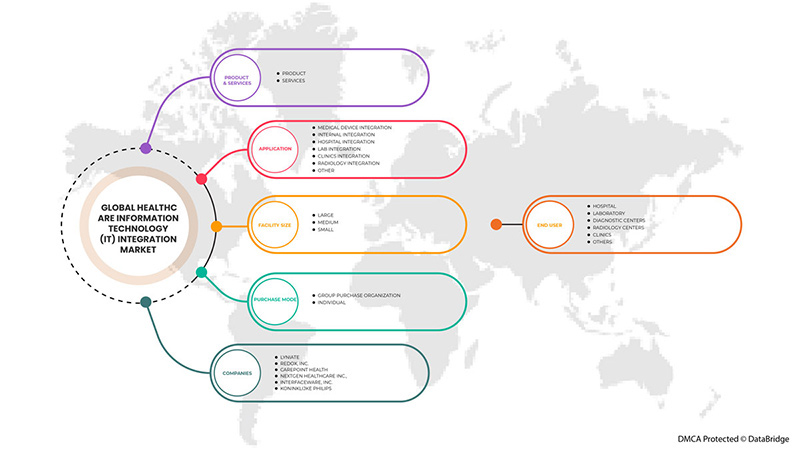

Marché européen de l'intégration des technologies de l'information (TI) dans le secteur de la santé, par produit et services (produit et services), application (intégration de dispositifs médicaux, intégration interne, intégration hospitalière, intégration de laboratoire, intégration de cliniques et intégration de radiologie), taille de l'établissement (grand, moyen et petit), mode d'achat (organisation d'achat groupé et individuel), utilisateur final ( hôpitaux , laboratoires, centres de diagnostic , centres de radiologie et cliniques), tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché de l'intégration des technologies de l'information (TI) dans le secteur de la santé en Europe

L'intégration informatique dans le secteur de la santé permet aux systèmes de santé de collecter des données, de les échanger avec le cloud et de communiquer entre eux, ce qui permet une analyse rapide et correcte de ces données. L'Internet des objets (IoT) combine les données de capteurs avec les communications pour fournir des tâches qui étaient jusqu'à récemment considérées comme théoriques, de la surveillance et du diagnostic aux méthodes d'administration. Les capteurs peuvent être intégrés dans un appareil, basés sur le cloud ou portables. Grâce aux développements de ces capteurs et des TIC, le secteur de la santé dispose désormais d'une collection dynamique de données sur les patients qui peuvent être utilisées pour soutenir les diagnostics et les soins préventifs et pour évaluer le succès probable du traitement préventif.

De plus, les initiatives d'intégration ont souvent une portée limitée. Elles n'intègrent qu'une petite partie des données des patients disponibles, car il est difficile de déplacer des informations entre des applications logicielles cliniques et commerciales disparates au sein et au-delà des frontières des entreprises de soins de santé. Cela nécessite une compréhension approfondie de la gouvernance des données, une connaissance approfondie des normes de messagerie médicale, un accès à une technologie sophistiquée et une expertise en intégration de systèmes, notamment en architecture orientée services (SOA) et en gestion de l'architecture d'entreprise (EAM). Le HIIF de CGI définit et décrit tous les paramètres nécessaires pour réaliser l'intégration dont les organisations de soins de santé ont besoin.

Toutefois, les coûts plus élevés associés aux solutions informatiques intégrées et les problèmes liés à l’interopérabilité devraient freiner la croissance du marché.

