Europe Rapid Diagnostic Tests Rdt Market

Taille du marché en milliards USD

TCAC :

%

USD

13.03 Billion

USD

24.49 Billion

2024

2032

USD

13.03 Billion

USD

24.49 Billion

2024

2032

| 2025 –2032 | |

| USD 13.03 Billion | |

| USD 24.49 Billion | |

|

|

|

|

Segmentation du marché des tests de diagnostic rapide (TDR) en Europe, par type de produit (consommables et kits, instruments et autres), mode (professionnel et en vente libre [OTC]), technologie (PCR, dosages en flux continu, dosages immunochromatographiques à flux latéral, dosage d'agglutination, microfluidique , technologie des substrats et autres), modalité (tests en laboratoire et tests hors laboratoire), tranche d'âge (adulte et enfant), type de test (détermination de la confirmation, tests sérologiques et séquençage viral), approche (diagnostic in vitro et diagnostic moléculaire ), échantillon (écouvillon, sang, urine, salive, expectorations et autres), application (dépistage des maladies infectieuses, surveillance de la glycémie, tests cardiologiques, tests oncologiques, tests cardiométaboliques, tests de dépistage de drogues, tests de grossesse et de fertilité, toxicologie) Tests et autres), utilisateur final (hôpital et clinique, laboratoire de diagnostic, établissement de soins à domicile, instituts de recherche et universitaires, et autres), canal de distribution (appel d'offres direct et vente au détail) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché européen des tests de diagnostic rapide (TDR)

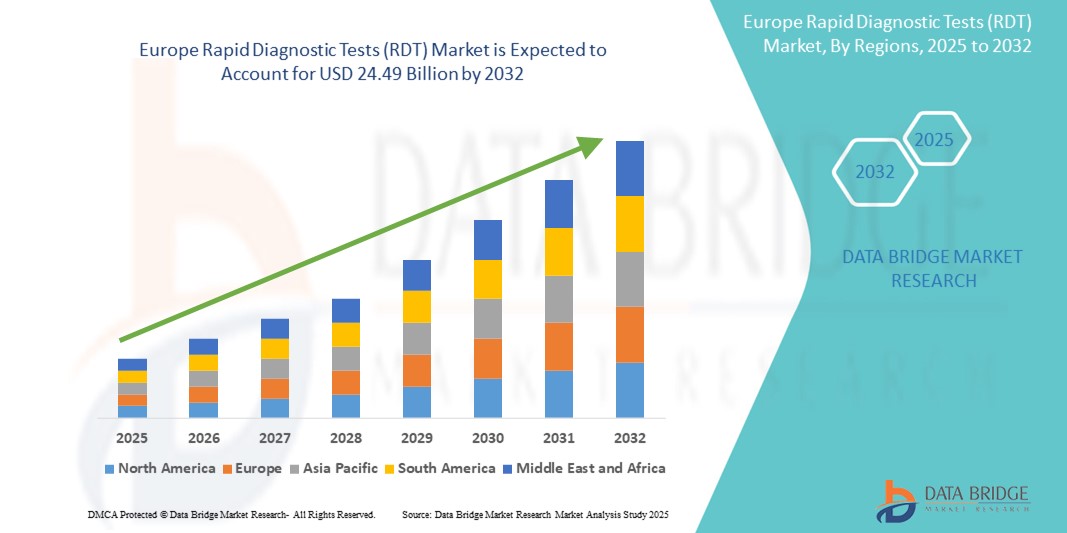

- La taille du marché européen des tests de diagnostic rapide (TDR) était évaluée à 13,03 milliards USD en 2024 et devrait atteindre 24,49 milliards USD d'ici 2032 , à un TCAC de 8,20 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption généralisée des tests au chevet du patient et à domicile, rendue possible par les avancées rapides des technologies diagnostiques telles que les tests à flux latéral, la microfluidique et les TDR moléculaires. Cela permet une détection plus rapide des maladies et contribue à alléger la charge pesant sur les infrastructures de laboratoire conventionnelles, tant en milieu urbain que rural en Europe.

