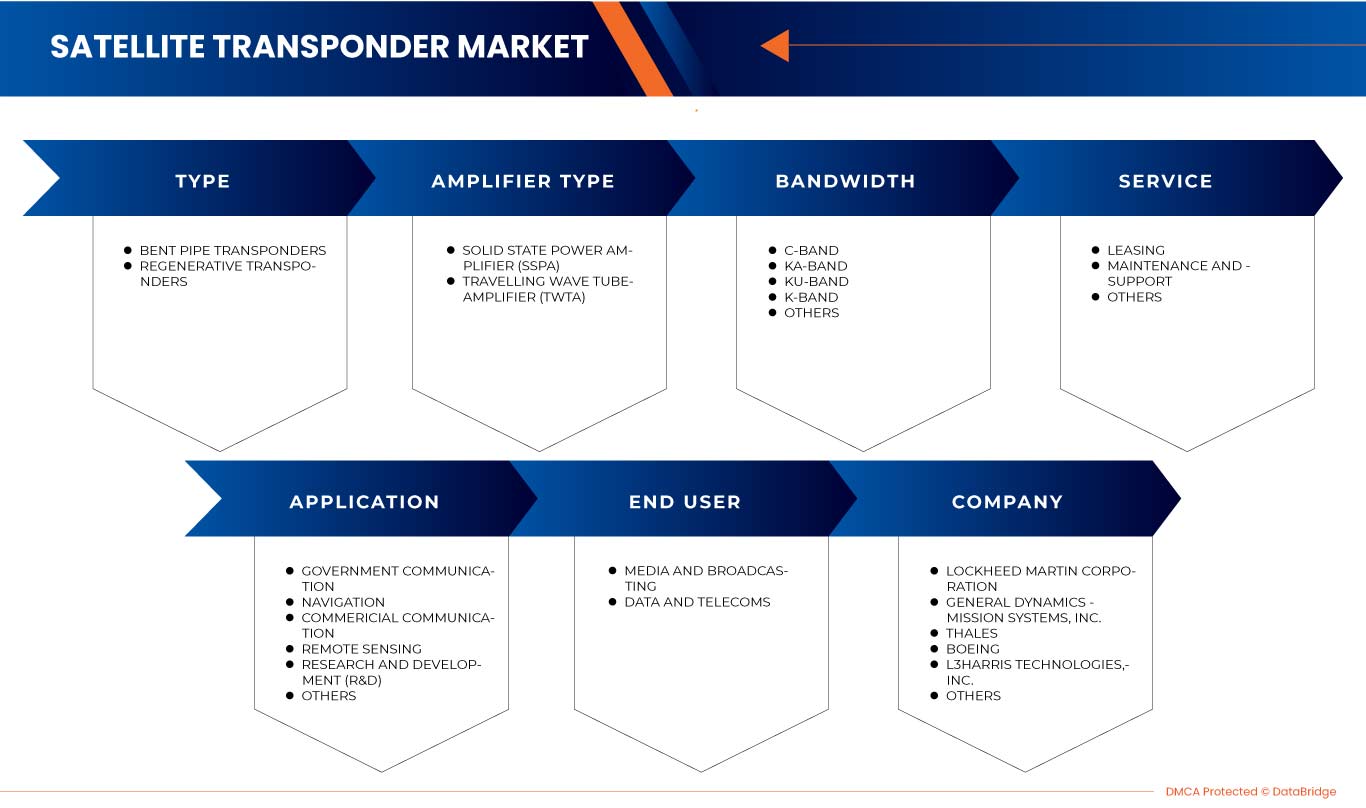

Marché européen des transpondeurs satellite, par service (location, maintenance et support, autres), type (transpondeurs à tube coudé, transpondeurs régénératifs), type d'amplificateur (amplificateurs de puissance à semi-conducteurs (SSPA), amplificateurs à tube à ondes progressives (TWTA)), bande passante (bande C, bande KA, bande KU, bande K, autres), application (communication commerciale, communication gouvernementale, navigation, télédétection, portée et développement (R&D), autres), utilisateur final (médias et radiodiffusion, données et télécommunications) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des transpondeurs satellite en Europe

