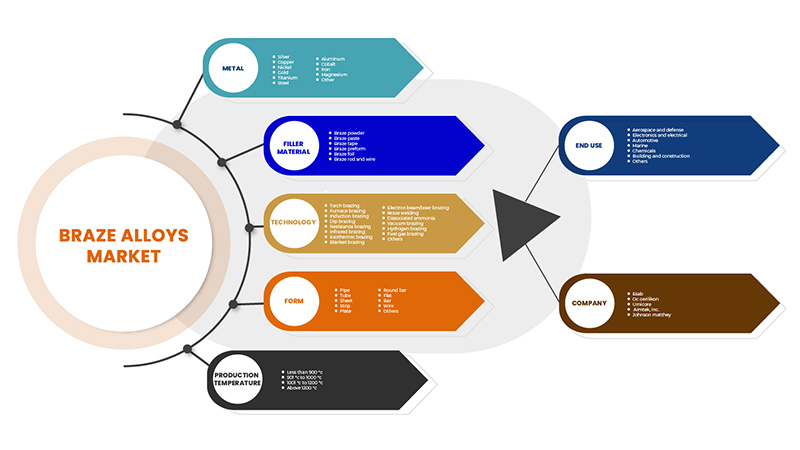

Europe Braze Alloys Market, By Metal (Nickel, Cobalt, Silver, Gold, Aluminum, Copper, Steel, Iron, Magnesium, Titanium and Others), Filler Material (Braze Powder, Braze Paste, Braze Tape, Braze Preform, Braze Foil and Braze Rod and Wire), Technology (Torch Brazing, Furnace Brazing, Induction Brazing, Dip Brazing, Resistance Brazing, Infrared Brazing, Exothermic Brazing, Blanket Brazing, Electron Beam/Laser Brazing, Braze Welding, Dissociated Ammonia, Vacuum Brazing, Hydrogen Brazing, Fuel Gas Brazing and Others), Form (Pipe, Tube, Sheet, Strip, Plate, Round Bar, Flat, Bar, Wire and Others), Production Temperature (Less than 900 °C, 901 °C to 1000 °C, 1001 °C to 1200 °C and Above 1200 °C), End Use (Aerospace and Defense, Electronics and Electrical, Automotive, Marine, Chemicals, Building and Construction and Others), Industry Trends and Forecast to 2029.

Market Analysis and Insights

Brazing fillers for joining applications are essential for manufacturing and designing advanced materials. Several types of brazing fillers have been developed in recent decades to join similar or different engineering materials. Important parts of automotive and aircraft components, including steel, are often joined by brazing. In addition, ceramic components in microwave devices and circuits have been joined with a high level of integration in microelectronic devices.

Similarly, in the medical field, metallic implants have been brazed to ceramic dental crowns. These advances have made human life more convenient. However, in brazing, there are certain issues with intermetallic compound (IMC) formation and residual stresses in joints at high temperatures.

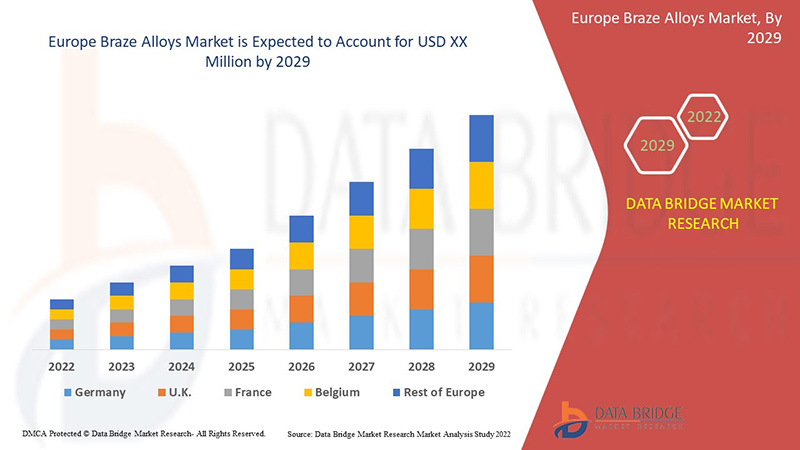

Increasing use of braze alloys coupled with growing application of braze alloys in different end industry like aerospace, buildings and electronics has surged its demand. Data Bridge Market Research analyses that the braze alloys market will grow at a CAGR of 5.0% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2020 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Tons, Pricing in USD |

