Marché européen des cartes de carburant pour flottes commerciales, par type de carte (cartes de carburant universelles, cartes de carburant de marque, cartes de carburant pour commerçants), fonctionnalités (rapports sur les véhicules, conformité EMV, tokenisation, mises à jour en temps réel, paiement mobile et transactions sans carte, autres), type d'abonnement (carte enregistrée, carte au porteur), utilitaire (frais de stationnement des véhicules, paiement des frais d'huile, entretien de la flotte, paiement des frais de péage, autres), utilisateur final (flottes de livraison, flottes de taxis, flottes de location de voitures, flottes de services publics, autres), pays (Royaume-Uni, Allemagne, France, Italie, Espagne, Russie, Pays-Bas, Belgique, Suisse, Turquie et reste de l'Europe) Tendances et prévisions du secteur jusqu'en 2029

Analyse et perspectives du marché : Marché européen des cartes de carburant pour flottes commerciales

Analyse et perspectives du marché : Marché européen des cartes de carburant pour flottes commerciales

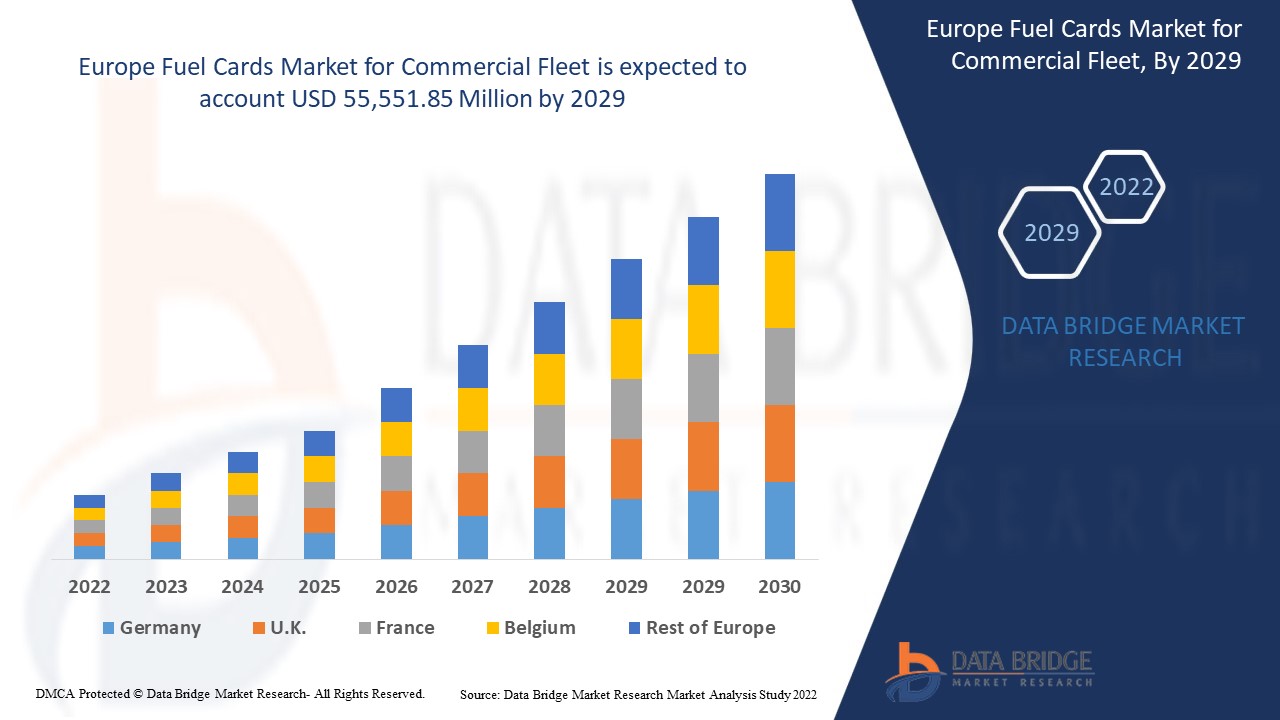

Le marché européen des cartes de carburant pour les flottes commerciales devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,3 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 55 551,85 millions USD d'ici 2029. L'augmentation de la demande de gadgets liés à la domotique intelligente stimule le marché.

