Europe Sanitary Ware Market

Taille du marché en milliards USD

TCAC :

%

USD

11.31 Billion

USD

16.98 Billion

2024

2032

USD

11.31 Billion

USD

16.98 Billion

2024

2032

| 2025 –2032 | |

| USD 11.31 Billion | |

| USD 16.98 Billion | |

|

|

|

|

Segmentation du marché européen des articles sanitaires, par type (lavabos, toilettes occidentales, robinets, douches, réservoirs de chasse d'eau, baignoires, urinoirs, accessoires de salle de bains, armoires à pharmacie, meubles-lavabos, bidets et miroirs, et autres), matériau (céramique, métal, verre, acrylique, plastique et plexiglas, et autres), mode de fonctionnement (manuel et automatisé), forme (rectangle, carré, courbe, cercle, dôme, parallélogramme, et autres), couleur (blanc, noir, et autres), utilisateur final (résidentiel, commercial, institutionnel, et autres), canal de distribution (hors ligne et en ligne) - Tendances du secteur et prévisions jusqu'en 2032

Quelle est la taille et le taux de croissance du marché européen des articles sanitaires ?

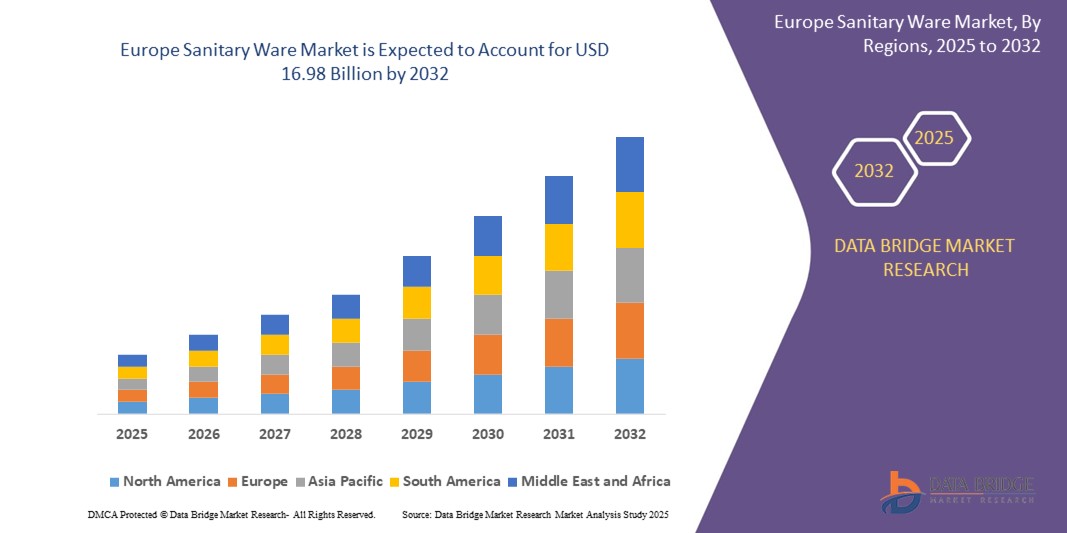

- Le marché européen des stations météorologiques et pluviomètres pour articles sanitaires était évalué à 11,31 milliards de dollars en 2024 et devrait atteindre 16,98 milliards de dollars d'ici 2032 , soit un TCAC de 5,20 % au cours de la période de prévision.

- La disponibilité d'une gamme de produits plus étendue stimule l'expansion du marché. De plus, ce dernier est également influencé par l'intérêt croissant des consommateurs pour les salles de bains personnalisées et design.

- Outre l'expansion, la R&D et la modernisation des produits sanitaires sur le marché ont ouvert de nouvelles perspectives commerciales aux fabricants.

- L'expansion du secteur immobilier, due à l'augmentation des espaces de bureaux et de logements locatifs et à la croissance du secteur de la construction, qui entraîne une hausse constante de la construction de sanitaires, accélère la croissance du marché.

Quels sont les principaux enseignements du marché des articles sanitaires ?

- De nombreuses matières premières sont utilisées pour fabriquer des articles sanitaires tels que robinets, baignoires et douches. Différents produits chimiques , minéraux, agents oxydants et catalyseurs permettent de produire divers articles sanitaires.

