Europe Elderly Care Market

Taille du marché en milliards USD

TCAC :

%

USD

352.83 Billion

USD

597.23 Billion

2024

2032

USD

352.83 Billion

USD

597.23 Billion

2024

2032

| 2025 –2032 | |

| USD 352.83 Billion | |

| USD 597.23 Billion | |

|

|

|

|

Segmentation du marché européen des soins aux personnes âgées, par type de produit (logement, appareils fonctionnels et produits pharmaceutiques), service (soins à domicile, soins en établissement et accueil de jour pour adultes), application (maladies cardiaques, respiratoires, diabète, ostéoporose, maladies neurologiques, cancer, maladies rénales, arthrite, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché européen des soins aux personnes âgées

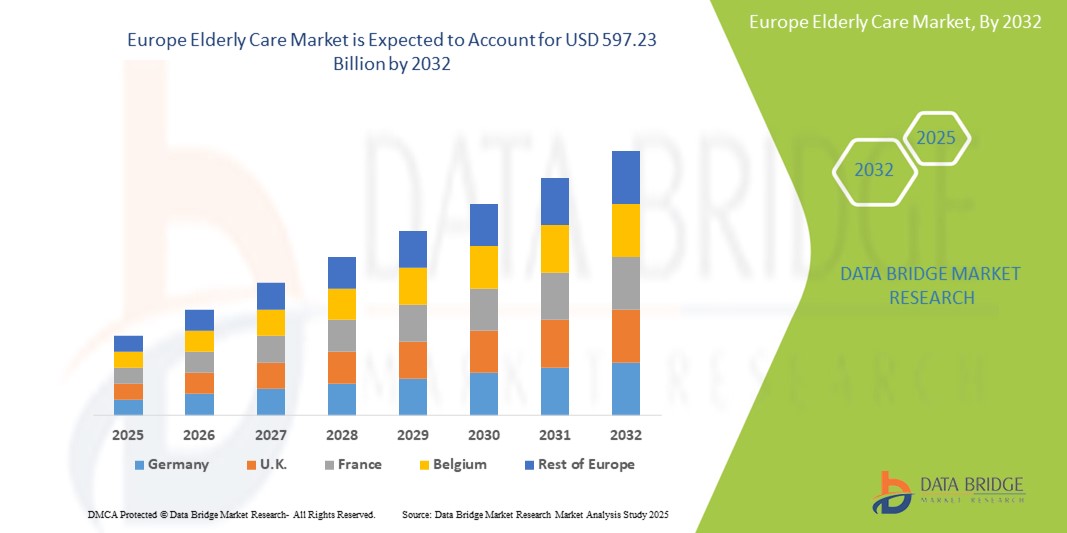

- La taille du marché européen des soins aux personnes âgées était évaluée à 352,83 milliards USD en 2024 et devrait atteindre 597,23 milliards USD d'ici 2032 , à un TCAC de 6,80 % au cours de la période de prévision.

- L'expansion du marché en Europe est principalement due au vieillissement rapide de la population du continent, qui entraîne une forte augmentation du nombre de personnes âgées nécessitant des soins et des services d'accompagnement spécialisés. Cette évolution démographique a généré une forte demande pour une gamme variée de services de soins aux personnes âgées, incluant les soins à domicile, les soins en établissement et les soins de jour pour adultes.

- Par ailleurs, l'incidence croissante des maladies chroniques chez les personnes âgées, telles que le diabète, les maladies cardiovasculaires et les troubles neurologiques, accroît le besoin de services de soins spécialisés. La préférence croissante pour les solutions de soins à domicile, conjuguée aux avancées technologiques en santé, comme la télésanté et la télésurveillance, ainsi qu'aux initiatives gouvernementales visant à améliorer la qualité et l'accessibilité des soins aux personnes âgées, stimulent encore davantage la croissance du marché.

Analyse du marché européen des soins aux personnes âgées

- Le marché européen des soins aux personnes âgées connaît une croissance significative, propulsée par l'évolution démographique et l'augmentation des besoins en matière de soins de santé, ce qui en fait un secteur vital dans le paysage économique européen.

- La demande croissante de services de soins aux personnes âgées est principalement due au vieillissement rapide de la population en Europe, qui entraîne une augmentation substantielle du nombre de personnes nécessitant des soins et un accompagnement de longue durée. Cette tendance démographique est encore accentuée par l'allongement de l'espérance de vie et la baisse de la natalité, ce qui exerce une pression considérable sur les systèmes de soins et les réseaux de soutien familial existants.