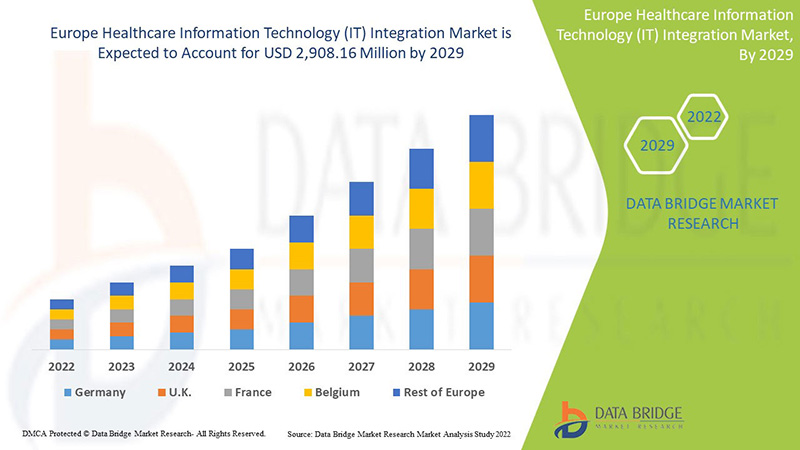

Data Bridge Market Research analyse que le marché européen de l'intégration des technologies de l'information (TI) dans le secteur de la santé devrait atteindre une valeur de 2 908,16 millions USD d'ici 2029, à un TCAC de 12,7 % au cours de la période de prévision. Les produits et services représentent le segment de type le plus important du marché en raison de la demande rapide de solutions et de services informatiques en Europe. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par produit et services (produit et services), application (intégration de dispositifs médicaux, intégration interne, intégration hospitalière, intégration de laboratoire, intégration de cliniques et intégration de radiologie), taille de l'établissement (grande, moyenne et petite), mode d'achat (organisation d'achat groupé et individuel), utilisateur final (hôpitaux, laboratoires, centres de diagnostic, centres de radiologie et cliniques). |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Espagne, Russie, Turquie, Belgique, Pays-Bas, Suisse et le reste de l'Europe. |

|

Acteurs du marché couverts |

Lyniate, Redox, Inc., Carepoint Health, Nextgen Healthcare Inc., Interfaceware, Inc. Koninklijke Philips, Oracle, AVI-SPL, INC., Allscripts Healthcare solutions, Inc, Epic Systems Corporation, Qualcomm Life Inc., Capsule Technologies Inc. Orion Health, Quality Systems, Inc., Cerner Corporation, Intersystems Corporation, Infor Inc., GE Healthcare, MCKESSON Corporation et Meditech, entre autres. |

Définition du marché européen de l'intégration des technologies de l'information (TI) dans le secteur de la santé

L'intégration des technologies de l'information en santé (TI) est le domaine des TI impliquant la conception, le développement, la création, l'utilisation et la maintenance des systèmes d'information pour le secteur de la santé. Les systèmes d'information de santé automatisés et interopérables continueront d'améliorer les soins médicaux et la santé publique, de réduire les coûts, d'augmenter l'efficacité, de réduire les erreurs et d'améliorer la satisfaction des patients, et d'optimiser le remboursement des prestataires de soins de santé ambulatoires et hospitaliers. L'importance des TI en santé résulte de la combinaison de l'évolution de la technologie et des politiques gouvernementales changeantes qui influencent la qualité des soins aux patients. Certains des produits d'intégration des technologies de l'information (TI) en santé sont les moteurs d'interface/intégration, les logiciels d'intégration de dispositifs médicaux et les solutions d'intégration de médias, et les services sont la mise en œuvre et l'intégration, le support et la maintenance, la formation et l'éducation, et le conseil. Les TI en santé permettent aux prestataires de soins de santé de mieux gérer les soins aux patients grâce à l'utilisation et au partage sécurisés des informations de santé. En développant des dossiers médicaux électroniques sécurisés et privés pour la plupart des Américains et en rendant les informations de santé disponibles par voie électronique quand et où elles sont nécessaires, les TI en santé peuvent améliorer la qualité des soins, tout en rendant les soins de santé plus rentables. Grâce aux technologies de l'information en santé, les prestataires de soins de santé disposeront : d'informations exactes et complètes sur la santé d'un patient. Ainsi, ils pourront prodiguer les meilleurs soins possibles, que ce soit lors d'une visite de routine ou d'une urgence médicale. La capacité de mieux coordonner les soins prodigués. Cela est particulièrement important si un patient souffre d'une maladie grave. C'est un moyen de partager des informations de manière sécurisée avec les patients et leurs aidants familiaux sur Internet, pour les patients qui optent pour cette commodité.

