Marché européen de l'acide phosphorique, par type de procédé (procédé humide et procédé thermique), forme (solide et liquide), qualité (qualité technique, qualité alimentaire et qualité alimentaire), application (aliments et boissons, aliments pour animaux, soins personnels, fabrication de produits chimiques, cuir et textile, agents de nettoyage, céramiques et réfractaires, engrais agricoles, métallurgie, traitement de l'eau, construction, exploitation minière, semi-conducteurs, soins bucco-dentaires, produits pharmaceutiques et autres), pays (Allemagne, France, Royaume-Uni, Italie, Espagne, Russie, Turquie, Belgique, Pays-Bas, Suisse et reste de l'Europe) Tendances et prévisions de l'industrie jusqu'en 2028

Analyse et perspectives du marché : marché européen de l'acide phosphorique

Analyse et perspectives du marché : marché européen de l'acide phosphorique

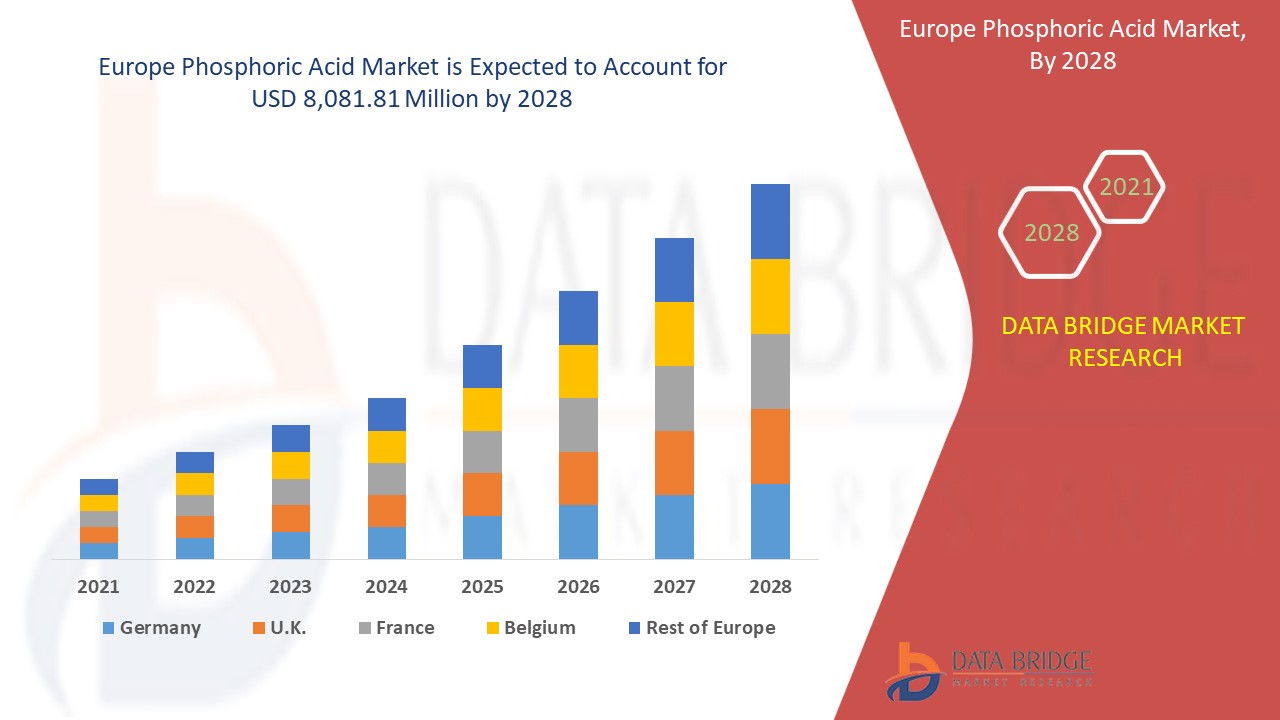

Le marché européen devrait croître au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,0 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 8 081,81 millions USD d'ici 2028. La demande accrue d'acide phosphorique dans les industries pharmaceutiques et la demande croissante des fabricants d'engrais stimulent ainsi la croissance du marché européen de l'acide phosphorique.

