Europe Personal Fall Protection Market

Taille du marché en milliards USD

TCAC :

%

USD

1,763.86 Billion

USD

2,726.96 Billion

2022

2030

USD

1,763.86 Billion

USD

2,726.96 Billion

2022

2030

| 2023 –2030 | |

| USD 1,763.86 Billion | |

| USD 2,726.96 Billion | |

|

|

|

Marché européen de la protection individuelle contre les chutes, par type (produits, services), industrie (construction, industrie générale, pétrole et gaz, énergie et services publics, exploitation minière, télécommunication, agriculture, transport, marine et construction navale, autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché de la protection individuelle contre les chutes en Europe

La demande croissante d'équipements de protection contre les chutes dans différentes industries telles que l'exploitation minière, la construction et d'autres, associée à une sensibilisation accrue à la sécurité dans les zones industrielles, sont les principaux facteurs qui stimulent le marché de la protection individuelle contre les chutes. Cependant, la mauvaise qualité et les extrémités lâches des équipements liés aux chutes augmentent le risque d'accidents et peuvent entraver la croissance du marché de la protection individuelle contre les chutes. En outre, l'adoption de technologies nouvelles et avancées pour fabriquer des produits de protection individuelle contre les chutes devrait créer d'énormes opportunités pour le marché de la protection individuelle contre les chutes.

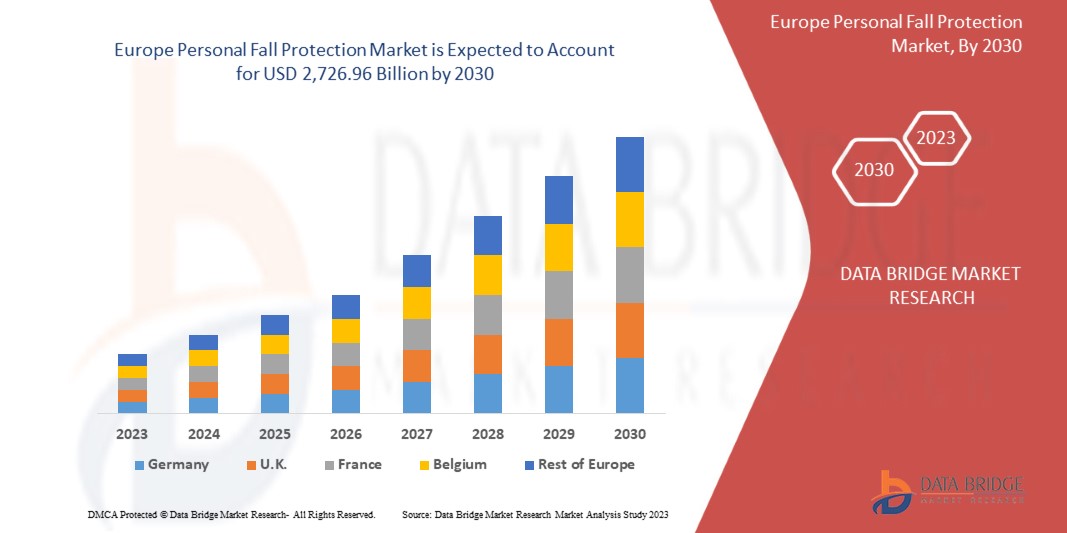

Data Bridge Market Research analyse que le marché de la protection individuelle contre les chutes, qui était de 1 763,86 milliards USD en 2022, devrait atteindre 2 726,96 milliards USD d'ici 2030 et devrait connaître un TCAC de 5,56 % au cours de la période de prévision de 2023 à 2030. Les « produits » dominent le segment type du marché de la protection individuelle contre les chutes en raison d'une sensibilisation accrue à la sécurité sur les lieux de travail et à ses utilisations dans de nombreux projets de construction et industriels à venir.