Une carte de carburant est un moyen pratique de payer l'essence, le diesel et d'autres carburants dans les stations-service. Plutôt que de payer en espèces, par carte de crédit ou par chèque, le conducteur remet la carte de carburant à la place. Elles offrent divers avantages aux fournisseurs de flottes en capturant des données de bas niveau sur le kilométrage des véhicules, les gallons de carburant remplis et la nécessité d'entretenir le véhicule. En outre, leurs fournisseurs de services ont commencé à intégrer une interface télématique et des fonctions de reporting robustes en tant qu'offres de produits standard pour améliorer la productivité de la gestion de flotte. En outre, l'augmentation de la préférence pour la numérisation des paiements et l'influence de l' Internet des objets (IoT) complètent considérablement la croissance du marché des cartes de carburant.

La demande croissante de surveillance des achats de véhicules et de la consommation de carburant est le principal facteur moteur du marché. L'utilisation croissante de skimmers pour dissimuler les achats afin de voler du carburant peut s'avérer être un défi, mais la disponibilité de remises lucratives sur les cartes de carburant s'avère être une opportunité. Le taux d'intérêt plus élevé de la carte sur l'achat de carburant peut constituer un frein à l'adoption des stores extérieurs.

Le rapport sur le marché des cartes de carburant pour les flottes commerciales fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché des cartes de carburant pour les flottes commerciales, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des cartes de carburant pour les flottes commerciales en Europe

Portée et taille du marché des cartes de carburant pour les flottes commerciales en Europe

Le marché européen des cartes de carburant pour flottes commerciales est segmenté en cinq segments notables : le type de carte, les fonctionnalités, le type d'abonnement, l'utilité et l'utilisateur final.

