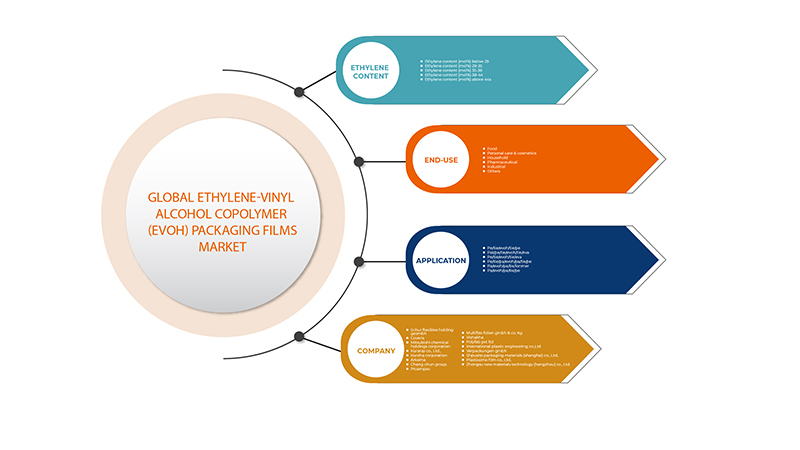

Europe Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market, By Ethylene Content (Ethylene Content (Mol%) Below 29, Ethylene Content (Mol%) 29-35, Ethylene Content (Mol%) 35-38, Ethylene Content (Mol%) 38-44, Ethylene Content (Mol%) Above 44), Application (PE/TIE/EVOH/TIE/PE, PAT/PE/TIE/EVOH/TIE/EVA, PE/TIE/EVOH/TIE/EVA, PE/TIE/PA/EVOH/PA/TIE/PE, PA/EVOH/PA/TIE/LONMER, and PA/EVOH/PA/TIE/PE), End-Use (Food, Personal Care & Cosmetics, Household, Pharmaceutical, Industrial, Others) Industry Trends and Forecast to 2029.

