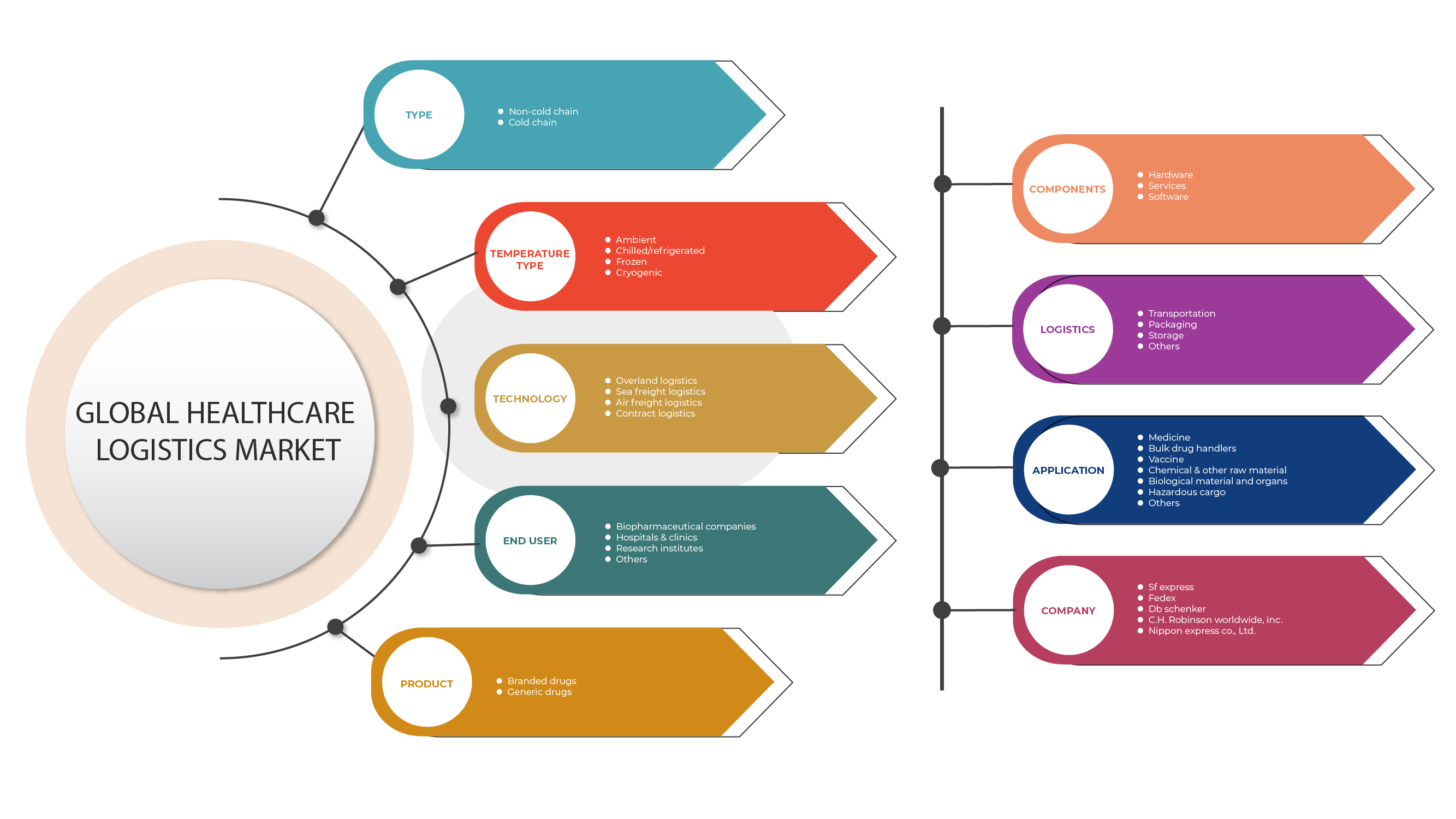

Europe Healthcare Logistics Market, By Type (Cold Chain and Non-Cold Chain), Component (Hardware, Software, and Services), Temperature Type (Ambient, Chilled/Refrigerated, Frozen and Cryogenic), Logistics (Transportation, Packaging, Storage, and Others), Logistic Type (Sea Freight Logistics, Air Freight Logistics, Overland Logistics, and Contract Logistics), Application (Medicine, Bulk Drug Handlers, Vaccine, Chemical & Other Raw Material, Biological Material, and Organs, Hazardous Cargo and Others), End User (Biopharmaceutical Companies, Hospitals & Clinics, Research Institutes, and Others) Industry Trends and Forecast to 2029.