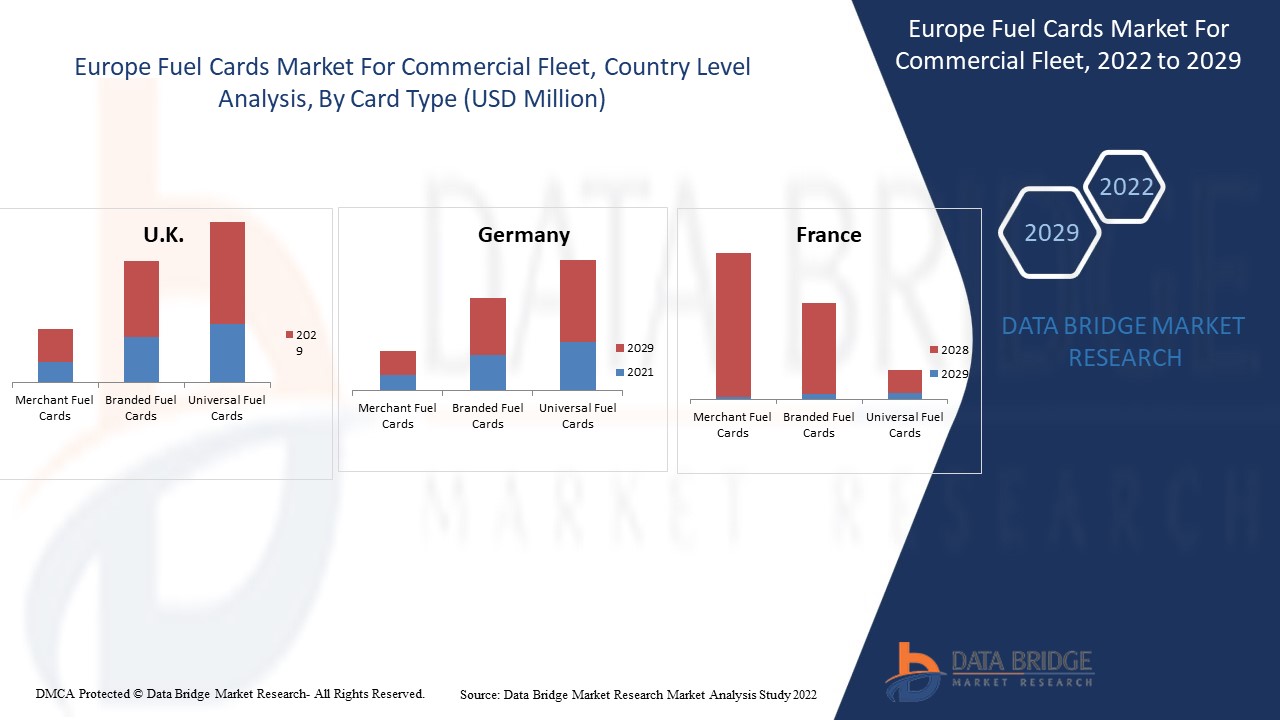

- Sur la base du type de carte, le marché européen des cartes carburant pour flottes commerciales est segmenté en cartes carburant universelles, cartes de marque et cartes de commerçants. En 2022, les cartes carburant universelles occupent le segment le plus élevé car elles offrent flexibilité, contrôle et commodité pour tous les besoins d'achat des entreprises, permettant ainsi un contrôle plus strict des dépenses de l'entreprise.

- Sur la base des fonctionnalités, le marché européen des cartes de carburant pour flottes commerciales est segmenté en rapports sur les véhicules, conformité EMV, tokenisation, mises à jour en temps réel, paiement mobile et transactions sans carte, etc. En 2022, le paiement mobile et les transactions sans carte occupent le segment le plus élevé car ils offrent une couche de sécurité supplémentaire pour tous les types d'entreprises.

- En fonction du type d'abonnement, le marché européen des cartes carburant pour flottes commerciales est segmenté en cartes enregistrées et cartes au porteur. En 2022, la carte enregistrée occupe le segment le plus élevé car elle aide les propriétaires d'entreprise à suivre toutes les dépenses et offre plus de flexibilité dans le suivi des véhicules.

- Sur la base de l'utilité, le marché européen des cartes de carburant pour les flottes commerciales est segmenté en frais de stationnement des véhicules, paiement des frais de carburant, entretien de la flotte, paiement des frais de péage, etc. En 2022, le paiement des frais de carburant occupe le segment le plus élevé, car l'application des cartes de carburant est davantage présente dans les stations-service et les utilisateurs bénéficient de nombreux avantages tels que des remises en argent, des récompenses en points et

- Sur la base de l'utilisateur final, le marché européen des cartes carburant pour les flottes commerciales est segmenté en flottes de livraison, flottes de location de voitures, flottes de services publics, flottes de taxis et autres. En 2022, les flottes de livraison occupent le segment le plus élevé car elles contribuent à améliorer le service client grâce à une interface télématique pour une bonne gestion de la flotte.

Analyse du marché européen des cartes de carburant pour les flottes commerciales au niveau des pays

Analyse du marché européen des cartes de carburant pour les flottes commerciales au niveau des pays

Le marché des cartes de carburant pour flotte commerciale est analysé et des informations sur la taille du marché sont fournies par pays, type de carte, fonctionnalités, type d'abonnement, utilitaire et utilisateur final comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché européen des cartes de carburant pour les flottes commerciales sont l'Allemagne, la France, l'Italie, le Royaume-Uni, l'Espagne, la Russie, les Pays-Bas, la Suisse, la Belgique, la Turquie et le reste de l'Europe.

Le Royaume-Uni domine le marché en raison des progrès réalisés dans la recherche et le développement liés à la qualité et à la conception des stores extérieurs. L'Allemagne se classe en deuxième position en raison de la demande croissante de maisons économes en énergie dans le pays. La France se classe en troisième position en raison d'une sensibilisation croissante à la protection contre les rayons UV nocifs dans les espaces résidentiels et commerciaux.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

L’inclination croissante vers la banque numérique stimule la croissance du marché européen des cartes de carburant pour les flottes commerciales.

Le marché européen des cartes carburant pour flottes commerciales vous fournit également une analyse de marché détaillée pour chaque pays en termes de croissance sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2012 à 2020.

Analyse du paysage concurrentiel et des parts de marché des cartes de carburant pour les flottes commerciales en Europe

Le paysage concurrentiel du marché des cartes de carburant pour les flottes commerciales fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché des cartes de carburant pour les flottes commerciales.