Market Analysis and Insights

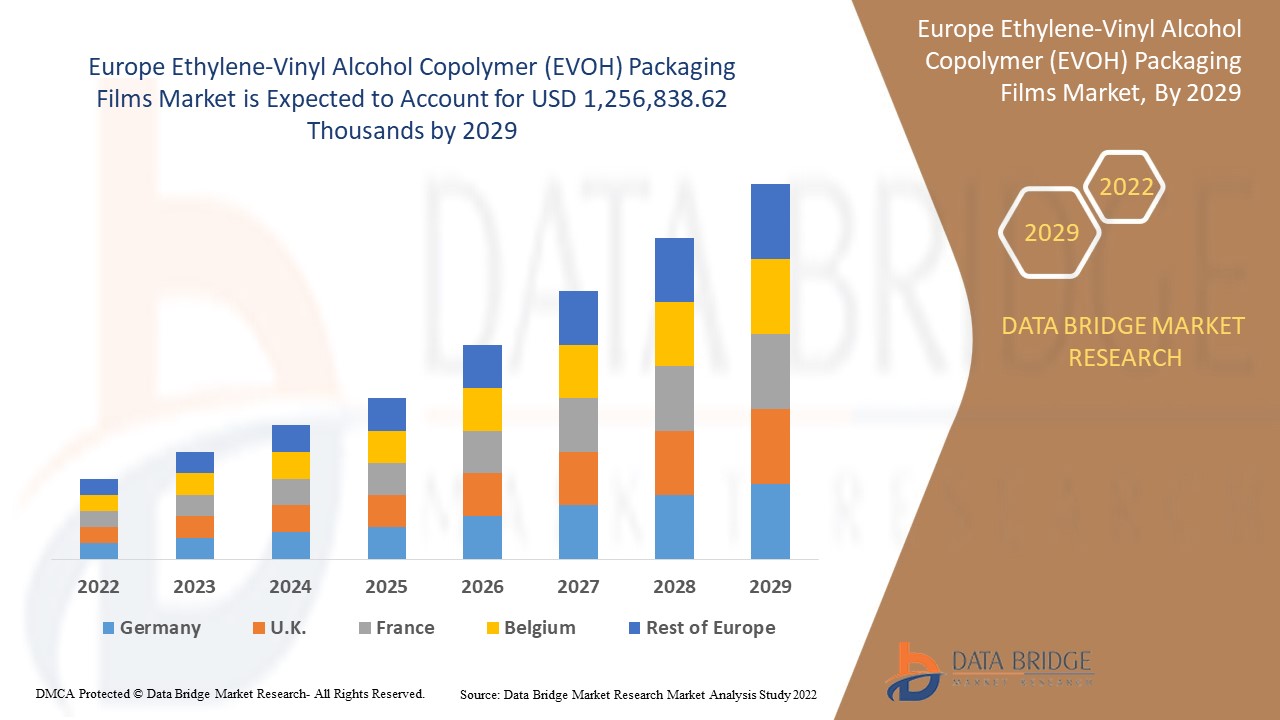

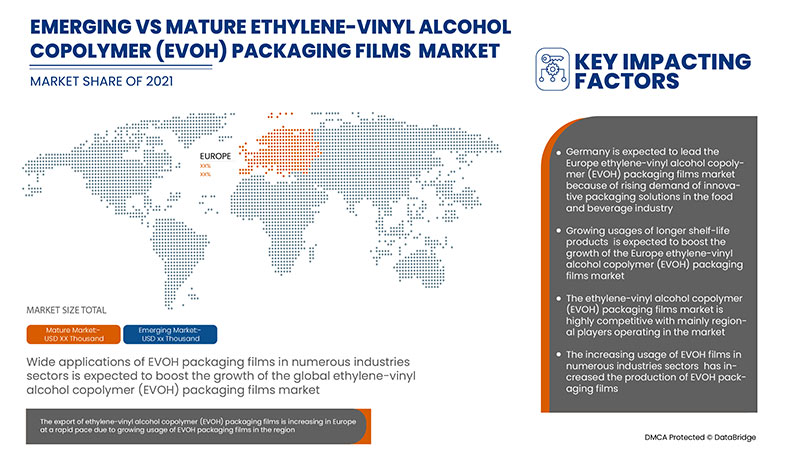

Europe ethylene-vinyl alcohol copolymer (EVOH) packaging films market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.4% in the forecast period of 2022 to 2029 and is expected to reach USD 1,256,838.62 thousand by 2029. The major factor driving the growth of the ethylene-vinyl alcohol copolymer (EVOH) packaging films are shifting consumer preference towards the flexible packaging, customer friendly and sustainable nature of EVOH packaging films.

Ethylene-vinyl alcohol copolymer or EVOH is a flexible, crystal clear, and glossy thermoplastic copolymer with excellent flex-crack resistance, and very high resistance to hydrocarbons, oils and organic solvents. It also has some of the best barrier properties to gases such as oxygen, nitrogen, and carbon dioxide making it especially suited for packaging of food, drugs, cosmetics, and other perishable or delicate products to extend shelf life. In comparison with many other common films, EVOH has superior barrier properties. However, EVOH loses its good gas barrier properties when exposed to moisture. For this reason and to optimize both cost and performance, it is frequently used in multilayer, co-extruded films like HDPE, PP, and PET, which have superior moisture barrier properties.

EVOH film for packaging has antistatic properties which ensures that dust particles in the atmosphere do not settle down on the packaging to prevent fungal growth that spoils the natural aroma and taste of products in the container. Due to heightened awareness regarding cleanliness to limit the spread of virus the demand for packaging that maintain hygiene of products placed in the container are expected to rise. This in turn is expected to surge the demand for EVOH film in the packaging market.

