Europe Resting Electrocardiograph Ecg Market

Taille du marché en milliards USD

TCAC :

%

USD

1.19 Billion

USD

2.07 Billion

2024

2032

USD

1.19 Billion

USD

2.07 Billion

2024

2032

| 2025 –2032 | |

| USD 1.19 Billion | |

| USD 2.07 Billion | |

|

|

|

|

Segmentation du marché européen des électrocardiographes de repos (ECG), par produit (ECG, moniteurs, logiciels et services, enregistreurs de boucle implantables et appareil de télémétrie cardiaque mobile ), nombre de dérivations (12, 15, 18 dérivations et autres), technologie (numérique et analogique), modalité (fixe et mobile), taille de l'appareil (grand, moyen et petit), connectivité (filaire et sans fil), mode de fonctionnement (automatique, semi-automatique et manuel), utilisateur final (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire, soins à domicile et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché européen des électrocardiographes de repos (ECG)

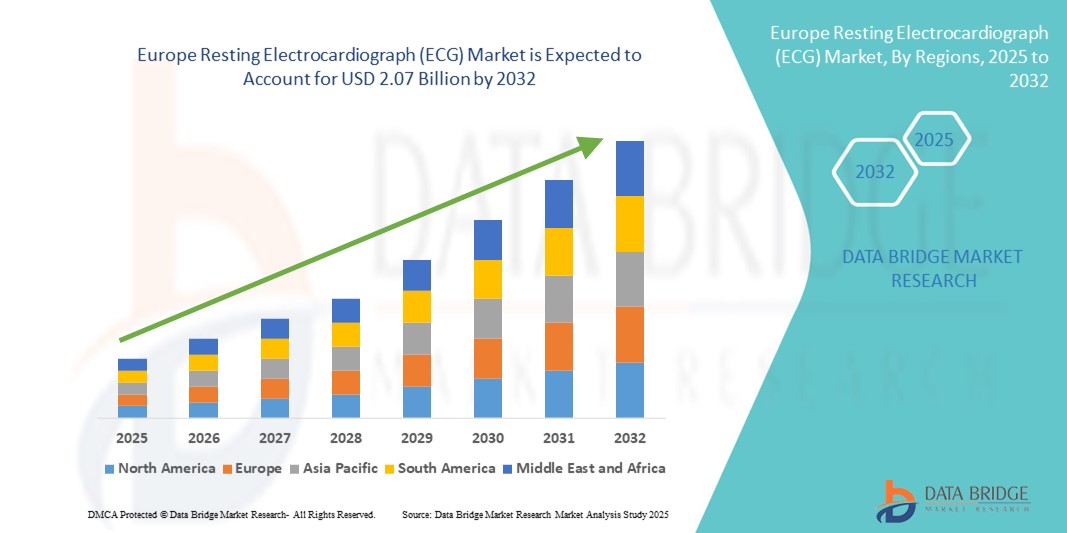

- La taille du marché européen des électrocardiographes de repos (ECG) était évaluée à 1,19 milliard USD en 2024 et devrait atteindre 2,07 milliards USD d'ici 2032 , à un TCAC de 7,10 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante et les avancées technologiques dans le domaine du diagnostic médical, en particulier dans les soins cardiaques, ce qui conduit à une numérisation et une intégration accrues des infrastructures de soins de santé dans les milieux hospitaliers et ambulatoires en Europe.

- Par ailleurs, la demande croissante de surveillance cardiaque précise, non invasive et en temps réel fait des électrocardiographes de repos (ECG) un outil de diagnostic essentiel. Ces facteurs convergents accélèrent l'adoption des solutions d'ECG de repos en Europe, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché européen des électrocardiographes de repos (ECG)

- Les systèmes d'électrocardiographe de repos (ECG), qui capturent l'activité électrique du cœur pendant que le patient est au repos, sont des outils de diagnostic essentiels dans les systèmes de santé européens en raison de leur fiabilité, de leur conception non invasive et de leur efficacité à détecter les affections cardiovasculaires telles que les arythmies, l'infarctus du myocarde et l'insuffisance cardiaque.

