Europe Safety Systems Market

Taille du marché en milliards USD

TCAC :

%

USD

1.38 Billion

USD

2.25 Billion

2024

2032

USD

1.38 Billion

USD

2.25 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 2.25 Billion | |

|

|

|

|

Segmentation du marché européen des systèmes de sécurité, par type (contrôleurs et relais de sécurité, vision industrielle de sécurité, capteurs et interrupteurs de sécurité), technologie (capteurs numériques, capteurs intelligents et capteurs analogiques), fonction (protection des machines, surveillance des processus, gestion de l'énergie, aide au stationnement, prévention des collisions, systèmes de surveillance des vibrations, systèmes d'arrêt d'urgence, etc.), taille de l'organisation (grande et moyenne entreprise), utilisateur final (automobile, aérospatiale et défense, santé, pétrole et gaz, transport et logistique, électronique grand public, agroalimentaire, construction, etc.), canal de distribution (ventes directes et indirectes) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché européen des systèmes de sécurité

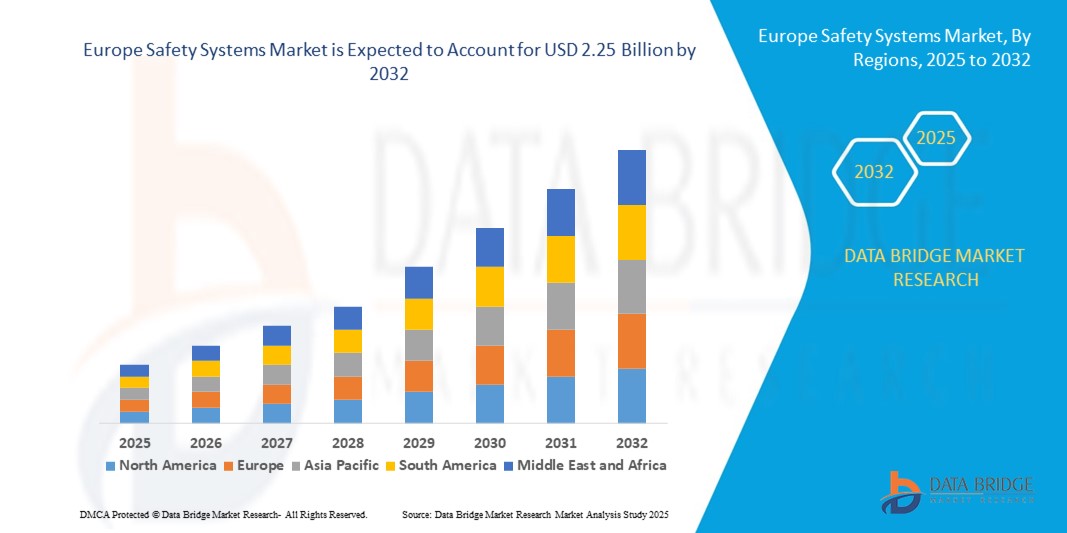

- La taille du marché européen des systèmes de sécurité était évaluée à 1,38 milliard USD en 2024 et devrait atteindre 2,25 milliards USD d'ici 2032 , à un TCAC de 6,3 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la mise en œuvre croissante de l'automatisation et des réglementations strictes en matière de sécurité au travail dans tous les secteurs, ce qui stimule la demande de systèmes de sécurité avancés pour protéger les machines, les travailleurs et les opérations.

- En outre, l’adoption croissante de capteurs intelligents, de vision artificielle et de solutions de surveillance compatibles IoT permet une gestion de la sécurité en temps réel, une maintenance prédictive et la conformité, accélérant ainsi l’adoption de systèmes de sécurité et stimulant considérablement l’expansion du marché.

Analyse du marché européen des systèmes de sécurité

- Les systèmes de sécurité sont des solutions intégrées qui incluent des capteurs, des contrôleurs, des relais et des dispositifs de surveillance conçus pour protéger les équipements, les processus et les opérateurs humains contre les conditions dangereuses dans des secteurs tels que l'automobile, le pétrole et le gaz, la fabrication et la santé.

- La demande croissante de systèmes de sécurité est principalement motivée par des cadres réglementaires plus stricts, une attention croissante portée à l'efficacité opérationnelle et le besoin croissant de minimiser les temps d'arrêt et les accidents du travail grâce à des technologies de sécurité automatisées et intelligentes.

