Marché européen des micro-réseaux, par connectivité (hors réseau/île/à distance, connecté au réseau), offre (matériel, logiciel, services), modèle (urbain, semi-urbain, île éloignée), source (générateurs diesel, cogénération, solaire photovoltaïque, gaz naturel, autres), stockage (lithium-ion, plomb-acide, batteries solaires, volant d'inertie, autres), type de réseau (micro-réseau CA, micro-réseau CC, micro-réseau hybride), capacité (moins de 5 000 MW, 5 001 à 10 000 MW, 10 001 à 15 000 MW, plus de 15 000 MW), contrôle (primaire (contrôle local), secondaire, tertiaire (optimisation)), application (emplacement distant, service public, industriel, campus, militaire, ville intelligente, centre de données, hôpital, école, autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Définition du marché

Un microréseau est un système énergétique distinct qui se compose de charges interconnectées et de ressources énergétiques distribuées capables de fonctionner en parallèle ou indépendamment du réseau électrique principal. Les microréseaux, en général, sont des versions plus petites des réseaux électriques qui transportent l'électricité des générateurs aux consommateurs. Ils contribuent à réduire les coûts globaux et fournissent une alimentation de secours au réseau en cas de panne. Les microréseaux sont plus efficaces que les réseaux électriques classiques et peuvent être intégrés à une variété de sources d'énergie renouvelables telles que l'énergie solaire, l'énergie éolienne, les petites centrales hydroélectriques, la géothermie, la valorisation énergétique des déchets et les systèmes de cogénération. Des batteries, des générateurs distribués et des panneaux solaires peuvent également être utilisés pour les alimenter. En outre, ils constituent également une source d'électricité fiable car ils fonctionnent en continu pendant les pannes de courant.