- Par ailleurs, la demande croissante des consommateurs pour des solutions de diagnostic rapides, précises et abordables, notamment pour les maladies infectieuses, les affections chroniques et le dépistage de la résistance aux antimicrobiens, fait des TDR des outils essentiels pour l'intervention précoce, le développement de la télésanté et la surveillance de la santé publique. Ces facteurs convergents accélèrent l'adoption de solutions de diagnostic rapide, stimulant ainsi considérablement la croissance du marché européen des TDR.

Analyse du marché européen des tests de diagnostic rapide (TDR)

- Les tests de diagnostic rapide (TDR), offrant des résultats rapides au point de service sans nécessiter d'infrastructure de laboratoire complexe, deviennent des outils essentiels dans la surveillance des maladies, la réponse aux épidémies et les diagnostics de routine dans les hôpitaux et les soins à domicile en raison de leur rapidité, de leur prix abordable et de leur facilité d'utilisation.

- La demande croissante de TDR est principalement motivée par la prévalence croissante des maladies infectieuses, le besoin croissant de soins de santé décentralisés et les progrès des technologies de flux latéral et d'immuno-essais qui ont amélioré la précision et la durée de conservation des tests.

- Le Royaume-Uni a dominé le marché européen des tests de diagnostic rapide (TDR) avec la plus grande part de marché (29,7 %) en 2024, grâce aux initiatives gouvernementales favorisant l'autotest, à un solide réseau de pharmacies de détail et à une utilisation généralisée des TDR pour le dépistage de la COVID-19, de la grippe et des IST. Le développement des services de santé en ligne favorise encore davantage le diagnostic à domicile dans le pays.

- L'Allemagne devrait être le pays connaissant la croissance la plus rapide sur le marché européen des tests de diagnostic rapide (TDR) au cours de la période de prévision, en raison de l'incidence croissante des maladies chroniques et infectieuses, de l'augmentation des dépenses de santé et de la forte adoption de technologies de diagnostic innovantes dans les hôpitaux et les établissements de soins ambulatoires.

- Le segment des consommables et des kits a dominé le marché européen des tests de diagnostic rapide (TDR) avec la plus grande part de revenus de 64,3 % en 2024, attribuée à la fréquence élevée des tests dans les établissements de santé et à la facilité de disponibilité.

Portée du rapport et segmentation du marché européen des tests de diagnostic rapide (TDR)

|

Attributs |

Analyse du marché européen des tests de diagnostic rapide (TDR) |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché européen des tests de diagnostic rapide (TDR)

« Amélioration de la précision et de l'accessibilité du diagnostic »

- Une tendance significative et croissante sur le marché européen des tests de diagnostic rapide (TDR) est l'intégration croissante de technologies avancées et de modèles de tests décentralisés visant à améliorer la vitesse et l'accessibilité du diagnostic dans les contextes cliniques et non cliniques.

- Par exemple, en mai 2023, Roche a annoncé le lancement européen de son système cobas pulse, un appareil portable combinant des outils de santé numériques et des tests rapides au chevet du patient. Cette innovation permet aux professionnels de santé de prendre des décisions diagnostiques plus rapides et plus précises, au chevet du patient ou en ambulatoire.

- Les plateformes RDT émergentes sont désormais dotées de fonctionnalités permettant une détection plus rapide des maladies infectieuses, des affections chroniques et des biomarqueurs grâce à des formats compacts et faciles à utiliser, ne nécessitant pas d'infrastructure de laboratoire centralisée. Ces outils sont particulièrement utiles dans les situations d'urgence, les cliniques rurales et les soins à domicile, où la rapidité des résultats est cruciale.

- De plus, le développement des tests multiplex permet d'identifier simultanément plusieurs agents pathogènes ou pathologies avec un seul test. Par exemple, les tests multiplex à flux latéral permettent de dépister simultanément la grippe, la COVID-19 et le VRS à l'aide d'un seul prélèvement nasal, ce qui permet de gagner du temps et de réduire les ressources tout en améliorant le triage des patients.

