Europe Polybutylene Succinate Pbs Market

Taille du marché en milliards USD

TCAC :

%

USD

38.08 Million

USD

64.46 Million

2025

2033

USD

38.08 Million

USD

64.46 Million

2025

2033

| 2026 –2033 | |

| USD 38.08 Million | |

| USD 64.46 Million | |

|

|

|

|

Europe Polybutylene Succinate (PBS) Market Segmentation, By Product (Conventional Polybutylene Succinate (PBS) and Bio-Based Polybutylene Succinate(PBS)), Process (Trans-Esterification and Direct Esterification), Application (Bags, Mulch Film, Packaging Film, Flushable Hygiene Products, Fishing Nets, Coffee Capsules, Wood Plastic Composites, and Others), Usage (Single-Use and Reusable) , Packaging Layer (Primary Packaging, Secondary Packaging, and Tertiary Packaging) , End-Use (Packaging, Agriculture, Textile, Consumer Goods, Electrical and Electronics, Automotive, and Others) - Industry Trends and Forecast to 2033

What is the Europe Polybutylene Succinate (PBS) Market Size and Growth Rate?

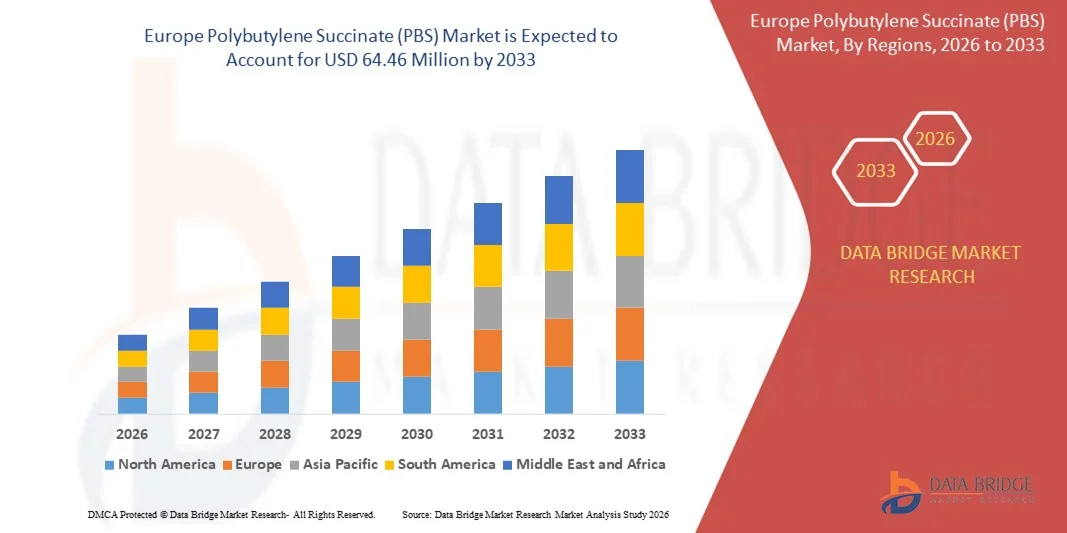

- The Europe polybutylene succinate (PBS) market size was valued at USD 38.08 million in 2025 and is expected to reach USD 64.46 million by 2033, at a CAGR of 6.8% during the forecast period

- the polybutylene succinate is frequently combined with natural fibers such as switchgrass (SG). These innovative composite materials are widely employed in the automotive sector since they are touted as viable bio-based alternatives to conventional petroleum-based polymers

- According to OICA, light commercial vehicle production in France increased by 6.5 percent from 4, 95,123 in 2018 to 5, 27,262 in 2019, while in Spain up by 5.6 percent from 4, 96,671 in 2018 to 5, 24,504 in 2019. As a result of rising automotive production, demand for polybutylene succinate will gradually rise, acting as a market driver

What are the Major Takeaways of Polybutylene Succinate (PBS) Market?

- Polybutylene succinate is becoming more widely used in agricultural applications, such as mulch films. Mulch films are commonly used to change soil temperature, control weed development, and reduce moisture loss, and increase crop yield and precociousness

- Governments are also investing extensively in agricultural projects and investments because it is one of the most effective ways to improve environmental sustainability

- Germany dominated the Europe polybutylene succinate (PBS) market with the largest revenue share of 34.5% in 2024, driven by rising demand for biodegradable packaging, compostable food service products, and sustainable agricultural films

- The France polybutylene succinate (PBS) market is witnessing steady growth at a cagr of 7.69%, supported by growing demand for compostable packaging films, flushable hygiene products, and eco-friendly consumer goods

- The Conventional PBS segment dominated the market with a 58.6% revenue share in 2024, driven by its established manufacturing base, cost competitiveness, and widespread use across packaging films, agricultural products, and consumer goods

Report Scope and Polybutylene Succinate (PBS) Market Segmentation

|

Attributes |

Polybutylene Succinate (PBS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Polybutylene Succinate (PBS) Market?

