Europe Medical Aesthetics Market

Taille du marché en milliards USD

TCAC :

%

USD

6.81 Billion

USD

16.83 Billion

2024

2032

USD

6.81 Billion

USD

16.83 Billion

2024

2032

| 2025 –2032 | |

| USD 6.81 Billion | |

| USD 16.83 Billion | |

|

|

|

|

Marché européen de l'esthétique médicale, par type de produit (appareils laser esthétiques, appareils énergétiques, appareils de remodelage corporel, appareils esthétiques faciaux, implants esthétiques et appareils esthétiques de la peau), application (anti-âge et rides, rajeunissement du visage et de la peau, augmentation mammaire, modelage du corps et cellulite, élimination des tatouages, lésions vasculaires, cicatrices, lésions pigmentaires, reconstruction, psoriasis et vitiligo, et autres), utilisateur final (centres de beauté, cliniques de dermatologie, hôpitaux et spas médicaux et centres de beauté), canal de distribution (direct et au détail), pays (États-Unis, Canada, Mexique) - Tendances et prévisions de l'industrie jusqu'en 2032

Analyse du marché européen de l'esthétique médicale

L’esthétique médicale a une riche histoire qui remonte aux civilisations anciennes, où les traitements de beauté étaient pratiqués à l’aide de remèdes naturels et des premières formes de procédures cosmétiques. Au début du XXe siècle, l’esthétique médicale a commencé à fusionner avec les progrès de la technologie médicale, avec des innovations telles que le premier collagène injectable pour le traitement des rides dans les années 1970. Le développement du Botox dans les années 1980 a marqué une étape majeure, en introduisant le rajeunissement facial non chirurgical. Au fil des décennies, le domaine s’est développé avec l’avènement des technologies laser, des produits de comblement dermique et des traitements de remodelage corporel non invasifs. Aujourd’hui, l’esthétique médicale allie une technologie de pointe au désir croissant de procédures cosmétiques non invasives, ce qui en fait une industrie en pleine croissance dans les soins de santé en Europe.

Taille du marché de l'esthétique médicale en Europe

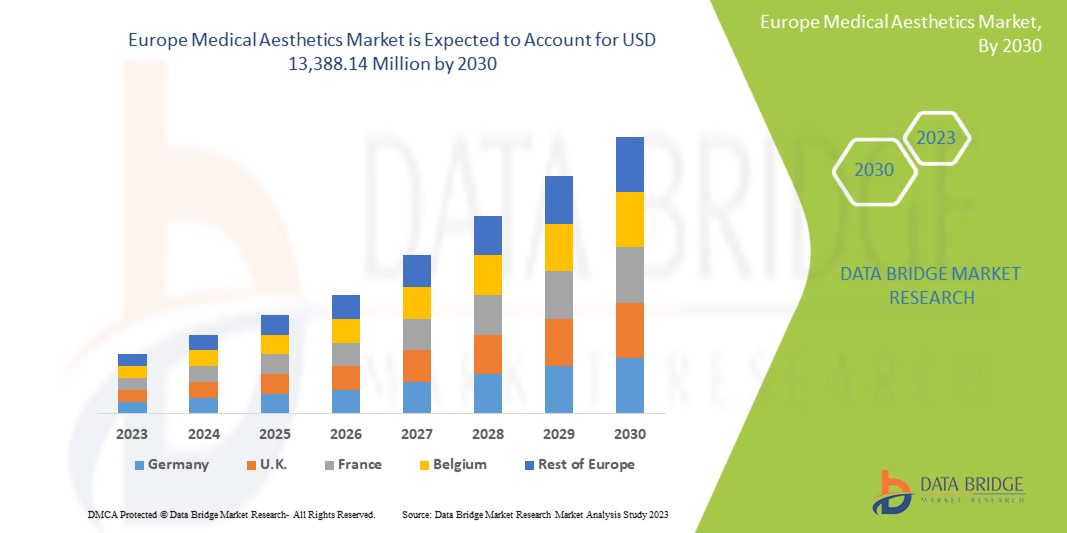

Le marché européen de l'esthétique médicale devrait atteindre 16,83 milliards USD d'ici 2032, contre 6,81 milliards USD en 2024, avec un TCAC de 12,0 % au cours de la période de prévision de 2024 à 2032. En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire.

Tendances du marché de l'esthétique médicale en Europe

« Demande croissante de procédures non chirurgicales »

Le marché européen de l'esthétique médicale connaît une tendance significative vers les procédures cosmétiques non chirurgicales, stimulée par les progrès technologiques, les temps de récupération minimaux et la préférence croissante des consommateurs pour des traitements moins invasifs. Des procédures telles que les injections de Botox, les produits de comblement dermique, les traitements au laser et le remodelage corporel non chirurgical deviennent de plus en plus populaires, car les individus cherchent à améliorer leur apparence sans les risques et les temps d'arrêt associés aux chirurgies traditionnelles. La sensibilisation croissante aux traitements esthétiques, associée à l'influence des médias sociaux sur les normes de beauté, a contribué à cette augmentation de la demande. En outre, l'augmentation du revenu disponible, associée au vieillissement de la population dans les marchés développés, alimente l'expansion du marché. La disponibilité croissante de traitements innovants et personnalisés et l'acceptation croissante de l'esthétique médicale dans la société traditionnelle accélèrent encore cette tendance, positionnant les options non chirurgicales comme le choix préféré de nombreux consommateurs.

