Marché européen de la surveillance et des soins à distance des patients, par type d'appareil (appareils de surveillance cardiaque, appareils de surveillance de la pression artérielle, appareils de surveillance de la glycémie, appareils de surveillance respiratoire, appareils de surveillance neurologique, appareils de surveillance multiparamétrique et autres), application (oncologie, diabète, maladies cardiovasculaires et autres), utilisateur final (patients hospitalisés, patients ambulatoires et patients recevant des soins à domicile) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de la surveillance et des soins à distance des patients en Europe

L'approche RPM et soins en matière de prestation de soins de santé est devenue de plus en plus populaire ces dernières années, notamment en raison de la pandémie de COVID-19, qui a entraîné une demande accrue d'options de soins à distance. La sensibilisation croissante à la RPM et aux soins à l'échelle mondiale a renforcé la demande pour le marché. L'augmentation des dépenses de santé pour de meilleurs services de santé contribue également à la croissance du marché. Les principaux acteurs du marché se concentrent sur divers lancements et approbations de services pendant cette période cruciale. En outre, l'augmentation des progrès technologiques améliorés des appareils contribue également à la demande croissante de RPM et de soins.

Le marché européen de la surveillance et des soins à distance des patients devrait croître au cours de l'année de prévision en raison de l'augmentation du nombre d'acteurs sur le marché et de la disponibilité d'appareils de surveillance à distance avancés. Parallèlement à cela, les fabricants sont engagés dans l'activité de développement pour lancer de nouveaux appareils et des produits RPM efficaces et précis sur le marché. Le développement croissant dans le domaine des techniques de soins de santé avancées stimule encore la croissance du marché. Cependant, des difficultés telles que les réglementations strictes pour la production et la commercialisation de RPM et de produits de soins devraient freiner la croissance du marché au cours de la période de prévision.

L'augmentation des dépenses consacrées au développement et à l'avancement des soins de santé devrait offrir des opportunités de croissance du marché. Cependant, le coût élevé des dispositifs de surveillance et de soins à distance devrait constituer un défi à la croissance du marché.

Diverses entreprises prennent des initiatives qui conduisent progressivement à une croissance du marché.

Par exemple,

- En janvier 2023, CoachCare a annoncé l'acquisition de la société RPM NVOLVE, basée à Winston-Salem, afin d'étendre son expertise RPM dans le domaine de la douleur, de la colonne vertébrale et de l'orthopédie. Cette acquisition aiderait l'entreprise dans son portefeuille de produits et son expansion commerciale.