Certains des principaux acteurs opérant sur le marché européen des cartes de carburant pour les flottes commerciales sont Exxon Mobil Corporation, Shell, UK Fuels Limited, WAG payment solutions, as, bp plc, DKV EURO SERVICE Gmbh + Co. KG, Wex Europe Services, UTA (une société Edenred), OMV Aktiengesellschaft et TotalEnergies, entre autres.

De nombreux développements, contrats, accords et extensions sont également initiés par les entreprises du monde entier qui accélèrent également le marché des cartes carburant pour les flottes commerciales.

Par exemple,

- En juillet 2021, UK Fuels Limited a étendu ses activités en augmentant son réseau à plus de 3 500 stations-service. Cette expansion a aidé l'entreprise à accroître sa clientèle en acquérant 97 % du marché européen, ce qui s'est traduit par une croissance du chiffre d'affaires et des bénéfices de l'entreprise.

- En septembre 2021, WAG Payment Solutions, as a étendu ses activités en Allemagne. Cette expansion permettra aux clients de l'entreprise d'utiliser leurs cartes Eurowag dans les stations-service TANKPOOL24 dans toute l'Allemagne. Cela aidera l'entreprise à inclure de nouveaux clients commerciaux dans son portefeuille de clients et contribuera également à diversifier le portefeuille de produits de l'entreprise.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché des cartes de carburant pour flotte commerciale, ce qui offre également l'avantage de la croissance des bénéfices de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FUEL CARDS FOR COMMERCIAL FLEET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 CARD TYPE TIMELINE CURVE

2.1 MARKET UTILITY COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CASE STUDIES

4.1.1 INTEGRAL

4.1.1.1 IDENTIFYING THE PROBLEM

4.1.1.2 SOLUTION

4.1.2 TOTAL PRODUCE

4.1.2.1 IDENTIFYING THE PROBLEM

4.1.2.2 SOLUTION

4.2 REGULATORY FRAMEWORK

4.2.1 PSD (PAYMENT SERVICE DIRECTIVE)

4.2.2 DIRECTIVE (EU) 2015/2366

4.3 TECHNOLOGICAL TRENDS

4.3.1 MOBILE & CONNECTED PAYMENTS

4.3.2 TELEMATICS INTERFACE

4.3.3 HOST CARD EMULATION

4.4 PRICING ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.6 TOP FLEET LEASING COMPANIES IN EUROPE

4.6.1 TOTAL COST OF OWNERSHIP (TCO) FOR A HEAVY DUTY FLEET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND OF MONITORING VEHICLE PURCHASE & FUEL ECONOMY