- Les sels solubles sont des complexes organiques aqueux de cations métalliques. Ils sont principalement utilisés pour décorer les carreaux de céramique vitrifiée, polis ou non, et se déclinent en diverses teintes, obtenues par dilution de la solution avec de l'eau. Les colorants céramiques sont utilisés pour la coloration grâce à leur fort pouvoir dispersant, qui peut être contrôlé par un procédé précis. Les dispersants servent également à défloculer l'argile et les minéraux en suspension qui y sont associés, en remplacement des silicates et des phosphates, qui peuvent introduire des alcalis indésirables dans le système.

- L'Allemagne a dominé le marché européen des articles sanitaires en 2024, grâce à une forte préférence pour la qualité, la durabilité et l'innovation technologique. Les consommateurs allemands privilégient les robinets sans contact, les toilettes intelligentes et les douches à faible consommation d'énergie, notamment dans les bâtiments urbains et les bâtiments certifiés écologiques.

- Le marché britannique devrait connaître la croissance la plus rapide au cours de la période de prévision, soutenu par une forte pénétration des maisons intelligentes , une demande croissante de solutions de salle de bains sans contact et une attention accrue portée à la sécurité et à l'accessibilité des salles de bains.

- Le segment des toilettes occidentales a dominé le marché avec la plus grande part de revenus (28,7 %) en 2024, grâce à une demande accrue pour des modèles de toilettes hygiéniques, économes en eau et axés sur le confort, tant dans les propriétés résidentielles que commerciales.

Portée du rapport et segmentation du marché des articles sanitaires

|

Attributs |

Principaux enseignements du marché des articles sanitaires |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des articles sanitaires ?

« Solutions de salle de bain intelligentes alimentées par l'IA et la commande vocale »

- L'une des tendances majeures du marché des articles sanitaires est l'intégration rapide de l'intelligence artificielle (IA) et des technologies vocales telles qu'Amazon Alexa, Google Assistant et Apple Siri, qui redéfinit l'expérience de la salle de bains moderne. Ces innovations permettent aux utilisateurs de contrôler les toilettes, les robinets, les douches et l'éclairage par commandes vocales, pour un confort mains libres optimal.

- Les toilettes intelligentes dotées de fonctionnalités basées sur l'IA, telles que la chasse d'eau automatique, le siège chauffant et des capteurs de suivi de santé, gagnent en popularité. Des marques comme TOTO et Kohler sont à la pointe de cette évolution avec des produits comme Neorest et Numi 2.0, qui offrent un nettoyage personnalisé, le contrôle de la température et une interaction vocale.

- L'intégration de la commande vocale permet d'automatiser les réglages de la salle de bain selon les préférences de chacun. Par exemple, les utilisateurs peuvent activer une température de douche prédéfinie, tamiser la lumière ou lancer de la musique, le tout par commande vocale, améliorant ainsi le confort et l'accessibilité pour les personnes de tous âges.

- Cette transformation fait évoluer les appareils sanitaires, passant de dispositifs passifs à des systèmes interactifs et connectés, en phase avec la demande croissante d'écosystèmes de maison intelligente. Ces innovations sont particulièrement prisées dans les secteurs résidentiel haut de gamme, de l'hôtellerie et du bien-être.

- Avec l'évolution constante de l'IA, les articles sanitaires sont conçus avec des alertes de maintenance prédictives, des technologies autonettoyantes et des analyses d'utilisateurs, offrant une expérience de salle de bain plus hygiénique, efficace et technologique.

- Cette tendance redéfinit les attentes des utilisateurs et constituera un facteur de différenciation clé pour les marques investissant dans des solutions de salle de bains intelligentes et sans contact.

Quels sont les principaux moteurs du marché des articles sanitaires ?

- L'urbanisation croissante à l'échelle mondiale, l'augmentation des revenus disponibles et la sensibilisation accrue à l'hygiène et à la conservation de l'eau sont les principaux moteurs de la croissance du marché des articles sanitaires. Les consommateurs privilégient de plus en plus les produits intelligents et économes en eau.

- En avril 2024, LIXIL Corporation a lancé en Europe sa nouvelle gamme de toilettes intelligentes et écologiques, équipées de capteurs d'IA qui surveillent les habitudes d'utilisation et réduisent la consommation d'eau jusqu'à 30 %.