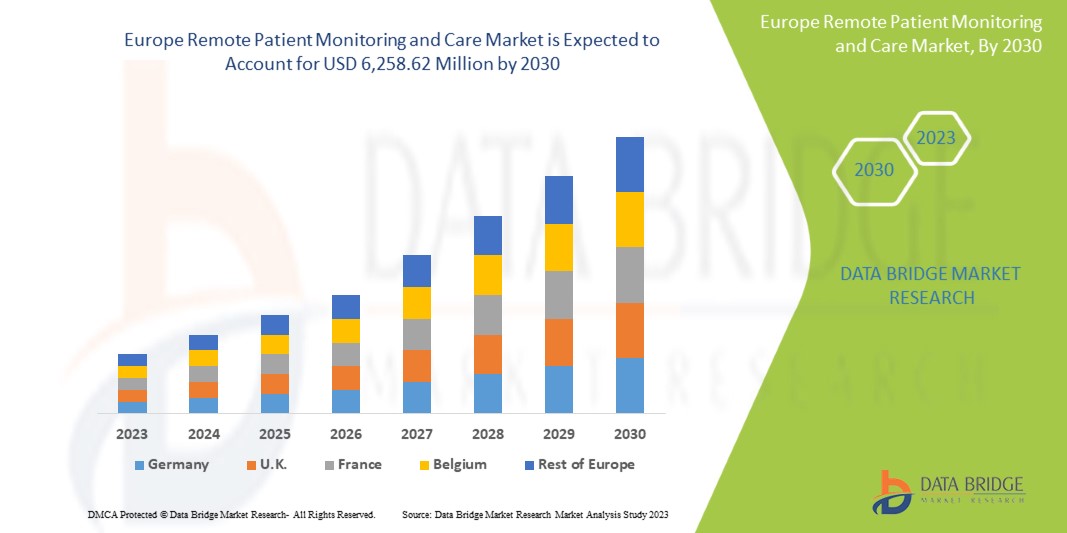

Data Bridge Market Research analyse que le marché européen de la surveillance et des soins à distance des patients devrait atteindre la valeur de 6 258,62 millions USD d'ici 2030, à un TCAC de 14,2 % au cours de la période de prévision 2023-2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type d'appareil (appareils de surveillance cardiaque, appareils de surveillance de la pression artérielle, appareils de surveillance de la glycémie, appareils de surveillance respiratoire, appareils de surveillance neurologique, appareils de surveillance multiparamétrique et autres), application (oncologie, diabète, maladies cardiovasculaires et autres), utilisateur final (patients hospitalisés, patients ambulatoires et patients recevant des soins à domicile) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Espagne, Belgique, Turquie, Pays-Bas, Russie, Suisse, Reste de l'Europe |

|

Acteurs du marché couverts |

Medtronic, Boston Scientific Corporation, VitalConnect, Biobeat, General Electric, Koninklijke Philips NV, OMRON Corporation, Abbott, Nihon Kohden Corporation, Vivify Health, Inc., Aerotel Medical Systems, BIOTRONIK SE & Co. KG, A&D Company, Limited, AliveCor, Inc., Masimo, Dexcom, Inc., Senseonics, Inc., ResMed, 100Plus., ChroniSense Medical, Ltd., Vitls, cardiomo, CoachCare, neteera et Withings, entre autres |

Définition du marché

La surveillance et les soins à distance des patients (RPM) constituent un modèle de prestation de soins de santé qui permet aux prestataires de soins de surveiller les patients à distance, à l'aide de divers appareils technologiques et outils de communication, sans avoir besoin de visites en face à face. Cette approche permet aux prestataires de soins de santé de prodiguer des soins et de suivre les données de santé des patients à distance, souvent en temps réel.

Le RPM implique généralement l'utilisation d'appareils portables dotés de capteurs et d'autres dispositifs technologiques qui peuvent suivre les signes vitaux d'un patient, l'observance du traitement, l'activité physique et d'autres informations liées à la santé. Les données collectées sont ensuite transmises aux prestataires de soins de santé qui peuvent analyser les informations et prendre les mesures appropriées, telles que l'ajustement des dosages des médicaments, la fourniture de conseils sur les changements de mode de vie ou la planification de rendez-vous de suivi.

Dynamique du marché européen de la télésurveillance et des soins aux patients

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteur

- Prévalence croissante des maladies chroniques

Le marché est en pleine expansion pour diverses raisons, notamment la prévalence croissante des maladies chroniques. Les maladies chroniques sont des maladies non transmissibles qui durent longtemps et nécessitent des soins médicaux et une gestion continus.

