Marché européen des joints et des garnitures d'étanchéité. Par type (joints et garnitures d'étanchéité), application (échangeurs de chaleur, récipients sous pression, couvercles de trou d'homme , trous d'homme, chapeaux de vanne, brides de tuyaux et autres), canal de distribution (OEM et marché secondaire), industrie (industrie du papier et de la pâte à papier, pétrole et gaz, électricité, automobile, aérospatiale, fabrication industrielle, marine et ferroviaire et autres) Tendances et prévisions de l'industrie jusqu'en 2030

Analyse et perspectives du marché des joints et des garnitures en Europe

Les joints assurent l'étanchéité d'une connexion entre deux composants et servent à combler les espaces vides entre deux surfaces, ce qui permet d'éviter les fuites et le gaspillage de fluides et de gaz dans l'application. Les produits de joints sont principalement utilisés comme joints statiques. Les produits d'étanchéité sont utilisés entre les pièces de moteur, les pompes et les arbres qui tournent plutôt que ceux qui sont statiques. Les joints et les joints sont spécialement conçus en fonction du type d'équipement et de la surface d'utilisation finale.

Les joints et les produits d'étanchéité assurent le bon fonctionnement des équipements rotatifs dans l'industrie manufacturière. Les produits d'étanchéité réduisent les coûts de maintenance, de réparation et d'exploitation (MRO) car ils sont capables de gérer les équipements sous haute pression et dans des conditions extrêmement difficiles. Plusieurs machines rotatives fonctionnent avec le système électrique et les produits d'étanchéité empêchent le fluide de pénétrer dans le système pour réduire les dommages.

Le rapport sur le marché des joints et des joints fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

