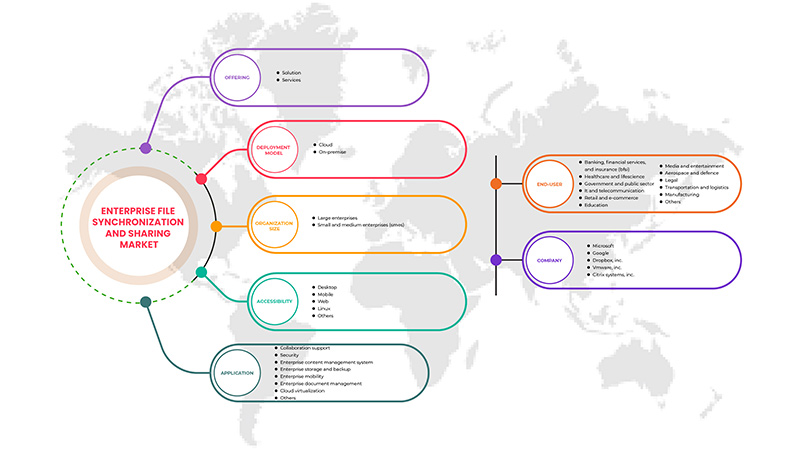

Marché européen de la synchronisation et du partage de fichiers d'entreprise, par offre (solution et services), par modèle de déploiement (sur site et dans le cloud), taille de l'organisation (grandes entreprises et petites et moyennes entreprises (PME)), accessibilité (bureau, mobile, Web, Linux et autres), application (support de collaboration, sécurité, système de gestion de contenu d'entreprise, stockage et sauvegarde d'entreprise, mobilité d'entreprise, gestion de documents d'entreprise , virtualisation dans le cloud et autres), utilisateur final (banque, services financiers et assurances (BFSI), soins de santé et sciences de la vie, gouvernement et secteur public, informatique et télécommunications, vente au détail et commerce électronique, éducation, médias et divertissement, aérospatiale et défense, juridique, transport et logistique, fabrication et autres), tendances et prévisions du secteur jusqu'en 2029

Analyse et perspectives du marché de la synchronisation et du partage de fichiers d'entreprise en Europe

Les entreprises peuvent utiliser la synchronisation et le partage de fichiers d'entreprise pour améliorer la gestion de contenu, la collaboration et le partage sécurisé de fichiers entre les employés. Les services EFSS incluent des fonctionnalités telles que les commentaires en direct, le suivi des versions de documents et la gestion des processus de workflow pour aider les utilisateurs à stocker, modifier, réviser et partager des fichiers. Les organisations adoptent souvent EFSS comme moyen de dissuader les employés de partager des données d'entreprise via des services de stockage et de partage de fichiers dans le cloud public orientés vers le consommateur qui échappent au contrôle du service informatique.

