Europe Laboratory Hoods And Enclosure Market

Taille du marché en milliards USD

TCAC :

%

USD

168.86 Million

USD

265.70 Million

2025

2033

USD

168.86 Million

USD

265.70 Million

2025

2033

| 2026 –2033 | |

| USD 168.86 Million | |

| USD 265.70 Million | |

|

|

|

|

Marché européen des hottes et enceintes de laboratoire, par produit (enceintes d'équilibre ventilées (VBE), armoires de sécurité biologique, armoires à flux laminaire, enceintes, hottes et autres), modularité (de paillasse et portables), matériau (PVC, acier inoxydable et autres), utilisateur final ( sociétés pharmaceutiques , instituts de recherche, centres universitaires et autres), pays (Allemagne, Royaume-Uni, France, Italie, Espagne, Suisse, Pays-Bas, Belgique, Russie, Turquie et reste de l'Europe) Tendances de l'industrie et prévisions jusqu'en 2028.

Analyse et perspectives du marché : marché européen des hottes et enceintes de laboratoire

Analyse et perspectives du marché : marché européen des hottes et enceintes de laboratoire

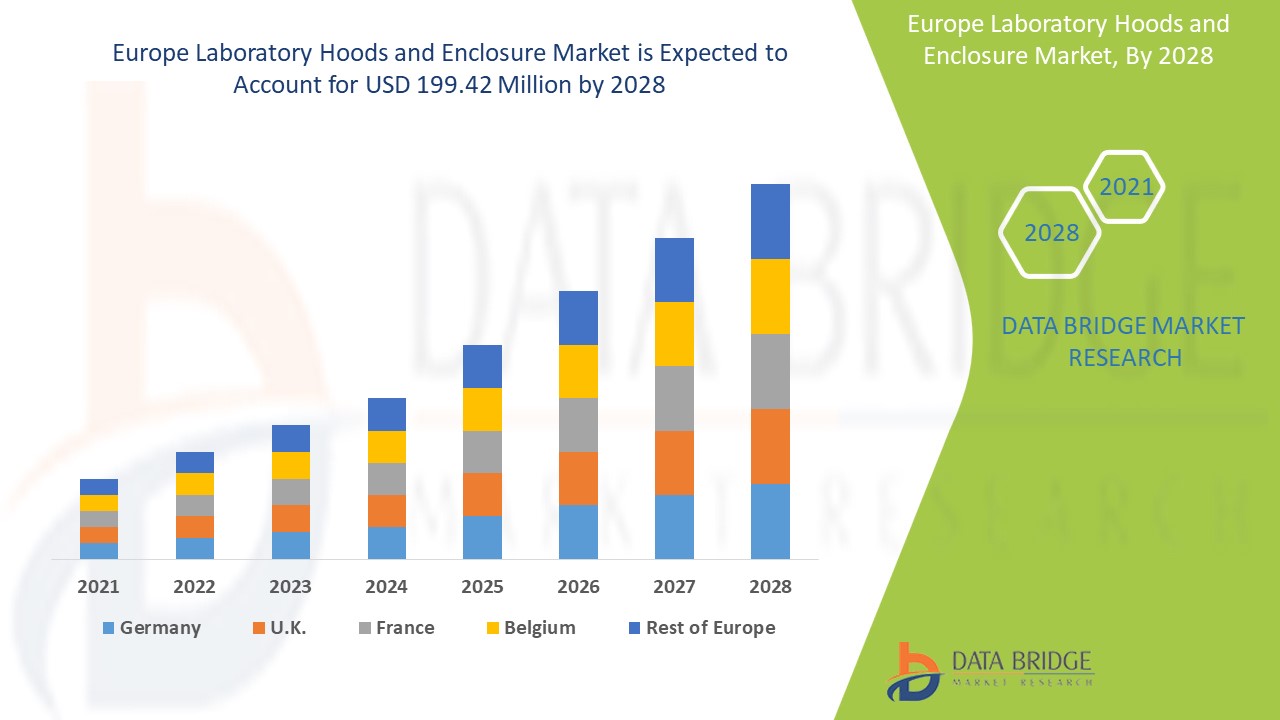

Le marché européen des hottes et enceintes de laboratoire devrait croître au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 5,7 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 199,42 millions USD d'ici 2028. La prévalence croissante des maladies chroniques exige des solutions et des services avancés en matière de hottes et d'enceintes de laboratoire, stimulant ainsi la croissance du marché européen des hottes et enceintes de laboratoire.

Les hottes aspirantes sont des enceintes ventilées qui éliminent les fumées chimiques dangereuses, les particules et les vapeurs volatiles du laboratoire, offrant ainsi une protection au personnel et l'empêchant d'inhaler ou d'absorber des produits chimiques dangereux et d'autres problèmes de santé. La hotte aspirante limite l'exposition aux fumées, vapeurs ou poussières dangereuses ou toxiques en éliminant en toute sécurité ces substances de l'environnement de travail immédiat. Elle sert également à protéger l'échantillon de l'environnement extérieur. Les enceintes de sécurité biologique (ou enceintes de biosécurité) utilisent des filtres HEPA pour assurer la protection de l'environnement, du personnel et des produits. Ils capturent les fumées impures et font recirculer ou évacuer l'air filtré pour protéger l'environnement et le personnel lors de la préparation des échantillons et des expériences. Une enceinte ventilée est une hotte chimique fabriquée sur site conçue pour contenir des processus, tels que des équipements de mise à l'échelle ou d'usine pilote. Les enceintes de balance ventilées sont utilisées dans les laboratoires pour peser les particules toxiques. Ces appareils sont installés avec des spécifications de vitesse frontale différentes de celles de la hotte chimique de laboratoire standard. Ils sont bien adaptés pour localiser les balances sensibles qui pourraient être perturbées si elles étaient placées dans une hotte chimique de laboratoire.

