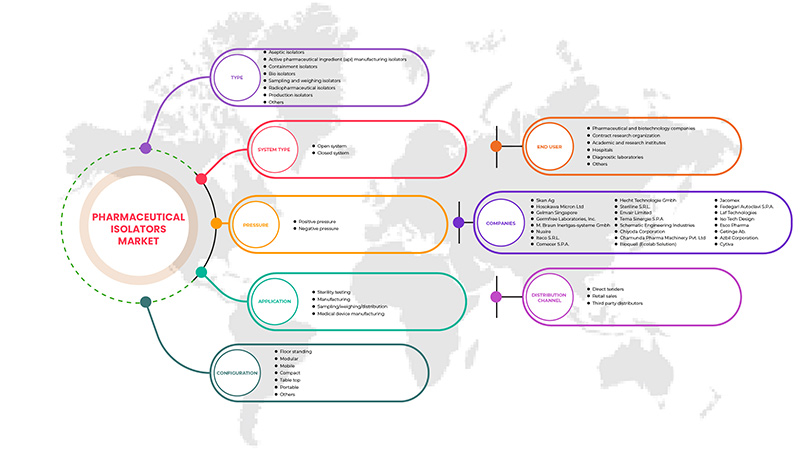

>Marché européen des isolateurs pharmaceutiques, par type (isolateurs aseptiques, isolateurs de confinement, isolateurs biologiques, isolateurs d'échantillonnage et de pesée, isolateurs de fabrication d'ingrédients pharmaceutiques actifs (API), isolateurs radiopharmaceutiques, isolateurs de production, autres), type de système (système fermé, système ouvert), pression (pression positive, pression négative), configuration (au sol, modulaire, mobile, compact, de table, portable , autres), application (test de stérilité, fabrication, échantillonnage/pesée/distribution, fabrication de dispositifs médicaux ), utilisateur final (hôpitaux, laboratoires de diagnostic, instituts universitaires et de recherche, sociétés pharmaceutiques et biotechnologiques, organismes de recherche sous contrat, autres), canal de distribution (appel d'offres direct, vente au détail, distributeurs tiers) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché européen des isolateurs pharmaceutiques

