plastique

- Céramique

- Peintures et revêtements

- Cosmétiques et soins personnels

- Médicaments

- Industrie alimentaire

- Industrie du caoutchouc

- Autres

En fonction des applications, le marché est segmenté en pâtes et papiers, industrie du plastique, céramique, peintures et revêtements, cosmétiques et soins personnels, produits pharmaceutiques, industrie alimentaire, industrie du caoutchouc, etc. Tous les segments sont ensuite segmentés en carbonate de talc, chlorite de talc, etc.

Analyse/perspectives régionales du marché du talc en Europe

Le marché européen du talc est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type de gisement, type et application comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché européen du talc sont l'Allemagne, le Royaume-Uni, l'Italie, la France, l'Espagne, la Russie, la Suisse, la Turquie, la Belgique, les Pays-Bas et le reste de l'Europe.

L’Espagne domine le marché du talc en raison des activités croissantes de recherche et de progrès pour le développement de nouvelles qualités de talc dans la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du talc en Europe

Le paysage concurrentiel du marché du talc en Europe fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché du talc en Europe.

Certains des principaux acteurs opérant sur le marché du talc sont Imerys, Minerals Technologies Inc., ELEMENTIS PLC., IMI Fabi SpA, MikronS, Nippon Talc Co., Ltd., Nordic Talc Oy, LITHOS Industrial Minerals GmbH, Expac (Preston) Ltd, Sibelco entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE TALC MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 DEPOSIT TYPE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 BRAND COMPARATIVE ANALYSIS

4.4 IMPORT EXPORT SCENARIO

4.5 LIST OF BUYERS

4.6 NEW PRODUCT LAUNCHES

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 PRICE ANALYSIS

4.9 PRODUCTION CONSUMPTION ANALYSIS- EUROPE TALC MARKET

4.1 VENDOR SELECTION CRITERIA

4.11 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.12 REGULATION COVERAGE

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT'S ROLE

5.4 ANALYST RECOMMENDATION

6 SUPPLY CHAIN ANALYSIS

6.1 RAW MATERIAL PROCUREMENT

6.2 MANUFACTURING AND PACKING

6.3 MARKETING AND DISTRIBUTION

6.4 END USERS

7 REGIONAL SUMMARY

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 EXTENSIVE APPLICATIONS IN PRODUCING LIGHTWEIGHT PLASTICS FOR AUTOMOTIVE COMPONENTS