Analyse et taille du marché

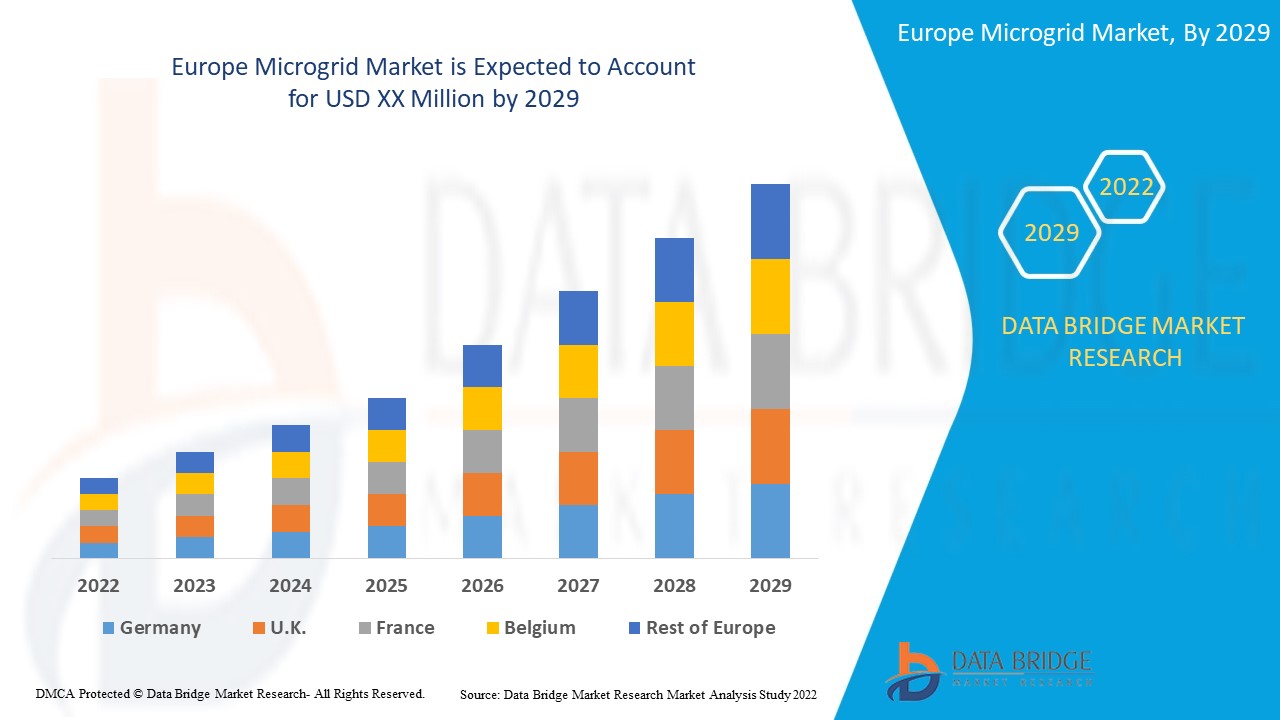

Data Bridge Market Research estime que le marché européen des microgrids devrait atteindre la valeur de 7 295,30 millions USD d'ici 2029, à un TCAC de 15,6 % au cours de la période de prévision. Le rapport sur le marché des microgrids couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable jusqu'en 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par connectivité (hors réseau/île/à distance, connecté au réseau), offre (matériel, logiciel, services), modèle (urbain, semi-urbain, île éloignée), source (générateurs diesel, cogénération, solaire photovoltaïque, gaz naturel, autres), stockage (lithium-ion, plomb-acide , batteries solaires, volant d'inertie, autres), type de réseau (micro-réseau CA, micro-réseau CC, micro-réseau hybride), capacité (moins de 5 000 MW, 5 001 à 10 000 MW, 10 001 à 15 000 MW, plus de 15 000 MW), contrôle (primaire (contrôle local), secondaire, tertiaire (optimisation)), application (emplacement distant, service public, industriel, campus, militaire, ville intelligente , centre de données, hôpital, école, autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie et reste de l'Europe en Europe |

|

Acteurs du marché couverts |

Français ABB, Rolls-Royce plc, Schneider Electric, Cummins Inc., Siemens, Caterpillar, General Electric, Tesla, Black & Veatch Holding Company, Honeywell International Inc., Eaton, Norvento Enerxía, InnoVentum et Hitachi Energy Ltd. |

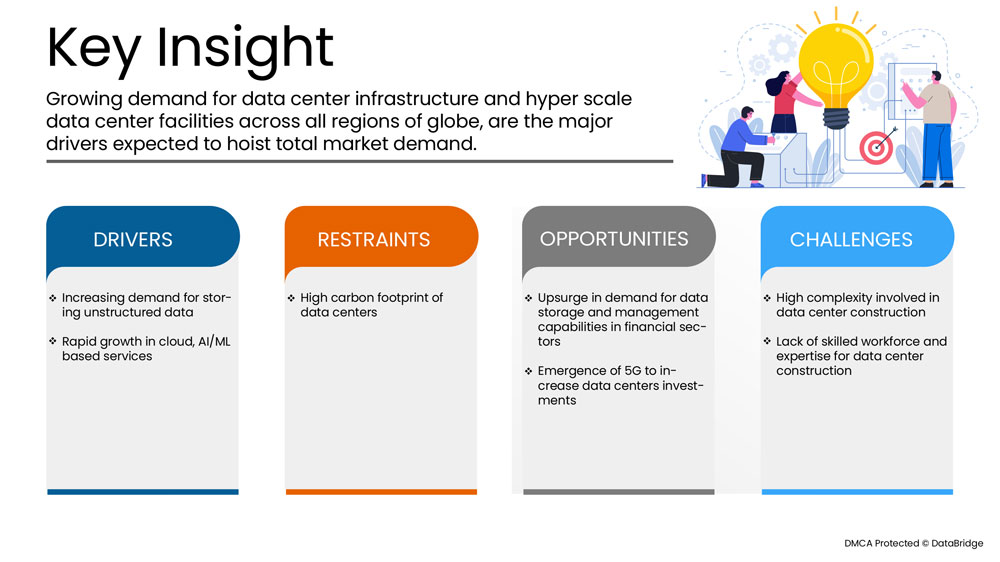

Dynamique du marché des micro-réseaux

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- L’évolution des tendances vers la production d’électricité à partir du gaz alimentera l’industrie des micro-réseaux à base de gaz naturel