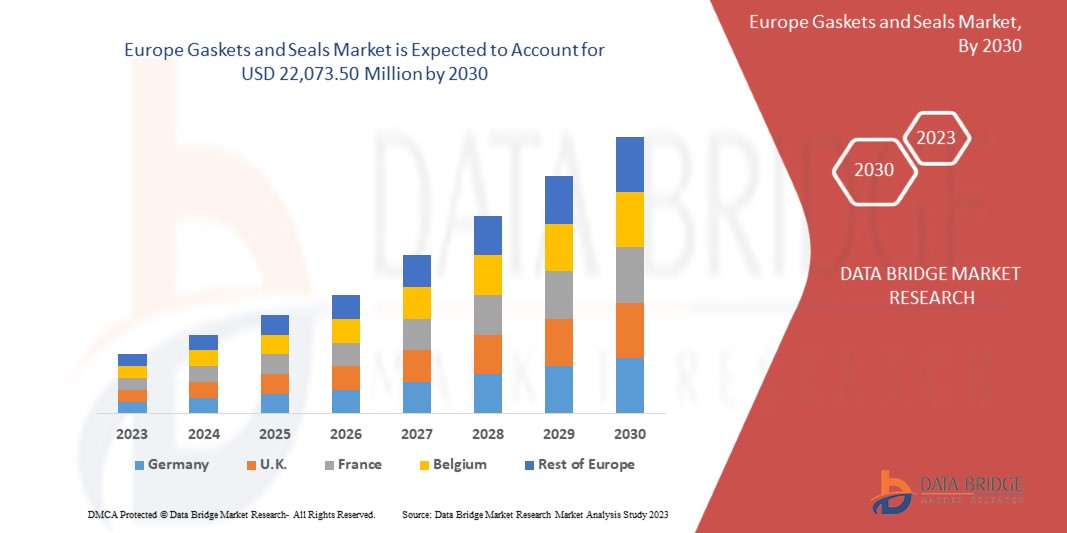

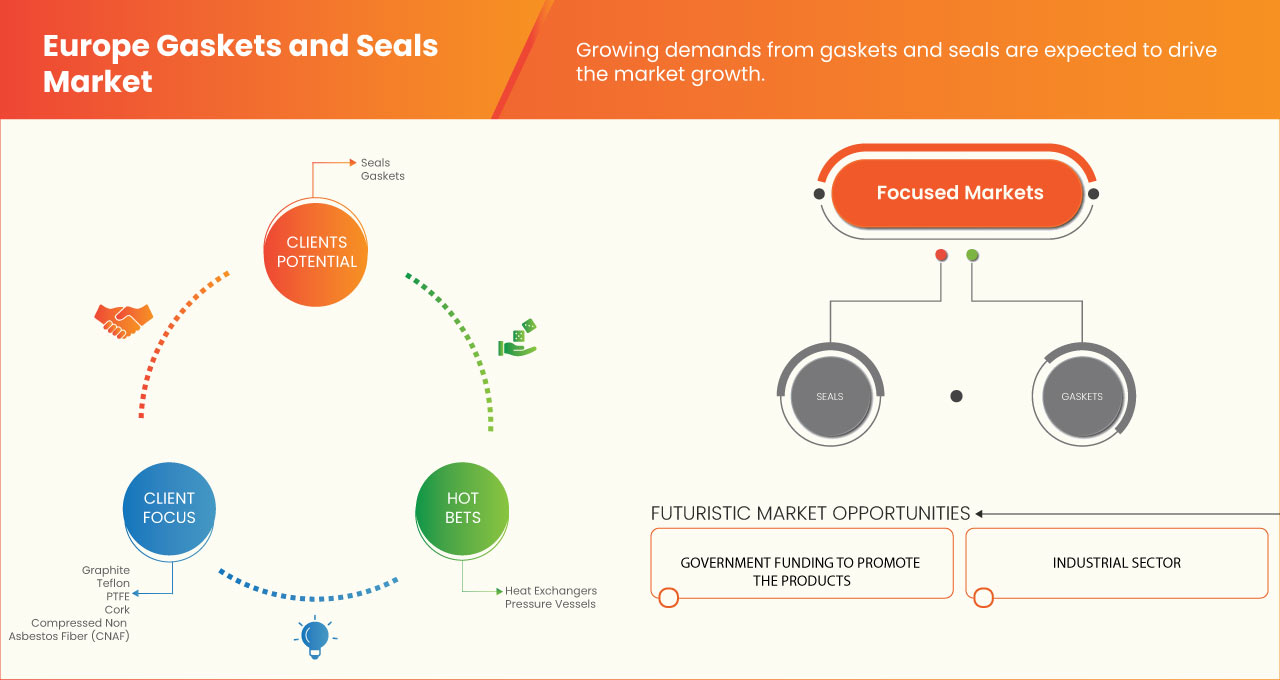

Le marché européen des joints et des joints devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît à un TCAC de 5,4 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 22 073,50 millions USD d'ici 2030. Le principal facteur à l'origine de la croissance des joints est la demande croissante de l'industrie automobile et les joints industriels ont des applications plus larges dans divers secteurs d'utilisation finale qui devraient stimuler la croissance du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (joints et joints d'étanchéité), application (échangeurs de chaleur, récipients sous pression, couvercles de trou d'homme, regards de visite, chapeaux de vanne, brides de tuyaux et autres), canal de distribution (OEM et marché secondaire), industrie (industrie du papier et de la pâte à papier, pétrole et gaz, électricité, automobile, aérospatiale, fabrication industrielle, marine et ferroviaire et autres). |

|

Pays couverts |

Allemagne, Royaume-Uni, Italie, France, Espagne, Russie, Turquie, Suisse, Belgique, Pays-Bas, reste de l'Europe. |

|

Acteurs du marché couverts |

SKF, Freudenberg FST GmbH (une filiale de Freudenberg), Flowserve Corporation, John Crane (une filiale de Smiths Group plc), BRUSS Sealing Systems GmbH, Trelleborg AB, ElringKlinger AG, Cooper Standard, GARLOCK FAMILY OF COMPANIES (une filiale d'EnPro Industries), Dätwyler Holding Inc., Lamons LGC US Asset Holdings, LLC (une filiale de TriMas), WL Gore & Associates, Inc., IDT, NICHIAS Corporation, Tenneco Inc, TT Gaskets, HAFF-Dichtungen GmbH., AMG Sealing Limited et PAR Group, entre autres. |

Définition du marché

Les joints et les bagues d'étanchéité sont de petits composants utilisés dans la fabrication de gros moteurs fonctionnant au carburant. Les joints et les bagues d'étanchéité ont pour fonction principale d'empêcher le mélange du fluide et d'empêcher les fuites de gaz du moteur. Les joints et les bagues d'étanchéité sont de formes différentes selon le moteur ou l'équipement utilisé dans l'industrie automobile, pétrolière et gazière.

Dynamique du marché

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

Demande croissante de joints dans l'automobile

Les joints sont des petits dispositifs ou substances utilisés pour joindre deux éléments dans le moteur afin d'éviter qu'ils ne se séparent et également pour empêcher tout passage entre eux. Les joints métalliques sont les petites pièces utilisées dans les équipements automobiles pour augmenter l'efficacité de la machine et réduire l'usure du moteur. Les joints de haute qualité peuvent survivre dans les véhicules lourds et aux vibrations extrêmes générées par le moteur en marche.

-

Utilisation croissante des équipements rotatifs dans les industries manufacturières

Avec la demande croissante de produits finis dans toutes les régions, la demande d'équipements dans l'industrie manufacturière a également augmenté. Plusieurs types de processus sont réalisés dans l'industrie qui nécessitent différentes machines pour la fabrication de produits finis. Les machines ont différents types de moteurs qui peuvent fonctionner au gaz ou au carburant. Pour réduire la friction entre les pièces des machines et l'usure, des joints et des produits de garniture sont utilisés.

Opportunités

-

Introduction de la haute technologie pour le contrôle de la qualité des joints et des produits d'étanchéité

Les joints et les garnitures sont une partie très petite de l'équipement mais jouent un rôle majeur car ils empêchent les fluides et les substances gazeuses de pénétrer dans la machine. Il est donc très important de garantir la qualité des joints ou des produits de joint avant de les mettre en œuvre dans la machine ou le moteur. Les joints et les produits de joint sont fabriqués sous différentes formes et matériaux selon l'application. Plusieurs contrôles sont effectués manuellement par les fabricants au cours du processus de fabrication dans l'industrie.

-

Introduction des scellés d'autosurveillance

Les machines ou les moteurs installés dans les usines ou dans l'industrie automobile sont conçus pour une longue durée mais sont utilisés régulièrement, ce qui entraîne une usure plus importante des pièces à l'intérieur du moteur. Les produits d'étanchéité installés avec la machine doivent fonctionner sous des pressions et des températures différentes, ce qui augmente l'usure des produits d'étanchéité. Plusieurs types de lubrifiants sont utilisés dans les machines, qui impliquent différentes compositions chimiques qui affectent parfois également la composition des produits d'étanchéité.

