Europe Nuts And Snacks Bars Market

Taille du marché en milliards USD

TCAC :

%

USD

3.90 Billion

USD

6.16 Billion

2025

2033

USD

3.90 Billion

USD

6.16 Billion

2025

2033

| 2026 –2033 | |

| USD 3.90 Billion | |

| USD 6.16 Billion | |

|

|

|

|

Segmentation du marché européen des barres de noix et de snacks, par type de produit (barres de céréales et barres de noix), allégation (classique, sans gluten, végétalien, sans lactose, sans colorants ni conservateurs artificiels, et autres), catégorie (classique, barre de substitution de repas, barres pré-entraînement, barres post-entraînement, barres de yoga, et autres), nature (conventionnel et biologique), saveur (classique et aromatisée), type de conditionnement (sachet individuel, format familial/multipack, et autres), emballage (sachet sous film plastique, sachets, boîtes en carton, et autres), marque (marque propre et marque de distributeur), canal de distribution (magasins physiques et vente en ligne) - Tendances du secteur et prévisions jusqu'en 2033

Quelle est la taille et le taux de croissance du marché européen des noix et des barres de céréales ?

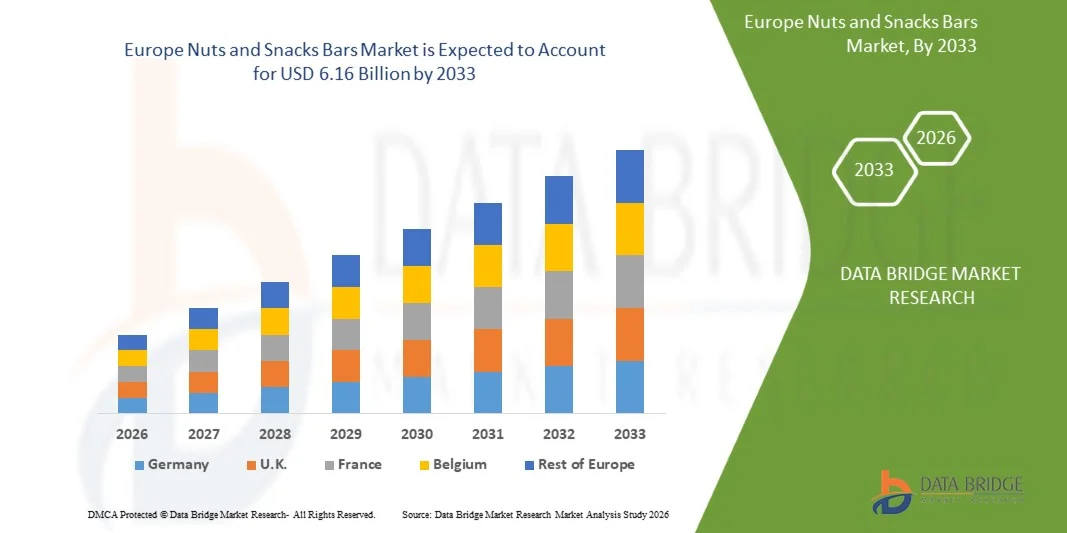

- Le marché européen des noix et des barres de céréales était évalué à 3,90 milliards de dollars en 2025 et devrait atteindre 6,16 milliards de dollars d'ici 2033 , avec un TCAC de 5,2 % au cours de la période de prévision.

- L'essor d'un mode de vie rapide et trépidant a engendré de nombreux problèmes de santé chez les consommateurs ces dernières années. Par conséquent, beaucoup privilégient un mode de vie plus sain et veillent à contrôler leur consommation de nutriments tels que le sucre, les glucides, etc.

- Les fabricants de noix et de snacks ont mis au point de nouveaux produits sans sucre, réduisant ainsi l'absorption de sucre par l'organisme. De nombreuses entreprises lancent actuellement de nouvelles barres de noix et de snacks aux compositions variées.

Quels sont les principaux enseignements du marché des noix et des barres de céréales ?