Portée du rapport et segmentation du marché de l'esthétique médicale en Europe

|

Attributs |

Aperçu du marché européen de l'esthétique médicale |

|

Segments couverts |

|

|

Région couverte |

Allemagne, France, Royaume-Uni, Italie, Espagne, Suisse, Russie, Belgique, Pays-Bas, Turquie et reste de l'Europe |

|

Principaux acteurs du marché |

Mentor WorldWide LLC (une filiale de Johnsons & Johnsons) (États-Unis), Allergan (une filiale d'AbbVie Inc.) (Irlande), GALDERMA (Suisse), Cutera, Inc. (États-Unis), Lumenis Be Ltd. (Israël), Densply Sirona (États-Unis), Institut Straumann AG (États-Unis), Candela Corporation (États-Unis), Medytrox (Corée du Sud), BioHorizons (États-Unis), BTL (Inde), Nobel Biocare Services AG (Suisse), Merz Pharma (Allemagne), Cynosure, LLC (États-Unis), Sharplight Technologies Inc. (Israël), Alma Lasers (États-Unis), MEGA'GEN IMPLANT CO., LTD. (Inde), 3M (États-Unis), Quanta System (Italie), Sciton (Californie) et entre autres. |

|

Opportunités de marché |

|

|

Ensembles d'informations sur les données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Définition du marché de l'esthétique médicale en Europe

L'esthétique médicale comprend tous les traitements médicaux qui visent à améliorer l'apparence esthétique des patients. L'esthétique médicale se situe dans une jolie petite niche entre l'industrie de la beauté et la chirurgie plastique. Les médecins, infirmières ou dentistes qualifiés peuvent vous proposer une multitude de traitements étonnants pour améliorer votre apparence. Ces traitements nécessitent un haut degré de compétence, de formation et de connaissance de votre anatomie et de votre physiologie. C'est ce qui distingue les traitements médico-esthétiques des traitements de beauté tels que l'épilation des sourcils, l'épilation à la cire ou les extensions de cils. En revanche, les traitements médico-esthétiques ne sont pas aussi agressifs que les interventions chirurgicales (les traitements médicaux esthétiques sont parfois appelés traitements cosmétiques non chirurgicaux), qui incluent des procédures telles que le lifting du visage, l'augmentation mammaire ou la liposuccion.

Définition et dynamique du marché de l'esthétique médicale en Europe

Conducteurs

- Augmentation du vieillissement de la population

L’augmentation de la population vieillissante stimule considérablement le marché des services esthétiques en raison du désir croissant des personnes âgées de conserver une apparence jeune et d’améliorer leur qualité de vie. À mesure que les gens vieillissent, ils subissent souvent une diminution de l’élasticité de la peau, l’apparition de rides et d’autres signes de vieillissement qui peuvent avoir un impact sur l’estime de soi et le bien-être général. Ce changement démographique a entraîné une demande accrue de divers traitements esthétiques, notamment des procédures non invasives telles que le botox, les produits de comblement dermique et les thérapies de rajeunissement de la peau. La sensibilisation croissante à ces options esthétiques, associée à l’accent culturel mis sur la beauté et l’apparence, incite les personnes âgées à rechercher des solutions qui leur permettent d’avoir une apparence aussi dynamique qu’elles le ressentent, alimentant ainsi la croissance du marché.

Par exemple,

- En septembre 2022, selon un article publié par The Nation, le secteur de la santé et de l'esthétique en Thaïlande a été stimulé par le vieillissement de la population du pays. De plus, selon la même source, au 31 décembre de l'année dernière, 12,24 millions de personnes, soit 18,5 %, de la population thaïlandaise étaient âgées de 60 ans ou plus

- En janvier 2024, selon les informations publiées par PRB, une augmentation significative de la population vieillissante aux États-Unis, le nombre d'Américains âgés de 65 ans et plus devant passer de 17 % à 23 % d'ici 2060. Ce changement démographique stimule le marché européen de l'esthétique médicale, car les personnes âgées recherchent des traitements pour répondre aux problèmes liés à l'âge comme les rides, le relâchement cutané et la perte de volume. La demande croissante de procédures anti-âge, telles que le Botox, les produits de comblement dermique et les traitements de rajeunissement de la peau, alimente la croissance du marché et l'innovation dans les produits et services esthétiques

- En mai 2023, selon les informations publiées par le US Census Bureau, le rapport met en évidence une augmentation de 38,6 % de la population américaine âgée de 65 ans et plus de 2010 à 2020, stimulant la demande de traitements anti-âge tels que le Botox et les produits de comblement dermique, alimentant ainsi la croissance du marché européen de l'esthétique médicale

De plus, l’augmentation du revenu disponible de la population vieillissante contribue à l’expansion du marché des services esthétiques. Les personnes âgées cherchant à investir dans leur apparence personnelle et leur bien-être sont plus disposées à dépenser pour des traitements d’amélioration.

