Europe Liquid Roofing Market

Taille du marché en milliards USD

TCAC :

%

USD

2.04 Billion

USD

4.06 Billion

2023

2033

USD

2.04 Billion

USD

4.06 Billion

2023

2033

| 2024 –2033 | |

| USD 2.04 Billion | |

| USD 4.06 Billion | |

|

|

|

Marché européen des toitures liquides, par type (revêtements bitumineux, revêtements acryliques, membranes élastomères, revêtements en silicone, hybrides PU/acrylique, revêtements en polyuréthane, revêtements époxy, caoutchoucs EPDM et autres), type de toit (toit plat, toit en pente, en dents de scie et autres), substrat (béton, composite, métal et autres), installation (réfection et réparation de toiture et nouvelle construction), utilisateur final (bâtiment résidentiel, bâtiment commercial, bâtiment industriel et infrastructure publique) – Tendances et prévisions de l’industrie jusqu’en 2033.

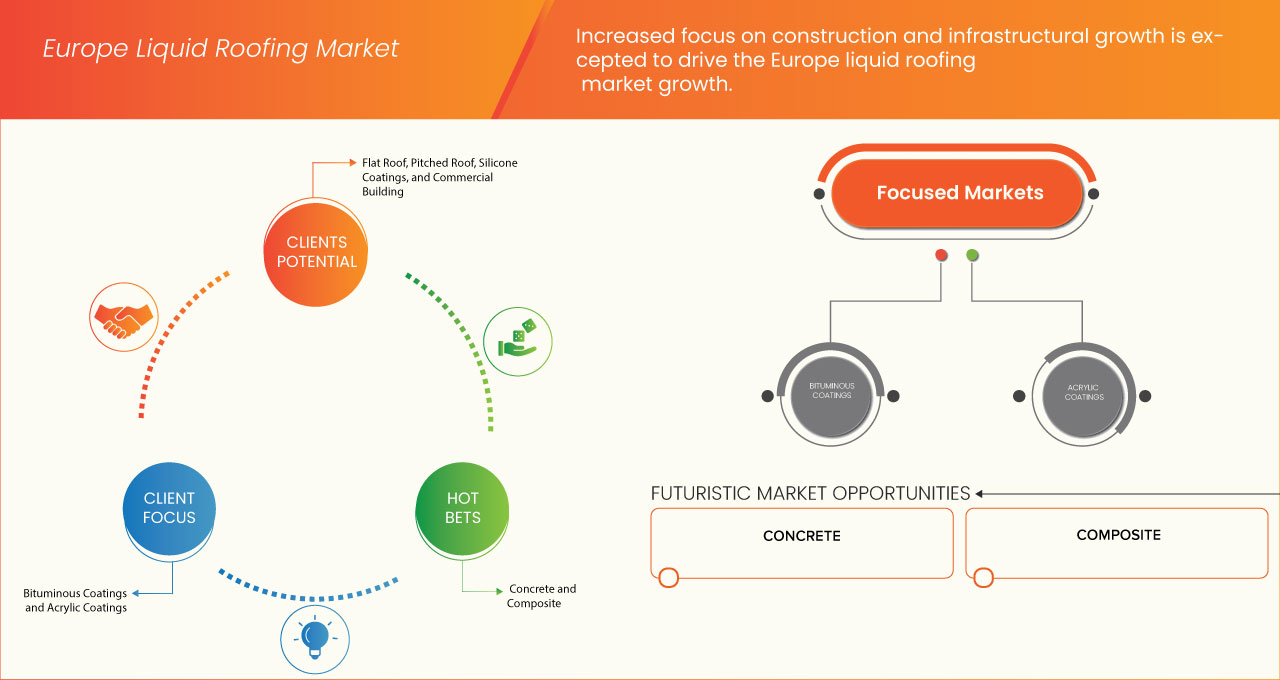

Analyse et perspectives du marché européen des toitures liquides

La demande croissante de solutions d'étanchéité et l'accent accru mis sur la construction et la croissance des infrastructures apparaîtront comme les principaux facteurs de croissance du marché. L'utilisation croissante de la toiture liquide en polyuréthane 2k aggravera encore la croissance du marché. La sensibilisation croissante à la restauration des toitures est un autre facteur qui renforce la croissance du marché. Cependant, les prix fluctuants des matières premières pour les produits de toiture liquide et la disponibilité de substituts alternatifs constitueront un frein à la croissance du marché.