- La sensibilisation croissante à la santé et l'évolution des modes de vie des consommateurs européens sont les principaux facteurs de croissance du marché.

- Dans plusieurs pays européens, on observe une tendance croissante vers une alimentation saine et des en-cas variés. Au Royaume-Uni, les consommateurs privilégient les barres de céréales pratiques offrant divers bienfaits pour la santé, tandis qu'en Allemagne, le marché des en-cas biologiques est immense. La culture alimentaire allemande se tourne de plus en plus vers le véganisme. Face à une prise de conscience accrue des consommateurs en matière de nutrition, l'industrie agroalimentaire s'adapte pour proposer des en-cas plus sains.

- L'Allemagne a dominé le marché européen des barres de céréales et de noix avec une part de marché de 34,5 % en 2025, grâce à la demande croissante des consommateurs pour des en-cas sains, des ingrédients naturels et des produits pratiques.

- La France devrait connaître le taux de croissance annuel composé le plus rapide, à 8,2 %, entre 2026 et 2033, porté par la demande croissante des salles de sport, des bureaux, des supermarchés et des ménages. Les consommateurs privilégient de plus en plus les barres de céréales bio, sans gluten et allégées, tandis que les options naturelles et végétales continuent de gagner du terrain.

- Le segment des barres de noix a dominé le marché avec une part de revenus de 54,2 % en 2025, porté par la demande croissante de collations riches en protéines, pauvres en sucre et à étiquetage clair, à base d'amandes, de noix de cajou, d'arachides et de mélanges de noix.

Portée du rapport et segmentation du marché des barres de noix et de snacks

|

Attributs |

Aperçu du marché des barres de noix et de grignotage |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des noix et des barres de céréales ?

« Tendance croissante vers des noix et des barres de céréales écologiques, à base de plantes et à étiquetage clair »

- Le marché des noix et des barres de céréales connaît une forte transition vers les ingrédients d'origine végétale, les emballages biodégradables et les formulations à étiquetage clair, sous l'impulsion d'une prise de conscience croissante des consommateurs en matière de santé, de durabilité et d'impact environnemental.

- Par exemple, en 2024, Kind LLC (États-Unis) et Clif Bar & Company (États-Unis) ont élargi leur gamme de produits avec des barres de céréales à base de plantes, à faible teneur en sucre et conditionnées dans des emballages compostables afin d'attirer les consommateurs soucieux de l'environnement.

- La demande croissante d'emballages sans plastique, d'ingrédients à base de noix biologiques et de céréales issues de sources durables accélère l'adoption d'innovations de produits plus écologiques.

- Les fabricants intègrent des emballages en film biodégradable, des édulcorants naturels et des noix issues de sources responsables pour répondre aux attentes des consommateurs en matière de collations plus saines et respectueuses de l'environnement.

- La pression réglementaire croissante en faveur des emballages durables, de la réduction du sucre et d'une meilleure transparence des étiquettes influence le développement des produits des marques mondiales.

- Avec l'essor des en-cas durables et sains, les barres de noix et de grignotage écologiques et végétales continueront de définir l'évolution future du marché et le positionnement concurrentiel.

Quels sont les principaux moteurs du marché des noix et des barres de céréales ?

- L'intérêt croissant porté aux collations saines, aux régimes riches en protéines et aux ingrédients naturels dans les foyers, les centres de remise en forme et chez les consommateurs nomades demeure un moteur de croissance essentiel pour le marché des noix et des barres de céréales.

- Par exemple, en 2025, General Mills (États-Unis) et Nestlé SA (Europe) ont élargi leurs gammes de barres de céréales avec des barres riches en protéines, sans gluten et à valeur nutritionnelle fonctionnelle afin de répondre à l'évolution des besoins en matière de santé.

- La préférence croissante pour les collations pratiques, portables et énergisantes stimule la pénétration du marché dans les régions urbaines et semi-urbaines.