Avec l'expansion de la technologie spatiale et de la communication par satellite, l'importance des transpondeurs satellite augmente rapidement. La présence d'un acteur du marché qui fournit des services de location de transpondeurs satellite ou des produits de transpondeurs selon différentes exigences à l'échelle mondiale montre l'importance des applications satellite dans diverses industries. Le marché européen des transpondeurs satellite devrait croître en raison de facteurs tels que l'augmentation du nombre de petits satellites en orbite terrestre. L'augmentation de la demande de communication par satellite et d'observation de la Terre et la demande croissante de services IoT et M2M par satellite sont les principaux facteurs moteurs du marché. En outre, la demande croissante de haut débit par satellite devrait encore stimuler le marché.

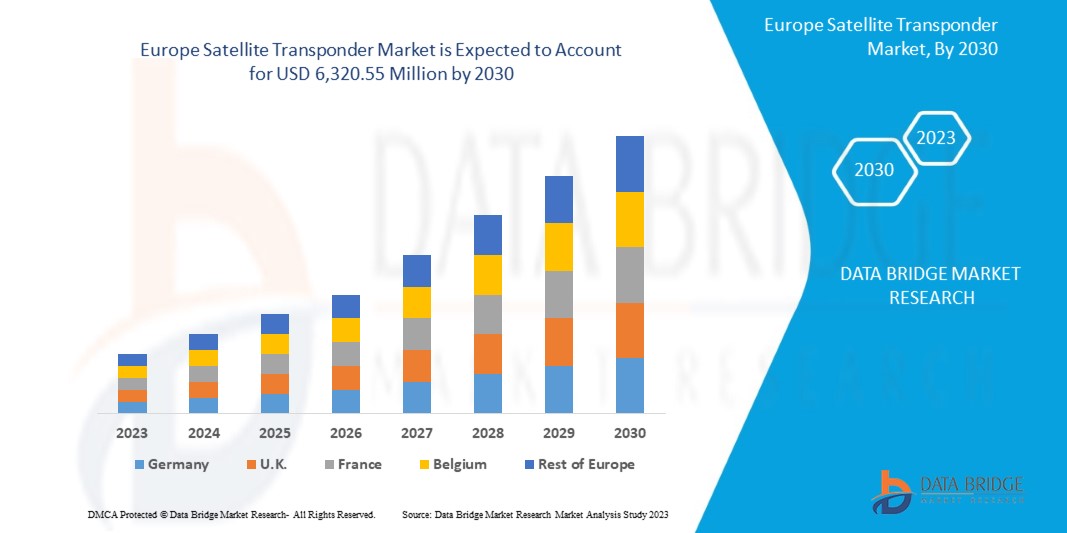

Selon les analyses de Data Bridge Market Research, le marché européen des transpondeurs satellites devrait atteindre une valeur de 6 320,55 millions USD d'ici 2030, à un TCAC de 4,4 % au cours de la période de prévision. Le rapport sur le marché européen des transpondeurs satellites couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par service (location, maintenance et support, autres), type (transpondeurs à tube coudé, transpondeurs régénératifs), type d'amplificateur (amplificateurs de puissance à semi-conducteurs (SSPA), amplificateurs à tube à ondes progressives (TWTA)), bande passante (bande C, bande KA, bande KU, bande K, autres), application (communication commerciale, communication gouvernementale, navigation, télédétection, portée et développement (R&D), autres), utilisateur final (médias et radiodiffusion, données et télécommunications) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Espagne, Russie, Turquie, Belgique, Pays-Bas, Suisse et le reste de l'Europe |

|

Acteurs du marché couverts |

EUTELSAT COMMUNICATIONS SA, L3Harris Technologies, Inc., AMOS Spacecom, Thaicom Public Company Limited, General Dynamics Mission Systems, Inc., Intelsat, Hispasat, MEASAT, IMT srl, ABS, Syrlinks, Singtel, ISRO, APT Satellite Co. Ltd / APSTAR, satsearch BV, Lockheed Martin Corporation, Thales, Boeing, ROMANTIS, kt sat et autres |