L'acide phosphorique est un acide cristallin généralement faible, incolore et inodore. Ces matières inorganiques sont corrosives pour les métaux ferreux et leurs alliages et possèdent une bonne solubilité dans l'eau. Elles ont tendance à se décomposer à haute température. Elles peuvent former des fumées toxiques lorsqu'elles sont combinées à de l'alcool. Procédé thermique, procédé au four sec et procédé humide utilisés pour la production d'acide phosphorique. Il donne aux boissons gazeuses une saveur acidulée et empêche la croissance de moisissures et de bactéries, qui peuvent se multiplier facilement dans une solution sucrée. La majeure partie de l'acidité du soda provient également de l'acide phosphorique.

L'acide phosphorique est fabriqué à partir du phosphore, un minéral naturellement présent dans le corps. Il agit en synergie avec le calcium pour renforcer les os et les dents. Il contribue également à soutenir la fonction rénale et la façon dont votre corps utilise et stocke l'énergie. Le phosphore aide vos muscles à récupérer après un entraînement intensif. Ce minéral joue un rôle majeur dans la croissance du corps et est même nécessaire à la production d'ADN et d'ARN, les codes génétiques des êtres vivants.

Le phosphore est d'abord transformé en pentoxyde de phosphore par un procédé de fabrication chimique. Il est ensuite traité à nouveau pour devenir de l'acide phosphorique.

Les principaux facteurs qui devraient stimuler la croissance du marché européen de l'acide phosphorique au cours de la période de prévision sont l'utilisation considérable de l'acide phosphorique pour la production d'engrais phosphatés. En outre, les réglementations gouvernementales strictes concernant l'acide phosphorique propulsent davantage le marché européen de l'acide phosphorique. D'autre part, des innovations importantes et des lancements de nouveaux produits devraient faire dérailler la croissance du marché européen de l'acide phosphorique. En outre, la disponibilité de produits de substitution pourrait créer d'autres obstacles sur le marché européen de l'acide phosphorique dans un avenir proche.

Le rapport sur le marché européen de l'acide phosphorique fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché européen de l'acide phosphorique, contactez Data Bridge Market Research pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché de l'acide phosphorique en Europe

Portée et taille du marché de l'acide phosphorique en Europe

Le marché européen de l'acide phosphorique est segmenté en quatre segments notables qui sont basés sur le type de processus, la forme, la qualité et l'application. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du type de procédé, le marché de l'acide phosphorique est segmenté en procédé humide et procédé thermique. En 2021, le segment du procédé humide devrait détenir la plus grande part de marché en raison de sa plus grande application dans la production d'engrais et de son coût de production inférieur à celui du procédé thermique.

- Sur la base de la forme, le marché de l'acide phosphorique est segmenté en liquide et solide. En 2021, le marché est dominé par la forme liquide en raison de son application dans diverses industries, en raison de sa nature soluble, tandis que la plupart des applications de l'acide phosphorique sont sous forme liquide.

- Sur la base de la qualité, le marché de l'acide phosphorique est segmenté en qualité alimentaire, qualité fourragère et qualité technique. En 2021, le marché est dominé par le segment de qualité technique en raison de son utilisation dans la production d'engrais, de nutriments pour les cultures et d'aliments pour animaux.

- En fonction des applications, le marché de l'acide phosphorique est segmenté en aliments et boissons, aliments pour animaux, soins personnels, fabrication de produits chimiques, cuir et textile, agents de nettoyage, céramiques et réfractaires, engrais agricoles, métallurgie, traitement de l'eau, construction, exploitation minière, semi-conducteurs, soins bucco-dentaires, produits pharmaceutiques et autres. En 2021, le marché est dominé par le segment des engrais agricoles en raison de l'utilisation croissante de divers engrais tels que l'augmentation du rendement des cultures et la satisfaction des besoins alimentaires croissants à travers le monde.

Analyse du marché de l'acide phosphorique en Europe au niveau des pays

Le marché européen de l’acide phosphorique est analysé et des informations sur la taille du marché sont fournies par pays, type de processus, forme, qualité et application comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché européen de l'acide phosphorique sont l'Allemagne, la France, l'Espagne, l'Italie, les Pays-Bas, la Suisse, la Russie, la Turquie, l'Autriche, l'Irlande et le reste de l'Europe.

- En 2021, le marché est dominé par l’Allemagne en raison de l’utilisation croissante de l’acide phosphorique dans différentes industries.