8.1.2 RAPID INDUSTRIALIZATION AND SURGE IN DISPOSABLE INCOME OF THE MIDDLE-CLASS POPULATION OF EMERGING ECONOMIES

8.1.3 EASY AVAILABILITY OF RAW MATERIALS ALONG WITH AFFORDABLE LABOR

8.2 RESTRAINTS

8.2.1 GUIDELINES REGULATING THE PRODUCTION AND USAGE OF TALC

8.2.2 MODERATE DEVELOPMENT OF THE PULP AND PAPER INDUSTRY DUE TO DIGITIZATION

8.3 OPPORTUNITY

8.3.1 RISING RESEARCH ACTIVITIES FOR THE ADVANCEMENT OF NEW GRADES OF TALC

8.4 CHALLENGE

8.4.1 EASY ACCESSIBILITY OF SUBSTITUTES

9 EUROPE TALC MARKET, BY DEPOSIT TYPE

9.1 OVERVIEW

9.2 TALC CARBONATE

9.3 TALC CHLORITE

9.4 OTHERS

10 EUROPE TALC MARKET, BY TYPE

10.1 OVERVIEW

10.2 FINE GRADE

10.2.1 3-5 MICRON TALC

10.2.2 6-15 MICRON TALC

10.2.3 20-25 MICRON TALC

10.3 OTHERS

11 EUROPE TALC MARKET, BY END USE

11.1 OVERVIEW

11.2 PULP & PAPER

11.2.1 TALC CARBONATE

11.2.2 TALC CHLORITE

11.2.3 OTHERS

11.3 PLASTIC INDUSTRY

11.3.1 TALC CARBONATE

11.3.2 TALC CHLORITE

11.3.3 OTHERS

11.4 PAINTS & COATINGS

11.4.1 TALC CARBONATE

11.4.2 TALC CHLORITE

11.4.3 OTHERS

11.5 CERAMICS

11.5.1 TALC CARBONATE

11.5.2 TALC CHLORITE

11.5.3 OTHERS

11.6 RUBBER INDUSTRY

11.6.1 TALC CARBONATE

11.6.2 TALC CHLORITE

11.6.3 OTHERS

11.7 COSMETICS & PERSONAL CARE

11.7.1 TALC CARBONATE

11.7.2 TALC CHLORITE

11.7.3 OTHERS

11.8 FOOD INDUSTRY

11.8.1 TALC CARBONATE

11.8.2 TALC CHLORITE

11.8.3 OTHERS

11.9 PHARMACEUTICALS

11.9.1 TALC CARBONATE

11.9.2 TALC CHLORITE

11.9.3 OTHERS

11.1 OTHERS

11.10.1 TALC CARBONATE

11.10.2 TALC CHLORITE

11.10.3 OTHERS

12 EUROPE TALC MARKET, BY COUNTRY

12.1 EUROPE

12.1.1 SPAIN

12.1.2 ITALY

12.1.3 GERMANY

12.1.4 U.K.

12.1.5 FRANCE

12.1.6 TURKEY

12.1.7 RUSSIA

12.1.8 SWITZERLAND

12.1.9 BELGIUM

12.1.10 NETHERLANDS

12.1.11 REST OF EUROPE

13 EUROPE TALC MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

13.2 MERGER & ACQUISITION

13.3 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 IMERYS

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATE

15.2 ELEMENTIS PLC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATE

15.3 MINERALS TECHNOLOGIES INC. (2021)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 MIKRONS

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT UPDATES

15.5 EXPAC (PRESTON) LTD

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT UPDATE

15.6 IMI FABI SPA

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATE

15.7 LITHOS INDUSTRIAL MINERALS GMBH

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT UPDATE

15.8 NIPPON TALC CO., LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATES

15.9 NORDIC TALC OY

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 SIBELCO

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF NATURAL STEATITE AND TALC, CRUSHED OR POWDERED; HS CODE - 252620 (USD THOUSAND)

TABLE 2 EXPORT DATA OF NATURAL STEATITE AND TALC, CRUSHED OR POWDERED; HS CODE - 252620 (USD THOUSAND)