5.1.2 THE GROWTH IN INCLINATION TOWARDS THE DIGITAL BANKING

5.1.3 INCREASE IN DEMAND FOR SECURE CASHLESS FUEL TRANSACTIONS ACROSS THE REGION

5.2 RESTRAINTS

5.2.1 HIGHER FUEL SURCHARGE (FSC) FEE BY A CARRIER

5.2.2 FUEL CARD ACCOUNTS CAN ONLY BE SET UP FOR BUSINESSES PURPOSES

5.3 OPPORTUNITIES

5.3.1 RISING IN THE STRATEGIC ACQUISITIONS AND PARTNERSHIPS AMONG VARIOUS ORGANIZATIONS

5.3.2 AVAILABILITY OF LUCRATIVE DISCOUNTS OVER THE FUEL CARDS

5.3.3 EFFICIENT FLEET ADMINISTRATION WITH THE HELP OF ENHANCED DATA CAPTURE

5.4 CHALLENGES

5.4.1 RISE IN NUMBER OF SKIMMERS TO DISGUISE PURCHASES TO STEAL FUEL

5.4.2 INCREASE IN CONCERN OF THE SECURITY ISSUES WITH THE FUEL CARD PAYMENT

6 ANALYSIS ON IMPACT OF COVID 19 ON THE EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET

6.1 AFTERMATH OF THE EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE

7.1 OVERVIEW

7.2 UNIVERSAL FUEL CARDS

7.2.1 FUEL CREDIT CARDS

7.2.2 OVER THE ROAD FUEL CARD

7.2.3 NETWORK CARDS

7.3 BRANDED FUEL CARDS

7.4 MERCHANT FUEL CARDS

8 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY FEATURES

8.1 OVERVIEW

8.2 MOBILE PAYMENT & CARDLESS TRANSACTIONS

8.3 VEHICLE REPORTING

8.4 REAL TIME UPDATES

8.5 EMV COMPLIANT

8.6 TOKENIZATION

8.7 OTHERS

9 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE

9.1 OVERVIEW

9.2 REGISTERED CARD

9.3 BEARER CARD

10 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY UTILITY

10.1 OVERVIEW

10.2 OIL FEE PAYMENT

10.3 FLEET MAINTENANCE

10.4 VEHICLE PARKING FEES

10.5 TOLL FEE PAYMENT

10.6 OTHERS

11 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY END-USER

11.1 OVERVIEW

11.2 DELIVERY FLEETS

11.2.1 MEDIUM/HEAVY DUTY FLEET

11.2.2 LIGHT DUTY FLEET

11.2.3 UNIVERSAL FUEL CARDS

11.2.4 BRANDED FUEL CARDS

11.2.5 MERCHANT FUEL CARDS

11.3 TAXI CAB FLEETS

11.3.1 UNIVERSAL FUEL CARDS

11.3.2 BRANDED FUEL CARDS

11.3.3 MERCHANT FUEL CARDS

11.4 CAR RENTAL FLEETS

11.4.1 UNIVERSAL FUEL CARDS

11.4.2 BRANDED FUEL CARDS

11.4.3 MERCHANT FUEL CARDS

11.5 PUBLIC UTILITY FLEETS

11.5.1 UNIVERSAL FUEL CARDS

11.5.2 BRANDED FUEL CARDS

11.5.3 MERCHANT FUEL CARDS

11.6 OTHERS

11.6.1 UNIVERSAL FUEL CARDS

11.6.2 BRANDED FUEL CARDS

11.6.3 MERCHANT FUEL CARDS

12 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY

12.1 EUROPE

12.1.1 U.K.

12.1.2 GERMANY

12.1.3 FRANCE

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 RUSSIA

12.1.7 NETHERLANDS

12.1.8 BELGIUM

12.1.9 SWITZERLAND

12.1.10 TURKEY

12.1.11 REST OF EUROPE

13 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 COMPANY PROFILE

14.1 BP P.L.C.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SWOT ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.1.6 DBMR ANALYSIS

14.2 OMV AKTIENGESELLSCHAFT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 SWOT ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.2.6 DBMR ANALYSIS

14.3 EXXON MOBIL CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SWOT ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.6 DBMR ANALYSIS

14.4 VALERO MARKETING AND SUPPLY COMPANY

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 SWOT ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.4.6 DBMR ANALYSIS

14.5 UK FUELS LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 SWOT ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.5.5 DBMR ANALYSIS

14.6 DKV EURO SERVICE GMBH + CO. KG

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 MORGAN FUELS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 TOTALENERGIES

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 SHELL

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 UTA (AN EDENRED COMPANY)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 W.A.G. PAYMENT SOLUTIONS, A.S.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 WEX EUROPE SERVICES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 LIST OF TOP LEASING COMPANIES AND THE FUEL CARDS USED BY THEM