Europe Healthcare Logistics Market Analysis and Size

Logistics is utilized in the healthcare industry to control the manner resources are kept, obtained, and transferred. The effective use of logistics in this business aids in the continual transport of pharmaceuticals, devices, and systems from vendors and providers positioned throughout the country. Hospitals and clinics, in addition to wholesalers of clinical objects and big pharmacy retail chains, make up the healthcare industry.

The increased preference for biological pharmaceuticals as well as the growing tendency of businesses to outsource are the main drivers anticipated to drive market growth. Significant numbers of healthcare items need to be shipped over considerable distances through firms these days. These materials are valuable and delicate. The developing market for temperature-sensitive drugs and biological clinical objects, in addition to growing awareness amongst pharmaceutical and logistics companies, is boosting the scope for temperature-controlled healthcare logistics, benefiting the whole healthcare logistics market.

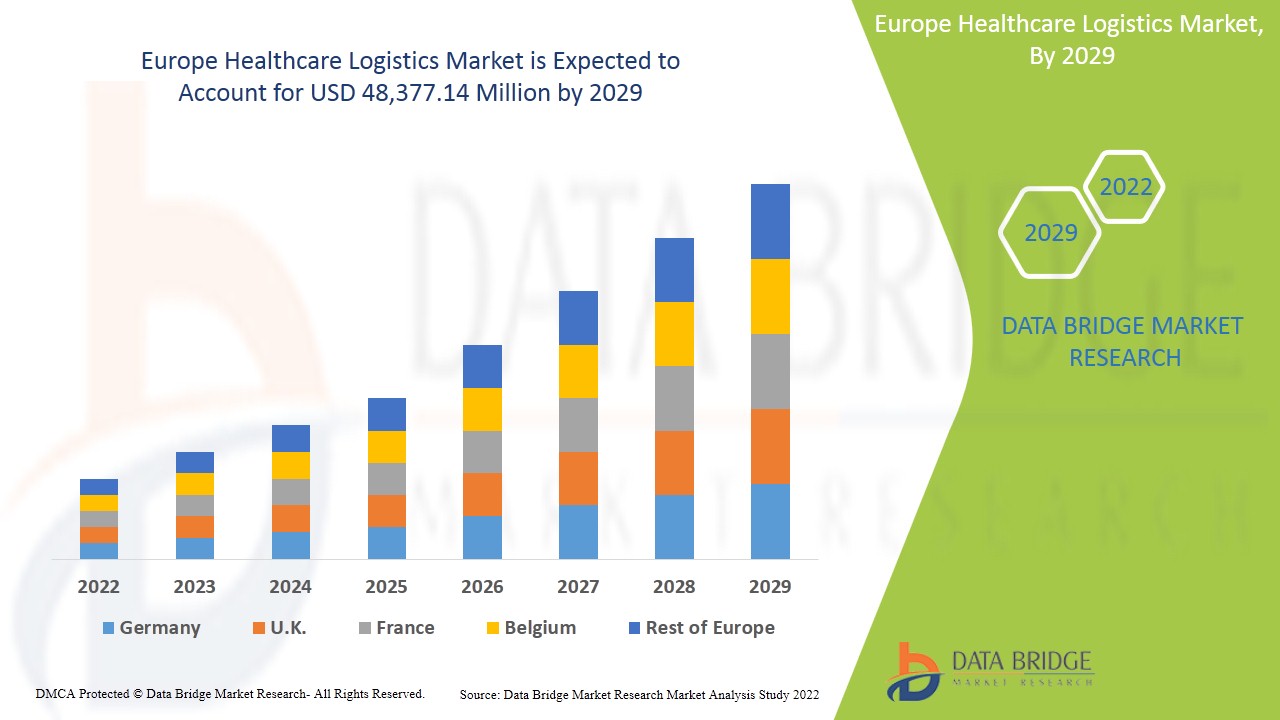

Data Bridge Market Research analyses that the healthcare logistics market is expected to reach the value of USD 48,377.14 million by 2029, at a CAGR of 7.5% during the forecast period. “Non-Cold Chain" accounts for the largest technology segment in the healthcare logistics market non-cold chain high benefits offered by third party logistics. The healthcare logistics market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

Par type (chaîne du froid et hors chaîne du froid), par composant (matériel, logiciel et services), par type de température (ambiante, réfrigérée, congelée et cryogénique), par logistique (transport, emballage, stockage et autres), par type de logistique (logistique de fret maritime, logistique de fret aérien, logistique terrestre et logistique contractuelle), par application (médicaments, manutentionnaires de médicaments en vrac, vaccins, produits chimiques et autres matières premières, matières et organes biologiques, marchandises dangereuses et autres), par utilisateur final (sociétés biopharmaceutiques, hôpitaux et cliniques, instituts de recherche et autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Espagne, Pays-Bas, Suisse, Belgique, Autriche, Reste de l'Europe en Europe |

|

Acteurs du marché couverts |

DB Schenker, Deutsche Post DHL Group, FedEx, ADAllen Pharma., Biosensors International Group, Ltd., Entero Healthcare, CRYOPDP, SF Express, Alloga, entre autres. |