Le secteur de l’énergie subit des changements importants pour promouvoir l’efficacité, réduire les émissions et déployer efficacement les technologies afin de trouver un compromis entre coûts et avantages. Une solution émergente consiste à appliquer la technologie power-to-gas, qui peut être utilisée à différentes fins dans les systèmes électriques. En outre, les normes et politiques gouvernementales favorables à l’intégration de sources de production d’énergie durables et efficaces ont stimulé l’infrastructure des micro-réseaux dans toute la région.

- Augmentation de la demande d'alimentation électrique ininterrompue et fiable pour diverses applications

Ces dernières années, la demande mondiale en énergie a augmenté, alimentée par la demande des économies émergentes et la croissance de l’économie mondiale dans son ensemble. De nos jours, des réseaux massifs sont construits dans toute la région, reliant les centrales électriques aux habitations et aux entreprises par des câbles. L’électricité produite par de grandes centrales électriques isolées est désormais connectée à des réseaux électriques centralisés et utilise des combustibles fossiles pour transmettre l’électricité dans différentes régions et différents pays. Cependant, les lacunes de ces centrales électriques en termes de transmission d’électricité inefficace sont devenues de plus en plus évidentes. Par conséquent, l’installation de micro-réseaux peut améliorer l’offre locale d’électricité et la gestion de la demande, ce qui peut contribuer à retarder les investissements coûteux des services publics dans de nouvelles productions d’électricité. En outre, les micro-réseaux peuvent déployer davantage de sources d’électricité à zéro émission, réduisant ainsi les émissions de gaz à effet de serre.

Opportunité

- Augmentation de la demande en énergie renouvelable dans la région

La demande d’énergie propre et verte dans les zones urbaines et isolées augmente de jour en jour. Les projets de micro-réseaux dans les zones isolées/insulaires fonctionnent principalement avec des sources d’énergie renouvelables comme l’énergie solaire, éolienne, hydraulique et autres. La moindre disponibilité des combustibles fossiles conventionnels dans ces zones contribue au besoin croissant d’énergie renouvelable. Les gouvernements s’efforcent également d’augmenter la production d’énergie renouvelable pour réduire l’empreinte carbone. La croissance du secteur des énergies renouvelables créera donc de nouvelles opportunités pour la croissance du marché européen des micro-réseaux.

Contraintes/Défis

- Incertitude dans les lois et règlements relatifs à la production d'énergie décentralisée

Malgré l’intérêt croissant pour la production d’énergie décentralisée, il n’existe pas de lois, de politiques ou d’instruments réglementaires clairs associés aux répercussions de l’intégration de la production décentralisée (DG) dans les systèmes d’énergie électrique. Des politiques et des instruments réglementaires clairement définis associés à la pénétration du réseau DG sont nécessaires pour que ces systèmes prospèrent. L’Union européenne ne dispose d’aucune loi ni réglementation pour les réseaux intelligents ou les micro-réseaux. Elle a seulement fourni des directives pour la mise en œuvre de solutions de micro-réseaux. Les obstacles réglementaires et politiques liés à l’incertitude, qui sont liés à une mauvaise conception des politiques, à la discontinuité et au manque de transparence des politiques et de la législation, constituent un facteur limitant la croissance du marché des micro-réseaux en Europe.

- Manque d'expérience opérationnelle avec les configurations de micro-réseaux

Il existe actuellement plusieurs obstacles potentiels à la mise en œuvre des micro-réseaux, pour lesquels les solutions sont encore en évolution. Le contrôle de la puissance et de la fréquence dans un petit système isolé est difficile car les variations de la demande locale et de la production décentralisée ont un impact relatif beaucoup plus important sur le système que les grands systèmes conventionnels. Le maintien de la stabilité est donc un défi de taille. La protection est également une préoccupation majeure car traditionnellement, les systèmes de protection des réseaux basse tension étaient conçus pour des flux d'énergie unidirectionnels. De plus, toute production décentralisée connectée doit se déconnecter dès la détection d'un défaut du système pour éviter des flux d'énergie inverses excessifs.