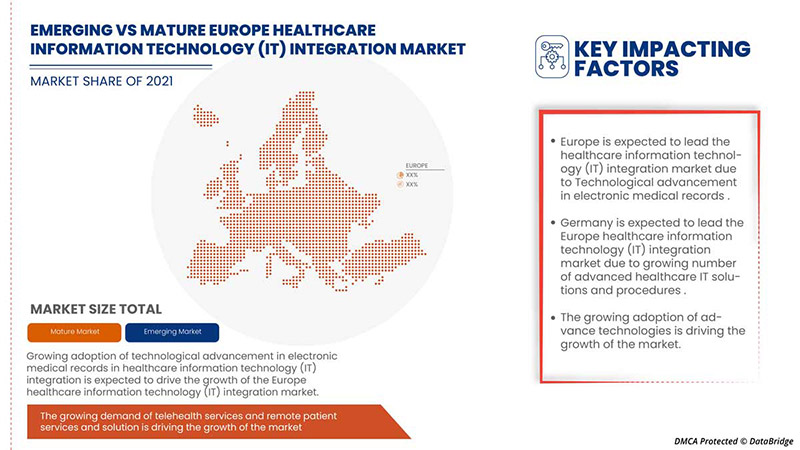

En outre, l'adoption rapide des dossiers médicaux électroniques et d'autres solutions informatiques de santé est l'un des moteurs à fort impact du marché. En outre, le besoin urgent d'intégrer les données des patients dans les systèmes de santé et les politiques gouvernementales favorables, les programmes de financement et les initiatives visant à déployer des solutions d'intégration informatique de santé sont les principaux moteurs de la croissance du marché.

Dynamique du marché de l'intégration des technologies de l'information (TI) dans le secteur de la santé en Europe

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Adoption rapide des dossiers médicaux électroniques et d’autres solutions informatiques pour les soins de santé

Les données des patients sont complexes, confidentielles et souvent non structurées. L'intégration de ces informations dans le processus de prestation de soins de santé est un défi à relever pour concrétiser l'opportunité d'améliorer les soins aux patients. Bien que le dossier médical électronique (DME) soit utilisé depuis plus d'une décennie, le marché a récemment connu une accélération en raison des initiatives gouvernementales de différents pays visant à améliorer la sécurité des données des patients.

Les exigences réglementaires imposées par HITECH ont stimulé l'adoption des DSE et des DME. Un autre facteur important, qui alimente la croissance du marché, est le nombre croissant d'organisations de soins responsables (ACO), qui accroissent la demande de DSE et de DME.

Les initiatives gouvernementales dans d’autres pays, comme le Danemark, la Suède, la France et le Canada, encouragent également l’adoption des DSE et imposent leur utilisation judicieuse pour contrôler les coûts des soins de santé.

En outre, les services informatiques contribuent à intégrer les différents utilisateurs finaux du système de santé, notamment les hôpitaux, les unités de soins infirmiers, les pharmacies et les compagnies d'assurance maladie. Cependant, l'intégration de ces données et leur disponibilité en temps réel sont essentielles pour que les professionnels de la santé puissent prendre des décisions efficaces. Par conséquent, avec la croissance prévue des systèmes EHR dans les années à venir, les hôpitaux se concentreront fortement sur l'amélioration de leurs capacités en intégrant différents systèmes hospitaliers avec EHR, créant ainsi des opportunités de développement pour le marché de l'intégration des technologies de l'information (TI) dans le domaine de la santé.

- Demande croissante de services de télésanté et de solutions de surveillance à distance des patients

Actuellement, les services de télésanté sont demandés à des fins de surveillance et de conseil. Les avancées dans les solutions de soins de santé ont permis de fournir du contenu éducatif et d'assurer une communication ininterrompue entre les patients et les prestataires de soins de santé. Le bon fonctionnement des solutions de surveillance à distance des patients dépend de l'intégration réussie des dispositifs médicaux et des technologies de l'information et de la communication (TIC) qui permettent la prestation de services médicaux sur de longues distances.

Étant donné que les médecins et les infirmières passent la majeure partie de leur temps à travailler sans ordinateur dans les hôpitaux, il leur est difficile d'emporter les dossiers des patients avec eux lors de leurs déplacements. Par conséquent, de nombreux acteurs du marché ont commencé à proposer des plateformes mobiles, telles que des applications mobiles, pour les solutions informatiques de santé.