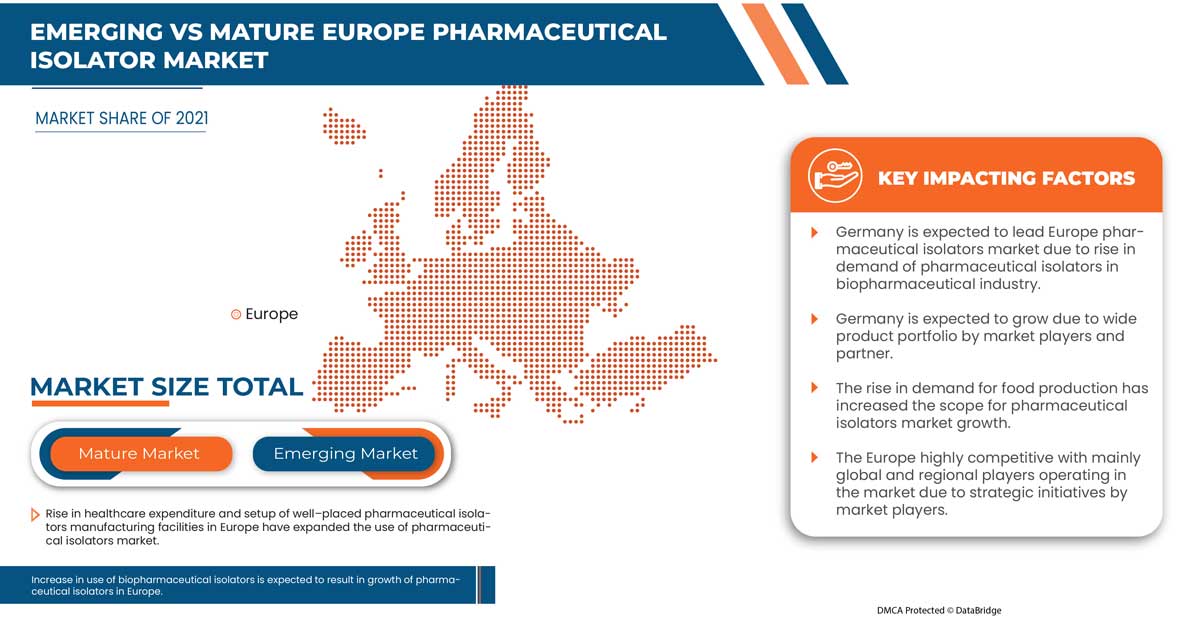

Les isolateurs pharmaceutiques sont utilisés dans l'industrie pharmaceutique comme système de barrière sans contamination. Les tests microbiologiques, le traitement de thérapie cellulaire, la fabrication pharmaceutique avancée (ATMP) et le pesage, l'emballage et la distribution de produits injectables stériles ne sont que quelques-unes des applications des isolateurs pharmaceutiques. L'utilisation d'isolateurs pharmaceutiques est alimentée par la croissance continue du marché pharmaceutique dans les pays en développement et développés et par l'augmentation des dépenses de R&D pour produire des traitements innovants. Les isolateurs médicaux avancés et les exigences de l'industrie pharmaceutique ont conduit les principaux fabricants à développer l'industrie des isolateurs médicaux. L'utilisation croissante de composés dangereux, le coût croissant de la non-conformité et l'augmentation des laboratoires de recherche sont des moteurs importants du marché des isolateurs pharmaceutiques au cours de la période de prévision.

Cependant, la plupart des experts ne sont pas d’accord pour dire que les entités réglementaires ne font plus obstacle à des avancées technologiques telles que le développement d’isolants pharmaceutiques.

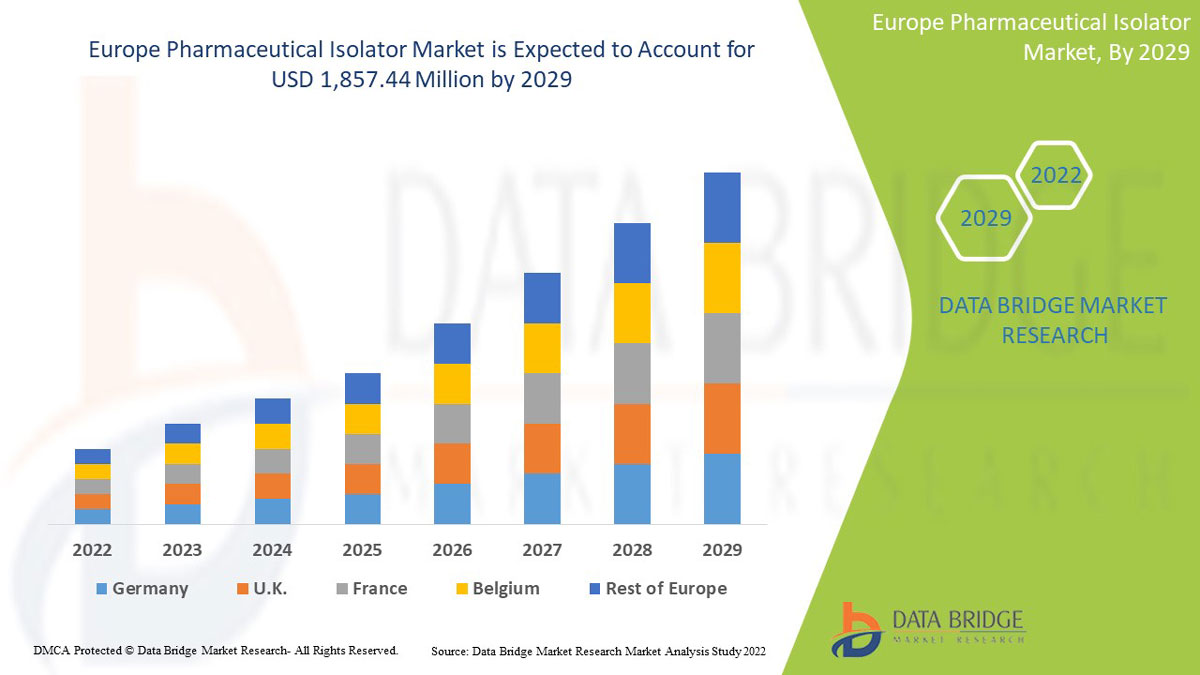

Data Bridge Market Research analyse que le marché européen des isolateurs pharmaceutiques devrait atteindre la valeur de 1 857,44 millions USD d'ici 2029, à un TCAC de 13,8 % au cours de la période de prévision. Le type représente le segment de type le plus important du marché en raison de la demande rapide d'isolateurs pharmaceutiques dans la région. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par type (isolateurs aseptiques, isolateurs de confinement, isolateurs biologiques, isolateurs d'échantillonnage et de pesée, isolateurs de fabrication d'ingrédients pharmaceutiques actifs (API), isolateurs radiopharmaceutiques, isolateurs de production, autres), type de système (système fermé, système ouvert), pression (pression positive, pression négative), configuration (au sol, modulaire, mobile, compact, de table, portable, autres), application (test de stérilité, fabrication, échantillonnage/pesée/distribution, fabrication de dispositifs médicaux), utilisateur final (hôpitaux, laboratoires de diagnostic, instituts universitaires et de recherche, sociétés pharmaceutiques et biotechnologiques, organismes de recherche sous contrat, autres), canal de distribution (appel d'offres direct, vente au détail, distributeurs tiers). |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Espagne, Russie, Turquie, Belgique, Pays-Bas, Suisse et le reste de l'Europe, |

|

Acteurs du marché couverts |

Français Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco SRL, Comecer SPA, Hecht Technologie Gmbh, Steriline SRL, Envair Limited, Tema Sinergie SPA, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi SpA, LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma entre autres. |

