Marché européen des emballages en polystyrène, par type (bols, pots, boîtes, gobelets, sacs, sachets, bouteilles, emballages et films, assiettes et autres), application (fruits, légumes, poissons, produits de la mer, produits carnés, produits laitiers/produits laitiers, boulangerie et confiserie, collations et aliments cuits), utilisateur final (aliments et boissons, produits pharmaceutiques et soins personnels et ménagers) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché européen des emballages en polystyrène

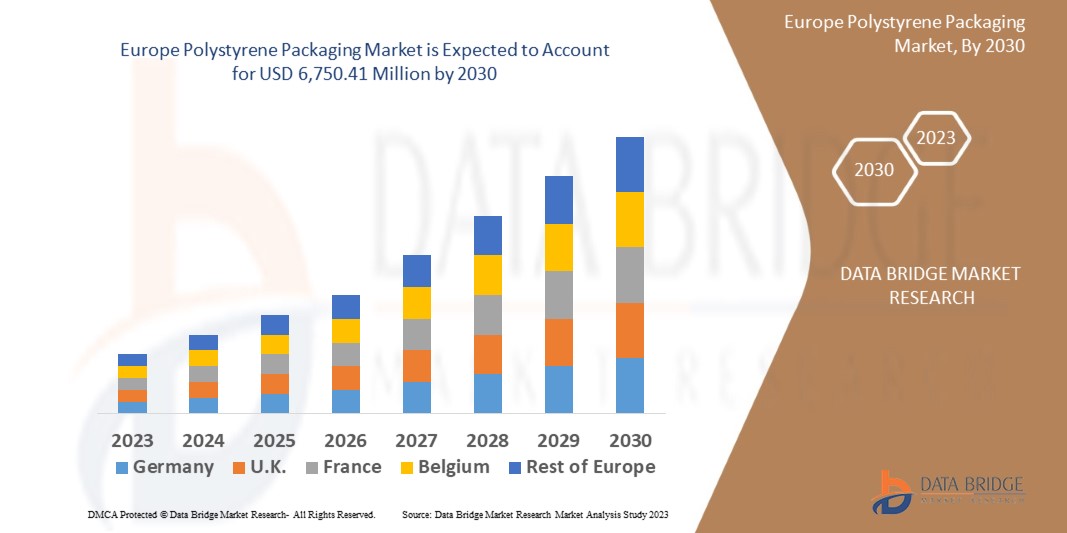

Le marché européen des emballages en polystyrène devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,4 % de 2023 à 2030 et devrait atteindre 6 750,41 millions USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché des emballages en polystyrène est l'utilisation croissante des emballages dans les industries médicales et pharmaceutiques. Le nombre croissant de points de vente de produits alimentaires devrait propulser la croissance du marché européen des emballages en polystyrène.

Le rapport sur le marché européen des emballages en polystyrène fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Contactez-nous pour un briefing d'analyste afin de comprendre l'analyse et le scénario du marché. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (bols, pots, boîtes, gobelets, sacs, sachets, bouteilles, emballages et films, assiettes et autres), application (fruits, légumes, poissons, produits de la mer, produits carnés, produits laitiers, boulangerie et confiserie, snacks et aliments cuits), utilisateur final (aliments et boissons, produits pharmaceutiques et soins personnels et ménagers) |

|

Pays couverts |

Royaume-Uni, Russie, France, Espagne, Italie, Allemagne, Turquie, Pays-Bas, Suisse, Belgique, Reste de l'Europe |

|

Acteurs du marché couverts |

Alpek SAB de CV, Sonoco Products Company, KANEKA CORPORATION, MONOTEZ, SUNPOR, Versalis SpA (une filiale d'Eni SpA), NEFAB GROUP et Synthos entre autres |

Définition du marché

Le polystyrène est un polymère polyvalent utilisé pour produire une large gamme de produits de consommation. Il est très utilisé comme matériau d'emballage en raison de ses propriétés plastiques solides et dures. Il offre une transparence à l'ensemble du produit. Le plastique se combine souvent avec des additifs et d'autres polymères pour le rendre idéal pour une application dans différentes industries telles que les produits pharmaceutiques, les produits ménagers, les soins personnels et autres.