- La demande d'ECG de repos continue de croître en Europe en raison du vieillissement de la population, de l'incidence croissante des maladies cardiaques et d'une sensibilisation croissante aux soins cardiaques préventifs. De plus, l'intégration des systèmes d'ECG numériques aux dossiers médicaux électroniques (DME), aux outils d'analyse basés sur l'IA et aux plateformes mobiles améliore considérablement la rapidité et la précision du diagnostic.

- L'Allemagne a dominé le marché européen des électrocardiographes de repos (ECG) avec la plus grande part de chiffre d'affaires (33,3 %) en 2024, grâce à son infrastructure de santé de pointe, à l'importance accordée au diagnostic cardiovasculaire précoce et à l'adoption généralisée des systèmes ECG à 12 dérivations dans les hôpitaux publics et privés. Le leadership du pays dans la fabrication de technologies médicales et ses investissements dans les services de télécardiologie favorisent encore l'adoption de l'ECG.

- Le Royaume-Uni devrait être le marché européen de l'électrocardiogramme de repos (ECG) à la croissance la plus rapide, avec un TCAC de 10,1 % sur la période de prévision (2025-2032). Cette croissance est tirée par la charge croissante des maladies cardiovasculaires, le recours accru à la surveillance ECG à domicile pour les patients âgés et les initiatives gouvernementales visant à moderniser les services de diagnostic du NHS grâce à des plateformes ECG basées sur l'IA et des unités de diagnostic mobiles.

- Le segment des électrocardiographes de repos (ECG) à 12 dérivations a dominé le marché européen des ECG de repos en 2024, avec une part de marché de 51,3 %, grâce à son utilisation standard en milieu hospitalier pour des évaluations cardiaques complètes. Il offre une vue détaillée de l'activité électrique du cœur, facilitant ainsi un diagnostic précis.

Portée du rapport et segmentation du marché européen des électrocardiographes de repos (ECG)

|

Attributs |

Informations clés sur le marché européen de l'électrocardiographe de repos (ECG) |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché européen des électrocardiographes de repos (ECG)

« Progrès en matière d'intégration numérique et de précision diagnostique »

- L'intégration croissante de l'intelligence artificielle (IA), de la connectivité cloud et des plateformes de santé mobiles dans les systèmes ECG constitue une tendance majeure et croissante sur le marché européen des électrocardiographes de repos (ECG). Ces avancées technologiques améliorent considérablement la rapidité, la précision et l'accessibilité du diagnostic, tant en clinique qu'à distance.

- Par exemple, les systèmes ECG basés sur l'IA peuvent désormais détecter des anomalies cardiaques subtiles plus tôt que les méthodes traditionnelles, en analysant de grands volumes de données patients et en reconnaissant des schémas complexes. Des appareils d'entreprises comme GE HealthCare et Philips intègrent des algorithmes d'apprentissage automatique pour aider les cliniciens à interpréter les données ECG en temps réel.

- Les appareils ECG mobiles et sans fil, tels que les moniteurs ECG portables à dérivation unique et les systèmes à patch, sont de plus en plus populaires auprès des patients et des professionnels de santé. Ces appareils permettent une surveillance continue en dehors du cadre clinique et peuvent transmettre les données aux professionnels de santé via Bluetooth ou des plateformes cloud pour une analyse et une intervention immédiates.

- L'intégration des systèmes d'ECG aux plateformes de télésanté permet le diagnostic à distance, réduisant ainsi le recours aux consultations en présentiel et élargissant l'accès aux soins cardiaques, notamment dans les populations rurales et vieillissantes. Cette évolution s'inscrit dans les stratégies nationales de santé de pays comme le Royaume-Uni et l'Allemagne, visant à moderniser la prise en charge des maladies chroniques grâce à une infrastructure de santé numérique.

- Les appareils ECG portables et les applications ECG connectées aux smartphones révolutionnent le secteur de la santé cardiaque grand public, offrant la détection des arythmies en temps réel, le suivi de la fréquence cardiaque et la synchronisation des données avec les dossiers médicaux électroniques (DME). Des entreprises comme AliveCor et Withings ouvrent la voie en Europe avec des appareils marqués CE et homologués pour une utilisation à domicile.