Définition du marché européen des isolateurs pharmaceutiques

Le concept d'isolement protège le processus de l'opérateur et/ou l'opérateur du processus, tout en protégeant l'environnement. La clé du confinement est une exposition minimale. En contrôlant la plage d'exposition en dessous du niveau de danger défini pour le composé, l'opérateur et l'environnement sont correctement protégés. Par conséquent, le produit est protégé et donc un problème réglementaire clé est résolu. Un isolateur pharmaceutique est une enceinte bactérienne scellée utilisée dans l'environnement pharmaceutique pour le remplissage aseptique et le processus toxique. Il est constitué d'un isolateur principal parfaitement stérile où les produits sont manipulés, stockés ou emballés à l'aide de gants à hauteur d'épaule placés sur l'une des parois. L'isolateur pharmaceutique permet le contrôle et le confinement des processus pharmaceutiques. Les conditions requises pour le fonctionnement d'un isolateur pharmaceutique sont un environnement stérile et exempt de micro-organismes viables. Un isolateur pharmaceutique garantit que la zone de production et l'environnement aseptique sont placés dans des positions séparées. Un isolateur de l'industrie pharmaceutique est rentable et efficace, par rapport aux salles blanches de l'industrie pharmaceutique dans un environnement aseptique. Il crée une atmosphère contrôlée pendant le processus de production microbienne et médicamenteuse en s'adaptant aux différentes normes de certification requises pour les isolateurs et les barrières d'accès restreint. Il assure en même temps la protection du produit, des opérateurs et de l'environnement.

Les applications abondantes des isolateurs pharmaceutiques varient selon les besoins de production et de contrôle. Il est utilisé lors de la manipulation, du transfert ou de l'emballage de médicaments pharmaceutiques solides, semi-solides ou en poudre, de la manipulation et du remplissage de solutions et de perfusions. Les isolateurs pharmaceutiques sont utilisés dans les tests de stérilité, la manipulation aseptique de tissus ou de systèmes de production biologique ou d'échantillons pathogènes, etc. Il peut être utilisé pour la production et le contrôle de médicaments et de produits pharmaceutiques. La forte demande d'isolateurs dans l'industrie pharmaceutique et biotechnologique, ainsi que les faibles coûts d'exploitation, le maintien élevé des conditions aseptiques dans la production de produits pharmaceutiques et la demande croissante de l'industrie biopharmaceutique sont les facteurs qui devraient stimuler la croissance du marché au cours de la période de prévision.

En outre, l'initiative stratégique des acteurs du marché, les progrès technologiques dans les isolateurs pharmaceutiques, l'assurance d'une stérilité élevée et l'augmentation des investissements dans les infrastructures de santé augmentent la demande sur le marché des isolateurs pharmaceutiques.

Dynamique du marché européen des isolateurs pharmaceutiques

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

La demande d'isolateurs pharmaceutiques augmente dans les industries pharmaceutiques en plein essor

L'isolateur pharmaceutique est un dispositif de séparation qui sépare une procédure ou une activité pharmaceutique de l'opérateur et de l'environnement adjacent. Il est utilisé à diverses fins telles que :

- Fournir un environnement aseptique catégorisé pour une activité ou une procédure et le protéger de la contamination microbienne et non microbienne provenant de l'opérateur et de l'environnement adjacent, ce qui est appelé protection du produit.

- Protection du produit contre la contamination produite par d'autres produits et procédés, même au cours d'opérations simultanées ou antérieures. On parle alors de protection contre la contamination générée par le procédé ou la contamination croisée.

Les problèmes de contamination croissants dans l'unité de fabrication dans laquelle intervient l'isolateur créent une demande d'isolateur pharmaceutique qui aide à la contamination et à la décontamination.

- Faible coût d'exploitation des isolateurs pharmaceutiques

Les enceintes scellées selon une norme d'étanchéité qui comprend un environnement intérieur contrôlé qualifié, en fonction des conditions environnantes, peuvent être utilisées dans la recherche et le développement, dans la production de produits pharmaceutiques, jusqu'à l'utilisation en laboratoire, en particulier pour le contrôle de la qualité microbiologique. Alors que la production pharmaceutique aseptique a des normes de propreté extrêmement élevées, les environnements sont presque totalement exempts de particules et de germes pour la production aseptique.

En raison de la croissance de l'industrie pharmaceutique et de l'élargissement de la gamme de produits, de plus en plus de fabricants et de fournisseurs doivent réfléchir à des investissements dans les dernières technologies ajoutées à la technologie des salles blanches.