Dynamique du marché européen des emballages en polystyrène

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de l'utilisation des emballages en polystyrène dans les cosmétiques et autres produits personnels en raison de leur durabilité accrue

La demande de produits cosmétiques et d'articles personnels a augmenté au fil des ans en raison de l'augmentation des revenus disponibles, du désir d'être belle et de maintenir une hygiène personnelle. Cependant, le contenu de ces produits est périssable et a une durée de conservation définie. L'exposition à l'air, à la chaleur, à la lumière et au froid peut dégrader la qualité et la stabilité des ingrédients des produits cosmétiques et d'articles personnels. Pour surmonter ces défis, les emballages en polystyrène offrent une excellente solution. Cela permet non seulement de conserver les produits dans l'état physique souhaité, mais peut également être utile pour faciliter le transport.

- Augmentation de l'utilisation dans les emballages de l'industrie médicale et pharmaceutique

L’accès amélioré aux services de santé, le recours croissant à l’assurance médicale, la sensibilisation croissante du public aux soins de santé, la démographie favorable, l’augmentation de la recherche et du développement et l’augmentation des revenus disponibles ont augmenté le marché de l’industrie médicale et pharmaceutique. Les produits pharmaceutiques sont sensibles à la contamination et doivent être fournis aux consommateurs avec une grande sécurité. Pour répondre à cette préoccupation, les emballages en polystyrène se présentent comme l’un des matériaux les plus largement utilisés par les sociétés pharmaceutiques

- Augmentation du nombre de points de vente de nourriture

L'urbanisation croissante, l'introduction de chaînes alimentaires européennes, l'augmentation des revenus, la démographie, l'avènement du commerce électronique dans l'industrie alimentaire et l'évolution des habitudes alimentaires sont autant de forces qui stimulent le marché de l'industrie alimentaire. Les métropoles dominent le marché de la restauration, car les consommateurs ont des revenus disponibles élevés et une capacité d'achat accrue. Ils sont également exposés à diverses cuisines et à des produits alimentaires emballés. L'avènement du commerce électronique dans l'industrie alimentaire et des boissons entraîne également l'augmentation du nombre de points de vente de produits alimentaires.