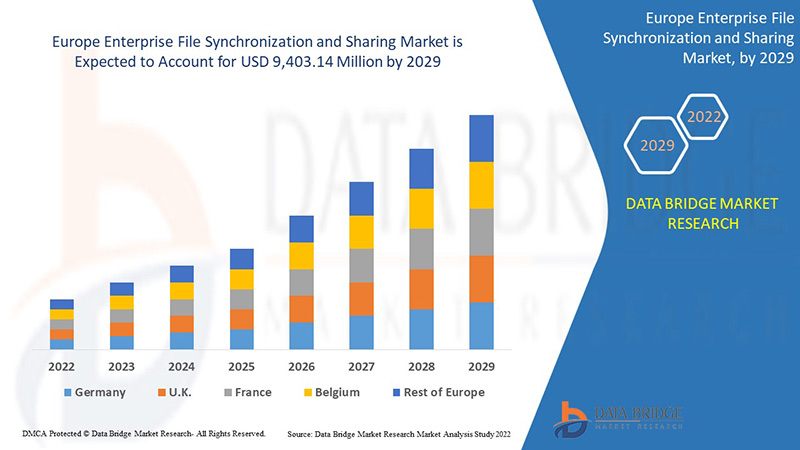

Selon les analyses de Data Bridge Market Research, le marché européen de la synchronisation et du partage de fichiers d'entreprise devrait atteindre une valeur de 9 403,14 millions USD d'ici 2029, à un TCAC de 27,1 % au cours de la période de prévision. Le segment des solutions représente le segment d'offre le plus important sur le marché européen de la synchronisation et du partage de fichiers d'entreprise. Le rapport sur le marché européen de la synchronisation et du partage de fichiers d'entreprise couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par offre (solution et services), par modèle de déploiement (sur site et dans le cloud), taille de l'organisation (grandes entreprises et petites et moyennes entreprises (PME)), accessibilité (bureau, mobile, Web, Linux et autres), application (support de collaboration, sécurité, système de gestion de contenu d'entreprise, stockage et sauvegarde d'entreprise, mobilité d'entreprise, gestion de documents d'entreprise, virtualisation dans le cloud et autres), utilisateur final (banque, services financiers et assurances (BFSI), soins de santé et sciences de la vie, gouvernement et secteur public, informatique et télécommunications, vente au détail et commerce électronique, éducation, médias et divertissement, aérospatiale et défense, juridique, transport et logistique, fabrication et autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie et reste de l'Europe |

|

Acteurs du marché couverts |

IBM Corporation, Axway, Citrix Systems, Inc., Google, Microsoft, Dropbox, Inc., Micro Focus, Nextcloud GmbH, Citrix Systems, Inc., Open Text Corporation, Qnext Corp., Thru, Inc., VMware, Inc., Thomson Reuters, FileCloud, Ziff Davis, Inc., Seafile Ltd., Files.com, ACCELLION, Egnyte, Inc., Intralinks, Inc., Box, ownCloud GmbH, MyWorkDrive LLC., CTERA Networks Ltd., DryvIQ, entre autres |

Définition du marché

La synchronisation et le partage de fichiers d'entreprise sont un service qui permet aux utilisateurs d'enregistrer des fichiers dans le cloud ou sur site, puis d'y accéder sur des ordinateurs de bureau et des appareils mobiles. Les outils de partage de fichiers d'entreprise permettent aux utilisateurs de partager en toute sécurité des documents, des photos, des vidéos et bien plus encore sur plusieurs appareils et avec plusieurs personnes. Ils utilisent la synchronisation ou la copie de fichiers pour permettre aux fichiers d'être stockés dans un référentiel de données approuvé, puis accessibles à distance par les employés à partir de PC, de tablettes ou de smartphones prenant en charge le produit EFSS.

Le partage peut avoir lieu entre des personnes au sein ou en dehors de l'organisation, ainsi qu'entre des applications. La recherche, la récupération et l'accès fluides aux fichiers stockés dans plusieurs référentiels de données à partir de différents appareils clients complètent ces offres, ainsi que les capacités de sécurité, de protection des données et de collaboration. Les offres EFSS permettent des scénarios modernes de productivité et de collaboration des utilisateurs pour la création d'un espace de travail numérique. Les architectures de déploiement typiques pour les offres EFSS peuvent être le cloud public, le cloud hybride, le cloud privé ou sur site.

Dynamique du marché

Conducteurs

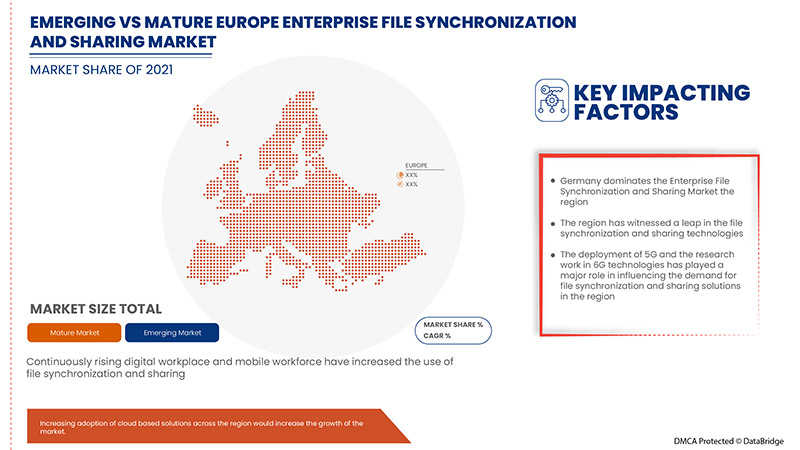

- L'espace de travail numérique et la main-d'œuvre mobile en constante augmentation

