Marché européen des emballages en carton ondulé, par matière première (carton de couverture et carton moyen), style (boîtes à fentes, télescopes, dossiers, plateaux, feuilles, papier en accordéon, papier découpé Bliss et intérieurs découpés), qualité (testliner non blanchi, testliner blanc, Kraftliner non blanchi, Kraftliner blanc, cannelure à base de déchets et cannelure semi-chimique), utilisation finale (aliments transformés, soins de santé, boissons, produits chimiques, textiles, soins personnels, produits électriques, pièces de véhicules, verrerie et céramique, produits en bois et en bois, soins ménagers, fruits et légumes, produits en papier, tabac et autres), pays (Allemagne, Royaume-Uni, France, Italie, Espagne, Pays-Bas, Belgique, Russie, Turquie, Suisse, Pologne, Finlande, Suède, Norvège, Lituanie, Lettonie, Estonie et reste de l'Europe) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché : marché européen des emballages en carton ondulé

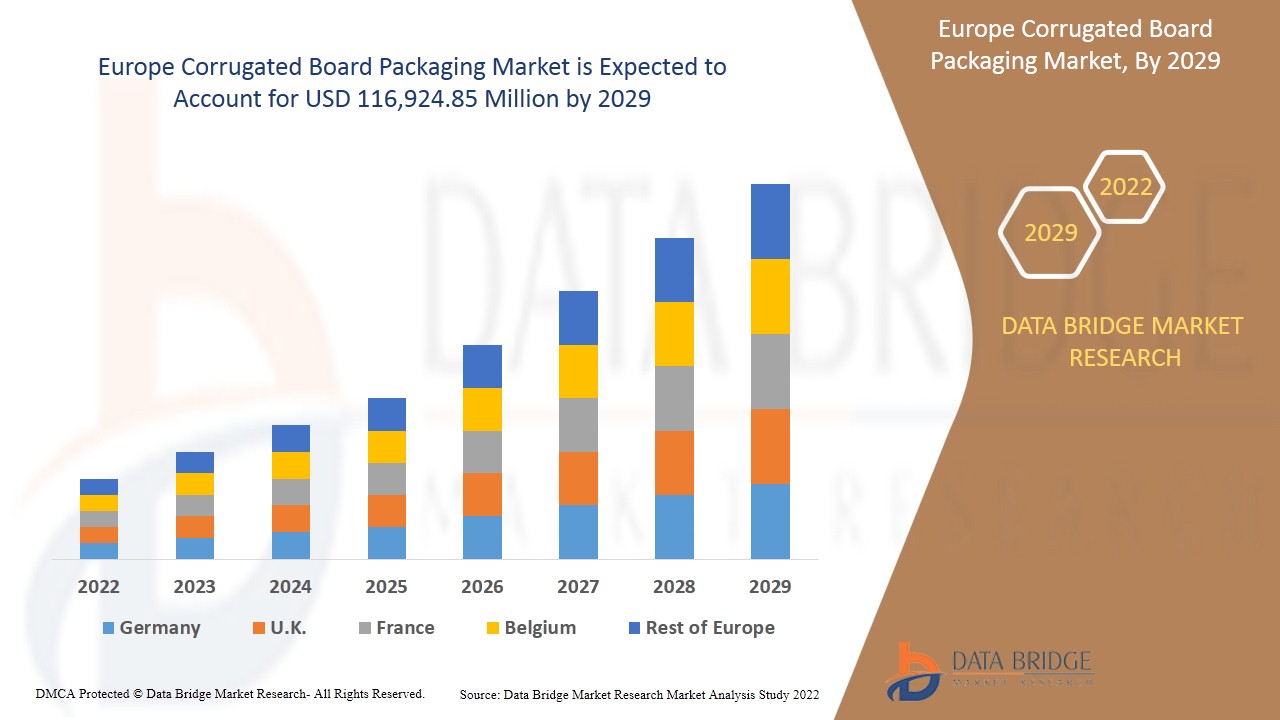

Le marché européen des emballages en carton ondulé devrait connaître une croissance de marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 5,9 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 116 924,85 millions USD d'ici 2029. Croissance des emballages en carton ondulé de petite et moyenne taille dans l'industrie de l'emballage des aliments et des boissons et préférences croissantes pour les produits en carton ondulé recyclé dans l'industrie de l'emballage. Afin de répondre à la demande croissante de produits d'emballage en carton ondulé dans l'industrie du bâtiment et de la construction et de l'électronique, certaines entreprises étendent leurs capacités de production en concluant des acquisitions, des coentreprises et en lançant des produits dans différentes régions.