- L'Allemagne domine le marché européen des soins aux personnes âgées, estimé à 28,5 % en 2025. Cette domination s'explique par son importante population âgée, ses infrastructures de santé bien développées et les importants investissements publics dans les soins aux personnes âgées. Une forte présence d'établissements de soins et l'accent mis sur des soins de haute qualité contribuent à la position de leader de l'Allemagne.

- L'Allemagne devrait être la région connaissant la croissance la plus rapide sur le marché européen des soins aux personnes âgées, avec un TCAC de 10,23 %, en raison de son importante population âgée, de ses infrastructures de soins de santé bien développées et de ses investissements gouvernementaux importants dans les soins aux personnes âgées.

- Les soins institutionnels, englobant les maisons de retraite et les résidences services, détenaient la plus grande part de marché, estimée à 45,8 % en 2025. Cela est dû à la nature établie de ces établissements dans la fourniture de soins complets aux personnes ayant des besoins médicaux complexes et à la dépendance historique à l'égard des milieux institutionnels pour les soins de longue durée.

Portée du rapport et segmentation du marché européen des soins aux personnes âgées

|

Attributs |

Informations clés sur le marché européen des soins aux personnes âgées |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché européen des soins aux personnes âgées

« Indépendance accrue et soins personnalisés grâce à l'intégration des technologies »

- Une tendance majeure et croissante sur le marché européen des soins aux personnes âgées est l'intégration croissante des technologies pour améliorer l'autonomie et offrir des soins plus personnalisés. Cette évolution est motivée par la nécessité d'accompagner une population vieillissante croissante, tout en répondant aux pénuries de personnel et au souhait des seniors de vieillir chez eux.

- Par exemple, les solutions de télésanté se généralisent, permettant des consultations et un suivi des signes vitaux à distance, comme le montrent des projets comme SI4CARE en Italie. Des capteurs portables et des appareils intelligents, comme ceux utilisés dans le cadre du projet PROCAREFUL, permettent une surveillance continue de la santé et une détection précoce des problèmes potentiels.

- L'intégration de l'IA est également en plein essor, avec des plateformes capables d'analyser les données des patients pour créer des plans de soins personnalisés et prédire les risques potentiels pour la santé. Les technologies de la maison connectée sont adoptées pour faciliter les tâches quotidiennes, améliorer la sécurité grâce à des systèmes de détection de chute comme la lampe connectée Nobi, et améliorer le bien-être général.

- L'intégration harmonieuse de ces technologies vise à créer un écosystème de soins connecté, permettant aux soignants et aux professionnels de santé de surveiller et d'accompagner plus efficacement les personnes âgées. Cette approche centralisée permet des interventions proactives, une meilleure communication et une expérience de soins plus globale et personnalisée.

- Cette tendance à exploiter la technologie pour une autonomie accrue et des soins personnalisés transforme profondément la prestation de services aux personnes âgées en Europe. Par conséquent, de nombreuses startups et entreprises établies développent des solutions innovantes, notamment des plateformes basées sur l'IA, des assistants robotisés pour la mobilité et l'accompagnement, et des systèmes de maison intelligente conçus spécifiquement pour les besoins des personnes âgées, comme ceux mis en avant par le Réseau européen du vieillissement.

- Cette tendance vers des systèmes de verrouillage plus intelligents, intuitifs et interconnectés transforme fondamentalement les attentes des utilisateurs en matière de sécurité domestique. C'est pourquoi des entreprises comme WELOCK développent des solutions Europe Elderly Care basées sur l'IA, avec des fonctionnalités telles que le verrouillage/déverrouillage automatique basé sur l'accès autorisé et la compatibilité avec la commande vocale Google Assistant et Amazon Alexa.

- La demande de soins aux personnes âgées offrant une intégration transparente de l'IA et de la commande vocale augmente rapidement dans les secteurs résidentiel et commercial, car les consommateurs privilégient de plus en plus la commodité et les fonctionnalités complètes de la maison intelligente.