- L'intégration transparente des TDR aux dossiers médicaux électroniques (DME) et aux systèmes d'aide à la décision clinique renforce encore leur utilité clinique. Les professionnels de santé peuvent désormais accéder aux résultats en temps réel et les intégrer directement dans les flux de gestion des patients, optimisant ainsi la mise en route et le suivi des traitements.

- Cette tendance vers des solutions de diagnostic plus efficaces, plus conviviales et plus interopérables transforme profondément les attentes au sein des systèmes de santé. Par conséquent, des entreprises comme Abbott, Siemens Healthineers et bioMérieux élargissent leur offre de TDR pour inclure des solutions professionnelles et en vente libre, destinées au suivi des maladies chroniques et au dépistage à l'échelle de la population.

- La demande de tests de diagnostic rapides fournissant des résultats rapides, précis et exploitables augmente rapidement dans les hôpitaux, les soins à domicile et les environnements médicaux décentralisés, car les agences de santé publique et les prestataires privés mettent de plus en plus l'accent sur les soins préventifs et l'intervention précoce.

Dynamique du marché européen des tests de diagnostic rapide (TDR)

Conducteur

« Besoin croissant en raison de la charge croissante de morbidité et de la demande de diagnostic rapide »

- La prévalence croissante des maladies infectieuses, notamment la grippe, la COVID-19, le VIH, le paludisme et le virus respiratoire syncytial (VRS), est un facteur important de la demande croissante de tests de diagnostic rapide (TDR) en Europe.

- Par exemple, en janvier 2024, Roche Diagnostics a lancé un nouveau test rapide à double antigène capable de détecter à la fois la COVID-19 et les virus grippaux A/B, fournissant des résultats en seulement 15 minutes. Ce lancement s'inscrit dans la volonté croissante du marché de proposer un diagnostic précoce et précis au point de service, contribuant ainsi à réduire la transmission et à améliorer les résultats pour les patients.

- Les gouvernements et les systèmes de santé de la région privilégient également les diagnostics décentralisés et communautaires afin de réduire la pression sur les hôpitaux et d'améliorer la surveillance des maladies. Cette tendance est renforcée par les initiatives du Centre européen de prévention et de contrôle des maladies (ECDC) et des agences de santé publique.

- De plus, les avancées technologiques dans les dosages à flux latéral, la microfluidique et l'intégration de biocapteurs ont considérablement amélioré la précision, la rapidité et la facilité d'utilisation des TDR. Ces innovations font des TDR une option pratique et fiable, tant pour les professionnels que pour les consommateurs.

- La commodité du dépistage à domicile, notamment pour les maladies chroniques et les infections nécessitant une surveillance régulière, accélère l'adoption des TDR. La sensibilisation accrue du public, stimulée par la pandémie, a également normalisé l'autotest, favorisant une plus grande acceptation par tous les groupes d'âge.

Retenue/Défi

« Préoccupations concernant la précision des tests et la conformité réglementaire »

- Malgré leurs avantages, les inquiétudes concernant la sensibilité et la spécificité de certains TDR continuent de freiner leur expansion commerciale. Les faux négatifs ou positifs peuvent entraîner des erreurs de diagnostic ou des retards de traitement, sapant ainsi la confiance des professionnels de santé et des patients.

- Par exemple, des études menées au début de la pandémie de COVID-19 ont révélé que plusieurs tests antigéniques en vente libre présentaient une sensibilité plus faible chez les personnes asymptomatiques, ce qui a entraîné un examen réglementaire et des rappels de produits.

- Les normes d'approbation strictes dans les pays européens et l'évolution des cadres réglementaires dans le cadre du règlement de l'UE sur les diagnostics in vitro (IVDR) posent des obstacles supplémentaires aux fabricants qui souhaitent commercialiser de nouveaux TDR.

- De plus, les disparités dans les politiques de remboursement entre des pays comme l'Allemagne, l'Italie et l'Espagne entravent l'adoption équitable des TDR, en particulier dans les milieux de santé publique et à faibles ressources.

- Le coût élevé des tests rapides de nouvelle génération, tels que ceux utilisant des plateformes de détection moléculaire, peut également limiter leur adoption dans les environnements à budget limité, malgré une sensibilité plus élevée.