En conclusion, les progrès technologiques ont rendu les procédures esthétiques plus sûres, moins invasives et plus accessibles, attirant un segment plus large de personnes âgées qui pouvaient auparavant hésiter à recourir à de telles interventions. Cette convergence des tendances démographiques, l’augmentation des revenus disponibles et l’amélioration des offres de services représentent une croissance significative pour le secteur des services esthétiques, stimulant l’innovation et la concurrence entre les prestataires.

- L'évolution des standards de beauté et l'influence des réseaux sociaux

L’évolution des standards de beauté et l’influence des réseaux sociaux stimulent considérablement la demande de traitements d’esthétique médicale. Les réseaux sociaux comme Instagram et TikTok présentent des standards de beauté idéalisés, encourageant les individus à rechercher des améliorations esthétiques pour obtenir des looks similaires. Les influenceurs et les célébrités font souvent la promotion des traitements esthétiques, les rendant plus courants et plus désirables. Cette tendance conduit à une sensibilisation et une acceptation accrues de l’esthétique médicale, stimulant ainsi la croissance du marché.

Par exemple,

- En juin 2023, selon un article publié dans la National Library of Medicine, la demande croissante en esthétique médicale est alimentée par le vieillissement de la population et les progrès technologiques. À mesure que les gens vieillissent, ils recherchent des traitements pour traiter les signes du vieillissement, tels que les rides et le relâchement cutané. Les progrès technologiques ont rendu ces traitements plus efficaces et plus accessibles, ce qui a encore stimulé la croissance du marché. En outre, la sensibilisation et l'acceptation croissantes des procédures esthétiques contribuent à l'expansion du marché

- En juillet 2024, selon un article publié dans ResearchGate, les médias sociaux ont eu une influence significative sur l’image corporelle et les considérations en matière de chirurgie esthétique. Les plateformes de médias sociaux présentent souvent des normes de beauté idéalisées, ce qui incite les individus à rechercher des améliorations esthétiques pour obtenir une apparence similaire. Cette tendance stimule la demande de traitements d’esthétique médicale, car les gens sont de plus en plus influencés par les images et les modes de vie qu’ils voient en ligne. L’étude souligne le rôle des médias sociaux dans la formation des perceptions de la beauté et l’acceptation croissante des procédures cosmétiques, alimentant ainsi la croissance du marché

Le marché européen de l'esthétique médicale est propulsé par l'évolution des standards de beauté et l'influence omniprésente des réseaux sociaux. Alors que les individus s'efforcent de répondre à ces idéaux en constante évolution, la demande de traitements esthétiques continue d'augmenter, favorisant l'innovation et l'expansion au sein du secteur.

Opportunités

- Développement de nouveaux traitements innovants

L’introduction de nouveaux traitements innovants représente une opportunité importante pour le marché de l’esthétique médicale. Grâce aux progrès de la technologie médicale, les traitements esthétiques ont évolué pour inclure des options non invasives et très efficaces qui répondent à la demande croissante de meilleurs résultats avec un temps d’arrêt minimal. Des traitements tels que les thérapies à base de cellules souches, les techniques laser avancées et les liftings non chirurgicaux du visage remodèlent le marché en offrant aux consommateurs un plus large éventail de choix qui répondent à leurs divers besoins et préférences. Ces innovations améliorent non seulement l’efficacité et la sécurité des traitements, mais réduisent également les risques associés aux procédures chirurgicales plus traditionnelles. Alors que les consommateurs recherchent de plus en plus des solutions de pointe pour préserver leur jeunesse et améliorer leur apparence, la demande pour ces services esthétiques avancés continue d’augmenter. Cette évolution vers des traitements plus récents et plus efficaces constitue une opportunité clé, stimulant la croissance du marché et le positionnant pour une expansion à long terme alors que la technologie continue de transformer l’industrie.

Par exemple,

- En février 2022, selon l’article publié par Science Direct, les cellules souches, utilisées à l’origine pour les maladies dégénératives chroniques, apparaissent désormais comme un traitement prometteur et peu invasif en esthétique. Cette évolution vers les thérapies à base de cellules souches offre des solutions efficaces pour le rajeunissement de la peau et la lutte contre le vieillissement, suscitant un intérêt croissant des consommateurs. À mesure que ce traitement innovant gagne du terrain, il présente une opportunité significative pour le marché des services esthétiques d’Asie du Sud-Est de se développer et d’évoluer

- En août 2021, selon l’article publié par le NCBI, les cellules souches, en particulier celles dérivées du tissu adipeux, gagnent en popularité en dermatologie esthétique en raison de leur capacité à s’auto-renouveler et à se différencier en différents types de cellules. Leur facilité de collecte et leur abondance en font une option intéressante pour les traitements esthétiques, tels que le rajeunissement de la peau. Cette innovation représente une opportunité précieuse pour le marché des services esthétiques d’Asie du Sud-Est de se développer et de diversifier ses offres