Les lieux de travail ont évolué, passant d'un espace physique comprenant des bureaux à des bureaux distants via des ordinateurs de bureau, des appareils mobiles et autres. De nombreux documents et projets de bureau sont passés à la messagerie instantanée, qui est devenue un choix de communication populaire dans le secteur des bureaux. Les solutions de lieu de travail numérique (DWS) créent des connexions et éliminent les barrières entre les personnes. La croissance dans le domaine du lieu de travail numérique et de la main-d'œuvre mobile contribue encore davantage à la croissance significative du marché européen de la synchronisation et du partage de fichiers d'entreprise.

- L'accent mis par les entreprises sur la sécurité des données d'entreprise

La sécurité des données a toujours été importante, mais son importance augmente chaque jour. La protection des données est la mesure défensive des organisations pour préserver toute entrée non autorisée dans les bases de données, les sites Web et les ordinateurs. Ces derniers temps, les entreprises doivent protéger leurs données contre tout type d'attaque. Il s'agit d'un problème sérieux à prendre en compte. L'augmentation des cyberattaques contre les entreprises oblige actuellement à introduire des plates-formes EFSS qui contribuent à la croissance du marché.

- Augmentation de la collaboration entre les employés et les entreprises

Les solutions de partage de fichiers en ligne gagnent en popularité dans des secteurs tels que la santé, le gouvernement, la finance, le droit, l'ingénierie, etc. Avec le besoin croissant de collaboration numérique et de contenu entre les points de terminaison, les équipes peuvent atteindre leurs objectifs et les employés peuvent suivre le rythme des exigences de leurs tâches. Les organisations s'orientent de plus en plus vers la collaboration des employés et des données à différents niveaux, ce qui propulse dans une certaine mesure la croissance du marché européen de la synchronisation et du partage de fichiers d'entreprise.

- Augmentation des cas de vol de données dans le secteur des BFSI et de la santé

Le vol de données est devenu l'un des principaux crimes informatiques qui se produisent de temps à autre dans le monde numérique depuis le tout début du monde virtuel. Les grandes et les petites entreprises de soins de santé sont ciblées par les cybercriminels. L'exigence de sécurité des données dans le secteur des BFSI et de la santé contribuera dans une certaine mesure à la croissance du marché européen de la synchronisation et du partage de fichiers d'entreprise.

Opportunités

-

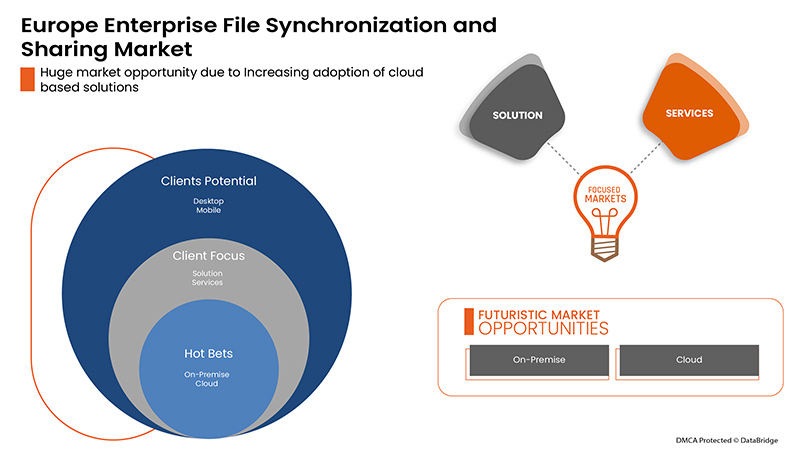

Adoption croissante de solutions basées sur le cloud

La solution EFSS basée sur le cloud offre plusieurs avantages tels que l'évolutivité, la flexibilité, la facilité d'accès, la prise en charge de plusieurs appareils et des coûts réduits. De plus, comme les solutions sur site ont un coût élevé, cela devient un obstacle pour les PME qui souhaitent adopter la solution EFSS. Cependant, avec l'émergence des services basés sur le cloud, les PME mettent facilement en œuvre des solutions EFSS.