Définition du marché

Les soins de santé comprennent le maintien ou l'amélioration du bien-être par la conclusion, l'anticipation, le traitement , la récupération ou la réparation d'une infection, d'une maladie, d'une blessure et de divers troubles physiques et mentaux chez les individus. L'aide aux soins de santé est fournie par des professionnels de la santé dans des domaines connexes de la santé. La dentisterie, la pharmacie, les soins infirmiers, l'audiologie , la médecine, l'optométrie, la sage-femme, la psychologie, l'ergothérapie et la physiothérapie, ainsi que d'autres professions de la santé sont tous des compléments aux soins de santé.

La logistique désigne la procédure générale de gestion de la manière dont les ressources sont acquises, stockées et transportées jusqu'à leur destination finale. Elle consiste à identifier les distributeurs et fournisseurs potentiels et à gérer leur efficacité et leur accessibilité. Par conséquent, la logistique des soins de santé est la logistique des fournitures médicales et chirurgicales, des produits pharmaceutiques, des dispositifs et équipements cliniques et des différents produits nécessaires pour aider les médecins, les infirmières et les autres spécialistes de la santé.

La gestion logistique des soins de santé est utilisée pour divers modes de transport tels que les routes, les chemins de fer, la mer et les voies aériennes. Le transport de marchandises effectué par la route est appelé segment. Il s'agit du type de mode de transport le plus courant car il nécessite un processus de document douanier unique. Le mode de transport ferroviaire est très économe en carburant et peut être qualifié de mode de transport « vert ». Les expéditions maritimes sont utilisées pour le transport de marchandises en vrac. Les voies aériennes sont le mode de transport le plus rapide et sont très utilisées pour réaliser le réapprovisionnement des stocks « juste à temps » (JIT) dans la logistique des soins de santé.

Dynamique du marché de la logistique des soins de santé

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

- Croissance rapide du secteur du commerce électronique

Le commerce électronique est le processus d'achat et de vente de biens et de services sur un réseau électronique ou une plateforme en ligne, principalement Internet. Ces derniers temps, l'utilisation généralisée de plateformes de commerce électronique telles qu'Amazon, Flipkart et eBay a contribué à une croissance substantielle de l'achat et de la vente de biens en ligne. Cela a fourni une plateforme aux consommateurs pour acheter librement des produits de santé et les utiliser selon leurs besoins.

- Avantages considérables offerts par la logistique tierce partie

La logistique tierce partie est externalisée avec la logistique opérationnelle de l'entreposage à la livraison, ce qui comprend la fourniture d'un certain nombre de services dans la chaîne d'approvisionnement tels que le transport de fret, l'emballage, l'exécution des commandes, la prévision des stocks, la préparation et l'emballage, l'entreposage et le transport. La logistique tierce partie offre un large éventail d'avantages car elle aide les propriétaires d'entreprise à se concentrer davantage sur les autres aspects de l'entreprise tels que le développement de produits, le marketing et les ventes. Les avantages importants offerts par la logistique tierce partie agissent donc comme le facteur majeur de stimulation de la croissance du marché mondial de la logistique des soins de santé .

- Croissance croissante des échanges transfrontaliers et mondialisation

La mondialisation est l'interdépendance des économies, des populations et des cultures du monde, réunies par le commerce transfrontalier de technologies, de biens et autres. Aujourd'hui, la majeure partie de l'économie du pays dépend fortement de l'achat et de la vente de biens entre différents pays. La région Asie-Pacifique et l'Amérique du Nord ont été les principaux acteurs du commerce européen et connaissent un volume élevé de flux commerciaux, ce qui a accru la demande de prestataires de services logistiques pour rendre le flux commercial plus pratique et plus rapide. Ainsi, cela stimule la croissance du marché de la logistique des soins de santé en Europe.

- Congestion associée aux routes commerciales

À mesure que le trafic routier et les embouteillages augmentent, les opérateurs de services de transport de marchandises et de marchandises doivent de plus en plus s’efforcer de respecter des horaires fiables. Cela affecte les chaînes d’approvisionnement et les entreprises dépendantes des camions, qui revêtent toutes deux une importance croissante pour les opérateurs régionaux publics et privés. De plus, de nombreux accidents sur les routes ou des déversements d’hydrocarbures en mer peuvent entraîner des contraintes logistiques inattendues dans le domaine de la santé. La récente pandémie de COVID-19 a également interrompu plusieurs opérations logistiques, causant de graves dommages à l’ensemble des opérations de la chaîne d’approvisionnement. Ces facteurs constituent un frein important à la croissance du marché européen de la logistique des soins de santé.