Le segment des procédés de la région Europe devrait connaître le taux de croissance le plus élevé au cours de la période de prévision de 2021 à 2028 en raison de l'utilisation croissante de l'acide phosphorique dans l'industrie pharmaceutique. L'Allemagne est en tête de la croissance du marché européen et le segment des procédés par voie humide domine dans ce pays en raison des impuretés présentes dans l'acide par voie humide qui favorisent le surrefroidissement et réduisent la tendance à la cristallisation.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Les activités stratégiques croissantes des principaux acteurs du marché visant à accroître la notoriété de l'acide phosphorique stimulent la croissance du marché européen de l'acide phosphorique

Le marché européen de l'acide phosphorique vous fournit également une analyse de marché détaillée de la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2011 à 2019.

Analyse du paysage concurrentiel et des parts de marché de l'acide phosphorique en Europe

Le paysage concurrentiel du marché européen de l'acide phosphorique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que l'orientation de l'entreprise vers le marché européen de l'acide phosphorique.

Certains des principaux acteurs opérant sur le marché européen de l'acide phosphorique sont Nutrien Ltd, OCP, JR Simplot Company, Brenntag North America, Inc, Arkema, ICL, Innophos, Spectrum Chemical, Solvay, Merck KGaA, Prayon SA, YPH, Clariant AG, Jordan Phosphate Mines Company (PLC) et Quadra Chemicals, entre autres.

Les analystes DBMR comprennent les atouts concurrentiels et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux lancements de produits sont également initiés par des entreprises du monde entier, ce qui accélère également le marché européen de l'acide phosphorique.

Par exemple,

- En septembre 2020, Clariant AG a lancé un nouvel ester phosphate innovant offrant des performances exceptionnelles et une durabilité supérieure dans les formulations de fluides de travail des métaux. Ce lancement de produit a permis à l'entreprise d'élargir son portefeuille de produits

- En août 2020, OCP a lancé la construction d’une nouvelle usine de production d’acide phosphorique purifié, à travers sa filiale Euro Maroc Phosphore (EMAPHOS). Ce lancement a permis à l’entreprise d’augmenter sa capacité de production

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché européen de l'acide phosphorique, ce qui profite également à la croissance des bénéfices de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PHOSPHORIC ACID MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 RAW MATERIAL PRICING ANALYSIS

4.2 PRODUCTION AND CONSUMPTION PATTERN

4.2.1 PRODUCTION PATTERN:

4.2.2 CONSUMPTION PATTERN:

4.2.3 CONCLUSION:

4.3 MARKETING STRATEGIES

4.4 LIST OF SUBSTITUTES IN THE MARKET

5 REGULATORY FRAMEWORK

6 PHOSPHORIC ACID MANUFACTURING PROCESS

7 BRAND ANALYSIS

8 COMPARITIVE ANALYSIS WITH PARENT MARKET

9 PRICING ANALYSIS

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 CONSIDERABLE USE OF PHOSPHORIC ACID FOR PRODUCTION OF PHOSPHATE FERTILIZERS

10.1.2 GROWING USAGE OF PHOSPHORIC ACID IN MEDICAL APPLICATIONS

10.1.3 INCREASING USE AS A FOOD ADDITIVE IN THE FOOD & BEVERAGE INDUSTRY

10.1.4 RISING USE IN KEY COMMERCIAL APPLICATIONS

10.2 RESTRAINTS

10.2.1 STRINGENT GOVERNMENT REGULATIONS FOR PHOSPHORIC ACID

10.2.2 ISSUES ARISING DUE TO OVER USAGE OF PHOSPHATE BASED PRODUCTS

10.2.3 AVAILABILITY OF SUBSTITUTE PRODUCTS

10.3 OPPORTUNITIES

10.3.1 SIGNIFICANT INNOVATION AND NEW PRODUCT LAUNCHES

10.3.2 GROWING USE OF PHOSPHORIC ACID IN FUEL CELLS

10.4 CHALLENGES

10.4.1 GROWING AWARENESS REGARDING THE ENVIRONMENTAL IMPACT OF PHOSPHORIC ACID

10.4.2 INCREASING ADOPTION OF GENETICALLY MODIFIED SEEDS

11 COVID-19 IMPACT ON THE EUROPE PHOSPHORIC ACID MARKET

11.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE EUROPE PHOSPHORIC ACID MARKET