Définition du marché

Un transpondeur satellite est un appareil électronique fonctionnant dans la gamme des micro-ondes et transmettant ou recevant des signaux. Un émetteur prend des données d'entrée et génère un signal à courant continu pour alimenter un système d'antenne. C'est un appareil qui envoie et reçoit des données du satellite. Lorsque vous envoyez ou recevez des données, elles passent par un transpondeur satellite, qui reçoit les signaux des stations terrestres envoyés par les utilisateurs et les retransmet à l'utilisateur sur un ou plusieurs canaux de liaison descendante. L'utilisation de fréquences pour communiquer via des satellites, et chaque bande de fréquence correspond à un type de service : communications vocales, de données ou vidéo. C'est un appareil qui crée et amplifie des signaux radio pour permettre la communication entre deux stations terrestres. Il peut être utilisé pour connecter plusieurs stations de réception à une seule station de transmission.

Dynamique du marché des transpondeurs satellite en Europe

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- L'augmentation de la demande en matière de communication par satellite et d'observation de la Terre

La communication par satellite est un type de télécommunication moderne dans lequel des satellites artificiels assurent des liaisons de communication entre différents points de la Terre. Elle joue un rôle important dans de nombreux secteurs d'activité tels que le pétrole et le gaz, l'IoT, la santé, le gouvernement, le transport maritime, l'exploitation minière et d'autres. De plus, les communications par satellite ont diverses applications commerciales, gouvernementales et militaires. Les satellites d'observation de la Terre (EO) sont spécialement conçus pour surveiller la Terre. Ils aident à surveiller, à protéger et à gérer l'environnement et les ressources et à alerter sur les catastrophes et les calamités naturelles majeures.

De plus, les communications par satellite fournissent des informations essentielles sur une vaste zone inexplorée, notamment les océans et les terres émergées. Cette utilisation croissante des satellites artificiels dans diverses industries nécessite des transpondeurs de satellite pour recevoir des signaux de fréquences diverses et transmettre des informations à la station terrestre. Par conséquent, l'augmentation de la demande de communications par satellite devrait agir comme un moteur de la croissance du marché.

- Augmentation du nombre de petits satellites sur les orbites terrestres

Le marché des petits satellites connaît une croissance considérable en raison des demandes des consommateurs en matière d'imagerie, de navigation et de communications à travers le monde. Cette explosion de la demande de mise en orbite de petits satellites pour diverses applications a stimulé l'intérêt des start-ups pour les petites fusées à entrer sur le marché. Selon United Launch Alliance, environ 120 start-ups de micro-lanceurs sont de petites fusées qui transporteraient un ou plusieurs petits satellites en orbite. Cette croissance spectaculaire du segment est due aux progrès technologiques des composants des satellites tels que les transpondeurs, les antennes et les télescopes, qui ont permis de réduire la taille de nombreux appareils et équipements ; la miniaturisation a affecté l'industrie des satellites et l'industrie spatiale. Ces satellites miniaturisés remplacent les satellites gros et lourds en raison de leur petite taille, de leur faible prix lors du développement et de la haute qualité offerte qui a permis l'adoption accrue de petits satellites en orbite. Cette augmentation des petits satellites a eu un impact positif sur le marché car ces satellites transportent des systèmes de transpondeurs petits et puissants.

Opportunité

- Progrès dans la technologie des transpondeurs satellite

Avec la demande constante de connectivité et de diffusion de chaînes avancées, les satellites de communication deviennent de plus en plus sophistiqués et complexes. Une grande partie du développement des satellites est liée aux progrès de la technologie des transpondeurs de satellite. Un transpondeur de satellite de communication est une série de petits circuits interconnectés de la taille d'une puce formant un canal de communication entre les antennes de réception et d'émission. Ces circuits sont intégrés aux satellites pour fournir une bande passante et une puissance sur des fréquences radio désignées. La bande passante et la puissance du transpondeur déterminent la capacité des informations transmises via le transpondeur et la taille de l'équipement au sol nécessaire pour recevoir le signal. Les progrès de la technologie des transpondeurs de satellite ont permis la compression et le multiplexage des données. Plusieurs canaux vidéo et audio peuvent circuler via un seul transpondeur sur une seule porteuse à large bande. Ces progrès ont permis au fabricant de satellites d'innover davantage et d'augmenter les propriétés des transpondeurs de satellite, ce qui constitue une opportunité pour le marché.