Les progrès de l’informatique ont permis de proposer un éventail toujours plus large d’options, telles que le haut débit avancé, la téléphonie mobile et les réseaux, la surveillance à distance des patients, la vidéoconférence haute définition et le DSE. Cela a créé d’importantes opportunités pour les fournisseurs de solutions d’intégration des technologies de l’information médicale. Grâce à un réseau de soins de santé IoT composé d’appareils médicaux connectés, les patients assis à domicile peuvent être surveillés à distance pour leurs signes vitaux, tels que leur tension artérielle, leur poids, leur glycémie, leur électrocardiogramme et leur température corporelle, car les données du patient sont automatiquement envoyées à l’infirmière ou au médecin.

Un environnement de soins de santé connecté permet aux médecins de surveiller et d'ajuster à distance l'état d'un patient. Les technologies de santé connectées impliquent une technologie de capteurs intelligents, une connectivité avancée, des améliorations d'interface et des analyses de données. Ces avancées contribuent à réduire les coûts des soins de santé en améliorant l'acceptation des patients et en réduisant les visites en clinique. De plus, même si les coûts de mise en œuvre peuvent être élevés, ces technologies contribuent à accélérer les opérations de nombreuses entreprises.

Grâce aux progrès technologiques, ces solutions jouent un rôle important dans l’amélioration de la surveillance à distance et de l’observance des traitements par les patients, et par conséquent, de leur qualité de vie. Par conséquent, la demande croissante de solutions de surveillance à distance et d’appareils à distance devrait stimuler la croissance des fournisseurs européens de solutions d’intégration des technologies de l’information (TI) dans le secteur de la santé dans les années à venir.

Retenue

- Problèmes liés à l'interopérabilité

L'hétérogénéité des systèmes d'information de santé pose des défis majeurs pour la mise en œuvre et l'utilisation réussies des solutions informatiques de santé. De nombreux pays ne disposent pas de normes informatiques spécifiques pour le stockage et l'échange de données, ce qui entraîne des problèmes d'interopérabilité. Bien qu'il existe de nombreuses normes différentes de stockage, de transport et de sécurité des données, la mise en œuvre et l'intégration de ces normes d'interopérabilité représentent un défi majeur pour les prestataires de soins et les fournisseurs de solutions informatiques médicales et de santé. En raison de l'absence d'un système d'information de santé unique pour répondre à toutes les exigences administratives, cliniques, techniques et de laboratoire des principaux prestataires de soins de santé, les exigences d'interopérabilité et les normes d'interopérabilité sont devenues importantes. Les fournisseurs suivent également des formats de données et des normes différents en raison d'une mauvaise connaissance ou d'un manque de connaissances techniques des normes définies, ce qui rend difficile le partage de données en temps réel avec les systèmes partenaires, ce qui augmente le coût de l'intégration informatique de santé. Les problèmes de qualité et d'intégrité des données, le non-respect des normes établies, le manque de professionnels qualifiés et la variation de disponibilité entre les prestataires de soins de santé font partie des problèmes qui constituent des obstacles majeurs à la mise en œuvre d'une infrastructure informatique de santé entièrement interopérable. Ces facteurs devraient freiner la croissance du marché.

Opportunités/Défis

- Défis liés à l'intégration des données

Les informations relatives aux patients proviennent de différents services. À tous les stades du traitement au sein de l'organisation des soins de santé, ce qui en fait un secteur à forte intensité d'informations et des dossiers patients fiables. Cependant, il est essentiel de fournir des informations fiables en combinant d'énormes quantités de données afin de produire des dossiers patients complets et fiables, car une variété d'équipements médicaux et d'instruments de diagnostic sont utilisés dans les systèmes de santé et un besoin croissant de connecter tous ces systèmes pour aider les professionnels de santé à réagir rapidement à différents points de prestation de soins.