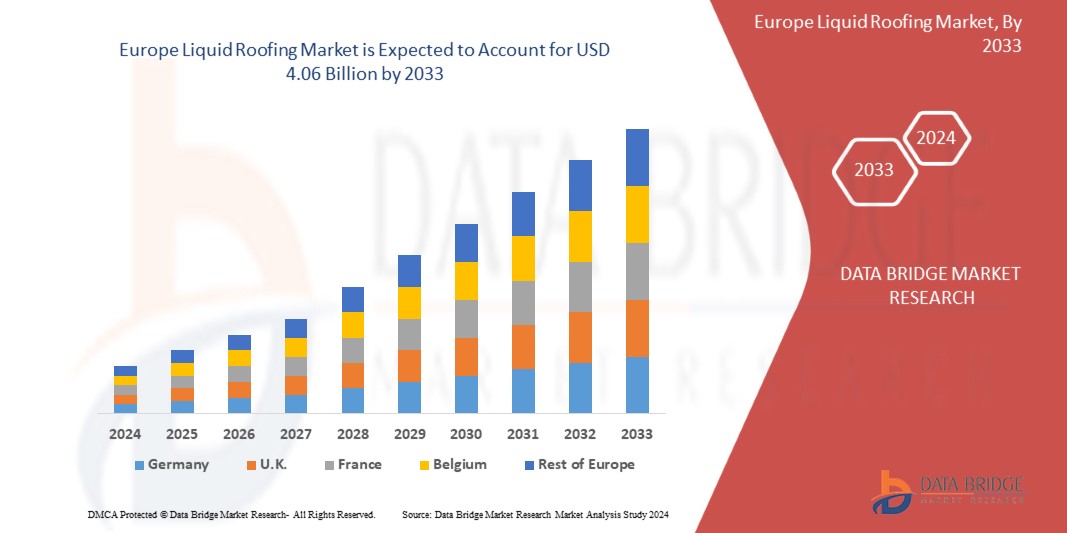

Data Bridge Market Research analyse que le marché européen des toitures liquides devrait atteindre 4,06 milliards USD d'ici 2033, contre 2,04 milliards USD en 2023, avec un TCAC de 7,1 % au cours de la période de prévision de 2024 à 2033.

|

Rapport métrique |

Détails |

|

Période de prévision |

2024 à 2033 |

|

Année de base |

2023 |

|

Années historiques |

2022 (personnalisable pour 2016-2021) |

|

Unités quantitatives |

Chiffre d'affaires en milliards USD |

|

Segments couverts |

Type (revêtements bitumineux, revêtements acryliques, membranes élastomères , revêtements en silicone, hybrides PU/acrylique, revêtements en polyuréthane , revêtements époxy , caoutchoucs EPDM et autres), type de toit (toit plat, toit en pente, toit en dents de scie et autres), substrat (béton, composite, métal et autres), installation (réfection et réparation de toiture et nouvelle construction), utilisateur final (bâtiment résidentiel, bâtiment commercial, bâtiment industriel et infrastructure publique) |

|

Pays couverts |

Allemagne, Royaume-Uni, France, Italie, Russie, Espagne, Turquie, Pays-Bas, Suisse, Belgique et reste de l'Europe |

|

Acteurs du marché couverts |

Parmi les autres sociétés, on compte RPM International Inc., 3M, BASF SE, Henkel Corporation, Sika AG, BMI Group Holdings UK Limited, SOPREMA, SAINT-GOBAIN, Dow, Johns Manville, MAPEI SpA, Akzo Nobel NV, Henry Company, KRATON CORPORATION, Pidilite Industries Ltd., Garland Industries, Inc., GAF, Inc., HB Fuller Company, Triflex (UK) Limited, Polyroof Products Ltd, Gaco, KEMPER SYSTEM, Triton Systems., Liquid Roofing Systems Ltd, ALT Global, LLC, Restec Roofing et Widopan Products GmbH. |