- Alors que les patients privilégient de plus en plus la surveillance en temps réel et que les cliniciens recherchent une meilleure assistance diagnostique, la demande de solutions d'ECG de repos intelligentes, connectées et conviviales ne cesse de croître sur le marché européen. Ces innovations améliorent non seulement les résultats cliniques, mais optimisent également l'efficacité des flux de travail et optimisent la continuité des soins.

Dynamique du marché européen des électrocardiographes de repos (ECG)

Conducteur

« Besoin croissant en raison de la charge croissante des maladies cardiovasculaires et de l'adoption de la santé numérique »

- La prévalence croissante des maladies cardiovasculaires (MCV) telles que les arythmies, les cardiopathies ischémiques et l'insuffisance cardiaque, associée à l'importance croissante accordée au diagnostic précoce et aux soins préventifs, stimule considérablement la demande de systèmes ECG de repos dans toute l'Europe.

- Par exemple, en mars 2024, Koninklijke Philips NV a lancé une plateforme logicielle ECG basée sur l'IA, conçue pour aider les cliniciens à détecter plus précisément les anomalies cardiaques au point de service, témoignant ainsi d'une tendance croissante vers le diagnostic intelligent. De telles stratégies devraient soutenir la croissance du marché européen des électrocardiographes de repos (ECG) au cours de la période de prévision.

- Alors que les systèmes de santé privilégient la rentabilité et les soins ambulatoires, les appareils ECG de repos sont de plus en plus adoptés dans les cliniques primaires, les milieux ambulatoires et même à domicile, en raison de leur simplicité et de leur utilité diagnostique.

- De plus, l'intégration croissante des plateformes de santé numériques, des dossiers médicaux électroniques (DME) et de la surveillance cardiaque à distance fait des systèmes d'ECG au repos un élément essentiel des flux de travail de diagnostic modernes, soutenant la prise de décision clinique avec des informations sur les données en temps réel.

- L'adoption d'appareils ECG compacts, sans fil et portables, offrant simplicité d'utilisation, diagnostics plus rapides et compatibilité avec la télésanté, accélère encore leur pénétration sur le marché, tant dans les établissements de santé publics que privés. L'essor de la surveillance ECG portable et des appareils connectés transforme également la prise en charge des soins cardiovasculaires.

Retenue/Défi

« Préoccupations liées à la confidentialité des données et coûts élevés d'intégration des systèmes »

- Malgré les avantages des solutions d'ECG numériques, les préoccupations concernant la confidentialité des données, l'interopérabilité et la sécurité du stockage posent des défis importants, en particulier dans les services de télécardiologie transfrontaliers en Europe.

- Par exemple, les failles de cybersécurité et les inquiétudes concernant la conformité au Règlement général sur la protection des données (RGPD) ont rendu de nombreux prestataires de soins de santé prudents quant à l'adoption du stockage de données ECG et de l'analyse de l'IA dans le cloud.

- Pour répondre à ces préoccupations, les fabricants doivent garantir un chiffrement de bout en bout, un traitement des données conforme au RGPD et des protocoles d'authentification robustes. Des entreprises comme Schiller AG et GE Healthcare mettent l'accent sur la connectivité sécurisée et la conformité des plateformes de données dans leurs actions marketing.

- En outre, le coût relativement élevé de l'intégration des systèmes d'ECG au repos avec l'infrastructure informatique de l'hôpital, le PACS (système d'archivage et de communication d'images) et le logiciel DSE peut dissuader les petites cliniques et les hôpitaux publics à budget limité de passer complètement aux plateformes d'ECG numériques.

- Bien que les coûts devraient diminuer avec l'augmentation de l'innovation et de la concurrence, l'investissement initial pour les systèmes ECG multi-dérivations de haute qualité reste un obstacle à l'adoption massive, en particulier en Europe de l'Est et dans les segments de santé sous-financés.

- Relever ces défis grâce à des modèles de tarification évolutifs, des diagnostics basés sur le cloud et des plateformes ECG modulaires sera essentiel pour parvenir à une pénétration plus profonde du marché et à une croissance à long terme.

