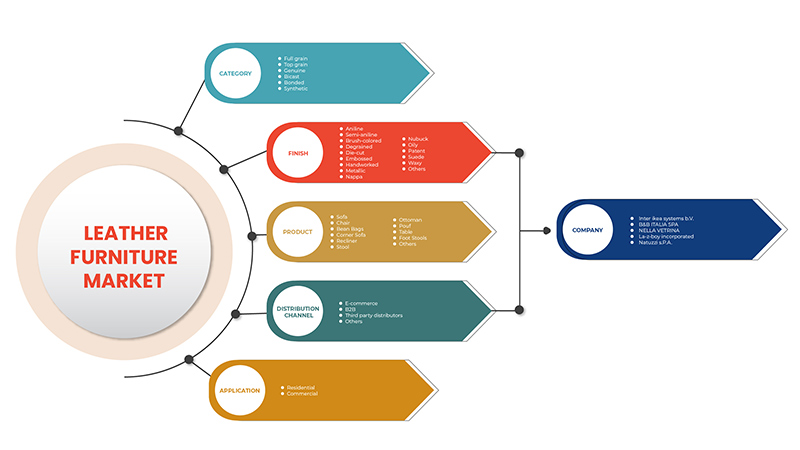

Marché européen des meubles en cuir, par catégorie (pleine fleur, fleur supérieure, véritable, bicast, collé et synthétique), finition (aniline, semi-aniline, couleur au pinceau, dégrainé, découpé, gaufré, travaillé à la main, métallique , nappa, nubuck, huileux, verni, daim, ciré et autres), produit (canapé, chaise, poufs, canapé d'angle, fauteuil inclinable tabouret, ottoman, pouf, table, repose-pieds et autres), canal de distribution (commerce électronique, B2B, distributeurs tiers et autres), application ( résidentielle et commerciale) - Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché

Le cuir est le type le plus durable et est utilisé dans la majorité des revêtements de meubles. Les meubles en cuir sont largement utilisés pour apporter de l'esthétique à l'espace. Ils sont considérés comme des produits de luxe et affichent la classe et le standard des gens. Les meubles en cuir sont plus robustes que les meubles en coton ou en tissu et peuvent durer des années. Les meubles en cuir peuvent être nettoyés rapidement avec un chiffon et un dépoussiérage, ce qui augmente leur demande sur le marché.

L'augmentation des préférences des consommateurs pour la décoration intérieure, l'augmentation du revenu disponible des personnes et l'évolution constante des modes de vie devraient stimuler la demande sur le marché européen des meubles en cuir. Cependant, les fluctuations des prix des matières premières pourraient encore limiter la croissance du marché.

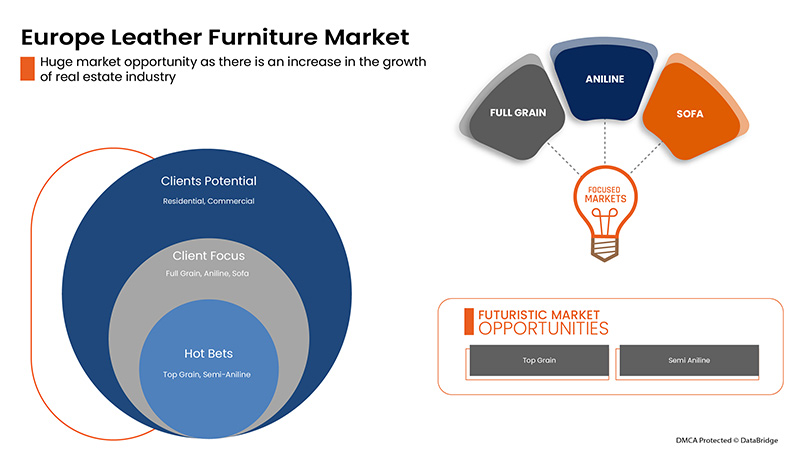

Plusieurs facteurs, tels que l'augmentation de la croissance du secteur immobilier, l'influence des médias sociaux et l'adoption croissante de nouvelles technologies et de nouveaux matériaux, devraient créer des opportunités pour le marché européen du mobilier en cuir. Cependant, le coût élevé du mobilier en cuir ne convient pas aux personnes qui préfèrent louer et risque de remettre en cause la croissance du marché au cours de la période de prévision.