Définition du marché

Le marché des toitures liquides fait référence au segment de l'industrie de la construction qui traite de l'application de membranes ou de revêtements appliqués sous forme liquide sur les toits à des fins d'étanchéité et de protection. Ces matériaux de toiture liquides sont généralement composés de polymères, de bitume, de résines et de divers additifs, offrant flexibilité, durabilité et résistance aux intempéries. Le marché englobe les produits utilisés dans les nouveaux projets de construction et la rénovation de toitures existantes dans les bâtiments résidentiels, commerciaux, industriels et institutionnels.

Dynamique du marché des toitures liquides en Europe

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de solutions d'étanchéité

Le changement climatique entraîne des phénomènes météorologiques plus extrêmes, et la nécessité de protéger les bâtiments et les infrastructures contre les dégâts des eaux devient primordiale. La toiture liquide offre une solution polyvalente et durable pour l'imperméabilisation des toits plats ou à faible pente, ce qui en fait un choix populaire pour les applications commerciales, résidentielles et industrielles.

L’un des principaux facteurs à l’origine de la demande croissante de toitures liquides est leur capacité à fournir une protection sans faille contre les infiltrations d’eau. Les matériaux de toiture traditionnels tels que l’asphalte ou le métal peuvent développer des joints et des raccords au fil du temps, qui peuvent devenir des points vulnérables à la pénétration de l’eau. La toiture liquide, en revanche, forme une membrane continue sur la surface du toit, scellant efficacement tout point d’entrée potentiel de l’eau. Cette nature sans faille améliore non seulement les performances d’étanchéité, mais réduit également le risque de fuites et de dommages ultérieurs à la structure sous-jacente.

- Accent accru sur la construction et la croissance des infrastructures

Les gouvernements et le secteur privé investissent massivement dans la construction de nouvelles structures et la rénovation de celles existantes pour répondre aux besoins de la croissance démographique et de l’urbanisation. Cette augmentation des activités de construction crée une forte demande pour des solutions de toiture qui sont non seulement durables et fiables, mais aussi rentables et faciles à installer – des qualités dans lesquelles les systèmes de toiture liquide excellent.

Les toitures liquides offrent plusieurs avantages par rapport aux matériaux de toiture traditionnels, ce qui en fait un choix intéressant pour divers projets de construction. Son application sans joint assure une étanchéité à l'eau, empêchant les fuites et les dégâts des eaux, ce qui est essentiel pour maintenir l'intégrité des bâtiments et des infrastructures. De plus, les systèmes de toiture liquide peuvent être appliqués à des géométries de toit complexes et à des surfaces irrégulières, offrant une polyvalence de conception et de construction. Ces qualités rendent les toitures liquides particulièrement adaptées aux projets de grande envergure où la rapidité, l'efficacité et les performances à long terme sont primordiales.

Opportunité

- Demande croissante de toitures liquides écologiques

La prise de conscience des problèmes environnementaux ne cesse de croître et l'accent est mis sur les pratiques de construction durables. Les toitures liquides vertes, qui utilisent des matériaux et des techniques respectueux de l'environnement, s'inscrivent parfaitement dans cette tendance. Les consommateurs et les entreprises privilégient de plus en plus les solutions qui minimisent l'impact environnemental, ce qui fait des toitures liquides vertes une option attrayante pour les projets de construction neuve et de rénovation de toiture.