TABLE 3 EUROPE TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 5 EUROPE TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 7 EUROPE FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 9 EUROPE TALC MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TALC MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 11 EUROPE PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 13 EUROPE PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 15 EUROPE PAINTS & COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PAINTS & COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 17 EUROPE CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 19 EUROPE RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 21 EUROPE COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 23 EUROPE FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 25 EUROPE PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 27 EUROPE OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 29 EUROPE TALC MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 30 EUROPE TALC MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 31 SPAIN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 32 SPAIN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 33 SPAIN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 SPAIN FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 SPAIN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 36 SPAIN FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 37 SPAIN TALC MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 38 SPAIN TALC MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 39 SPAIN PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 40 SPAIN PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 41 SPAIN PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 42 SPAIN PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 43 SPAIN CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 44 SPAIN CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 45 SPAIN PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 46 SPAIN PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 47 SPAIN COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 48 SPAIN COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 49 SPAIN PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 50 SPAIN PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 51 SPAIN FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 52 SPAIN FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 53 SPAIN RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 54 SPAIN RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 55 SPAIN OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 56 SPAIN OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 57 ITALY TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 58 ITALY TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 59 ITALY TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 ITALY FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 ITALY TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 62 ITALY FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 63 ITALY TALC MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 64 ITALY TALC MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 65 ITALY PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 66 ITALY PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 67 ITALY PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 68 ITALY PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 69 ITALY CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 70 ITALY CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 71 ITALY PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 72 ITALY PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 73 ITALY COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 74 ITALY COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 75 ITALY PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 76 ITALY PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 77 ITALY FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 78 ITALY FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 79 ITALY RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 80 ITALY RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 81 ITALY OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 82 ITALY OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 83 GERMANY TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 84 GERMANY TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 85 GERMANY TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 GERMANY FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 GERMANY TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 88 GERMANY FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 89 GERMANY TALC MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 90 GERMANY TALC MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 91 GERMANY PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 92 GERMANY PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 93 GERMANY PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 94 GERMANY PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 95 GERMANY CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 96 GERMANY CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 97 GERMANY PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 98 GERMANY PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 99 GERMANY COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 100 GERMANY COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 101 GERMANY PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 102 GERMANY PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 103 GERMANY FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 104 GERMANY FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 105 GERMANY RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 106 GERMANY RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 107 GERMANY OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 108 GERMANY OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 109 U.K. TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.K. TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 111 U.K. TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.K. FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.K. TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 114 U.K. FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 115 U.K. TALC MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 116 U.K. TALC MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 117 U.K. PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 118 U.K. PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 119 U.K. PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 120 U.K. PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 121 U.K. CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 122 U.K. CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 123 U.K. PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 124 U.K. PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 125 U.K. COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 126 U.K. COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 127 U.K. PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 128 U.K. PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 129 U.K. FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 130 U.K. FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 131 U.K. RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 132 U.K. RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 133 U.K. OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 134 U.K. OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 135 FRANCE TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 136 FRANCE TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 137 FRANCE TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 FRANCE FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 FRANCE TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 140 FRANCE FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 141 FRANCE TALC MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 142 FRANCE TALC MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 143 FRANCE PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 144 FRANCE PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 145 FRANCE PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 146 FRANCE PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 147 FRANCE CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 148 FRANCE CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 149 FRANCE PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 150 FRANCE PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 151 FRANCE COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 152 FRANCE COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 153 FRANCE PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 154 FRANCE PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 155 FRANCE FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 156 FRANCE FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 157 FRANCE RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 158 FRANCE RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 159 FRANCE OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 160 FRANCE OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 161 TURKEY TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 162 TURKEY TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 163 TURKEY TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 TURKEY FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 TURKEY TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 166 TURKEY FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 167 TURKEY TALC MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 168 TURKEY TALC MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 169 TURKEY PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 170 TURKEY PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 171 TURKEY PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 172 TURKEY PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 173 TURKEY CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 174 TURKEY CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 175 TURKEY PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 176 TURKEY PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 177 TURKEY COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 178 TURKEY COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 179 TURKEY PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 180 TURKEY PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 181 TURKEY FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 182 TURKEY FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 183 TURKEY RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 184 TURKEY RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 185 TURKEY OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 186 TURKEY OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 187 RUSSIA TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 188 RUSSIA TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 189 RUSSIA TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 RUSSIA FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 RUSSIA TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 192 RUSSIA FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 193 RUSSIA TALC MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 194 RUSSIA TALC MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 195 RUSSIA PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 196 RUSSIA PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 197 RUSSIA PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 198 RUSSIA PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 199 RUSSIA CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 200 RUSSIA CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 201 RUSSIA PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 202 RUSSIA PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 203 RUSSIA COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 204 RUSSIA COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 205 RUSSIA PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 206 RUSSIA PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 207 RUSSIA FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 208 RUSSIA FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 209 RUSSIA RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 210 RUSSIA RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 211 RUSSIA OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 212 RUSSIA OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 213 SWITZERLAND TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 214 SWITZERLAND TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 215 SWITZERLAND TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 SWITZERLAND FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 SWITZERLAND TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 218 SWITZERLAND FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 219 SWITZERLAND TALC MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 220 SWITZERLAND TALC MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 221 SWITZERLAND PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 222 SWITZERLAND PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 223 SWITZERLAND PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 224 SWITZERLAND PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 225 SWITZERLAND CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 226 SWITZERLAND CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 227 SWITZERLAND PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 228 SWITZERLAND PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 229 SWITZERLAND COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 230 SWITZERLAND COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 231 SWITZERLAND PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 232 SWITZERLAND PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 233 SWITZERLAND FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 234 SWITZERLAND FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 235 SWITZERLAND RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 236 SWITZERLAND RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 237 SWITZERLAND OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 238 SWITZERLAND OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 239 BELGIUM TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 240 BELGIUM TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 241 BELGIUM TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 BELGIUM FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 BELGIUM TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 244 BELGIUM FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 245 BELGIUM TALC MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 246 BELGIUM TALC MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 247 BELGIUM PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 248 BELGIUM PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 249 BELGIUM PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 250 BELGIUM PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 251 BELGIUM CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 252 BELGIUM CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 253 BELGIUM PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 254 BELGIUM PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 255 BELGIUM COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 256 BELGIUM COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 257 BELGIUM PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 258 BELGIUM PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 259 BELGIUM FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 260 BELGIUM FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 261 BELGIUM RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 262 BELGIUM RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 263 BELGIUM OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 264 BELGIUM OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 265 NETHERLANDS TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 266 NETHERLANDS TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 267 NETHERLANDS TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 NETHERLANDS FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 NETHERLANDS TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 270 NETHERLANDS FINE GRADE IN TALC MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 271 NETHERLANDS TALC MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 272 NETHERLANDS TALC MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 273 NETHERLANDS PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 274 NETHERLANDS PULP & PAPER IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 275 NETHERLANDS PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 276 NETHERLANDS PLASTIC INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 277 NETHERLANDS CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 278 NETHERLANDS CERAMICS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 279 NETHERLANDS PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 280 NETHERLANDS PAINTS AND COATINGS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 281 NETHERLANDS COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 282 NETHERLANDS COSMETICS & PERSONAL CARE IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 283 NETHERLANDS PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 284 NETHERLANDS PHARMACEUTICALS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 285 NETHERLANDS FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 286 NETHERLANDS FOOD INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 287 NETHERLANDS RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 288 NETHERLANDS RUBBER INDUSTRY IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 289 NETHERLANDS OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 290 NETHERLANDS OTHERS IN TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