Opportunités

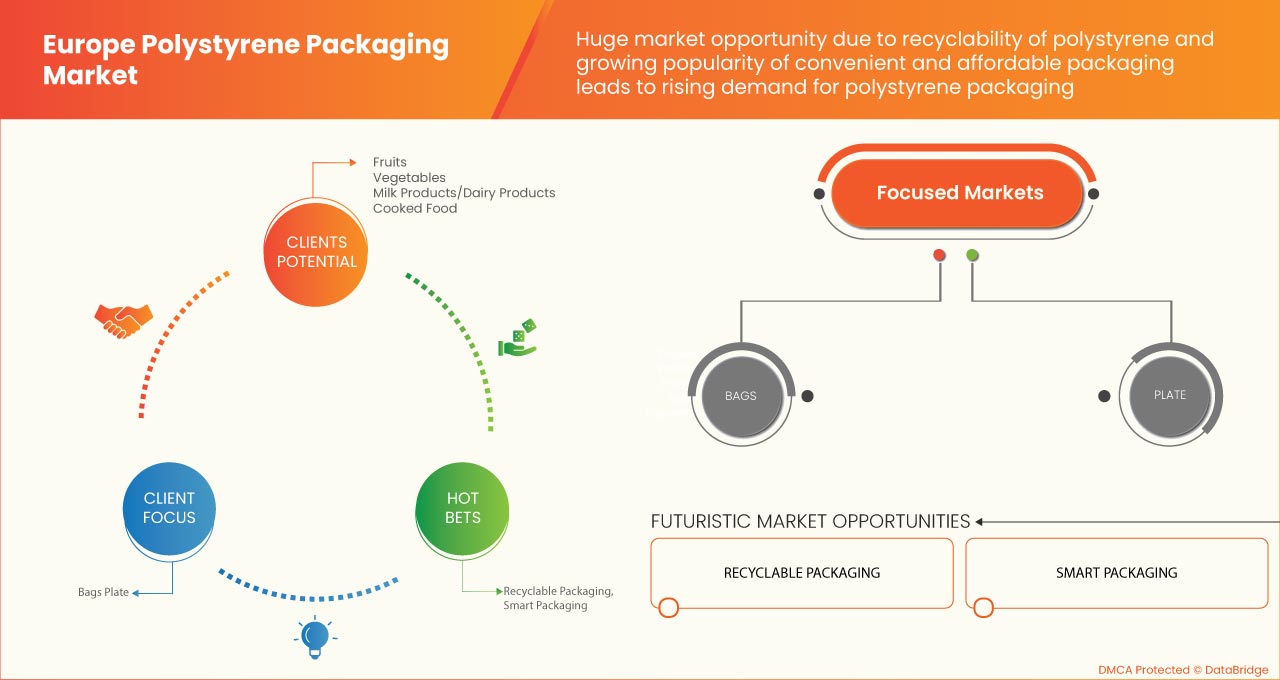

- Capacité à recycler les matériaux en polystyrène

Le polystyrène est un polymère souple utilisé pour divers articles, notamment les emballages, les transports, les biens de consommation, etc. Cependant, il est nocif pour l'environnement car il n'est pas dégradable lorsque ces articles sont jetés. Par conséquent, une plus grande importance est accordée au recyclage et à la réutilisation des matériaux en polystyrène. Après utilisation, une quantité importante de PS expansé est libérée par les supermarchés, les grands magasins, les marchés de gros, les magasins et les restaurants, les entreprises qui vendent du matériel électrique et les industries où sont fabriquées des machines. Les matériaux à base de polystyrène qui doivent être recyclés sont lavés pour éliminer toute poussière ou particules étrangères, puis broyés.

- Augmenter la propension des consommateurs à privilégier des emballages pratiques et abordables

L'emballage est au cœur du plan marketing car il augmente la valeur du produit en rayon et facilite sa manipulation. De plus, il est essentiel de réfléchir à la manière de rendre l'emballage plus attrayant tout en protégeant le produit qu'il contient des effets environnementaux et en préservant sa fraîcheur. Selon la commodité du consommateur, l'emballage consiste à placer les articles dans des emballages attrayants. Pour augmenter la demande de produits auprès des consommateurs, un emballage approprié et attrayant est utilisé comme stratégie promotionnelle.

Restrictions

- Disponibilité d'une large gamme de substituts

Le polystyrène est l'un des plastiques les plus flexibles en raison de sa nature légère, de sa facilité de traitement et de son coût minimal. Il est devenu le contenant à emporter de référence pour de nombreux restaurants et industries en raison de ses caractéristiques de performance avantageuses, notamment la tolérance et la rétention de la chaleur. Cependant, ces matériaux ont un impact négatif sur la santé humaine et l'environnement, obligeant les consommateurs à rechercher d'autres alternatives durables. Les exigences des consommateurs, la sensibilisation à la durabilité et les réglementations sont les freins à l'origine du déclin du marché européen des emballages en polystyrène.

Ces derniers temps, d'autres matériaux légers, peu coûteux et écologiques ont remplacé les emballages en polystyrène. Le papier doublé d'acide polylactique a été utilisé comme contenant ou gobelet pour emballer des aliments chauds ou froids. Les gobelets comestibles fabriqués à partir de produits céréaliers naturels sont très demandés pour emballer et servir des boissons chaudes et froides dans le secteur de la restauration.

- Problèmes de santé et d’environnement liés au polystyrène

Le polystyrène pollue et a un impact négatif sur l’environnement et notre santé en raison de son utilisation intensive. Il met près de 500 ans à se décomposer naturellement et reste donc dans l’environnement pendant très longtemps. Ces matériaux à base de polystyrène s’ajoutent aux décharges et aux plans d’eau, dégradant davantage la qualité du sol et de l’eau. De petits fragments de polystyrène pourraient être consommés par les animaux présents sur terre et provoquer un étouffement ou une occlusion intestinale. Après s’être désintégré dans l’océan, le polystyrène peut potentiellement être mangé par les poissons, qui peuvent être mangés par les espèces marines situées plus haut dans la chaîne alimentaire, ce qui concentrerait la contamination