Le rapport sur le marché européen des films d'emballage en copolymère d'éthylène et d'alcool vinylique (EVOH) fournit des détails sur la part de marché, les nouveaux développements, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers, prix en USD |

|

Segments couverts |

Par teneur en éthylène (teneur en éthylène (% molaire) inférieure à 29, teneur en éthylène (% molaire) 29-35, teneur en éthylène (% molaire) 35-38, teneur en éthylène (% molaire) 38-44, teneur en éthylène (% molaire) Application (PE/TIE/EVOH/TIE/PE, PAT/PE/TIE/EVOH/TIE/EVA, PE/TIE/EVOH/TIE/EVA, PE/TIE/PA/EVOH/PA/TIE/PE, PA/EVOH/PA/TIE/LONMER et PA/EVOH/PA/TIE/PE), utilisation finale (alimentation, soins personnels et cosmétiques, ménage, produits pharmaceutiques, industrie, autres) |

|

Pays couverts |

Allemagne, Royaume-Uni, Italie, France, Espagne, Russie, Suisse, Turquie, Belgique, Pays-Bas, Luxembourg et le reste de l'Europe. |

|

Acteurs du marché couverts |

Français Schur Flexibles Holding GesmbH, Coveris, Mitsubishi Chemical Holdings Corporation, KURARAY CO., LTD., KUREHA CORPORATION, Arkema, Chang Chun Group., ProAmpac, MULTIFLEX FOLIEN GMBH & CO. KG, Vishakha Polyfab Pvt Ltd, International Plastic Engineering Co., Ltd, Verpackungen GmbH, Shpusite Packaging Materials (Shanghai) Co., Ltd, Plastissimo Film Co., Ltd et Zhongsu New Materials Technology (Hangzhou) Co., Ltd. |

Dynamique du marché européen des films d'emballage en copolymère d'éthylène et d'alcool vinylique (EVOH)

Cette section traite des facteurs moteurs, des contraintes, des opportunités et des défis du marché :

Conducteurs

- Les préférences des consommateurs évoluent vers les emballages flexibles

L'industrie de l'emballage à travers le monde a été témoin d'une demande croissante de la part des secteurs de l'alimentation et des boissons, des produits pharmaceutiques et de santé, des cosmétiques et des soins personnels, entre autres, pour que leurs produits soient emballés dans des emballages flexibles. Les films d'emballage EVOH offrent également diverses autres propriétés en plus de leur nature flexible, telles que la rentabilité, la résistance élevée du joint, l'affichage et le transport facile. De plus, ces films offrent d'excellents avantages pour l'emballage, tels que l'allongement de la durée de conservation et la limitation des pertes de produits, ce qui rend l'adoption des films EVOH généralisée dans l'industrie de l'emballage. Cela stimulera sa demande sur le marché et entraînera la croissance du marché des films d'emballage EVOH

- Nature conviviale et durable des films d'emballage EVOH

La demande croissante de produits biologiques qui n'utilisent aucun élément synthétique et sont périssables par nature devrait stimuler la demande de films EVOH pour l'emballage. De plus, l'EVOH est résistant à l'huile et aux solvants organiques, ce qui en fait un bon choix pour conserver les produits comestibles et les aliments pendant une durée plus longue. De plus, contrairement au PVDC, les films EVOH ne contiennent aucun élément nocif tel que le chlore, les métaux et les dioxines, qui peuvent provoquer des troubles endocriniens chez l'homme et également nuire à l'environnement. Par conséquent, les films EVOH sont respectueux de l'environnement et un produit recyclable qui cause très peu de dommages à l'environnement. Ces propriétés respectueuses de la nature des films d'emballage en copolymère d'éthylène-alcool vinylique (EVOH) stimuleront la demande pour le matériau et stimuleront le marché européen des films d'emballage en copolymère d'éthylène-alcool vinylique (EVOH).