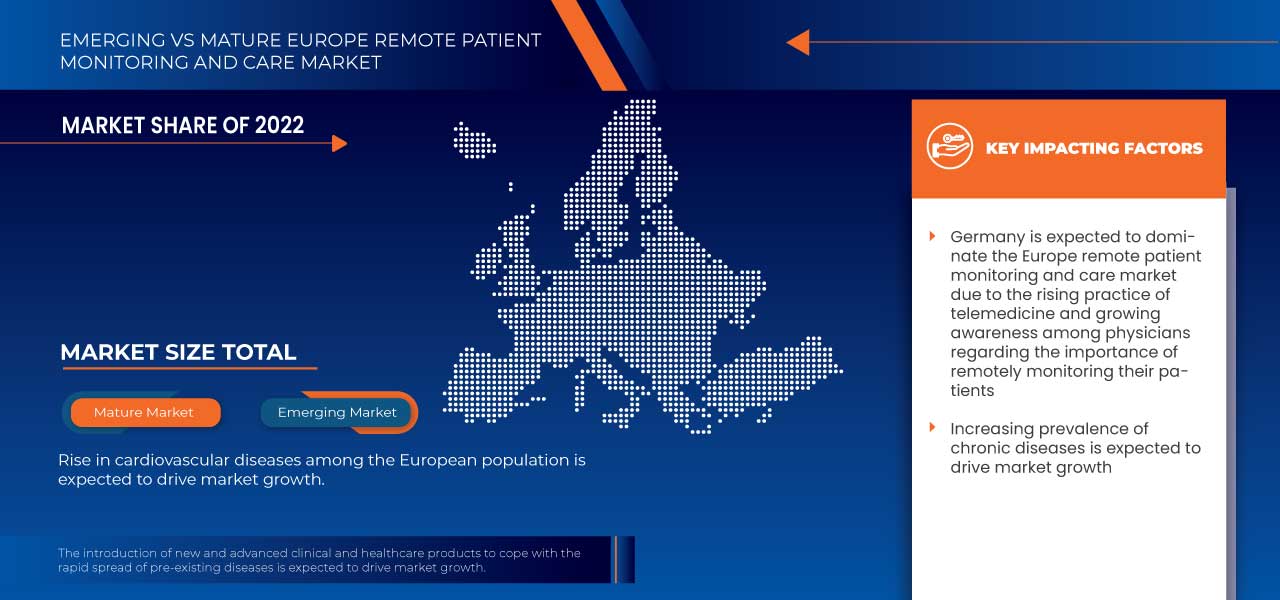

Selon l’Organisation mondiale de la santé, les maladies chroniques sont responsables de près de 70 % des décès dans le monde, les maladies cardiovasculaires étant la principale cause. La prévalence croissante des maladies chroniques est due à de nombreuses variables, notamment le vieillissement de la population, la sédentarité, la mauvaise alimentation et les facteurs environnementaux. La gestion des maladies chroniques et les soins peuvent aider les prestataires de soins de santé à gérer les maladies chroniques de manière plus efficace et efficiente.

En raison du mode de vie sédentaire des personnes, la prévalence des troubles associés au mode de vie tels que l'hypertension et le diabète a augmenté. Ainsi, la prévalence croissante des maladies chroniques avec l'intégration croissante des données de santé aux appareils portables devrait exiger une gestion de la santé appropriée, ce qui entraînera une demande croissante de RPM et de soins sur le marché au cours de la période de prévision.

Retenue

- Cadre réglementaire strict

Les organismes de réglementation jouent un rôle essentiel pour garantir que les technologies de surveillance à distance des patients répondent aux normes de sécurité et de qualité et protègent la confidentialité des patients. Cependant, la conformité réglementaire peut constituer un obstacle important à l'entrée sur le marché pour de nombreuses entreprises et peut ralentir l'adoption des technologies de surveillance à distance des patients.

La réglementation relative aux dispositifs médicaux a pour mission de protéger la santé des personnes travaillant dans le secteur des dispositifs médicaux. Elle impose aux fabricants d'intégrer des systèmes de qualité (fondés sur des normes internationales reconnues en la matière) dans le processus de conception des dispositifs de classe III et IV. Elle impose également aux fabricants de les intégrer dans le processus de fabrication des dispositifs de classe II, III et IV.

En plus de cette réglementation stricte sur les dispositifs médicaux, il a également été signalé que la décision de Santé Canada concernant les demandes d'homologation de dispositifs médicaux n'est pas opportune. Elle implique l'examen des preuves scientifiques présentées par les fabricants pour garantir l'efficacité de divers dispositifs.

Cela suggère qu'une procédure aussi fastidieuse a conduit au développement d'autres appareils technologiquement avancés et pose donc un défi de taille aux fabricants d'appareils lors de la soumission de la documentation d'approbation.

Les réglementations imposées retarderaient la fourniture des instruments et l'homologation à long terme des appareils. Ce facteur devrait freiner la croissance du marché.