Retenue/Défi

- Coût élevé associé aux services de lancement de satellite et de location de transpondeurs

Français À mesure que la technologie s'améliore et que de nouveaux concurrents et rivaux entrent en scène dans le secteur des services de lancement de satellites, les prix des services de lancement doivent baisser. Cependant, ce n'est pas le cas, car le lancement d'un satellite n'est pas une tâche/un effort facile. Selon Europe COM, le coût du lancement d'un seul satellite traditionnel est estimé entre 50 et 400 millions de dollars, selon la nature et le type de satellite. Le lancement d'une mission de navette spatiale peut coûter 500 millions de dollars, bien qu'une seule mission puisse transporter plusieurs satellites et les envoyer en orbite. La technologie avancée et l'introduction de lanceurs de fusées réutilisables peuvent réduire le coût jusqu'à 30 millions de dollars. Par conséquent, au lieu de coûter 100 millions de dollars par vol, si la fusée est réutilisée, le coût de la fusée n'est que de 30 millions de dollars par vol. Il s'agit toujours d'un coût plus élevé associé aux services de lancement de satellites. Ce coût élevé associé aux services de lancement de satellites affecte directement le lancement du satellite et la demande régionale de composants de satellites. Pour bénéficier des services de lancement de satellites, de nombreux acteurs régionaux doivent obtenir un soutien financier du gouvernement ou des grands acteurs du marché du secteur des satellites. Cela peut restreindre la demande de composants satellites, ce qui a un impact négatif sur le marché.

Impact de la pandémie de COVID-19 sur le marché européen des transpondeurs satellite

La pandémie de COVID-19 a eu un impact négatif sur le marché européen des transpondeurs de satellites. L'augmentation du financement public dans le développement des satellites et dans le secteur spatial et les progrès de la technologie des transpondeurs de satellites devraient offrir des opportunités lucratives pour la croissance du marché européen des transpondeurs de satellites. En outre, l'augmentation des partenariats, des acquisitions et de la collaboration entre les acteurs du marché et la demande croissante de services en bande Ku devraient alimenter davantage la croissance du marché. En outre, la croissance est élevée depuis l'ouverture du marché après le COVID-19, et on s'attend à ce qu'il y ait une croissance considérable dans le secteur. Les acteurs du marché mènent de multiples activités de recherche et développement pour améliorer la technologie impliquée dans le produit. Grâce à cela, les entreprises apporteront des progrès et de l'innovation au marché.

Développement récent

- En août 2021, L3Harris Technologies Inc. a annoncé que la campagne multidimensionnelle de retour d'échantillons martiens (MSR) de l'entreprise allait recueillir des échantillons martiens. La mission martienne intègre deux transpondeurs L3Harris et est de conception flexible pour terminer la mission selon la planification. Cette étape a permis à l'entreprise de devenir célèbre sur le marché européen des transpondeurs satellites

- En octobre 2020, EUTELSAT COMMUNICATIONS SA a annoncé que 1Sat Telecomunicaçoes avait lancé le service DTH au Brésil en utilisant le satellite EUTELSAT 65 West A. Cela a renforcé la domination de l'entreprise dans le secteur des transpondeurs satellites, car le satellite est équipé d'un transpondeur haute capacité, ce qui lui permet de se positionner sur le marché européen des transpondeurs satellites.