- Propriétés barrières et antistatiques étendues des films d'emballage EVOH

L'augmentation des applications industrielles des matériaux d'emballage barrières déclenche une demande de matières premières aux propriétés hautement spécialisées parmi les acteurs du marché des films d'emballage EVOH. Cela a conduit de nombreuses entreprises à se concentrer sur la prise de décisions stratégiques pour gagner des parts de marché compétitives sur le marché. Ces propriétés devraient à leur tour augmenter la demande de films d'emballage EVOH durables qui préservent la qualité des produits pendant de longues durées, en agissant comme une barrière contre différents gaz et particules de poussière présents dans l'atmosphère

Opportunités

- Inclination croissante des consommateurs vers des emballages écologiques et durables

En raison de leur faible odeur, de leur résistance chimique élevée et de leur inertie, de nombreuses qualités d'EVOH conviennent aux applications d'emballage alimentaire, médical et pharmaceutique conformément aux réglementations de la FDA. Ainsi, la demande croissante de films d'emballage à haute barrière écologiques et durables tels que les films d'emballage en copolymère d'éthylène-alcool vinylique (EVOH) devrait créer des opportunités lucratives pour les fabricants de films sur ce marché européen des films d'emballage en copolymère d'éthylène-alcool vinylique (EVOH).

- Demande croissante de solutions d'emballage innovantes dans l'industrie agroalimentaire

L'utilisation intensive d'EVOH dans l'industrie agroalimentaire, notamment pour éviter la contamination des aliments, devrait constituer une opportunité importante pour alimenter la demande sur le marché européen des films d'emballage en copolymère éthylène-alcool vinylique (EVOH). De plus, ces films EVOH peuvent être facilement moulés en feuilles, tubes ou bouteilles en raison de leur excellent effet barrière contre les gaz et les liquides organiques. Le besoin de solutions d'emballage innovantes dans l'industrie agroalimentaire et dans d'autres industries pour attirer les consommateurs soucieux de l'environnement devrait encore augmenter la demande de films d'emballage EVOH dans le monde entier

Contraintes/Défis

- Disponibilité d'alternatives qui ont incité les consommateurs

Le nombre croissant de consommateurs et de fabricants soucieux de l'environnement qui se tournent vers des solutions d'emballage en papier pourrait freiner la demande de films d'emballage EVOH dans un avenir proche. La disponibilité croissante de nombreux produits alternatifs aux films EVOH, tels que le laminage PE, les produits en papier et les films met-PET pour les clients, pourrait limiter la croissance de ce marché

- Faibles caractéristiques d'adhérence des résines EVOH

Les résines EVOH ont une très faible adhérence, c'est pourquoi on utilise des résines adhésives polyoléfines modifiées pour lier la couche EVOH à la couche adjacente lors de la coextrusion. Par conséquent, il est nécessaire de traiter les résines EVOH sur des équipements disponibles dans le commerce en utilisant divers procédés tels que le revêtement par coextrusion pour films et papier, le laminage de films par coextrusion, le moulage par soufflage par coinjection, l'extrusion de films monocouches soufflés et coulés, le revêtement par poudre et bien d'autres. Cela affecte également les propriétés des films EVOH car, comme d'autres polymères d'extrusion, les résines EVOH peuvent facilement se dégrader par une exposition prolongée à l'énergie thermique, à la fois par séchage et par extrusion

- Sensibilité à la dégradation des films à haute barrière

Les films d'emballage EVOH sont créés en combinant deux ou plusieurs films coextrudés ou laminés pour créer un seul film homogène avec des couches individuelles uniques. Ceux-ci offrent un certain nombre de qualités que les films monocouches ne peuvent égaler. Cependant, comme ces films multicouches sont fabriqués à partir d'une gamme de matériaux, leur recyclabilité est un problème sérieux. Par conséquent, le recyclage de divers matériaux nécessite un traitement séparé, ce qui n'est pas une option viable. Le recyclage mécanique devient également un problème avec les structures multicouches contenant plus d'un type de plastique, car elles ne peuvent pas être facilement recyclées.