- Le Royaume-Uni a dominé le marché des systèmes de sécurité en 2024, en raison de sa base industrielle solide, de son secteur manufacturier de pointe et de ses réglementations strictes en matière de sécurité au travail dans des secteurs tels que l'automobile, l'aérospatiale et le pétrole et le gaz.

- L'Allemagne devrait être le pays connaissant la croissance la plus rapide sur le marché des systèmes de sécurité au cours de la période de prévision en raison de l'expansion rapide des pratiques de l'Industrie 4.0, de l'adoption de la robotique avancée et de la dépendance croissante aux machines automatisées dans ses centres de fabrication.

- Le segment des capteurs intelligents a dominé le marché avec une part de marché de 42 % en 2024, grâce à sa capacité à fournir des données précises, sa connectivité avec les plateformes IoT et ses capacités de surveillance en temps réel. Ces capteurs sont largement privilégiés pour la maintenance prédictive et l'amélioration de l'efficacité opérationnelle dans des secteurs tels que l'aérospatiale, la santé et l'automobile. Leur adaptabilité aux systèmes d'automatisation avancés et leur intégration aux analyses cloud garantissent une protection fiable et des processus rationalisés. La demande croissante d'interprétation intelligente des données et d'autodiagnostic dans les systèmes de sécurité renforce leur leadership.

Portée du rapport et segmentation du marché des systèmes de sécurité

|

Attributs |

Informations clés sur le marché des systèmes de sécurité |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande. |

Tendances du marché des systèmes de sécurité en Europe

Adoption croissante des machines intelligentes et de l'industrie 4.0

- Le marché des systèmes de sécurité connaît une croissance significative grâce à l'adoption croissante de l'Industrie 4.0 et des technologies des machines intelligentes. L'automatisation et la numérisation avancées nécessitent des mécanismes de sécurité intégrés pour garantir un fonctionnement fluide dans des environnements industriels de plus en plus complexes.

- Par exemple, Rockwell Automation intègre des technologies de sécurité intelligentes à ses solutions d'automatisation industrielle. Ses systèmes sont conçus pour intégrer la sécurité aux opérations numériques, fournissant des analyses prédictives qui améliorent la protection des travailleurs et réduisent les temps d'arrêt des usines de fabrication.

- La combinaison de capteurs intelligents, de connectivité IoT et d'apprentissage automatique améliore les systèmes de sécurité en les rendant plus proactifs. Ces avancées permettent une surveillance en temps réel, une maintenance prédictive et des arrêts automatisés dans les environnements dangereux, améliorant ainsi considérablement la sécurité au travail.

- De plus, la demande de robotique collaborative et d'équipements industriels autonomes exige une intégration avancée de la sécurité. Les systèmes de sécurité sont essentiels pour permettre aux machines et aux humains de travailler côte à côte sans accident, favorisant ainsi la productivité et la résilience opérationnelle.

- L'importance croissante de la prise de décision basée sur les données dans les usines souligne la nécessité de systèmes de sécurité connectés à des plateformes centralisées. Ces systèmes fournissent des rapports d'incidents et des données de conformité en temps réel, alignant ainsi la sécurité industrielle sur les stratégies de transformation numérique.

- Globalement, l'adoption de l'Industrie 4.0 place les systèmes de sécurité au cœur de la production et des opérations modernes. Leur intégration aux technologies intelligentes garantit un équilibre entre progrès industriel et protection renforcée des actifs, des processus et du capital humain.

Dynamique du marché européen des systèmes de sécurité

Conducteur

Progrès dans la technologie des systèmes de sécurité

- Les avancées technologiques en matière de systèmes de sécurité stimulent considérablement la croissance du marché, les fabricants intégrant des solutions innovantes pour répondre aux besoins industriels modernes. Efficacité accrue, connectivité numérique et automatisation intelligente deviennent des caractéristiques clés des solutions de sécurité de nouvelle génération.

- Par exemple, Siemens a développé des systèmes d'automatisation intégrant la sécurité, alliant productivité et sécurité avancée. Ces plateformes permettent aux entreprises de respecter des normes strictes tout en améliorant la flexibilité et en réduisant les délais de commercialisation des nouveaux produits.

- Les nouvelles technologies de sécurité, telles que les automates programmables, la vision industrielle avancée et les réseaux de communication à sécurité intégrée, garantissent une réactivité accrue et une précision accrue. Ces innovations minimisent les risques et offrent une sécurité sur mesure pour différentes opérations industrielles.