- En janvier 2023, selon l'article publié dans le magazine MedEsthetics, des innovations technologiques importantes stimulent la croissance du marché de l'esthétique médicale. Ces avancées comprennent des procédures indolores de nouvelle génération, des appareils avancés, le resurfaçage fractionné, la lipoplastie assistée par ultrasons de troisième génération et l'imagerie cutanée avancée. L'intégration de la RV, de la RA, de l'IA, de la CAO, de la télémédecine et de l'IoT améliore la précision et l'efficacité des procédures, les rendant plus précises et moins invasives

- En février 2024, selon l'article publié dans MDPI, les avancées en médecine régénératrice pour la dermatologie esthétique se concentrent sur des traitements innovants et peu invasifs pour le rajeunissement et la régénération du visage. La corrélation étroite entre la réparation, la régénération et le vieillissement des tissus a ouvert la voie à l'application des principes de la médecine régénératrice en dermatologie esthétique

L’introduction de traitements nouveaux et avancés offre une opportunité précieuse au marché de l’esthétique médicale. Des innovations telles que les thérapies à base de cellules souches, les traitements au laser améliorés et les liftings non chirurgicaux offrent aux consommateurs des options plus sûres et plus efficaces qui nécessitent moins de temps de récupération. Ces avancées répondent à la demande croissante de procédures non invasives et séduisent ceux qui recherchent des résultats meilleurs et plus durables. À mesure que ces traitements gagnent en popularité, ils créent une forte demande, agissant comme un moteur clé de la croissance du marché et le positionnant pour une expansion continue.

- Partenariats et innovations médicales

Les partenariats et innovations médicales représentent une opportunité importante pour le marché de l’esthétique médicale en améliorant la crédibilité et la qualité des services offerts. Les collaborations entre les prestataires de services esthétiques et les professionnels de la santé qualifiés, tels que les dermatologues et les chirurgiens plasticiens, garantissent que les traitements sont non seulement efficaces mais également sûrs pour les consommateurs. Ces partenariats permettent également l’intégration de technologies et de techniques médicales avancées dans les procédures esthétiques, rendant les services plus fiables et plus attrayants pour une clientèle plus large. Avec l’implication de professionnels de la santé de confiance, les consommateurs se sentent plus confiants dans les procédures, ce qui entraîne une demande accrue de services esthétiques. De plus, de telles collaborations ouvrent la voie au développement de nouveaux traitements de pointe qui répondent aux besoins émergents des consommateurs. Cette alliance entre l’esthétique et la médecine stimule la croissance du marché en le positionnant comme un secteur de confiance, innovant et de haute qualité.

Par exemple,

- En novembre 2024, selon l'article publié par The Nation, le partenariat de MASTER avec l'entreprise indonésienne « Lumeo Health » le positionne comme le premier fournisseur de chirurgie esthétique en Asie du Sud-Est. Cette collaboration favorise l'innovation et renforce les partenariats médicaux, offrant des services esthétiques avancés à un marché en pleine croissance. En combinant expertise et ressources, cette alliance ouvre de nouvelles opportunités pour un accès élargi, des traitements de pointe et de meilleurs résultats pour les patients, alimentant la croissance du secteur esthétique

- En octobre 2023, selon l'article publié par Health365, leur partenariat avec l'hôpital de Bangkok marque une étape importante dans l'amélioration des services esthétiques en Asie du Sud-Est. En combinant l'expertise de Health365 avec l'innovation médicale de l'hôpital de Bangkok, cette collaboration favorise l'accès à des traitements de classe mondiale et à des technologies avancées. Cette alliance stratégique présente une opportunité précieuse d'élever le marché des services esthétiques de la région, de stimuler la croissance et d'améliorer les soins aux patients

Les partenariats médicaux représentent une opportunité précieuse pour le marché des services médico-esthétiques en améliorant la crédibilité et la qualité des services. Les collaborations entre prestataires de soins esthétiques et professionnels de la santé qualifiés garantissent des traitements sûrs et efficaces, renforçant ainsi la confiance des consommateurs. Ces partenariats facilitent également l'introduction de techniques et de technologies avancées, attirant ainsi une clientèle plus large. En combinant l'expertise médicale à l'innovation esthétique, le marché connaît une croissance et une demande accrues.

Contraintes/Défis

- Manque de professionnels formés

Le manque de professionnels qualifiés sur le marché des services esthétiques freine considérablement la croissance et la prolifération de ces services. Les procédures esthétiques, qui nécessitent souvent des compétences et des connaissances spécialisées, nécessitent une main-d'œuvre bien au fait des dernières technologies, techniques et protocoles de sécurité. La pénurie de praticiens certifiés limite la disponibilité des services et présente des risques pour la sécurité des patients, entraînant des complications potentielles et une insatisfaction quant aux résultats. Cela crée un cycle dans lequel les consommateurs hésitent à s'engager dans des offres esthétiques, ce qui freine encore davantage la croissance du marché.