TABLE 291 REST OF EUROPE TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD MILLION)

TABLE 292 REST OF EUROPE TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (KILO TONS)

Liste des figures

FIGURE 1 EUROPE TALC MARKET: SEGMENTATION

FIGURE 2 EUROPE TALC MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE TALC MARKET: DROC ANALYSIS

FIGURE 4 EUROPE TALC MARKET: REGION VS COUNTRY ANALYSIS

FIGURE 5 EUROPE TALC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE TALC MARKET: DEPOSIT TYPE LIFE LINE CURVE

FIGURE 7 EUROPE TALC MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE TALC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE TALC MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE TALC MARKET: APPLICATION COVERAGE GRID

FIGURE 11 EUROPE TALC MARKET: CHALLENGE MATRIX

FIGURE 12 EUROPE TALC MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE TALC MARKET: SEGMENTATION

FIGURE 14 RAPID INDUSTRIALIZATION AND INCREASED DISPOSABLE INCOME OF THE MIDDLE-CLASS POPULATION ARE EXPECTED TO DRIVE THE EUROPE TALC MARKET IN THE FORECAST PERIOD

FIGURE 15 TALC CARBONATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE TALC MARKET IN 2022 & 2029

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 SUPPLY CHAIN ANALYSIS – EUROPE TALC MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE TALC MARKET

FIGURE 19 EUROPE TALC MARKET, BY DEPOSIT TYPE, 2021

FIGURE 20 EUROPE TALC MARKET, BY TYPE, 2021

FIGURE 21 EUROPE TALC MARKET, BY END USE, 2021

FIGURE 22 EUROPE TALC MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE TALC MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE TALC MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE TALC MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE TALC MARKET: BY DEPOSIT TYPE (2022-2029)

FIGURE 27 EUROPE TALC MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.