- Pour surmonter ces contraintes, les acteurs doivent se concentrer sur la validation clinique, la transparence des données de performance et l'alignement avec les normes IVDR. Un investissement accru dans la production locale, les partenariats public-privé et l'innovation rentable seront essentiels pour garantir une plus grande accessibilité et une croissance durable du marché.

Portée du marché européen des tests de diagnostic rapide (TDR)

Le marché est segmenté en type de produit, mode, technologie, modalité, tranche d'âge, type de test, approche, échantillon, application, utilisateur final et canal de distribution.

- Par type de produit

En fonction du type de produit, le marché européen des tests de diagnostic rapide (TDR) est segmenté en consommables et kits, instruments et autres. Le segment des consommables et kits a dominé le marché avec la plus grande part de chiffre d'affaires (64,3 %) en 2024, grâce à la fréquence élevée des tests dans les établissements de santé et à leur disponibilité.

Le segment des instruments devrait connaître le TCAC le plus rapide de 10,8 % entre 2025 et 2032, stimulé par la demande croissante d'équipements de diagnostic au point de service dans les cliniques et les environnements éloignés.

- Par mode

Sur la base du mode de distribution, le marché européen des tests de diagnostic rapide (TDR) est segmenté en tests professionnels et en vente libre. Le segment professionnel détenait la plus grande part de marché, soit 71,5 % en 2024, grâce à son utilisation généralisée dans les hôpitaux et les laboratoires de diagnostic.

Le segment des médicaments en vente libre devrait enregistrer la croissance la plus rapide avec un TCAC de 12,4 % entre 2025 et 2032, grâce à l'augmentation des tendances en matière d'auto-test et à la disponibilité des produits dans les pharmacies de détail.

- Par technologie

Sur le plan technologique, le marché européen des tests de diagnostic rapide (TDR) est segmenté en tests basés sur la PCR, les tests à flux continu, les tests immunochromatographiques à flux latéral, les tests d'agglutination, la microfluidique et la technologie des substrats, entre autres. Les tests immunochromatographiques à flux latéral détenaient la part la plus importante (38,9 %) en 2024, en raison de leur simplicité et de leur faible coût.

Le segment de la microfluidique devrait connaître un TCAC maximal de 13,1 % entre 2025 et 2032, grâce à l'essor des technologies de laboratoire sur puce pour les tests multiplex rapides.

- Par modalité

En fonction de leur modalité, le marché européen des tests de diagnostic rapide (TDR) est segmenté en tests de laboratoire et tests hors laboratoire. Le segment des tests hors laboratoire domine le marché avec une part de marché de 58,7 % en 2024, grâce à leur simplicité d'utilisation et à leurs délais d'exécution plus courts.

Les tests en laboratoire devraient connaître le TCAC le plus rapide entre 2025 et 2032, car ces tests offrent une précision supérieure et des résultats fiables, ce qui les rend essentiels pour la détection précoce des maladies infectieuses et des maladies chroniques.

- Par groupe d'âge

En fonction de la tranche d'âge, le marché européen des tests de diagnostic rapide (TDR) est segmenté en deux catégories : adulte et pédiatrique. Le segment adulte a représenté la plus grande part de marché, soit 76,4 % en 2024, grâce à une charge de morbidité plus élevée et à la demande accrue de suivi des maladies chroniques.

Le segment pédiatrique devrait connaître le TCAC le plus rapide entre 2025 et 2032, en raison de l’accent accru mis sur la détection précoce des maladies chez les enfants.

- Par type de test

En fonction du type de test, le marché européen des tests de diagnostic rapide (TDR) est segmenté en deux catégories : test de confirmation, test sérologique et séquençage viral. En 2024, le test de confirmation a dominé le marché grâce à sa grande précision, son utilisation répandue dans la détection des maladies infectieuses et sa préférence pour les diagnostics de confirmation tels que la RT-PCR.

Les tests sérologiques devraient connaître le TCAC le plus rapide entre 2025 et 2032, grâce à la détection des maladies infectieuses et au suivi de la réponse immunitaire.