Par exemple,

- En août 2023, selon un article publié par The Malaysian Reserve, l’ignorance ou le manque de sensibilisation concernant les procédures esthétiques à risque pratiquées par des esthéticiennes ou des praticiens non agréés en Malaisie constitue une menace sérieuse pour les consommateurs. L’utilisation de produits de qualité inférieure ou de pratiques insalubres peut entraîner de graves problèmes de santé, des infections ou des dommages irréversibles. De plus, l’absence de surveillance réglementaire rend les consommateurs vulnérables aux pratiques trompeuses, ce qui rend difficile pour eux de chercher un recours en cas de faute professionnelle ou d’effets indésirables

- En juillet 2019, selon un article intitulé « L'association promeut les esthéticiennes qualifiées en Malaisie », il a été déclaré que les estimations locales suggéraient qu'il y avait 20 000 esthéticiennes non certifiées contre seulement 200 titulaires de qualifications professionnelles certifiées. Cela met le secteur au défi de maintenir ses normes de prestation de services esthétiques

- En octobre 2024, selon l'article publié dans The Evaluation Company, la pénurie importante de personnel médical aux États-Unis constitue un frein pour le marché européen de l'esthétique médicale. La pénurie touche non seulement les médecins, mais aussi les infirmières et autres professionnels de la santé, ce qui entraîne des délais d'attente plus longs et une disponibilité réduite des traitements esthétiques. Cette pénurie de professionnels qualifiés peut limiter la croissance et l'expansion du marché de l'esthétique médicale, car la demande de praticiens qualifiés dépasse l'offre

De plus, ce manque de talents peut empêcher les cliniques et les prestataires de services d’étendre leurs activités ou d’élargir leur offre. Alors que la demande de services esthétiques continue d’augmenter, en particulier parmi les jeunes à la recherche de traitements non invasifs, la capacité à répondre à cette demande est entravée par un bassin limité de professionnels qualifiés. Ce défi a un impact sur la réputation et la confiance de la marque, car les clients sont plus susceptibles de choisir des établissements connus pour leur personnel qualifié et expérimenté. Par conséquent, sans programmes de formation ciblés et initiatives de soutien pour former les professionnels de la santé en esthétique, le potentiel du marché européen de l’esthétique médicale reste sous-exploité.

- Risque d'effets secondaires associés à ces procédures

Le risque d’effets secondaires associés aux procédures esthétiques constitue un frein important pour le marché de l’esthétique médicale en créant une appréhension chez les clients potentiels. De nombreuses procédures esthétiques, qu’elles soient chirurgicales ou non, comportent un risque inhérent de complications telles que des infections, des cicatrices ou des résultats insatisfaisants. Cette peur des effets indésirables peut dissuader les individus de recourir à ces services, car les consommateurs sont de plus en plus informés via les médias sociaux et les plateformes en ligne des expériences des autres, y compris des résultats négatifs. Par conséquent, le risque d’effets secondaires peut créer une perception selon laquelle ces procédures ne valent pas le risque, ce qui entraîne une réduction de la demande et de la participation au marché.

Par exemple,

- En octobre 2024, selon un article intitulé « Dangers de la chirurgie esthétique en Thaïlande par le Dr Ehsan Jadoon », les dangers liés aux chirurgies esthétiques comprennent le gonflement, les ecchymoses, les infections, les réactions allergiques, les résultats asymétriques, les lésions vasculaires, les traumatismes nerveux, les troubles visuels, les traumatismes psychologiques et les lésions corporelles graves.

- En octobre 2024, selon un article publié dans le Journal of Cutaneous and Aesthetic Surgery, de nombreux événements indésirables ne sont pas signalés en raison d’un manque de réglementation et d’une mauvaise application de la loi, car les procédures sont souvent effectuées dans des environnements non médicaux tels que des spas et des salons de beauté. Ce manque de surveillance peut entraîner des complications telles que la nécrose graisseuse, des infections et d’autres effets secondaires, en particulier lorsque des praticiens inexpérimentés effectuent des procédures. La crainte d’une publicité médiatique négative et les faibles taux de signalement aggravent encore ces problèmes, ce qui rend crucial pour le secteur de mettre en œuvre des mesures rigoureuses d’évaluation des risques et de prévention pour garantir la sécurité des patients et maintenir la croissance du marché

- En août 2020, selon les informations publiées dans The PMFA Journal, des complications peuvent survenir en raison de divers facteurs, notamment la sélection des patients, les techniques d’injection et les risques inhérents aux procédures elles-mêmes. Ces complications peuvent aller de problèmes mineurs tels que des ecchymoses et des gonflements à des problèmes plus graves tels que des infections, des occlusions vasculaires et des réactions allergiques. La peur de ces complications potentielles peut dissuader les individus de rechercher des traitements esthétiques, limitant ainsi la croissance du marché

De plus, l’influence des systèmes de santé locaux et des environnements réglementaires amplifie encore davantage les inquiétudes concernant les effets secondaires dans la région. Si les individus ont l’impression que la clinique ne donne pas la priorité à la sécurité ou ne respecte pas les réglementations sanitaires rigoureuses, ils peuvent être moins susceptibles de recourir à des traitements esthétiques. Ce scepticisme peut être aggravé par la couverture médiatique des procédures bâclées et des pratiques dangereuses, ce qui rend les clients potentiels méfiants quant aux risques associés. En conséquence, la peur de ressentir des effets secondaires non seulement freine l’intérêt individuel, mais pose également des défis pour la croissance du marché, car les entreprises s’efforcent de renforcer la confiance des consommateurs dans leurs services.