Contraintes/Défis

- Coût élevé de la solution EFSS

Le coût élevé de ces solutions constitue un obstacle à l'expansion du marché européen de la synchronisation et du partage de fichiers d'entreprise, malgré les avantages considérables associés à l'installation de solutions et de services EFSS. Les fournisseurs proposent des solutions EFSS sous la forme de modèles d'abonnement d'entreprise ou de modèles de licences par utilisateur à des coûts très élevés. Pour un utilisateur unique, le prix de vente moyen annuel (ASP) des systèmes EFSS se situe entre 150 et 170 USD et comprend, entre autres, la personnalisation, l'intégration, le coût des fonctionnalités cloud et les outils de récupération.

Impact du COVID-19 sur le marché européen de la synchronisation et du partage de fichiers d'entreprise

La COVID-19 a eu un impact majeur sur diverses industries, car presque tous les pays ont opté pour la fermeture de toutes les installations, à l'exception de celles qui traitent du secteur des biens essentiels. Le gouvernement a pris des mesures strictes telles que la fermeture des installations et la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui font face à cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

L'épidémie de COVID-19 suscite une inquiétude généralisée et des difficultés économiques pour les consommateurs, les entreprises et les communautés du monde entier. La COVID-19 a obligé de nombreuses organisations à transformer numériquement leurs lieux de travail et d'enseignement pour fonctionner efficacement. De nos jours, les entreprises s'appuient de plus en plus sur des technologies avancées, telles que le cloud, l'IA et l'IoT, pour soutenir la course à la transformation numérique et garder une longueur d'avance sur leurs concurrents. Le comportement pandémique a obligé les entreprises à adopter un modèle de travail à domicile afin de pouvoir continuer à travailler tout en prenant des mesures pour arrêter la propagation du virus. Les tendances croissantes en matière d'espace de travail numérique et de main-d'œuvre mobile parmi les entreprises sont devenues les moteurs de la croissance du marché européen de la synchronisation et du partage de fichiers d'entreprise pendant la période de pandémie.

Les fabricants prennent diverses décisions stratégiques pour répondre à la demande croissante en période de COVID-19. Les acteurs sont impliqués dans des activités stratégiques telles que des partenariats, des collaborations, des acquisitions et autres pour améliorer la technologie impliquée dans le marché européen de la synchronisation et du partage de fichiers d'entreprise. Grâce à cela, les entreprises apporteront des solutions avancées et précises au marché. En outre, les initiatives gouvernementales visant à stimuler la numérisation dans tous les secteurs ont conduit à la croissance du marché.

Développements récents

- En septembre 2021, Google a annoncé le lancement de deux produits, Google Filestore Enterprise et Backup for Google Kubernetes Engine (GKE). Le service vise à aider les entreprises à migrer les besoins courants en matière de stockage NAS de fichiers sur site vers le cloud sans avoir à reconstruire à une plus grande échelle que leurs niveaux de base et supérieurs précédents. Ainsi, avec cela, l'entreprise élargit son portefeuille de produits sur le marché

- En janvier 2021, Microsoft a annoncé qu'il permettrait aux utilisateurs de partager des fichiers volumineux jusqu'à 250 Go via SharePoint, Teams et OneDrive. La société a également inclus une fonction de synchronisation différentielle, qui synchronise essentiellement les modifications apportées par l'utilisateur ou son collègue de travail dans le fichier, afin que l'utilisateur n'ait pas à passer du temps à attendre la synchronisation de fichiers volumineux uniquement pour les télécharger à nouveau après qu'une petite modification a été apportée. Ainsi, avec cela, l'entreprise répond aux besoins des gens et attire plus de clients

Portée du marché européen de la synchronisation et du partage de fichiers d'entreprise

Le marché européen de la synchronisation et du partage de fichiers d'entreprise est segmenté en fonction de l'offre, du modèle de déploiement, de la taille de l'organisation, de l'accessibilité, de l'application et de l'utilisateur final. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

En offrant

- Solution

- Services

Sur la base de l'offre, le marché européen de la synchronisation et du partage de fichiers d'entreprise est segmenté en solutions et services.