- Coût élevé associé à la logistique inverse

Le coût associé aux services de logistique inverse proposés par divers fabricants et prestataires de services est élevé. Les services de logistique inverse sont très populaires dans le secteur de la santé en raison de la forte demande de divers produits liés à la santé. Selon Thomas Publishing Company, les taux de retour des équipements industriels sont d'environ 4 à 8 %, tandis que ceux des équipements de santé sont de 8 à 20 %. Le chiffre d'affaires total américain impacté par les retours est estimé entre 52 et 106 millions USD.

La raison pour laquelle les services de logistique inverse sont si chers est une combinaison de divers facteurs qui déterminent le prix de ces services.

- Préoccupations liées à la gestion des stocks dans la logistique des soins de santé

La gestion des stocks est le processus de commande, de stockage et de vente des produits d'une entreprise et de tenue à jour de ses registres. Cela comprend la gestion des matières premières, des composants et des produits finis, ainsi que l'entreposage et le traitement des articles retournés.

Les stocks constituent l'actif le plus précieux d'une entreprise. L'adoption d'une gestion des stocks peut augmenter la productivité, réduire les coûts, atténuer les risques, améliorer la satisfaction des clients, réduire les coûts et maximiser le rendement des actifs. Cependant, la gestion des stocks est devenue assez difficile pour les prestataires de services logistiques de soins de santé.