11.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

11.3 IMPACT ON PRICE

11.4 IMPACT ON DEMAND

11.5 IMPACT ON SUPPLY CHAIN

11.6 CONCLUSION

12 EUROPE PHOSPHORIC ACID MARKET, BY PROCESS TYPE

12.1 OVERVIEW

12.2 WET PROCESS

12.3 THERMAL PROCESS

13 EUROPE PHOSPHORIC ACID MARKET, BY GRADE

13.1 OVERVIEW

13.2 TECHNICAL GRADE

13.3 FOOD GRADE

13.4 FEED GRADE

14 EUROPE PHOSPHORIC ACID MARKET, BY FORM

14.1 OVERVIEW

14.2 LIQUID

14.3 SOLID (CRYSTAL SOLID)

15 EUROPE PHOSPHORIC ACID MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 AGRICULTURE FERTILIZERS

15.3 FOOD & BEVERAGES

15.3.1 BEVERAGES

15.3.1.1 BEVERAGES

15.3.1.2 FRUIT JUICE

15.3.1.3 OTHERS

15.3.2 DAIRY PRODUCTS

15.3.2.1 CHEESE

15.3.2.2 MAYONNAISE

15.3.2.3 OTHERS

15.3.3 BAKERY PRODUCTS

15.3.4 CANNED FOOD

15.3.5 EDIBLE OIL

15.3.6 SAUCES

15.3.7 JAMES, JELLIES

15.3.8 SUGAR

15.3.9 OTHERS

15.4 ANIMAL FEED

15.5 CHEMICAL MANUFACTURING

15.5.1 PHOSPHORIC ACID LINE CLEANERS

15.5.2 METAL PHOSPHATING SOLUTION

15.5.3 ALUMINUM BRIGHT DIP SOLUTION

15.5.4 TRANSITION METAL PHOSPHATE SALT

15.6 PHARMACEUTICAL

15.7 PERSONAL CARE

15.7.1 SOAP

15.7.2 PERFUMES

15.7.3 SHAMPOO

15.7.4 NAIL PAINTS

15.7.5 CLEANERS

15.7.6 CREAMS

15.7.7 OTHERS

15.8 MINING

15.9 CLEANING AGENTS

15.9.1 FOOD PROCESSING CLEANING AGENTS

15.9.2 LAUNDRY CLEANING AGENTS

15.9.3 HOUSEHOLD CLEANING AGENTS

15.9.4 TRANSPORTATION CLEANING AGENTS

15.9.5 OTHERS

15.1 ORAL & DENTAL CARE

15.10.1 ABRASIVE

15.10.2 MOUTHWASHES

15.10.3 WHITENING & SENSITIVE TEETH

15.10.4 TARTAR CONTROL

15.11 WATER TREATMENT

15.12 SEMICONDUCTORS

15.13 LEATHER & TEXTILE

15.14 CONSTRUCTION

15.15 METALLURGY

15.16 CERAMIC & REFRACTORIES

15.17 OTHERS

16 EUROPE PHOSPHORIC ACID MARKET, BY REGION

16.1 EUROPE

16.1.1 GERMANY

16.1.2 U.K.

16.1.3 FRANCE

16.1.4 SPAIN

16.1.5 ITALY

16.1.6 RUSSIA

16.1.7 SWITZERLAND

16.1.8 NETHERLANDS

16.1.9 TURKEY

16.1.10 BELGIUM

16.1.11 REST OF EUROPE

17 EUROPE PHOSPHORIC ACID MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: EUROPE

17.2 MERGER & ACQUISITION

17.3 EXPANSION

17.4 NEW PRODUCT DEVELOPMENTS

17.5 PRESENTATIONS

17.6 AGREEMENTS

17.7 AWARDS AND CERTIFICATIONS

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 OCP

19.1.1 COMPANY SNAPSHOT

19.1.2 COMPANY SHARE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENT

19.2 ICL

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 NUTRIEN LTD.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUS ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 BRENNTAG SE

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 MERCK KGAA

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUS ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 JORDAN PHOSPHATE MINES COMPANY (PLC).

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUS ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENT

19.7 ARKEMA

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENT

19.8 CLARIANT AG

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUS ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 INNOPHOS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 J.R. SIMPLOT COMPANY.