- L'EVOH perd ses bonnes propriétés de barrière aux gaz lorsqu'il est exposé à l'humidité

Les copolymères EVOH constituent une excellente barrière contre la pénétration de l'oxygène, des gaz et des composés organiques dans des conditions sèches, mais à forte humidité, la perméation de l'oxygène de l'EVOH augmente considérablement, ce qui affecte davantage la qualité des produits emballés. L'effet de la température et de l'humidité réduit la protection des couches intérieures et extérieures des structures et l'EVOH absorbe de grandes quantités d'eau, ce qui réduit considérablement les caractéristiques de barrière. Par conséquent, les copolymères EVOH ne sont pas des polymères idéaux en matière de résistance à l'humidité. La forte sensibilité à l'humidité peut être un problème avec les propriétés de barrière élevées des films EVOH, agissant donc comme un défi pour le marché européen des films d'emballage en copolymère éthylène-alcool vinylique (EVOH).

Développements récents

- En février 2022, Arkema a acquis l'activité Performance Adhesives d'Ashland, leader de premier plan dans le domaine des adhésifs hautes performances aux États-Unis. Cette opération constitue une étape majeure dans le renforcement du segment Adhesive Solutions d'Arkema. Cette acquisition apportera de nouvelles opportunités à l'entreprise et accroîtra sa croissance sur le marché.

- En avril 2022, Kuraray Co., Ltd a été incluse dans les indices d'investissement ESG (environnementaux, sociaux et de gouvernance) : FTSE Blossom Japan Sector Relative Index conçu par le fournisseur d'indices européens FTSE Russell. Cela fait de la société un constituant de tous les indices d'investissement ESG pour les actions japonaises adoptés par le Fonds d'investissement des pensions du gouvernement japonais (GPIF). Cette initiative de durabilité renforcera la réputation de l'entreprise sur le marché

- En décembre 2021, Mitsubishi Chemical Holdings Corporation a été reconnue comme leader européen de la gestion durable de l'eau et s'est vu décerner une place sur la Water A List de l'année, soit la note la plus élevée du CDP Water Security 2021. La Water A List comprend 118 entreprises sur un total de 12 000 interrogées dans le monde. Cela renforce l'image de l'entreprise sur le marché européen

Portée du marché européen des films d'emballage en copolymère d'éthylène et d'alcool vinylique (EVOH)

Le marché européen des films d'emballage en copolymère éthylène-alcool vinylique (EVOH) est classé en fonction de la teneur en éthylène, de l'application et de l'utilisation finale. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Teneur en éthylène

- Teneur en éthylène (% en moles) inférieure à 29

- Teneur en éthylène (% en moles) 29-35

- Teneur en éthylène (% en moles) 35-38

- Teneur en éthylène (% en moles) 38-44

- Teneur en éthylène (% en moles) supérieure à 44

Sur la base de la teneur en éthylène, le marché européen des films d'emballage en copolymère éthylène-alcool vinylique (EVOH) est segmenté en teneur en éthylène (mol%) inférieure à 29, teneur en éthylène (mol%) 29-35, teneur en éthylène (mol%) 35-38, teneur en éthylène (mol%) 38-44, teneur en éthylène (mol%) supérieure à 44.