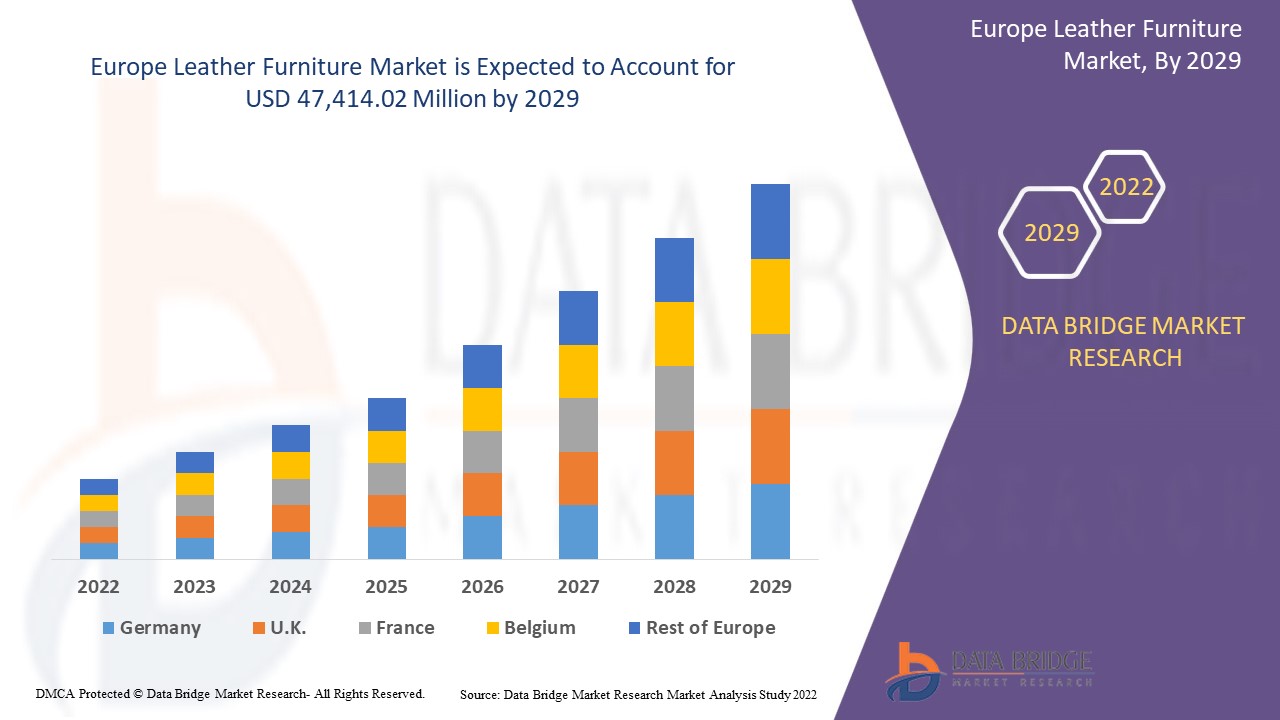

Selon les analyses de Data Bridge Market Research, le marché européen du mobilier en cuir devrait atteindre 47 414,02 millions USD d'ici 2029, à un TCAC de 7,2 % au cours de la période de prévision. Le segment d'application le plus important sur le marché concerné est le « résidentiel », en raison de l'essor du secteur immobilier. Le rapport de marché élaboré par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volume en unités, prix en USD |

|

Segments couverts |

Par catégorie (pleine fleur, fleur supérieure, véritable, bicast, collé et synthétique), finition (aniline, semi-aniline, coloré au pinceau, dégrainé, découpé, gaufré, travaillé à la main, métallique, nappa, nubuck, huileux, verni, daim, ciré et autres), produit (canapé, chaise, poufs, canapé d'angle, fauteuil inclinable, tabouret, ottomane, pouf, table, repose-pieds et autres), canal de distribution (commerce électronique, B2B, distributeurs tiers et autres), application (résidentielle et commerciale) |

|

Pays couverts |

Allemagne, France, Italie, Royaume-Uni, Belgique, Espagne, Russie, Turquie, Pays-Bas, Suisse, Reste de l'Europe |

|

Acteurs du marché couverts |

Inter IKEA Systems BV, B&B ITALIA SPA, NELLA VETRINA, La-Z-Boy Incorporated, Natuzzi SpA, Duresta, entre autres |