De nombreuses organisations de soins de santé ont investi dans de nombreuses applications de gestion de l'information, notamment des systèmes de gestion des actifs, des systèmes d'imagerie, des systèmes de gestion du courrier électronique, des systèmes de gestion des formulaires, des systèmes d'information clinique, des systèmes de gestion des effectifs, des systèmes de gestion de bases de données, des systèmes de gestion de contenu, des systèmes de gestion du cycle de revenus, des systèmes de flux de travail cliniques et non cliniques et des systèmes de gestion des relations clients. Les organisations de soins de santé adoptant de plus en plus divers systèmes informatiques, il devient de plus en plus nécessaire d'intégrer différents types de systèmes informatiques dans l'architecture informatique de l'organisation pour garantir l'utilisation optimale de ces systèmes et contribuer à une prise de décision précise. La combinaison réussie de systèmes informatiques de soins de santé avec d'autres systèmes est au cœur des projets de développement d'infrastructures informatiques dans les organisations de soins de santé.

Ainsi, chaque organisation de soins de santé utilise des systèmes différents, et il existe un risque élevé de diagnostic erroné et d'examen incorrect du rapport en raison de l'intégration des données qui démolit l'utilisation des technologies de l'information médicale, ce qui peut constituer un défi à la croissance du marché.

Impact post-COVID-19 sur le marché européen de l'intégration des technologies de l'information (TI) dans le secteur de la santé

L’épidémie de COVID-19 a eu des conséquences drastiques sur les soins de santé en Europe, le Royaume-Uni étant l’un des pays les plus durement touchés. En raison de l’épidémie de COVID-19, toutes les cliniques de soins de santé sont soumises à une pression immense et les établissements de santé du monde entier sont surchargés par les visites quotidiennes de nombreux patients. La prévalence croissante de la maladie à coronavirus a stimulé la demande d’appareils de diagnostic et de traitement précis dans plusieurs pays du monde. À cet égard, les technologies de soins connectés se sont révélées très utiles. Elles permettent aux prestataires de soins de santé de surveiller les patients à l’aide d’appareils non invasifs connectés numériquement tels que des tensiomètres à domicile et des oxymètres de pouls. De plus, la propagation rapide de cette maladie en Europe a entraîné une pénurie de lits d’hôpitaux et de personnels de santé. En conséquence, les appareils médicaux connectés ont été de plus en plus adoptés pour surveiller les signes vitaux, et une tendance similaire devrait être observée dans les années à venir.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de R&D et de lancement de produits, ainsi que des partenariats stratégiques pour améliorer la technologie et les résultats des tests impliqués dans le marché des tests pharmacogénétiques.

Développements récents

- En août 2022, Cognizant a annoncé avoir été sélectionné par AXA UK & Ireland comme partenaire technologique pour l'aider à consolider, moderniser et gérer une partie de ses opérations informatiques. AXA UK & Ireland transforme son écosystème technologique pour créer un environnement informatique plus numérique, moderne et agile, riche en données, sécurisé et durable, avec un coût global inférieur. Cognizant fournira des services informatiques intégrés couvrant le support et la maintenance du service desk, l'informatique destinée aux utilisateurs finaux, le développement et la maintenance d'applications, les opérations cloud et la gestion de l'infrastructure informatique. Cela a aidé l'entreprise à développer ses activités.

- En juillet 2022, NXGN Management, LLC, a présenté son NextGen Office primé, le seul dossier médical électronique (DME) intégré au registre de l'American Podiatric Medical Association (APMA), lors de la conférence annuelle du groupe qui s'est tenue du 28 au 31 juillet à Orlando. NextGen Healthcare est un partenaire fondateur du registre APMA, qui a fourni des informations cliniquement pertinentes aux clients de NextGen Healthcare. Cela a aidé l'entreprise à présenter ses produits à l'APMA et à obtenir une reconnaissance.

Portée du marché européen de l'intégration des technologies de l'information (TI) dans le secteur de la santé