Restreindre/défier

- Changements dans les moteurs automobiles

Avec le développement du secteur automobile, de nouveaux moteurs ont été introduits, ce qui nécessite la production de différents types de joints et de garnitures sur le marché. Le fabricant a du mal à écouler ses anciens stocks, ce qui entraîne d'énormes pertes pour les fabricants. L'arrivée du moteur BS4 dans les pays en développement a modifié plusieurs pièces de rechange du moteur, ce qui oblige les fabricants à produire des joints et des garnitures de différentes dimensions.

Développement récent

- En avril 2020, Trelleborg AB a décidé de lancer la nouvelle génération de joints coupe-feu, qui sont utilisés dans l'industrie automobile et aérospatiale. Ce développement aide l'entreprise à augmenter ses revenus.

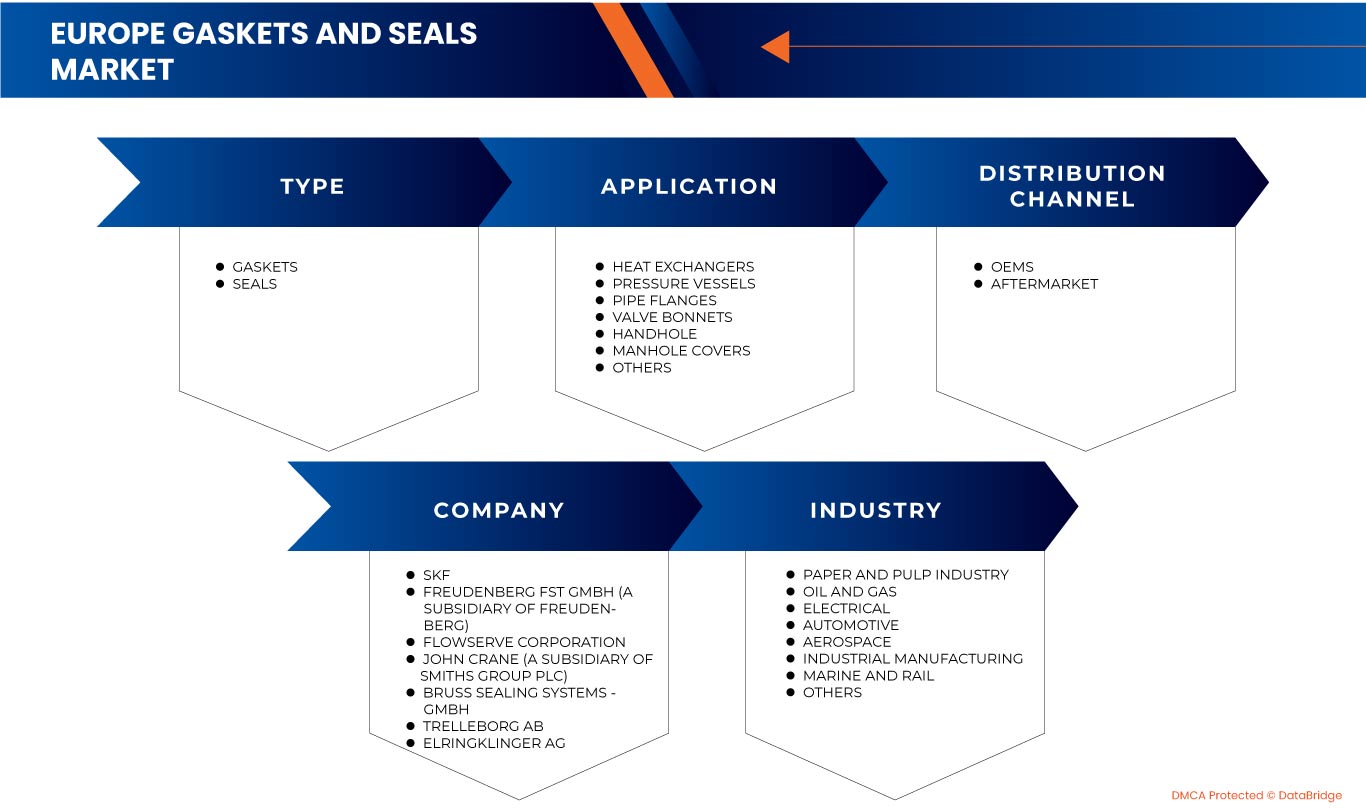

Portée et taille du marché des joints et des joints en Europe

Le marché européen des joints et des bagues d'étanchéité est classé par type, application, canal de distribution et industrie. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Taper

- Joints

- Scellés

Sur la base du type, le marché est segmenté en joints et en joints d'étanchéité.

Application

- Échangeurs de chaleur à réservoir sous pression

- Couvercles de regards

- Trou d'homme

- chapeaux de soupape

- Brides de tuyaux

- Autres

Sur la base de l'application, le marché est segmenté en échangeurs de chaleur, récipients sous pression, couvercles de regards, regards de visite, chapeaux de vannes, brides de tuyaux et autres.

Canal de distribution

- OEM

- Pièces de rechange

Sur la base du canal de distribution, le marché est segmenté en OEM et marché secondaire.

Industrie

- Industrie du papier et de la pâte à papier

- Pétrole et gaz

- Électrique

- Automobile

- Aérospatial

- Fabrication industrielle

- Marine et ferroviaire

- Autres

Sur la base de l'industrie, le marché est segmenté en industrie du papier et de la pâte à papier, pétrole et gaz, électricité, automobile, aérospatiale, fabrication industrielle, marine et ferroviaire et autres.