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une production et une capacité géographiquement représentées par l'entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse du déficit de la chaîne d'approvisionnement et de la demande.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par type (produits, services), industrie (construction, industrie générale, pétrole et gaz, énergie et services publics, exploitation minière, télécommunications, agriculture, transport, marine et construction navale, autres) |

|

Pays couverts |

Allemagne, Royaume-Uni, Italie, France, Espagne, Russie, Turquie, Belgique, Pays-Bas, Suisse, Reste de l'Europe |

|

Acteurs du marché couverts |

Honeywell International Inc. (États-Unis), Carl Stahl Hebetechnik GmbH (Allemagne), 3M (États-Unis), Bergman & Beving AB (Suède), ABS Safety GmbH (Allemagne), Adolf Wurth GmbH & Co. KG (Allemagne), SafetyLink Pty Ltd. (Australie), Guardian Fall (États-Unis), Eurosafe Solutions (Royaume-Uni), Petzl (France), SKYLOTECH (Allemagne), WernerCo. (États-Unis), MSA (États-Unis), Kee Safety, Inc. (États-Unis), Fallprotec SA (France) |

|

Opportunités de marché |

|

Définition du marché

La protection individuelle contre les chutes désigne un système de mesures et d'équipements de sécurité conçus pour prévenir ou atténuer le risque de chute d'individus depuis des surfaces élevées, telles que des toits, des chantiers de construction ou des structures industrielles. Elle englobe une gamme de dispositifs et d'équipements, notamment des harnais, des longes, des ancrages et des lignes de vie, qui sont utilisés pour sécuriser et protéger les travailleurs ou les personnes travaillant en hauteur. L'objectif principal de la protection individuelle contre les chutes est d'assurer la sécurité des travailleurs et de prévenir les blessures en minimisant le risque de chute. Il s'agit d'un élément essentiel des protocoles de sécurité sur le lieu de travail et sur les chantiers de construction.

Dynamique du marché européen de la protection individuelle contre les chutes

Conducteurs

- Réglementations et normes de sécurité européennes

Les autorités européennes ont établi des normes et des réglementations de sécurité complètes qui imposent l'utilisation d'équipements de protection contre les chutes dans divers secteurs. Ces réglementations visent à préserver le bien-être des travailleurs et à réduire les accidents du travail. L'application de ces réglementations oblige les entreprises et les organisations à investir dans des systèmes et des équipements de protection individuelle contre les chutes, contribuant ainsi à la demande soutenue de ces produits. En outre, le strict respect des normes de sécurité souligne l'engagement de la région à créer un environnement de travail plus sûr, en favorisant une culture de sensibilisation et de conformité à la sécurité parmi les employeurs et les employés. Par conséquent, la protection individuelle contre les chutes n'est pas seulement un choix mais une obligation légale, ce qui favorise son adoption et la croissance du marché.

- Sensibilisation accrue à la sécurité des travailleurs

Les travailleurs, les employeurs et les autorités de sécurité sont de plus en plus conscients des risques associés au travail en hauteur. Des incidents très médiatisés et l'importance croissante accordée à la sécurité au travail ont souligné le besoin crucial de mesures de protection contre les chutes. Cette prise de conscience accrue a conduit à une approche proactive dans l'adoption et l'utilisation d'équipements de protection contre les chutes dans divers secteurs, stimulant ainsi la demande pour ces produits. De plus, la promotion de la culture de la sécurité par le biais de programmes de formation et d'éducation a contribué à un sens accru des responsabilités parmi les employeurs et les travailleurs pour investir dans des solutions de protection contre les chutes et les utiliser, alimentant ainsi davantage la croissance du marché.

Opportunité

- Offrir des solutions de protection antichute sur mesure et adaptables à divers secteurs d'activité

Différents secteurs et environnements de travail ont des exigences de sécurité différentes et des défis spécifiques à chaque site. En proposant des solutions de protection antichute sur mesure, les fabricants peuvent répondre à ces besoins uniques. En proposant des conceptions et des configurations personnalisées, les entreprises peuvent améliorer le confort et la sécurité des utilisateurs, ce qui accroît la satisfaction et la fidélité des clients. La personnalisation s'étend également à l'adaptation des produits à des réglementations et normes industrielles spécifiques, ce qui permet aux entreprises de se conformer plus facilement aux exigences de sécurité. Cette approche crée non seulement de l'innovation, mais ouvre également de nouvelles sources de revenus pour les fabricants qui peuvent répondre aux diverses demandes de différents secteurs et applications.