Définition du marché

Les meubles en cuir sont des meubles synthétiques qui comprennent des chaises, des canapés, des poufs, des fauteuils inclinables, des tables, des poufs et des tabourets, entre autres. Ils sont très demandés en raison de la préférence croissante des consommateurs pour la décoration intérieure avec le mobilier approprié. Ils sont considérés comme des meubles de luxe. Les meubles de luxe comprennent des pièces mobiles qui présentent le meilleur de l'artisanat et du design exceptionnels d'une époque spécifique. Les meubles en cuir de haute qualité conservent leur forme et leur apparence pendant de nombreuses années.

Cadre réglementaire

- Conformément au règlement (CE) n° 1069/2009 et au règlement (UE) n° 142/2011 de la Commission relatif aux sous-produits animaux et produits dérivés non destinés à la consommation humaine, les cuirs et peaux sont des matières d'origine animale utilisées en dehors de la chaîne alimentaire.

La dynamique du marché européen des meubles en cuir comprend :

Facteurs moteurs/opportunités

- L'augmentation des préférences des consommateurs pour la décoration intérieure

Les gens pensent que la décoration intérieure augmente leurs valeurs, leurs aspirations et leurs goûts. Apporter de l'esthétique à la maison ou au bureau le rend agréable sur le plan personnel, mental et esthétique. L'amélioration de l'esthétique des maisons, des bureaux et d'autres espaces comprend des rénovations ; l'ajout de miroirs, de meubles et plus encore peut ajouter de la vie à l'espace ou à la zone et apaise les yeux et l'esprit. Cela aide à changer la mauvaise humeur et à donner un sentiment de calme et de détente, ce qui est considéré comme l'une des principales raisons d'être en bonne santé et comme un complément à des fins esthétiques. Par conséquent, la sensibilisation croissante à la décoration et à l'ameublement de la maison devrait stimuler le marché au cours des prochaines années.

- L'augmentation du niveau de revenu disponible des personnes et l'évolution constante du mode de vie

L'augmentation du revenu disponible des consommateurs et l'urbanisation ont entraîné une hausse du coût de la vie dans les mégalopoles. Ainsi, le concept de partage des espaces de vie a vu le jour, augmentant la demande d'idées permettant d'économiser de l'espace, telles que les meubles en cuir. Ainsi, l'augmentation du niveau de vie due à l'augmentation du revenu disponible des consommateurs et à l'urbanisation devrait accroître le marché européen des meubles en cuir.

- Changement de tendance des consommateurs vers les produits de luxe

Les gens sont très attentifs lorsqu’ils achètent des produits ou des meubles de luxe pour leur maison. Ils ont tendance à opter pour la qualité et le confort, indépendamment de leurs économies et de leurs revenus. En raison des nombreux avantages liés à l’achat de meubles de luxe, les gens améliorent leur décision d’achat. Les gens accordent la plus grande importance à la couleur, à la forme, au tissu et à la finition des meubles de leur salon, de leur cuisine, de leur chambre ou même de leur jardin. Les meubles de luxe haut de gamme confèrent un attrait intemporel à la maison. Avec l’aide de conseils professionnels, les gens obtiennent de meilleurs conseils concernant les meubles adaptés à leur espace.

- Augmentation de la forte demande pour diverses industries d'utilisation finale telles que le résidentiel et le commercial

Les secteurs résidentiel et commercial utilisent stratégiquement des meubles en cuir pour améliorer la décoration. Dans la plupart des cas, les meubles en cuir ou les meubles en cuir mobiles sont déguisés en armoire élégante dans une petite salle de réunion, qui peut être retirée en cas de besoin, ce qui permet d'augmenter l'espace à diverses fins. L'augmentation des activités de construction dans diverses industries d'utilisation finale, telles que le résidentiel et le commercial, offrira des opportunités de croissance à l'industrie du meuble. L'augmentation de l'installation de meubles en cuir dans ces industries devrait stimuler le marché.