Impact post-COVID-19 sur le marché des micro-réseaux

La COVID-19 a eu un impact majeur sur le marché des micro-réseaux, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels.

La pandémie de COVID-19 a eu un impact négatif sur le marché des micro-réseaux. Ainsi, le marché a enregistré un taux de croissance annuel estimé inférieur à celui de 2019 en raison de la diminution des activités des secteurs associés au marché des micro-réseaux. Cependant, la croissance a été élevée après l'ouverture du marché après COVID-19, et on s'attend à ce qu'il y ait une croissance considérable dans le secteur en raison d'une demande accrue d'énergie distribuée. Et ce facteur devrait en outre stimuler la croissance globale du marché.

Les fabricants et les fournisseurs de solutions prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans le microgrid. Grâce à cela, les entreprises apporteront des technologies avancées au marché. En outre, les initiatives gouvernementales pour l'utilisation des véhicules électriques ont conduit à la croissance du marché

Développements récents

- En mars 2022, Siemens a déployé le premier microgrid du Moyen-Orient conçu pour une utilisation industrielle, permettant à Qatar Solar Energy (QSE) de réduire ses coûts d'électricité, de limiter ses émissions de carbone et de bénéficier d'un approvisionnement électrique plus stable.

- En janvier 2021, ABB a piloté le déploiement de micro-réseaux à l'échelle mondiale pour fournir des solutions intelligentes et durables à un monde qui a besoin d'une transition majeure vers les énergies renouvelables pour parvenir à une réduction annuelle mondiale des gaz à effet de serre.

Portée du marché européen des micro-réseaux

Le marché des micro-réseaux est segmenté sur la base de la connectivité, de l'offre, du modèle, de la source, du stockage, du type de réseau, de la capacité, du contrôle et de l'application.

La croissance parmi ces segments vous aidera à analyser les faibles segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Connectivité

- Hors réseau/île/à distance

- Connecté au réseau

Sur la base de la connectivité, le marché européen des micro-réseaux est segmenté en hors réseau/île/à distance et connecté au réseau.

Offre

- Matériel

- Logiciel

- Services

Sur la base de l'offre, le marché européen des micro-réseaux a été segmenté en matériel, logiciels et services.

Modèle

- Urbain

- Semi-urbain

- Île isolée

Sur la base du modèle, le marché européen des micro-réseaux est segmenté en zones urbaines, semi-urbaines et îles éloignées.

Source

- Générateurs Diesel

- CHP

- Solaire PV

- Gaz naturel

- Autres

Sur la base de la source, le marché européen des micro-réseaux a été segmenté en générateurs diesel, cogénération, solaire photovoltaïque, gaz naturel et autres.

Stockage

- Lithium-ion

- Acide de plomb

- Batteries solaires

- Volant

- Piles à flux

- Autres

Sur la base du stockage, le marché européen des micro-réseaux a été segmenté en batteries lithium-ion, plomb-acide, batteries solaires, volants d'inertie, batteries à flux et autres.

Type de grille

- Micro-réseau à courant alternatif

- Micro-réseau CC

- Micro-réseau hybride

Sur la base du type de réseau, le marché européen des micro-réseaux a été segmenté en micro-réseaux CA, micro-réseaux CC et micro-réseaux hybrides.

Capacité

- Moins de 5 000 MW

- 5 001 à 10 000 MW

- 10 001 – 15 000 MW

- Plus de 15 000 MW

Sur la base de la capacité, le marché européen des micro-réseaux a été segmenté en moins de 5 000 MW, 5 001 à 10 000 MW, 10 001 à 15 000 MW et plus de 15 000 MW.

Contrôle

- Primaire (Contrôle local)

- Secondaire

- Contrôle tertiaire (optimisation)

Sur la base du contrôle, le marché européen des micro-réseaux a été segmenté en contrôle primaire (contrôle local), secondaire et tertiaire (optimisation).