Portée du marché européen de l'esthétique médicale

Le marché est segmenté en fonction des produits, des applications, des utilisateurs finaux et des canaux de distribution. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Appareils laser esthétiques

- Dispositifs de resurfaçage cutané ablatif

- Laser CO2

- Laser Erbium

- Autres

- Dispositifs de resurfaçage laser fractionné non ablatif

- Radiofréquence

- Lumière pulsée intense

- Laser fractionné

- Le laser ND:YAG à commutation Q

- Autres

- Appareils énergétiques

- Appareils de chirurgie au laser

- Appareils d'électrocautérisation

- Appareils d'électrochirurgie

- Dispositifs de cryochirurgie

- Scalpel harmonique

- Appareils à micro-ondes

- Appareils de remodelage corporel

- Liposuccion

- Raffermissement cutané non chirurgical

- Traitement de la cellulite

- Appareils d'esthétique faciale

- Injection de Botox

- Remplissage dermique

- Agents de comblement cutané naturels

- Agents de comblement dermique synthétiques

- Injections de collagène

- Peeling chimique

- Tonification du visage

- Fraxel

- Acupuncture esthétique

- Électrothérapie

- Microdermabrasion

- Maquillage permanent

- Implants esthétiques

- Augmentation mammaire

- Implants salins

- Implants en silicone

- Augmentation des fesses

- Implants dentaires esthétiques

- Implants dentaires en titane

- Implants dentaires en zerconium

- Implants faciaux

- Implants de tissus mous

- Implant transdermique

- Autres

- Appareils d'esthétique cutanée

- Appareils de resurfaçage cutané au laser

- Dispositifs de raffermissement cutané non chirurgicaux

- Appareils de luminothérapie

- Appareils de suppression de tatouage

- Produits de micro-aiguilletage

- Produits de lifting par fils

- Appareils laser pour le traitement des ongles

- Autres

Application

- Anti-âge et rides

- Rajeunissement du visage et de la peau

- Augmentation mammaire

- Remodelage du corps et cellulite

- Suppression de tatouage

- Lésions vasculaires

- Sears, lésions pigmentaires, reconstructives

- Psoriasis et vitiligo

- Autres

Utilisateur final

- Centres de cosmétique

- Cliniques de dermatologie

- Hôpitaux

- Spas médicaux et centres de beauté

Canal de distribution

- Appel d'offres direct

- Vente au détail

Analyse régionale du marché de l'esthétique médicale en Europe

Le marché est analysé et des informations sur la taille et les tendances du marché sont fournies en fonction du pays, des produits, de l’application, de l’utilisateur final et du canal de distribution comme référencé ci-dessus.

Les régions couvertes par le marché sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, la Suisse, la Russie, la Belgique, les Pays-Bas, la Turquie et le reste de l'Europe.

L'Allemagne connaît la croissance la plus rapide et domine le marché en raison de son système de santé robuste, de ses niveaux élevés de revenu disponible et d'une forte demande de traitements cosmétiques. L'Allemagne s'est imposée comme une plaque tournante de l'esthétique médicale avancée, avec une infrastructure bien développée qui prend en charge les technologies de pointe dans les procédures non chirurgicales comme le Botox, les produits de comblement dermique et les traitements au laser. La classe moyenne croissante du pays et le vieillissement de la population contribuent à la demande accrue de solutions esthétiques.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Part de marché de l'esthétique médicale en Europe

Le paysage concurrentiel du marché fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Les leaders du marché européen de l'esthétique médicale opérant sur le marché sont :

- Mentor WorldWide LLC (une filiale de Johnsons & Johnsons) (États-Unis)

- Allergan (une filiale d'AbbVie Inc.) (Irlande)

- GALDERMA (Suisse)

- Cutera, Inc. (États-Unis)

- Lumenis Be Ltd. (Israël)

- Densply Sirona (États-Unis)

- Institut Straumann AG (États-Unis)

- Candela Corporation (États-Unis)

- Medytrox (Corée du Sud)

- BioHorizons (États-Unis)

- BTL (Inde)

- Nobel Biocare Services AG (Suisse)

- Merz Pharma (Allemagne)

- Cynosure, LLC (États-Unis)

- Sharplight Technologies Inc. (Israël)

- Alma Lasers (États-Unis)

- MEGA'GEN IMPLANT CO., LTD. (Inde)

- 3M (États-Unis)

- Système Quanta (Italie)

- Sciton (Californie)

Les derniers développements sur le marché européen de l'esthétique médicale

- En janvier 2023, Galderma a annoncé le lancement de FACE by Galderma, une application innovante de réalité augmentée. Cette solution révolutionnaire permet aux praticiens esthétiques et aux patients de visualiser les résultats du traitement au stade de la planification. La technologie sera présentée à la communauté scientifique esthétique lors du congrès mondial 2023 de l'International Master Course on Aging Science (IMCAS)

- En février 2022, Allergan (une filiale d'AbbVie Inc.) a annoncé l'approbation par la FDA de JUVÉDERM VOLBELLA XC pour l'amélioration des creux infraorbitaires chez les adultes de plus de 21 ans. Cela a aidé l'entreprise à élargir son portefeuille de produits esthétiques sur le marché américain