Dynamique du marché européen des soins aux personnes âgées

Conducteur

« Besoins croissants en raison de l'augmentation de la population âgée et des demandes de soins complexes »

- La prévalence croissante d’une population vieillissante rapide à travers l’Europe, associée à l’incidence croissante de problèmes de santé complexes chez les personnes âgées, constitue un facteur important de la demande accrue de services de soins aux personnes âgées.

- Par exemple, les projections démographiques d'Eurostat indiquent systématiquement une proportion croissante de personnes âgées de 65 ans et plus, ce qui accroît la pression sur les systèmes de santé et de protection sociale. Cette tendance nécessite des solutions innovantes et des investissements accrus dans le secteur des soins aux personnes âgées.

- L'augmentation du nombre de personnes âgées s'accompagne d'un besoin accru de soins spécialisés pour la prise en charge des maladies chroniques, des limitations de mobilité et des troubles cognitifs. Les technologies intelligentes et les modèles de soins avancés offrent un suivi renforcé, un accompagnement personnalisé et une meilleure qualité de vie aux personnes âgées, constituant une avancée significative par rapport aux approches de soins traditionnelles.

- De plus, la préférence croissante pour une vie indépendante et le désir de rester dans un environnement familial familier font des solutions de soins à domicile basées sur la technologie un élément essentiel de l'écosystème de soins, offrant une intégration transparente avec les services de surveillance et d'assistance à distance.

- La commodité de recevoir des soins à domicile, le suivi médical à distance pour une intervention précoce et la possibilité de gérer les soins via des plateformes numériques sont des facteurs clés qui stimulent l'adoption de technologies et de services innovants dans le secteur des soins aux personnes âgées, tant en établissement qu'en institution. La tendance aux plans de soins personnalisés et la disponibilité croissante de technologies d'assistance conviviales contribuent également à la croissance du marché.

Retenue/Défi

« Inquiétudes concernant la cybersécurité et les coûts initiaux élevés »

- Les préoccupations concernant la sécurité et la confidentialité des données sensibles des patients, ainsi que les coûts élevés associés à la prestation de soins de qualité, constituent des défis majeurs pour le développement du marché des soins aux personnes âgées en Europe. Avec l'adoption croissante des dossiers médicaux numériques, des systèmes de télésurveillance et des plateformes de soins basées sur l'IA, le risque de violation de données et d'accès non autorisé suscite des inquiétudes chez les patients et les professionnels de santé quant à la confidentialité et à l'intégrité des informations médicales personnelles.

- Par exemple, les incidents signalés de cyberattaques contre des établissements de santé à travers l’Europe ont rendu les parties prenantes hésitantes à adopter pleinement des solutions numériques interconnectées sans protocoles de sécurité robustes et mesures de protection des données.

- Répondre à ces préoccupations en matière de sécurité des données grâce à un chiffrement rigoureux des données, à des protocoles d'authentification sécurisés conformes au RGPD et à des audits réguliers des systèmes est essentiel pour instaurer la confiance et garantir une utilisation éthique des technologies dans les soins aux personnes âgées. Des organisations telles que l'Agence de l'Union européenne pour la cybersécurité (ENISA) fournissent des lignes directrices et des bonnes pratiques pour sécuriser les services de santé numériques. De plus, les coûts opérationnels relativement élevés associés à la fourniture de soins complets et de qualité aux personnes âgées, notamment en termes de personnel, de formation et d'équipement spécialisé, peuvent constituer un obstacle à l'accessibilité et à l'abordabilité, en particulier pour les personnes aux ressources financières limitées ou dans les régions où les infrastructures de santé sont moins développées. Si les soins à domicile et les services de proximité peuvent offrir des alternatives plus rentables aux soins en établissement, garantir un soutien de qualité et adéquat reste un défi financier.

- Bien que les progrès technologiques et les modèles de soins innovants visent à améliorer l'efficacité, le coût perçu élevé des soins spécialisés et des technologies avancées peut encore entraver leur adoption généralisée, en particulier pour les systèmes de santé financés par des fonds publics et les personnes soucieuses de leur budget.

- Surmonter ces défis grâce à la mise en œuvre de cadres de sécurité des données robustes, à la promotion de la littératie numérique parmi les utilisateurs et les fournisseurs, à l'optimisation de l'allocation des ressources et à l'exploration de modèles de financement durables sera essentiel pour la croissance soutenue et équitable du marché européen des soins aux personnes âgées.