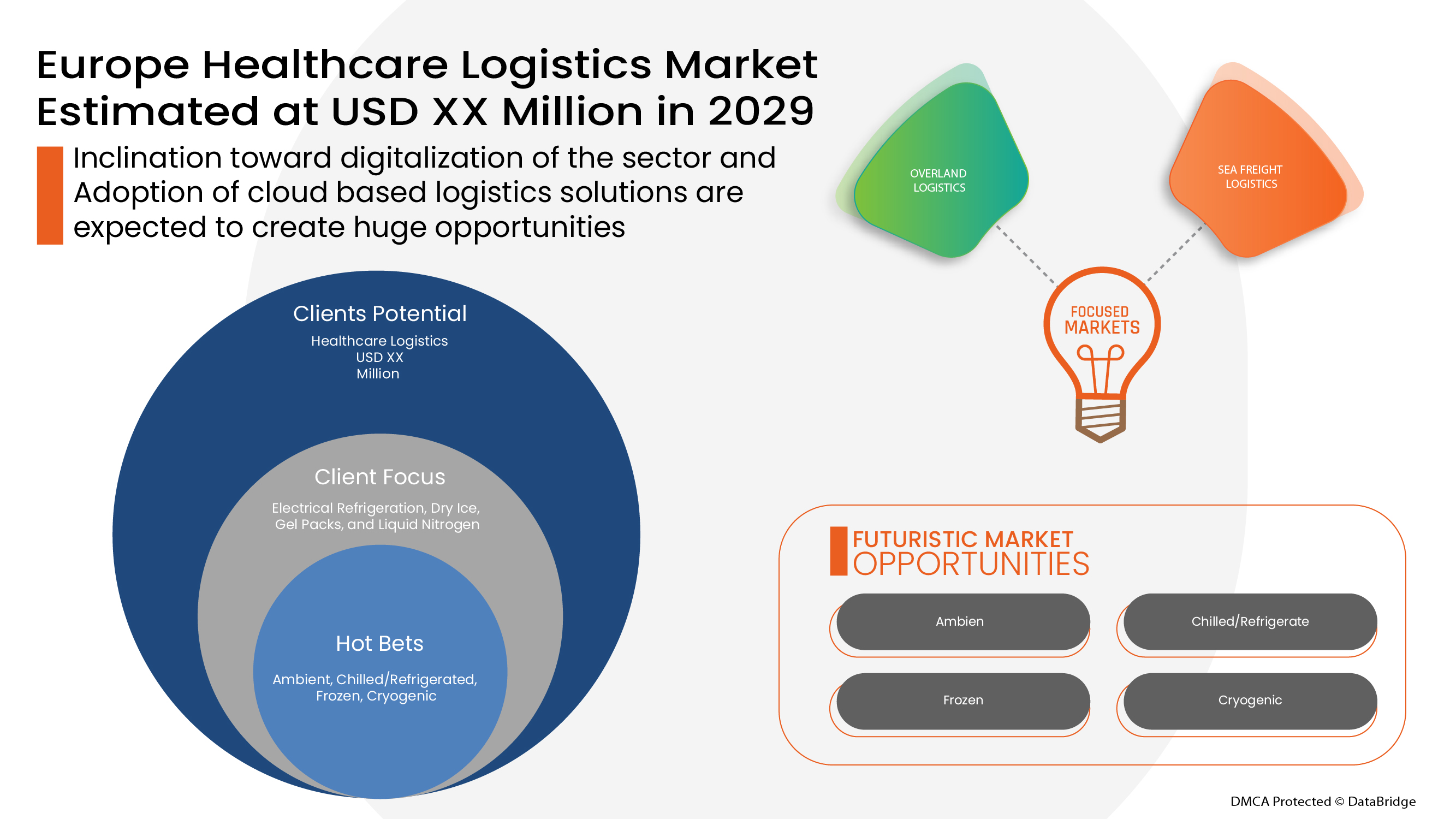

- Tendance à la numérisation du secteur

La transformation numérique fait référence aux changements qu'une entreprise subit en adoptant la technologie numérique. Il est devenu nécessaire pour le transport et la logistique d'accorder une importance extrême à l'optimisation, à l'efficacité, à la rapidité et au timing. L'évolution du scénario du marché et les nouvelles tendances à venir ont rendu très importante la transformation numérique du secteur des transports. Les entreprises de logistique de la santé utilisent des appareils mobiles pour améliorer leur agilité. De plus, les applications mobiles aident les clients à commander, traiter et suivre les retours à tout moment. Cette transformation numérique croissante du secteur de la logistique stimule ainsi la croissance du marché de la logistique de la santé.

- Insuffisance des ressources en main d'oeuvre pour gérer le retour

Le processus global de gestion de la chaîne logistique implique l'analyse d'une grande quantité de données et d'un grand nombre de retours. En raison de la croissance rapide du secteur du commerce électronique, la main-d'œuvre doit prendre les mesures nécessaires au bon moment. Les informations fournies doivent être bien exécutées afin de fournir des résultats et une qualité de services optimaux.

Cependant, le manque de main-d'œuvre qualifiée et de formation des employés peut entraîner plusieurs erreurs entraînant une inefficacité dans les services offerts, ce qui constitue un défi majeur pour la croissance du secteur de la logistique des soins de santé. Cela peut constituer un obstacle majeur car la satisfaction du client est primordiale dans le secteur de la logistique des soins de santé. La main-d'œuvre travaillant dans la logistique des soins de santé doit être formée à l'identification de numéros de série ou de pièces spécifiques. De plus, la main-d'œuvre doit connaître l'inventaire faisant autorité, la politique de garantie et les informations comptables hébergées dans son système central de planification des ressources de l'entreprise (ERP), mais il est difficile de trouver une main-d'œuvre qualifiée pour gérer les retours de produits de santé.

Impact post-COVID-19 sur le marché de la logistique médicale

La COVID-19 a eu un impact majeur sur le marché de la logistique des soins de santé, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui interviennent dans cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché de la logistique des soins de santé est due à l'augmentation de la croissance de la logistique par voie aérienne et maritime et à la croissance rapide du secteur du commerce électronique à travers le monde. Cependant, des facteurs tels que les préoccupations liées à la gestion des stocks dans la logistique des soins de santé freinent la croissance du marché. La fermeture des installations de production pendant la situation de pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans la logistique des soins de santé. Grâce à cela, les entreprises mettront sur le marché des contrôleurs avancés et précis. En outre, l'utilisation de la logistique des soins de santé par les autorités gouvernementales dans la logistique du fret maritime, la logistique du fret aérien, la logistique terrestre et la logistique contractuelle a conduit à la croissance du marché.

Développements récents

- En janvier 2022, DB Schenker a lancé le transport de marchandises diverses au Moyen-Orient et en Afrique. Cette expansion est basée sur la vision d'opérer dans les industries pétrolières et gazières du Moyen-Orient. Cette expansion a contribué à améliorer la présence mondiale de l'entreprise.

- En janvier 2022, ADAllen Pharma a obtenu la conformité aux nouvelles normes ISO 9001:2015 selon les normes BSI. Les normes ISO 9001 ont été révisées en 2015 par BSI à partir des normes précédentes de 2008 et constituent un outil puissant qui aide à gérer efficacement les activités d'ADAllen Pharma. La norme révisée garantira que la gestion de la qualité est désormais complètement intégrée et alignée sur les stratégies commerciales de l'organisation ADAllen Pharma. Cette réalisation a contribué à améliorer la présence mondiale de l'entreprise.

Portée du marché européen de la logistique des soins de santé

Le marché de la logistique des soins de santé est segmenté en fonction du type, de l'application, des composants, du type de température, de la logistique, du type de logistique et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Hors chaîne du froid

- Chaîne du froid

Sur la base de la technologie, le marché européen de la logistique des soins de santé est segmenté en chaîne du froid et hors chaîne du froid.