Analyse du marché des joints et des garnitures d'étanchéité au niveau régional/national

Le marché européen est analysé et des informations sur la taille du marché sont fournies par pays, type, application, canal de distribution et industrie, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché européen des joints et des joints sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, la Russie, la Turquie, la Belgique, les Pays-Bas, la Suisse, la Pologne et le reste de l'Europe.

Le marché européen des joints et des joints domine le marché en raison de la forte utilisation des joints dans l’industrie pétrolière et gazière de la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données du pays.

Croissance de l'industrie des joints et des garnitures

Le marché européen des joints et des garnitures vous fournit également une analyse détaillée du marché pour chaque pays, la croissance de la base installée de différents types de produits pour le marché des joints et des garnitures, l'impact de la technologie utilisant des courbes de vie et les changements dans les scénarios réglementaires des préparations pour nourrissons et leur impact sur le marché des joints et des garnitures. Les données sont disponibles pour la période historique de 2010 à 2019.

Analyse du paysage concurrentiel et des parts de marché des joints et des joints d'étanchéité

Le paysage concurrentiel du marché européen des joints et des garnitures fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et la respiration du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché européen des joints et des garnitures.

Français Les principaux acteurs couverts dans le rapport sont SKF, Freudenberg FST GmbH (une filiale de Freudenberg), Flowserve Corporation, John Crane (une filiale de Smiths Group plc), BRUSS Sealing Systems GmbH, Trelleborg AB, ElringKlinger AG, Cooper Standard, GARLOCK FAMILY OF COMPANIES (une filiale d'EnPro Industries), Dätwyler Holding Inc., Lamons LGC US Asset Holdings, LLC (une filiale de TriMas), WL Gore & Associates, Inc., IDT, NICHIAS Corporation, Tenneco Inc, TT Gaskets, HAFF-Dichtungen GmbH., AMG Sealing Limited et PAR Group, entre autres.

Les analystes DBMR comprennent les atouts concurrentiels et fournissent une analyse concurrentielle pour chaque concurrent séparément.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of EUROPE GASKETS AND SEALS MARKET

- LIMITATION

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- Type LIFE LINE CURVE

- MULTIVARIATE MODELING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- MARKET APPLICATION COVERAGE GRID

- DBMR MARKET CHALLENGE MATRIX

- vendor share analysis

- IMPORT-EXPORT DATA

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Distributors List

- VALUE CHAIN ANALYSIS

- POTER’S FIVE FORCE ANALYSIS

- market overview

- drivers

- Increasing demand of seals in automotive

- Increasing usage of rotating equipment in manufacturing industries

- Increasing use of gaskets and seals in oil and gas industry

- Growing stringent industrial emission standards

- Rise in commercial aerospace industry

- Restraints

- Increasing wastage of raw materials

- Difficulty in mechanical joint gaskets

- Opportunities

- Introduction of high technology for checking the quality of gaskets and sealing products

- Introduction of self-monitoring seals

- Increasing use of composite materials

- Challenges

- Changes in automotive engines

- Fluctuation in raw material price

- Rising Environment effects from Rubber Seals

- COVID-19 IMPACT ON EUROPE GASKETS AND SEALS MARKET

- ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- PRICE IMPACT

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe Gaskets and Seals market, BY Type

- overview

- Seals

- Seals segment are further divided by Form

- Round

- Flat

- Others

- Seals segment are further divided by Type

- Environmental Seals

- Liquid Seals

- Anti Vibration

- Mountings

- Others

- Gaskets

- Gaskets segment are further divided by type

- Metallic

- METALLIC SEGMENT ARE FURTHER DIVIDED BY MATERIALS

- Rubber

- Graphite

- Teflon

- PTFE

- Cork

- Compressed Non Asbestos Fiber (CNAF)

- Others

- Non-Metallic

- NON-METALLIC SEGMENT ARE FURTHER DIVIDED BY MATERIALS

- Rubber

- Graphite

- Teflon

- PTFE

- Cork

- Compressed Non Asbestos Fiber (CNAF)

- Others

- Composite

- COMPOSITE SEGMENT ARE FURTHER DIVIDED BY MATERIALS

- Rubber

- Graphite

- Teflon

- PTFE

- Cork

- Compressed Non Asbestos Fiber (CNAF)