Le traitement aseptique des médicaments pharmaceutiques est le facteur majeur qui doit être inclus dans les bonnes pratiques de fabrication conformes aux réglementations gouvernementales. Le coût élevé du maintien de l'état aseptique par la technologie des salles blanches, qui est environ 62 % plus élevé que celui des isolateurs pharmaceutiques, incite les fabricants à acquérir la technologie des isolateurs et limite le coût global de fabrication des produits pharmaceutiques.

Retenue

Réglementations gouvernementales strictes

Les ingrédients pharmaceutiques actifs (IPA) et les intermédiaires à usage pharmaceutique (par exemple biologiques, radiopharmaceutiques et pharmaceutiques) et ceux utilisés pour la production de médicaments destinés aux essais cliniques sont réglementés par les divisions 1A et 2, partie C du Règlement sur les aliments et drogues.

- La division 1A, partie C du Règlement sur les aliments et drogues décrit les activités pour lesquelles la conformité aux bonnes pratiques de fabrication (BPF) est requise et doit être démontrée avant la délivrance d'une licence d'établissement d'IPA (LE).

- La division 2 de la partie C du Règlement sur les aliments et drogues définit les exigences relatives aux BPF des IPA et des intermédiaires des IPA, qui sont interprétées dans le présent document d’orientation.

En raison de cette réglementation stricte du gouvernement qui doit être suivie pour la production par les directives sur les bonnes pratiques de fabrication (BPF) pour les ingrédients pharmaceutiques actifs (API) - (GUI-0104) qui limitent le taux de croissance du marché.

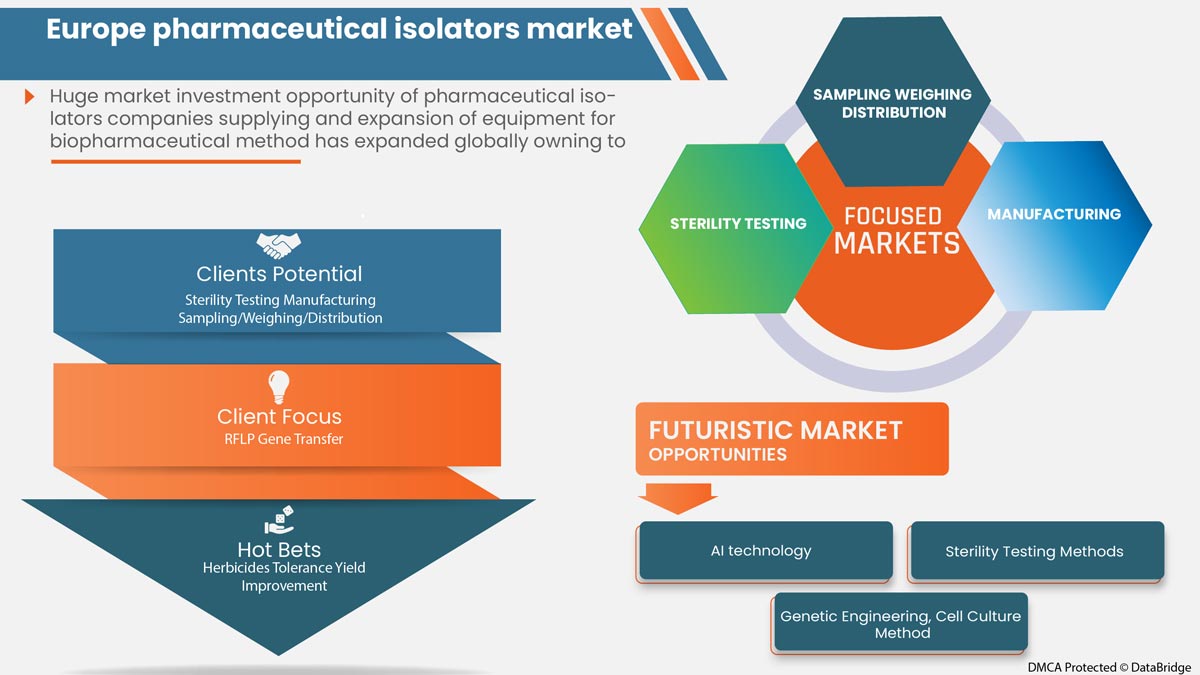

Opportunité

- Initiatives stratégiques des acteurs du marché

L'essor du marché des isolateurs pharmaceutiques accroît le besoin d'idées commerciales stratégiques. Cela comprend un partenariat, une expansion commerciale et d'autres développements. La demande croissante de produits pharmaceutiques augmente considérablement la demande d'excipients et pour faire face à cette demande, les entreprises construisent de nouveaux sites de fabrication parmi d'autres initiatives stratégiques.