Contraintes/Défis

- Fluctuations des prix des matières premières

Les entreprises ont du mal à évaluer correctement le risque de fortes fluctuations des coûts des matières premières. Si elles ne transfèrent que de manière minimale, retardée ou trop conservatrice l'augmentation des coûts, ou si l'augmentation des coûts des matières premières et la baisse des prix de vente se produisent en même temps, alors la baisse de la rentabilité est inévitable. Des coûts de matières premières très fluctuants et une gestion des prix inefficace peuvent sérieusement compromettre le succès des entreprises. De plus, l'augmentation du commerce mondial, l'urbanisation, les besoins en transport et les tendances fluctuantes du marché exercent une pression supplémentaire sur le coût des intermédiaires nécessaires à la fabrication de meubles. Par conséquent, les variations des coûts de production des matières premières agissent comme des facteurs restrictifs pour le marché.

- Le coût élevé des meubles en cuir ne convient pas aux personnes qui louent

Certaines personnes préfèrent déplacer leurs meubles en cuir lorsqu'elles déménagent, mais le processus est fastidieux et peut nécessiter une équipe de travailleurs, ce qui leur coûte cher. De plus, les meubles en cuir personnalisés sont fabriqués en fonction de l'espace disponible dans l'appartement. Tous les appartements n'ont pas le même espace et la même hauteur, ce qui peut rendre le déplacement des meubles en cuir plus difficile. Par conséquent, la plupart des personnes qui vivent en location ne préfèrent pas acheter de meubles en cuir, car il n'est pas facile de déplacer des meubles en cuir sans payer des frais supplémentaires de déplacement, de démontage et d'installation. Ainsi, les meubles en cuir ne conviennent pas aux personnes qui louent. Compte tenu du coût de la vie élevé, la majorité des personnes préfèrent vivre dans des appartements loués ou partagés pour partager les coûts. Par conséquent, cela peut constituer un défi pour le marché.

Le COVID-19 a eu un impact minime sur le marché européen des meubles en cuir

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, aucun impact significatif n'a été constaté sur leurs opérations et leur chaîne d'approvisionnement en meubles en cuir en Europe, car l'importation et l'exportation de vaccins et de biens essentiels ont entraîné une augmentation de la demande de meubles en cuir. Cette demande croissante des consommateurs augmente la croissance du marché européen des meubles en cuir.

Portée du marché européen des meubles en cuir

Le marché européen des meubles en cuir est segmenté en fonction de la catégorie, de la finition, du produit, du canal de distribution et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Catégorie

- Pleine fleur

- Grain supérieur

- Authentique

- Bicast

- Lié

- Synthétique

Sur la base de la catégorie, le marché européen du mobilier en cuir est segmenté en pleine fleur, fleur supérieure, véritable, bicast, collé et synthétique.

Finition

- Aniline

- Semi-Aniline

- Couleur au pinceau

- Dégrainé

- Découpe

- En relief

- Travaillé à la main

- Métallique

- Nappa

- Nubuck

- Huileux

- Brevet

- Suède

- Cireux

- Autres

Sur la base de la finition, le marché européen des meubles en cuir est segmenté en aniline, semi-aniline, coloré au pinceau, dégrainé, découpé, gaufré, travaillé à la main, métallique, nappa, nubuck, huileux, verni, daim, ciré et autres.

Produit

- Canapé

- Chaise

- Poufs

- Canapé d'angle

- Fauteuil inclinable

- Tabouret

- ottoman

- Pouf

- Tableau

- Repose-pieds

- Autres

Sur la base du produit, le marché européen du meuble en cuir est segmenté en canapé, chaise, poufs, canapé d'angle, fauteuil inclinable, tabouret, pouf, table, repose-pieds et autres.

Canal de distribution

- Commerce électronique

- B2B

- Distributeurs tiers

- Autres

Sur la base du canal de distribution, le marché européen du meuble en cuir est segmenté en commerce électronique, B2B, distributeurs tiers et autres.

Application

- Résidentiel

- Commercial

Sur la base des applications, le marché européen du meuble en cuir est segmenté en résidentiel et commercial.

Analyse/perspectives régionales du marché européen des meubles en cuir

Le marché européen des meubles en cuir est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, catégorie, finition, produit, canal de distribution et application, comme référencé ci-dessus.

Certains des pays couverts dans le rapport sur le marché européen des meubles en cuir sont l'Allemagne, la France, l'Italie, le Royaume-Uni, la Belgique, l'Espagne, la Russie, la Turquie, les Pays-Bas, la Suisse et le reste de l'Europe.