Composants

- Matériel

- Services

- Logiciel

Sur la base des composants, le marché européen de la logistique des soins de santé a été segmenté en matériel, logiciels et services.

Type de température

- Ambiant

- Réfrigéré/réfrigéré

- Congelé

- Cryogénique

Sur la base du type de température, le marché européen de la logistique des soins de santé a été segmenté en température ambiante, réfrigérée, congelée et cryogénique.

Logistique

- Transport

- Conditionnement

- Stockage

- Autres

Sur la base de la logistique, le marché européen de la logistique des soins de santé a été segmenté en transport, emballage, stockage et autres.

Type de logistique

- Logistique terrestre

- Logistique de fret maritime

- Logistique de fret aérien

- Logistique contractuelle

Sur la base du type logistique, le marché européen de la logistique des soins de santé a été segmenté en logistique de fret maritime, logistique de fret aérien, logistique terrestre et logistique contractuelle.

Application

- Médecine

- Manutentionnaires de médicaments en vrac

- Vaccin

- Produits chimiques et autres matières premières

- Matériel biologique et organes

- Marchandises dangereuses

- Autres

Sur la base des applications, le marché européen de la logistique des soins de santé a été segmenté en médicaments, manutentionnaires de médicaments en vrac, vaccins, produits chimiques et autres matières premières, matières biologiques et organes, marchandises dangereuses et autres.

Utilisateur final

- Sociétés biopharmaceutiques

- Hôpitaux et cliniques

- Instituts de recherche

- Autres

Sur la base de l'utilisateur final, le marché européen de la logistique des soins de santé a été segmenté en sociétés biopharmaceutiques, hôpitaux et cliniques, instituts de recherche et autres.

Analyse/perspectives régionales du marché de la logistique des soins de santé

Le marché de la logistique des soins de santé est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, application, composants, type de température, logistique, type de logistique et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de la logistique des soins de santé sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, les Pays-Bas, la Suisse, la Belgique, l'Autriche et le reste de l'Europe en Europe.

Le Royaume-Uni domine le marché européen de la logistique des soins de santé, ce qui est dû aux avantages considérables offerts par la logistique tierce. En outre, la plate-forme permet aux consommateurs d'acheter librement des produits de santé et de les utiliser selon leurs besoins en Allemagne. La demande dans cette région devrait être stimulée par la logistique tierce qui offre un large éventail d'avantages, car elle aide les propriétaires d'entreprises à se concentrer davantage sur les autres aspects de l'entreprise tels que le développement de produits, le marketing et les ventes.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Healthcare Logistics Market Share Analysis

The healthcare logistics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to healthcare logistics market.

Some of the major players operating in the healthcare logistics market are - DB Schenker, Deutsche Post DHL Group, FedEx, ADAllen Pharma., Biosensors International Group, Ltd., Entero Healthcare, CRYOPDP, SF Express, Alloga, among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEALTHCARE LOGISTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID GROWTH IN E-COMMERCE SECTOR