Retenue/Défi

- Adhérer à des réglementations et normes de sécurité complexes et évolutives

Les défis liés à la conformité représentent un frein important sur le marché européen de la protection individuelle contre les chutes. Le paysage réglementaire de la protection contre les chutes est complexe et en constante évolution, ce qui oblige les fabricants et les utilisateurs finaux à suivre le rythme d'une multitude de normes et d'exigences de sécurité. S'assurer que les produits répondent à ces réglementations strictes et obtiennent les certifications nécessaires peut être un processus long et coûteux. En outre, les réglementations variables selon les pays européens peuvent entraîner des incohérences dans les efforts de conformité. Cela crée des défis pour les fabricants en termes de conception, de test et de documentation des produits, tandis que les utilisateurs finaux peuvent trouver fastidieux de sélectionner, de mettre en œuvre et de maintenir des solutions de protection contre les chutes qui répondent aux exigences légales en constante évolution, ce qui peut entraver la croissance du marché.

Ce rapport sur le marché de la protection individuelle contre les chutes fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de la protection individuelle contre les chutes, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développements récents

- En janvier 2021, Guardian Fall a annoncé son nouveau produit appelé nouvelle longe de câble, qui est compatible avec les bords d'attaque avec la durabilité légère d'une longueur fixe jusqu'à 12 pieds de protection contre les chutes pendant les travaux en hauteur. Le lancement de ce nouveau produit a aidé l'entreprise à élargir son portefeuille de produits

- En mars 2019, SKYLOTECH a lancé une nouvelle solution appelée « Claw Line », un système antichute à câble en acier pour protéger les échelles contre les chutes. Ce lancement de nouveau produit a aidé l'entreprise à améliorer son portefeuille de produits

Portée du marché européen de la protection individuelle contre les chutes

Le marché de la protection individuelle contre les chutes est segmenté en fonction du type et de l'industrie. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Produits

- Services

Industrie

- Construction

- Industrie générale

- Pétrole et gaz

- Énergie et services publics

- Exploitation minière

- Télécommunication

- Agriculture

- Transport

- Marine et construction navale

- Autres

Analyse/perspectives régionales du marché de la protection individuelle contre les chutes en Europe

Le marché de la protection individuelle contre les chutes est analysé et des informations sur la taille du marché et les tendances sont fournies par type, et l'industrie est référencée ci-dessus.

Les pays couverts par le rapport sur le marché de la protection individuelle contre les chutes sont l’Allemagne, le Royaume-Uni, l’Italie, la France, l’Espagne, la Russie, la Turquie, la Belgique, les Pays-Bas, la Suisse et le reste de l’Europe.

L'Allemagne devrait dominer le marché en raison de la sensibilisation croissante des clients à la sécurité des travailleurs, associée à diverses initiatives gouvernementales en faveur de la sécurité des travailleurs. L'Italie devrait connaître la croissance la plus élevée en raison de la sensibilisation croissante à la sécurité des travailleurs et de l'importance de la protection individuelle contre les chutes.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la protection individuelle contre les chutes en Europe

Le paysage concurrentiel du marché de la protection individuelle contre les chutes fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de la protection individuelle contre les chutes.

Certains des principaux acteurs opérant sur le marché de la protection individuelle contre les chutes sont :

- Honeywell International Inc. (États-Unis)

- Carl Stahl Hebetechnik GmbH (Allemagne)

- 3M (États-Unis)

- Bergman & Beving AB (Suède)

- ABS Safety GmbH (Allemagne)

- Adolf Wurth GmbH & Co. KG (Allemagne)

- SafetyLink Pty Ltd. (Australie)

- Guardian Fall (États-Unis)

- Eurosafe Solutions (Royaume-Uni)

- Petzl (France)

- SKYLOTECH (Allemagne)

- WernerCo. (États-Unis)

- MSA (États-Unis)

- Kee Safety, Inc. (États-Unis)

- Fallprotec SA (France)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of EUROPE PERSONAL FALL PROTECTION MARKET

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- primary interviews with key opinion leaders

- TYPE LIFELINE CURVE

- DBMR MARKET POSITION GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- EUROPE PERSONAL FALL PROTECTION MARKET- INDUSTRY INSIGHTS

- Market Overview

- drivers

- grow IN demand for personal fall protection equipment in construction and mining project

- IncreasE IN safety awareness in the industrial area

- Stringent government regulations for mandatING THE use of personal fall protection equipment

- RisE IN incidence of fall-related injuries and accidents

- IncreaSE IN number of launches for personal fall protected equipment

- Restraints

- Poor quality and loose ends of fall-related equipment increases the risk of accident