Opportunité

-

Initiatives stratégiques des acteurs du marché

Les initiatives stratégiques prises par les principaux acteurs du marché ont contribué à l'essor des technologies et aux avancées dans les produits et dispositifs de surveillance à distance des patients. Ils prennent des initiatives telles que des lancements de produits, des collaborations, des fusions et des acquisitions, entre autres, qui devraient créer davantage d'opportunités de croissance du marché.

Les fournisseurs de produits de santé ont une énorme opportunité de travailler avec de nouvelles entreprises technologiques pour assurer la croissance continue, la créativité et la viabilité du secteur.

Pour découvrir et développer des installations avancées de surveillance à distance, les entreprises lancent de nouvelles initiatives et collaborent avec d’autres acteurs clés pour fournir des résultats et des services plus fiables.

Ces initiatives stratégiques telles que les lancements de produits, les approbations, les acquisitions et les fusions réalisées par les grandes entreprises du marché ont ouvert une opportunité pour les entreprises de diverses régions. Cette stratégie permet aux entreprises de renforcer leur présence sur le marché. Par conséquent, il est prévu que l'initiative stratégique devrait offrir une opportunité de croissance du marché.

Défi

- Manque de professionnels qualifiés

La surveillance à distance des patients nécessite une gamme de professionnels dotés de connaissances et d’une expertise spécialisées, notamment des cliniciens, des techniciens et des analystes de données.

Les cliniciens sont responsables de la surveillance à distance de la santé des patients et de l’interprétation des données recueillies par les dispositifs de surveillance à distance des patients.

De plus, les techniciens sont responsables de l'installation, de la maintenance et du dépannage des dispositifs de surveillance à distance des patients. Les analystes de données sont chargés d'analyser les données collectées par les dispositifs de surveillance à distance des patients et de fournir des informations aux prestataires de soins de santé. Cependant, il existe actuellement une pénurie d'analystes de données, de cliniciens et de techniciens possédant les compétences et l'expérience nécessaires pour fournir des informations utiles à partir des données de surveillance à distance des patients.

Le manque de professionnels qualifiés peut également limiter l’adoption des technologies RPM et limiter leur potentiel à améliorer les résultats des soins de santé. Sans professionnels qualifiés, les prestataires de soins de santé peuvent avoir du mal à interpréter les données des patients et à fournir des interventions appropriées, ce qui limite l’efficacité des technologies RPM pour améliorer les résultats des patients. Ainsi, le manque de professionnels qualifiés est un facteur important qui devrait constituer un défi à la croissance du marché.

Développements récents

- En janvier 2023, Masimo et Philips ont annoncé l'extension de leur partenariat pour augmenter les capacités de surveillance des patients dans les applications de télésanté à domicile avec la montre de suivi de santé avancée Masimo W1. Cette extension de collaboration aiderait l'entreprise à élargir son portefeuille de produits de surveillance à distance des patients.

- En décembre 2022, Masimo a annoncé la commercialisation complète de l'indice d'hydratation (Hi) pour la montre Masimo W1. La Masimo W1, un dispositif portable de suivi de la santé avancé, est la première montre à offrir des mesures d'oxymétrie de pouls précises et continues et des données de santé pertinentes, provenant du leader de l'oxymétrie de pouls hospitalière. Cette mise à niveau du produit aiderait l'entreprise à développer son activité produits.

Portée du marché européen de la surveillance et des soins à distance des patients