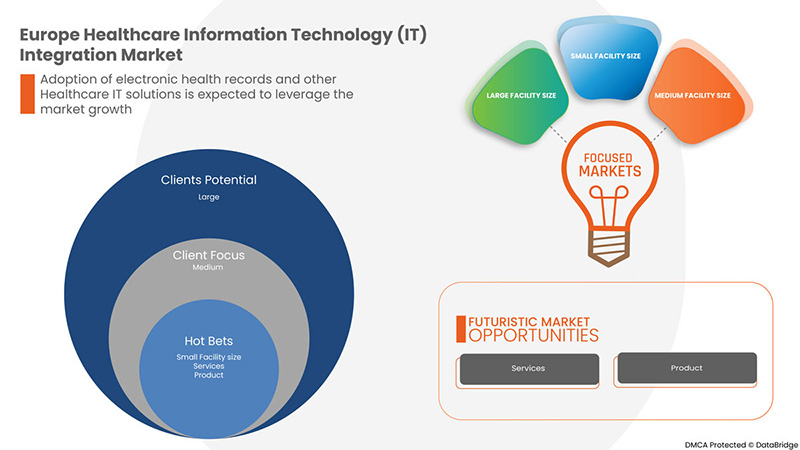

Le marché européen de l'intégration des technologies de l'information (TI) dans le secteur de la santé est segmenté en produits et services, applications, taille de l'établissement, mode d'achat et utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Par produits et services

- Produit

- Services

Sur la base des produits et services, le marché européen de l'intégration des technologies de l'information (TI) dans le domaine de la santé est segmenté en produits et services.

Par applications

- Intégration de dispositifs médicaux

- Intégration interne

- Intégration hospitalière

- Intégration de laboratoire

- Intégration des cliniques

- Intégration de la radiologie

- Autre

Sur la base des applications, le marché européen de l'intégration des technologies de l'information (TI) dans le domaine de la santé est segmenté en intégration de dispositifs médicaux, intégration interne, intégration hospitalière, intégration de laboratoire, intégration clinique, intégration de radiologie et autres.

Par taille d'établissement

- Grand

- Moyen

- Petit

Sur la base de la taille des installations, le marché européen de l'intégration des technologies de l'information (TI) dans le domaine de la santé est segmenté en grandes, moyennes et petites.

Par mode d'achat

- Organisation d'achat groupé

- Individuel

Sur la base du mode d'achat, le marché européen de l'intégration des technologies de l'information (TI) dans le domaine de la santé est segmenté en achats groupés et individuels.

Par utilisateur final

- Hôpital

- Laboratoire

- Centres de diagnostic

- Centres de radiologie

- Cliniques

- Autres

Sur la base des utilisateurs finaux, le marché européen de l'intégration des technologies de l'information (TI) dans le domaine de la santé est segmenté en hôpitaux, laboratoires, centres de diagnostic, centres de radiologie, cliniques et autres.

Analyse/perspectives régionales du marché de l'intégration des technologies de l'information (TI) dans le secteur de la santé en Europe

Le marché européen de l'intégration des technologies de l'information (TI) dans le domaine de la santé est analysé et des informations sur la taille du marché sont fournies par produit et services, application, taille de l'établissement, mode d'achat et utilisateur final.

Les pays couverts dans ce rapport de marché sont l’Allemagne, la France, le Royaume-Uni, l’Italie, l’Espagne, la Russie, la Turquie, la Belgique, les Pays-Bas, la Suisse et le reste de l’Europe.

En 2022, l’Europe sera le deuxième pays le plus important en termes de programmes de financement et d’initiatives visant à mettre en œuvre des solutions d’intégration informatique dans le secteur de la santé. L’Allemagne devrait connaître une croissance grâce à l’augmentation des investissements dans la R&D et à l’adoption rapide des dossiers médicaux électroniques et d’autres solutions informatiques dans le secteur de la santé.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'intégration des technologies de l'information (TI) dans le secteur de la santé en Europe

Le paysage concurrentiel du marché européen de l'intégration des technologies de l'information (TI) dans le secteur de la santé fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché européen de l'intégration des technologies de l'information (TI) dans le secteur de la santé.

Certains des principaux acteurs opérant sur le marché européen de l'intégration des technologies de l'information (TI) dans le domaine de la santé sont Lyniate, Redox, Inc., carepoint health, Nextgen Healthcare Inc., Interfaceware, Inc., Koninklijke Philips, Oracle, AVI-SPL, INC., Allscripts Healthcare solutions, Inc., Epic Systems Corporation, Qualcomm Life Inc., Capsule Technologies Inc., Orion Health, Quality Systems, Inc., Cerner Corporation, Intersystems Corporation, Infor Inc., GE Healthcare, MCKESSON Corporation et Meditech, entre autres.