L'Allemagne devrait dominer le marché européen du mobilier en cuir en raison de la croissance des activités de construction dans les secteurs d'utilisation finale tels que le résidentiel et le commercial. En raison de l'influence des médias sociaux et du taux d'adoption croissant de nouvelles technologies et de nouveaux matériaux, les fabricants se sont engagés dans le développement de nouveaux produits de mobilier en cuir qui pourraient stimuler la demande de meubles en cuir dans la région.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du mobilier en cuir en Europe

Le paysage concurrentiel du marché européen des meubles en cuir fournit des informations sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché européen des meubles en cuir.

Certains des principaux acteurs opérant sur le marché européen du mobilier en cuir sont Inter IKEA Systems BV, B&B ITALIA SPA, NELLA VETRINA, La-Z-Boy Incorporated, Natuzzi SpA, Duresta, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE LEATHER FURNITURE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 DISTRIBUTION CHANNEL LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET CONSUMER CATEGORY COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 FACTORS INFLUENCING BUYING DECISION

4.3 PESTLE ANALYSIS

4.4 PORTER’S FIVE FORCES:

4.5 PRODUCT ADOPTION CRITERIA

4.5.1 OVERVIEW

4.5.1.1 PRODUCT AWARENESS

4.5.1.2 PRODUCT INTEREST

4.5.1.3 PRODUCT EVALUATION

4.5.1.4 PRODUCT TRIAL

4.5.1.5 PRODUCT ADOPTION

4.5.1.6 CONCLUSION

4.6 CONSUMERS BUYING BEHAVIOUR

4.6.1 OVERVIEW

4.6.1.1 COMPLEX BUYING BEHAVIOR

4.6.1.2 DISSONANCE-REDUCING BUYING BEHAVIOR

4.6.1.3 HABITUAL BUYING BEHAVIOR

4.6.1.4 VARIETY SEEKING BEHAVIOR

4.6.1.5 CONCLUSION

5 LEATHER FURNITURE MARKET

5.1 EUROPE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE IN THE CONSUMER PREFERENCE FOR HOME DECORATION

6.1.2 THE RISE IN LEVEL OF DISPOSABLE INCOME OF PEOPLE AND CONTINUOUS CHANGING LIFESTYLE

6.1.3 SHIFT IN INCLINATION TOWARD LUXURY PRODUCTS AMONG CONSUMERS

6.1.4 UPSURGE IN THE STRONG DEMAND FOR VARIOUS END-USE INDUSTRIES SUCH AS RESIDENTIAL AND COMMERCIAL

6.2 RESTRAINT

6.2.1 FLUCTUATION IN THE PRICES OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 INCREASE IN THE GROWTH OF THE REAL ESTATE INDUSTRY