- Par approche

Selon l'approche adoptée, le marché européen des tests de diagnostic rapide (TDR) est segmenté en diagnostic in vitro et diagnostic moléculaire. Le segment du diagnostic in vitro détient une part dominante en raison de son accessibilité financière et de sa compatibilité avec de nombreux types d'analytes.

Le segment du diagnostic moléculaire devrait connaître un TCAC maximal entre 2025 et 2032, en raison de sa précision et de sa sensibilité élevée.

- Par spécimen

Sur la base des échantillons, le marché européen des tests de diagnostic rapide (TDR) est segmenté en écouvillons, sang, urine, salive, crachats, etc. Le segment des écouvillons détenait la plus grande part de marché en 2024 en raison de son utilisation répandue dans le dépistage des maladies infectieuses.

Les échantillons de sang devraient connaître le TCAC le plus rapide entre 2025 et 2032, en raison de leur grande précision diagnostique et de leur utilisation généralisée dans la détection des maladies infectieuses et chroniques.

- Par application

En fonction des applications, le marché européen des tests de diagnostic rapide (TDR) est segmenté en tests de maladies infectieuses, surveillance de la glycémie, tests cardiologiques, tests oncologiques, tests cardiométaboliques, tests de dépistage de drogues, tests de grossesse et de fertilité, tests toxicologiques, etc. En 2024, les tests de maladies infectieuses ont dominé le marché avec 42,6 %, en raison d'une préparation accrue aux pandémies et d'une forte demande de diagnostic.

Les tests cardiométaboliques devraient connaître le TCAC le plus rapide entre 2025 et 2032, en raison de la prévalence croissante des maladies cardiovasculaires et métaboliques associée aux progrès des diagnostics rapides basés sur des biomarqueurs.

- Par utilisateur final

En fonction de l'utilisateur final, le marché européen des tests de diagnostic rapide (TDR) est segmenté entre hôpitaux et cliniques, laboratoires de diagnostic, soins à domicile, instituts de recherche et universitaires, et autres. Le segment des hôpitaux et cliniques détenait la part la plus élevée, soit 46,2 %, en 2024, grâce à des volumes de tests élevés et à l'infrastructure institutionnelle.

Le segment des soins à domicile devrait connaître le TCAC le plus rapide, soit 11,5 %, entre 2025 et 2032, grâce aux tendances en matière de surveillance à distance.

- Par canal de distribution

En fonction du canal de distribution, le marché européen des tests de diagnostic rapide (TDR) est segmenté entre les appels d'offres directs et la vente au détail. Les appels d'offres directs ont été le principal canal en 2024, notamment pour les achats institutionnels et les marchés publics.

Les ventes au détail devraient connaître le TCAC le plus rapide entre 2025 et 2032, en raison de la disponibilité des kits de test en vente libre dans les pharmacies et les plateformes en ligne.

Analyse régionale du marché européen des tests de diagnostic rapide (TDR)

- L'Europe a dominé le marché mondial des tests de diagnostic rapide (TDR) avec une part de revenus substantielle de 40,01 % en 2024, grâce à une demande accrue de tests au point de service, à la charge croissante des maladies infectieuses et à l'augmentation des investissements gouvernementaux dans les infrastructures de santé publique.

- La région bénéficie d'un système de santé robuste, d'une forte sensibilisation des consommateurs et des praticiens et d'une infrastructure de diagnostic avancée, qui favorisent l'adoption généralisée des TDR

- En outre, les initiatives du Centre européen de prévention et de contrôle des maladies (ECDC) et l'alignement sur le règlement de l'UE sur les diagnostics in vitro (IVDR) renforcent le paysage diagnostique et garantissent la fiabilité et la sécurité des produits.