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 PRAYON S.A.

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 QUADRA CHEMICALS

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 SOLVAY

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUS ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENT

19.14 SPECTRUM CHEMICAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 YPH

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF PRODUCT: 2809 DIPHOSPHORUS PENTAOXIDE; PHOSPHORIC ACID; POLYPHOSPHORIC ACIDS, WHETHER OR NOT CHEMICALLY DEFINED

TABLE 2 EXPORT DATA OF PRODUCT: 2809 DIPHOSPHORUS PENTAOXIDE; PHOSPHORIC ACID; POLYPHOSPHORIC ACIDS, WHETHER OR NOT CHEMICALLY DEFINED

TABLE 3 WORLD PRODUCTION/SUPPLY OF PHOSPHORIC ACID (2015 – 2020)

TABLE 4 WORLD CONSUMPTION OF PHOSPHORIC ACID (2019 – 2022)

TABLE 5 REGULATORY FRAMEWORK

TABLE 6 AVERAGE PRICE OF PHOSPHORIC ACID (2020-2022)

TABLE 7 EUROPE PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 8 EUROPE PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (TONS)

TABLE 9 EUROPE WET PROCESS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 EUROPE THERMAL PROCESS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 EUROPE PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 12 EUROPE TECHNICAL GRADE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 EUROPE FOOD GRADE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 EUROPE FEED GRADE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 EUROPE PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 16 EUROPE LIQUID IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 EUROPE SOLID (CRYSTAL SOLID) IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 EUROPE PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 19 EUROPE AGRICULTURE FERTILIZERS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 EUROPE FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 EUROPE FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 22 EUROPE BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 23 EUROPE DAIRY PRODUCT IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 24 EUROPE ANIMAL FEED IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 EUROPE CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 EUROPE CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 27 EUROPE PHARMACEUTICAL IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 EUROPE PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 EUROPE PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 30 EUROPE MINING IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 EUROPE CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 EUROPE CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 33 EUROPE ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 EUROPE ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 35 EUROPE WATER TREATMENT IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 EUROPE SEMICONDUCTORS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 37 EUROPE LEATHER & TEXTILE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 EUROPE CONSTRUCTION IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 39 EUROPE METALLURGY IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 EUROPE CERAMIC & REFRACTORIES IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 41 EUROPE OTHERS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 42 EUROPE PHOSPHORIC ACID MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 43 EUROPE PHOSPHORIC ACID MARKET, BY COUNTRY, 2019-2028 (THOUSAND METRIC TONS)

TABLE 44 EUROPE PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 45 EUROPE PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 46 EUROPE PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 47 EUROPE PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 48 EUROPE PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 49 EUROPE FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 50 EUROPE DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 51 EUROPE BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 52 EUROPE PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 53 EUROPE CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 54 EUROPE CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 55 EUROPE ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 56 GERMANY PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 57 GERMANY PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 58 GERMANY PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 59 GERMANY PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 60 GERMANY PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 61 GERMANY FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 62 GERMANY DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 63 GERMANY BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 64 GERMANY PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 65 GERMANY CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 66 GERMANY CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 67 GERMANY ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 68 U.K. PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 69 U.K. PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 70 U.K. PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 71 U.K. PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 72 U.K. PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 73 U.K. FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 74 U.K. DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 U.K. BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 76 U.K. PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 77 U.K. CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 78 U.K. CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 79 U.K. ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 80 FRANCE PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 81 FRANCE PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 82 FRANCE PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 83 FRANCE PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 84 FRANCE PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 85 FRANCE FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 86 FRANCE DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 87 FRANCE BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 88 FRANCE PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 89 FRANCE CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 90 FRANCE CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 91 FRANCE ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 92 SPAIN PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 93 SPAIN PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 94 SPAIN PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 95 SPAIN PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 96 SPAIN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 97 SPAIN FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 98 SPAIN DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 99 SPAIN BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 100 SPAIN PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 101 SPAIN CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 102 SPAIN CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 103 SPAIN ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 104 ITALY PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 105 ITALY PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 106 ITALY PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 107 ITALY PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 108 ITALY PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 109 ITALY FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 110 ITALY DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 111 ITALY BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 112 ITALY PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 113 ITALY CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 114 ITALY CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 115 ITALY ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 116 RUSSIA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 117 RUSSIA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 118 RUSSIA PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 119 RUSSIA PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 120 RUSSIA PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 121 RUSSIA FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 122 RUSSIA DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 123 RUSSIA BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 124 RUSSIA PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 125 RUSSIA CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 126 RUSSIA CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 127 RUSSIA ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 128 SWITZERLAND PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 129 SWITZERLAND PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 130 SWITZERLAND PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 131 SWITZERLAND PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 132 SWITZERLAND PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 133 SWITZERLAND FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 134 SWITZERLAND DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 135 SWITZERLAND BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 136 SWITZERLAND PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 137 SWITZERLAND CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 138 SWITZERLAND CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 139 SWITZERLAND ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 140 NETHERLANDS PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 141 NETHERLANDS PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 142 NETHERLANDS PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 143 NETHERLANDS PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 144 NETHERLANDS PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 145 NETHERLANDS FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 146 NETHERLANDS DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 147 NETHERLANDS BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 148 NETHERLANDS PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 149 NETHERLANDS CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 150 NETHERLANDS CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 151 NETHERLANDS ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 152 TURKEY PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 153 TURKEY PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 154 TURKEY PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 155 TURKEY PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 156 TURKEY PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 157 TURKEY FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 158 TURKEY DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 159 TURKEY BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 160 TURKEY PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 161 TURKEY CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 162 TURKEY CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 163 TURKEY ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 164 BELGIUM PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 165 BELGIUM PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 166 BELGIUM PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 167 BELGIUM PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 168 BELGIUM PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 169 BELGIUM FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 170 BELGIUM DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 171 BELGIUM BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 172 BELGIUM PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 173 BELGIUM CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 174 BELGIUM CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 175 BELGIUM ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 176 REST OF EUROPE PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 177 REST OF EUROPE PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