6.3.2 INFLUENCE OF SOCIAL MEDIA AND RISING ADOPTION RATE OF NEW TECHNOLOGIES AND MATERIALS

6.4 CHALLENGE

6.4.1 HIGH COST OF LEATHER FURNITURE IS NOT SUITABLE FOR PEOPLE WHO PREFER TO RENT

7 EUROPE LEATHER FURNITURE MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 FULL GRAIN

7.3 TOP GRAIN

7.4 GENUINE

7.5 BICAST

7.6 BONDED

7.7 SYNTHETIC

8 EUROPE LEATHER FURNITURE MARKET, BY FINISH

8.1 OVERVIEW

8.2 ANILINE

8.3 SEMI-ANILINE

8.4 BRUSH-COLORED

8.5 DEGRAINED

8.6 DIE-CUT

8.7 EMBOSSED

8.8 HANDWORKED

8.9 METALLIC

8.1 NAPPA

8.11 NUBUCK

8.12 OILY

8.13 PATENT

8.14 SUEDE

8.15 WAXY

8.16 OTHERS

9 EUROPE LEATHER FURNITURE MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 SOFA

9.3 CHAIR

9.4 BEAN BAGS

9.5 CORNER SOFA

9.6 RECLINER

9.7 STOOL

9.8 OTTOMAN

9.9 POUF

9.1 TABLE

9.11 FOOT STOOL

9.12 OTHERS

10 EUROPE LEATHER FURNITURE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 RESIDENTIAL

10.3 COMMERCIAL

10.3.1 COMMERCIAL, BY APPLICATION

10.3.1.1 HOTELS

10.3.1.2 RESORTS

10.3.1.3 UNIVERSITY

10.3.1.4 HOSPITAL

10.3.1.5 PUBLIC OFFICES

10.3.1.6 RESTAURANTS

10.3.1.7 PRIVATE OFFICES

10.3.1.8 SHOPPING MALLS

10.3.1.9 OTHERS

11 EUROPE LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 B2B

11.3 THIRD PARTY DISTRIBUTORS

11.4 E-COMMERCE

11.5 OTHERS

12 EUROPE LEATHER FURNITURE MARKET, BY COUNTRY

12.1 EUROPE

12.1.1 GERMANY

12.1.2 ITALY

12.1.3 U.K.

12.1.4 RUSSIA

12.1.5 TURKEY

12.1.6 FRANCE

12.1.7 SPAIN

12.1.8 SWITZERLAND

12.1.9 NETHERLANDS

12.1.10 BELGIUM

12.1.11 REST OF EUROPE

13 EUROPE LEATHER FURNITURE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

13.1.1 NEW PRODUCT DEVELOPMENT

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 LA-Z-BOY INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATE

15.2 B&B ITALIA SPA

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENTS

15.3 INTER IKEA SYSTEMS B.V.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 NATUZZI S.P.A.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATE

15.5 DOMICILE FURNITURE

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 DURESTA

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 NELLA VETRINA

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 NORWALK

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 PALLISER FURNITURE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 ROWE FURNITURE

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF LEATHER OF PATENT LEATHER AND PATENT LAMINATED LEATHER; METALLISED LEATHER (EXCLUDING LACQUERED OR METALLISED RECONSTITUTED LEATHER); HS CODE - 411420 (USD THOU.S.ND)

TABLE 2 EXPORT DATA OF LEATHER OF PATENT LEATHER AND PATENT LAMINATED LEATHER; METALLISED LEATHER (EXCLUDING LACQUERED OR METALLISED RECONSTITUTED LEATHER) – 411420 (USD THOU.S.ND)

TABLE 3 EUROPE LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 4 EUROPE LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

TABLE 5 EUROPE LEATHER FURNITURE MARKET, BY FINISH, 2020-2029 (USD MILLION)

TABLE 6 EUROPE LEATHER FURNITURE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 EUROPE LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE COMMERCIAL IN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 10 EUROPE LEATHER FURNITURE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 11 EUROPE LEATHER FURNITURE MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 12 GERMANY LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 13 GERMANY LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

TABLE 14 GERMANY LEATHER FURNITURE MARKET, BY FINISH, 2020-2029 (USD MILLION)

TABLE 15 GERMANY LEATHER FURNITURE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 16 GERMANY LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 17 GERMANY LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 GERMANY COMMERCIAL IN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 ITALY LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 20 ITALY LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

TABLE 21 ITALY LEATHER FURNITURE MARKET, BY FINISH, 2020-2029 (USD MILLION)

TABLE 22 ITALY LEATHER FURNITURE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 23 ITALY LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 ITALY LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 ITALY COMMERCIAL IN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 U.K. LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 27 U.K. LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

TABLE 28 U.K. LEATHER FURNITURE MARKET, BY FINISH, 2020-2029 (USD MILLION)

TABLE 29 U.K. LEATHER FURNITURE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 30 U.K. LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 U.K. LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 U.K. COMMERCIAL IN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 RUSSIA LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 34 RUSSIA LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

TABLE 35 RUSSIA LEATHER FURNITURE MARKET, BY FINISH, 2020-2029 (USD MILLION)

TABLE 36 RUSSIA LEATHER FURNITURE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 37 RUSSIA LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 RUSSIA LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 RUSSIA COMMERCIAL IN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 TURKEY LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 41 TURKEY LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

TABLE 42 TURKEY LEATHER FURNITURE MARKET, BY FINISH, 2020-2029 (USD MILLION)

TABLE 43 TURKEY LEATHER FURNITURE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 44 TURKEY LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 TURKEY LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 TURKEY COMMERCIAL IN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 FRANCE LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 48 FRANCE LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

TABLE 49 FRANCE LEATHER FURNITURE MARKET, BY FINISH, 2020-2029 (USD MILLION)

