Europe Sports Medicine Market

Taille du marché en milliards USD

TCAC :

%

USD

5.83 Billion

USD

9.29 Billion

2021

2029

USD

5.83 Billion

USD

9.29 Billion

2021

2029

| 2022 –2029 | |

| USD 5.83 Billion | |

| USD 9.29 Billion | |

|

|

|

|

Marché européen de la médecine sportive , par produits (produits de reconstruction corporelle, produits de soutien et de récupération du corps), application (blessures au genou, à la hanche, à l'épaule et au coude, au pied et à la cheville, à la main et au poignet, au dos et à la colonne vertébrale, autres blessures), procédure ( procédures d'arthroscopie du genou , procédures d'arthroscopie de la hanche, procédures d'arthroscopie de l'épaule et du coude, procédures d'arthroscopie du pied et de la cheville, procédures d'arthroscopie de la main et du poignet, autres), utilisateur final (hôpitaux, cliniques orthopédiques, centres de chirurgie ambulatoire, autres) - Tendances et prévisions du secteur jusqu'en 2029

Analyse et taille du marché

L'un des principaux facteurs favorisant la croissance du marché en Europe est la participation accrue des individus aux sports et autres activités sportives. En conséquence, la sensibilisation croissante du grand public aux problèmes de santé a conduit à l'acceptation de l'athlétisme comme un moyen viable de maintenir la forme physique et de lutter contre les troubles du mode de vie. En conséquence, les blessures liées au sport et les déchirures musculaires ont augmenté, ce qui a entraîné un besoin accru de procédures de traitement et de produits thérapeutiques. Diverses avancées en matière de produits, comme l'introduction d'implants résorbables, qui sont couramment utilisés pour les chirurgies arthroscopiques , contribuent également à faire progresser le marché. D'autres raisons, comme la préférence croissante pour les traitements chirurgicaux mini-invasifs et les progrès des infrastructures de soins de santé, devraient alimenter la croissance.