Application

- Emplacement éloigné

- Utilitaire

- Industriel

- Campus

- Militaire

- Ville intelligente

- Centre de données

- Hôpital

- École

- Autres

Sur la base du contrôle, le marché européen des micro-réseaux a été segmenté en sites distants, services publics, industriels, campus, militaires, villes intelligentes, centres de données, hôpitaux, écoles et autres.

Analyse/perspectives régionales du marché des micro-réseaux

Le marché des micro-réseaux est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, connectivité, offre, modèle, source, stockage, type de réseau, capacité, contrôle, application comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des micro-réseaux sont l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie et le reste de l'Europe. L'Allemagne domine la région Europe en raison de la dépendance croissante au bois qui a pris de l'ampleur.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des micro-réseaux

Le paysage concurrentiel du marché des micro-réseaux fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises vers le marché des micro-réseaux.

Certains des principaux acteurs opérant sur le marché des microgrids sont ABB, Rolls-Royce plc, Schneider Electric, Cummins Inc., Siemens, Caterpillar, General Electric, Tesla, Black & Veatch Holding Company, Honeywell International Inc., Eaton, Norvento Enerxía, InnoVentum, Hitachi Energy Ltd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE MICROGRID MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 CONNECTIVITY TIMELINE CURVE

2.9 MARKET CHALLENGE MATRIX

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY LANDSCAPE:

4.2 PORTER'S FIVE FORCES MODEL

4.3 ADOPTION RATES AND HEADWINDS IN TECHNOLOGY

4.4 COST ANALYSIS BREAKDOWN OF MICROGRIDS

4.5 LIST OF MICROGRIDS PROJECTS

4.6 EUROPEAN GRANTS FOR MICROGRID PROJECTS

4.7 CASE STUDY

4.7.1 PROBLEM STATEMENT & SOLUTION:

4.7.2 PROBLEM STATEMENT & SOLUTION:

4.8 EXAMPLES OF TYPICAL MICROGRID PROJECTS IN EUROPE

4.8.1 PACE PROJECT

4.8.2 KYTHNOS MICROGRID PROJECT

4.8.3 ISLE OF EIGG MICROGRID PROJECT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE SHIFT IN TRENDS TOWARD GAS-BASED POWER GENERATION WILL FUEL THE NATURAL GAS-BASED MICROGRID INDUSTRY