Application

- PE/TIE/EVOH/TIE/PE

- PAT/PE/TIE/EVOH/TIE/EVA

- PE/TIE/EVOH/TIE/EVA

- PE/TIE/PA/EVOH/PA/TIE/PE

- PA/EVOH/PA/TIE/LONMER

- PA/EVOH/PA/TIE/PE

Sur la base de l'application, le marché européen des films d'emballage en copolymère éthylène-alcool vinylique (EVOH) est segmenté en PE/TIE/EVOH/TIE/PE, PAT/PE/TIE/EVOH/TIE/EVA, PE/TIE/EVOH/TIE/EVA, PE/TIE/PA/EVOH/PA/TIE/PE, PA/EVOH/PA/TIE/LONMER et PA/EVOH/PA/TIE/PE

Utilisation finale

- Nourriture

- Soins personnels et cosmétiques

- Ménage

- Pharmaceutique

- Industriel

- Autres

Sur la base de l'utilisation finale, le marché européen des films d'emballage en copolymère éthylène-alcool vinylique (EVOH) est segmenté en aliments, soins personnels et cosmétiques, produits ménagers, pharmaceutiques, industriels, autres.

Analyse/perspectives régionales des films d'emballage en copolymère d'éthylène et d'alcool vinylique (EVOH) en Europe

Le marché européen des films d'emballage en copolymère éthylène-alcool vinylique (EVOH) est en outre segmenté en Allemagne, au Royaume-Uni, en Italie, en France, en Espagne, en Russie, en Suisse, en Turquie, en Belgique, aux Pays-Bas, au Luxembourg et dans le reste de l'Europe.

L'Allemagne domine le marché européen des films d'emballage en copolymère éthylène-alcool vinylique (EVOH) en termes de part de marché et de chiffre d'affaires et continuera à accroître sa domination au cours de la période de prévision. Cela est dû à l'évolution des préférences des consommateurs en faveur des emballages flexibles.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Paysage concurrentiel et analyse des parts de marché des films d'emballage en copolymère d'éthylène et d'alcool vinylique (EVOH) en Europe

Le paysage concurrentiel du marché européen des films d'emballage en copolymère éthylène-alcool vinylique (EVOH) fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des films d'emballage en copolymère éthylène-alcool vinylique (EVOH).

Français Certains des principaux acteurs opérant sur le marché européen des films d'emballage en copolymère éthylène-alcool vinylique (EVOH) sont Schur Flexibles Holding GesmbH, Coveris, Mitsubishi Chemical Holdings Corporation, KURARAY CO., LTD., KUREHA CORPORATION, Arkema, Chang Chun Group., ProAmpac, MULTIFLEX FOLIEN GMBH & CO. KG, Vishakha Polyfab Pvt Ltd, International Plastic Engineering Co., Ltd, Verpackungen GmbH, Shpusite Packaging Materials (Shanghai) Co., Ltd, Plastissimo Film Co., Ltd et Zhongsu New Materials Technology (Hangzhou) Co., Ltd.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché Europe vs région et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.2 KEY BUYER LIST

4.3 KEY PATENT LAUNCHED

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS:

4.4.2 ECONOMIC FACTORS:

4.4.3 SOCIAL FACTORS:

4.4.4 TECHNOLOGICAL FACTORS:

4.5 LEGAL FACTORS:

4.5.1 ENVIRONMENTAL FACTORS:

4.6 PORTER’S FIVE FORCES:

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 REGULATORY COVERAGE

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL PROCUREMENT

4.9.2 MANUFACTURING AND PACKING

4.9.3 MARKETING AND DISTRIBUTION

4.9.4 END USERS

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.11 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SHIFT IN CONSUMER PREFERENCE TOWARD THE FLEXIBLE PACKAGING

5.1.2 CUSTOMER-FRIENDLY AND SUSTAINABLE NATURE OF EVOH PACKAGING FILMS

5.1.3 EXTENSIVE BARRIER AND ANTISTATIC PROPERTIES OF EVOG PACKAGING FILMS

5.1.4 WIDE APPLICATIONS OF EVOH PACKAGING FILMS IN NUMEROUS INDUSTRIES SECTORS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF ALTERNATIVES THAT INDUCED THE CONSUMERS