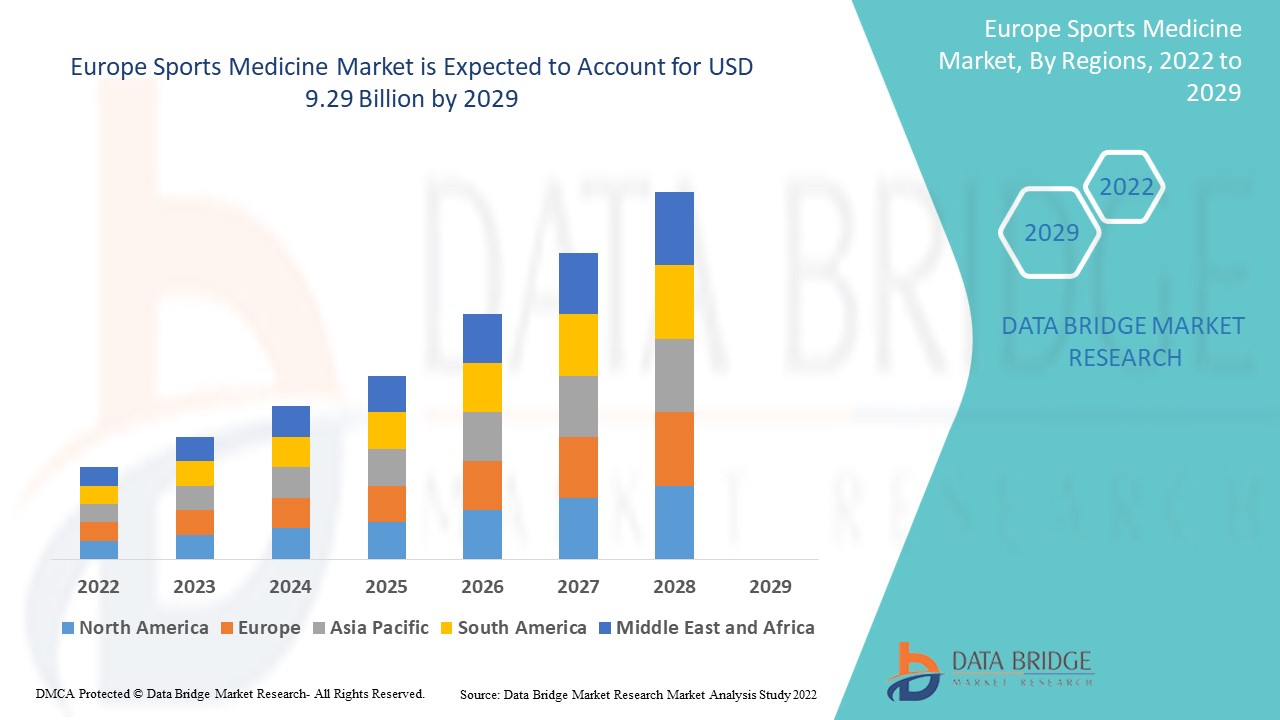

Data Bridge Market Research analyse que le marché de la médecine sportive, qui était de 5,83 milliards USD en 2021, devrait atteindre 9,29 milliards USD d'ici 2029 et devrait connaître un TCAC de 6,00 % au cours de la période de prévision 2022 à 2029. Le rapport de marché élaboré par l'équipe Data Bridge Market Research comprend une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire.

Définition du marché

La médecine du sport est une branche de la médecine qui se concentre sur la prévention et le traitement des blessures et des maladies résultant de la pratique d'un sport. La médecine du sport englobe les implants, les produits de réparation des fractures et des ligaments, les appareils d'arthroscopie, les prothèses, les produits orthobiologiques et les produits de soutien et de récupération du corps tels que les appareils orthopédiques et de contention, les vêtements de compression, les équipements de physiothérapie, la thermothérapie, l'électrostimulation et les accessoires.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliards USD, volumes en unités, prix en USD |

|

Segments couverts |

Produits (produits de reconstruction corporelle, produits de soutien et de récupération du corps), application (blessures au genou, à la hanche, à l'épaule et au coude, au pied et à la cheville, à la main et au poignet, au dos et à la colonne vertébrale, autres blessures), procédure (procédures d'arthroscopie du genou, procédures d'arthroscopie de la hanche, procédures d'arthroscopie de l'épaule et du coude, procédures d'arthroscopie du pied et de la cheville, procédures d'arthroscopie de la main et du poignet, autres), utilisateur final (hôpitaux, cliniques orthopédiques, centres de chirurgie ambulatoire, autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Reste de l'Europe en Europe |

|

Acteurs du marché couverts |

Arthrex, Inc (États-Unis), Smith & Nephew plc (Royaume-Uni), Stryker (États-Unis), Breg Inc. (États-Unis), DJO LLC (États-Unis), Mueller Sports Medicine, Inc (États-Unis), Wright Medical Group NV (États-Unis), Medtronic (Irlande), RTI Surgical (États-Unis), Performance Health (États-Unis), KARL STORZ (Allemagne), Bauerfeind (Allemagne), Össur (Islande), MedShape (États-Unis), Cramer Products (États-Unis), Agilent Technologies, Inc (Inde), RôG Sports Medicine (États-Unis) |

|

Opportunités de marché |

|

Dynamique du marché de la médecine sportive

Conducteurs

- Augmentation de l'incidence des blessures sportives

Les principaux facteurs de la demande en médecine sportive sont la demande croissante d'opérations peu invasives, le recours accru aux chirurgies arthroscopiques et l'arrivée de nouveaux produits et modalités de traitement. Cependant, au cours de la période de projection, le coût élevé des produits de médecine sportive et le danger associé aux dispositifs implantables sont susceptibles d'étouffer l'expansion du marché.

- Le fardeau croissant des blessures sportives

De nouveaux produits et de nouvelles modalités de traitement sont constamment développés et la demande en chirurgies mini-invasives augmente. Les foulures et entorses, la spondylolyse et le spondylolisthésis, les piqûres, les lésions discales et la maladie de Scheuermann sont toutes des blessures sportives courantes. Par conséquent, le marché européen devrait être stimulé par la prévalence accrue des blessures liées au sport. En outre, la sensibilisation croissante du public à la médecine du sport et l'augmentation du nombre d'associations de médecine du sport propulsent le secteur vers l'avant.