- decrease rate of tourism and sportS industry due to pandemic

- OPPORTUNITIES

- increaSE IN adoption of smart technologies for manufacturing of fall protection equipment

- introduction of iot and asset tracking features in fall protection equipment

- Challenges

- high competition among the market players

- high cost associated with the products

- personal fall protection equipment can lead to limited productivity FOR workers

- IMPACT OF COVID-19 ON THE EUROPE PERSONAL FALL PROTECTION MARKET

- ANALYSIS ON IMPACT OF COVID-19 ON THE EUROPE PERSONAL FALL PROTECTION MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST EUROPE PERSONAL FALL PROTECTION MARKET

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- europe personal fall protection market, by type

- overview

- PRODUCTs

- SOFT GOODS

- ROPES

- BODY BELTS

- HARNESS

- FULL BODY HARNESS

- CHEST HARNESS

- LANYARD

- ROPE LANYARD

- SHOCK-ABSORBING LANYARD

- WIRE ROPE LANYARD

- HARD GOODS

- ROPE GRABS

- FALL ARRESTER

- MANUAL FALL ARRESTER

- ANCHORS

- KARABINER

- CONNECTORS

- RETRACTABLE BLOCKS

- INSTALLED SYSTEMS

- VERTICAL SYSTEM

- PORTABLE LADDER

- STEP LADDER

- EXTENSION

- ORCHARD

- TRESTLE

- OTHERS

- SUPPORT SCAFFOLD

- OTHERS

- HORIZONTAL SYSTEM

- LIFELINE SYSTEM

- GUARDRAIL SYSTEM

- SERVICES

- INSPECTION AND MAINTENANCE

- ASSEMBLY AND DEASSEMBLY

- TRAINING

- europe personal fall protection market, by Industry

- overview

- Construction

- BY INDUSTRY

- BRIDGE DECKING

- FLOOR OPENINGS

- REROOFING

- FIXED SCAFFOLDS

- LEADING EDGE WORK

- BY TYPE

- PRODUCTS

- SERVICES

- General industry

- PRODUCTS

- SERVICES

- energy & UTILITIES

- PRODUCTS

- SERVICES

- Oil & Gas

- PRODUCTS

- SERVICES

- Mining

- PRODUCTS

- SERVICES

- Telecommunication

- PRODUCTS

- SERVICES

- Agriculture

- PRODUCTS

- SERVICES

- Marine & Shipbuilding

- PRODUCTS

- SERVICES

- TRANSPORTATION

- PRODUCTS

- SERVICES

- others

- PRODUCTS

- SERVICES

- Europe personal fall protection market, BY COUNTRY

- Germany

- France

- Italy

- U.K.

- Turkey

- russia

- Spain

- Netherlands

- Switzerland

- Belgium

- Rest of Europe

- COMPANY landscape

- company share analysis: Europe

- Swot analysis

- Company profile

- 3M

- COMPANY SNAPSHOT

- REVENUE analysis

- product Portfolio

- Recent Development

- adolf wurth gmbh & co. kg

- company snapshot

- revenue analysis

- product portfolio

- Recent Development

- honeywell international iNc

- COMPANY SNAPSHot

- REVENUE ANALYSIS

- product Portfolio

- Recent Development

- WERNER CO.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- skylotec

- company snapshot

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ABS SAFETY GMBH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- Recent Development

- bergman & beving ab

- company snapshot

- revenue analysis

- PRODUCT PORTFOLIO

- Recent Development

- CARL STAHL HEBETECHNIK GMBH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- eurosafe solutions

- company snapshot

- PRODUCT PORTFOLIO

- Recent Development

- Fallprotec s.a.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- Recent Development

- guardian fall

- company snapshot

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- KEE SAFETY, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- Recent Development

- MSA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- petzl

- company snapshot

- PRODUCT PORTFOLIO

- Recent Development

- safetylink pty ltd

- company snapshot

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- questionnaire

- related reports

Liste des tableaux

TABLE 1 Europe Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 2 Europe products in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 3 Europe soft goods in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 4 Europe harness in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 5 Europe lanyard in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 6 Europe HARD goods in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 7 Europe rope grabs in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 8 Europe installed systems in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 9 Europe vertical system in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 10 Europe Portable Ladder in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 11 Europe horizontal system in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 12 Europe Services in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 13 Europe Personal fall protection Market, By Industry, 2019-2028 (USD Million)