De plus, la prévalence croissante des maladies infectieuses dans le monde a encore accru la demande de hottes et d'enceintes de laboratoire. La prévalence croissante des infections nosocomiales est susceptible d'alimenter la croissance du marché européen des hottes et enceintes de laboratoire pour empêcher la propagation des infections tout en effectuant des recherches et développements et la préparation d'échantillons à travers le monde. Les principaux acteurs du marché investissent massivement dans la recherche et le développement pour lancer de nouveaux produits et services, ce qui constitue une opportunité de croissance. Cependant, le coût élevé des hottes et enceintes de laboratoire et les effets secondaires et limitations environnementaux associés à leur utilisation constituent un frein à leur croissance sur le marché.

Les fabricants se concentrent de plus en plus sur les activités de recherche et développement pour fournir des solutions stratégiques aux maladies émergentes, augmentant ainsi l'application des hottes et des enceintes. En outre, la prévalence croissante des maladies infectieuses telles que la COVID-19 augmente la demande de hottes et d'enceintes de laboratoire. Ces facteurs devraient propulser la croissance du marché. La politique de réglementation stricte constitue un défi majeur pour la croissance du marché.

Le rapport sur le marché européen des hottes et enceintes de laboratoire fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché européen des hottes et enceintes de laboratoire, contactez Data Bridge Market Research pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des hottes et enceintes de laboratoire en Europe

Portée et taille du marché des hottes et enceintes de laboratoire en Europe

Le marché européen des hottes et enceintes de laboratoire est segmenté en fonction du produit, de la modularité, du matériau et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du produit, le marché européen des hottes et enceintes de laboratoire est segmenté en enceintes ventilées (VBE), enceintes de sécurité biologique, enceintes à flux laminaire, enceintes, hottes et autres. En 2021, le segment des hottes devrait dominer le marché européen des hottes et enceintes de laboratoire car il offre d'énormes avantages lors des activités de recherche.

- Sur la base de la modularité, le marché européen des hottes et enceintes de laboratoire est segmenté en hottes de paillasse et portables. En 2021, le segment des hottes de paillasse devrait dominer le marché européen des hottes et enceintes de laboratoire en raison de sa demande croissante dans toute l'Europe.

- Sur la base du matériau, le marché européen des hottes et enceintes de laboratoire est segmenté en PVC, acier inoxydable et autres. En 2021, le segment de l'acier inoxydable devrait dominer le marché européen des hottes et enceintes de laboratoire en raison de sa rigidité et de sa résistance.

- Sur la base de l'utilisateur final, le marché européen des hottes et enceintes de laboratoire est segmenté en sociétés pharmaceutiques, instituts de recherche, centres universitaires et autres. En 2021, le segment des sociétés pharmaceutiques chez l'utilisateur final devrait dominer le marché en raison des activités croissantes de recherche et développement.

Analyse du marché des hottes et enceintes de laboratoire en Europe au niveau des pays

Le marché européen des hottes et enceintes de laboratoire est analysé et des informations sur la taille du marché sont fournies par pays, produit, modularité, matériau et utilisateur final comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché européen des hottes et enceintes de laboratoire sont l'Allemagne, la France, l'Espagne, l'Italie, les Pays-Bas, la Suisse, la Russie, la Turquie, l'Autriche, l'Irlande et le reste de l'Europe. L'Allemagne domine la région européenne en raison des avancées technologiques.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Les activités stratégiques croissantes des principaux acteurs du marché visant à accroître la notoriété des hottes et enceintes de laboratoire stimulent la croissance du marché européen des hottes et enceintes de laboratoire

Le marché européen des hottes et enceintes de laboratoire vous fournit également une analyse de marché détaillée pour la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2010 à 2019.

Analyse du paysage concurrentiel et des parts de marché des hottes et enceintes de laboratoire en Europe

Le paysage concurrentiel du marché européen des hottes et enceintes de laboratoire fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché européen des hottes et enceintes de laboratoire.

Les principales entreprises européennes spécialisées dans les hottes et enceintes de laboratoire sont Thermo Fisher Scientific Inc., WALDNER Holding GmbH & Co. KG, Köttermann GmbH, Bigneat Ltd., Esco Micro Pte. Ltd., Monmouth Scientific Limited et Kewaunee International Group, entre autres acteurs nationaux. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux contrats et accords sont également initiés par les entreprises du monde entier, ce qui accélère également le marché européen des hottes et enceintes de laboratoire.

Par exemple,

- En août 2021, Bigneat Ltd. a été entièrement rachetée par Caron Products and Services. La combinaison de notre solide réseau européen et du leadership de Caron sur le marché américain offre aux deux entreprises des opportunités immédiates pour mieux servir leurs clients

- En avril 2018, Thermo Fisher Scientific Inc. a annoncé la sortie de sa première enceinte de sécurité biologique HeraSafe 2030i compatible avec le cloud, afin de répondre aux besoins de contrôle de la contamination sans compromis, de connectivité transparente des flux de travail et de simplicité d'utilisation améliorée dans les laboratoires de culture cellulaire. Cela a permis à l'entreprise d'accélérer sa croissance dans le domaine des équipements de laboratoire et de maintenir ainsi sa présence sur le marché.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché européen des hottes et enceintes de laboratoire, ce qui profite également à la croissance des bénéfices de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.