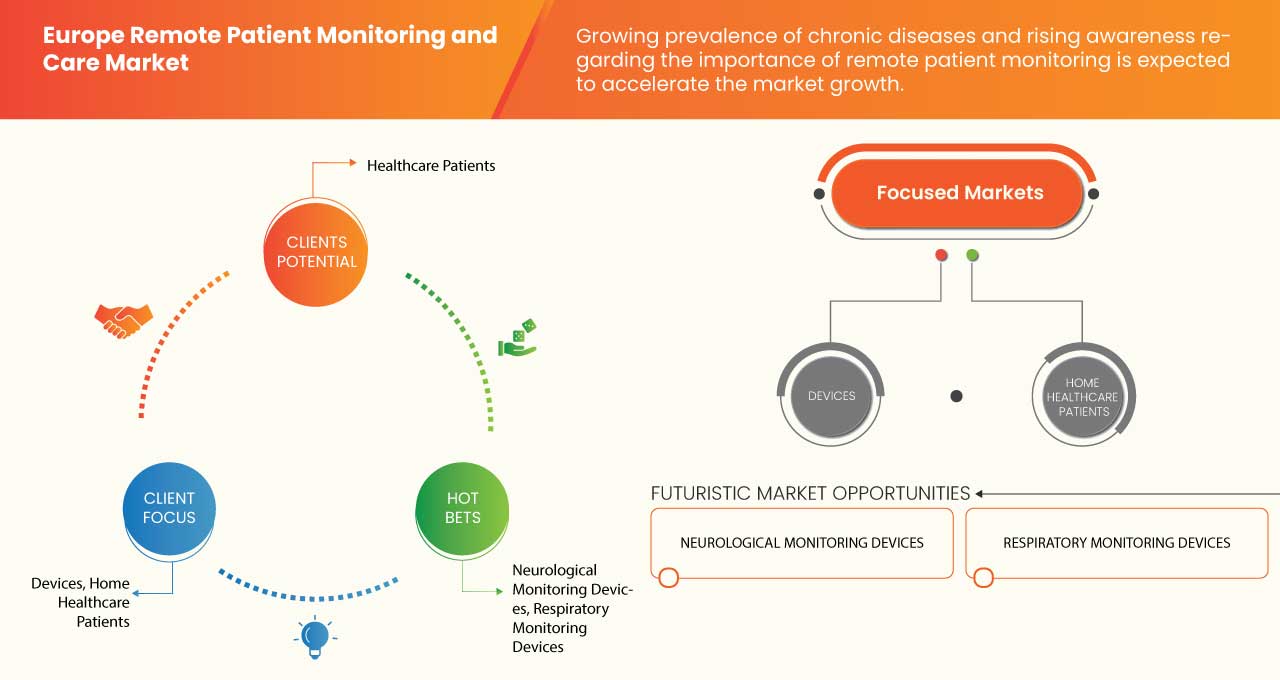

Le marché européen de la télésurveillance et des soins aux patients est segmenté en trois segments importants, à savoir le type d'appareil, l'application et l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type d'appareil

- Dispositifs de surveillance cardiaque

- Appareils de surveillance de la pression artérielle

- Appareils de surveillance de la glycémie

- Appareils de surveillance respiratoire

- Dispositifs de surveillance neurologique

- Dispositifs de surveillance multiparamètres

- Autres

Sur la base du type d'appareil, le marché est segmenté en appareils de surveillance cardiaque, appareils de surveillance de la pression artérielle, appareils de surveillance de la glycémie, appareils de surveillance respiratoire, appareils de surveillance neurologique, appareils de surveillance multiparamétriques et autres.

Application

- Oncologie

- Diabète

- Maladies cardiovasculaires

- Autres

Sur la base des applications, le marché est segmenté en oncologie, diabète, maladies cardiovasculaires et autres.

Utilisateur final

- Patients hospitalisés

- Patients ambulatoires

- Soins à domicile pour les patients

Sur la base de l’utilisateur final, le marché est segmenté en patients hospitalisés, patients ambulatoires et patients bénéficiant de soins à domicile.

Analyse/perspectives régionales du marché de la surveillance et des soins à distance des patients en Europe

Le marché européen de la surveillance et des soins à distance des patients est segmenté en trois segments notables en fonction du type d'appareil, de l'application et de l'utilisateur final.

Les pays couverts dans ce rapport de marché sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, la Belgique, la Turquie, les Pays-Bas, la Russie, la Suisse et le reste de l'Europe.