- La demande croissante de solutions durables et de produits sanitaires sans contact, notamment dans le contexte post-pandémique, incite les établissements résidentiels et commerciaux à adopter des équipements sanitaires modernes à capteurs.

- Les initiatives gouvernementales promouvant des infrastructures d'assainissement propres, telles que la mission « Swachh Bharat » en Inde et les objectifs de développement durable des Nations Unies, encouragent davantage l'adoption d'articles sanitaires, notamment dans les régions en développement.

- De plus, les secteurs de l'hôtellerie et de l'immobilier adoptent rapidement les articles sanitaires haut de gamme comme un atout pour les maisons et les hôtels modernes, renforçant ainsi la trajectoire ascendante du marché.

Quel facteur freine la croissance du marché des articles sanitaires ?

- Un défi majeur pour le marché des articles sanitaires réside dans le coût initial élevé et l'entretien conséquent des produits de salle de bains intelligents de pointe. Bien que ces équipements permettent de réaliser des économies à long terme, leur prix d'achat initial freine souvent leur adoption sur les marchés sensibles aux prix.

- Par exemple, les toilettes intelligentes et les robinets dotés d'intelligence artificielle peuvent coûter jusqu'à 5 fois plus cher que les alternatives classiques, ce qui les rend moins accessibles à la classe moyenne.

- Les limitations des infrastructures, telles que le manque d'approvisionnement fiable en eau et en électricité dans les régions rurales et sous-développées, entravent davantage le déploiement de solutions sanitaires intelligentes.

- De plus, les préoccupations relatives à la sécurité des données et à la compatibilité des systèmes dans les systèmes à commande vocale peuvent susciter du scepticisme chez les consommateurs méfiants face à la surveillance ou aux dysfonctionnements techniques.

- Pour atténuer ces obstacles, des entreprises comme Roca et Duravit investissent dans des gammes de produits abordables, améliorent la durabilité et proposent des options de mise à niveau modulaires.

- La résolution des problèmes liés au coût, à la compatibilité et à la formation des utilisateurs sera essentielle pour accélérer l'adoption généralisée des articles sanitaires intelligents auprès de tous les segments de clientèle.

Comment le marché des articles sanitaires est-il segmenté ?

Le marché est segmenté en fonction du type, du matériau, du mode de fonctionnement, de la forme, de la couleur, de l'utilisateur final et du canal de distribution.

- Par type

Le marché des articles sanitaires est segmenté par type en lavabos, toilettes occidentales, robinetterie, douches, réservoirs de chasse d'eau, baignoires, urinoirs, accessoires de salle de bains, armoires à pharmacie, meubles-lavabos, bidets et miroirs, et autres. Le segment des toilettes occidentales a dominé le marché en 2024, représentant la plus grande part de revenus (28,7 %), grâce à une demande accrue de toilettes hygiéniques, économes en eau et confortables, tant dans les habitations que dans les locaux commerciaux. L'urbanisation rapide, l'amélioration des infrastructures sanitaires et la sensibilisation croissante à la santé sont les principaux facteurs expliquant cette position dominante.

Le segment des robinets devrait connaître le TCAC le plus rapide entre 2025 et 2032, soutenu par la demande croissante de systèmes de robinets sans contact et à capteurs dans les maisons intelligentes et les toilettes publiques, stimulée par la sensibilisation à l'hygiène post-pandémie et les initiatives de conservation de l'eau.

- Par matériau

Le marché est segmenté selon le matériau : céramique, métal, verre, acrylique, plastique et plexiglas, et autres. En 2024, le segment de la céramique représentait la plus grande part de marché (52,1 %), grâce à sa durabilité, sa facilité d’entretien et son utilisation répandue dans la fabrication de lavabos, de toilettes et de baignoires. Son esthétique et son rapport coût-efficacité en font un matériau de choix pour les projets résidentiels et commerciaux.

Le segment du verre devrait connaître le taux de croissance annuel composé le plus rapide au cours de la période prévisionnelle, porté par la demande croissante d'accessoires de salle de bains de luxe, notamment dans les secteurs résidentiel et hôtelier haut de gamme.

- Par mode de fonctionnement

Selon leur mode de fonctionnement, les appareils sanitaires se divisent en deux segments : manuel et automatisé. Le segment manuel représentait la part la plus importante (64,6 %) en 2024, principalement grâce à son prix abordable et à sa position dominante sur les marchés émergents où l’adoption de la maison connectée n’en est qu’à ses débuts.