Portée du marché européen des soins aux personnes âgées

Le marché est segmenté en fonction du type de produit, des services et de l'application

- Par type de produit

En fonction du type de produit, le marché européen des soins aux personnes âgées est segmenté entre les aides à l'habitat et les appareils fonctionnels, et les produits pharmaceutiques. Ce segment représentait la plus grande part de chiffre d'affaires en 2025, porté par le besoin croissant de logements spécialisés et de technologies d'assistance favorisant l'autonomie et la sécurité des personnes âgées. Ce phénomène est également soutenu par l'infrastructure bien établie des établissements de soins et l'adoption croissante d'aménagements du domicile et d'aides à l'adaptation.

Le secteur pharmaceutique devrait connaître une croissance significative, alimentée par la prévalence croissante des maladies chroniques chez les personnes âgées et la demande croissante de médicaments pour les traiter. Les progrès de la pharmacologie gériatrique et le développement de nouveaux médicaments adaptés aux personnes âgées contribuent également à cette croissance.

- Par services

En termes de services, le marché européen des soins aux personnes âgées se segmente en soins à domicile, soins en établissement et accueil de jour pour adultes. Les soins en établissement détenaient la plus grande part de chiffre d'affaires du marché, soit 45,8 % en 2025, grâce à l'infrastructure établie des maisons de retraite médicalisées et des résidences services offrant une prise en charge complète des personnes ayant des besoins complexes.

Le segment des soins à domicile devrait connaître la croissance la plus rapide, alimentée par la préférence croissante des personnes âgées pour vieillir chez elles, les progrès des technologies de télésurveillance et de télésanté permettant la prestation de soins à domicile, et le souhait de solutions de soins personnalisées. Le segment des centres de jour pour adultes devrait également connaître une croissance substantielle, offrant une solution économique et socialement engageante aux personnes âgées nécessitant des soins et un accompagnement de jour.

- Par application

En fonction des applications, le marché européen des soins aux personnes âgées est segmenté en maladies cardiaques, maladies respiratoires, diabète, ostéoporose, maladies neurologiques, cancer, maladies rénales, arthrite, etc. En 2025, les maladies cardiaques représentaient la plus grande part de marché, en raison de la forte prévalence des maladies cardiovasculaires chez les personnes âgées.

Les maladies neurologiques devraient connaître la croissance la plus rapide, alimentée par l'incidence croissante de la démence et d'autres maladies neurodégénératives nécessitant des soins spécialisés et de longue durée. Parmi les autres domaines d'application importants figurent le diabète, l'arthrite et le cancer, reflétant les défis de santé courants auxquels est confrontée la population vieillissante en Europe.

Analyse régionale du marché européen des soins aux personnes âgées

- L'Allemagne domine le marché européen des soins aux personnes âgées avec la plus importante part de revenus, estimée à 28,5 % en 2025. Cette part est portée par une population âgée importante, un système de santé sophistiqué et un soutien gouvernemental solide aux services de soins aux personnes âgées. L'engagement du pays en faveur de services de soins complets et de qualité supérieure en fait un marché prédominant dans la région.

- La demande croissante de soins diversifiés et de qualité pour les personnes âgées est très appréciée par la population vieillissante et leurs familles partout en Europe. Des facteurs tels que la prévalence croissante des maladies chroniques, le désir de soins personnalisés et le besoin d'environnements de vie bienveillants stimulent la croissance du marché.

- Cette demande généralisée est renforcée par l'augmentation des dépenses de santé, une prise de conscience croissante de l'importance des soins spécialisés aux personnes âgées et une préférence pour les soins à domicile et en institution, offrant un accompagnement complet et bienveillant. Cela fait des soins aux personnes âgées un secteur vital et en pleine expansion dans les pays européens.

Aperçu du marché des soins aux personnes âgées au Royaume-Uni et en Europe

Le marché britannique des soins aux personnes âgées devrait connaître une croissance annuelle moyenne (TCAC) remarquable au cours de la période de prévision, portée par la tendance croissante au vieillissement à domicile et le souhait d'une sécurité et d'une commodité accrues dans la prestation des soins. De plus, les préoccupations concernant le bien-être et la sécurité des personnes âgées incitent les familles et le gouvernement à opter pour des solutions de soins complètes et surveillées. L'adoption par le Royaume-Uni des technologies dans le secteur de la santé, conjuguée à la solidité de ses infrastructures, devrait continuer de stimuler la croissance du marché.