Portée du marché européen des électrocardiographes de repos (ECG)

Le marché est segmenté sur la base du produit, du nombre de prospects, de la technologie, de la modalité, de la taille de l'appareil, de la connectivité, du mode de fonctionnement et de l'utilisateur final.

- Par produit

En fonction du produit, le marché européen des électrocardiographes de repos (ECG) est segmenté en appareils ECG, moniteurs, logiciels et services, enregistreurs de boucle implantables et appareils de télémétrie cardiaque mobiles. Le segment des appareils ECG détenait la plus grande part de marché, soit 38,6 % en 2024, en raison de leur utilisation répandue dans les diagnostics cardiaques de routine dans les hôpitaux et les cliniques. Ces appareils sont essentiels à la détection des arythmies, des cardiopathies ischémiques et d'autres anomalies cardiovasculaires.

Le segment des appareils de télémétrie cardiaque mobiles devrait connaître le TCAC le plus rapide de 20,9 % entre 2025 et 2032, en raison de la demande croissante de surveillance cardiaque à distance en temps réel et de l'incidence croissante des maladies cardiaques chroniques parmi la population vieillissante.

- Par nombre de prospects

En fonction du nombre de dérivations, le marché européen des électrocardiographes de repos (ECG) est segmenté en 12, 15 et 18 dérivations, entre autres. Le segment des 12 dérivations a dominé le marché en 2024, avec une part de chiffre d'affaires de 51,3 %, grâce à son utilisation courante en milieu hospitalier pour des évaluations cardiaques complètes. Il fournit une vue détaillée de l'activité électrique du cœur, facilitant ainsi un diagnostic précis.

Le segment des 15 dérivations devrait connaître une croissance au TCAC le plus élevé de 18,7 % au cours de la période de prévision, car il offre une détection améliorée des infarctus postérieurs et ventriculaires droits, en particulier dans les contextes de soins avancés et de cardiologie.

- Par technologie

Sur le plan technologique, le marché est segmenté en numérique et analogique. Le segment numérique représentait la plus grande part de chiffre d'affaires, soit 72,4 % en 2024, grâce à sa précision supérieure, sa capacité à stocker et à partager des données par voie électronique et sa compatibilité avec les plateformes de télésanté.

Le segment analogique, bien qu’en déclin, reste pertinent dans les environnements à faibles ressources et devrait connaître une croissance modeste en raison de son prix abordable et de sa simplicité.

- Par modalité

En fonction de la modalité, le marché européen des électrocardiographes de repos (ECG) est segmenté en systèmes ECG fixes et mobiles. Le segment fixe détenait une part dominante de 61,1 % en 2024, grâce à des taux d'installation élevés dans les hôpitaux et les centres de diagnostic pour une utilisation à long terme.

Le segment mobile devrait connaître une croissance TCAC très rapide de 22,3 % entre 2025 et 2032, soutenue par la demande croissante de portabilité, de diagnostics à domicile et de prestations de soins de santé par télémédecine.

- Par taille d'appareil

En fonction de la taille des appareils, le marché européen des électrocardiographes de repos (ECG) est segmenté en grandes, moyennes et petites tailles. Le segment des appareils ECG de taille moyenne a conquis la plus grande part de marché, avec 44,5 % en 2024, car ils allient portabilité et fonctionnalité, ce qui les rend idéaux pour les cliniques et les services ambulatoires.

Le segment des petits appareils devrait connaître une croissance au TCAC le plus élevé de 21,1 %, alimentée par l'intérêt accru des consommateurs pour les moniteurs ECG portables et les appareils de santé compatibles avec les smartphones.

- Par connectivité

En termes de connectivité, le marché européen des électrocardiographes de repos (ECG) est segmenté en modèles filaires et sans fil. Le segment filaire représentait la plus grande part de marché, avec 58,6 % en 2024, notamment en milieu hospitalier où une transmission ECG sécurisée et continue est essentielle.

Le segment sans fil devrait enregistrer le taux de croissance le plus rapide de 23,6 % entre 2025 et 2032, en raison de l'adoption rapide des systèmes ECG Bluetooth et connectés au cloud qui permettent la surveillance à distance et le partage de données en temps réel.