5.2.2 POOR ADHESION CHARACTERISTICS OF EVOH RESINS

5.3 OPPORTUNITIES

5.3.1 RISING CONSUMER INCLINATION TOWARDS GREEN AND SUSTAINABLE PACKAGING

5.3.2 EASE OF PRINTING ON EVOH PACKAGING FILMS

5.3.3 GROWING USAGES OF LONGER SHELF-LIFE PRODUCTS

5.3.4 RISE IN DEMAND FOR INNOVATIVE PACKAGING SOLUTIONS IN THE FOOD AND BEVERAGE INDUSTRY

5.4 CHALLENGES

5.4.1 SUSCEPTIBILITY TO DEGRADATION OF HIGH BARRIER FILMS

5.4.2 EVOH LOSES ITS GOOD GAS BARRIER PROPERTIES WHEN EXPOSED TO HUMIDITY

6 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT

6.1 OVERVIEW

6.2 ETHYLENE CONTENT (MOL%) BELOW 29

6.3 ETHYLENE CONTENT (MOL%) 29-35

6.4 ETHYLENE CONTENT (MOL%) 35-38

6.5 ETHYLENE CONTENT (MOL%) 38-44

6.6 ETHYLENE CONTENT (MOL%) ABOVE 44

7 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 PE/TIE/EVOH/TIE/PE

7.3 PAT/PE/TIE/EVOH/TIE/EVA

7.4 PE/TIE/EVOH/TIE/EVA

7.5 PE/TIE/PA/EVOH/PA/TIE/PE

7.6 PA/EVOH/PA/TIE/LONMER

7.7 PA/EVOH/PA/TIE/PE

7.7.1 CO-EXTRUTION CAST FILMS

7.7.2 CO-EXTRUTION BLOWN FILMS

8 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE

8.1 OVERVIEW

8.2 FOOD

8.2.1 MEAT, POULTRY & SEAFOOD

8.2.2 PET FOOD

8.2.3 BABY FOOD

8.2.4 OTHERS

8.3 PERSONAL CARE & COSMETICS

8.4 HOUSEHOLD

8.5 PHARMACEUTICAL

8.6 INDUSTRIAL

8.7 OTHERS

9 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION

9.1 EUROPE

9.1.1 GERMANY

9.1.2 U.K.

9.1.3 FRANCE

9.1.4 ITALY

9.1.5 SPAIN

9.1.6 RUSSIA

9.1.7 SWITZERLAND

9.1.8 TURKEY

9.1.9 BELGIUM

9.1.10 NETHERLANDS

9.1.11 LUXEMBURG

9.1.12 REST OF EUROPE

10 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

10.1.1 SUSTAINABILITY

10.1.2 AWARDS

10.1.3 FACILITY EXPANSIONS

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 ARKEMA

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 MITSUBISHI CHEMICAL HOLDINGS CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT UPDATES

12.3 KURARAY CO., LTD.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT UPDATE

12.4 COVERIS

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATES

12.5 CHANG CHUN GROUP

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT UPDATES

12.6 INTERNATIONAL PLASTIC ENGINEERING CO., LTD

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATES

12.7 KUREHA CORPORATION

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATES

12.8 MULTIFLEX FOLIEN GMBH & CO. KG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 PLASTISSIMO FILM CO., LTD.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATES

12.1 PROAMPAC

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT UPDATES

12.11 SCHUR FLEXIBLES HOLDINGS GESMBH

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT UPDATE

12.12 SHPUSITE PACKAGING MATERIALS (SHANGHAI) CO., LTD.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATES

12.13 VERPACKUNGEN GMBH

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT UPDATE

12.14 VISHAKHA POLYFAB PVT LTD

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATE

12.15 ZHONGSU NEW MATERIALS TECHNOLOGY (HANGZHOU) CO., LTD.

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF PLATES, SHEETS, FILM, FOIL AND STRIP, OF NON-CELLULAR POLYMERS OF ETHYLENE, NOT REINFORCED; HS CODE – 392010 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PLATES, SHEETS, FILM, FOIL AND STRIP, OF NON-CELLULAR POLYMERS OF ETHYLENE, NOT REINFORCED; HS CODE – 392010 (USD THOUSAND)