- Augmentation de l'adoption d'activités sportives extrêmes

Le marché de la médecine sportive devrait augmenter en raison de l’augmentation du nombre de blessures liées au sport, de l’amélioration des connaissances du public sur la forme physique et le sport, de la disponibilité des dispositifs médicaux et des progrès rapides de la médecine sportive.

Opportunités

- Opportunités d'expansion et de pénétration du marché dans les économies émergentes

En raison de l’augmentation des revenus disponibles (résultant d’une expansion économique rapide) et de la participation accrue aux activités sportives et physiques, les pays émergents comme l’Inde et la Chine devraient offrir un potentiel de croissance important aux acteurs de la médecine sportive. En outre, les gouvernements de ces pays cherchent à étendre et à moderniser leurs systèmes de santé. Dans les prochaines années, cependant, les marchés inexploités et l’évolution des conditions réglementaires de la médecine sont susceptibles de créer une opportunité de remplacement pour le secteur de la médecine sportive.

Contraintes/Défis

- Coût élevé des implants orthopédiques

Le coût élevé des implants constitue un obstacle majeur à l’expansion du marché de la médecine sportive. Le coût de ces implants constitue un obstacle majeur à l’expansion du marché dans des pays comme l’Inde, où seul un faible pourcentage de la population est couvert par une assurance (selon l’IRDA, en 2017, 76 % de la population indienne n’était pas assurée). Avec un coût moyen de plus de 12 000 USD dans les pays en développement, la majeure partie de la population ne peut pas se permettre un traitement aussi coûteux.

Les procédures de médecine régénératrice, comme les implants et les prothèses, sont coûteuses. Une seule injection de PRP, par exemple, coûte entre 500 et 2 000 dollars, tandis que les injections de cellules souches de moelle osseuse coûtent entre 2 000 et 5 000 dollars.

Ce rapport sur le marché de la médecine sportive fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de la médecine sportive, contactez Data Bridge Market Research pour un briefing d'analyste , notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché de la médecine sportive

Pendant la pandémie, le marché de la médecine sportive a également été touché. La COVID-19 a eu un impact négatif sur le marché en général. Cela est dû à une diminution de la demande de médecine sportive. Attribuée aux confinements mondiaux stricts en 2020, la baisse initiale de la demande était due à une réduction du nombre de compétitions sportives et d'activités sportives. En outre, les perturbations dans les chaînes d'approvisionnement de l'industrie de la médecine sportive ont eu un impact négatif sur le marché. En outre, pendant la première vague de la pandémie, la fabrication pharmaceutique a été perturbée, ce qui a eu un impact négatif en 2020. L'industrie de la médecine sportive devrait se redresser en 2021, grâce à une demande accrue et à l'assouplissement des mesures de confinement, ce qui a augmenté le nombre d'activités sportives dans le monde.

Développement récent

Le 8 février 2022, la société mondiale DJO a annoncé avoir renouvelé son partenariat avec la Professional Football Athletic Trainers Society (PFATS). La Professional Football Athletic Trainers Society (PFATS) est une organisation d'entraîneurs sportifs agréés qui opèrent dans le football professionnel. Dans le cadre de sa coopération avec DJO, la PFATS recommandera et approuvera des produits DJO spécifiques.

Smith & Nephew a obtenu l'autorisation de marquage CE pour l'implant bioinductif Regeneten en juin 2020, lui permettant d'être vendu dans les principaux pays européens.

Portée du marché européen de la médecine sportive

Le marché de la médecine sportive est segmenté en fonction du produit, de l'application et de l'utilisateur final. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Reconstruction corporelle

- Produits de réparation des fractures et des ligaments

- Dispositifs d'arthroscopie

- Implants

- Produits orthobiologiques

- Prothèses

- Soutien et récupération du corps

- Appareils orthopédiques et supports

- Physiothérapie

- Thérapie thermale

- Thérapie par ultrasons

- Thérapie au laser

- Thérapie par électrostimulation

- Suivi et évaluation du corps

- Surveillance cardiaque

- Surveillance respiratoire

- Surveillance hémodynamique

- Surveillance musculo-squelettique

- Vêtements de compression

- Accessoires

- Pansements

- Désinfectants

- Bandes

- Autres

Application:

- Blessures au genou

- Blessures à l'épaule

- Blessures au pied et à la cheville

- Blessures à la hanche et à l'aine

- Blessures au coude et au poignet

- Blessures au dos et à la colonne vertébrale

- Autres

Utilisateur final :

- Hôpitaux

- Cliniques spécialisées en orthopédie

- Centres de fitness et d'entraînement

- Centres de chirurgie ambulatoire (CCA)

- Autres

Analyse/perspectives régionales du marché de la médecine sportive

Le marché de la médecine sportive est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, produit, application et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de la médecine sportive sont l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie et le reste de l'Europe en Europe.