Méthodologie de recherche : Marché européen de l'intégration des technologies de l'information (TI) dans le secteur de la santé

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'Europe par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT AND SERVICES LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 POTENTIAL HEALTHCARE IT TECHNOLOGIES

4.1.1 EHR

4.1.2 EMR

4.1.3 ARTIFICIAL INTELLIGENCE

4.1.4 TELEMEDICINE

5 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET SHARE ANALYSIS-

6 REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RAPID ADOPTION OF ELECTRONIC HEALTH RECORDS AND OTHER HEALTHCARE IT SOLUTIONS

7.1.2 GROWING DEMAND FOR TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS

7.1.3 GROWING REQUIREMENT OF TELEHEALTH SERVICES ACROSS HEALTHCARE SECTOR

7.2 RESTRAINS

7.2.1 ISSUES ASSOCIATED WITH INTEROPERABILITY

7.2.2 HIGH COSTS ASSOCIATED WITH INTEGRATED IT SOLUTIONS

7.3 OPPORTUNITIES

7.3.1 EARLY MEDICAL DECISIONS AND CLINICAL DECISION SUPPORT

7.3.2 DATA UNIFORMITY AND STANDARDIZED DATA EXCHANGE

7.3.3 INCREASING AWARENESS AMONG PEOPLE

7.4 CHALLENGES

7.4.1 DATA INTEGRATION RELATED CHALLENGES

7.4.2 RISING HEALTHCARE FRAUDS

8 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT AND SERVICES

8.1 OVERVIEW

8.2 SERVICES

8.2.1 SUPPORT & MAINTENANCE

8.2.2 IMPLEMENTATION & INTEGRATION

8.2.3 TRAINING & EDUCATION

8.2.4 CONSULTING

8.3 PRODUCT

8.3.1 INTERFACE/INTEGRATION ENGINES

8.3.1.1 GROUP PURCHASE ORGANIZATION

8.3.1.2 INDIVIDUAL

8.3.2 MEDICAL DEVICE INTEGRATION SOFTWARE

8.3.2.1 GROUP PURCHASE ORGANIZATION

8.3.2.2 INDIVIDUAL

8.3.3 MEDIA INTEGRATION SOLUTIONS

8.3.3.1 GROUP PURCHASE ORGANIZATION

8.3.3.2 INDIVIDUAL

8.3.4 OTHER INTEGRATION TOOLS

9 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL DEVICE INTEGRATION

9.3 HOSPITAL INTEGRATION

9.4 INTERNAL INTEGRATION

9.5 RADIOLOGY INTEGRATION

9.6 LAB INTEGRATION

9.7 CLINICS INTEGRATION

9.8 OTHERS

10 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE

10.1 OVERVIEW

10.2 LARGE

10.3 MEDIUM

10.4 SMALL

11 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE

11.1 OVERVIEW

11.2 GROUP PURCHASE ORGANIZATION

11.3 INDIVIDUAL

12 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 DIAGNOSTIC CENTERS

12.4 RADIOLOGY CENTERS

12.5 LABORATORY

12.6 CLINICS

12.7 OTHERS

13 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K.

13.1.4 ITALY

13.1.5 RUSSIA

13.1.6 SPAIN

13.1.7 TURKEY

13.1.8 NETHERLANDS

13.1.9 SWITZERLAND

13.1.10 BELGIUM

13.1.11 REST OF EUROPE

14 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 EMR PROVIDERS

16.2 ALLSCRIPTS HEALTHCARE, LLC AND/OR ITS AFFILIATES.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 NXGN MANAGEMENT, LLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 EPIC SYSTEMS CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 MEDICAL INFORMATION TECHNOLOGY, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 TEGRATION PROVIDERS

16.7 INFOR.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 LYNIATE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 QVERA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 INTERSYSTEM CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL ELECTRIC HEALTHCARE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 COMPANY SHARE ANALYSIS

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENTS

16.12 INTERFACEWARE INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ORION HEALTH GROUP

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 IBM (2021)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 COMPANY SHARE ANALYSIS

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENTS

16.15 SUMMIT HEALTHCARE SERVICES, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MASIMO (2021)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 MDI SOLUTIONS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 COGNIZANT