Ces initiatives stratégiques telles que les lancements de produits, les accords et l’expansion commerciale du principal acteur du marché stimuleront la croissance du marché des isolateurs pharmaceutiques et devraient constituer une opportunité pour le marché européen de l’affichage médical.

Défi

Manque d'expertise qualifiée

La pénurie de compétences qualifiées pourrait mettre à mal le rythme de la reprise et de la croissance dans un endroit donné. Souvent, les personnes au chômage dans un endroit donné possèdent des compétences qui sont rares ailleurs. De plus, les progrès technologiques rapides dans ce domaine entraînent également un manque de compétences.

Le manque de professionnels qualifiés dans la manipulation des isolateurs pharmaceutiques constitue un défi majeur lors de la sélection et du développement des isolateurs pharmaceutiques. Les données de Phys.org 2003 indiquent que les industries de l'affichage médical sont confrontées à une pénurie de travailleurs en raison de la demande croissante d'isolateurs pharmaceutiques dans la région Asie-Pacifique et de la grave pénurie de micropuces utilisées dans les écrans LED et LCD, ce qui augmente les délais de production des LCD.

Les exigences en matière de compétences étant trop élevées, il est devenu difficile de conserver et de gérer les professionnels ayant les compétences requises. De plus, les progrès technologiques sont un autre aspect qui entraîne une demande accrue de professionnels qualifiés. Les neurologues signalent d'importants besoins non satisfaits en matière de soins de soutien et des obstacles dans leurs centres, seule une petite minorité se considérant comme compétente pour fournir des soins de soutien. Il est urgent de former les neurologues et les professionnels au traitement de la démence et de leur fournir les ressources nécessaires en matière de soins de soutien. Le manque de professionnels formés et expérimentés et les lacunes persistantes en matière de compétences limitent les perspectives d'employabilité et l'accès à des emplois de qualité. Il est donc évident que la disponibilité de professionnels dotés de compétences adéquates devrait constituer un défi à la croissance du marché.

Impact post-COVID-19 sur le marché européen des isolateurs pharmaceutiques

La pandémie de COVID-19 est devenue la menace la plus grave au monde. Elle a fait des ravages dans de nombreux magasins et entreprises du monde entier. La pandémie, en revanche, a offert de nombreuses opportunités aux sociétés pharmaceutiques et biopharmaceutiques d'étendre leurs activités de recherche et développement pour développer de nouveaux vaccins contre le nouveau coronavirus. Les entreprises mènent des essais cliniques pour tenter d'arrêter la propagation du virus COVID-19. Les fournisseurs d'isolants pharmaceutiques aux organisations biopharmaceutiques ont davantage d'opportunités à mesure que le nombre d'essais cliniques augmente.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de R&D, de lancement de produits et de partenariats stratégiques pour améliorer la technologie et les résultats des tests impliqués dans le marché de l'affichage médical pharmaceutique.

Développements récents

- En juin 2022, la société a annoncé un partenariat avec Medical Supply Company (MSC) pour commercialiser et entretenir les équipements Jacomex auprès des industries pharmaceutiques et pharmaceutiques en Irlande. MSC possède de nombreuses années d'expertise reconnue sur le marché avec des équipes de terrain au plus près des clients et l'équipe commerciale de l'entreprise travaillant actuellement à l'étranger a eu le plaisir d'accueillir Cian Murphy et de finaliser l'accord entre Jacomex et MSC. Le début d'une longue et fructueuse collaboration. Cela a aidé l'entreprise à développer son activité.

- En janvier 2022, Clario s'est associé à XingImaging, une société de production de produits radiopharmaceutiques et d'acquisition de tomographie par émission de positons (TEP), pour réaliser des essais cliniques d'imagerie TEP afin de tester de nouvelles thérapies en Chine. Le partenariat propose de partager les ressources communes et les experts en neurosciences de Clario et de XingImaging pour accélérer le démarrage des essais cliniques et la découverte de médicaments en Chine.

Portée du marché européen des isolateurs pharmaceutiques

Le marché européen des isolateurs pharmaceutiques est segmenté en type, pression, application, configuration, type de système, utilisateur final et canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

MARCHÉ EUROPÉEN DES ISOLATEURS PHARMACEUTIQUES, PAR TYPE

- ISOLATEURS ASEPTIQUES

- ISOLATEURS DE CONFINEMENT

- ISOLATEURS BIO

- ISOLATEURS D'ÉCHANTILLONNAGE ET DE PESÉE

- ISOLATEURS DE FABRICATION D'INGRÉDIENTS PHARMACEUTIQUES ACTIFS (API)

- ISOLATEURS RADIOPHARMACEUTIQUES

- ISOLATEURS DE PRODUCTION

- AUTRES

Sur la base du type, le marché européen des isolateurs pharmaceutiques est segmenté en isolateurs aseptiques, isolateurs de confinement, isolateurs biologiques, isolateurs d'échantillonnage et de pesée, isolateurs de fabrication d'ingrédients pharmaceutiques actifs (API), isolateurs radiopharmaceutiques, isolateurs de production, autres.