Les produits d'emballage en carton ondulé sont conçus pour offrir une protection extrême aux produits fragiles, lourds, volumineux ou de grande valeur pendant le stockage et le transport. Un emballage en carton ondulé à plusieurs couches confère au produit d'emballage sa résistance et le rend plus résistant que le carton moyen. Différents types de doublures sont utilisés dans le carton ondulé pour assurer la résistance, tels que les doublures kraft, les doublures d'essai et les doublures linéaires à copeaux. Le carton ondulé sert également de coussin pour le produit en transit. Les produits d'emballage en carton ondulé sont 100 % renouvelables et rentables par nature et sont utilisés pour remplacer les emballages en bois et en métal. Il existe plusieurs types d'emballages en carton ondulé, tels que les emballages monophasés, à simple paroi, à double paroi, à triple paroi et autres. L'emballage en carton ondulé monophasé comprend une seule cannelure et une ou deux feuilles de carton linéaire. L'emballage en carton ondulé à simple paroi comprend une feuille de support ondulé collée et placée entre deux feuilles de carton de doublure. Le carton double paroi désigne le type d'emballage en carton ondulé constitué de deux couches de carton ondulé collées entre trois couches de carton de couverture. Le carton triple paroi désigne le type d'emballage en carton ondulé considéré comme le plus résistant de tous les types d'emballages en carton ondulé car il se compose de trois couches de carton ondulé et de quatre couches de carton de couverture.

L'augmentation des achats de boîtes en carton ondulé léger dans tous les secteurs devrait stimuler la croissance du marché. Cependant, les réglementations gouvernementales strictes en matière d'emballage des produits devraient restreindre le marché de l'emballage en carton ondulé en Asie-Pacifique. L'augmentation des acquisitions et de la collaboration entre les entreprises devrait créer des opportunités de croissance pour le marché, mais le manque de sensibilisation à la durabilité de l'emballage constitue un défi majeur pour la croissance du marché.

Le rapport sur le marché des emballages en carton ondulé fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché des emballages en carton ondulé, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des emballages en carton ondulé