|

Segments Covered |

Par métal (nickel, cobalt , argent, or, aluminium , cuivre, acier, fer, magnésium, titane et autres), matériau d'apport (poudre de brasure, pâte de brasure, ruban de brasure, préforme de brasure, feuille de brasure et tige et fil de brasure), technologie (brasage au chalumeau, brasage au four, brasage par induction, brasage par immersion, brasage par résistance, brasage infrarouge, brasage exothermique, brasage par couverture, brasage par faisceau d'électrons/laser, brasage par brasure, ammoniac dissocié, brasage sous vide, brasage à l'hydrogène, brasage au gaz combustible et autres), forme (tuyau, tube, feuille, bande, plaque, barre ronde, plat, barre, fil et autres), température de production (moins de 900 °C, de 901 °C à 1000 °C, de 1001 °C à 1200 °C et plus de 1200 °C), utilisation finale (aérospatiale et défense, électronique et électricité, automobile, marine, Produits chimiques , bâtiment et construction et autres), |

|

Pays couverts |

Allemagne, Royaume-Uni, France, Italie, Espagne, Pays-Bas, Belgique, Suisse, Russie, Turquie, Reste de l'Europe |

|

Acteurs du marché couverts |

Johnson Matthey, OC Oerlikon Management AG, Morgan Advanced Materials et ses filiales, Aimtek, Inc., AMETEK. Inc., TSI Technologies, ESAB (filiale de Colfax Corporation), Umicore |

Dynamique du marché des alliages de brasure en Europe

Conducteurs

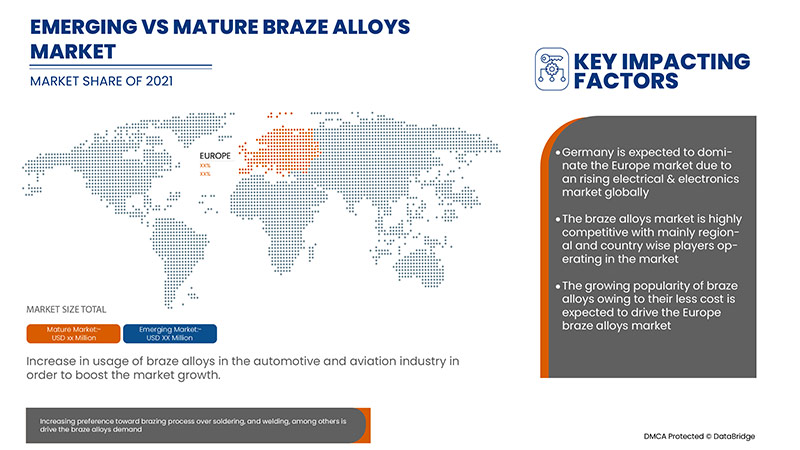

- Augmentation de l'utilisation des alliages de brasure dans l'industrie automobile et aéronautique

Les alliages de brasure sont très demandés par l'industrie automobile, où ils sont utilisés comme raccords de condenseur et d'évaporateur pour les systèmes de climatisation, les tuyaux d'injection de carburant et les garnitures de frein. L'industrie automobile et aéronautique s'efforce de développer des composants automobiles légers.

- Préférence croissante pour le processus de brasage par rapport à la soudure et au soudage, entre autres

Le brasage est un procédé d'assemblage de métaux dans lequel deux ou plusieurs éléments métalliques sont assemblés en faisant fondre et en faisant couler un métal d'apport dans le joint. Il est largement utilisé pour joindre des conducteurs métalliques dans des systèmes de mise à la terre électriques à haute et basse tension. Ce procédé est actuellement utilisé au Royaume-Uni, en Irlande et dans d'autres pays du monde entier pour créer un joint permanent de deux métaux conducteurs, généralement du cuivre ou de l'acier.