- Les progrès technologiques en matière de torréfaction des noix, d'extraction des arômes naturels et d'amélioration de la texture permettent une meilleure qualité des produits et une adoption plus large par les consommateurs.

- La croissance de secteurs tels que la nutrition sportive, le commerce de détail de voyage, les programmes de bien-être en entreprise et l'épicerie en ligne accroît la consommation de barres de noix et de snacks.

- Avec l'essor des modes de vie soucieux de la santé sur les marchés mondiaux, le secteur des barres de noix et de grignotage devrait connaître une croissance régulière, portée par la tendance des produits naturels et l'innovation continue en matière de produits.

Quel facteur freine la croissance du marché des noix et des barres de céréales ?

- Les coûts de production élevés, la fluctuation des prix des noix, des graines et des édulcorants naturels, ainsi que les réglementations strictes en matière de sécurité alimentaire constituent des défis majeurs pour la croissance du marché.

- Par exemple, entre 2024 et 2025, plusieurs fabricants régionaux ont subi des pressions sur leurs coûts en raison de la hausse des prix des amandes, des arachides, du cacao et des matériaux d'emballage durables.

- Les préoccupations croissantes concernant la teneur en sucre, les allergènes (comme les arachides) et la densité calorique limitent la consommation à grande échelle chez certains groupes de consommateurs.

- La concurrence des barres de céréales bon marché, des biscuits apéritifs et des confiseries classiques exerce une pression à la baisse sur les prix des fabricants de barres de céréales haut de gamme.

- La disponibilité limitée des installations de recyclage des emballages multicouches et les difficultés à maintenir la conformité aux normes d'étiquetage clair constituent des obstacles opérationnels.

- Pour surmonter ces contraintes, les entreprises privilégient une production rentable, un approvisionnement diversifié en ingrédients et des solutions d'emballage biodégradables afin d'améliorer l'accessibilité au marché et la confiance des consommateurs.

Comment le marché des noix et des barres de céréales est-il segmenté ?

Le marché est segmenté en fonction du type de produit, de l'allégation, de la catégorie, de la nature, de la saveur, du type d'emballage, du conditionnement, de la marque et du canal de distribution .

• Par type de produit

Le marché des barres de céréales et de noix se divise en deux segments : les barres de céréales et les barres de noix. En 2025, le segment des barres de noix dominait le marché avec une part de revenus de 54,2 %, porté par la demande croissante de collations riches en protéines, pauvres en sucre et à composition saine, à base d’amandes, de noix de cajou, d’arachides et de mélanges de noix. Leur profil nutritionnel avantageux, leur pouvoir rassasiant et leur compatibilité avec les régimes cétogène, pauvre en glucides et riche en protéines font des barres de noix un produit très apprécié des consommateurs soucieux de leur santé.

Le segment des barres de céréales devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, porté par la consommation croissante d'alternatives pratiques, riches en fibres et à base de céréales complètes pour le petit-déjeuner. L'adoption croissante de l'avoine, des flocons multigrains, du granola et des céréales anciennes dans la composition des barres séduit les consommateurs soucieux de leur santé digestive. La disponibilité accrue de barres de céréales aromatisées dans les points de vente hors taxes, les écoles et les bureaux contribue également à l'expansion de ce segment sur les marchés mondiaux.

• Par réclamation

Le marché est segmenté en plusieurs catégories : barres énergétiques classiques, sans gluten, végétaliennes, sans lactose, sans colorants ni conservateurs artificiels, et autres. En 2025, le segment des barres classiques dominait le marché avec 41,7 % des revenus, grâce à leur large disponibilité, leur prix abordable et leur forte popularité dans la grande distribution. Les barres classiques restent le choix privilégié pour les collations, les activités sportives et la consommation nomade.