La popularité croissante du sport et de l’activité physique, la sensibilisation croissante à la prévention et au traitement des blessures sportives et les investissements croissants en médecine du sport stimulent le marché nord-américain de la médecine du sport au cours de la période de prévision.

L'Allemagne devrait connaître le rythme de croissance le plus rapide au cours de la période de prévision de 2022 à 2029. Avec un recours accru à la médecine du sport dans diverses formes de blessures sportives dans la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Croissance des infrastructures de santé Base installée et pénétration des nouvelles technologies

Le marché de la médecine sportive vous fournit également une analyse détaillée du marché pour chaque pays, la croissance des dépenses de santé pour les équipements en capital, la base installée de différents types de produits pour le marché de la médecine sportive, l'impact de la technologie à l'aide de courbes de vie et les changements dans les scénarios réglementaires des soins de santé et leur impact sur le marché de la médecine sportive. Les données sont disponibles pour la période historique 2010-2020.

Analyse du paysage concurrentiel et des parts de marché de la médecine sportive

Le paysage concurrentiel du marché de la médecine sportive fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de la médecine sportive.

Certains des principaux acteurs opérant sur le marché de la médecine sportive sont :

- Arthrex, Inc (États-Unis)

- Smith & Nephew plc (Royaume-Uni)

- Stryker (États-Unis)

- Breg Inc. (États-Unis)

- DJO LLC (États-Unis)

- Mueller Sports Medicine, Inc (États-Unis)

- Wright Medical Group NV (États-Unis)

- Medtronic (Irlande)

- RTI Surgical (États-Unis)

- Performance Health (États-Unis)

- KARL STORZ (Allemagne)

- Bauerfeind (Allemagne)

- Össur (Islande)

- MedShape (États-Unis)

- Cramer Products (États-Unis)

- Agilent Technologies, Inc (Inde)

- RôG Médecine du sport (États-Unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE SPORTS MEDICINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING INCIDENCE OF SPORTS INJURIES