Opportunités

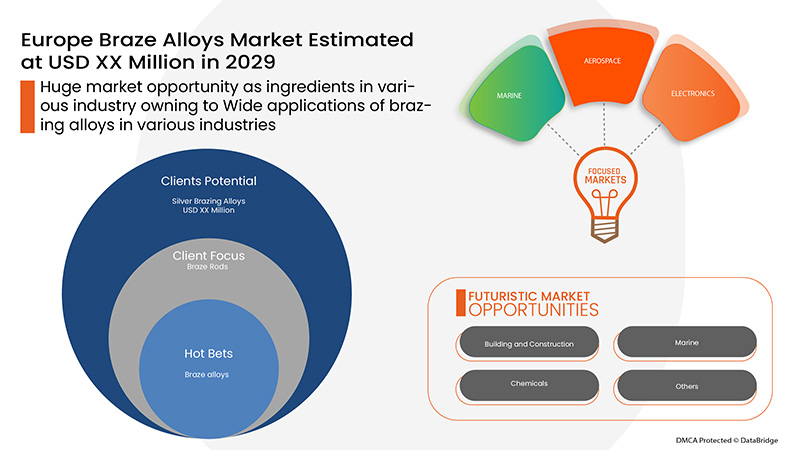

- Larges applications des alliages de brasure dans diverses industries

Le brasage est un procédé d'assemblage largement utilisé car il permet d'assembler presque tous les métaux à l'exception de l'aluminium et du magnésium. Il est utilisé pour les composants électriques, les raccords de tuyauterie, entre autres. Les métaux d'épaisseur inégale peuvent être assemblés par brasage. Le brasage est utilisé pour lier une variété de métaux, des métaux dissemblables et même des non-métaux.

Contraintes/Défis

- Fluctuations des prix des métaux de brasure

Les prix des matières premières fluctuent actuellement à des niveaux sans précédent, tant aux États-Unis qu'ailleurs dans le monde. En effet, les prix sont affectés par le resserrement des marchés de l'offre. Au-delà de l'offre et de la demande, un autre facteur influe sur les fluctuations à court terme des prix des matières premières. Les investisseurs peuvent soudainement s'éloigner de ce qu'ils perçoivent comme des paris plus risqués, notamment les actions et les matières premières.

- Effets néfastes du brasage sur l'environnement

Le brasage est l'une des technologies fondamentales de la fabrication et est largement utilisé dans l'aérospatiale, le transport ferroviaire, les semi-conducteurs, les appareils de réfrigération et d'autres domaines.

Le processus de brasage traditionnel implique des effets nocifs sur l'environnement. La principale cause de pollution est l'excès de flux résiduel. Le processus de brasage comprend l'incapacité à contrôler précisément le flux. L'excès de flux résiduel et le nettoyage après le brasage entraînent un gaspillage important de flux et une pollution de l'environnement. En outre, cela affecte la durée de vie de la soudure.

Ce rapport sur le marché des alliages de brasure fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des alliages de brasure, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact post-COVID-19 sur le marché des alliages de brasure

La pandémie de COVID-19 a fortement perturbé la chaîne d'approvisionnement des matières premières utilisées pour fabriquer des alliages de brasure et la perturbation de la chaîne d'approvisionnement des industries utilisatrices finales. Elle a été attribuée au manque de ressources et de transports, ce qui a entraîné une baisse de l'accès, des retards dans les stocks et des approvisionnements en matières premières. En outre, de nombreux gouvernements ont restreint la circulation des marchandises entre les pays et l'ensemble de la chaîne d'approvisionnement a été perturbé. En raison de la perturbation de la chaîne d'approvisionnement, le transport des matières premières a été interrompu, ce qui a paralysé la production. De même, la hausse des prix et l'arrêt de la production d'alliages de brasure ont entraîné une demande non satisfaite d'alliages de brasure chez divers utilisateurs finaux tels que la construction, l'électronique, l'aérospatiale et la défense.

La pandémie de COVID-19 a également des effets négatifs sur les industries utilisatrices finales d'alliages de brasure. Elle a eu un impact négatif sur le secteur de la construction.

Par exemple,

Selon les données mondiales, la production du secteur de la construction en Amérique du Nord pourrait diminuer de 122 milliards USD en 2020 en raison du choc économique de la COVID-19. Une augmentation de 0,6 % de la production du secteur de la construction était prévue en Amérique du Nord avant la pandémie, mais elle devrait désormais chuter d'environ 6,5 % aux États-Unis et de 7 % au Canada.

En conséquence, le marché des alliages de brasure sera également affecté car les techniques de brasage sont utilisées dans les bâtiments et la construction.

Ainsi, les perturbations de la chaîne d’approvisionnement dues à la pandémie de COVID-19 devraient constituer un défi pour le marché européen des alliages de brasure.