Le segment automatisé devrait connaître la plus forte croissance annuelle composée au cours de la période de prévision, alimentée par la popularité croissante des toilettes à capteurs, des robinets sans contact et des douches intelligentes intégrant les technologies d'IA et d'IoT.

- Par forme

Selon la forme, le marché est segmenté en rectangle, carré, courbe, cercle, dôme, parallélogramme et autres. Le segment rectangulaire dominait le marché avec une part de 36,3 % en 2024, plébiscité pour son optimisation de l'espace et son design moderne, aussi bien dans les salles de bains compactes que spacieuses.

Le segment des appareils incurvés devrait enregistrer la croissance la plus rapide, reflétant l'évolution des préférences des consommateurs pour une esthétique plus douce et des designs ergonomiques qui améliorent le confort et l'accessibilité.

- Par couleur

Le marché des articles sanitaires est segmenté en fonction de la couleur : blanc, noir et autres. En 2024, le segment blanc détenait la plus grande part de marché (69,8 %), grâce à sa position dominante traditionnelle, sa facilité d’harmonisation avec tout type de décoration et son association avec la propreté et l’hygiène.

Le segment des salles de bains noires prend de l'ampleur et devrait connaître une croissance annuelle composée significative, alimentée par la demande d'esthétique haut de gamme et design dans les environnements urbains et luxueux.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en résidentiel, commercial, institutionnel et autres. Le segment résidentiel détenait la plus grande part de marché (54,2 %) en 2024, grâce à la hausse des constructions de logements, à l'augmentation des rénovations domiciliaires et à l'intérêt croissant pour la modernisation des salles de bains.

Le segment commercial est en passe de connaître une croissance rapide, soutenue par l'augmentation des installations dans les hôtels, les aéroports, les bureaux d'entreprises et les points de vente au détail qui nécessitent des solutions sanitaires à la fois élégantes et durables.

- Par canal de distribution

Selon le canal de distribution, le marché des articles sanitaires se divise en deux segments : le commerce physique et le commerce en ligne. En 2024, le segment physique dominait le marché avec une part de 66,4 %, les magasins physiques offrant aux clients la possibilité de voir et de toucher les produits, des conseils professionnels et des services d’installation.

Le segment en ligne devrait connaître le taux de croissance annuel composé le plus rapide au cours de la période prévisionnelle, grâce à la numérisation, à la préférence croissante pour le commerce électronique et à l'accès facile aux avis sur les produits, aux remises et à une grande variété de choix.

Quel pays détient la plus grande part du marché européen des articles sanitaires ?

- L'Allemagne a dominé le marché européen des articles sanitaires en 2024, grâce à une forte préférence pour la qualité, la durabilité et l'innovation technologique. Les consommateurs allemands privilégient les robinets sans contact, les toilettes intelligentes et les douches à faible consommation d'énergie, notamment dans les bâtiments urbains et les bâtiments certifiés écologiques.

- Une production nationale solide, une R&D robuste et une réglementation favorable aux dispositifs d'économie d'eau stimulent davantage la croissance du marché en Allemagne.

Analyse du marché français des articles sanitaires

Le marché français des articles sanitaires connaît une forte croissance, portée par la hausse des rénovations de logements, l'intérêt croissant pour les salles de bains design et les investissements publics dans le logement durable. Privilégiant l'esthétique et l'hygiène, les consommateurs français adoptent rapidement les appareils sanitaires en céramique, les WC suspendus et les mitigeurs thermostatiques, notamment dans les secteurs du logement urbain et de l'hôtellerie-restauration.

Analyse du marché britannique des articles sanitaires

Le marché britannique devrait connaître la croissance la plus rapide au cours de la période de prévision, porté par une forte pénétration des maisons connectées, une demande croissante de solutions sanitaires sans contact et une attention accrue portée à la sécurité et à l'accessibilité des salles de bains. La tendance aux systèmes de douche numériques, aux toilettes sans bride et aux sièges de bidet chauffants s'accentue, notamment auprès des consommateurs des segments résidentiels haut de gamme et moyen de gamme. La croissance du commerce électronique stimule également les achats d'articles sanitaires en ligne.