De plus, les progrès de la technologie et de la science des matériaux ont conduit au développement de produits de toiture liquide écologiques innovants qui offrent des performances et une durabilité supérieures à celles des matériaux de toiture traditionnels. Ces avancées comprennent une résistance accrue aux intempéries, des propriétés d'isolation améliorées et une durée de vie plus longue, ce qui fait de la toiture liquide écologique un choix convaincant pour les propriétaires de bâtiments qui cherchent à investir dans des solutions durables à long terme.

Contraintes/ Défis

- Fluctuations des prix des matières premières pour les produits de toiture liquide

Les fluctuations des prix des matières premières pour les produits de toiture liquide ont depuis longtemps un impact significatif sur les fabricants, les entrepreneurs et, en fin de compte, les consommateurs en raison des perturbations des chaînes d'approvisionnement, qui augmentent les coûts de production. La volatilité des coûts des matières premières influence directement les dépenses de production globales, ce qui entraîne des incertitudes dans les stratégies de tarification et les marges bénéficiaires. Cette imprévisibilité peut entraver la croissance du marché, car les fabricants peuvent avoir du mal à maintenir des prix compétitifs tout en garantissant la rentabilité. De plus, les pics soudains des prix des matières premières peuvent perturber les chaînes d'approvisionnement et les calendriers de production, entraînant des retards dans les délais des projets et augmentant potentiellement les coûts pour les utilisateurs finaux.

En outre, les fluctuations des prix des matières premières constituent un obstacle à l’entrée de nouveaux acteurs sur le marché. L’incertitude entourant les coûts des intrants complique la tâche des start-ups et des petites entreprises qui souhaitent établir des structures de prix stables et concurrencer les entreprises établies. Cette dynamique peut limiter l’innovation et la diversité du marché, car les entreprises peuvent être plus enclines à se concentrer sur des mesures de réduction des coûts plutôt qu’à investir dans des initiatives de R&D pour améliorer la qualité et les performances des produits.

- La toiture liquide devient glissante avec le temps

Compte tenu du marché, il est essentiel pour les fabricants et les consommateurs de comprendre le phénomène de glissement des surfaces. Il devient impératif de répondre aux préoccupations liées au glissement des surfaces pour garantir la sécurité et l'efficacité de ces systèmes de toiture, car la demande de solutions de toiture liquide continue d'augmenter à l'échelle mondiale.

Développements récents

- En décembre 2022, Dow s'est associé à AB Specialty Silicones pour distribuer des revêtements de toiture élastomères, améliorant ainsi l'accès au marché et soutenant les objectifs de développement durable. Cette collaboration s'appuie sur l'expertise d'AB Specialty Silicones et sur l'investissement de Dow dans la capacité des polymères de silicone, favorisant l'adoption de revêtements durables et hautement réfléchissants pour l'efficacité énergétique et la réduction de la chaleur urbaine

- En décembre 2022, Akzo Nobel NV enrichit son portefeuille de revêtements hautes performances grâce à l'acquisition de l'activité de revêtements liquides pour roues de Lankwitzer Lackfabrik. Cette opération renforce la position d'AkzoNobel en élargissant sa gamme de produits innovants, complétant ainsi son offre existante de revêtements en poudre. En conclusion, l'acquisition consolide la présence d'AkzoNobel dans le secteur des revêtements, promettant des capacités et une diversité de produits améliorées

Portée du marché européen des toitures liquides

Le marché européen des toitures liquides est segmenté en cinq segments notables qui sont basés sur le type, le type de toiture, le substrat, l'installation et l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et les différences dans vos marchés cibles.