Portée du marché des transpondeurs satellite en Europe

Le marché européen des transpondeurs satellite est segmenté en fonction du service, du type, du type d'amplificateur, de la bande passante, de l'application et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

MARCHÉ EUROPÉEN DES TRANSPONDEURS SATELLITE, PAR SERVICE

- Location

- Maintenance et support

- Autres

Sur la base du service, le marché européen des transpondeurs satellites a été segmenté en location, maintenance et support, et autres

MARCHÉ EUROPÉEN DES TRANSPONDEURS SATELLITE, PAR TYPE

- Transpondeurs à tube courbé

- Transpondeurs régénératifs

Sur la base du type, le marché européen des transpondeurs satellites a été segmenté en transpondeurs à tube coudé et en transpondeurs régénératifs

MARCHÉ EUROPÉEN DES TRANSPONDEURS SATELLITE, PAR TYPE D'AMPLIFICATEUR

- Amplificateur de puissance à semi-conducteurs (SSPA)

- Amplificateur à tube à ondes progressives (TWTA)

Sur la base du type d'amplificateur, le marché européen des transpondeurs satellites a été segmenté en amplificateurs de puissance à semi-conducteurs (SSPA) et amplificateurs à tube à ondes progressives (TWTA)

MARCHÉ EUROPÉEN DES TRANSPONDEURS SATELLITE, PAR BANDE PASSANTE

- Bande C

- Bande KA

- Bande KU

- Bande K

- autres

Sur la base de la bande passante, le marché européen des transpondeurs satellites a été segmenté en bande C, bande KA, bande KU, bande K et autres

MARCHÉ EUROPÉEN DES TRANSPONDEURS SATELLITE, PAR APPLICATION

- Communication commerciale

- Communication gouvernementale

- Navigation

- Télédétection

- Recherche et développement (R&D)

- Autres

Sur la base des applications, le marché européen des transpondeurs satellites a été segmenté en communication commerciale, communication gouvernementale, navigation, télédétection, portée et développement (R&D) et autres

MARCHÉ EUROPÉEN DES TRANSPONDEURS SATELLITE, PAR UTILISATEUR FINAL

- Médias et radiodiffusion

- Données et Télécoms

Sur la base de l'utilisateur final, le marché européen des transpondeurs satellite a été segmenté en médias et diffusion, données et télécommunications.

Analyse/perspectives régionales du marché des transpondeurs satellite en Europe

Le marché européen des transpondeurs satellites est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, service, type, type d'amplificateur, bande passante, application et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des transpondeurs satellites en Europe sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, la Russie, la Turquie, la Belgique, les Pays-Bas, la Suisse et le reste de l'Europe.

L'Allemagne domine le marché européen des transpondeurs satellites avec la plus grande part de marché. Cette part est attribuable à la présence d'acteurs clés du marché et à la demande croissante de services de télécommunications tels que le DTH, le haut débit et les plateformes over-the-top (OTT) telles que Netflix et Amazon Prime, ainsi qu'aux avancées technologiques rapides et au développement de technologies innovantes.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario du marché pour chaque pays. En outre, la présence et la disponibilité des marques européennes et les défis rencontrés en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des transpondeurs satellite en Europe

Le paysage concurrentiel du marché des transpondeurs satellites en Europe fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des transpondeurs satellites en Europe.

Certains des principaux acteurs opérant sur le marché européen des transpondeurs satellites sont EUTELSAT COMMUNICATIONS SA, L3Harris Technologies, Inc., AMOS Spacecom, Thaicom Public Company Limited, General Dynamics Mission Systems, Inc., Intelsat, Hispasat, MEASAT, IMT srl, ABS, Syrlinks, Singtel, ISRO, APT Satellite Co. Ltd / APSTAR, satsearch BV, Lockheed Martin Corporation, Thales, Boeing, ROMANTIS, kt sat et d'autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE SATELLITE TRANSPONDER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 SERVICE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS ANALYSIS

4.3 REGULATORY LANDSCAPE

4.3.1 LICENSING REGIME OF DOT FOR SATELLITE-BASED COMMUNICATION SERVICES

4.3.2 SPECTRUM ALLOTMENT AND USE

4.4 TECHNOLOGICAL ADVANCEMENT

4.5 PATENT ANALYSIS

4.5.1 COMMUNICATION SATELLITE TRANSPONDER INTERCONNECTION UTILIZING VARIABLE BANDPASS FILTER

4.5.2 VARIABLE BANDWIDTH FILTERING AND FREQUENCY CONVERTING SYSTEM

4.5.3 FREQUENCY AGILE SATELLITE RECEIVER

4.5.4 AGILE BANDPASS FILTER

4.5.5 METHOD AND APPARATUS FOR FILTERING RADIO FREQUENCY SIGNALS

4.6 VALUE CHAIN ANALYSIS

4.7 CASE STUDY

4.7.1 EUTELSAT COMMUNICATIONS SA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR SATELLITE COMMUNICATION AND EARTH OBSERVATION