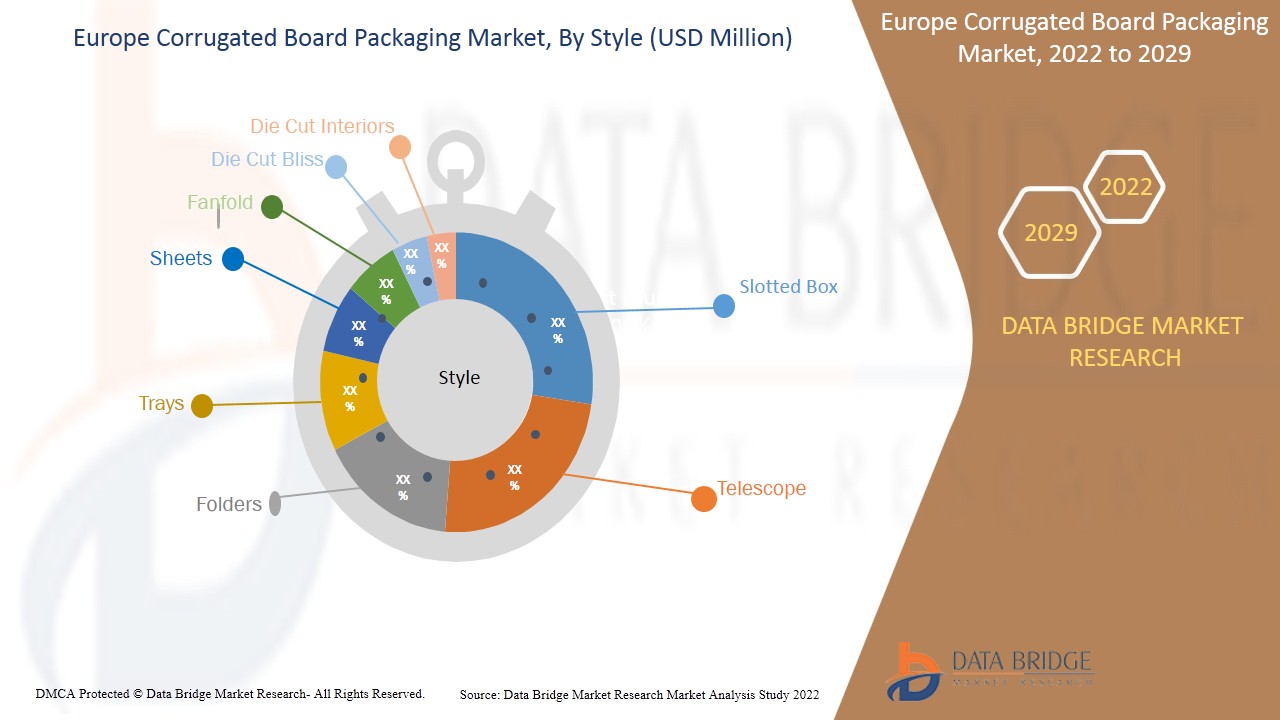

Le marché européen des emballages en carton ondulé est segmenté en quatre segments notables qui sont basés sur la qualité, la matière première, le style et l'utilisation finale. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- On the basis of raw material, the Europe corrugated board packaging market is segmented into linerboard and medium. In 2022, the linerboard segment is expected to dominate the Europe corrugated board packaging market due to the easy processing techniques, improved efficiencies as well as easier usage. However, limited amount of strength restricts consumption in the market.

- On the basis of style segment, the Europe corrugated board packaging market is segmented into slotted box, telescopes, folders, trays, die cut bliss, die cut interiors, sheets, and fanfold. In 2022, the slotted box segment is expected to dominate the market owing to its growing application in the food and beverage industry in the Europe market. The easy availability in the market drives the slotted box segment in the Europe market.

- On the basis of grade segment, the Europe corrugated board packaging market is segmented into white-top kraftliner, unbleached kraftliner, white-top testliner, unbleached testliner, waste-based fluting, and semi-chemical fluting. In 2022, the unbleached testliner segment is expected to dominate the market owing to availability in abundance, which maximizes consumption in the Europe market. The force's resistance properties maximize application in various areas that drive the unbleached testliner segment in the Europe market.

- On the basis of end-use segment, the Europe corrugated board packaging market is segmented into processed foods, fruits and vegetables, beverages, personal care, healthcare, household care, chemicals, paper products, electrical goods, glassware and ceramics, wood and timber products, textiles, tobacco, vehicle parts, and others. In 2022, the processed food segment is expected to dominate the market owing to increasing demand for packaged food in developing countries. The easy carrying properties drive the food and beverages segment in the Europe market.

Corrugated Board Packaging Market Country Level Analysis

The corrugated board packaging market is analyzed and market size information is provided by the country, raw material, style, grade and end-use as referenced above.

The countries covered in the corrugated board packaging market report are the Germany, U.K., France, Italy, Spain, Netherlands, Belgium, Russia, Turkey, Switzerland, Poland, Finland, Sweden, Norway, Lithuania, Latvia, Estonia & Rest of Europe.