MARCHÉ EUROPÉEN DES ISOLATEURS PHARMACEUTIQUES, PAR TYPE DE SYSTÈME

- SYSTÈME FERMÉ

- SYSTÈME OUVERT

Sur la base du type de système, le marché européen des isolateurs pharmaceutiques est segmenté en système fermé et système ouvert.

MARCHÉ EUROPÉEN DES ISOLATEURS PHARMACEUTIQUES, PAR PRESSION

- PRESSION POSITIVE

- PRESSION NÉGATIVE

Sur la base de la pression, le marché européen des isolateurs pharmaceutiques est segmenté en pression positive et pression négative.

MARCHÉ EUROPÉEN DES ISOLATEURS PHARMACEUTIQUES, PAR CONFIGURATION

- SUR PIED

- MODULAIRE

- MOBILE

- COMPACT

- PLATEAU DE TABLE

- PORTABLE

- AUTRES

Sur la base de la configuration, le marché européen des isolateurs pharmaceutiques est segmenté en isolateurs au sol, modulaires, mobiles, compacts, de table, portables, autres.

MARCHÉ EUROPÉEN DES ISOLATEURS PHARMACEUTIQUES, PAR APPLICATION

- TEST DE STÉRILITÉ

- FABRICATION

- ÉCHANTILLONNAGE/PESÉE/DISTRIBUTION

- FABRICATION DE DISPOSITIFS MÉDICAUX

- AUTRES

Sur la base de l'application, le marché européen des isolateurs pharmaceutiques est segmenté en tests de stérilité, fabrication, échantillonnage/pesage/distribution, fabrication de dispositifs médicaux, etc.

MARCHÉ EUROPÉEN DES ISOLATEURS PHARMACEUTIQUES, PAR UTILISATEUR FINAL

- HÔPITAUX

- LABORATOIRES DE DIAGNOSTIC

- INSTITUTS ACADÉMIQUES ET DE RECHERCHE

- ENTREPRISES PHARMACEUTIQUES ET BIOTECHNOLOGIQUES

- ORGANISMES DE RECHERCHE CONTRACTUELLE

- AUTRES

Sur la base de l'utilisateur final, le marché européen des isolateurs pharmaceutiques est segmenté en hôpitaux, laboratoires de diagnostic, instituts universitaires et de recherche, sociétés pharmaceutiques et biotechnologiques, organismes de recherche sous contrat, etc.

MARCHÉ EUROPÉEN DES ISOLATEURS PHARMACEUTIQUES, PAR CANAL DE DISTRIBUTION

- APPEL D'OFFRES DIRECT

- VENTES AU DÉTAIL

- DISTRIBUTEURS TIERS

Sur la base du canal de distribution, le marché européen des isolateurs pharmaceutiques est segmenté en appels d'offres directs, ventes au détail et distributeurs tiers.

Analyse/perspectives régionales du marché européen des isolateurs pharmaceutiques

Le marché européen des isolateurs pharmaceutiques est analysé et des informations sur la taille du marché sont fournies : type, pression, application, configuration, type de système, utilisateur final et canal de distribution.

Les pays couverts par ce rapport de marché sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, la Russie, la Turquie, la Belgique, les Pays-Bas, la Suisse et le reste de l'Europe.

En 2022, l’Allemagne domine en raison de la croissance rapide du marché pharmaceutique, associée à l’augmentation de la production d’équipements pharmaceutiques et à la demande croissante des marchés émergents et à l’expansion des industries de la santé.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des isolateurs pharmaceutiques en Europe

Le paysage concurrentiel du marché européen des isolateurs pharmaceutiques fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et la portée du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché européen des isolateurs pharmaceutiques.

Français Certains des principaux acteurs opérant sur le marché européen des isolateurs pharmaceutiques sont Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco SRL, Comecer SPA, Hecht Technologie Gmbh, Steriline SRL, Envair Limited, Tema Sinergie SPA, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi SpA, LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma.

Méthodologie de recherche : Marché européen des isolateurs pharmaceutiques

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'Europe par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel à l'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PHARMACEUTICAL ISOLATOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 INDUSTRIAL INSIGHTS:

5 EUROPE PHARMACEUTICAL ISOLATORS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR THE PHARMACEUTICAL ISOLATORS ACROSS BOOMING PHARMACEUTICAL

6.1.2 LOW OPERATIONAL COST OF PHARMACEUTICAL ISOLATORS

6.1.3 HIGH MAINTENANCE OF ASEPTIC CONDITIONS IN THE PRODUCTION OF PHARMACEUTICAL PRODUCTS

6.1.4 LOW OPERATING COST OF PHARMACEUTICAL ISOLATORS & GROWING DEMAND IN THE BIOPHARMACEUTICAL INDUSTRY

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENTAL REGULATIONS

6.2.2 HIGH COST OF INSTALLATION & LIMITED ADOPTION OF RABS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN PHARMACEUTICAL ISOLATORS