TABLE 2 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE UNIVERSAL FUEL CARDS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 5 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 7 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 8 EUROPE DELIVERY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE DELIVERY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TAXI CAB FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE CAR RENTAL FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE OTHERS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 16 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 18 EUROPE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 20 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 21 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 23 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 25 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 26 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 28 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 30 EUROPE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 32 EUROPE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 34 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 36 EUROPE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 38 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 40 U.K. UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.K. UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 42 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 43 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 45 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 46 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 47 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 48 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 50 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 51 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 52 U.K. TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 54 U.K. CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.K. CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 U.K. PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.K. PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 58 U.K. OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 60 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 62 GERMANY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 63 GERMANY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 64 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 65 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 66 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 67 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 68 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 69 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 70 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 71 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 72 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 73 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 74 GERMANY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 75 GERMANY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 76 GERMANY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 77 GERMANY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 78 GERMANY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 79 GERMANY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 80 GERMANY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 81 GERMANY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 82 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 83 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 84 FRANCE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 85 FRANCE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 86 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 87 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 88 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 89 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 90 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 91 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 92 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 93 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 94 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 95 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 96 FRANCE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 97 FRANCE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 98 FRANCE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 99 FRANCE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 100 FRANCE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 101 FRANCE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 102 FRANCE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 103 FRANCE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 104 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 105 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 106 ITALY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 107 ITALY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 108 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 109 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 110 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 111 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 112 TALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 114 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 115 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 116 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 117 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 118 ITALY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 119 ITALY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 120 ITALY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 121 ITALY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 122 ITALY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 123 ITALY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 124 ITALY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 125 ITALY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 126 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 127 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 128 SPAIN UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 129 SPAIN UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 130 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 131 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 132 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 133 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 134 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 135 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 136 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 137 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 138 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 139 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 140 SPAIN TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 141 SPAIN TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 142 SPAIN CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 143 SPAIN CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 144 SPAIN PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 145 SPAIN PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 146 SPAIN OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 147 SPAIN OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 148 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 150 RUSSIA UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 152 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 155 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 157 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 158 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 159 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 160 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 161 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 162 RUSSIA TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 163 RUSSIA TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 164 RUSSIA CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 165 RUSSIA CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 166 RUSSIA PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 167 RUSSIA PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 168 RUSSIA OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 169 RUSSIA OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 170 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 171 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 172 NETHERLANDS UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 173 NETHERLANDS UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 174 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 175 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 176 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 177 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 178 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 179 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 180 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 181 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 182 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 183 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 184 NETHERLANDS TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 186 NETHERLANDS CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 187 NETHERLANDS CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 188 NETHERLANDS PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 189 NETHERLANDS PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 190 NETHERLANDS OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 191 NETHERLANDS OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 192 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 193 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 194 BELGIUM UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 195 BELGIUM UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 196 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 197 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 198 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 199 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 200 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 201 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 202 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 203 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 204 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 205 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 206 BELGIUM TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 208 BELGIUM CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 210 BELGIUM PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 212 BELGIUM OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 214 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 215 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 216 SWITZERLAND UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 217 SWITZERLAND UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 218 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 219 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 220 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 221 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 222 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 223 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 224 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 225 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 226 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 227 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 228 SWITZERLAND TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 229 SWITZERLAND TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 230 SWITZERLAND CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 231 SWITZERLAND CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 232 SWITZERLAND PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 233 SWITZERLAND PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 234 SWITZERLAND OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 235 SWITZERLAND OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 236 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 237 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 238 TURKEY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 239 TURKEY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 240 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 241 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 242 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 243 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 244 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 245 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 246 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 247 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 248 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 249 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 250 TURKEY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 251 TURKEY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 252 TURKEY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 253 TURKEY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 254 TURKEY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 255 TURKEY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 256 TURKEY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 257 TURKEY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 258 REST OF EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE FUEL CARDS FOR COMMERCIAL FLEET MARKET: SEGMENTATION

FIGURE 2 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: DATA TRIANGULATION

FIGURE 3 EUROPE FUEL CARDS FOR COMMERCIAL FLEET MARKET: DROC ANALYSIS

FIGURE 4 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: SEGMENTATION

FIGURE 10 INCREASING IN DEMAND FOR MONITORING VEHICLE PURCHASE & FUEL ECONOMY IS EXPECTED TO DRIVE EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 11 CARD TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET IN 2022 & 2029

FIGURE 12 ANNUAL CHARGES ON FUEL CARDS OFFERED BY VARIOUS COMPANIES

FIGURE 13 AVERAGE COST OF OWNERSHIP FOR HEAVY DUTY FLEET (IN %)

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET

FIGURE 15 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY CARD TYPE, 2021

FIGURE 16 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY FEATURES, 2021

FIGURE 17 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY SUBSCRIPTION TYPE, 2021

FIGURE 18 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY UTILITY, 2021

FIGURE 19 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY END-USER, 2021

FIGURE 20 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: SNAPSHOT (2021)

FIGURE 21 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2021)

FIGURE 22 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY CARD TYPE (2022-2029)

FIGURE 25 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.