- De plus, l'intégration aux plateformes IIoT améliore les capacités d'analyse des données, permettant aux entreprises de détecter les risques de manière proactive. Les systèmes de sécurité fonctionnent désormais non seulement comme des mesures réactives, mais aussi comme des outils prédictifs et préventifs, ce qui les place au cœur de l'excellence opérationnelle.

- Ces avancées technologiques témoignent de l'innovation continue du secteur. En harmonisant la sécurité avec la modernisation numérique, les organisations garantissent une fiabilité, une conformité et une efficacité accrues dans les environnements industriels, renforçant ainsi les systèmes de sécurité comme moteur de croissance à long terme.

Retenue/Défi

Augmentation des exigences réglementaires et des normes de conformité

- Le marché des systèmes de sécurité est confronté à des défis liés à l'évolution constante des cadres réglementaires et aux exigences de conformité strictes dans tous les secteurs. Les entreprises doivent régulièrement mettre à niveau leurs systèmes pour répondre aux diverses normes régionales, ce qui accroît les coûts et la complexité opérationnelle.

- Par exemple, des entreprises comme ABB et Honeywell subissent une pression constante pour aligner leurs solutions de sécurité sur les différentes directives de sécurité, telles que la norme ISO 13849 et la réglementation OSHA. La conformité à ces normes internationales et nationales nécessite souvent des investissements importants dans la conception et la certification des systèmes.

- Le rythme d'évolution réglementaire dépasse la capacité d'adaptation des petites entreprises, ce qui crée des disparités dans l'adoption des nouvelles technologies au sein du secteur. Pour de nombreuses entreprises, les coûts liés aux mises à jour continues freinent le déploiement généralisé de technologies de sécurité avancées.

- De plus, la fragmentation des réglementations de sécurité sur les marchés mondiaux complique le développement et le déploiement des produits. Les entreprises doivent composer avec des exigences redondantes, ce qui allonge les délais de lancement et ralentit l'adoption des produits dans certaines régions.

- Relever ces défis de conformité exige une collaboration plus étroite entre les entreprises et les autorités de réglementation, ainsi que des investissements dans des solutions de sécurité flexibles et évolutives. Développer des systèmes adaptables à de multiples conditions réglementaires sera essentiel pour soutenir la croissance du marché des systèmes de sécurité.

Portée du marché européen des systèmes de sécurité

Le marché est segmenté en fonction du type, de la technologie, de la fonction, de la taille de l’organisation, de l’utilisateur final et du canal de distribution.

- Par type

Le marché des systèmes de sécurité est segmenté selon leur type : contrôleurs et relais de sécurité, vision industrielle de sécurité, capteurs de sécurité et interrupteurs de sécurité. En 2024, le segment des contrôleurs et relais de sécurité a dominé la plus grande part de chiffre d'affaires du marché, grâce à son rôle central dans la gestion et la coordination des opérations de sécurité des machines industrielles et des lignes de production. Ces dispositifs garantissent la conformité aux normes de sécurité internationales les plus strictes, notamment dans des secteurs comme l'automobile et la construction mécanique lourde. Leur facilité d'intégration aux infrastructures d'automatisation existantes, combinée à leur fiabilité éprouvée en matière de réduction des risques sur le lieu de travail, renforce leur domination. La demande croissante de certifications de sécurité fonctionnelle et l'importance croissante accordée à la protection des opérateurs humains stimulent également leur adoption.

Le segment de la vision industrielle de sécurité devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce aux progrès rapides de la reconnaissance d'images et de l'automatisation basées sur l'IA. Les systèmes de vision industrielle sont de plus en plus déployés pour la surveillance en temps réel, la détection des défauts et l'inspection automatisée afin de prévenir les dysfonctionnements et les accidents des équipements. L'adoption croissante des pratiques de l'Industrie 4.0 et des usines intelligentes amplifie l'utilisation de la vision industrielle de sécurité pour l'analyse prédictive et l'optimisation des processus. De plus, leur évolutivité dans diverses applications, notamment les secteurs pharmaceutique, agroalimentaire et de l'assemblage électronique, positionne ce segment pour une croissance accélérée.

- Par technologie

Sur le plan technologique, le marché des systèmes de sécurité est segmenté en capteurs numériques, capteurs intelligents et capteurs analogiques. Le segment des capteurs intelligents a dominé le marché avec une part de 42 % en 2024, grâce à sa capacité à fournir des données précises, sa connectivité avec les plateformes IoT et ses capacités de surveillance en temps réel. Ces capteurs sont largement privilégiés pour la maintenance prédictive et l'amélioration de l'efficacité opérationnelle dans des secteurs tels que l'aérospatiale, la santé et l'automobile. Leur adaptabilité aux systèmes d'automatisation avancés et leur intégration aux analyses cloud garantissent une protection fiable et des processus rationalisés. La demande croissante d'interprétation intelligente des données et d'autodiagnostic dans les systèmes de sécurité renforce encore leur leadership.