6.3.3 HIGH STERILITY ASSURANCE

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 ENGINEERING CHALLENGES FACED WHILE DESIGNING THE PHARMACEUTICAL ISOLATORS

7 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE

7.1 OVERVIEW

7.2 ASEPTIC ISOLATOR

7.3 ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS

7.4 CONTAINMENT ISOLATORS

7.5 BIO ISOLATORS

7.6 SAMPLING AND WEIGHING ISOLATORS

7.7 RADIOPHARMACEUTICAL ISOLATORS

7.8 PRODUCTION ISOLATORS

7.9 OTHERS

8 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE

8.1 OVERVIEW

8.2 OPEN SYSTEM

8.3 CLOSED SYSTEM

9 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE

9.1 OVERVIEW

9.2 POSITIVE PRESSURE

9.3 NEGATIVE PRESSURE

10 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION

10.1 OVERVIEW

10.2 FLOOR STANDING

10.3 MODULAR

10.4 MOBILE

10.5 COMPACT

10.6 TABLE TOP

10.7 PORTABLE

10.8 OTHERS

11 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 STERILITY TESTING

11.3 MANUFACTURING

11.4 SAMPLING/WEIGHING/DISTRIBUTION

11.5 MEDICAL DEVICE MANUFACTURING

12 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTORS

13 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY END USER

13.1 OVERVIEW

13.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

13.2.1 STERILE FILTERING

13.2.2 AMPULE FILLING

13.2.3 SYRINGE FILLING

13.2.4 SAMPLING

13.2.5 SAMPLE TESTING

13.2.6 STERILITY TESTING

13.2.7 PACKAGING

13.2.8 OTHERS

13.3 CONTRACT RESEARCH ORGANIZATION

13.3.1 STERILE FILTERING

13.3.2 AMPULE FILLING

13.3.3 SYRINGE FILLING

13.3.4 SAMPLING

13.3.5 SAMPLE TESTING

13.3.6 STERILITY TESTING

13.3.7 PACKAGING

13.3.8 OTHERS

13.4 ACADEMIC AND RESEARCH INSTITUTES

13.4.1 STERILE FILTERING

13.4.2 AMPULE FILLING

13.4.3 SYRINGE FILLING

13.4.4 SAMPLING

13.4.5 SAMPLE TESTING

13.4.6 STERILITY TESTING

13.4.7 PACKAGING

13.4.8 OTHERS

13.5 HOSPITALS

13.5.1 STERILE FILTERING

13.5.2 AMPULE FILLING

13.5.3 SYRINGE FILLING

13.5.4 SAMPLING

13.5.5 SAMPLE TESTING

13.5.6 STERILITY TESTING

13.5.7 PACKAGING

13.5.8 OTHERS

13.6 DIAGNOSTIC LABORATORIES

13.6.1 STERILE FILTERING

13.6.2 AMPULE FILLING

13.6.3 SYRINGE FILLING

13.6.4 SAMPLING

13.6.5 SAMPLE TESTING

13.6.6 STERILITY TESTING

13.6.7 PACKAGING

13.6.8 OTHERS

13.7 OTHERS

14 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 FRANCE

14.1.3 U.K.

14.1.4 ITALY

14.1.5 RUSSIA

14.1.6 SPAIN

14.1.7 TURKEY

14.1.8 NETHERLANDS

14.1.9 SWITZERLAND

14.1.10 BELGIUM

14.1.11 REST OF EUROPE

15 EUROPE PHARMACEUTICAL ISOLATORS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GETINGE AB

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 CYTIVA (A SUBSIDIARY OF DANAHER CORPORATION)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 AZBIL CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CHIYODA CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 HOSOKAWA MICRON LTD

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BIOQUELL, AN ECOLAB SOLUTION (A SUBSIDIARY OF ECOLAB)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 CHAMUNDA PHARMA MACHNIERY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 COMECER S.P.A. (A SUBSIDIARY OF ATS AUTOMATION TOOLS) (2021)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 ENVAIR TECHNOLOGY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ESCO MICRO PTE. LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 FEDEGARI AUTOCLAVI S.P.A

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 GERMFREE LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GELMAN SINGAPORE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 HECT TECHNOLOGIE GMBH (2021)

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 ISO TECH DESIGN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 ITECO SRL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 JACOMEX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LAF TECHNOLOGIES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 MBRAUN.(2021)

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 NUAIRE (A SUBSIDIARY OF GENUIT GROUP PLC)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 STERILINE (2021)

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SCHEMATIC ENGINEERING INDUSTRY