Aperçu du marché des tests de diagnostic rapide (TDR) au Royaume-Uni

Le marché britannique des tests de diagnostic rapide (TDR) a dominé le marché européen avec une part de chiffre d'affaires de 29,7 % en 2024, portée par une forte adoption des kits de dépistage à domicile et de solides initiatives de santé publique. Le Service national de santé (NHS) joue un rôle essentiel dans la distribution et le financement à grande échelle des TDR pour des maladies telles que la COVID-19, le VIH et la grippe. De plus, la solide infrastructure de commerce électronique du Royaume-Uni a facilité l'accès aux TDR en vente libre pour les maladies chroniques et infectieuses. Les programmes de sensibilisation et les campagnes de dépistage menés par le gouvernement continuent également de promouvoir le dépistage précoce et les soins préventifs.

Aperçu du marché allemand des tests de diagnostic rapide (TDR)

Le marché allemand des tests de diagnostic rapide (TDR) devrait connaître la croissance la plus rapide en Europe, avec un TCAC de 10,6 % prévu entre 2025 et 2032, porté par l'innovation technologique, la demande croissante de diagnostics décentralisés et l'augmentation des investissements dans les solutions de santé numérique. La solide base industrielle du pays en matière de dispositifs médicaux et de diagnostics accélère la disponibilité nationale des TDR. De plus, l'accent mis par l'Allemagne sur la durabilité et les diagnostics basés sur les données favorise l'intégration des TDR de nouvelle génération dans les pratiques de santé, notamment en ambulatoire et à distance.

Analyse du marché français des tests de diagnostic rapide (TDR)

Le marché français des tests de diagnostic rapide (TDR) connaît une croissance régulière, soutenue par des politiques de remboursement avantageuses et par le développement de partenariats public-privé pour la préparation aux pandémies et la surveillance des maladies. Le pays constate également une adoption croissante des tests rapides pour la santé des femmes, les marqueurs cardiovasculaires et les affections respiratoires, en milieu urbain comme rural.

Aperçu du marché italien des tests de diagnostic rapide (TDR)

Le marché italien des tests de diagnostic rapide (TDR) est en pleine expansion grâce à l'accent mis sur la prévention et à la modernisation des infrastructures de diagnostic après la COVID-19. La demande croissante de tests à domicile et de diagnostics en pharmacie au point de service transforme la prestation des soins de santé dans le nord et le sud de l'Italie.

Part de marché des tests de diagnostic rapide (TDR) en Europe

L’industrie des tests de diagnostic rapide (TDR) est principalement dirigée par des entreprises bien établies, notamment :

- Abbott (États-Unis)

- Danaher (États-Unis)

- Cellex (États-Unis)

- Fujirebio (Japon)

- AdvaCare Pharma (États-Unis)

- ACCESS BIO (États-Unis)

- Cardinal Health (États-Unis)

- Bio-Rad Laboratories, Inc. (États-Unis)

- Céphéide (États-Unis)

- BD (États-Unis)

- F. Hoffmann-La Roche SA (Suisse)

- BIOMÉRIEUX (France)

- InBios International, Inc. (États-Unis)

- Luminex Corporation (États-Unis)

- Gnomegen LLC (États-Unis)

- QIAGEN (Pays-Bas)

- Quidel Corporation (États-Unis)

- Sysmex Corporation (Japon)

- Siemens Healthineers AG (Allemagne)

- MEGACOR Diagnostik GmbH (Autriche)

- PerkinElmer (États-Unis)

- Sekisui Diagnostics (États-Unis/Japon)

- Diagnostics PTS (États-Unis)

- Werfen (Espagne)

- Nova Biomedical (États-Unis)

- Trinity Biotech (Irlande)

Derniers développements sur le marché européen des tests de diagnostic rapide (TDR)

- En mai 2023, F. HOFFMANN-LA ROCHE LTD a annoncé officiellement l'acquisition de Stratos Genomics. Cette acquisition a permis le développement du séquençage de l'ADN à des fins diagnostiques. Elle a ainsi renforcé le segment du diagnostic médical de l'entreprise, générant ainsi davantage de revenus.

- En avril 2023, le panel respiratoire BIOFIRE 2.1 plus de bioMérieux SA, qui teste 23 agents pathogènes, dont le SARS-CoV-2, responsable d'infections des voies respiratoires, est commercialisé dans le monde entier et contribue au diagnostic précoce des infections respiratoires. Ce développement a permis à l'entreprise de générer davantage de revenus.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.