- Par mode de fonctionnement

En fonction du mode de fonctionnement, le marché européen des électrocardiographes de repos (ECG) est segmenté en modèles automatiques, semi-automatiques et manuels. Le segment automatique détenait la plus grande part de marché, soit 49,3 % en 2024, grâce à la préférence pour les systèmes réduisant l'intervention de l'opérateur et améliorant la cohérence diagnostique.

Le segment semi-automatique devrait connaître le TCAC le plus rapide de 19,8 %, car il offre un équilibre rentable entre le contrôle manuel et l'automatisation, en particulier dans les environnements cliniques de niveau intermédiaire.

- Par utilisateur final

En fonction de l'utilisateur final, le marché européen des électrocardiographes de repos (ECG) est segmenté en hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire, services de soins à domicile, etc. Le segment hospitalier a dominé avec une part de marché de 46,2 % en 2024, grâce à un volume important de patients, à la disponibilité d'équipements de diagnostic avancés et à la compétence des professionnels.

Le segment des soins à domicile est sur le point de connaître un TCAC maximal de 24,7 % entre 2025 et 2032, grâce à l’évolution vers des soins centrés sur le patient, à l’essor de la gestion des maladies chroniques à domicile et à l’utilisation croissante de solutions ECG portables.

Analyse régionale du marché européen des électrocardiographes de repos (ECG)

- L'Europe a dominé le marché mondial des électrocardiographes de repos (ECG) avec la plus grande part de revenus de 36,7 % en 2024, sous l'effet de la charge croissante des maladies cardiovasculaires (MCV), de la demande croissante de solutions de diagnostic précoce et des initiatives de dépistage médical soutenues par le gouvernement.

- La croissance de la population gériatrique, la forte prévalence des maladies cardiaques liées au mode de vie et l'accent mis sur les soins de santé préventifs sont des facteurs clés qui stimulent l'adoption de systèmes d'ECG au repos dans les hôpitaux, les cliniques et les établissements de soins primaires de la région.

- En outre, l'intégration de technologies numériques telles que l'interprétation d'ECG basée sur l'IA, la connectivité au cloud et l'interopérabilité avec les DSE soutient davantage la croissance du marché en améliorant la précision du diagnostic et l'efficacité du flux de travail clinique.

Aperçu du marché britannique des électrocardiographes de repos (ECG)

Le marché mondial des électrocardiographes de repos (ECG) au Royaume-Uni connaît une forte croissance, portée par l'augmentation des cas d'arythmie et d'hypertension, ainsi que par l'accent mis par le NHS sur le diagnostic cardiaque précoce en soins primaires. Les campagnes de santé cardiaque financées par le gouvernement et la disponibilité accrue des appareils ECG dans les établissements de santé de proximité encouragent leur utilisation généralisée. L'intégration croissante de l'analyse ECG par IA et des solutions ECG mobiles contribue également à une prise de décision clinique plus rapide et plus précise.

Aperçu du marché allemand des électrocardiographes de repos (ECG)

Le marché mondial allemand de l'électrocardiographe de repos (ECG) occupe une place prépondérante, avec 33,3 % du marché européen de l'ECG de repos, grâce à son infrastructure cardiologique avancée, à la large adoption des solutions de santé numériques et à ses dépenses de santé élevées. Le solide soutien réglementaire du pays à l'innovation dans les technologies médicales et la demande croissante de diagnostics cardiaques non invasifs chez les patients âgés favorisent l'adoption de systèmes ECG portables et multi-dérivations, tant dans les hôpitaux urbains que dans les cliniques rurales.

Aperçu du marché français des électrocardiographes de repos (ECG)

Le marché mondial français de l'électrocardiogramme de repos (ECG) est en constante expansion, soutenu par les directives gouvernementales en matière de dépistage cardiaque systématique et l'accent mis sur la prévention des accidents vasculaires cérébraux (AVC). L'adoption de plateformes ECG en cloud, notamment dans les hôpitaux publics, améliore l'accès aux diagnostics cardiologiques dans les régions mal desservies. De plus, la collaboration entre les établissements de santé et les fabricants d'ECG améliore la formation et la mise en œuvre des outils ECG numériques.