TABLE 50 FRANCE LEATHER FURNITURE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 FRANCE LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 FRANCE LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 FRANCE COMMERCIAL IN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SPAIN LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 55 SPAIN LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

TABLE 56 SPAIN LEATHER FURNITURE MARKET, BY FINISH, 2020-2029 (USD MILLION)

TABLE 57 SPAIN LEATHER FURNITURE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 SPAIN LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 59 SPAIN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 SPAIN COMMERCIAL IN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 SWITZERLAND LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 62 SWITZERLAND LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

TABLE 63 SWITZERLAND LEATHER FURNITURE MARKET, BY FINISH, 2020-2029 (USD MILLION)

TABLE 64 SWITZERLAND LEATHER FURNITURE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 SWITZERLAND LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 SWITZERLAND LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 SWITZERLAND COMMERCIAL IN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 NETHERLANDS LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 69 NETHERLANDS LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

TABLE 70 NETHERLANDS LEATHER FURNITURE MARKET, BY FINISH, 2020-2029 (USD MILLION)

TABLE 71 NETHERLANDS LEATHER FURNITURE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 NETHERLANDS LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 NETHERLANDS LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 NETHERLANDS COMMERCIAL IN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 BELGIUM LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 76 BELGIUM LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

TABLE 77 BELGIUM LEATHER FURNITURE MARKET, BY FINISH, 2020-2029 (USD MILLION)

TABLE 78 BELGIUM LEATHER FURNITURE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 79 BELGIUM LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 BELGIUM LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 BELGIUM COMMERCIAL IN LEATHER FURNITURE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 REST OF EUROPE LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 83 REST OF EUROPE LEATHER FURNITURE MARKET, BY CATEGORY, 2020-2029 (MILLION UNITS)

Liste des figures

FIGURE 1 EUROPE LEATHER FURNITURE MARKET: SEGMENTATION

FIGURE 2 EUROPE LEATHER FURNITURE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE LEATHER FURNITURE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE LEATHER FURNITURE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE LEATHER FURNITURE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE LEATHER FURNITURE MARKET: DISTRIBUTION CHANNEL LIFE LINE CURVE

FIGURE 7 EUROPE LEATHER FURNITURE MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE LEATHER FURNITURE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE LEATHER FURNITURE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE LEATHER FURNITURE MARKET: CONSUMER CATEGORY COVERAGE GRID

FIGURE 11 EUROPE LEATHER FURNITURE MARKET: CHALLENGE MATRIX

FIGURE 12 EUROPE LEATHER FURNITURE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE LEATHER FURNITURE MARKET: SEGMENTATION

FIGURE 14 THE RISING LEVEL OF DISPOSABLE INCOME OF PEOPLE AND CONTINUOUS CHANGING LIFESTYLE IS EXPECTED TO DRIVE THE EUROPE LEATHER FURNITURE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 FULL GRAIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE LEATHER FURNITURE MARKET IN 2022 & 2029

FIGURE 16 EUROPE LEATHER FURNITURE MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 17 EUROPE LEATHER FURNITURE MARKET: TYPES OF CONSUMER BUYING BEHAVIOUR

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE LEATHER FURNITURE MARKET

FIGURE 19 URBANIZATION IN DIFFERENT REGIONS

FIGURE 20 RENTER OCCUPIED HOUSING UNITS IN U.S. IN QUARTER FOUR OF 2015 TO 2021

FIGURE 21 EUROPE LEATHER FURNITURE MARKET, BY CATEGORY, 2021

FIGURE 22 EUROPE LEATHER FURNITURE MARKET, BY FINISH, 2021

FIGURE 23 EUROPE LEATHER FURNITURE MARKET, BY PRODUCT, 2021

FIGURE 24 EUROPE LEATHER FURNITURE MARKET, BY APPLICATION, 2021

FIGURE 25 EUROPE LEATHER FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 EUROPE LEATHER FURNITURE MARKET: SNAPSHOT (2021)

FIGURE 27 EUROPE LEATHER FURNITURE MARKET: BY COUNTRY (2021)

FIGURE 28 EUROPE LEATHER FURNITURE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 EUROPE LEATHER FURNITURE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 EUROPE LEATHER FURNITURE MARKET: BY CATEGORY (2022-2029)

FIGURE 31 EUROPE LEATHER FURNITURE MARKET: company share 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.