- En janvier 2022, Mentor Worldwide LLC (une filiale de Johnson & Johnson Medical Devices Companies) a annoncé que la FDA avait approuvé l'implant mammaire MENTOR MemoryGel BOOST pour l'augmentation mammaire et la reconstruction mammaire. Ce produit a aidé l'entreprise à élargir son portefeuille de produits esthétiques sur le marché américain

- En janvier 2021, Cutera, Inc. a annoncé le lancement d'un truSculpt Flex+, optimisé pour offrir une sculpture ciblée, répétable et uniforme des zones à problèmes. Cela permet à l'entreprise d'améliorer son portefeuille de produits sur le marché

- En novembre 2019, Lumenis Be Ltd. a annoncé son acquisition auprès de Baring Private Equity Asia (BPEA), un fournisseur leader d'appareils médicaux spécialisés à base d'énergie dans le domaine de l'esthétique. Cela montre que l'entreprise bénéficie d'un soutien solide au sein du marché de l'esthétique pour son portefeuille de produits

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE MEDICAL AESTHETIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE AGEING POPULATION

5.1.2 CHANGING BEAUTY STANDARDS AND SOCIAL MEDIA INFLUENCE

5.1.3 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES

5.1.4 INCREASE IN THE NUMBER OF TECHNOLOGICAL ADVANCEMENTS IN DERMATOLOGY

5.2 RESTRAINTS

5.2.1 LACK OF TRAINED PROFESSIONALS

5.2.2 RISK OF SIDE EFFECTS ASSOCIATED WITH THESE PROCEDURES

5.3 OPPORTUNITIES

5.3.1 DEVELOPMENT OF NEW INNOVATIVE TREATMENTS

5.3.2 MEDICAL PARTNERSHIPS AND INNOVATIONS

5.3.3 INCREASING DISPOSABLE INCOME

5.4 CHALLENGES

5.4.1 SAFETY AND LIABILITY RISKS ASSOCIATED WITH AESTHETIC TREATMENTS

5.4.2 LIMITED INSURANCE COVERAGE

6 EUROPE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 AESTHETIC LASER DEVICES

6.2.1 ABLATIVE SKIN RESURFACING DEVICES

6.2.2 NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES

6.3 ENERGY DEVICES

6.4 BODY CONTOURING DEVICES

6.5 FACIAL AESTHETIC DEVICES

6.5.1 DERMAL FILLERS

6.6 AESTHETIC IMPLANTS

6.6.1 BREAST AUGMENTATION

6.6.2 AESTHETIC DENTAL IMPLANTS

6.7 SKIN AESTHETIC DEVICES

7 EUROPE MEDICAL AESTHETIC MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 ANTI-AGING AND WRINKLES

7.3 FACIAL AND SKIN REJUVENATION

7.4 BREAST ENHANCEMENT

7.5 BODY SHAPING AND CELLULITE

7.6 TATTOO REMOVAL

7.7 VASCULAR LESIONS

7.8 SEARS, PIGMENT LESIONS, RECONSTRUCTIVE

7.9 PSORIASIS AND VITILIGO

7.1 OTHERS

8 EUROPE MEDICAL AESTHETIC MARKET, BY END USER

8.1 OVERVIEW

8.2 COSMETIC CENTERS

8.3 DERMATOLOGY CLINICS

8.4 HOSPITALS

8.5 MEDICAL SPAS AND BEAUTY CENTERS

9 EUROPE MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.3 RETAIL

10 EUROPE MEDICAL AESTHETIC MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 U.K.

10.1.3 ITALY

10.1.4 FRANCE

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 TURKEY

10.1.8 SWITZERLAND

10.1.9 NETHERLANDS

10.1.10 BELGIUM

10.1.11 REST OF EUROPE

11 EUROPE MEDICAL AESTHETIC MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ALLERGAN (A SUBSIDIARY OF ABBVIE INC.)

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 CUTERA, INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MENTOR WORLDWIDE LLC (A SUBSIDIARY OF JOHNSONS & JOHNSONS)

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 LUMENIS BE LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 GALDERMA

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALMA LASERS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BIOHORIZONS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BTL

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CANDELA CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CYNOSURE, LLC

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 DENTSPLY SIRONA

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 INSTITUT STRAUMANN AG

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 MEDYTROX

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MEGA'GEN IMPLANT CO., LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 MERZ PHARMA