5.1.2 INCREASE IN DEMAND FOR UNINTERRUPTED AND RELIABLE POWER SUPPLY FOR VARIOUS APPLICATIONS

5.1.3 RISE IN ENERGY- AS- A -SERVICE (EAAS) MODEL TO MINIMIZE COST IN THE ENERGY SECTOR

5.2 RESTRAINTS

5.2.1 UNCERTAINTY IN-LAWS AND REGULATIONS RELATED TO DISTRIBUTED ENERGY GENERATION

5.2.2 INCREASE IN ENERGY PRICES IN EUROPE

5.3 OPPORTUNITIES

5.3.1 RISE IN ACQUISITIONS & PARTNERSHIPS AMONG VARIOUS ORGANIZATIONS

5.3.2 INCREASE IN DEMAND FOR RENEWABLE ENERGY ACROSS THE REGION

5.3.3 GOVERNMENT FUNDING IN MICROGRID PROJECTS

5.4 CHALLENGES

5.4.1 LACK OF OPERATING EXPERIENCE WITH MICROGRID CONFIGURATIONS

5.4.2 RESTRICTIONS FROM UTILITY FRANCHISE RIGHTS AND LIMITED RETAIL MARKET ACCESS

5.4.3 INCREASE IN CYBER SECURITY CONCERNS AND REGULATORY BARRIERS

6 EUROPE MICROGRID MARKET, BY CONNECTIVITY

6.1 OVERVIEW

6.2 GRID CONNECTED

6.3 OFF-GRID/ISLAND/REMOTE

7 EUROPE MICROGRID MARKET, BY OFFERING

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 POWER GENERATORS

7.2.1.1 PV MODULES

7.2.1.2 WIND GENERATORS

7.2.1.3 SMALL HYDRO

7.2.1.4 FUEL CELLS

7.2.1.5 BIOMASS PLANT

7.2.1.6 MICROTURBINES

7.2.1.7 OTHERS

7.2.2 ENERGY STORAGE & DISTRIBUTORS

7.2.2.1 BATTERIES

7.2.2.2 FLYWHEELS

7.2.2.3 ULTRACAPACITORS

7.2.3 CONTROLLERS

7.2.4 OTHERS

7.3 SOFTWARE

7.4 SERVICES

7.4.1 SUPPORT & MAINTENANCE

7.4.2 IMPLEMENTATION

7.4.3 TESTING

7.4.4 TRAINING

8 EUROPE MICROGRID MARKET, BY PATTERN

8.1 OVERVIEW

8.2 URBAN

8.3 REMOTE ISLAND

8.4 SEMI-URBAN

9 EUROPE MICROGRID MARKET, BY SOURCE

9.1 OVERVIEW

9.2 DIESEL GENERATORS

9.3 CHP

9.4 SOLAR PV

9.5 NATURAL GAS

9.6 OTHERS

10 EUROPE MICROGRID MARKET, BY STORAGE

10.1 OVERVIEW

10.2 LITHIUM-ION

10.3 LEAD ACID

10.4 FLYWHEEL

10.5 FLOW BATTERIES

10.6 OTHERS

11 EUROPE MICROGRID MARKET, BY GRID TYPE

11.1 OVERVIEW

11.2 AC MICROGRID

11.3 DC MICROGRID

11.4 HYBRID MICROGRID

12 EUROPE MICROGRID MARKET, BY CAPACITY

12.1 OVERVIEW

12.2 LESS THAN 5,000 MW

12.3 5,001 MW - 10,000 MW

12.4 10,001 MW - 15,000 MW

12.5 MORE THAN 15,000 MW

13 EUROPE MICROGRID MARKET, BY CONTROL

13.1 OVERVIEW

13.2 PRIMARY (LOCAL CONTROL)

13.3 SECONDARY

13.3.1 DECENTRALIZED

13.3.2 CENTRALIZED

13.4 TERTIARY (OPTIMIZATION) CONTROL

14 EUROPE MICROGRID MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 REMOTE LOCATION

14.2.1 HARDWARE

14.2.2 SOFTWARE

14.2.3 SERVICES

14.3 UTILITY

14.3.1 HARDWARE

14.3.2 SOFTWARE

14.3.3 SERVICES

14.4 INDUSTRIAL

14.4.1 HARDWARE

14.4.2 SOFTWARE

14.4.3 SERVICES

14.5 CAMPUS

14.5.1 HARDWARE

14.5.2 SOFTWARE

14.5.3 SERVICES

14.6 MILITARY

14.6.1 HARDWARE

14.6.2 SOFTWARE

14.6.3 SERVICES

14.7 SMART CITY

14.7.1 HARDWARE

14.7.2 SOFTWARE

14.7.3 SERVICES

14.8 DATA CENTER

14.8.1 HARDWARE

14.8.2 SOFTWARE

14.8.3 SERVICES

14.9 HOSPITAL

14.9.1 HARDWARE

14.9.2 SOFTWARE

14.9.3 SERVICES

14.1 SCHOOL

14.10.1 HARDWARE

14.10.2 SOFTWARE

14.10.3 SERVICES

14.11 OTHERS

15 EUROPE

15.1 GERMANY

15.2 U.K.

15.3 FRANCE

15.4 SPAIN

15.5 ITALY

15.6 RUSSIA

15.7 NETHERLANDS

15.8 SWITZERLAND

15.9 BELGIUM

15.1 TURKEY

15.11 REST OF EUROPE

16 EUROPE MICROGRID MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 ABB

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 SERVICE PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 ROLLS-ROYCE PLC

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 SCHINDER ELECTRIC

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 CUMMINS INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 SIEMENS

18.5.1 COMPANY SNPASHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 BLACK & VEATCH HOLDING COMPANY

18.6.1 COMPANY SNAPSHOT

18.6.2 SERVICE PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 CATERPILLAR

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 SERVICE PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 EATON

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 GENERAL ELECTRIC

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 HITACHI ENERGY LTD

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 SOLUTION PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 HONEYWELL INTERNATIONAL INC.