Taper

- Revêtements bitumineux

- Revêtements acryliques

- Membranes élastomères

- Revêtements en silicone

- Hybrides PU / Acrylique

- Revêtements en polyuréthane

- Revêtements époxy

- Caoutchoucs EPDM

- Autres

Sur la base du type, le marché européen des toitures liquides est segmenté en revêtements bitumineux, revêtements acryliques, membranes élastomères, revêtements en silicone, hybrides PU/acrylique, revêtements en polyuréthane, revêtements époxy, caoutchoucs EPDM et autres.

Type de toit

- Toit plat

- Toiture en pente

- Dent de scie

- Autres

Sur la base du type de toit, le marché européen des toitures liquides est segmenté en toit plat, toit en pente, en dents de scie et autres.

Substrat

- Béton

- Composite

- Métal

- Autres

Sur la base du substrat, le marché européen des toitures liquides est segmenté en béton, composite, métal et autres.

Installation

- Réfection et réparation de toiture

- Nouvelle construction

Sur la base de l'installation, le marché européen des toitures liquides est segmenté en réfection et réparation de toitures et en nouvelle construction.

Utilisateur final

- Bâtiment résidentiel

- Bâtiment commercial

- Bâtiment industriel

- Infrastructures publiques

En fonction de l’utilisateur final, le marché européen des toitures liquides est segmenté en bâtiments résidentiels, bâtiments commerciaux, bâtiments industriels et infrastructures publiques.

Analyse/perspectives régionales du marché des toitures liquides en Europe

Le marché européen des toitures liquides est segmenté en cinq segments notables qui sont basés sur le type, le type de toiture, le substrat, l’installation et l’utilisateur final.

Sur la base du pays, le marché est segmenté en Allemagne, Royaume-Uni, France, Italie, Russie, Espagne, Turquie, Pays-Bas, Suisse, Belgique, reste de l'Europe.

L'Allemagne devrait dominer le marché européen des toitures liquides avec une hausse des activités de construction dans les secteurs résidentiel, commercial et industriel.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des toitures liquides en Europe

Le paysage concurrentiel du marché européen des toitures liquides fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'étendue du produit, la domination des applications et la courbe de survie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché européen des toitures liquides.

Français Certains des principaux acteurs opérant sur le marché européen des toitures liquides sont RPM International Inc., 3M, BASF SE, Henkel Corporation, Sika AG, BMI Group Holdings UK Limited, SOPREMA, Saint-Gobain, Dow, Johns Manville, MAPEI SpA, Akzo Nobel NV, Henry Company (une filiale de Carlisle Companies Inc.), KRATON CORPORATION, Pidilite Industries Ltd., Garland Industries, Inc., GAF, Inc., HB Fuller Company, Triflex (UK) Limited., Polyroof Products Ltd, , Gaco., KEMPER SYSTEM, Triton Systems., Liquid Roofing Systems Ltd, ALT Europe, LLC (en tant que filiale de WestWood Kunststofftechnik), Restec Roofing et Widopan Products GmbH, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE LIQUID ROOFING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 MARKET END-USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.2 PESTEL ANALYSIS

4.3 RAW MATERIAL COVERAGE

4.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4.1 MATERIAL SCIENCE REVOLUTION

4.4.2 APPLICATION TECHNOLOGY TRANSFORMATION

4.4.3 SUSTAINABILITY: A STRATEGIC IMPERATIVE

4.4.4 ADDITIONAL CONSIDERATIONS

4.5 VENDOR SELECTION CRITERIA

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 LOGISTICS COST SCENARIO

4.6.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

5 REGULATION COVERAGE

5.1 LIQUID APPLIED WATERPROOFING SYSTEMS (LAWS)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR WATERPROOFING SOLUTIONS