TABLE 14 Europe construction in Personal fall protection Market, By Industry, 2019-2028 (USD Million)

TABLE 15 Europe construction in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 16 Europe General industry in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 17 Europe Energy & Utilities in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 18 Europe Oil & Gas in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 19 Europe Mining in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 20 Europe Telecommunication in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 21 Europe Agriculture in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 22 Europe Marine & Shipbuilding in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 23 Europe Transportation in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 24 Europe Others in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 25 Europe personal fall protection market, By COUNTRY, 2019-2028 (USD million)

TABLE 26 Germany personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 27 Germany products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 28 Germany soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 29 Germany harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 30 Germany lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 31 Germany hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 32 Germany rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 33 Germany installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 34 Germany vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 35 Germany portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 36 Germany horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 37 Germany Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 38 Germany personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 39 Germany construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 40 Germany construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 41 Germany general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 42 Germany energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 43 Germany oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 44 Germany mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 45 Germany telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 46 Germany agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 47 Germany marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 48 Germany transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 49 Germany others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 50 France personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 51 France products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 52 France soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 53 France harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 54 France lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 55 France hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 56 France rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 57 France installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 58 France vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 59 France portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 60 France horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 61 France Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 62 France personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 63 France construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 64 France construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 65 France general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 66 France energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 67 France oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 68 France mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 69 France telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 70 France agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 71 France marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 72 France transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 73 France others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 74 Italy personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 75 Italy products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 76 Italy soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 77 Italy harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 78 Italy lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 79 Italy hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 80 Italy rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 81 Italy installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 82 Italy vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 83 Italy portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 84 Italy horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 85 Italy Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 86 Italy personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 87 Italy construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 88 Italy construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 89 Italy general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 90 Italy energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 91 Italy oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 92 Italy mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 93 Italy telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 94 Italy agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 95 Italy marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 96 Italy transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 97 Italy others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 98 U.K. personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 99 U.K. products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 100 U.K. soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 101 U.K. harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 102 U.K. lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 103 U.K. hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 104 U.K. rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 105 U.K. installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 106 U.K. vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 107 U.K. portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 108 U.K. horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 109 U.K. Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 110 U.K. personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 111 U.K. construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 112 U.K. construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 113 U.K. general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 114 U.K. energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 115 U.K. oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 116 U.K. mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 117 U.K. telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 118 U.K. agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 119 U.K. marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 120 U.K. transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 121 U.K. others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 122 TURKEY personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 123 TURKEY products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 124 TURKEY soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 125 TURKEY harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 126 TURKEY lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 127 TURKEY hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 128 TURKEY rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 129 TURKEY installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 130 TURKEY vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 131 TURKEY portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 132 TURKEY horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 133 TURKEY Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 134 TURKEY personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 135 TURKEY construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 136 TURKEY construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 137 TURKEY general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 138 TURKEY energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 139 TURKEY oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 140 TURKEY mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 141 TURKEY telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 142 TURKEY agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 143 TURKEY marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 144 TURKEY transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 145 TURKEY others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 146 RUSSIA personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 147 RUSSIA products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 148 RUSSIA soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 149 RUSSIA harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 150 RUSSIA lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 151 RUSSIA hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 152 RUSSIA rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 153 RUSSIA installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 154 RUSSIA vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 155 RUSSIA portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 156 RUSSIA horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 157 RUSSIA Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 158 RUSSIA personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 159 RUSSIA construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 160 RUSSIA construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 161 RUSSIA general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 162 RUSSIA energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 163 RUSSIA oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 164 RUSSIA mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 165 RUSSIA telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 166 RUSSIA agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 167 RUSSIA marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 168 RUSSIA transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 169 RUSSIA others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 170 SPAIN personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 171 SPAIN products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 172 SPAIN soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 173 SPAIN harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 174 SPAIN lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 175 SPAIN hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 176 SPAIN rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 177 SPAIN installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 178 SPAIN vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 179 SPAIN portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 180 SPAIN horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 181 SPAIN Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 182 SPAIN personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 183 SPAIN construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 184 SPAIN construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 185 SPAIN general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 186 SPAIN energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 187 SPAIN oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 188 SPAIN mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 189 SPAIN telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 190 SPAIN agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 191 SPAIN marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 192 SPAIN transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 193 SPAIN others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 194 NETHERLANDS personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 195 NETHERLANDS products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 196 NETHERLANDS soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 197 NETHERLANDS harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 198 NETHERLANDS lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 199 NETHERLANDS hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 200 NETHERLANDS rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 201 NETHERLANDS installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 202 NETHERLANDS vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 203 NETHERLANDS portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 204 NETHERLANDS horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 205 NETHERLANDS Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 206 NETHERLANDS personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 207 NETHERLANDS construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 208 NETHERLANDS construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 209 NETHERLANDS general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 210 NETHERLANDS energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 211 NETHERLANDS oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 212 NETHERLANDS mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 213 NETHERLANDS telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 214 NETHERLANDS agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 215 NETHERLANDS marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 216 NETHERLANDS transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 217 NETHERLANDS others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 218 SWITZERLAND personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 219 SWITZERLAND products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 220 SWITZERLAND soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 221 SWITZERLAND harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 222 SWITZERLAND lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 223 SWITZERLAND hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 224 SWITZERLAND rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 225 SWITZERLAND installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 226 SWITZERLAND vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 227 SWITZERLAND portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 228 SWITZERLAND horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 229 SWITZERLAND Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 230 SWITZERLAND personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 231 SWITZERLAND construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 232 SWITZERLAND construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 233 SWITZERLAND general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 234 SWITZERLAND energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 235 SWITZERLAND oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 236 SWITZERLAND mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 237 SWITZERLAND telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 238 SWITZERLAND agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 239 SWITZERLAND marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 240 SWITZERLAND transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 241 SWITZERLAND others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 242 BELGIUM personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 243 BELGIUM products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 244 BELGIUM soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 245 BELGIUM harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 246 BELGIUM lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 247 BELGIUM hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 248 BELGIUM rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 249 BELGIUM installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 250 BELGIUM vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 251 BELGIUM portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 252 BELGIUM horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 253 BELGIUM Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 254 BELGIUM personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 255 BELGIUM construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 256 BELGIUM construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 257 BELGIUM general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 258 BELGIUM energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 259 BELGIUM oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 260 BELGIUM mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 261 BELGIUM telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 262 BELGIUM agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 263 BELGIUM marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 264 BELGIUM transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 265 BELGIUM others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 266 REST OF EUROPE personal fall protection market, By Type, 2019-2028 (USD million)