Le segment des capteurs numériques devrait connaître le TCAC le plus rapide entre 2025 et 2032, grâce à sa rentabilité, sa compacité et son fonctionnement économe en énergie. Les capteurs numériques sont de plus en plus utilisés pour surveiller la température, les vibrations et la pression dans les environnements industriels où une réactivité est essentielle pour prévenir les pannes. Leur facilité d'intégration aux systèmes de contrôle automatisés et leur compatibilité avec les technologies embarquées les rendent très attractifs pour les PME. L'adoption croissante des jumeaux numériques et de la simulation en temps réel accélère encore la demande de capteurs numériques pour les systèmes de sécurité modernes.

- Par fonction

Sur la base de la fonction, le marché est segmenté en protection des machines, surveillance des processus, gestion de l'énergie, aide au stationnement, prévention des collisions, systèmes de surveillance des vibrations, systèmes d'arrêt d'urgence, etc. En 2024, le segment de la protection des machines a dominé le marché, soutenu par son rôle essentiel dans la protection des machines industrielles de grande valeur contre les défaillances mécaniques et les erreurs humaines. Les fabricants privilégient les systèmes de protection des machines en raison de leur capacité à réduire les temps d'arrêt, à améliorer l'efficacité opérationnelle et à prolonger la durée de vie des équipements. Leur adoption est forte dans l'automobile, l'aéronautique et l'industrie lourde, où la fiabilité des équipements a un impact direct sur la productivité. L'application des réglementations internationales en matière de sécurité et la hausse du coût des accidents du travail renforcent encore la demande.

Le segment de la prévention des collisions devrait connaître sa plus forte croissance entre 2025 et 2032, porté par un déploiement croissant dans les véhicules autonomes, la robotique d'entrepôt et les applications aéronautiques. Les systèmes anticollision s'appuient sur des capteurs avancés, le LiDAR et des algorithmes d'IA pour détecter les dangers potentiels et prévenir les accidents en temps réel. L'adoption croissante des systèmes d'aide à la conduite dans les secteurs de l'automobile et de la logistique contribue significativement à leur croissance. Face à l'obligation imposée par les gouvernements d'intégrer des dispositifs de sécurité avancés dans les véhicules et à l'adoption croissante de l'automatisation dans les industries, les systèmes anticollision deviennent un élément essentiel de la réduction des risques opérationnels.

- Par taille d'organisation

Selon la taille des organisations, le marché est segmenté en petites et moyennes entreprises et en grandes organisations. Les grandes organisations ont dominé le marché en 2024, grâce à leur capacité d'investissement plus importante, à leur adoption massive de l'automatisation et à leur strict respect des normes de sécurité. Les entreprises de secteurs tels que le pétrole et le gaz, l'automobile et l'aérospatiale privilégient les systèmes de sécurité avancés pour protéger leurs actifs et leurs employés et assurer la continuité de leurs opérations. Le déploiement à grande échelle de la robotique et des machines connectées nécessite des solutions de sécurité sophistiquées et intégrées, renforçant ainsi la part de marché de ce segment.

Le segment des PME devrait enregistrer la croissance la plus rapide entre 2025 et 2032, grâce à une sensibilisation accrue à la sécurité au travail, à des solutions rentables et aux exigences de conformité réglementaire. Les PME adoptent de plus en plus des systèmes de sécurité modulaires et évolutifs, adaptés à leurs budgets et permettant des mises à niveau progressives. Les incitations gouvernementales à l'adoption de solutions de sécurité et la disponibilité de technologies abordables et faciles à installer encouragent encore davantage cette adoption. Cette évolution est particulièrement visible dans les économies émergentes, où les PME constituent le pilier de l'activité industrielle.

- Par utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en : automobile, aérospatiale et défense, santé, pétrole et gaz, transport et logistique, électronique grand public, agroalimentaire, construction, etc. En 2024, le segment automobile a dominé le marché, grâce à l'importance croissante accordée à la sécurité des conducteurs et des passagers, ainsi qu'à l'adoption croissante des systèmes avancés d'aide à la conduite (ADAS). Les constructeurs automobiles investissent massivement dans l'intégration de capteurs de sécurité, de vision industrielle et de systèmes anticollision afin de respecter les réglementations en matière de sécurité et d'améliorer la fiabilité des véhicules. La croissance du secteur des véhicules électriques stimule encore davantage la demande en systèmes de sécurité avancés.