Le segment des produits sans gluten devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la prévalence croissante de l'intolérance au gluten, l'adoption de régimes sans gluten par choix de vie et la demande grandissante de produits naturels à base de noix, de graines, de millet, de quinoa et de riz soufflé. Les catégories « végétalien » et « sans conservateurs » sont également en pleine expansion, les consommateurs recherchant des en-cas végétaux, sans allergènes ni produits chimiques, issus d'un approvisionnement durable et transparent en ingrédients.

• Par catégorie

Le marché des barres de noix et de grignotage se divise en plusieurs catégories : barres classiques, barres de substitution de repas, barres pré-entraînement, barres post-entraînement, barres de yoga et autres. Le segment des barres classiques dominait le marché en 2025 avec une part de revenus de 48,5 %, grâce à sa forte consommation par les actifs, les étudiants et les familles qui recherchent une collation pratique.

Le segment des barres de substitution de repas devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par un intérêt croissant pour la gestion du poids, les régimes hypocaloriques et les formules riches en protéines offrant une nutrition équilibrée. Les barres pré- et post-entraînement gagnent également en popularité grâce à l'essor rapide de la culture du fitness, de la participation aux marathons et des tendances en matière de nutrition sportive. La catégorie des barres de yoga et des barres fonctionnelles bien-être poursuit son expansion, les consommateurs recherchant des en-cas sains et peu transformés, conçus pour un bien-être global et une énergie durable.

• Par nature

Le marché des barres énergétiques naturelles se divise en deux segments : les barres conventionnelles et les barres biologiques. En 2025, le segment conventionnel dominait le marché avec 67,9 % des parts de marché, grâce à ses prix abordables, sa large disponibilité et la variété de saveurs proposées en grande distribution, en ligne et dans les commerces de proximité.

Le segment bio devrait connaître la plus forte croissance annuelle composée entre 2026 et 2033, porté par l'intérêt croissant des consommateurs pour les ingrédients sans produits chimiques, les noix non OGM, les céréales issues de l'agriculture biologique et les chaînes d'approvisionnement transparentes. La prise de conscience accrue en matière de santé, les préoccupations liées à l'exposition aux pesticides et les incitations réglementaires en faveur d'une agriculture durable stimulent la demande de barres bio. Les marques haut de gamme élargissent leurs gammes bio en utilisant des noix issues de sources responsables, des protéines végétales et des édulcorants naturels tels que le miel, les dattes et le sirop d'érable, contribuant ainsi à la croissance du secteur sur les marchés mondiaux.

• Par saveur

Le marché des barres de noix et de grignotage est segmenté en deux catégories : les barres nature et les barres aromatisées. En 2025, le segment des barres aromatisées dominait le marché avec 62,3 % des parts de marché, porté par la préférence croissante des consommateurs pour des saveurs gourmandes comme le chocolat, les fruits rouges, le caramel, la noix de coco, les agrumes, le beurre de cacahuète et les associations originales. L’innovation en matière de saveurs demeure un élément clé de la stratégie de marque des leaders du marché.

Le segment des barres énergétiques classiques devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par l'adoption croissante de barres sans sucre ajouté, à la composition naturelle et sans sucre, à base de noix, de graines et de céréales complètes. L'intérêt grandissant pour les barres à faible teneur en sucre et aux arômes naturels (épices, fruits et plantes) continue de stimuler la demande dans les secteurs du fitness, du bien-être et de l'art de vivre.

• Par type d'emballage

Le marché est segmenté en emballages individuels, emballages familiaux/multipacks et autres. Le segment des emballages individuels a dominé le marché avec une part de revenus de 58,4 % en 2025, grâce à une forte demande pour la praticité à emporter, les en-cas en portions contrôlées et les achats impulsifs en magasin.

Le segment des packs familiaux/multipacks devrait connaître la plus forte croissance annuelle composée entre 2026 et 2033, portée par la hausse de la consommation des ménages, les achats en gros et la demande des bureaux, des écoles et des salles de sport. La popularité croissante des packs avantageux, des offres promotionnelles et des multipacks par abonnement sur les plateformes de commerce électronique contribue également à l'expansion du marché.