Germany is expected to dominate the European region due to growing demand for fresh food & beverages, home & personal products, logistics application, electronic goods, building consumer awareness towards sustainable packaging, and growth of the e-commerce industry have led to a regular progression in the corrugated packaging demand in Germany.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

La tendance croissante des achats de boîtes en carton ondulé léger dans l'ensemble du secteur devrait stimuler la croissance du marché

Le marché des emballages en carton ondulé vous fournit également une analyse de marché détaillée pour la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique 2020.

Analyse du paysage concurrentiel et des parts de marché du secteur des emballages en carton ondulé

Le paysage concurrentiel du marché des emballages en carton ondulé fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des emballages en carton ondulé.

Certains des principaux acteurs opérant sur le marché de l'emballage en carton ondulé sont Packaging Corporation of America, WestRock Company, International Paper, DS Smith, Rengo, Cascades Inc., Mondi, NEFAB GROUP, NIPPON PAPER INDUSTRIES CO., LTD, Sealed Air et Smurfit Kappa, entre autres.

De nombreux contrats et accords sont également initiés par les entreprises européennes qui accélèrent également le marché des emballages en carton ondulé.

Par exemple,

- En 2021, NEFAB GROUP a acquis le groupe Reflex Packaging, leader mondial du rembourrage thermoformé durable, afin de renforcer encore son engagement à économiser les ressources dans les chaînes d'approvisionnement. Cette décision a été prise pour réduire les coûts et l'impact environnemental à l'échelle mondiale.

- En août 2021, NIPPON PAPER INDUSTRIES CO., LTD. a obtenu deux certifications éco-rail pour ses produits respectueux de l'environnement. La certification a été obtenue par le ministère japonais des Infrastructures. Le produit a été reconnu par les entreprises et a été salué. Le marché proposera une nouvelle gamme de produits.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE CORRUGATED BOARD PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 RAW MATERIAL TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVER

5.1.1 GROWING INCLINATION OF PURCHASES TOWARD LIGHT WEIGHT CORRUGATED BOXES ACROSS THE INDUSTRY

5.1.2 CONTINUED INDUSTRIALIZATION ACROSS EUROPELY FOR UNIQUE CARTONS AND MATERIALS

5.1.3 RISING DEMAND FOR SUSTAINABLE AND AESTHETIC PACKAGING IN THE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGHER COST OF CORRUGATED BOARD FOR PACKAGING