Défis

- Réglementation stricte concernant l'utilisation du polystyrène

Les emballages en polystyrène sont largement utilisés dans les emballages alimentaires, comme les couverts et assiettes jetables, les gobelets jetables pour boissons chaudes ou froides, les plateaux à viande et à œufs, et les contenants pour produits pharmaceutiques et de soins personnels. Cependant, en raison de leur utilisation diversifiée, les matériaux en polystyrène finissent souvent par être jetés aux ordures. Le polystyrène, en raison de sa nature légère, se brise en petits fragments et n'est pas facilement biodégradable, ce qui le rend persistant dans l'environnement et sensible à la contamination par les microplastiques. Le styrène est également un cancérigène potentiel à partir duquel le polystyrène est fabriqué. Une exposition fréquente au polystyrène peut entraîner des effets néfastes sur la santé

- Volatilité des prix des matières premières

Fabriqué à partir du monomère styrène, le polystyrène est un polymère hydrocarboné aromatique artificiel. En combinant l'éthylène et le benzène , on obtient du styrène . Le styrène est composé de 26 % d'éthylène et de 74 % de benzène. Outre le benzène et l'éthylène, un catalyseur tel que le trichlorure d'aluminium, l'oxyde de magnésium et l'oxyde de fer sont les autres matières premières utilisées dans la production de polystyrène. Il est raisonnable de prévoir que le benzène et l'éthylène étant des produits de la transformation du pétrole et du gaz naturel, leurs prix suivront le prix du pétrole brut. De plus, les installations nécessaires à la production de ce polystyrène nécessitent des capitaux importants et une infrastructure étendue.

Développement récent

- En mai 2022, Alpek, SAB de CV a reçu toutes les approbations nécessaires des autorités réglementaires et a finalisé son acquisition d'OCTAL Holding SAOC. La société a acquis 100 % des actions d'OCTAL pour 620 millions USD sur une base sans dette