• Par emballage

Le marché des barres de noix et de grignotage est segmenté en emballages individuels, sachets, boîtes en carton et autres. Le segment des emballages individuels a dominé le marché en 2025 avec une part de revenus de 64,1 %, grâce à son rapport coût-efficacité, sa praticité et sa capacité à préserver l'humidité et la fraîcheur du produit.

Le segment des boîtes en carton devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, porté par la demande croissante d'emballages écologiques, recyclables et haut de gamme pour les lots et les coffrets cadeaux. Les fabricants adoptent de plus en plus les films compostables, les laminés à base de papier et les emballages biodégradables afin de s'aligner sur les tendances en matière de développement durable et de réduire l'utilisation du plastique.

• Par marque

Le marché est segmenté en produits de marque et produits de marque distributeur. Le segment des marques a dominé le marché avec une part de revenus de 69,3 % en 2025, grâce à une forte confiance des consommateurs, une constance des produits, une R&D avancée et une large disponibilité dans les supermarchés, les hypermarchés et les magasins de nutrition spécialisés.

Le segment des marques de distributeur devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, porté par la sensibilité des consommateurs aux prix et l'expansion rapide des marques propres aux distributeurs, qui proposent une qualité compétitive à des prix plus bas. L'engouement croissant pour les barres protéinées, les barres de céréales et les barres de noix de marques de distributeur en Europe, aux États-Unis et en Asie continue de renforcer ce segment.

• Par canal de distribution

Le marché se divise en deux catégories : les détaillants physiques et les détaillants en ligne. En 2025, les détaillants physiques dominaient le marché avec une part de revenus de 72,8 %, grâce à une forte visibilité des produits, aux achats impulsifs et à une présence importante dans les supermarchés, les commerces de proximité, les magasins spécialisés et les pharmacies.

Le segment de la vente hors magasin devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par l'essor fulgurant du e-commerce, des services d'abonnement et des marques de nutrition en vente directe au consommateur (D2C). Les plateformes en ligne offrent une plus grande variété de produits, des emballages personnalisables et des promotions ciblées, ce qui favorise leur adoption par les millennials et les consommateurs urbains.

Quelle région détient la plus grande part du marché des noix et des barres de céréales ?

- L'Allemagne a dominé le marché européen des barres de céréales et de noix avec une part de marché de 34,5 % en 2025, grâce à la demande croissante des consommateurs pour des en-cas sains, des ingrédients naturels et des produits pratiques.

- Une forte présence dans le commerce de détail, des gammes de produits biologiques en expansion et des investissements dans les barres de céréales végétales, riches en protéines et faibles en sucre sont les principaux moteurs du leadership régional de l'Allemagne, tandis que les plateformes de vente d'épicerie en ligne accélèrent encore sa pénétration du marché.

Analyse du marché français des barres de céréales et de noix

La France devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 8,2 %, entre 2026 et 2033, porté par la demande croissante des salles de sport, des bureaux, des supermarchés et des ménages. Les consommateurs privilégient de plus en plus les barres de céréales bio, sans gluten et allégées, tandis que les produits naturels et d'origine végétale continuent de gagner du terrain. Le développement de la distribution, la forte croissance du e-commerce et l'intérêt grandissant pour des alternatives saines au petit-déjeuner contribuent également à la contribution croissante de la France au marché européen.

Analyse du marché britannique des barres de céréales et de noix

Le Royaume-Uni contribue de manière constante à la croissance régionale, portée par l'adoption croissante des barres protéinées, des barres végétaliennes et des en-cas céréaliers fonctionnels dans les foyers, les entreprises et les salles de sport. Les consommateurs privilégient les barres de céréales emballées riches en fibres, pauvres en sucre et respectueuses de l'environnement, tandis que les marques investissent dans des formules haut de gamme, des ingrédients naturels et des saveurs innovantes. L'évolution des modes de vie urbains, la tendance aux en-cas nomades et l'expansion de l'offre en points de vente renforcent la position du Royaume-Uni sur le marché européen des barres de céréales et de noix.