Par modèle de déploiement

- Sur site

- Nuage

Sur la base du modèle de déploiement, le marché européen de la synchronisation et du partage de fichiers d'entreprise est segmenté en sur site et en cloud.

Par taille d'organisation

- Grandes entreprises

- Petites et moyennes entreprises (PME).

Sur la base de la taille de l'organisation, le marché européen de la synchronisation et du partage de fichiers d'entreprise est segmenté en grandes entreprises et petites et moyennes entreprises (PME).

Par Accessibilité

- Bureau

- Mobile

- Web

- Linux

- Autres

Sur la base de l'accessibilité, le marché européen de la synchronisation et du partage de fichiers d'entreprise est segmenté en ordinateurs de bureau, mobiles, Web, Linux et autres.

Par application

- Soutien à la collaboration

- Sécurité

- Système de gestion de contenu d'entreprise

- Stockage et sauvegarde d'entreprise

- Mobilité d'entreprise

- Gestion des documents d'entreprise

- Virtualisation du Cloud

- Autres

Sur la base des applications, le marché européen de la synchronisation et du partage de fichiers d'entreprise est segmenté en support de collaboration, sécurité, système de gestion de contenu d'entreprise, stockage et sauvegarde d'entreprise, mobilité d'entreprise, gestion de documents d'entreprise, virtualisation du cloud et autres.

Par utilisateur final

- Banque, services financiers et assurances (BFSI)

- Santé et sciences de la vie

- Gouvernement et secteur public

- Informatique et télécommunication

- Commerce de détail et commerce électronique

- Éducation

- Médias et divertissement

- Aérospatiale et Défense

- Légal

- Transport et logistique

- Fabrication

- Autres

Sur la base de l'utilisateur final, le marché européen de la synchronisation et du partage de fichiers d'entreprise est segmenté en banque, services financiers et assurances (BFSI), soins de santé et sciences de la vie, gouvernement et secteur public, informatique et télécommunications, vente au détail et commerce électronique, éducation, médias et divertissement, aérospatiale et défense, juridique, transport et logistique, fabrication, et autres.

Analyse/perspectives régionales du marché de la synchronisation et du partage de fichiers d'entreprise en Europe

Le marché européen de la synchronisation et du partage de fichiers d'entreprise est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, offre, modèle de déploiement, taille de l'organisation, accessibilité, application et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché européen de la synchronisation et du partage de fichiers d'entreprise sont l'Allemagne, le Royaume-Uni, la France, l'Italie, l'Espagne, les Pays-Bas, la Russie, la Suisse, la Turquie, la Belgique et le reste de l'Europe.

L'Allemagne domine le marché européen de la synchronisation et du partage de fichiers d'entreprise. L'Allemagne est susceptible d'être le marché européen de la synchronisation et du partage de fichiers d'entreprise qui connaît la croissance la plus rapide en raison de l'augmentation continue du lieu de travail numérique et de la main-d'œuvre mobile. De plus, le Royaume-Uni a été extrêmement réactif à l'adoption des dernières avancées technologiques, notamment les appareils mobiles, le cloud computing et l'IoT, au sein des entreprises, ce qui propulse la croissance du marché.

The country section of the Europe enterprise file synchronization and sharing market report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Enterprise File Synchronization and Sharing Market Share Analysis

The Europe enterprise file synchronization and sharing market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, application dominance. The above data points are only related to the companies' focus on the Europe enterprise file synchronization and sharing market.

Some of the major players operating in the Europe enterprise file synchronization and sharing market are IBM Corporation, Axway, Citrix Systems, Inc., Google, Microsoft, Dropbox, Inc., Micro Focus, Nextcloud GmbH, Citrix Systems, Inc., Open Text Corporation, Qnext Corp., Thru, Inc., VMware, Inc., Thomson Reuters, FileCloud, Ziff Davis, Inc., Seafile Ltd., Files.com, ACCELLION, Egnyte, Inc., Intralinks, Inc., Box, ownCloud GmbH, MyWorkDrive LLC., CTERA Networks Ltd., DryvIQ among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FEDERAL INFORMATION SECURITY MANAGEMENT ACT (FISMA)