Rising Adoption of Bio-Based and Compostable Materials for Sustainable Packaging and Consumer Applications

- A major and accelerating trend in the polybutylene succinate (PBS) market is the growing shift toward bio-based, biodegradable, and compostable polymers as alternatives to conventional petroleum-based plastics. This transition is driven by increasing environmental concerns, regulatory pressure on single-use plastics, and rising consumer demand for sustainable materials across packaging, agriculture, and consumer goods applications

- For instance, leading material producers such as BASF SE, Indorama Ventures, Mitsubishi Chemical, and Far Eastern New Century are expanding bio-based PBS production and developing high-performance grades suitable for films, molded products, and blends with PLA and PBAT

- The increasing use of PBS in packaging films, compostable bags, disposable cutlery, and food-contact materials is enabling manufacturers to meet sustainability targets while maintaining flexibility, heat resistance, and processability comparable to conventional plastics

- Advancements in bio-succinic acid production, polymer blending technologies, and cost optimization are further improving the commercial viability of PBS in large-scale applications

- Growing adoption of circular economy principles, compostable packaging standards, and biodegradable certification programs is reinforcing the importance of PBS as a core material in sustainable plastic alternatives

- As sustainability expectations continue to rise globally, Polybutylene Succinate is becoming a critical material for enabling environmentally responsible product design without compromising functional performance

What are the Key Drivers of Polybutylene Succinate (PBS) Market?

- A key growth driver for the polybutylene succinate (PBS) market is the increasing implementation of plastic reduction policies and bans on single-use plastics across packaging, food service, and agricultural sectors

- For instance, during 2024–2025, governments across Europe and Europe strengthened regulations promoting compostable materials, driving higher adoption of PBS in packaging films, disposable products, and agricultural mulch applications

- Rising demand for sustainable food packaging, compostable consumer goods, and biodegradable agricultural inputs is accelerating PBS consumption across end-use industries

- Technological advancements in bio-based feedstocks, fermentation processes, and polymer modification are improving PBS mechanical strength, thermal stability, and cost competitiveness

- Increasing brand commitments toward carbon neutrality, eco-labeling, and sustainable packaging transitions are encouraging manufacturers to integrate PBS into product portfolios

- Supported by environmental regulations, corporate sustainability goals, and growing consumer awareness, the polybutylene succinate (PBS) market is expected to witness robust long-term growth across global markets

Which Factor is Challenging the Growth of the Polybutylene Succinate (PBS) Market?

- The basic materials for polybutylene succinate, notably succinic acid and 1, 4 butane-diols, are derived from petroleum feedstock

- As a result, crude oil price fluctuations affect the price of polybutylene succinate raw materials. The price of polybutylene succinate also rises as a result of the uncertainty in crude oil prices

- As a result, the polybutylene succinate market makers are such asly to face severe fluctuation in crude oil prices. This factor is projected to challenge growth of the global polybutylene succinate (PBS) market.

How is the Polybutylene Succinate (PBS) Market Segmented?

The market is segmented on the basis of product, process, application, usage, packaging layer, and end-use.

- By Product

On the basis of product, the polybutylene succinate (PBS) market is segmented into Conventional Polybutylene Succinate (PBS) and Bio-Based Polybutylene Succinate (PBS). The Conventional PBS segment dominated the market with a 58.6% revenue share in 2024, driven by its established manufacturing base, cost competitiveness, and widespread use across packaging films, agricultural products, and consumer goods. Conventional PBS offers reliable mechanical strength, flexibility, and thermal stability, making it suitable for large-scale commercial applications.

The Bio-Based PBS segment is expected to witness the fastest CAGR from 2025 to 2032, supported by rising environmental regulations, growing demand for compostable plastics, and increasing availability of bio-based succinic acid. Brand sustainability commitments and advancements in bio-feedstock processing are further accelerating adoption.

- By Process

Based on process, the market is segmented into Trans-Esterification and Direct Esterification. The Direct Esterification segment held the largest market share of 54.2% in 2024, owing to its simplified process flow, lower production costs, and suitability for large-scale PBS manufacturing. This method is widely adopted by major producers to improve yield efficiency and reduce operational complexity.

The Trans-Esterification segment is projected to grow at the fastest CAGR during 2025–2032, driven by its ability to deliver higher molecular weight polymers and improved material consistency. Increasing investments in advanced polymerization technologies are supporting its adoption for high-performance and specialty PBS grades.

- By Application

On the basis of application, the polybutylene succinate (PBS) market is segmented into Bags, Mulch Film, Packaging Film, Flushable Hygiene Products, Fishing Nets, Coffee Capsules, Wood Plastic Composites, and Others. The Packaging Film segment dominated the market with a 31.4% share in 2024, driven by growing demand for biodegradable food packaging, compostable films, and sustainable alternatives to conventional plastics.

The Mulch Film segment is expected to register the fastest CAGR from 2025 to 2032, supported by rising adoption of biodegradable agricultural inputs and government initiatives promoting sustainable farming practices.