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 3M

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 NOBEL BIOCARE SERVICES AG

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 QUANTA SYSTEM

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 SCITON

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 SHARPLIGHT TECHNOLOGIES INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 EUROPE AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 EUROPE AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 EUROPE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE DERMAL FILLERS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE BREAST AUGMENTATION IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE ANTI-AGING AND WRINKLES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE FACIAL AND SKIN REJUVENATION IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE BREAST ENHANCEMENT IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE BODY SHAPING AND CELLULITE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE VASCULAR LESIONS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE SEARS, PIGMENT LESIONS, RECONSTRUCTIVE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE PSORIASIS AND VITILIGO IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE OTHERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE COSMETIC CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE DERMATOLOGY CLINICS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE HOSPITALS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE MEDICAL SPAS AND BEAUTY CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE DIRECT TENDER IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE RETAIL IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE MEDICAL AESTHETIC MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 GERMANY MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 GERMANY AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 GERMANY ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 GERMANY NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 GERMANY ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 GERMANY BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 GERMANY FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 GERMANY DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 GERMANY AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 GERMANY BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 GERMANY AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 GERMANY SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 GERMANY MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 GERMANY MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 66 GERMANY MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 67 U.K. MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.K. AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.K. ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.K. NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 U.K. ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.K. BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.K. FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.K. DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.K. AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.K. BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.K. AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.K. SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.K. MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 80 U.K. MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 81 U.K. MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 82 ITALY MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 ITALY AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 ITALY ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 ITALY NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 ITALY ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 ITALY BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 ITALY DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 ITALY AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 ITALY BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 ITALY AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 ITALY SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 ITALY MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 94 ITALY MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 95 ITALY MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 96 FRANCE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 FRANCE AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 FRANCE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 FRANCE NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 FRANCE ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 FRANCE BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 FRANCE FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 FRANCE DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 FRANCE AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 FRANCE BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 FRANCE AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 FRANCE SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 FRANCE MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 FRANCE MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 110 FRANCE MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 111 SPAIN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 SPAIN AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SPAIN ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 SPAIN NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 SPAIN ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SPAIN BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 SPAIN FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 SPAIN DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 SPAIN AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SPAIN BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SPAIN AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SPAIN SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SPAIN MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 124 SPAIN MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 125 SPAIN MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 126 RUSSIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 RUSSIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 RUSSIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 RUSSIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 RUSSIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 RUSSIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 RUSSIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 RUSSIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 RUSSIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 RUSSIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 RUSSIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 RUSSIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 RUSSIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 RUSSIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 140 RUSSIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 141 TURKEY MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 TURKEY AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 TURKEY ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 TURKEY NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 TURKEY ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 TURKEY BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 TURKEY FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 TURKEY DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 TURKEY AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 TURKEY BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 TURKEY AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 TURKEY SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 TURKEY MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 154 TURKEY MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 155 TURKEY MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 156 SWITZERLAND MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SWITZERLAND AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SWITZERLAND ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SWITZERLAND NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 SWITZERLAND ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 SWITZERLAND BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 SWITZERLAND FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 SWITZERLAND DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 SWITZERLAND AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 SWITZERLAND BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 SWITZERLAND AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 SWITZERLAND SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 SWITZERLAND MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 169 SWITZERLAND MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 170 SWITZERLAND MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 171 NETHERLANDS MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 NETHERLANDS AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 NETHERLANDS ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NETHERLANDS NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 NETHERLANDS ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 NETHERLANDS BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 NETHERLANDS FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 NETHERLANDS DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NETHERLANDS AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 NETHERLANDS BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 NETHERLANDS AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 NETHERLANDS SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 NETHERLANDS MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 184 NETHERLANDS MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 185 NETHERLANDS MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 186 BELGIUM MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 BELGIUM AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 BELGIUM ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 BELGIUM NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 BELGIUM ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 BELGIUM BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 BELGIUM FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 BELGIUM DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 BELGIUM AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 BELGIUM BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 BELGIUM AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 BELGIUM SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 BELGIUM MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 BELGIUM MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 200 BELGIUM MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 201 REST OF EUROPE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 EUROPE MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 2 EUROPE MEDICAL AESTHETIC MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MEDICAL AESTHETIC MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MEDICAL AESTHETIC MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE MEDICAL AESTHETIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MEDICAL AESTHETIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE MEDICAL AESTHETIC MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE MEDICAL AESTHETIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 SIX SEGMENTS COMPRISE THE EUROPE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES IS DRIVING THE GROWTH OF THE EUROPE MEDICAL AESTHETIC MARKET FROM 2025 TO 2032

FIGURE 14 THE AESTHETIC LASER DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE MEDICAL AESTHETIC MARKET IN 2025 AND 2032

FIGURE 15 EUROPE MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2024

FIGURE 16 EUROPE MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 17 EUROPE MEDICAL AESTHETIC MARKET: PRODUCT TYPE, CAGR (2025-2032)

FIGURE 18 EUROPE MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 EUROPE MEDICAL AESTHETIC MARKET: BY APPLICATION, 2024

FIGURE 20 EUROPE MEDICAL AESTHETIC MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 21 EUROPE MEDICAL AESTHETIC MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 22 EUROPE MEDICAL AESTHETIC MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 23 EUROPE MEDICAL AESTHETIC MARKET: BY END USER, 2024

FIGURE 24 EUROPE MEDICAL AESTHETIC MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 25 EUROPE MEDICAL AESTHETIC MARKET: BY END USER, CAGR (2025-2032)

FIGURE 26 EUROPE MEDICAL AESTHETIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 27 EUROPE MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 28 EUROPE MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 29 EUROPE MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 30 EUROPE MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 EUROPE MEDICAL AESTHETIC MARKET: SNAPSHOT (2024)

FIGURE 32 EUROPE MEDICAL AESTHETIC MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.