5.1.2 INCREASE IN THE NUMBER OF SMALL SATELLITES IN EARTH ORBITS

5.1.3 GROW IN DEMAND FOR SATELLITE IOT AND M2M SERVICES

5.1.4 INCREASING DEMAND FOR BROADBAND OVER SATELLITE

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH THE SATELLITE LAUNCH AND TRANSPONDER LEASING SERVICES

5.2.2 HAZARDOUS ENVIRONMENTAL IMPACT OF SATELLITE LAUNCH

5.3 OPPORTUNITIES

5.3.1 INCREASING GOVERNMENT FUNDING IN SATELLITE DEVELOPMENT AND THE SPACE SECTOR

5.3.2 INCREASING PARTNERSHIP, ACQUISITION AND COLLABORATION AMONG MARKET PLAYERS

5.3.3 RISING DEMAND FOR KU-BAND SERVICES

5.3.4 ADVANCEMENT IN THE SATELLITE TRANSPONDER TECHNOLOGY

5.4 CHALLENGES

5.4.1 LIMITATIONS DUE TO REGULATORY FRAMEWORK

5.4.2 CYBERSECURITY THREATS IN COMMERCIAL COMMUNICATION NETWORKS

6 EUROPE SATELLITE TRANSPONDER MARKET, BY SERVICE

6.1 OVERVIEW

6.2 LEASING

6.3 MAINTENANCE AND SUPPORT

6.4 OTHERS

7 EUROPE SATELLITE TRANSPONDER MARKET, BY TYPE

7.1 OVERVIEW

7.2 BENT PIPE TRANSPONDERS

7.3 REGENERATIVE TRANSPONDERS

8 EUROPE SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE

8.1 OVERVIEW

8.2 TRAVELLING WAVE TUBE AMPLIFIER (TWTA)

8.3 SOLID STATE POWER AMPLIFIER (SSPA)

9 EUROPE SATELLITE TRANSPONDER MARKET, BY BANDWIDTH

9.1 OVERVIEW

9.2 C-BAND

9.3 KU-BAND

9.4 KA-BAND

9.5 K-BAND

9.6 OTHERS

10 EUROPE SATELLITE TRANSPONDER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 COMMERCIAL COMMUNICATION

10.2.1 VIDEO DISTRIBUTION

10.2.2 DTH

10.2.3 BROADBAND SATELLITE ACCESS SERVICES

10.2.4 LEGACY TELEPHONE AND CARRIER SERVICES

10.2.5 COMMERCIAL MOBILITY SERVICES

10.2.6 ENTERPRISE DATA SERVICE

10.2.7 OAKLAND UNIVERSITY TV (OUTV)

10.2.8 OTHERS

10.3 NAVIGATION

10.4 GOVERNMENT COMMUNICATION

10.5 REMOTE SENSING

10.6 RESEARCH AND DEVELOPMENT (R&D)

10.7 OTHERS

11 EUROPE SATELLITE TRANSPONDER MARKET, BY END USER

11.1 OVERVIEW

11.2 MEDIA AND BROADCASTING

11.3 DATA AND TELECOMS

12 EUROPE SATELLITE TRANSPONDER MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 U.K.

12.1.3 FRANCE

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 TURKEY

12.1.7 RUSSIA

12.1.8 NETHERLANDS

12.1.9 BELGIUM

12.1.10 SWITZERLAND

12.1.11 DENMARK

12.1.12 SWEDEN

12.1.13 POLAND

12.1.14 NORWAY

12.1.15 FINLAND

12.1.16 ICELAND

12.1.17 LUXEMBOURG

12.1.18 REST OF EUROPE

13 EUROPE SATELLITE TRANSPONDER MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILING

15.1 LOCKHEED MARTIN CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 GENERAL DYNAMICS MISSION SYSTEMS, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 THALES