L'Allemagne devrait dominer le marché européen de la surveillance et des soins à distance des patients en raison de la demande croissante des marchés émergents et de l'expansion.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Paysage concurrentiel et analyse des parts de marché du suivi et des soins à distance des patients en Europe

Le paysage concurrentiel du marché européen de la télésurveillance et des soins aux patients fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'étendue du produit, la domination des applications et la courbe de survie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Certains des principaux acteurs du marché opérant sur le marché européen de la surveillance et des soins à distance des patients sont Medtronic, Boston Scientific Corporation, VitalConnect, Biobeat, General Electric, Koninklijke Philips NV, OMRON Corporation, Abbott, Nihon Kohden Corporation, Vivify Health, Inc., Aerotel Medical Systems, BIOTRONIK SE & Co. KG, A&D Company, Limited, AliveCor, Inc., Masimo, Dexcom, Inc., Senseonics, Inc., ResMed, 100Plus., ChroniSense Medical, Ltd., Vitls, cardiomo, CoachCare, neteera et Withings, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CARDIAC MONITORING DEVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 VALUE CHAIN ANALYSIS:

4.3 COMPETITIVE ANALYSIS

4.4 BRAND ANALYSIS

4.5 ECOSYSTEM MAPS

4.6 TECHNOLOGICAL TRENDS

4.7 TOP WINNING STRATEGIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING PREVALENCE OF CHRONIC DISEASES

5.1.2 GROWTH IN TECHNOLOGICAL ADVANCEMENTS

5.1.3 INCREASING DEMAND FOR REMOTE PATIENT MONITORING

5.1.4 INCREASING GOVERNMENT INITIATIVES

5.2 RESTRAINTS

5.2.1 STRICT REGULATORY FRAMEWORK

5.2.2 LACK OF STANDARDIZATION

5.3 OPPORTUNITIES

5.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.2 PROVIDES QUICK AND REAL TIME RESULTS

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS

5.4.2 RISK TO PATIENT'S DATA SECURITY

6 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE

6.1 OVERVIEW

6.2 CARDIAC MONITORING DEVICES

6.3 BLOOD PRESSURE MONITORING DEVICES

6.4 MULTI-PARAMETER MONITORING DEVICES

6.5 BLOOD GLUCOSE MONITORING DEVICES

6.6 RESPIRATORY MONITORING DEVICES

6.7 NEUROLOGICAL MONITORING DEVICES

6.8 OTHERS

7 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 CARDIOVASCULAR DISEASE

7.2.1 CORONARY HEART DISEASE

7.2.2 STROKE

7.2.3 PERIPHERAL ARTERIAL DISEASE

7.2.4 AORTIC DISEASE

7.2.5 OTHERS

7.3 DIABETES

7.4 ONCOLOGY

7.5 OTHERS

8 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER

8.1 OVERVIEW

8.2 HOME HEALTHCARE PATIENTS

8.2.1 BLOOD GLUCOSE MONITORING DEVICES

8.2.2 CARDIAC MONITORING DEVICES

8.2.3 BLOOD PRESSURE MONITORING DEVICES

8.2.4 MULTI-PARAMETER MONITORING DEVICES

8.2.5 RESPIRATORY MONITORING DEVICES

8.2.6 NEUROLOGICAL MONITORING DEVICES

8.2.7 OTHERS

8.3 AMBULATORY PATIENTS

8.3.1 MULTI-PARAMETER MONITORING DEVICES

8.3.2 RESPIRATORY MONITORING DEVICES

8.3.3 CARDIAC MONITORING DEVICES

8.3.4 BLOOD PRESSURE MONITORING DEVICES

8.3.5 BLOOD GLUCOSE MONITORING DEVICES

8.3.6 NEUROLOGICAL MONITORING DEVICES

8.3.7 OTHERS

8.4 HOSPITAL-BASED PATIENTS

8.4.1 MULTI-PARAMETER MONITORING DEVICES

8.4.2 CARDIAC MONITORING DEVICES

8.4.3 RESPIRATORY MONITORING DEVICES

8.4.4 BLOOD PRESSURE MONITORING DEVICES

8.4.5 BLOOD GLUCOSE MONITORING DEVICES

8.4.6 NEUROLOGICAL MONITORING DEVICES

8.4.7 OTHERS

9 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION

9.1 EUROPE

9.1.1 GERMANY

9.1.2 U.K.

9.1.3 FRANCE

9.1.4 ITALY

9.1.5 RUSSIA

9.1.6 SPAIN

9.1.7 TURKEY

9.1.8 SWITZERLAND

9.1.9 NETHERLANDS

9.1.10 BELGIUM

9.1.11 REST OF EUROPE

10 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 MEDTRONIC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 DEXCOM, INC.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 ABBOTT

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENT

12.4 RESMED

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 BIOTRONIK SE & CO. KG

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 100 PLUS.