Le secteur de la santé devrait connaître la croissance la plus rapide entre 2025 et 2032, portée par les exigences de précision, de surveillance en temps réel et de sécurité des patients en soins intensifs. Les systèmes de sécurité dans les établissements de santé sont essentiels pour garantir des diagnostics précis, surveiller l'état des équipements et protéger le personnel médical contre les expositions dangereuses. La numérisation rapide des hôpitaux, l'adoption de systèmes de surveillance IoT et l'augmentation des investissements dans les infrastructures de santé intelligentes amplifient cette croissance. La demande est également soutenue par l'accent mis par la réglementation sur la sécurité des dispositifs médicaux et la prévention des erreurs.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en ventes directes et ventes indirectes. En 2024, le segment des ventes directes a dominé le marché, soutenu par la préférence des fabricants pour un engagement direct avec leurs clients afin de leur fournir des solutions sur mesure, un service après-vente et des contrats à long terme. Les canaux de vente directe sont particulièrement importants dans des secteurs tels que l'aéronautique, l'automobile et le pétrole et le gaz, où des solutions de sécurité personnalisées à forte valeur ajoutée sont déployées. La force de ce canal réside dans la création de relations clients solides et dans l'offre d'une expertise technique complète.

Le segment des ventes indirectes devrait connaître sa plus forte croissance entre 2025 et 2032, porté par le rôle croissant des distributeurs, des intégrateurs de systèmes et des plateformes de commerce électronique. Les canaux indirects offrent une plus grande portée commerciale, notamment pour les PME et les marchés émergents, où les clients font appel à des fournisseurs tiers pour des solutions rentables. La demande croissante de dispositifs de sécurité modulaires prêts à l'emploi et l'essor des plateformes de distribution numérique renforcent encore le potentiel de croissance du canal de vente indirecte.

Analyse régionale du marché européen des systèmes de sécurité

- Le Royaume-Uni a dominé le marché des systèmes de sécurité avec la plus grande part de revenus en 2024, grâce à sa base industrielle solide, son secteur manufacturier de pointe et ses réglementations strictes en matière de sécurité au travail dans des secteurs tels que l'automobile, l'aérospatiale et le pétrole et le gaz.

- Le leadership du pays est renforcé par l’adoption généralisée de l’automatisation, l’intégration de capteurs intelligents et de technologies de vision artificielle, ainsi que par des investissements continus dans la modernisation des infrastructures de sécurité industrielle.

- L'accent croissant mis sur le respect des normes de sécurité internationales, associé à la demande croissante de solutions de maintenance prédictive et de protection des travailleurs, renforce encore la position du Royaume-Uni.

Aperçu du marché allemand des systèmes de sécurité

L'Allemagne devrait enregistrer le TCAC le plus rapide d'Europe entre 2025 et 2032, grâce à l'essor des pratiques de l'Industrie 4.0, à l'adoption de la robotique avancée et à la dépendance croissante aux machines automatisées dans ses centres de production. Cette croissance est soutenue par les initiatives gouvernementales en faveur de la sécurité industrielle, les investissements massifs dans les usines intelligentes et la forte demande de systèmes de surveillance compatibles avec l'IoT. Le leadership du pays dans les secteurs de l'automobile, de l'ingénierie et de l'automatisation industrielle crée d'importantes opportunités pour les technologies de sécurité de nouvelle génération. L'accent mis par l'Allemagne sur l'intégration de la vision artificielle basée sur l'IA, des systèmes anticollision et des capteurs numériques dans les processus industriels accélère l'adoption de ces technologies et favorise une forte expansion du marché.

Aperçu du marché des systèmes de sécurité en France

La France devrait connaître une croissance soutenue entre 2025 et 2032, portée par un secteur industriel bien établi, l'adoption croissante de l'automatisation dans la construction et les transports, et une attention croissante portée à la conformité en matière de sécurité au travail. La demande croissante de capteurs de sécurité, de systèmes d'arrêt d'urgence et de technologies de protection des machines dans les secteurs de l'agroalimentaire et de l'électronique grand public stimule l'adoption de ces technologies. La collaboration entre les entreprises nationales et les fabricants internationaux de systèmes de sécurité améliore l'accessibilité, l'innovation produit et la pénétration du marché. L'accent mis par le pays sur les opérations durables, l'harmonisation réglementaire et l'adoption de technologies de sécurité numérique continue de consolider les perspectives du marché français.