5.1.2 RISING DEMAND FOR MINIMALLY INVASIVE SURGERIES

5.1.3 INCREASING ADOPTION OF ARTHROSCOPIC SURGERIES

5.1.4 GROWING INFLUX OF NEW PRODUCTS AND TREATMENT MODALITIES

5.2 RESTRAINTS

5.2.1 HIGH COST OF SPORTS MEDICINE PRODUCTS

5.2.2 RISK ASSOCIATED WITH IMPLANT DEVICES

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND FOR 3D-PRINTED IMPLANTS

5.3.2 ACTIVE GOVERNMENT PARTICIPATION IN ENCOURAGING SPORTS ACTIVITIES

5.3.3 RISING INFLUX OF ATHLETES

5.4 CHALLENGES

5.4.1 DEARTH OF SKILLED PROFESSIONALS

5.4.2 STRICT REGULATIONS AND STANDARDS FOR THE APPROVAL AND COMMERCIALIZATION OF SPORTS MEDICINE IMPLANTS DEVICES

6 COVID-19 IMPACT ON SPORTS MEDICINE MARKET IN HEALTHCARE INDUSTRY

6.1 INTRODUCTION

6.2 GRADUATED RETURN TO PLAY (GRTP) PROTOCOL

6.3 IMPACT ON DEMAND

6.4 PRICE IMPACT

6.5 CONCLUSION

7 EUROPE SPORTS MEDICINE MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 BODY RECONSTRUCTION PRODUCTS

7.2.1 IMPLANTS

7.2.2 FRACTURE AND LIGAMENT REPAIR PRODUCTS

7.2.3 ARTHOSCOPY DEVICES

7.2.4 PROSTHETICS

7.2.5 ORTHOBIOLOGICS

7.3 BODY SUPPORT AND RECOVERY PRODUCTS

7.3.1 BRACES AND SUPPORTS

7.3.2 COMPRESSION CLOTHING

7.3.3 PHYSIOTHERAPY EQUIPMENT

7.3.4 THERMAL THERAPY

7.3.5 ELECTROSIMULATION

7.3.6 OTHER THERAPIES

7.3.6.1 ULTRASOUND THERAPY

7.3.6.2 LASER THERAPY

7.3.7 ACCESSORIES

8 EUROPE SPORTS MEDICINE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 KNEE

8.3 HIP

8.4 SHOULDER AND ELBOW

8.5 FOOT AND ANKLE

8.6 HAND AND WRIST

8.7 BACK AND SPINE INJURIES

8.8 OTHER INJURIES

9 EUROPE SPORTS MEDICINE MARKET, BY PROCEDURE

9.1 OVERVIEW

9.2 KNEE ARTHROSCOPY PROCEDURES

9.3 HIP ARTHROSCOPY PROCEDURES

9.4 SHOULDER AND ELBOW ARTHROSCOPY PROCEDURES

9.5 FOOT AND ANKLE ARTHROSCOPY PROCEDURES

9.6 HAND AND WRIST ARTHROSCOPY PROCEDURES

9.7 OTHERS

10 EUROPE SPORTS MEDICINE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 ORTHOPEDIC CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 OTHERS

11 EUROPE SPORTS MEDICINE MARKET, BY GEOGRAPHY

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 SWITZERLAND

11.1.7 RUSSIA

11.1.8 NETHERLANDS

11.1.9 BELGIUM

11.1.10 TURKEY

11.1.11 DENMARK

11.1.12 PORTUGAL

11.1.13 SWEDEN

11.1.14 AUSTRIA

11.1.15 CZECH REPUBLIC

11.1.16 NORWAY

11.1.17 FINLAND

11.1.18 REST OF EUROPE

12 EUROPE SPORTS MEDICINE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ARTHREX, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 SMITH & NEPHEW

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 JOHNSON & JOHNSON SERVICES, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 STRYKER

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 ZIMMER BIOMET

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ARTHROSURFACE (A SUBSIDIARY OF ANIKA THERAPEUTICS, INC.)

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 BIRD & CRONIN

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 BREG, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 CONMED CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 DJO, LLC (A SUBSIDIARY OF COLFAX CORPORATION)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 MEDTRONIC

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 MUELLER SPORTS MEDICINE, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 ÖSSUR CORPORATE

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 SURGALIGN

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 WRIGHT MEDICAL GROUP N.V.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 IMPLANTS AND THE ASSOCIATED SIDE EFFECTS

TABLE 2 EUROPE SPORTS MEDICINE MARKET, BY PRODUCTS, 2018 – 2027, (USD MILLION)

TABLE 3 EUROPE BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 EUROPE BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018 – 2027, (USD MILLION)

TABLE 5 EUROPE BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 EUROPE BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018 – 2027, (USD MILLION)

TABLE 7 EUROPE OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018 – 2027, (USD MILLION)

TABLE 8 EUROPE SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 9 EUROPE KNEE IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 EUROPE HIP IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 EUROPE SHOULDER AND ELBOW IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 EUROPE FOOT AND ANKLE IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 EUROPE HAND AND WRIST IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 EUROPE BACK AND SPINE INJURIES IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 15 EUROPE OTHER INJURIES IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 EUROPE SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 17 EUROPE KNEE ARTHROSCOPY PROCEDURES IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 EUROPE HIP ARTHROSCOPY PROCEDURES IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 19 EUROPE SHOULDER AND ELBOW ARTHROSCOPY IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 EUROPE FOOT AND ANKLE ARTHROSCOPY PROCEDURES IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 EUROPE HAND AND WRIST ARTHROSCOPY PROCEDURES IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 EUROPE OTHERS IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 EUROPE SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 24 EUROPE HOSPITALS IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 EUROPE ORTHOPEDIC CLINICS IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 EUROPE AMBULATORY SURGICAL CENTERS IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 EUROPE OTHERS IN SPORTS MEDICINE MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 EUROPE SPORTS MEDICINE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 29 EUROPE SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 30 EUROPE BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 31 EUROPE BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 32 EUROPE OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 33 EUROPE SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 34 EUROPE SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 35 EUROPE SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 36 GERMANY SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 37 GERMANY BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 38 GERMANY BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 39 GERMANY OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 40 GERMANY SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 41 GERMANY SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 42 GERMANY SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 43 U.K. SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 44 U.K. BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027