6.1.2 HIGH BENEFITS OFFERED BY THIRD PARTY LOGISTICS

6.1.3 RISING GROWTH IN CROSS BORDER TRADES AND EUROPEIZATION

6.1.4 INCREASE IN GROWTH OF LOGISTICS THROUGH AIRWAYS AND WATER WAYS

6.2 RESTRAINTS

6.2.1 CONGESTION ASSOCIATED WITH TRADE ROUTES

6.2.2 HIGH COST ASSOCIATED WITH REVERSE LOGISTICS

6.2.3 CONCERNS RELATED TO INVENTORY MANAGEMENT IN HEALTHCARE LOGISTICS

6.3 OPPORTUNITIES

6.3.1 INCLINATION TOWARDS DIGITALIZATION OF THE SECTOR

6.3.2 ADOPTION OF CLOUD BASED LOGISTICS SOLUTIONS

6.3.3 INCREASING GROWTH INVESTMENTS AND EXPANSIONS MADE BY THE MARKET PLAYERS

6.3.4 EMERGENCE OF NEW ADVANCED TECHNOLOGIES

6.4 CHALLENGES

6.4.1 INADEQUATE LABOUR RESOURCES TO HANDLE RETURN

6.4.2 FREQUENT DELAYS IN DELIVERY 0F PRODUCTS DUE TO VARIOUS TECHNICAL FACTORS

7 EUROPE HEALTHCARE LOGISTICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-COLD CHAIN

7.3 COLD CHAIN

7.3.1 ELECTRICAL REFRIGERATION

7.3.2 DRY ICE

7.3.3 GEL PACKS

7.3.4 LIQUID NITROGEN

7.3.5 OTHERS

8 EUROPE HEALTHCARE LOGISTICS MARKET, BY COMPONENTS

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 SENSORS & DATA LOGGERS

8.2.2 NETWORKING DEVICES

8.2.3 BARCODE SCANNERS

8.2.4 RFID DEVICES

8.2.5 TELEMATICS & TELEMETRY DEVICES

8.2.6 OTHERS

8.3 SERVICES

8.3.1 DIRECT DISTRIBUTION FOR RETAILERS

8.3.2 AFTER SALES LOGISTICS

8.3.3 REVERSE LOGISTICS

8.3.4 OTHERS

8.4 SOFTWARE

8.4.1 CLOUD BASED

8.4.2 ON-PREMISE

9 EUROPE HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE

9.1 OVERVIEW

9.2 AMBIENT

9.3 CHILLED/REFRIGERATED

9.4 FROZEN

9.5 CRYOGENIC

10 EUROPE HEALTHCARE LOGISTICS MARKET, BY LOGISTICS

10.1 OVERVIEW

10.2 TRANSPORTATION

10.3 PACKAGING

10.4 STORAGE

10.5 OTHERS

11 EUROPE HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE

11.1 OVERVIEW

11.2 OVERLAND LOGISTICS

11.3 SEA FREIGHT LOGISTICS

11.4 AIR FREIGHT LOGISTICS

11.5 CONTRACT LOGISTICS

12 EUROPE HEALTHCARE LOGISTICS MARKET, BY PRODUCT

12.1 OVERVIEW

12.2 BRANDED DRUGS

12.3 GENERIC DRUGS

13 EUROPE HEALTHCARE LOGISTICS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 MEDICINE

13.2.1 CHEMICAL MEDICINES

13.2.2 SPECIALITY MEDICINES

13.2.2.1 RECOMBINANT THERAPEUTIC PROTEINS

13.2.2.2 REGENERATIVE MEDICINE

13.2.2.2.1 STEM CELL THERAPY

13.2.2.2.2 GENE THERAPY

13.2.2.3 OTHERS

13.2.3 BIO MEDICINES

13.2.4 OTHERS

13.3 BULK DRUG HANDLERS

13.4 VACCINE

13.5 CHEMICAL & OTHER RAW MATERIAL

13.6 BIOLOGICAL MATERIAL AND ORGANS

13.7 HAZARDOUS CARGO

13.8 OTHERS

14 EUROPE HEALTHCARE LOGISTICS MARKET, BY END USER

14.1 OVERVIEW

14.2 BIOPHARMACEUTICAL COMPANIES

14.3 HOSPITALS & CLINICS

14.4 RESEARCH INSTITUTES

14.5 OTHERS

15 EUROPE HEALTHCARE LOGISTICS MARKET BY GEOGRAPHY

15.1 EUROPE

16 EUROPE HEALTHCARE LOGISTICS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SF EXPRESS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 FEDEX

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 SERVICE PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 DB SCHENKER

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 C.H. ROBINSON WORLDWIDE, INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 SERVICE PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 NIPPON EXPRESS CO., LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ABBOTT.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 ADALLEN PHARMA

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 AGILITY

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 AGRO MERCHANTS GROUP

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 AIR CANADA

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 SERVICE PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 ALLOGA

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 AMERISOURCEBERGEN CORPORATION

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 BDP INTERNATIONAL

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 BIOSENSORS INTERNATIONAL GROUP, LTD.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 BURRIS LOGISTICS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 CAVALIER LOGISTICS MANAGEMENT II, INC.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 CEVA LOGISTICS

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 CRYOPDP

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 DEUTSCHE POST AG

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 EMERALD FREIGHT

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 ENTERO HEALTHCARE

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

18.22 INGRAM MICRO SERVICES

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 KERRY LOGISTICS NETWORK LIMITED

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 SERVICE PORTFOLIO

18.23.4 RECENT DEVELOPMENTS

18.24 NICHIREI CORPORATION

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 OIA EUROPE

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 PCI PHARMA SERVICES

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS

18.27 PENSKE

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENTS

18.28 TOTAL QUALITY LOGISTICS, LLC

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

18.29 TRANSPLACE

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENTS

18.3 UNITED PARCEL SERVICE OF AMERICA, INC.

18.30.1 COMPANY SNAPSHOT

18.30.2 REVENUE ANALYSIS

18.30.3 SERVICES PORTFOLIO

18.30.4 RECENT DEVELOPMENTS

18.31 VERSACOLD LOGISTICS SERVICES

18.31.1 COMPANY SNAPSHOT

18.31.2 PRODUCT PORTFOLIO

18.31.3 RECENT DEVELOPMENTS

18.32 X2 GROUP

18.32.1 COMPANY SNAPSHOT

18.32.2 PRODUCT PORTFOLIO

18.32.3 RECENT DEVELOPMENTS

18.33 YUSEN LOGISTICS CO., LTD.

18.33.1 COMPANY SNAPSHOT

18.33.2 PRODUCT PORTFOLIO

18.33.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE NON-COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY STORAGE TECHNIQUES, 2020-2029 (USD MILLION)