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 INNOVENTUM

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 NORVENTO ENERXÍA

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 TESLA

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 2 EUROPE MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 3 EUROPE HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ENERGY STORAGE & DISTRIBUTORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 8 EUROPE MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 12 EUROPE MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 13 EUROPE SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 16 EUROPE UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 17 EUROPE INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 18 EUROPE CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 19 EUROPE MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 20 EUROPE SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 21 EUROPE DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 22 EUROPE HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 23 EUROPE SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 24 EUROPE MICROGRID MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 GERMANY MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 26 GERMANY MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 27 GERMANY HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 GERMANY POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 GERMANY ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 GERMANY SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 GERMANY MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 32 GERMANY MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 33 GERMANY MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 34 GERMANY MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 35 GERMANY MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 36 GERMANY MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 37 GERMANY SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 GERMANY MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 GERMANY REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 40 GERMANY UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 41 GERMANY INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 42 GERMANY CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 43 GERMANY MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 44 GERMANY SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 45 GERMANY DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 46 GERMANY HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 47 GERMANY SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 48 U.K. MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 49 U.K. MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 U.K. HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.K. POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.K. ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.K. MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 55 U.K. MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 56 U.K. MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 57 U.K. MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.K. MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 59 U.K. MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 60 U.K. SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 U.K. REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 63 U.K. UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 64 U.K. INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 65 U.K. CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 66 U.K. MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 67 U.K. SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 68 U.K. DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 69 U.K. HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 U.K. SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 71 FRANCE MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 72 FRANCE MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 73 FRANCE HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 FRANCE POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 FRANCE SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 FRANCE MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 78 FRANCE MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 79 FRANCE MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 80 FRANCE MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 81 FRANCE MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 82 FRANCE MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 83 FRANCE SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 FRANCE MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 FRANCE REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 86 FRANCE UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 87 FRANCE INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 88 FRANCE CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 89 FRANCE MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 90 FRANCE SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 91 FRANCE DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 92 FRANCE HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 93 FRANCE SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 SPAIN MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 95 SPAIN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 96 SPAIN HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SPAIN POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SPAIN ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SPAIN SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 101 SPAIN MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 102 SPAIN MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 103 SPAIN MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 104 SPAIN MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 105 SPAIN MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 106 SPAIN SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SPAIN MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 SPAIN REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 109 SPAIN UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 SPAIN INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 111 SPAIN CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 112 SPAIN MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 113 SPAIN SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 114 SPAIN DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 115 SPAIN HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 116 SPAIN SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 117 ITALY MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 118 ITALY MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 119 ITALY HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 ITALY POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 ITALY ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 ITALY SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 ITALY MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 124 ITALY MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 125 ITALY MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 126 ITALY MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 127 ITALY MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 128 ITALY MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 129 ITALY SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 ITALY MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 ITALY REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 132 ITALY UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 133 ITALY INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 134 ITALY CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 135 ITALY MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 136 ITALY SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 137 ITALY DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 138 ITALY HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 139 ITALY SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 142 RUSSIA HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 RUSSIA POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 RUSSIA ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 RUSSIA SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 RUSSIA MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 147 RUSSIA MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 150 RUSSIA MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 155 RUSSIA UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 157 RUSSIA CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 158 RUSSIA MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 159 RUSSIA SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 160 RUSSIA DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 161 RUSSIA HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 163 NETHERLANDS MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 164 NETHERLANDS MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 165 NETHERLANDS HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 NETHERLANDS POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 NETHERLANDS ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 NETHERLANDS SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 NETHERLANDS MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 170 NETHERLANDS MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 171 NETHERLANDS MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 172 NETHERLANDS MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 173 NETHERLANDS MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 174 NETHERLANDS MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 175 NETHERLANDS SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 NETHERLANDS MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 177 NETHERLANDS REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 178 NETHERLANDS UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 179 NETHERLANDS INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 180 NETHERLANDS CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 181 NETHERLANDS MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 182 NETHERLANDS SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 183 NETHERLANDS DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 184 NETHERLANDS HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 186 SWITZERLAND MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 187 SWITZERLAND MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 188 SWITZERLAND HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 SWITZERLAND POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 SWITZERLAND ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 SWITZERLAND SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 SWITZERLAND MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 193 SWITZERLAND MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 194 SWITZERLAND MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 195 SWITZERLAND MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 196 SWITZERLAND MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 197 SWITZERLAND MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 198 SWITZERLAND SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 SWITZERLAND MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 SWITZERLAND REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 201 SWITZERLAND UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 202 SWITZERLAND INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 203 SWITZERLAND CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 204 SWITZERLAND MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 205 SWITZERLAND SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 206 SWITZERLAND DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 207 SWITZERLAND HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 208 SWITZERLAND SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 210 BELGIUM MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 216 BELGIUM MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 217 BELGIUM MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 218 BELGIUM MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 219 BELGIUM MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 220 BELGIUM MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 221 BELGIUM SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 BELGIUM MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 223 BELGIUM REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 224 BELGIUM UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 225 BELGIUM INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 226 BELGIUM CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 227 BELGIUM MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 228 BELGIUM SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 229 BELGIUM DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 230 BELGIUM HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 231 BELGIUM SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 232 TURKEY MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 233 TURKEY MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 234 TURKEY HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 TURKEY POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 236 TURKEY ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 TURKEY SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 TURKEY MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 239 TURKEY MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 240 TURKEY MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 241 TURKEY MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 242 TURKEY MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 243 TURKEY MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 244 TURKEY SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 TURKEY MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 246 TURKEY REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 247 TURKEY UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 248 TURKEY INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 249 TURKEY CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 250 TURKEY MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 251 TURKEY SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 252 TURKEY DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 253 TURKEY HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 254 TURKEY SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 255 REST OF EUROPE MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE MICROGRID MARKET: SEGMENTATION