- Others

- Gaskets segment are further divided by PRODUCT

- Ring Gasket

- Sheet Gaskets

- SHEET GASKETS SEGMENT ARE FURTHER DIVIDED BY TYPE

- Spiral Wound Gaskets

- Camprofile Gaskets

- Jacketed Gasket

- JACKETED GASKET SEGMENT ARE FURTHER DIVIDED BY TYPE

- Double Jacketed

- Metal Jacket Laminates

- Double Jacketed Corrugated

- Others

- Octagonal Ring Gasket

- Others

- Gaskets segment are further divided by Flat Surfaces

- Flange

- FLANGE SEGMENT ARE FURTHER DIVIDED BY TYPE

- Spiral

- Ring Joint

- Soft

- Component

- Gaskets segment are further divided by FORM

- Manway Gaskets

- Trasformer Gaskets

- Others

- Gaskets segment are further divided by Thickness

- 0.5 MM

- 2.0 MM

- 2.5 MM

- 3.00 MM

- 3.5 MM

- 3.75 MM

- 4.5 MM

- 5.0 MM

- Others

- Europe Gaskets and Seals market, BY Application

- overview

- Heat Exchangers

- Pressure Vessels

- Pipe Flanges

- Valve Bonnets

- Handhole

- Manhole Covers

- Others

- Europe Gaskets and Seals market, BY Distribution Channel

- overview

- OEMS

- Aftermarket

- Europe Gaskets and Seals market, BY Industry

- overview

- Automotive

- Automotive segment are further divided by Application

- Cars

- Boats

- Trains

- Others

- Automotive segment are further divided by type

- Seals

- Gaskets

- Marine and Rail

- Marine and Rail segment are further divided by type

- Seals

- Gaskets

- Aerospace

- Aerospace segment are further divided by type

- Seals

- Gaskets

- Oil and Gas

- Oil and Gas segment are further divided by type

- Seals

- Gaskets

- Industrial Manufacturing

- Industrial Manufacturing segment are further divided by type

- Seals

- Gaskets

- Electrical

- Electrical segment are further divided by type

- Seals

- Gaskets

- Paper and Pulp Industry

- Paper and Pulp segment are further divided by type

- Seals

- Gaskets

- Others

- Others segment are further divided by type

- Seals

- Gaskets

- EUROPE Gaskets and Seals Market, BY GEOGRAPHY

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Netherlands

- Belgium

- Russia

- Turkey

- Switzerland

- Rest of Europe

- EUROPE GASKETS AND SEALS Market: COMPANY landscape

- company share analysis: EUROPE

- swot

- company profile

- Freudenberg FST GmbH (a Subsidiary of Freudenberg)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- SKF

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- IDT

- COMPANY SNAPSHOT

- company share analysis

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Flowserve Corporation

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- SSP Manufacturing Inc.

- COMPANY SNAPSHOT

- company share analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- A.J. Rubber & Sponge Ltd.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- BRUSS Sealing Systems GmbH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Cooper Standard

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Dätwyler Holding Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- ElringKlinger AG

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- GARLOCK FAMILY OF COMPANIES (a Subsidiary of EnPro Industries)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- John Crane (a Subsidiary of Smiths Group plc)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Lamons LGC US Asset Holdings, LLC (a Subsidiary of TriMas)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Trelleborg AB

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- W. L. Gore & Associates, Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- questionnaire

- related reports

Liste des tableaux

TABLE 1 IMPORT DATA of Gaskets, washers and other seals of vulcanised rubber (excluding hard rubber and those of cellular rubber); HS Code - 401693 (USD Thousand)

TABLE 2 EXPORT DATA of Gaskets, washers and other seals of vulcanised rubber (excluding hard rubber and those of cellular rubber); HS Code - 401693 (USD Thousand)

TABLE 3 New MoDEL AnnOUNCEMENT OF ELECTRICAL CARS

TABLE 4 Europe Gaskets and Seals market, BY Type, 2019-2028 (USD million)

TABLE 5 Europe Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 6 Europe Seals in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 7 Europe Seals in gaskets and seals Market, By Region,2019-2028 (Million Units)

TABLE 8 Europe Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 9 Europe Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 10 Europe Gaskets in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 11 Europe Gaskets in gaskets and seals Market, By Region,2019-2028 (Million Units)

TABLE 12 Europe Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 13 Europe Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 14 Europe Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 15 Europe Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 16 Europe Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 17 Europe Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 18 Europe Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 19 Europe Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 20 Europe Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 21 Europe Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 22 Europe Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 23 Europe Gaskets and Seals market, BY Application, 2019-2028 (USD million)

TABLE 24 Europe Heat Exchangers in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 25 Europe Pressure Vessels in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 26 Europe Pipe Flanges in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 27 Europe Valve Bonnets in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 28 Europe Handhole in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 29 Europe Manhole Covers in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 30 Europe Others in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 31 Europe Gaskets and Seals market, BY Distribution Channel, 2019-2028 (USD million)

TABLE 32 Europe OEMS in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 33 Europe Aftermarket in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 34 Europe Gaskets and Seals market, BY Industry, 2019-2028 (USD million)

TABLE 35 Europe Automotive in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 36 Europe Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 37 Europe Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 38 Europe Marine and Rail in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 39 Europe Gaskets and Seals MARKET, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 40 Europe Aerospace in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 41 Europe Gaskets and Seals MARKET, Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 42 Europe Oil and Gas in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 43 Europe Gaskets and Seals MARKET, Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 44 Europe Industrial Manufacturing in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 45 Europe Gaskets and Seals MARKET, Industrial Manufacturing, BY Type, 2019-2028 (USD Million)

TABLE 46 Europe Electrical in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 47 Europe Gaskets and Seals MARKET, Electrical, BY Type, 2019-2028 (USD Million)

TABLE 48 Europe Paper and Pulp Industry in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 49 Europe Gaskets and Seals MARKET, Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 50 Europe Others in gaskets and seals Market, By Region,2019-2028 (USD MILLION)

TABLE 51 Europe Gaskets and Seals MARKET, Others, BY Type, 2019-2028 (USD Million)

TABLE 52 Europe Gaskets and Seals Market, BY COUNTRY ,2019-2028

TABLE 53 Europe Gaskets and Seals Market, BY COUNTRY,2019-2028 (Million Units)

TABLE 54 Europe Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 55 Europe Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 56 Europe Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 57 Europe Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 58 Europe Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 59 Europe Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 60 Europe Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 61 Europe Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 62 Europe Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 63 Europe Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 64 Europe Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 65 Europe Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 66 Europe Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 67 Europe Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 68 Europe Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 69 Europe Gaskets and Seals Market, By Application, 2019-2028 (USD Million)