Portée du marché européen des emballages en polystyrène

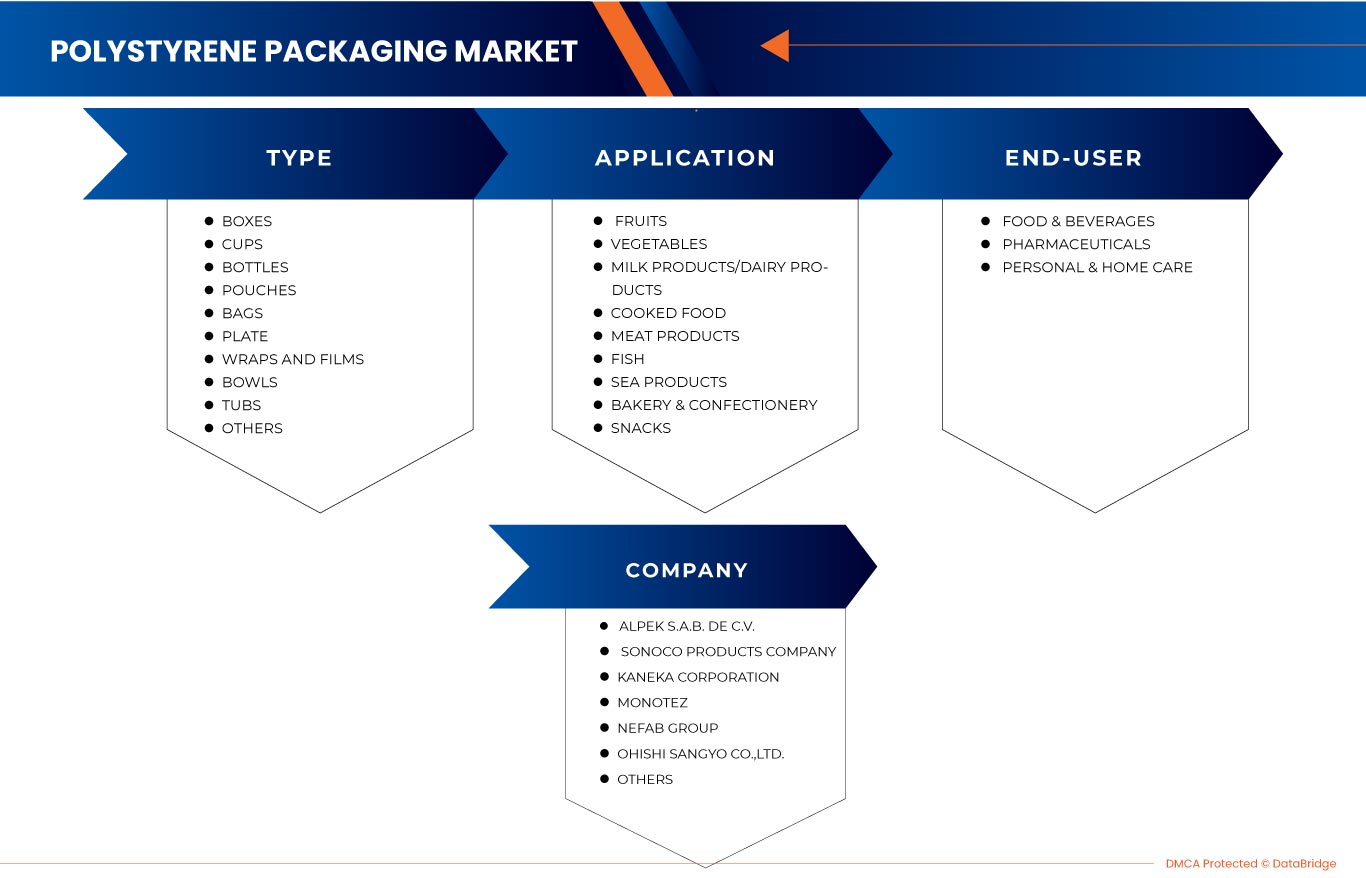

Le marché européen des emballages en polystyrène est classé en fonction du type, de l'application et de l'utilisateur final. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Boules

- Baignoires

- Boîtes

- Tasses

- Sacs

- Pochettes

- Bouteilles

- Enveloppes et films

- Plaque

- Autres

En fonction du type, le marché européen des emballages en polystyrène est classé en dix segments : bols, pots, boîtes, gobelets, sacs, pochettes, bouteilles, emballages et films, assiettes et autres.

Application

- Fruits

- Légume

- Poisson

- Produits de la mer

- Produits à base de viande

- Produits laitiers/Produits laitiers

- Boulangerie et confiserie

- Collations

- Plats cuisinés

En fonction du produit, le marché européen des emballages en polystyrène est classé en neuf segments : fruits, légumes, poissons, produits de la mer, produits carnés, produits laitiers/produits laitiers, boulangerie et confiserie, snacks et aliments cuits.

Utilisateur final

- Alimentation et boissons

- Médicaments

- Soins personnels et à domicile

En fonction des utilisateurs finaux, le marché européen des emballages en polystyrène est classé en trois segments : aliments et boissons, produits pharmaceutiques et soins personnels et ménagers.

Analyse/perspectives régionales du marché des emballages en polystyrène en Europe

Le marché européen des emballages en polystyrène est segmenté en fonction du type, de l’application et des utilisateurs finaux.

Les pays du marché européen des emballages en polystyrène sont le Royaume-Uni, la Russie, la France, l’Espagne, l’Italie, l’Allemagne, la Turquie, les Pays-Bas, la Suisse, la Belgique et le reste de l’Europe.

L’Allemagne devrait dominer le marché européen des emballages en polystyrène en raison de la demande croissante d’emballages en polystyrène dans la région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances technologiques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques européennes et les défis rencontrés en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des emballages en polystyrène en Europe

Le paysage concurrentiel du marché européen des emballages en polystyrène fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que les entreprises se concentrant sur le marché européen des emballages en polystyrène.