- By Usage

Based on usage, the market is segmented into Single-Use and Reusable applications. The Single-Use segment accounted for the largest revenue share of 62.7% in 2024, driven by widespread use in disposable packaging, hygiene products, and agricultural films. PBS is increasingly replacing conventional plastics in short-life applications due to its compostability and regulatory compliance.

The Reusable segment is projected to grow at the fastest CAGR during the forecast period, supported by material enhancements that improve durability, mechanical strength, and resistance to repeated use, particularly in consumer goods and packaging applications.

- By Packaging Layer

On the basis of packaging layer, the market is segmented into Primary Packaging, Secondary Packaging, and Tertiary Packaging. The Primary Packaging segment dominated the market with a 46.9% revenue share in 2024, driven by direct food contact applications such as packaging films, bags, and containers.

The Secondary Packaging segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing use of biodegradable materials for wrapping, grouping, and protective packaging in logistics and retail supply chains.

- By End-Use

By end-use, the polybutylene succinate (PBS) market is segmented into Packaging, Agriculture, Textile, Consumer Goods, Electrical and Electronics, Automotive, and Others. The Packaging segment held the largest market share of 38.5% in 2024, driven by rising demand for sustainable food packaging and compostable consumer products.

The agriculture segment is anticipated to grow at the fastest CAGR during 2025–2032, fueled by increasing use of biodegradable mulch films and government support for eco-friendly agricultural solutions.

Which Region Holds the Largest Share of the Polybutylene Succinate (PBS) Market?

- Germany dominated the Europe polybutylene succinate (PBS) market with the largest revenue share of 34.5% in 2024, driven by rising demand for biodegradable packaging, compostable food service products, and sustainable agricultural films. Strong domestic production capacity and increasing adoption of eco-friendly materials are accelerating PBS integration across packaging, consumer goods, and agricultural applications

- The country’s leadership in bioplastics research, government incentives for sustainable polymers, and investments in bio-based polymer production infrastructure are driving large-scale adoption of Polybutylene Succinate (PBS). Collaborations with global PBS manufacturers and technology providers are further strengthening Germany’s position as the primary hub for Europe’s PBS market, concluding that Germany is central to regional growth and the promotion of sustainable polymer solutions

France Polybutylene Succinate (PBS) Market Insight

The France polybutylene succinate (PBS) market is witnessing steady growth at a cagr of 7.69%, supported by growing demand for compostable packaging films, flushable hygiene products, and eco-friendly consumer goods. French manufacturers are focusing on high-performance PBS grades, biodegradable formulations, and sustainable processing technologies to meet strict environmental regulations. Strategic collaborations with European and global suppliers, along with government-backed initiatives for circular economy adoption, are reinforcing France’s role as a key innovation and growth contributor in the Europe PBS market, concluding that the country is an important driver of regional sustainability adoption.

Italy Polybutylene Succinate (PBS) Market Insight

The Italy Polybutylene Succinate (PBS) market is expanding steadily, driven by increasing adoption of eco-friendly packaging, biodegradable consumer products, and agricultural films. Rising consumer awareness of environmental sustainability, supportive government policies, and investments in bio-based polymer manufacturing are supporting market growth. Continuous innovation in material performance, scalable production processes, and high-quality PBS formulations are positioning Italy as an important manufacturing and growth hub within the Europe Polybutylene Succinate (PBS) market, concluding that the country is a key contributor to the regional adoption of sustainable polymer solutions.

Which are the Top Companies in Polybutylene Succinate (PBS) Market?

The polybutylene succinate (PBS) industry is primarily led by well-established companies, including:

- Indorama Ventures Public Company Limited (Thailand)

- Alpek S.A.B. de C.V. (Mexico)

- Jiangsu Sanfangxiang Group Co., Ltd. (China)

- Far Eastern New Century Corporation (Taiwan)

- DAK Americas (U.S.)

- BASF SE (Germany)

- Zhejiang Biodegradable Advanced Material Co. Ltd (China)

- Xinhaibio (China)

- Lubrilog (France)

- ECCO Gleittechnik GmbH (Germany)

- HUSK-ITT Corporation (U.S.)

- Setral Chemie GmbH (Germany)

- IKV Tribology Ltd (Germany)

- Hangzhou Ruijiang Chemical Co. (China)

- WILLEAP (South Korea)

What are the Recent Developments in Global Polybutylene Succinate (PBS) Market?

- In September 2022, Technip Energies, a France-based engineering and technology company, strengthened its sustainable chemicals portfolio by acquiring DSM’s biosuccinium technology, securing exclusive licensing rights for the production of bio-based succinic acid, a key raw material for polybutylene succinate (PBS). The acquisition includes multiple patent families and proprietary yeast strains validated at commercial scale, concluding that this move significantly enhances Technip Energies’ leadership and long-term positioning in bio-based polymer value chains

- In April 2021, Mitsubishi Chemical Corporation developed a marine-biodegradable grade of BioPBS as part of its efforts to advance plant-derived polybutylene succinate (PBS) products and expand application potential. This development supports portfolio diversification and revenue growth while addressing environmental sustainability requirements, concluding that the innovation strengthens the company’s competitive edge in biodegradable and eco-friendly polymer markets

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.