Aperçu du marché des soins aux personnes âgées en Allemagne et en Europe

Le marché allemand des soins aux personnes âgées devrait connaître une croissance annuelle moyenne (TCAC) considérable au cours de la période de prévision, alimentée par une prise en compte croissante des besoins des personnes âgées et une demande croissante de solutions technologiques de pointe centrées sur la personne. Le développement des infrastructures allemandes, combiné à l'importance accordée à l'innovation et à la qualité de vie de ses seniors, favorise l'adoption de services diversifiés de soins aux personnes âgées, notamment dans les résidences services et les maisons de retraite médicalisées. L'intégration des technologies aux services de soins aux personnes âgées, comme la télésurveillance et la télésanté, se généralise également, avec une forte préférence pour des solutions sécurisées et respectueuses de la vie privée, adaptées aux attentes des consommateurs locaux.

Part de marché des soins aux personnes âgées en Europe

Le secteur européen des soins aux personnes âgées est principalement dirigé par des entreprises bien établies, notamment :

- Clariane (France)

- DomusVi SAS ( France)

- Attendo Group AB (Suède)

- HC-One (Royaume-Uni)

- Victor's Group GmbH (Allemagne)

- Maisons de Famille SAS (France)

- Bupa (Royaume-Uni) (exploite les maisons de retraite Bupa)

- Deutsche Wohnen SE (Allemagne)

- Kursana Residenzen GmbH (Allemagne)

- KOS Group SpA (Italie)

- LNA Santé (France)

- Care UK Limited (Royaume-Uni)

- Vitalia Home SLU (Espagne)

- Azurit Hansa GmbH (Allemagne)

- EMVIA Living GmbH (Allemagne)

- Emera SAS (France)

- Ambea AB (Suède)

Derniers développements sur le marché européen des soins aux personnes âgées

- En avril 2024, le Groupe Korian (France) a annoncé une expansion significative de ses services de téléassistance en Europe, visant à améliorer le suivi et l'accompagnement à distance des personnes âgées vivant à domicile. Cette initiative s'appuie sur les technologies numériques pour offrir des soins personnalisés et des interventions rapides, répondant ainsi à la demande croissante de solutions de maintien à domicile et améliorant la sécurité et le bien-être des seniors. Cette initiative stratégique souligne l'engagement de Korian en faveur de l'innovation et sa position dans le paysage européen en pleine évolution des soins aux personnes âgées.

- En mars 2024, Lottie (Royaume-Uni), plateforme de services pour les maisons de retraite, a obtenu un financement substantiel pour développer sa plateforme et étendre sa présence au Royaume-Uni et sur d'autres marchés européens. Ce financement servira à améliorer l'expérience utilisateur des familles en recherche de maisons de retraite et à mieux accompagner les prestataires de soins dans le recrutement des places vacantes. Cet investissement souligne l'importance croissante accordée aux solutions numériques pour améliorer l'accès et l'efficacité du secteur des soins aux personnes âgées.

- En mars 2024, la Commission européenne a lancé une nouvelle initiative visant à promouvoir la culture et les compétences numériques des personnes âgées afin d'améliorer leur accès aux services de santé en ligne et aux relations sociales. Ce programme vise à réduire l'exclusion numérique et à permettre aux personnes âgées d'utiliser les technologies pour gérer leur santé et leur bien-être, reconnaissant ainsi le rôle croissant des outils numériques dans les soins modernes aux personnes âgées.

- En février 2024, une collaboration entre plusieurs instituts de recherche et prestataires de soins allemands a annoncé le succès du projet pilote de systèmes de détection des chutes basés sur l'IA dans les établissements de soins résidentiels. Cette technologie utilise des capteurs et l'intelligence artificielle pour détecter automatiquement les chutes et alerter le personnel soignant, ce qui accélère les temps de réponse et améliore la sécurité des résidents. Ce développement illustre l'intégration croissante de l'IA pour améliorer la sécurité et la surveillance dans les établissements de soins.

- En janvier 2024, le gouvernement suédois a annoncé une augmentation du financement des services de soins à domicile, afin de soutenir un plus grand nombre de personnes âgées souhaitant vieillir chez elles. Ce changement de politique reflète une tendance croissante en Europe à privilégier les soins de proximité et à fournir les ressources nécessaires pour permettre aux seniors de vivre plus longtemps de manière autonome.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.