FIGURE 2 EUROPE MICROGRID MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MICROGRID MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MICROGRID MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MICROGRID MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MICROGRID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE MICROGRID MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE MICROGRID MARKET: SEGMENTATION

FIGURE 9 SHIFTING TRENDS TOWARDS GAS BASED POWER GENERATION IS EXPECTED TO DRIVE THE EUROPE MICROGRID MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 10 GRID CONNECTED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE MICROGRID MARKET IN 2022 & 2029

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE MICROGRID MARKET

FIGURE 12 NON-HOUSEHOLD ENERGY PRICES IN EUROPEAN UNION

FIGURE 13 EUROPE MICROGRID MARKET: BY CONNECTIVITY, 2021

FIGURE 14 EUROPE MICROGRID MARKET: BY OFFERING, 2021

FIGURE 15 EUROPE MICROGRID MARKET: BY PATTERN, 2021

FIGURE 16 EUROPE MICROGRID MARKET: BY SOURCE, 2021

FIGURE 17 EUROPE MICROGRID MARKET: BY STORAGE, 2021

FIGURE 18 EUROPE MICROGRID MARKET: BY GRID TYPE, 2021

FIGURE 19 EUROPE MICROGRID MARKET: BY CAPACITY, 2021

FIGURE 20 EUROPE MICROGRID MARKET: BY CONTROL, 2021

FIGURE 21 EUROPE MICROGRID MARKET: BY APPLICATION, 2021

FIGURE 22 EUROPE MICROGRID MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE MICROGRID MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE MICROGRID MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE MICROGRID MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE MICROGRID MARKET: BY CONNECTIVITY (2022-2029)

FIGURE 27 EUROPE MICROGRID MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.