4.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)

4.3 GENERAL DATA PROTECTION REGULATION (GDPR)

4.4 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) 27001

4.5 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI DSS)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 CONSTANT RISING DIGITAL WORKPLACE AND MOBILE WORKFORCE

5.1.2 EMPHASIS OF BUSINESSES ON CORPORATE DATA SECURITY

5.1.3 INCREASE IN COLLABORATION AMONG EMPLOYEES AND ENTERPRISES

5.1.4 SURGING FOCUS AND ADOPTION OF REMOTE WORKING CULTURE

5.1.5 RISE IN INCIDENCE OF DATA THEFT IN BFSI & HEALTHCARE SECTOR

5.2 RESTRAINTS

5.2.1 HIGH COST OF EFSS SOLUTION

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF CLOUD BASED SOLUTIONS

5.3.2 INCREASE IN USAGE OF SMARTPHONES

5.3.3 INCREASING BYOD TREND ACROSS ENTERPRISES

5.3.4 INCREASING PACE OF DIGITALIZATION IN BUSINESSES

5.4 CHALLENGES

5.4.1 CONCERNS REGARDING DATA SECURITY AND PRIVACY

6 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 INTEGRATED EFSS SOLUTION

6.2.2 STANDALONE EFSS SOLUTION

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.1.1 INTEGRATION AND DEPLOYMENT

6.3.1.2 TRAINING AND CONSULTING

6.3.1.3 SUPPORT AND MAINTENANCE

6.3.2 MANAGED SERVICES

7 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 CLOUD

7.2.1 PUBLIC

7.2.2 HYBRID

7.2.3 PRIVATE

7.3 ON-PREMISE

8 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISES

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

9 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY

9.1 OVERVIEW

9.2 DESKTOP

9.2.1 WINDOWS

9.2.2 MAC

9.3 MOBILE

9.3.1 ANDROID

9.3.2 IOS

9.4 WEB

9.5 LINUX

9.6 OTHERS

10 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 COLLABORATION SUPPORT

10.3 SECURITY

10.4 ENTERPRISE CONTENT MANAGEMENT SYSTEM

10.5 ENTERPRISE STORAGE AND BACKUP

10.6 ENTERPRISE MOBILITY

10.7 ENTERPRISE DOCUMENT MANAGEMENT

10.8 CLOUD VIRTUALIZATION

10.9 OTHERS

11 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END-USER

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

11.2.1 SOLUTION

11.2.2 SERVICES

11.3 HEALTHCARE AND LIFESCIENCE

11.3.1 SOLUTION

11.3.2 SERVICES

11.4 GOVERNMENT AND PUBLIC SECTOR

11.4.1 SOLUTION

11.4.2 SERVICES

11.5 IT AND TELECOMMUNICATION

11.5.1 SOLUTION

11.5.2 SERVICES

11.6 RETAIL AND E-COMMERCE

11.6.1 SOLUTION

11.6.2 SERVICES

11.7 EDUCATION

11.7.1 SOLUTION

11.7.2 SERVICES

11.8 MEDIA AND ENTERTAINMENT

11.8.1 SOLUTION

11.8.2 SERVICES

11.9 AEROSPACE AND DEFENCE

11.9.1 SOLUTION

11.9.2 SERVICES

11.1 LEGAL

11.10.1 SOLUTION

11.10.2 SERVICES

11.11 TRANSPORTATION AND LOGISTICS

11.11.1 SOLUTION

11.11.2 SERVICES

11.12 MANUFACTURING

11.12.1 SOLUTION

11.12.2 SERVICES

11.13 OTHERS

12 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 U.K.

12.1.3 FRANCE

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 NETHERLANDS

12.1.7 RUSSIA

12.1.8 SWITZERLAND

12.1.9 TURKEY

12.1.10 BELGIUM

12.1.11 REST OF EUROPE

13 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MICROSOFT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DROPBOX, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 VMWARE, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 CITRIX SYSTEMS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 BOX, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCTS PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ZIFF DAVIS, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 ACCELLION

15.8.1 COMPANY SNAPSHOT

15.8.2 SOLUTION PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 AXWAY

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 CTERA NETWORKS LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCTS PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DRYVIQ (SKYSYNC)

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCTS PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 EGNYTE, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FILECLOUD

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FILES.COM

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 IBM CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 INTRALINKS, INC.(SS&C)

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 MICRO FOCUS

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 MYWORKDRIVE (BY WANPATH LLC.)