Certains acteurs importants du marché européen des emballages en polystyrène sont Alpek SAB de CV, Sonoco Products Company, KANEKA CORPORATION, MONOTEZ, SUNPOR, Versalis SpA (une filiale d'Eni SpA), NEFAB GROUP et Synthos, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE POLYSTYRENE PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 PRICE TREND ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 VENDOR SELECTION CRITERIA

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 RAW MATERIAL ANALYSIS

4.1 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN THE USE OF POLYSTYRENE PACKAGING IN COSMETICS AND OTHER PERSONAL GOODS DUE TO ENHANCED DURABILITY

5.1.2 INCREASE IN THE USE IN PACKAGING OF MEDICAL AND PHARMACEUTICAL INDUSTRY

5.1.3 RISE IN THE NUMBER OF FOOD OUTLETS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF A WIDE RANGE OF SUBSTITUTES

5.2.2 HEALTH AND ENVIRONMENTAL ISSUES ASSOCIATED WITH POLYSTYRENE

5.2.3 UNABLE TO TOLERATE HIGH MECHANICAL, CHEMICAL, AND THERMAL STRESS

5.3 OPPORTUNITIES

5.3.1 ABILITY TO RECYCLE POLYSTYRENE MATERIALS

5.3.2 INCREASING CONSUMER'S INCLINATION TOWARD CONVENIENT AND AFFORDABLE PACKAGING

5.4 CHALLENGES

5.4.1 STRINGENT REGULATIONS REGARDING THE USE OF POLYSTYRENE

5.4.2 VOLATILITY IN RAW MATERIAL PRICES

6 EUROPE POLYSTYRENE PACKAGING MARKET, BY TYPE

6.1 OVERVIEW

6.2 BOXES

6.3 CUPS

6.4 BOTTLES

6.5 POUCHES

6.6 BAGS

6.7 PLATE

6.8 WRAPS AND FILMS

6.9 BOWLS

6.1 TUBS

6.11 OTHERS

7 EUROPE POLYSTYRENE PACKAGING MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 FRUITS

7.3 VEGETABLES

7.4 MILK PRODUCTS/DAIRY PRODUCTS

7.5 COOKED FOOD

7.6 MEAT PRODUCTS

7.7 FISH

7.8 SEA PRODUCTS

7.9 BAKERY & CONFECTIONERY

7.1 SNACKS

8 EUROPE POLYSTYRENE PACKAGING MARKET, BY END-USER

8.1 OVERVIEW

8.2 FOOD & BEVERAGES

8.2.1 BOXES

8.2.2 CUPS

8.2.3 BOTTLES

8.2.4 POUCHES

8.2.5 BAGS

8.2.6 PLATE

8.2.7 WRAPS AND FILMS

8.2.8 BOWLS

8.2.9 TUBS

8.2.10 OTHERS

8.2.10.1 FRUITS

8.2.10.2 VEGETABLES

8.2.10.3 MILK PRODUCTS/DAIRY PRODUCTS

8.2.10.4 COOKED FOOD

8.2.10.5 MEAT PRODUCTS

8.2.10.6 FISH

8.2.10.7 SEA PRODUCTS

8.2.10.8 BAKERY & CONFECTIONERY

8.2.10.9 SNACKS

8.3 PHARMACEUTICALS

8.3.1 BOXES

8.3.2 CUPS

8.3.3 BOTTLES

8.3.4 POUCHES

8.3.5 BAGS

8.3.6 PLATE

8.3.7 WRAPS AND FILMS

8.3.8 BOWLS

8.3.9 TUBS

8.3.10 OTHERS

8.4 PERSONAL & HOME CARE

8.4.1 BOXES

8.4.2 CUPS

8.4.3 BOTTLES

8.4.4 POUCHES

8.4.5 BAGS

8.4.6 PLATE

8.4.7 WRAPS AND FILMS

8.4.8 BOWLS

8.4.9 TUBS

8.4.10 OTHERS

9 EUROPE POLYSTYRENE PACKAGING MARKET, BY REGION

9.1 EUROPE

9.1.1 GERMANY

9.1.2 U.K.

9.1.3 FRANCE

9.1.4 ITALY

9.1.5 SPAIN

9.1.6 RUSSIA

9.1.7 SWITZERLAND

9.1.8 TURKEY

9.1.9 BELGIUM

9.1.10 NETHERLANDS

9.1.11 REST OF EUROPE

10 EUROPE POLYSTYRENE PACKAGING MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

10.2 EXPANSIONS

10.3 ACQUISITIONS

10.4 AWARDS

10.5 AGREEMENT

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 ALPEK S.A.B. DE C.V.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 SONOCO PRODUCTS COMPANY