TABLE 5 EUROPE HEALTHCARE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 6 EUROPE HARDWARE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 7 EUROPE HARDWARE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE SERVICES IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 9 EUROPE SERVICES IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE SOFTWARE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 11 EUROPE SOFTWARE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE AMBIENT IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 14 EUROPE CHILLED/REFRIGERATED IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 15 EUROPE FROZEN IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 16 EUROPE CRYOGENIC IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 17 EUROPE HEALTHCARE LOGISTICS MARKET, BY LOGISTICS, 2020-2029 (USD MILLION)

TABLE 18 EUROPE TRANSPORTATION IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 19 EUROPE PACKAGING IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 20 EUROPE STORAGE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 21 EUROPE OTHERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 22 EUROPE HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE OVERLAND LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 24 EUROPE SEA FREIGHT LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 25 EUROPE AIR FREIGHT LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 26 EUROPE CONTRACT LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 27 EUROPE HEALTHCARE LOGISTICS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 EUROPE BRANDED DRUGS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 29 EUROPE GENERIC DRUGS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 30 EUROPE HEALTHCARE LOGISTICS MARKET, BY APPLICATION, 2020-2029 (USD

TABLE 31 EUROPE MEDICINE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 32 EUROPE MEDICINE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE SPECIALITY MEDICINES IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 EUROPE REGENERATIVE MEDICINE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE BULK DRUG HANDLERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 36 EUROPE VACCINE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 37 EUROPE CHEMICAL & OTHER RAW MATERIAL IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 38 EUROPE BIOLOGICAL MATERIAL AND ORGANS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 39 EUROPE HAZARDOUS CARGO IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 40 EUROPE OTHERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 41 EUROPE HEALTHCARE LOGISTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 EUROPE BIOPHARMACEUTICAL COMPANIES IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 43 EUROPE HOSPITAL & CLINICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 44 EUROPE RESEARCH INSTITUTES IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 45 EUROPE OTHERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

Liste des figures

FIGURE 1 EUROPE HEALTHCARE LOGISTICS MARKET: SEGMENTATION

FIGURE 2 EUROPE HEALTHCARE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEALTHCARE LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEALTHCARE LOGISTICS MARKET: EUROPE VS. REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEALTHCARE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEALTHCARE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HEALTHCARE LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE HEALTHCARE LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE HEALTHCARE LOGISTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE HEALTHCARE LOGISTICS MARKET: SEGMENTATION

FIGURE 11 INCREASING GROWTH IN EUROPEIZATION LEADING TO HIGH FREIGHT TRANSPORTATION IS EXPECTED TO DRIVE EUROPE HEALTHCARE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 NON-COLD CTYPE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE HEALTHCARE LOGISTICS MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE EUROPE HEALTHCARE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGE OF EUROPE HEALTHCARE LOGISTICS MARKET

FIGURE 15 ECONOMIES BY SIZE OF MERCHANDISE TRADE, 2020

FIGURE 16 TONNAGE LOADED AND UNLOADED, 2019 (BILLIONS OF TONS)

FIGURE 17 CONTAINER PORT TRAFFIC BY REGIONS

FIGURE 18 EUROPE HEALTHCARE LOGISTICS MARKET: BY TYPE, 2021

FIGURE 19 EUROPE HEALTHCARE LOGISTICS MARKET: BY COMPONENTS, 2021

FIGURE 20 EUROPE HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, 2021

FIGURE 21 EUROPE HEALTHCARE LOGISTICS MARKET: BY LOGISTICS, 2021

FIGURE 22 EUROPE HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, 2021

FIGURE 23 EUROPE HEALTHCARE LOGISTICS MARKET: BY PRODUCT, 2021

FIGURE 24 EUROPE HEALTHCARE LOGISTICS MARKET: BY APPLICATION, 2021

FIGURE 25 EUROPE HEALTHCARE LOGISTICS MARKET: BY END USER, 2021

FIGURE 26 EUROPE HEALTHCARE LOGISTICS MARKET: SNAPSHOT(2021)

FIGURE 27 EUROPE HEALTHCARE LOGISTICS MARKET: BY COUNTRY (2021)

FIGURE 28 EUROPE HEALTHCARE LOGISTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 EUROPE HEALTHCARE LOGISTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 EUROPE HEALTHCARE LOGISTICS MARKET: BY TYPE (2022-2029)

FIGURE 31 EUROPE HEALTHCARE LOGISTICS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.