TABLE 70 Europe Gaskets and Seals Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 71 Europe Gaskets and Seals Market, By Industry, 2019-2028 (USD Million)

TABLE 72 Europe Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 73 Europe Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 74 Europe Gaskets and Seals Market, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 75 Europe Gaskets and Seals Market,Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 76 Europe Gaskets and Seals Market,Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 77 Europe Gaskets and Seals Market,Industrial Manufacturing , BY Type, 2019-2028 (USD Million)

TABLE 78 Europe Gaskets and Seals Market,Electrical, BY Type, 2019-2028 (USD Million)

TABLE 79 Europe Gaskets and Seals Market,Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 80 Europe Gaskets and Seals Market,Others, BY Type, 2019-2028 (USD Million)

TABLE 81 Germany Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 82 Germany Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 83 Germany Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 84 Germany Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 85 Germany Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 86 Germany Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 87 Germany Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 88 Germany Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 89 Germany Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 90 Germany Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 91 Germany Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 92 Germany Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 93 Germany Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 94 Germany Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 95 Germany Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 96 Germany Gaskets and Seals Market, By Application, 2019-2028 (USD Million)

TABLE 97 Germany Gaskets and Seals Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 98 Germany Gaskets and Seals Market, By Industry, 2019-2028 (USD Million)

TABLE 99 Germany Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 100 Germany Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 101 germany Gaskets and Seals Market, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 102 Germany Gaskets and Seals Market,Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 103 Germany Gaskets and Seals Market,Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 104 Germany Gaskets and Seals Market,Industrial Manufacturing , BY Type, 2019-2028 (USD Million)

TABLE 105 Germany Gaskets and Seals Market,Electrical, BY Type, 2019-2028 (USD Million)

TABLE 106 Germany Gaskets and Seals Market,Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 107 Germany Gaskets and Seals Market,Others, BY Type, 2019-2028 (USD Million)

TABLE 108 U.K. Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 109 U.K. Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 110 U.K. Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 111 U.K. Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 112 U.K. Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 113 U.K. Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 114 U.K. Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 115 U.K. Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 116 U.K. Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 117 U.K. Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 118 U.K. Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 119 U.K. Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 120 U.K. Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 121 U.K. Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 122 U.K. Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 123 U.K. Gaskets and Seals Market, By Application, 2019-2028 (USD Million)

TABLE 124 U.K. Gaskets and Seals Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 125 U.K. Gaskets and Seals Market, By Industry, 2019-2028 (USD Million)

TABLE 126 U.K. Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 127 U.K. Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 128 U.K. Gaskets and Seals Market, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 129 U.K. Gaskets and Seals Market,Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 130 U.K. Gaskets and Seals Market,Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 131 U.K. Gaskets and Seals Market,Industrial Manufacturing , BY Type, 2019-2028 (USD Million)

TABLE 132 U.K. Gaskets and Seals Market,Electrical, BY Type, 2019-2028 (USD Million)

TABLE 133 U.K. Gaskets and Seals Market,Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 134 U.K. Gaskets and Seals Market,Others, BY Type, 2019-2028 (USD Million)

TABLE 135 France Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 136 France Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 137 France Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 138 France Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 139 France Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 140 France Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 141 France Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 142 France Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 143 France Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 144 France Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 145 France Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 146 France Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 147 France Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 148 France Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 149 France Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 150 France Gaskets and Seals Market, By Application, 2019-2028 (USD Million)

TABLE 151 France Gaskets and Seals Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 152 France Gaskets and Seals Market, By Industry, 2019-2028 (USD Million)

TABLE 153 France Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 154 France Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 155 france Gaskets and Seals Market, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 156 France Gaskets and Seals Market,Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 157 France Gaskets and Seals Market,Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 158 France Gaskets and Seals Market,Industrial Manufacturing , BY Type, 2019-2028 (USD Million)

TABLE 159 France Gaskets and Seals Market,Electrical, BY Type, 2019-2028 (USD Million)

TABLE 160 France Gaskets and Seals Market,Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 161 France Gaskets and Seals Market,Others, BY Type, 2019-2028 (USD Million)

TABLE 162 Italy Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 163 Italy Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 164 Italy Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 165 Italy Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 166 Italy Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 167 Italy Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 168 Italy Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 169 Italy Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 170 Italy Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 171 Italy Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 172 Italy Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 173 Italy Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 174 Italy Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 175 Italy Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 176 Italy Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 177 Italy Gaskets and Seals Market, By Application, 2019-2028 (USD Million)

TABLE 178 Italy Gaskets and Seals Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 179 Italy Gaskets and Seals Market, By Industry, 2019-2028 (USD Million)

TABLE 180 Italy Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 181 Italy Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 182 Italy Gaskets and Seals Market, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 183 Italy Gaskets and Seals Market,Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 184 Italy Gaskets and Seals Market,Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 185 Italy Gaskets and Seals Market,Industrial Manufacturing , BY Type, 2019-2028 (USD Million)

TABLE 186 Italy Gaskets and Seals Market,Electrical, BY Type, 2019-2028 (USD Million)

TABLE 187 Italy Gaskets and Seals Market,Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 188 Italy Gaskets and Seals Market,Others, BY Type, 2019-2028 (USD Million)

TABLE 189 Spain Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 190 Spain Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 191 Spain Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 192 Spain Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 193 Spain Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 194 Spain Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 195 Spain Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 196 Spain Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 197 Spain Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 198 Spain Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 199 Spain Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 200 Spain Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 201 Spain Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 202 Spain Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 203 Spain Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 204 Spain Gaskets and Seals Market, By Application, 2019-2028 (USD Million)