Analyse du marché italien des articles sanitaires

L'Italie, réputée pour sa clientèle sensible au design, séduit de plus en plus les consommateurs par le luxe et les solutions sanitaires optimisant l'espace. Le marché connaît une croissance des équipements de salle de bains compacts, des réservoirs encastrés et des vasques en céramique haut de gamme, notamment dans les appartements et les hôtels de charme. Les incitations fiscales du gouvernement pour les rénovations écologiques, dans le cadre du dispositif « Superbonus 110 % », encouragent également les consommateurs à moderniser leurs installations de salle de bains.

Analyse du marché espagnol des articles sanitaires

L'Espagne affiche une croissance prometteuse, alimentée par le développement des infrastructures touristiques, les projets de construction modernes et la demande croissante de produits intelligents et économes en eau. Face à une clientèle de plus en plus soucieuse de l'environnement, la demande de toilettes à double chasse, de robinets à capteur et de douches à faible débit augmente, tant dans les espaces résidentiels que commerciaux. L'adoption de normes de construction favorables contribue également à accélérer ce phénomène.

Quelles sont les principales entreprises du marché des articles sanitaires ?

Le secteur des articles sanitaires est principalement dominé par des entreprises bien établies, notamment :

- TOTO EUROPE GmbH (Allemagne)

- Kohler Co. (États-Unis)

- Cersanit SA (Pologne)

- LAUFEN Bathrooms AG (Suisse)

- Creavit (Turquie)

- Geberit AG (Suisse)

- LIXIL Corporation (Japon)

- Roca Sanitario, SA (Espagne)

- Jaquar Inde (Inde)

- Duravit AG (Allemagne)

- CERAMICA CATALANO SPA (Italie)

- Villeroy & Boch (Allemagne)

- BETTE GmbH & Co. KG (Allemagne)

- Eczacıbaşı Holding A.Ş. (Dinde)

- Lecico Égypte (Égypte)

- Ideal Standard (Royaume-Uni) Ltd (Royaume-Uni)

- GROHE AG (Allemagne)

- Société saoudienne de céramique (Arabie saoudite)

- AQUACUBIC (Chine)

- bthaüs (Inde)

Quels sont les développements récents sur le marché européen des articles sanitaires ?

- En octobre 2023, le groupe Roca a finalisé l'acquisition d'Alape GmbH, fabricant allemand de produits de salle de bains haut de gamme en acier émaillé. Cette acquisition stratégique devrait renforcer la présence commerciale des deux marques en Europe. Elle s'inscrit dans la stratégie de Roca visant à développer son portefeuille de produits premium et à acquérir un avantage concurrentiel sur les principaux marchés internationaux.

- En septembre 2023, TOTO a intégré à sa gamme Washlet Apricot P un bidet pilotable par smartphone, doté d'un abattant de toilettes à ouverture automatique. Cette innovation répond à la demande croissante de solutions d'hygiène sans contact dans les salles de bains modernes. Ce lancement témoigne de l'engagement de TOTO à allier hygiène, confort et technologie pour satisfaire les besoins changeants des utilisateurs.

- En août 2023, Duravit AG a annoncé son projet de construction, au Québec (Canada), de la première usine au monde de produits sanitaires en céramique à bilan carbone neutre. L'usine produira des toilettes et des lavabos écologiques, alimentés entièrement par des énergies renouvelables. Ce développement positionne Duravit comme un chef de file mondial de la fabrication durable de produits sanitaires.

- En avril 2023, Villeroy & Boch a enrichi sa collection O.novo avec de nouveaux lavabos ovales, venant ainsi étoffer sa gamme de produits pour la salle de bains et offrir aux consommateurs une plus grande variété de styles et de fonctionnalités. Ce lancement s'inscrit dans la stratégie de croissance de l'entreprise, axée sur la diversification de son portefeuille et l'innovation en matière de design.

- En mars 2023, Bette a présenté ses derniers produits de salle de bains en acier titane émaillé au salon ISH de Francfort (Hall 3.1, Stand C 99). L'exposition mettait l'accent sur la liberté de conception et la simplicité d'installation. Cette présentation renforce la visibilité de Bette sur le segment haut de gamme tout en élargissant son attrait auprès des architectes et des concepteurs d'intérieurs contemporains.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.