Part de marché des systèmes de sécurité en Europe

L’industrie des systèmes de sécurité est principalement dirigée par des entreprises bien établies, notamment :

- Siemens (Allemagne)

- Panasonic Corporation (Japon)

- ABB (Suisse)

- Honeywell International Inc. (États-Unis)

- Rockwell Automation (États-Unis)

- Festo SE & Co. KG (Allemagne)

- Schneider Electric (France)

- SICK AG (Allemagne)

- KEYENCE CORPORATION (Japon)

- OMRON Corporation (Japon)

- Sensata Technologies, Inc. (États-Unis)

- Pepperl+Fuchs SE (Allemagne)

- Balluff GmbH (Allemagne)

- TankScan (États-Unis)

- Autonics Corporation (Corée du Sud)

- Hans Turck GmbH & Co. KG (Allemagne)

Derniers développements sur le marché européen des systèmes de sécurité

- En août 2024, Siemens Smart Infrastructure a présenté le SICAM Enhanced Grid Sensor (EGS), qui fait progresser significativement la digitalisation des réseaux de distribution. En assurant une surveillance continue et en prévenant les surcharges, cette solution prête à l'emploi permet aux gestionnaires de réseau d'optimiser l'utilisation des infrastructures existantes tout en garantissant une efficacité et une stabilité accrues. Cette innovation favorise l'intégration des énergies renouvelables au réseau, une nécessité croissante dans le cadre de la transition énergétique mondiale. Ce lancement renforce le leadership de Siemens sur le marché des solutions énergétiques intelligentes, le positionnant comme un partenaire privilégié des services publics en quête de transformation numérique et d'infrastructures résilientes.

- En décembre 2023, Panasonic Holdings Corporation a dévoilé un capteur inertiel 6-en-1 conçu pour améliorer la sécurité et les performances automobiles. En combinant plusieurs fonctionnalités de détection dans une seule unité compacte, cette innovation améliore la stabilité du véhicule et les systèmes d'aide à la conduite, répondant ainsi à la demande croissante de technologies de sécurité automobile avancées. Ce développement a renforcé la position de Panasonic sur le marché des capteurs automobiles, lui permettant d'accroître sa part de marché et de renforcer ses collaborations avec les constructeurs automobiles spécialisés dans les solutions de mobilité intelligente.

- En mai 2023, ABB a finalisé l'acquisition de l'activité moteurs NEMA basse tension de Siemens, une opération stratégique qui a élargi le portefeuille de moteurs industriels d'ABB. Grâce à cette acquisition, ABB a renforcé ses capacités de production et amélioré sa couverture de services auprès de clients internationaux dans des secteurs tels que l'automatisation, l'énergie et la fabrication. Ce développement a renforcé le leadership d'ABB sur le marché des moteurs industriels, lui permettant de répondre à la demande croissante de solutions de moteurs fiables et économes en énergie, tant sur les marchés développés qu'émergents.

- En janvier 2023, Honeywell International Inc. a renforcé son partenariat avec Nexceris afin de proposer des solutions de sécurité renforcées pour les véhicules électriques. En intégrant la technologie de capteurs de batterie d'Honeywell au système de détection de gaz Li-Ion Tamer de Nexceris, cette collaboration a permis de réduire les risques d'emballement thermique à l'origine des incendies de batteries de véhicules électriques. Ce partenariat a renforcé la position d'Honeywell sur le marché des solutions de sécurité automobile, notamment dans le secteur en pleine expansion des véhicules électriques, et a démontré sa capacité à proposer des technologies innovantes et vitales répondant aux exigences croissantes du secteur en matière de sécurité.

- En août 2022, Rockwell Automation a lancé ses capteurs photoélectriques Allen-Bradley 42EA RightSight S18 et 42JA VisiSight M20A, destinés aux industries exigeant des solutions de détection compactes, fiables et polyvalentes. Économiques, ces capteurs simplifient l'installation et la maintenance tout en offrant des performances élevées dans les environnements restreints. Ce lancement a renforcé la position de Rockwell sur les marchés de l'automatisation industrielle et des capteurs en répondant à la demande de technologies de détection économiques et avancées, élargissant ainsi sa clientèle à diverses applications industrielles.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.