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SIEMENS HEALTHCARE GMBH

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 COMPANY SHARE ANALYSIS

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENTS

16.2 REDOX, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 BOTH PROVIDERS

16.22 ORACLE (2021)

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 COMPANY SHARE ANALYSIS

16.22.4 PRODUCT PORTFOLIO

16.22.5 RECENT DEVELOPMENTS

16.23 KONNKLIJKE PHILIPS N.V. (2021)

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 2 EUROPE SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 EUROPE PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 6 EUROPE INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 7 EUROPE MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 8 EUROPE MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 9 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE MEDICAL DEVICE INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE HOSPITAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE INTERNAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE RADIOLOGY INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE LAB INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE CLINICS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE OTHERS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE LARGE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE MEDIUM IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE SMALL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE GROUP PURCHASE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE INDIVIDUAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 25 EUROPE HOSPITAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE DIAGNOSTIC CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE RADIOLOGY CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE LABORATORY IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE CLINICS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE OTHERS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 33 EUROPE SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 34 EUROPE PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 35 EUROPE INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 36 EUROPE MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 37 EUROPE MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 38 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 GERMANY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 43 GERMANY SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 44 GERMANY PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 45 GERMANY INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 46 GERMANY MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 47 GERMANY MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 48 GERMANY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 GERMANY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 50 GERMANY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 51 GERMANY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 FRANCE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 53 FRANCE SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 54 FRANCE PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 55 FRANCE INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 56 FRANCE MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 57 FRANCE MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 58 FRANCE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 FRANCE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 60 FRANCE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 61 FRANCE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 U.K. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 63 U.K. SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 64 U.K. PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 65 U.K. INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 66 U.K. MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 67 U.K. MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 68 U.K. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 U.K. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 70 U.K. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 71 U.K. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 72 ITALY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 73 ITALY SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 74 ITALY PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 75 ITALY INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 76 ITALY MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 77 ITALY MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 78 ITALY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 ITALY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 80 ITALY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 81 ITALY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 RUSSIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 83 RUSSIA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 84 RUSSIA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 85 RUSSIA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 86 RUSSIA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 87 RUSSIA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 88 RUSSIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 RUSSIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 90 RUSSIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 91 RUSSIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 SPAIN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 93 SPAIN SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 94 SPAIN PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 95 SPA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 96 SPAIN MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 97 SPAIN MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 98 SPAIN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 SPAIN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 101 SPAIN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 TURKEY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 103 TURKEY SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 104 TURKEY PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 105 TURKEY INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 106 TURKEY MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 107 TURKEY MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 108 TURKEY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 TURKEY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 110 TURKEY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 111 TURKEY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 112 NETHERLANDS HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 113 NETHERLANDS SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 114 NETHERLANDS PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 115 NETHERLANDS INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 116 NETHERLANDS MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 117 NETHERLANDS MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 118 NETHERLANDS HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 NETHERLANDS HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 120 NETHERLANDS HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 121 NETHERLANDS HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 132 BELGIUM HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 133 BELGIUM SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 134 BELGIUM PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 135 BELGIUM INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 136 BELGIUM MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 137 BELGIUM MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 138 BELGIUM HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 139 BELGIUM HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 141 BELGIUM HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 142 REST OF EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 2 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR HEALTHCARE IT SOLUTION, TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS ARE EXPECTED TO DRIVE THE EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

FIGURE 14 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2021

FIGURE 15 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 16 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, CAGR (2022-2029)

FIGURE 17 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, LIFELINE CURVE

FIGURE 18 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2021

FIGURE 19 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 20 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 21 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 22 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2021

FIGURE 23 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2022-2029 (USD MILLION)

FIGURE 24 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, CAGR (2022-2029)

FIGURE 25 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, LIFELINE CURVE

FIGURE 26 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2021

FIGURE 27 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 28 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 29 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, LIFELINE CURVE

FIGURE 30 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2021

FIGURE 31 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, CAGR (2022-2029)

FIGURE 33 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, LIFELINE CURVE

FIGURE 34 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SNAPSHOT (2021)

FIGURE 35 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021)

FIGURE 36 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT & SERVICES (2022-2029)

FIGURE 39 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.