TABLE 205 Spain Gaskets and Seals Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 206 Spain Gaskets and Seals Market, By Industry, 2019-2028 (USD Million)

TABLE 207 Spain Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 208 Spain Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 209 Spain Gaskets and Seals Market, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 210 Spain Gaskets and Seals Market,Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 211 Spain Gaskets and Seals Market,Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 212 Spain Gaskets and Seals Market,Industrial Manufacturing , BY Type, 2019-2028 (USD Million)

TABLE 213 Spain Gaskets and Seals Market,Electrical, BY Type, 2019-2028 (USD Million)

TABLE 214 Spain Gaskets and Seals Market,Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 215 Spain Gaskets and Seals Market,Others, BY Type, 2019-2028 (USD Million)

TABLE 216 Netherlands Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 217 Netherlands Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 218 Netherlands Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 219 Netherlands Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 220 Netherlands Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 221 Netherlands Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 222 Netherlands Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 223 Netherlands Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 224 Netherlands Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 225 Netherlands Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 226 Netherlands Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 227 Netherlands Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 228 Netherlands Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 229 Netherlands Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 230 Netherlands Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 231 Netherlands Gaskets and Seals Market, By Application, 2019-2028 (USD Million)

TABLE 232 Netherlands Gaskets and Seals Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 233 Netherlands Gaskets and Seals Market, By Industry, 2019-2028 (USD Million)

TABLE 234 Netherlands Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 235 Netherlands Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 236 Netherlands Gaskets and Seals Market, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 237 Netherlands Gaskets and Seals Market,Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 238 Netherlands Gaskets and Seals Market,Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 239 Netherlands Gaskets and Seals Market,Industrial Manufacturing , BY Type, 2019-2028 (USD Million)

TABLE 240 Netherlands Gaskets and Seals Market,Electrical, BY Type, 2019-2028 (USD Million)

TABLE 241 Netherlands Gaskets and Seals Market,Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 242 Netherlands Gaskets and Seals Market,Others, BY Type, 2019-2028 (USD Million)

TABLE 243 Belgium Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 244 Belgium Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 245 Belgium Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 246 Belgium Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 247 Belgium Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 248 Belgium Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 249 Belgium Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 250 Belgium Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 251 Belgium Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 252 Belgium Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 253 Belgium Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 254 Belgium Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 255 Belgium Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 256 Belgium Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 257 Belgium Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 258 Belgium Gaskets and Seals Market, By Application, 2019-2028 (USD Million)

TABLE 259 Belgium Gaskets and Seals Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 260 Belgium Gaskets and Seals Market, By Industry, 2019-2028 (USD Million)

TABLE 261 Belgium Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 262 Belgium Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 263 Belgium Gaskets and Seals Market, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 264 Belgium Gaskets and Seals Market,Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 265 Belgium Gaskets and Seals Market,Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 266 Belgium Gaskets and Seals Market,Industrial Manufacturing , BY Type, 2019-2028 (USD Million)

TABLE 267 Belgium Gaskets and Seals Market,Electrical, BY Type, 2019-2028 (USD Million)

TABLE 268 Belgium Gaskets and Seals Market,Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 269 Belgium Gaskets and Seals Market,Others, BY Type, 2019-2028 (USD Million)

TABLE 270 Russia Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 271 Russia Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 272 Russia Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 273 Russia Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 274 Russia Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 275 Russia Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 276 Russia Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 277 Russia Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 278 Russia Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 279 Russia Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 280 Russia Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 281 Russia Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 282 Russia Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 283 Russia Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 284 Russia Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 285 Russia Gaskets and Seals Market, By Application, 2019-2028 (USD Million)

TABLE 286 Russia Gaskets and Seals Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 287 Russia Gaskets and Seals Market, By Industry, 2019-2028 (USD Million)

TABLE 288 Russia Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 289 Russia Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 290 Russia Gaskets and Seals Market, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 291 Russia Gaskets and Seals Market,Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 292 Russia Gaskets and Seals Market,Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 293 Russia Gaskets and Seals Market,Industrial Manufacturing , BY Type, 2019-2028 (USD Million)

TABLE 294 Russia Gaskets and Seals Market,Electrical, BY Type, 2019-2028 (USD Million)

TABLE 295 Russia Gaskets and Seals Market,Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 296 Russia Gaskets and Seals Market,Others, BY Type, 2019-2028 (USD Million)

TABLE 297 Turkey Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 298 Turkey Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 299 Turkey Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 300 Turkey Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 301 Turkey Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 302 Turkey Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 303 Turkey Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 304 Turkey Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 305 Turkey Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 306 Turkey Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 307 Turkey Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 308 Turkey Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 309 Turkey Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 310 Turkey Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 311 Turkey Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 312 Turkey Gaskets and Seals Market, By Application, 2019-2028 (USD Million)

TABLE 313 Turkey Gaskets and Seals Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 314 Turkey Gaskets and Seals Market, By Industry, 2019-2028 (USD Million)

TABLE 315 Turkey Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 316 Turkey Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 317 Turkey Gaskets and Seals Market, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 318 Turkey Gaskets and Seals Market,Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 319 Turkey Gaskets and Seals Market,Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 320 Turkey Gaskets and Seals Market,Industrial Manufacturing , BY Type, 2019-2028 (USD Million)

TABLE 321 Turkey Gaskets and Seals Market,Electrical, BY Type, 2019-2028 (USD Million)

TABLE 322 Turkey Gaskets and Seals Market,Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 323 Turkey Gaskets and Seals Market,Others, BY Type, 2019-2028 (USD Million)