Liste des figures

FIGURE 1 EUROPE PHOSPHORIC ACID MARKET: SEGMENTATION

FIGURE 2 EUROPE PHOSPHORIC ACID MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PHOSPHORIC ACID MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PHOSPHORIC ACID MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PHOSPHORIC ACID MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PHOSPHORIC ACID MARKET: PRODUCT LIFELINE CURVE

FIGURE 7 EUROPE PHOSPHORIC ACID MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE PHOSPHORIC ACID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE PHOSPHORIC ACID MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE PHOSPHORIC ACID MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE PHOSPHORIC ACID MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 EUROPE PHOSPHORIC ACID: THE MARKET CHALLENGE MATRIX

FIGURE 13 EUROPE PHOSPHORIC ACID MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE EUROPE PHOSPHORIC ACID MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 CONSIDERABLE USE OF PHOSPHORIC ACID FOR THE PRODUCTION OF PHOSPHATE FERTILIZERSIS DRIVING THE GROWTH OF THE EUROPE PHOSPHORIC ACID MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 16 WET PROCESS SUB-SEGMENT IN PROCESS TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PHOSPHORIC ACID MARKET IN 2021 & 2028

FIGURE 17 FIG: AVERAGE PRICE OF PHOSPHATE ROCK FROM FEB 2021-SEPT-2021 (PER METRIC TON)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF EUROPE PHOSPHORIC ACID MARKET

FIGURE 19 EUROPE PHOSPHORIC ACID MARKET: BY PROCESS TYPE, 2020

FIGURE 20 EUROPE PHOSPHORIC ACID MARKET: BY GRADE, 2020

FIGURE 21 EUROPE PHOSPHORIC ACID MARKET: BY FORM, 2020

FIGURE 22 EUROPE PHOSPHORIC ACID MARKET: BY APPLICATION, 2020

FIGURE 23 EUROPE PHOSPHORIC ACID MARKET: SNAPSHOT (2020)

FIGURE 24 EUROPE PHOSPHORIC ACID MARKET: BY COUNTRY (2020)

FIGURE 25 EUROPE PHOSPHORIC ACID MARKET: BY COUNTRY (2021 & 2028)

FIGURE 26 EUROPE PHOSPHORIC ACID MARKET: BY COUNTRY (2020 & 2028)

FIGURE 27 EUROPE PHOSPHORIC ACID MARKET: BY PROCESS TYPE (2021 & 2028)

FIGURE 28 EUROPE PHOSPHORIC ACID MARKET: COMPANY SHARE 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.