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 A&D COMPANY, LIMITED

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 COMPANY SHARE ANALYSIS

12.7.4 PRODUCT PORTFOLIO

12.7.5 RECENT DEVELOPMENT

12.8 AEROTEL MEDICAL SYSTEMS

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 ALIVECOR, INC.

12.9.1 COMPANY SNAPSHOT

12.9.2 COMPANY SHARE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 BIOBEAT

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 BOSTON SCIENTIFIC CORPORATION

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 COMPANY SHARE ANALYSIS

12.11.4 PRODUCT PORTFOLIO

12.11.5 RECENT DEVELOPMENT

12.12 CARDIOMO

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS

12.13 CHRONISENSE MEDICAL, LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 COACHCARE

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 GENERAL ELECTRIC

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 COMPANY SHARE ANALYSIS

12.15.4 PRODUCT PORTFOLIO

12.15.5 RECENT DEVELOPMENT

12.16 KONINKLIJKE PHILIPS N.V.

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 COMPANY SHARE ANALYSIS

12.16.4 PRODUCT PORTFOLIO

12.16.5 RECENT DEVELOPMENT

12.17 MASIMO

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 COMPANY SHARE ANALYSIS

12.17.4 PRODUCT PORTFOLIO

12.17.5 RECENT DEVELOPMENT

12.18 NETEERA

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENT

12.19 NIHON KOHDEN CORPORATION

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 COMPANY SHARE ANALYSIS

12.19.4 PRODUCT PORTFOLIO

12.19.5 RECENT DEVELOPMENT

12.2 OMRON CORPORATION

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 COMPANY SHARE ANALYSIS

12.20.4 PRODUCT PORTFOLIO

12.20.5 RECENT DEVELOPMENT

12.21 SENSEONICS, INC.

12.21.1 COMPANY SNAPSHOT

12.21.2 REVENUE ANALYSIS

12.21.3 COMPANY SHARE ANALYSIS

12.21.4 PRODUCT PORTFOLIO

12.21.5 RECENT DEVELOPMENT

12.22 VITALCONNECT

12.22.1 COMPANY SNAPSHOT

12.22.2 PRODUCT PORTFOLIO

12.22.3 RECENT DEVELOPMENT

12.23 VITLS

12.23.1 COMPANY SNAPSHOT

12.23.2 PRODUCT PORTFOLIO

12.23.3 RECENT DEVELOPMENT

12.24 VIVIFY HEALTH INC.

12.24.1 COMPANY SNAPSHOT

12.24.2 PRODUCT PORTFOLIO

12.24.3 RECENT DEVELOPMENTS

12.25 WITHINGS

12.25.1 COMPANY SNAPSHOT

12.25.2 COMPANY SHARE ANALYSIS

12.25.3 PRODUCT PORTFOLIO

12.25.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 2 EUROPE CARDIAC MONITORING DEVICES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 EUROPE BLOOD PRESSURE MONITORING DEVICES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 EUROPE MULTI-PARAMETER MONITORING DEVICES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 EUROPE BLOOD GLUCOSE MONITORING DEVICES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 EUROPE RESPIRATORY MONITORING DEVICES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 EUROPE NEUROLOGICAL MONITORING DEVICES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 EUROPE OTHERS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 10 EUROPE CARDIOVASCULAR DISEASE IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 EUROPE CARDIOVASCULAR DISEASE IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 12 EUROPE DIABETES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 EUROPE ONCOLOGY IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 EUROPE OTHERS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 16 EUROPE HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 EUROPE HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 18 EUROPE AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 EUROPE AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 20 EUROPE HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 EUROPE HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 22 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 23 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 24 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 25 EUROPE CARDIOVASCULAR DISEASES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 26 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 27 EUROPE HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 28 EUROPE AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 29 EUROPE HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 30 GERMANY REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 31 GERMANY REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 GERMANY CARDIOVASCULAR DISEASES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 33 GERMANY REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 34 GERMANY HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 35 GERMANY AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 36 GERMANY HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.K REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.K REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 39 U.K CARDIOVASCULAR DISEASES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 40 U.K REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 41 U.K HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.K AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 43 U.K HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 44 FRANCE REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 45 FRANCE REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 46 FRANCE CARDIOVASCULAR DISEASES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 47 FRANCE REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 48 FRANCE HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 49 FRANCE AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 50 FRANCE HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 51 ITALY REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 52 ITALY REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 53 ITALY CARDIOVASCULAR DISEASES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 ITALY REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 55 ITALY HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 56 ITALY AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 57 ITALY HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 58 RUSSIA REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 59 RUSSIA REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 60 RUSSIA CARDIOVASCULAR DISEASES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 61 RUSSIA REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 62 RUSSIA HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 63 RUSSIA AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 64 RUSSIA HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 65 SPAIN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 66 SPAIN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 67 SPAIN CARDIOVASCULAR DISEASES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 SPAIN REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 69 SPAIN HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 70 SPAIN AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 71 SPAIN HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 72 TURKEY REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 73 TURKEY REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 TURKEY CARDIOVASCULAR DISEASES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 75 TURKEY REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 76 TURKEY HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 77 TURKEY AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 78 TURKEY HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 79 SWITZERLAND REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 80 SWITZERLAND REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 81 SWITZERLAND CARDIOVASCULAR DISEASES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 82 SWITZERLAND REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 83 SWITZERLAND HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 84 SWITZERLAND AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 85 SWITZERLAND HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 86 NETHERLANDS REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 87 NETHERLANDS REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 88 NETHERLANDS CARDIOVASCULAR DISEASES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 89 NETHERLANDS REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 90 NETHERLANDS HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 91 NETHERLANDS AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 92 NETHERLANDS HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 93 BELGIUM REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 94 BELGIUM REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 95 BELGIUM CARDIOVASCULAR DISEASES IN REMOTE PATIENT MONITORING AND CARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 96 BELGIUM REMOTE PATIENT MONITORING AND CARE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 97 BELGIUM HOME HEALTHCARE PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 98 BELGIUM AMBULATORY PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 99 BELGIUM HOSPITAL-BASED PATIENTS IN REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 100 REST OF EUROPE REMOTE PATIENT MONITORING AND CARE MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: SEGMENTATION

FIGURE 2 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: SEGMENTATION

FIGURE 11 THE INCREASING PREVALENCE OF CHRONIC DISEASES IS EXPECTED TO DRIVE THE GROWTH OF THE EUROPE REMOTE PATIENT MONITORING AND CARE MARKET IN THE FORECAST PERIOD

FIGURE 12 THE CARDIAC MONITORING DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE REMOTE PATIENT MONITORING AND CARE MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE REMOTE PATIENT MONITORING AND CARE MARKET

FIGURE 14 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY DEVICE TYPE, 2022

FIGURE 15 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY DEVICE TYPE, 2023-2030 (USD MILLION)

FIGURE 16 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY DEVICE TYPE, CAGR (2023-2030)

FIGURE 17 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY DEVICE TYPE, LIFELINE CURVE

FIGURE 18 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY APPLICATION, 2022

FIGURE 19 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 20 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 21 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 22 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY END USER, 2022

FIGURE 23 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 24 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY END USER, CAGR (2023-2030)

FIGURE 25 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY END USER, LIFELINE CURVE

FIGURE 26 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: SNAPSHOT (2022)

FIGURE 27 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY COUNTRY (2022)

FIGURE 28 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: DEVICE TYPE (2023-2030)

FIGURE 31 EUROPE REMOTE PATIENT MONITORING AND CARE MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.