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 KANEKA CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 MONOTEZ

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 NEFAB GROUP

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 HEUBACH CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 OHISHI SANGYO CO, LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 SUNPOR

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 SYNTHOS

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 VERSALIS S.P.A. (A SUBSIDIARY OF ENI S.P.A)

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF PLATES, SHEETS, FILM, FOIL, AND STRIPS OF PLASTICS, REINFORCED, LAMINATED, SUPPORTED, OR SIMILARLY COMBINED WITH OTHER MATERIALS, OR OF CELLULAR PLASTIC, UNWORKED OR MERELY SURFACE-WORKED OR MERELY CUT INTO SQUARES OR RECTANGLES (EXCLUDING SELF-ADHESIVE PRODUCTS, FLOOR, WALL AND CEILING COVERINGS; HS CODE – 3912 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PLATES, SHEETS, FILM, FOIL, AND STRIPS OF PLASTICS, REINFORCED, LAMINATED, SUPPORTED, OR SIMILARLY COMBINED WITH OTHER MATERIALS, OR OF CELLULAR PLASTIC, UNWORKED OR MERELY SURFACE-WORKED OR MERELY CUT INTO SQUARES OR RECTANGLES (EXCLUDING SELF-ADHESIVE PRODUCTS, FLOOR, WALL AND CEILING COVERINGS; HS CODE – 3912 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 EUROPE POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 EUROPE POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 6 EUROPE BOXES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 EUROPE BOXES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 8 EUROPE CUPS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE CUPS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 10 EUROPE BOTTLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 EUROPE BOTTLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 12 EUROPE POUCHES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 EUROPE POUCHES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 14 EUROPE BAGS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 EUROPE BAGS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 16 EUROPE PLATE IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 EUROPE PLATE IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 18 EUROPE WRAPS AND FILMS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 EUROPE WRAPS AND FILMS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 20 EUROPE BOWLS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 EUROPE BOWLS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 22 EUROPE TUBS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 EUROPE TUBS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 24 EUROPE OTHERS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 EUROPE OTHERS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 26 EUROPE POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 27 EUROPE POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 28 EUROPE FRUITS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 EUROPE FRUITS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 30 EUROPE VEGETABLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 EUROPE VEGETABLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 32 EUROPE MILK PRODUCTS/DAIRY PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 EUROPE MILK PRODUCTS/DAIRY PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 34 EUROPE COOKED FOOD IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 EUROPE COOKED FOOD IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 36 EUROPE MEAT PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 EUROPE MEAT PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 38 EUROPE FISH IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 EUROPE FISH IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 40 EUROPE SEA PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 EUROPE SEA PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 42 EUROPE BAKERY & CONFECTIONERY IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 EUROPE BAKERY & CONFECTIONERY IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 44 EUROPE SNACKS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 EUROPE SNACKS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 46 EUROPE POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 47 EUROPE POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 48 EUROPE FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 EUROPE FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 50 EUROPE FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 EUROPE FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 EUROPE PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 EUROPE PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 54 EUROPE PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 EUROPE PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 EUROPE PERSONAL & HOME CAREIN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 57 EUROPE PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 EUROPE POLYSTYRENE PACKAGING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 59 EUROPE POLYSTYRENE PACKAGING MARKET, BY COUNTRY, 2021-2030 (MILLION UNITS)