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCTS PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 NEXTCLOUD GMBH

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 OPEN TEXT CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 OWNCLOUD GMBH

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCTS PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 QNEXT CORP.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 SEAFILE, INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 THOMSON REUTERS

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 THRU, INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 EUROPE SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 8 EUROPE CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE ON-PREMISE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE LARGE ENTERPRISES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE WEB IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE LINUX IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE OTHERS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE COLLABORATION SUPPORT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE SECURITY IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE ENTERPRISE CONTENT MANAGEMENT SYSTEM IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE ENTERPRISE STORAGE AND BACKUP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE ENTERPRISE MOBILITY IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE ENTERPRISE DOCUMENT MANAGEMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE CLOUD VIRTUALIZATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE OTHERS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 32 EUROPE BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 34 EUROPE HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE HEALTHCARE AND LIFESCIENCE SEGMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 36 EUROPE GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 38 EUROPE IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 40 EUROPE RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE RETAIL AND E-COMMERCE SEGMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 42 EUROPE EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 44 EUROPE MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 46 EUROPE AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 48 EUROPE LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 EUROPE TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 52 EUROPE MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 54 EUROPE OTHERS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 56 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 57 EUROPE SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 EUROPE SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 EUROPE PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 61 EUROPE CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 63 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 64 EUROPE DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 EUROPE MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 EUROPE BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 69 EUROPE HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 EUROPE GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 71 EUROPE IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 72 EUROPE RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 73 EUROPE EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 74 EUROPE MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 75 EUROPE AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 76 EUROPE LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 77 EUROPE TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 78 EUROPE MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 79 GERMANY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 80 GERMANY SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 GERMANY SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 GERMANY PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 GERMANY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 84 GERMANY CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 GERMANY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 86 GERMANY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 87 GERMANY DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 GERMANY MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 GERMANY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 GERMANY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 GERMANY BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 92 GERMANY HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 93 GERMANY GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 GERMANY IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 95 GERMANY RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 96 GERMANY EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 97 GERMANY MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 98 GERMANY AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 99 GERMANY LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 100 GERMANY TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 101 GERMANY MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 102 U.K. ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 103 U.K. SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.K. SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 U.K. PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.K. ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 107 U.K. CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.K. ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 109 U.K. ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 110 U.K. DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.K. MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.K. ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 U.K. ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 U.K. BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 115 U.K. HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 116 U.K. GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 117 U.K. IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 118 U.K. RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 119 U.K. EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 120 U.K. MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 121 U.K. AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 122 U.K. LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 123 U.K. TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 124 U.K. MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 125 FRANCE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 126 FRANCE SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 FRANCE SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 FRANCE PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 FRANCE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 130 FRANCE CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 FRANCE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 132 FRANCE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 133 FRANCE DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 FRANCE MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 FRANCE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 FRANCE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 FRANCE BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 138 FRANCE HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 139 FRANCE GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 140 FRANCE IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 141 FRANCE RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 142 FRANCE EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 143 FRANCE MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 144 FRANCE AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 145 FRANCE LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 146 FRANCE TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 147 FRANCE MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 148 ITALY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 149 ITALY SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 ITALY SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 ITALY PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 ITALY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 153 ITALY CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 ITALY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 155 ITALY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 156 ITALY DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 ITALY MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 ITALY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 ITALY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 ITALY BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 161 ITALY HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 162 ITALY GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 163 ITALY IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 164 ITALY RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 165 ITALY EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 166 ITALY MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 167 ITALY AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 168 ITALY LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 169 ITALY TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 170 ITALY MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 171 SPAIN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 172 SPAIN SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 SPAIN SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 SPAIN PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 SPAIN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 