Liste des figures

FIGURE 1 EUROPE PERSONAL FALL PROTECTION MARKET: segmentation

FIGURE 2 EUROPE PERSONAL FALL PROTECTION MARKET: data triangulation

FIGURE 3 EUROPE PERSONAL FALL PROTECTION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PERSONAL FALL PROTECTION MARKET: regional VS COUNTRY MARKET analysiS

FIGURE 5 EUROPE PERSONAL FALL PROTECTION MARKET: company research analysis

FIGURE 6 EUROPE PERSONAL FALL PROTECTION MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE PERSONAL FALL PROTECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE PERSONAL FALL PROTECTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE PERSONAL FALL PROTECTION MARKET: SEGMENTATION

FIGURE 10 increasing safety awareness in the industrial areas is driving the Europe personal fall protection market in the forecast period of 2021 to 2028

FIGURE 11 product segment is expected to account for the largest share of the EUROPE PERSONAL FALL PROTECTION MARKET in 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGEs OF THE EUROPE PERSONAL FALL PROTECTION MARKET

FIGURE 13 Europe Personal fall protection Market, By type, 2020

FIGURE 14 Europe Personal fall protection Market, By Industry, 2020

FIGURE 15 Europe personal fall protection market: SNAPSHOT (2020)

FIGURE 16 Europe personal fall protection market: BY COUNTRY (2020)

FIGURE 17 Europe personal fall protection market: BY COUNTRY (2021 & 2028)

FIGURE 18 Europe personal fall protection market: BY COUNTRY (2020 & 2028)

FIGURE 19 Europe personal fall protection market: BY TYPE (2021 & 2028)

FIGURE 20 EUROPE PERSONAL FALL PROTECTION MARKET: company share 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.