TABLE 45 U.K. BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 46 U.K.OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 47 U.K. SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 48 U.K. SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 49 U.K. SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 50 FRANCE SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 51 FRANCE BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027

TABLE 52 FRANCE BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 53 FRANCE OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 54 FRANCE SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 55 FRANCE SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 56 FRANCE SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 57 ITALY SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 58 ITALY BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027

TABLE 59 ITALY BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 60 ITALY OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 61 ITALYSPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 62 ITALY SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 63 ITALY SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 64 SPAIN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 65 SPAIN BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027

TABLE 66 SPAIN BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 67 SPAIN OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 68 SPAIN SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 69 SPAIN SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 70 SPAIN SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 71 SWITZERLAND SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 72 SWITZERLAND BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027

TABLE 73 SWITZERLAND BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 74 SWITZERLAND OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 75 SWITZERLAND SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 76 SWITZERLAND SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 77 SWITZERLAND SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 78 RUSSIA SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 79 RUSSIA BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027

TABLE 80 RUSSIA BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 81 RUSSIA OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 82 RUSSIA SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 83 RUSSIA SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 84 RUSSIA SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 85 NETHERLANDS SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 86 NETHERLANDS BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027

TABLE 87 NETHERLANDS BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 88 NETHERLANDS OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 89 NETHERLANDS SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 90 NETHERLANDS SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 91 NETHERLANDS SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 92 BELGIUM SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 93 BELGIUM BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027

TABLE 94 BELGIUM BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 95 BELGIUM OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 96 BELGIUM SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 97 BELGIUM SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 98 BELGIUM SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 99 TURKEY SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 100 TURKEY BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 101 TURKEY BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 102 TURKEY OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 103 TURKEY SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 104 TURKEY SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 105 TURKEY SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 106 DENMARK SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 107 DENMARK BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 108 DENMARK BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 109 DENMARK OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 110 DENMARK SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 111 DENMARK SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 112 DENMARK SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 113 PORTUGAL SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 114 PORTUGAL BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 115 PORTUGAL BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 116 PORTUGAL OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 117 PORTUGAL SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 118 PORTUGAL SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 119 PORTUGAL SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 120 SWEDEN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 121 SWEDEN BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 122 SWEDEN BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 123 SWEDEN OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 124 SWEDEN SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 125 SWEDEN SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 126 SWEDEN SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 127 AUSTRIA SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 128 AUSTRIA BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 129 AUSTRIA BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 130 AUSTRIA OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 131 AUSTRIA SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 132 AUSTRIA SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 133 AUSTRIA SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 134 CZECH REPUBLIC SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 135 CZECH REPUBLIC BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 136 CZECH REPUBLIC BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 137 CZECH REPUBLIC OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 138 CZECH REPUBLIC SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 139 CZECH REPUBLIC SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 140 CZECH REPUBLIC SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 141 NORWAY SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 142 NORWAY BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 143 NORWAY BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 144 NORWAY OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 145 NORWAY SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 146 NORWAY SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 147 NORWAY SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 148 FINLAND SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 149 FINLAND BODY RECONSTRUCTION PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 150 FINLAND BODY SUPPORT AND RECOVERY PRODUCTS IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 151 FINLAND OTHER THERAPIES IN SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

TABLE 152 FINLAND SPORTS MEDICINE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 153 FINLAND SPORTS MEDICINE MARKET, BY PROCEDURE, 2018-2027 (USD MILLION)

TABLE 154 FINLAND SPORTS MEDICINE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 155 REST OF EUROPE SPORTS MEDICINE MARKET, BY PRODUCTS, 2018-2027 (USD MILLION)