6.1.2 INCREASED FOCUS ON CONSTRUCTION AND INFRASTRUCTURAL GROWTH

6.1.3 RISING USAGE OF 2K POLYURETHANE LIQUID ROOFING

6.1.4 GROWING AWARENESS FOR ROOF RESTORATION

6.1.5 EXTREME WEATHER EVENTS AND CLIMATE RESILIENCE INCREASES THE DEMAND FOR LIQUID ROOFING SYSTEM

6.2 RESTRAINTS

6.2.1 FLUCTUATING RAW MATERIAL PRICES FOR LIQUID ROOFING PRODUCTS

6.2.2 AVAILABILITY OF ALTERNATIVE SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR GREEN LIQUID ROOFING

6.3.2 ADVANCEMENTS IN LIQUID ROOFING TECHNOLOGY

6.3.3 STRATEGIC PARTNERSHIP AND COLLABORATION FOR LIQUID ROOFING

6.4 CHALLENGES

6.4.1 LIQUID ROOFING GETS SLIPPERY OVER TIME

6.4.2 INSTALLATION AND WEATHER DEPENDENCY COMPLEXITY

7 EUROPE LIQUID ROOFING MARKET, BY TYPE

7.1 OVERVIEW

7.2 BITUMINOUS COATINGS

7.3 ACRYLIC COATINGS

7.4 ELASTOMERIC MEMBRANES

7.5 SILICONE COATINGS

7.6 PU / ACRYLIC HYBRIDS

7.7 POLYURETHANE COATINGS

7.8 EPOXY COATINGS

7.9 EPDM RUBBERS

7.1 OTHERS

8 EUROPE LIQUID ROOFING MARKET, BY ROOF TYPE

8.1 OVERVIEW

8.2 FLAT ROOF

8.3 PITCHED ROOF

8.4 SAW TOOTH

8.5 OTHERS

9 EUROPE LIQUID ROOFING MARKET, BY SUBSTRATE

9.1 OVERVIEW

9.2 CONCRETE

9.3 COMPOSITE

9.4 METAL

9.5 OTHERS

10 EUROPE LIQUID ROOFING MARKET, BY INSTALLATION

10.1 OVERVIEW

10.2 REROOFING AND REPAIRS

10.3 NEW CONSTRUCTION

11 EUROPE LIQUID ROOFING MARKET, BY END USER

11.1 OVERVIEW

11.2 RESIDENTIAL BUILDING

11.2.1 BY HOUSING TYPE

11.2.2 BY TYPE

11.3 COMMERCIAL BUILDING

11.3.1 BY BUILDING TYPE

11.3.2 BY TYPE

11.4 INDUSTRIAL BUILDING

11.4.1 BY CONSTRUCTION TYPE

11.4.2 BY TYPE

11.5 PUBLIC INFRASTRUCTURE

11.5.1 BY TYPE

12 EUROPE LIQUID ROOFING MARKET, BY COUNTRY

12.1 EUROPE

12.1.1 GERMANY

12.1.2 FRANCE

12.1.3 U.K.

12.1.4 ITALY

12.1.5 RUSSIA

12.1.6 SPAIN

12.1.7 TURKEY

12.1.8 NETHERLANDS

12.1.9 SWITZERLAND

12.1.10 BELGIUM

12.1.11 REST OF EUROPE

13 EUROPE LIQUID ROOFING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 RPM INTERNATIONAL INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 BRAND PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 3M

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 BASF SE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 HENKEL CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 BRAND PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SIKA AG

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 AKZO NOBEL N.V.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 BRAND PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ALT GLOBAL, LLC (AS A SUBSDIARY OF WESTWOOD KUNSTSTOFFTECHNIK)

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BMI GROUP HOLDINGS UK LIMITED

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 DOW

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 GACO

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 GAF, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 GARLAND INDUSTRIES, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 H.B. FULLER COMPANY

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 HENRY COMPANY (A SUBSIDIARY OF CARLISLE COMPANIES INC.)

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 JOHNS MANVILLE

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 KEMPER SYSTEM (A SUBSDIARY OF KEMPER SYSTEM GMBH & CO. KG)

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 KRATON CORPORATION

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 LIQUID ROOFING SYSTEMS LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 MAPEI S.P.A.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 PIDILITE INDUSTRIES LTD

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 POLYROOF PRODUCTS LTD

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 RESTEC ROOFING

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 SAINT-GOBAIN

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 BRAND PORTFOLIO

15.23.4 RECENT DEVELOPMENTS

15.24 SOPREMA

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 TRIFLEX (UK) LIMITED

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 TRITON SYSTEMS.