TABLE 324 Switzerland Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 325 Switzerland Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

TABLE 326 Switzerland Gaskets and Seals Market, Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 327 Switzerland Gaskets and Seals Market, Metallic, By Materials, 2019-2028 (USD Million)

TABLE 328 Switzerland Gaskets and Seals Market, Non-Metallic,By Materials, 2019-2028 (USD Million)

TABLE 329 Switzerland Gaskets and Seals Market, Composite, By Materials, 2019-2028 (USD Million)

TABLE 330 Switzerland Gaskets and Seals Market, Gaskets, By Product, 2019-2028 (USD Million)

TABLE 331 Switzerland Gaskets and Seals Market, Sheet Gaskets, BY Type, 2019-2028 (USD Million)

TABLE 332 Switzerland Gaskets and Seals Market, Jacketed Gasket, By Type, 2019-2028 (USD Million)

TABLE 333 Switzerland Gaskets and Seals Market, Gaskets, By Flat Surfaces, 2019-2028 (USD Million)

TABLE 334 Switzerland Gaskets and Seals Market,Flange, By Type, 2019-2028 (USD Million)

TABLE 335 Switzerland Gaskets and Seals Market,Gaskets, By Form, 2019-2028 (USD Million)

TABLE 336 Switzerland Gaskets and Seals Market,Gaskets, By Thickness, 2019-2028 (USD Million)

TABLE 337 Switzerland Gaskets and Seals Market,Seals, By Form, 2019-2028 (USD Million)

TABLE 338 Switzerland Gaskets and Seals Market,Seals, By Type, 2019-2028 (USD Million)

TABLE 339 Switzerland Gaskets and Seals Market, By Application, 2019-2028 (USD Million)

TABLE 340 Switzerland Gaskets and Seals Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 341 Switzerland Gaskets and Seals Market, By Industry, 2019-2028 (USD Million)

TABLE 342 Switzerland Gaskets and Seals Market,Automotive, BY Application, 2019-2028 (USD Million)

TABLE 343 Switzerland Gaskets and Seals Market,Automotive, BY Type, 2019-2028 (USD Million)

TABLE 344 Switzerland Gaskets and Seals Market, Marine and Rail, BY Type, 2019-2028 (USD Million)

TABLE 345 Switzerland Gaskets and Seals Market,Aerospace, BY Type, 2019-2028 (USD Million)

TABLE 346 Switzerland Gaskets and Seals Market,Oil and Gas, BY Type, 2019-2028 (USD Million)

TABLE 347 Switzerland Gaskets and Seals Market,Industrial Manufacturing , BY Type, 2019-2028 (USD Million)

TABLE 348 Switzerland Gaskets and Seals Market,Electrical, BY Type, 2019-2028 (USD Million)

TABLE 349 Switzerland Gaskets and Seals Market,Paper and Pulp, BY Type, 2019-2028 (USD Million)

TABLE 350 Switzerland Gaskets and Seals Market,Others, BY Type, 2019-2028 (USD Million)

TABLE 351 Rest of Europe Gaskets and Seals Market, By Type, 2019-2028 (USD Million)

TABLE 352 Rest of Europe Gaskets and Seals Market, By Type, 2019-2028 (Million Units)

Liste des figures

FIGURE 1 EUROPE GASKETS AND SEALS MARKET: segmentation

FIGURE 2 EUROPE GASKETS AND SEALS MARKET: data triangulation

FIGURE 3 EUROPE GASKETS AND SEALS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE GASKETS AND SEALS MARKET: Europe VS. regional MARKET analysis

FIGURE 5 EUROPE GASKETS AND SEALS MARKET: company research analysis

FIGURE 6 EUROPE GASKETS AND SEALS MARKET: THE type LIFE LINE CURVE

FIGURE 7 EUROPE GASKETS AND SEALS MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE GASKETS AND SEALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE GASKETS AND SEALS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE GASKETS AND SEALS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE GASKETS AND SEALS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE Gaskets and seals Market: vendor share analysis

FIGURE 13 EUROPE GASKETS AND SEALS MARKET: SEGMENTATION

FIGURE 14 INCREASING USage OF rotating equipment in MANUFACTURING industries IS DRIVING EUROPE gaskets and seals market in the forecast period of 2021 to 2028

FIGURE 15 Seals SEGMENT is expected to account for the largest share of the EUROPE GASKETS AND SEALS MARKET in 2021 & 2028

FIGURE 16 DRIVERS, RESTRAINTs, OPPORTUNITies AND CHALLENGEs OF Europe gaskets and seals market

FIGURE 17 Europe Gaskets and Seals market: BY Type, 2020

FIGURE 18 Europe Gaskets and Seals market: BY Application, 2020

FIGURE 19 Europe Gaskets and Seals market: BY Distribution Channel, 2020

FIGURE 20 Europe Gaskets and Seals market: BY Industry, 2020

FIGURE 21 EUROPE Gaskets and Seals market: SNAPSHOT (2020)

FIGURE 22 EUROPE Gaskets and Seals market: by COUNTRY (2020)

FIGURE 23 EUROPE Gaskets and Seals market: by COUNTRY (2021 & 2028)

FIGURE 24 EUROPE Gaskets and Seals market: by COUNTRY (2020 & 2028)

FIGURE 25 EUROPE Gaskets and Seals market: by TYPE (2021-2028)

FIGURE 26 EUROPE Gaskets and Seals Market: company share 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.