Liste des figures

LIST OF FIGURES

FIGURE 1 EUROPE SPORTS MEDICINE MARKET: SEGMENTATION

FIGURE 2 EUROPE SPORTS MEDICINE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE SPORTS MEDICINE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE SPORTS MEDICINE MARKET : EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE SPORTS MEDICINE MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE SPORTS MEDICINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE SPORTS MEDICINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE SPORTS MEDICINE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE SPORTS MEDICINE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE SPORTS MEDICINE MARKET: SEGMENTATION

FIGURE 11 INCREASING INCIDENCE OF SPORTS INJURIES AND RISING DEMAND FOR MINIMALLY INVASIVE SURGERIES ARE EXPECTED TO DRIVE THE EUROPE SPORTS MEDICINE MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 BODY RECONSTRUCTION PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE SPORTS MEDICINE MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE SPORTS MEDICINE MARKET

FIGURE 14 SPORTS INJURIES AMONG THE BASKETBALL ATHLETES IN THE U.S.

FIGURE 15 SPORTS INJURIES AMONG THE BICYCLE ATHLETES IN THE U.S.

FIGURE 16 SPORTS INJURIES AMONG THE BASEBALL ATHLETES IN THE U.S.

FIGURE 17 SPORTS INJURIES AMONG THE SOCCER ATHLETES IN THE U.S.

FIGURE 18 SPORTS INJURIES AMONG THE FOOTBALL ATHLETES IN THE U.S.

FIGURE 19 PERCENTAGE OF ATHLETES TREATED IN EUROPEAN REGION HOSPITALS FOR SPORTS INJURIES EACH YEAR

FIGURE 20 NUMBER OF ATHLETES TREATED IN THE US HOSPITALS FOR TOP 5 SPORTS INJURIES

FIGURE 21 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR SPORTS MEDICINE MANUFACTURERS IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 22 EUROPE SPORTS MEDICINE MARKET: BY PRODUCTS, 2019

FIGURE 23 EUROPE SPORTS MEDICINE MARKET: BY PRODUCTS, 2019-2027 (USD MILLION)

FIGURE 24 EUROPE SPORTS MEDICINE MARKET: BY PRODUCTS, CAGR (2019-2027)

FIGURE 25 EUROPE SPORTS MEDICINE MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 26 EUROPE SPORTS MEDICINE MARKET: BY APPLICATION, 2019

FIGURE 27 EUROPE SPORTS MEDICINE MARKET: BY APPLICATION, 2019-2027 (USD MILLION)

FIGURE 28 EUROPE SPORTS MEDICINE MARKET: BY APPLICATION YPE, CAGR (2019-2027)

FIGURE 29 EUROPE SPORTS MEDICINE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 EUROPE SPORTS MEDICINE MARKET: BY PROCEDURE, 2019

FIGURE 31 EUROPE SPORTS MEDICINE MARKET: BY PROCEDURE, 2019-2027 (USD MILLION)

FIGURE 32 EUROPE SPORTS MEDICINE MARKET: BY PROCEDURE, CAGR (2019-2027)

FIGURE 33 EUROPE SPORTS MEDICINE MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 34 EUROPE SPORTS MEDICINE MARKET: BY END USER, 2019

FIGURE 35 EUROPE SPORTS MEDICINE MARKET: BY END USER, 2019-2027 (USD MILLION)

FIGURE 36 EUROPE SPORTS MEDICINE MARKET: BY END USER, CAGR (2019-2027)

FIGURE 37 EUROPE SPORTS MEDICINE MARKET: BY END USER, LIFELINE CURVE

FIGURE 38 EUROPE SPORTS MEDICINE MARKET: SNAPSHOT (2019)

FIGURE 39 EUROPE SPORTS MEDICINE MARKET: BY COUNTRY (2019)

FIGURE 40 EUROPE SPORTS MEDICINE MARKET: BY COUNTRY (2020 & 2027)

FIGURE 41 EUROPE SPORTS MEDICINE MARKET: BY COUNTRY (2019 & 2027)

FIGURE 42 EUROPE SPORTS MEDICINE MARKET: BY PRODUCTS (2020-2027)

FIGURE 43 EUROPE SPORTS MEDICINE MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.