Aperçu du marché italien des électrocardiographes de repos (ECG)

Le marché mondial italien des électrocardiographes de repos (ECG) est stimulé par la charge croissante des maladies coronariennes et par les programmes gouvernementaux favorisant l'évaluation du risque cardiovasculaire chez les personnes âgées. L'évolution croissante du système de santé italien vers les soins à domicile et la surveillance ambulatoire crée une demande pour des systèmes ECG compacts et conviviaux. L'intégration du diagnostic ECG dans les plateformes de télécardiologie prend également de l'ampleur.

Aperçu du marché espagnol des électrocardiographes de repos (ECG)

Le marché mondial espagnol des électrocardiographes de repos (ECG) connaît une croissance significative de l'adoption de ces appareils, principalement grâce au développement des infrastructures de soins cardiaques et aux partenariats public-privé visant à moderniser les diagnostics. La sensibilisation accrue à l'arrêt cardiaque soudain (ACS) et l'importance du dépistage par ECG dans les milieux sportifs et de santé au travail favorisent la pénétration du marché, notamment dans les cliniques et les centres de bien-être.

Part de marché des électrocardiographes de repos (ECG) en Europe

L'industrie européenne des électrocardiographes de repos (ECG) est principalement dirigée par des entreprises bien établies, notamment :

- GE Healthcare (États-Unis)

- Koninklijke Philips NV (Pays-Bas)

- Baxter (États-Unis)

- SCHILLER AG (Suisse)

- Cardioline SPA (Italie)

- EDAN Instruments, Inc. (Chine)

- FUKUDA DENSHI (Japon)

- Personal MedSystems GmbH (Allemagne)

- VYAIRE MEDICAL, INC. (États-Unis)

- Innomed Medical Inc. (Hongrie)

- Norav Medical (États-Unis)

- OSI Systems, Inc. (Spacelabs Healthcare) (États-Unis)

- Lepu Medical Technology (Beijing) Co., Ltd. (Chine)

- Dawei Médical (Chine)

- Gima SPA (Italie)

- Zimmer Benelux BV (Allemagne)

- AMEDTEC Medizintechnik Aue GmbH (Allemagne)

- BTL (Inde)

- Contec Medical Systems Co., Ltd (Chine)

Derniers développements sur le marché européen des électrocardiographes de repos (ECG)

- En mars 2022, Cardioline SPA, fabricant italien leader de technologies ECG, a rejoint l'initiative PariSanté Campus pour favoriser l'innovation en santé numérique en Europe. Grâce à ce partenariat, l'entreprise vise à accélérer le développement du diagnostic ECG et à intégrer des analyses basées sur l'IA pour une meilleure évaluation du risque cardiovasculaire.

- En avril 2023, Philips a lancé sa nouvelle solution d'ECG de repos à 12 dérivations, intégrée à l'IA, destinée aux hôpitaux et cliniques spécialisées d'Europe. Ce système améliore la précision du diagnostic grâce à un traitement avancé du signal et prend en charge l'interprétation des ECG à distance, facilitant ainsi la prestation de soins en milieu urbain comme rural.

- En février 2023, GE HealthCare a lancé le système ECG MAC VU360 en Allemagne, en France et au Royaume-Uni. Cet appareil ECG haut de gamme est conçu pour automatiser les flux de travail dans les grands hôpitaux et les laboratoires de diagnostic. Ses algorithmes d'apprentissage profond offrent une meilleure détection des arythmies et un reporting plus rapide pour les équipes cardiaques.

- En janvier 2023, Schiller AG, société suisse spécialisée dans les technologies ECG, a annoncé un partenariat avec plusieurs hôpitaux d'Europe de l'Est afin d'élargir l'accès à son système ECG CARDIOVIT AT-102 G2. Cet appareil, doté de fonctionnalités USB et sans fil, contribue à moderniser les services de cardiologie des cliniques de taille moyenne de l'UE.

- En décembre 2022, Nihon Kohden Europe GmbH a dévoilé son système ECG Cardiofax S amélioré, optimisé pour une utilisation dans les centres de cardiologie à haut débit au Royaume-Uni et en Allemagne. Il intègre une détection avancée des dérivations, des capacités d'impression plus rapides et une intégration transparente aux systèmes d'information hospitaliers (SIH).

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.