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BOEING

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 L3HARRIS TECHNOLOGIES, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ABS

15.6.1 COMPANY SNAPSHOT

15.6.2 SOLUTION PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 AMOS SPACECOM

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 APT SATELLITE CO. LTD / APSTAR

15.8.1 COMPANY SNAPSHOT

15.8.2 SERVICE PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 EUTELSAT COMMUNICATIONS SA

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 SOLUTION PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 HISPASAT

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 IMT SRL

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 INTELSAT

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 ISRO

15.13.1 COMPANY SNAPSHOT

15.13.2 SERVICE PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 KT SAT

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 MEASAT

15.15.1 COMPANY SNAPSHOT

15.15.2 SOLUTION PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 ROMANTIS

15.16.1 COMPANY SNAPSHOT

15.16.2 SERVICE PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SATSEARCH B.V.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SINGTEL

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 SYRLINKS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 THAICOM PUBLIC COMPANY LIMITED

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 SOLUTION PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 COMMERCIAL TRANSPONDER RENTAL RATES

TABLE 2 EUROPE SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 3 EUROPE LEASING IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 EUROPE MAINTENANCE AND SUPPORT IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 EUROPE OTHERS IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 EUROPE SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 EUROPE BENT PIPE TRANSPONDERS IN SATELLITE TRANSPONDER MARKET , BY REGION, 2021-2030 (USD MILLION)

TABLE 8 EUROPE REGENERATIVE TRANSPONDERS IN SATELLITE TRANSPONDER MARKET , BY REGION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 10 EUROPE TRAVELLING WAVE TUBE AMPLIFIER (TWTA) IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 EUROPE SOLID STATE POWER AMPLIFIER (SSPA) IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 EUROPE SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 13 EUROPE C-BAND IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 EUROPE KU-BAND IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 EUROPE KA-BAND IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE K-BAND IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 EUROPE OTHERS IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 EUROPE SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 19 EUROPE COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 EUROPE COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 21 EUROPE NAVIGATION IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 EUROPE GOVERNMENT COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 EUROPE REMOTE SENSING IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 EUROPE RESEARCH AND DEVELOPMENT (R&D) IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 EUROPE OTHERS IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 EUROPE SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 27 EUROPE MEDIA AND BROADCASTING IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 EUROPE DATA AND TELECOMS IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 EUROPE SATELLITE TRANSPONDER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 30 EUROPE SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 31 EUROPE SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 EUROPE SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 33 EUROPE SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 34 EUROPE SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 EUROPE COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 EUROPE SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 GERMANY SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 38 GERMANY SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 GERMANY SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 40 GERMANY SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 41 GERMANY SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 GERMANY COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 43 GERMANY SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 44 U.K. SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 45 U.K. SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.K. SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.K. SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 48 U.K. SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 U.K. COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 50 U.K. SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 51 FRANCE SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 52 FRANCE SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 FRANCE SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 54 FRANCE SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 55 FRANCE SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 FRANCE COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 FRANCE SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 58 ITALY SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 59 ITALY SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 ITALY SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 61 ITALY SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 62 ITALY SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 ITALY COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 64 ITALY SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 65 SPAIN SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 66 SPAIN SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 SPAIN SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 68 SPAIN SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 69 SPAIN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 SPAIN COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 SPAIN SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 72 TURKEY SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 73 TURKEY SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 TURKEY SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 75 TURKEY SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 76 TURKEY SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 77 TURKEY COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 TURKEY SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 79 RUSSIA SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 80 RUSSIA SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 RUSSIA SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 82 RUSSIA SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 83 RUSSIA SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 84 RUSSIA COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 85 RUSSIA SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 86 NETHERLANDS SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 87 NETHERLANDS SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 NETHERLANDS SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 89 NETHERLANDS SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 90 NETHERLANDS SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 91 NETHERLANDS COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 92 NETHERLANDS SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 93 BELGIUM SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 94 BELGIUM SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 BELGIUM SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 96 BELGIUM SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 97 BELGIUM SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 BELGIUM COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 99 BELGIUM SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 100 SWITZERLAND SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 101 SWITZERLAND SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 SWITZERLAND SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 103 SWITZERLAND SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 104 SWITZERLAND SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 105 SWITZERLAND COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 106 SWITZERLAND SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 107 DENMARK SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 108 DENMARK SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 DENMARK SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 110 DENMARK SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 111 DENMARK SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 112 DENMARK COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 113 DENMARK SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 114 SWEDEN SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 115 SWEDEN SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 SWEDEN SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 117 SWEDEN SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 118 SWEDEN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 119 SWEDEN COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 120 SWEDEN SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 121 POLAND SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 122 POLAND SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 POLAND SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 124 POLAND SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 125 POLAND SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 126 POLAND COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 127 POLAND SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 128 NORWAY SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 129 NORWAY SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 NORWAY SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 131 NORWAY SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 132 NORWAY SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 133 NORWAY COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 134 NORWAY SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 135 FINLAND SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 136 FINLAND SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 FINLAND SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 138 FINLAND SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 139 FINLAND SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 FINLAND COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 141 FINLAND SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 142 ICELAND SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 143 ICELAND SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 ICELAND SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 145 ICELAND SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 146 ICELAND SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 147 ICELAND COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 148 ICELAND SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 149 LUXEMBOURG SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 150 LUXEMBOURG SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 LUXEMBOURG SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 152 LUXEMBOURG SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 153 LUXEMBOURG SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 154 LUXEMBOURG COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 155 LUXEMBOURG SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 156 REST OF EUROPE SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE SATELLITE TRANSPONDER MARKET: SEGMENTATION