176 SPAIN CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 SPAIN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 178 SPAIN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 179 SPAIN DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 SPAIN MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 SPAIN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 SPAIN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 183 SPAIN BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 184 SPAIN HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 185 SPAIN GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 186 SPAIN IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 187 SPAIN RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 188 SPAIN EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 189 SPAIN MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 190 SPAIN AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 191 SPAIN LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 192 SPAIN TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 193 SPAIN MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 194 NETHERLANDS ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 195 NETHERLANDS SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 NETHERLANDS SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 NETHERLANDS PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 NETHERLANDS ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 199 NETHERLANDS CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 NETHERLANDS ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 201 NETHERLANDS ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 202 NETHERLANDS DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 NETHERLANDS MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 NETHERLANDS ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 205 NETHERLANDS ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 206 NETHERLANDS BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 207 NETHERLANDS HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 208 NETHERLANDS GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 209 NETHERLANDS IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 210 NETHERLANDS RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 211 NETHERLANDS EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 212 NETHERLANDS MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 213 NETHERLANDS AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 214 NETHERLANDS LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 215 NETHERLANDS TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 216 NETHERLANDS MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 217 RUSSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 218 RUSSIA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 RUSSIA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 RUSSIA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 221 RUSSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 222 RUSSIA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 RUSSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 224 RUSSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 225 RUSSIA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 RUSSIA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 RUSSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 228 RUSSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 229 RUSSIA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 230 RUSSIA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 231 RUSSIA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 232 RUSSIA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 233 RUSSIA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 234 RUSSIA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 235 RUSSIA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 236 RUSSIA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 237 RUSSIA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 238 RUSSIA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 239 RUSSIA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 240 SWITZERLAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 241 SWITZERLAND SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 SWITZERLAND SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 SWITZERLAND PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 SWITZERLAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 245 SWITZERLAND CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 SWITZERLAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 247 SWITZERLAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 248 SWITZERLAND DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 SWITZERLAND MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 SWITZERLAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 251 SWITZERLAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 252 SWITZERLAND BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 253 SWITZERLAND HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 254 SWITZERLAND GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 255 SWITZERLAND IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 256 SWITZERLAND RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 257 SWITZERLAND EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 258 SWITZERLAND MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 259 SWITZERLAND AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 260 SWITZERLAND LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 261 SWITZERLAND TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 262 SWITZERLAND MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 263 TURKEY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 264 TURKEY SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 TURKEY SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 TURKEY PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 TURKEY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 268 TURKEY CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 TURKEY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 270 TURKEY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 271 TURKEY DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 TURKEY MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 273 TURKEY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 274 TURKEY ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 275 TURKEY BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 276 TURKEY HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 277 TURKEY GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 278 TURKEY IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 279 TURKEY RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 280 TURKEY EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 281 TURKEY MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 282 TURKEY AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 283 TURKEY LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 284 TURKEY TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 285 TURKEY MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 286 BELGIUM ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 287 BELGIUM SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 288 BELGIUM SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 289 BELGIUM PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 BELGIUM ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 291 BELGIUM CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 BELGIUM ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 293 BELGIUM ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 294 BELGIUM DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 295 BELGIUM MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 BELGIUM ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 297 BELGIUM ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 298 BELGIUM BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 299 BELGIUM HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 300 BELGIUM GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 301 BELGIUM IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 302 BELGIUM RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 303 BELGIUM EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 304 BELGIUM MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 305 BELGIUM AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 306 BELGIUM LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 307 BELGIUM TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 308 BELGIUM MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 309 REST OF EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: SEGMENTATION

FIGURE 2 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: SEGMENTATION

FIGURE 11 CONTINUOUSLY RISING DIGITAL WORKPLACE AND MOBILE WORKFORCE IS EXPECTED TO DRIVE EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKETIN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 12 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKETIN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET

FIGURE 15 NUMBER OF SMARTPHONE USERS WORLDWIDE, FROM 2017 TO 2022

FIGURE 16 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY OFFERING, 2021

FIGURE 17 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DEPLOYMENT MODEL, 2021

FIGURE 18 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 19 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY ACCESSIBILITY, 2021

FIGURE 20 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY APPLICATION, 2021

FIGURE 21 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY END-USER, 2021

FIGURE 22 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY OFFERING (2022-2029)

FIGURE 27 EUROPE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.