TABLE 3 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 5 EUROPE ETHYLENE CONTENT (MOL%) BELOW 29 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE ETHYLENE CONTENT (MOL%) BELOW 29 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 7 EUROPE ETHYLENE CONTENT (MOL%) 29-35 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE ETHYLENE CONTENT (MOL%) 29-35 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 9 EUROPE ETHYLENE CONTENT (MOL%) 35-38 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE ETHYLENE CONTENT (MOL%) 35-38 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 11 EUROPE ETHYLENE CONTENT (MOL%) 38-44 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE ETHYLENE CONTENT (MOL%) 38-44 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 13 EUROPE ETHYLENE CONTENT (MOL%) ABOVE 44 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE ETHYLENE CONTENT (MOL%) ABOVE 44 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 15 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE PE/TIE/EVOH/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE PAT/PE/TIE/EVOH/TIE/EVA IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE PE/TIE/EVOH/TIE/EVA IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE PE/TIE/PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE PA/EVOH/PA/TIE/LONMER IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE PERSONAL CARE & COSMETICS ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE HOUSEHOLD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE PHARMACEUTICAL IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE INDUSTRIAL IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE OTHERS IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 33 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 35 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 39 GERMANY ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 40 GERMANY ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 41 GERMANY ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 42 GERMANY PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 43 GERMANY ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 44 GERMANY FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 45 U.K. ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 46 U.K. ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 47 U.K. ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 U.K. PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 U.K. ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 50 U.K. FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 51 FRANCE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 52 FRANCE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 53 FRANCE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 FRANCE PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 FRANCE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 56 FRANCE FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 57 ITALY ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 58 ITALY ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 59 ITALY ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 ITALY PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 ITALY ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 62 ITALY FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 63 SPAIN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 64 SPAIN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 65 SPAIN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 SPAIN PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 67 SPAIN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 68 SPAIN FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 69 RUSSIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 70 RUSSIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 71 RUSSIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 RUSSIA PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 RUSSIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 74 RUSSIA FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 75 SWITZERLAND ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 76 SWITZERLAND ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 77 SWITZERLAND ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 SWITZERLAND PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 SWITZERLAND ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 80 SWITZERLAND FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 81 TURKEY ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 82 TURKEY ETHYLENE -VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 83 TURKEY ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 TURKEY PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 TURKEY ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 86 TURKEY FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 87 BELGIUM ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 88 BELGIUM ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 89 BELGIUM ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 BELGIUM PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 91 BELGIUM ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 92 BELGIUM FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 93 NETHERLANDS ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 94 NETHERLANDS ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 95 NETHERLANDS ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 NETHERLANDS PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 NETHERLANDS ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 98 NETHERLANDS FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 99 LUXEMBURG ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 100 LUXEMBURG ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 101 LUXEMBURG ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 LUXEMBURG PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 LUXEMBURG ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 104 LUXEMBURG FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 105 REST OF EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 106 REST OF EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

Liste des figures

FIGURE 1 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET

FIGURE 2 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 EXTENSIVE BARRIER AND ANTISTATIC PROPERTIES OF EVOH PACKAGING FILMS IS EXPECTED TO DRIVE EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET IN THE FORECAST PERIOD

FIGURE 16 ETHYLENE CONTENT (MOL%) BELOW 29 SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET IN 2022 & 2029

FIGURE 17 SUPPLY CHAIN ANALYSIS- EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET

FIGURE 20 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY ETHYLENE CONTENT, 2021

FIGURE 21 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY APPLICATION, 2021

FIGURE 22 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY END-USE, 2021

FIGURE 23 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY ETHYLENE CONTENT (2022 & 2029)

FIGURE 28 EUROPE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.