5.2.2 STRINGENT GOVERNMENT REGULATIONS FOR PACKAGING OF PRODUCTS

5.3 OPPORTUNITIES

5.3.1 RISE IN THE ACQUISITIONS & COLLABORATIONS BETWEEN THE COMPANIES

5.3.2 BAN ON PLASTIC PACKAGING PRODUCTS ON THE EUROPE MARKET

5.3.3 SURGING E-COMMERCE & COURIER SECTOR ACROSS DEVELOPED COUNTRIES

5.4 CHALLENGES

5.4.1 LACK OF AWARNESS ABOUT SUSTAINABLE PACKAGING

5.4.2 IMPACT OF HUMID AND MOIST WEATHER ON THE FIRMNESS OF CORRUGATED BOX

6 ANALYSIS ON IMPACT OF COVID 19 ON THE MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST MARKET GROWTH

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE & DEMAND

6.4 IMPACT ON SUPPLY CHAIN

6.5 CONCLUSION

7 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 LINERBOARD

7.2.1 RECYCLED RESOURCES

7.2.1.1 OCC

7.2.1.2 RECOVERY PAPER

7.2.1.3 MIXED PAPER

7.2.1.4 OFFICE PAPER

7.2.2 NATURAL RESOURCES

7.3 MEDIUM

7.3.1 RECYCLED RESOURCES

7.3.1.1 OCC

7.3.1.2 RECOVERY PAPER

7.3.1.3 MIXED PAPER

7.3.1.4 OFFICE PAPER

7.3.2 NATURAL RESOURCES

8 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY STYLE

8.1 OVERVIEW

8.2 SLOTTED BOX

8.3 TELESCOPES

8.4 FOLDERS

8.5 TRAYS

8.6 SHEETS

8.7 FANFOLD

8.8 DIE CUT BLISS

8.9 DIE CUT INTERIORS

9 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY GRADE

9.1 OVERVIEW

9.2 UNBLEACHED TESTILINER

9.3 WHITE-TOP TESTILINER

9.4 UNBLEACHED KRAFTLINER

9.5 WHITE-TOP KRAFTLINER

9.6 WASTE-BASED FLUTING

9.7 SEMI-CHEMICAL FLUTING

10 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY END-USE

10.1 OVERVIEW

10.2 PROCESSED FOODS

10.3 HEALTHCARE

10.4 BEVERAGES

10.5 CHEMICALS

10.6 TEXTILES

10.7 PERSONAL CARE

10.8 ELECTRICAL GOODS

10.9 VEHICLE PARTS

10.1 GLASSWARE AND CERAMICS

10.11 WOOD AND TIMBER PRODUCTS

10.12 HOUSEHOLD CARE

10.13 FRUITS AND VEGETABLES

10.14 PAPER PRODUCTS

10.15 TOBACCO

10.16 OTHER

11 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 NETHERLANDS

11.1.7 BELGIUM

11.1.8 RUSSIA

11.1.9 TURKEY

11.1.10 SWITZERLAND

11.1.11 POLAND

11.1.12 FINLAND

11.1.13 SWEDEN

11.1.14 NORWAY

11.1.15 LITHUANIA

11.1.16 LATVIA

11.1.17 ESTONIA

11.1.18 REST OF EUROPE

12 EUROPE CORRUGATED BOARD PACKAGING MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY SHARE ANALYSIS

14.1 WESTROCK COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 INTERNATIONAL PAPER

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 PACKAGING CORPORATION OF AMERICA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 DS SMITH

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 RENGO CO, LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ARABIAN PACKAGING CO, LLC

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 B SMITH PACKAGING LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CASCADE INC

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 GEORGIA PACIFIC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 JONSAC AB

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 KLABIN S.A.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 KLINGELE PAPIERWERKE GMBH & CO.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MONDI

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 NEFAB GROUP

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NEWAY PACKAGING

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 NIPPON

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 OJI HOLDING CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 SMURFIT KAPPA

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 SEALED AIR

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 WERTHEIMER BOX CORPORATION

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 BASIC RULES TO CONSIDER FOR SINGLE WALL CORRUGATED FIBERBOARD BOXES:

TABLE 2 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 3 EUROPE LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 EUROPE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE SLOTTED BOX IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE TELESCOPE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE FOLDERS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE TRAYS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE SHEETS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE FANFOLD IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE DIE CUT BLISS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE DIE CUT INTERIORS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE UNBLEACHED TESTILINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE WHITE-TOP TESTILINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE UNBLEACHED KRAFTLINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE WHITE-TOP KRAFTLINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE WASTE-BASED FLUTING IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE SEMI-CHEMICAL FLUTING IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE PROCESSED FOODS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE HEALTHCARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 28 EUROPE BEVERAGES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE CHEMICALS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE TEXTILES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE PERSONAL CARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE ELECTRICAL GOODS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE VEHICLE PARTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE GLASSWARE AND CERAMICS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE WOOD AND TIMBER PRODUCTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE HOUSEHOLD CARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE FRUITS AND VEGETABLES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE PAPER PRODUCTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE TOBACCO IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE OTHER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 42 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 43 EUROPE LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 EUROPE MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 EUROPE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 48 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 50 GERMANY CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 51 GERMANY LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 GERMANY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 GERMANY MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 GERMANY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 GERMANY CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 56 GERMANY CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 U.K. CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 U.K. LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.K. RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.K. CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 64 U.K. CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 65 U.K. CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 66 FRANCE CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 67 FRANCE LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 FRANCE MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 FRANCE CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 72 FRANCE CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 74 ITALY CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 75 ITALY LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ITALY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 ITALY MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 ITALY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 ITALY CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 80 ITALY CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 81 ITALY CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 82 SPAIN CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 83 SPAIN LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SPAIN RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 SPAIN MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 SPAIN RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SPAIN CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 88 SPAIN CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 89 SPAIN CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 90 NETHERLANDS CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 91 NETHERLANDS LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 NETHERLANDS RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 NETHERLANDS MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 NETHERLANDS RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 NETHERLANDS CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 96 NETHERLANDS CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 97 NETHERLANDS CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 98 BELGIUM CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 BELGIUM LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 BELGIUM RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 BELGIUM MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 BELGIUM RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 BELGIUM CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 104 BELGIUM CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 105 BELGIUM CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 106 RUSSIA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 107 RUSSIA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 RUSSIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 RUSSIA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 RUSSIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 RUSSIA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 112 RUSSIA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 113 RUSSIA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 114 TURKEY CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 115 TURKEY LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 TURKEY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 TURKEY MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 TURKEY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 TURKEY CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 120 TURKEY CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 121 TURKEY CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 130 POLAND CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 131 POLAND LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 POLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 POLAND MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 POLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 POLAND CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 136 POLAND CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 137 POLAND CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 138 FINLAND CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 139 FINLAND LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 FINLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 FINLAND MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 FINLAND RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 FINLAND CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 144 FINLAND CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 145 FINLAND CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 146 SWEDEN CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 147 SWEDEN LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 SWEDEN RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 SWEDEN MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 SWEDEN RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 SWEDEN CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 152 SWEDEN CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 153 SWEDEN CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 154 NORWAY CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 155 NORWAY LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 NORWAY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 NORWAY MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 NORWAY RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 NORWAY CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 160 NORWAY CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 161 NORWAY CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 162 LITHUANIA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 163 LITHUANIA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 LITHUANIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 LITHUANIA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 LITHUANIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 LITHUANIA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 168 LITHUANIA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 169 LITHUANIA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 170 LATVIA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 171 LATVIA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 LATVIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 LATVIA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 LATVIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 LATVIA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 176 LATVIA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 177 LATVIA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 178 ESTONIA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 179 ESTONIA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 ESTONIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 ESTONIA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 ESTONIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 ESTONIA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 184 ESTONIA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 185 ESTONIA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 186 REST OF EUROPE CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE CORRUGATED BOARD PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE CORRUGATED BOARD PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE CORRUGATED BOARD PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE CORRUGATED BOARD PACKAGING MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE CORRUGATED BOARD PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE CORRUGATED BOARD PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE CORRUGATED BOARD PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE CORRUGATED BOARD PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE CORRUGATED BOARD PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE CORRUGATED BOARD PACKAGING MARKET: SEGMENTATION

FIGURE 11 GROWING INCLINATION OF PURCHASES TOWARD LIGHT WEIGHT CORRUGATED BOXES ACROSS THE INDUSTRY IS EXPECTED TO DRIVE EUROPE CORRUGATED BOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 RAW MATERIAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE CORRUGATED BOARD PACKAGING MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND ALSO THE FASTEST GROWING REGION IN THE EUROPE CORRUGATED BOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVER, RESTRAINTS, OPPORTUNITIES, CHALLENGES FOR EUROPE CORRUGATED BOARD PACKAGING MARKET

FIGURE 15 BELOW FIGURE DEPICTS THE EARNING REVENUE FROM DIFFERENT TYPE OF PACKAGING IN U.S. PACKAGING INDUSTRY IN 2016 (IN %)

FIGURE 16 U.S RETAIL SALES VIA E-COMMERCE IN 2019

FIGURE 17 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY RAW MATERIAL, 2021

FIGURE 18 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY STYLE, 2021

FIGURE 19 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY GRADE, 2021

FIGURE 20 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY END-USE, 2021

FIGURE 21 EUROPE CORRUGATED BOARD PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE CORRUGATED BOARD PACKAGING MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 26 EUROPE CORRUGATED BOARD PACKAGING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.