TABLE 60 EUROPE POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 EUROPE POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 62 EUROPE POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 EUROPE POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 64 EUROPE POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 65 EUROPE POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 66 EUROPE FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 EUROPE FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 EUROPE PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 EUROPE PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 GERMANY POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 GERMANY POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 72 GERMANY POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 GERMANY POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 74 GERMANY POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 75 GERMANY POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 76 GERMANY FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 GERMANY FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 GERMANY PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 GERMANY PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 U.K. POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 U.K. POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 82 U.K. POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 83 U.K. POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 84 U.K. POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 85 U.K. POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 86 U.K. FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 U.K. FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 88 U.K. PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 U.K. PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 FRANCE POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 FRANCE POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 92 FRANCE POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 93 FRANCE POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 94 FRANCE POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 95 FRANCE POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 96 FRANCE FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 FRANCE FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 FRANCE PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 FRANCE PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 ITALY POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 ITALY POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 102 ITALY POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 103 ITALY POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 104 ITALY POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 105 ITALY POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 106 ITALY FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 ITALY FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 108 ITALY PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 ITALY PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 SPAIN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 SPAIN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 112 SPAIN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 113 SPAIN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 114 SPAIN POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 115 SPAIN POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 116 SPAIN FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 SPAIN FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 118 SPAIN PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 SPAIN PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 RUSSIA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 RUSSIA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 122 RUSSIA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 123 RUSSIA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 124 RUSSIA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 125 RUSSIA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 126 RUSSIA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 RUSSIA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 128 RUSSIA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 RUSSIA PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 SWITZERLAND POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 SWITZERLAND POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 132 SWITZERLAND POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 133 SWITZERLAND POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 134 SWITZERLAND POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 135 SWITZERLAND POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 136 SWITZERLAND FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 SWITZERLAND FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 138 SWITZERLAND PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 SWITZERLAND PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 TURKEY POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 TURKEY POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 142 TURKEY POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 143 TURKEY POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 144 TURKEY POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 145 TURKEY POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 146 TURKEY FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 TURKEY FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 148 TURKEY PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 TURKEY PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 BELGIUM POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 BELGIUM POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 152 BELGIUM POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 153 BELGIUM POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 154 BELGIUM POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 155 BELGIUM POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 156 BELGIUM FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 BELGIUM FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 158 BELGIUM PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 BELGIUM PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 NETHERLANDS POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 NETHERLANDS POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 162 NETHERLANDS POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 163 NETHERLANDS POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 164 NETHERLANDS POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 165 NETHERLANDS POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 166 NETHERLANDS FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 NETHERLANDS FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 168 NETHERLANDS PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 NETHERLANDS PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 REST OF EUROPE POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 REST OF EUROPE POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

Liste des figures

FIGURE 1 EUROPE POLYSTYRENE PACKAGING MARKET

FIGURE 2 EUROPE POLYSTYRENE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE POLYSTYRENE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE POLYSTYRENE PACKAGING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE POLYSTYRENE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE POLYSTYRENE PACKAGING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 EUROPE POLYSTYRENE PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE POLYSTYRENE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE POLYSTYRENE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE POLYSTYRENE PACKAGING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 EUROPE POLYSTYRENE PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE POLYSTYRENE PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE POLYSTYRENE PACKAGING MARKET: SEGMENTATION

FIGURE 14 RISING USE OF POLYSTYRENE PACKAGING IN COSMETICS AND OTHER PERSONAL GOODS DUE TO ENHANCED DURABILITY IS EXPECTED TO DRIVE THE EUROPE POLYSTYRENE PACKAGING MARKET IN THE FORECAST PERIOD

FIGURE 15 BOXES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE POLYSTYRENE PACKAGING MARKET IN 2022 & 2029

FIGURE 16 PRICE ANALYSIS FOR POLYSTYRENE PACKAGING PRODUCTS (USD/UNIT)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE POLYSTYRENE PACKAGING MARKET

FIGURE 18 EUROPE POLYSTYRENE PACKAGING MARKET: BY TYPE, 2022

FIGURE 19 EUROPE POLYSTYRENE PACKAGING MARKET: BY APPLICATION, 2022

FIGURE 20 EUROPE POLYSTYRENE PACKAGING MARKET: BY END-USER, 2022

FIGURE 21 EUROPE POLYSTYRENE PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 22 EUROPE POLYSTYRENE PACKAGING MARKET: BY COUNTRY (2022)

FIGURE 23 EUROPE POLYSTYRENE PACKAGING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 EUROPE POLYSTYRENE PACKAGING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 EUROPE POLYSTYRENE PACKAGING MARKET: BY TYPE (2023 - 2030)

FIGURE 26 EUROPE POLYSTYRENE PACKAGING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.