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 WIDOPAN PRODUCTS GMBH

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 2 EUROPE LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 3 EUROPE LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 4 EUROPE LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 5 EUROPE LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 6 EUROPE LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 7 EUROPE RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 8 EUROPE RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 9 EUROPE COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 10 EUROPE COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 11 EUROPE INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 12 EUROPE INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 13 EUROPE PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 14 EUROPE LIQUID ROOFING MARKET, BY COUNTRY, 2022-2033 (USD THOUSAND)

TABLE 15 EUROPE LIQUID ROOFING MARKET, BY COUNTRY, 2022-2033 (THOUSAND LITER)

TABLE 16 EUROPE LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 17 EUROPE LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 18 EUROPE LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 19 EUROPE LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 20 EUROPE LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 21 EUROPE LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 22 EUROPE RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 23 EUROPE RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 24 EUROPE COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 25 EUROPE COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 26 EUROPE INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 27 EUROPE INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 28 EUROPE PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 29 GERMANY LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 30 GERMANY LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 31 GERMANY LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 32 GERMANY LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 33 GERMANY LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 34 GERMANY LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 35 GERMANY RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 36 GERMANY RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 37 GERMANY COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 38 GERMANY COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 39 GERMANY INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 40 GERMANY INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 41 GERMANY PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 42 FRANCE LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 43 FRANCE LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 44 FRANCE LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 45 FRANCE LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 46 FRANCE LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 47 FRANCE LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 48 FRANCE RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 49 FRANCE RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 50 FRANCE COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 51 FRANCE COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 52 FRANCE INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 53 FRANCE INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 54 FRANCE PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 55 U.K. LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 56 U.K. LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 57 U.K. LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 58 U.K. LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 59 U.K. LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 60 U.K. LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 61 U.K. RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 62 U.K. RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 63 U.K. COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 64 U.K. COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 65 U.K. INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 66 U.K. INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 67 U.K. PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 68 ITALY LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 69 ITALY LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 70 ITALY LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 71 ITALY LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 72 ITALY LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 73 ITALY LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 74 ITALY RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 75 ITALY RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 76 ITALY COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 77 ITALY COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 78 ITALY INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 79 ITALY INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 80 ITALY PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 81 RUSSIA LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 82 RUSSIA LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 83 RUSSIA LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 84 RUSSIA LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 85 RUSSIA LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 86 RUSSIA LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 87 RUSSIA RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 88 RUSSIA RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 89 RUSSIA COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 90 RUSSIA COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 91 RUSSIA INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 92 RUSSIA INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 93 RUSSIA PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 94 SPAIN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 95 SPAIN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 96 SPAIN LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 97 SPAIN LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 98 SPAIN LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 99 SPAIN LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 100 SPAIN RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 101 SPAIN RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 102 SPAIN COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 103 SPAIN COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 104 SPAIN INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 105 SPAIN INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 106 SPAIN PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 107 TURKEY LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 108 TURKEY LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 109 TURKEY LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 110 TURKEY LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 111 TURKEY LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 112 TURKEY LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 113 TURKEY RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 114 TURKEY RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 115 TURKEY COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 116 TURKEY COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 117 TURKEY INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 118 TURKEY INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 119 TURKEY PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 120 NETHERLANDS LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 121 NETHERLANDS LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 122 NETHERLANDS LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 123 NETHERLANDS LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 124 NETHERLANDS LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 125 NETHERLANDS LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 126 NETHERLANDS RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 127 NETHERLANDS RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 128 NETHERLANDS COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 129 NETHERLANDS COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 130 NETHERLANDS INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 131 NETHERLANDS INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 132 NETHERLANDS PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 133 SWITZERLAND LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 134 SWITZERLAND LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 135 SWITZERLAND LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 136 SWITZERLAND LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 137 SWITZERLAND LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 138 SWITZERLAND LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 139 SWITZERLAND RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 140 SWITZERLAND RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 141 SWITZERLAND COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 142 SWITZERLAND COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 143 SWITZERLAND INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 144 SWITZERLAND INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 145 SWITZERLAND PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 146 BELGIUM LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 147 BELGIUM LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (THOUSAND LITER)