Analyse du marché italien des barres de céréales et de noix

Le marché italien des barres de céréales à base de noix, artisanales et aux arômes naturels connaît une croissance soutenue, tant auprès des particuliers que des professionnels. La demande d'emballages biodégradables, de formules à faible teneur en sucre et de céréales végétales est en hausse chez les consommateurs soucieux de leur santé. Les fabricants proposent des variantes aux fruits, biologiques et riches en fibres, tandis que la modernisation du commerce de détail et la progression du e-commerce contribuent à cette croissance durable.

Analyse du marché espagnol des barres de céréales et de noix

L'Espagne s'impose comme un marché clé en Europe, portée par la préférence croissante des consommateurs pour les barres de céréales saines, pratiques et riches en protéines. La sensibilisation accrue à l'importance d'une alimentation équilibrée, à la nutrition sportive et aux ingrédients naturels stimule la demande dans les foyers, les salles de sport et les bureaux. L'expansion des réseaux de distribution, l'innovation des marques de distributeur et la performance des plateformes de vente en ligne renforcent la contribution de l'Espagne au marché européen des barres de céréales et de noix.

Quelles sont les principales entreprises du marché des noix et des barres de céréales ?

Le secteur des barres de noix et de grignotage est principalement dominé par des entreprises bien établies, notamment :

- Mondelez International (États-Unis)

- General Mills (États-Unis)

- Kellogg's (États-Unis)

- La société Simply Good Foods (États-Unis)

- Associated British Foods plc (Royaume-Uni)

- Nestlé (Suisse)

- La société Quaker Oats (États-Unis)

- Clif Bar and Company (États-Unis)

- Céréales Siro Foods (Espagne)

- Danone (France)

- Bühler (Suisse)

- Mars, Incorporated (États-Unis)

- Mangez des produits naturels (Royaume-Uni)

- Hero Group (Suisse)

Quels sont les développements récents sur le marché européen des noix et des barres de céréales ?

- En août 2024, Mars, Incorporated a annoncé un accord portant sur l'acquisition de Kellanova, un important producteur de produits céréaliers et de grignotage, dans le but de renforcer son portefeuille de produits de grignotage et d'étendre sa présence mondiale. Cette acquisition devrait améliorer considérablement la position concurrentielle de Mars sur le marché mondial des produits de grignotage.

- En mai 2023, Nature Valley, une marque de General Mills, a lancé ses barres Savory Nut Crunch en trois saveurs : cheddar blanc, barbecue fumé et bagel « tout garni ». Ces barres sont élaborées grâce à une méthode de liaison exclusive qui élimine le besoin d’agents liants sucrés. Ce lancement marque l’entrée stratégique de Nature Valley sur le marché des en-cas salés et contribue à l’innovation de ses produits.

- En mai 2023, Nature Valley a enrichi son offre avec le lancement de sa première gamme de barres de céréales salées, les Savory Nut Crunch Bars, apportant ainsi une nouvelle dimension gustative à son portefeuille de produits. Cette initiative témoigne de l'engagement de la marque à diversifier ses saveurs et à répondre à l'évolution des préférences des consommateurs.

- En avril 2023, Ferrero a acquis une usine de fabrication de barres de céréales en Allemagne afin de soutenir sa croissance à long terme sur le segment des en-cas sains. Cette acquisition renforce les capacités de production de Ferrero et accélère sa présence sur le marché des barres de céréales axées sur la santé.

- En novembre 2022, Mars Incorporated a lancé des barres de céréales reconditionnées à partir de plastique issu d'un recyclage avancé, développé en collaboration avec SABIC, Landbell, Plastic Energy, Taghleef et SIT. Ce procédé permet un emballage monomatériau en polypropylène entièrement recyclable. Cette initiative d'emballage durable illustre l'engagement de Mars en faveur de l'économie circulaire et des matériaux écologiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.