FIGURE 2 EUROPE SATELLITE TRANSPONDER MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE SATELLITE TRANSPONDER MARKET: DROC ANALYSIS

FIGURE 4 EUROPE SATELLITE TRANSPONDER MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE SATELLITE TRANSPONDER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE SATELLITE TRANSPONDER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE SATELLITE TRANSPONDER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE SATELLITE TRANSPONDER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE SATELLITE TRANSPONDER MARKET: APPLICATION COVERAGE GRID

FIGURE 10 EUROPE SATELLITE TRANSPONDER MARKET: SEGMENTATION

FIGURE 11 THE RISE IN DEMAND FOR SATELLITE COMMUNICATION AND EARTH OBSERVATION IS EXPECTED TO DRIVE THE EUROPE SATELLITE TRANSPONDER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 THE LEASING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE SATELLITE TRANSPONDER MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE SATELLITE TRANSPONDER MARKET

FIGURE 14 TOTAL NUMBER OF ACTIVE COMMERCIAL SATELLITES IN EARTH'S ORBIT

FIGURE 15 EUROPE SATELLITE TRANSPONDER MARKET : BY SERVICE, 2022

FIGURE 16 EUROPE SATELLITE TRANSPONDER MARKET : BY TYPE, 2022

FIGURE 17 EUROPE SATELLITE TRANSPONDER MARKET : BY AMPLIFIER TYPE, 2022

FIGURE 18 EUROPE SATELLITE TRANSPONDER MARKET : BY BANDWIDTH, 2022

FIGURE 19 EUROPE SATELLITE TRANSPONDER MARKET : BY APPLICATION, 2022

FIGURE 20 EUROPE SATELLITE TRANSPONDER MARKET : BY END USER, 2022

FIGURE 21 EUROPE SATELLITE TRANSPONDER MARKET: SNAPSHOT (2022)

FIGURE 22 EUROPE SATELLITE TRANSPONDER MARKET: BY COUNTRY (2022)

FIGURE 23 EUROPE SATELLITE TRANSPONDER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 EUROPE SATELLITE TRANSPONDER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 EUROPE SATELLITE TRANSPONDER MARKET: BY SERVICE (2023-2030)

FIGURE 26 EUROPE SATELLITE TRANSPONDER MARKET: COMPANY SHARE 2022(%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.