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 SKAN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 TEMA SINERGIE S.P.A

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 OPERATING COSTS FOR ASEPTIC PRODUCTION UNDER RABS OR ISOLATOR

TABLE 2 APPLICATION OF GUI-0104 TO API MANUFACTURING

TABLE 3 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE ASEPTIC ISOLATOR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE CONTAINMENT ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE BIO ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE SAMPLING AND WEIGHING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE RADIOPHARMACEUTICAL ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE PRODUCTION ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE OPEN SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE CLOSED SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE POSITIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE NEGATIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE FLOOR STANDING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE MODULAR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE MOBILE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE COMPACT IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE TABLE TOP IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE PORTABLE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE STERILITY TESTING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE SAMPLING/WEIGHING/DISTRIBUTION IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE MEDICAL DEVICE MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 EUROPE DIRECT TENDER IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE RETAIL SALES INPHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE THIRD PARTY DISTRIBUTORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 36 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGICAL COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 EUROPE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 EUROPE ACADEMIC AND RESEARCH INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 EUROPE HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 EUROPE DIAGNOSTIC LABARATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE DIAGNOSTICS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 EUROPE OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 48 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 50 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 EUROPE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 EUROPE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 EUROPE HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 EUROPE DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 62 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 63 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 64 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 GERMANY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 GERMANY CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 GERMANY ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 GERMANY HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 GERMANY DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 74 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 76 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 FRANCE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 FRANCE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 FRANCE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 FRANCE HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 FRANCE DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 87 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 88 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 U.K. PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 U.K. CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 U.K. ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 U.K. HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 U.K. DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 95 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 96 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 98 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 99 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 100 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 ITALY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 ITALY CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 ITALY ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 ITALY HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 106 ITALY DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 108 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 110 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 111 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 112 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 RUSSIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 122 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 123 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 124 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 126 SPAIN PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 127 SPAIN CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 128 SPAIN ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 SPAIN HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 130 SPAIN DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 131 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 132 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 134 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 135 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 136 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 TURKEY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 139 TURKEY CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 TURKEY ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 TURKEY HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 142 TURKEY DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 143 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 144 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 146 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 147 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 148 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 149 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 150 NETHERLAND PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 151 NETHERLAND CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 152 NETHERLAND ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 NETHERLAND HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 154 NETHERLAND DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 155 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 156 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 158 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 159 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 160 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 161 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 162 SWITZERLAND PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 163 SWITZERLAND CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 SWITZERLAND ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 165 SWITZERLAND HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 166 SWITZERLAND DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 167 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 170 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 171 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 172 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 173 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 BELGIUM PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 BELGIUM CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 BELGIUM ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 177 BELGIUM HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 178 BELGIUM DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 179 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 180 REST OF EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 2 EUROPE PHARMACEUTICAL ISOLATOR MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PHARMACEUTICAL ISOLATOR MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PHARMACEUTICAL ISOLATOR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE PHARMACEUTICAL ISOLATOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PHARMACEUTICAL ISOLATOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE PHARMACEUTICAL ISOLATOR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE PHARMACEUTICAL ISOLATOR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE PHARMACEUTICAL ISOLATOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF PHARMACEUTICAL ISOLATORS IS EXPECTED TO DRIVE THE EUROPE PHARMACEUTICAL ISOLATOR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ASEPTIC ISOLATORS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PHARMACEUTICAL ISOLATOR MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE PHARMACEUTICAL ISOLATOR MARKET

FIGURE 14 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2021

FIGURE 15 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 16 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2021

FIGURE 19 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2022-2029 (USD MILLION)

FIGURE 20 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, CAGR (2022-2029)

FIGURE 21 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, LIFELINE CURVE

FIGURE 22 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2021

FIGURE 23 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2022-2029 (USD MILLION)

FIGURE 24 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, CAGR (2022-2029)

FIGURE 25 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, LIFELINE CURVE

FIGURE 26 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2021

FIGURE 27 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2022-2029 (USD MILLION)

FIGURE 28 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, CAGR (2022-2029)

FIGURE 29 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, LIFELINE CURVE

FIGURE 30 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2021

FIGURE 31 EUROPEPHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 32 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 33 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 EUROPEPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 EUROPEPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 EUROPEPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 EUROPE PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2021

FIGURE 39 EUROPE PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 EUROPE PHARMACEUTICAL ISOLATOR MARKET : BY END USER, CAGR (2022-2029)

FIGURE 41 EUROPE PHARMACEUTICAL ISOLATOR MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 EUROPE PHARMACEUTICAL ISOLATOR MARKET: SNAPSHOT (2021)

FIGURE 43 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021)

FIGURE 44 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 EUROPE PHARMACEUTICAL ISOLATOR MARKET: TYPE (2022-2029)

FIGURE 47 EUROPE PHARMACEUTICAL ISOLATORS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.