TABLE 148 BELGIUM LIQUID ROOFING MARKET, BY ROOF TYPE, 2022-2033 (USD THOUSAND)

TABLE 149 BELGIUM LIQUID ROOFING MARKET, BY SUBSTRATE, 2022-2033 (USD THOUSAND)

TABLE 150 BELGIUM LIQUID ROOFING MARKET, BY INSTALLATION, 2022-2033 (USD THOUSAND)

TABLE 151 BELGIUM LIQUID ROOFING MARKET, BY END USER, 2022-2033 (USD THOUSAND)

TABLE 152 BELGIUM RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY HOUSING TYPE, 2022-2033 (USD THOUSAND)

TABLE 153 BELGIUM RESIDENTIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 154 BELGIUM COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY BUILDING TYPE, 2022-2033 (USD THOUSAND)

TABLE 155 BELGIUM COMMERCIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 156 BELGIUM INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY CONSTRUCTION TYPE, 2022-2033 (USD THOUSAND)

TABLE 157 BELGIUM INDUSTRIAL BUILDING IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 158 BELGIUM PUBLIC INFRASTRUCTURE IN LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

TABLE 159 REST OF EUROPE LIQUID ROOFING MARKET, BY TYPE, 2022-2033 (USD THOUSAND)

Liste des figures

FIGURE 1 EUROPE LIQUID ROOFING MARKET: SEGMENTATION

FIGURE 2 EUROPE LIQUID ROOFING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE LIQUID ROOFING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE LIQUID ROOFING MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE LIQUID ROOFING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE LIQUID ROOFING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE LIQUID ROOFING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE LIQUID ROOFING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 EUROPE LIQUID ROOFING MARKET: SEGMENTATION

FIGURE 10 GROWING DEMAND FOR WATERPROOFING SOLUTIONS AND INCREASED FOCUS ON CONSTRUCTION AND INFRASTRUCTURAL GROWTH IS DRIVING THE GROWTH OF THE EUROPE LIQUID ROOFING MARKET IN THE FORECAST PERIOD OF 2024 TO 2033

FIGURE 11 BITUMINOUS COATINGS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE LIQUID ROOFING MARKET IN 2024 AND 2033

FIGURE 12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 PESTEL ANALYSIS

FIGURE 14 RAW MATERIAL USED IN LIQUID PROOFING

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE LIQUID ROOFING MARKET

FIGURE 17 GROWTH IN CONSTRUCTION GLOBAL REGIONS

FIGURE 18 EUROPE LIQUID ROOFING MARKET: BY TYPE, 2023

FIGURE 19 EUROPE LIQUID ROOFING MARKET: BY ROOF TYPE, 2023

FIGURE 20 EUROPE LIQUID ROOFING MARKET: BY SUBSTRATE, 2023

FIGURE 21 EUROPE LIQUID ROOFING MARKET: BY INSTALLATION, 2023

FIGURE 22 EUROPE LIQUID ROOFING MARKET: BY END USER, 2023

FIGURE 23 EUROPE LIQUID ROOFING MARKET: SNAPSHOT (2023)

FIGURE 24 EUROPE LIQUID ROOFING MARKET: COMPANY SHARE 2023 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.