Développement récent

- En février 2022, OC Oerlikon Management AG a étendu sa plateforme de commande en ligne à ses clients européens. Cette expansion a permis à l'entreprise d'attirer une clientèle plus large.

Portée du marché européen des alliages de brasure

Le marché des alliages de brasure est segmenté en métal, matériau d'apport, technologie, forme, température de production et utilisation finale.

La croissance parmi ces segments vous aidera à analyser les faibles segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Métaux

- Argent

- Cuivre

- Nickel

- Or

- Titane

- Acier

- Aluminium

- Cobalt

- Fer

- Magnésium

- Autre

En fonction des métaux, le marché est segmenté en argent, cuivre, nickel, or, titane, acier, aluminium, cobalt, fer, magnésium et autres.

Matériau de remplissage

- Pâte à braser

- Tige et fil de brasure

- Poudre de brasure

- Préforme de brasure

- Feuille de brasure

- Ruban de brasure

En fonction du matériau de remplissage, le marché est segmenté en pâte de brasure, tige et fil de brasure, poudre de brasure, préforme de brasure, feuille de brasure et ruban de brasure.

Technologie

- Brasage au chalumeau

- Brasage au four

- Brasage par résistance

- Brasage par induction

- Brasage par immersion

- Brasage infrarouge

- Brasage sous vide

- Brasage par faisceau d'électrons/laser

- Brasage exothermique

- Soudure par brasure

- Brasage à l'hydrogène

- Brasage sous couverture

- Ammoniac dissocié

- Brasage au gaz combustible

- Autres

En fonction de la technologie, le marché est segmenté en brasage au chalumeau, brasage au four, brasage par résistance, brasage par induction, brasage par immersion, brasage infrarouge, brasage sous vide, brasage par faisceau d'électrons/laser, brasage exothermique, soudage par soudobrasage, brasage à l'hydrogène, brasage par couverture, ammoniac dissocié, brasage au gaz combustible et autres.

Formulaire

- Fil

- Bande

- Bar

- Tuyau

- Tube

- Plat

- Feuille

- Plaque

- Barre ronde

- Autres

En fonction de la forme, le marché est segmenté en fil, bande, barre, tuyau, tube, plat, tôle, plaque, barre ronde et autres.

Température de production

- 1001 °C à 1200 °C

- Moins de 900 °C

- 901 °C à 1000 °C

- Au-dessus de 1200 °C

En fonction de la température de production, le marché est segmenté en 1 001 °C à 1 200 °C, moins de 900 °C, 901 °C à 1 000 °C et plus de 1 200 °C.

Utilisation finale

- Automobile

- Aérospatiale et Défense

- Électronique et électricité

- Bâtiment et construction

- Produits chimiques

- Marin

- Autres

En fonction de l'utilisation finale, le marché est segmenté en automobile, aérospatiale et défense, électronique et électricité, bâtiment et construction, produits chimiques, marine et autres.

Analyse/perspectives régionales du marché des alliages de brasure

Le marché des alliages de brasure est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, métal, matériau de remplissage, technologie, forme, température de production et utilisation finale.

Les régions couvertes par le rapport sur le marché des alliages de brasure en Europe sont l'Allemagne, le Royaume-Uni, la France, l'Italie, l'Espagne, les Pays-Bas, la Belgique, la Suisse, la Russie, la Turquie et le reste de l'Europe.

L'Allemagne domine la région Europe en raison de l'utilisation croissante des alliages de brasure dans la région. Le Royaume-Uni domine la région en raison de la croissance de l'industrie aérospatiale et du bâtiment et de la construction dans la région.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Europe brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Braze Alloys Market Share Analysis

The Europe braze market alloys competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, GCC presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on Europe braze alloys market.

Some of the major players operating in the braze alloys market are Johnson Matthey, OC Oerlikon Management AG, Morgan Advanced Materials and its affiliates, Aimtek, Inc., AMETEK. Inc., TSI Technologies, ESAB (Subsidiary of Colfax Corporation), Umicore among others

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Europe Vs Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE BRAZE ALLOYS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 METAL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 EUROPE BRAZE ALLOYS MARKET- VENDOR SELECTION CRITERIA

4.2 TECHNOLOGICAL ADVANCEMENT IN BRAZE ALLOYS MARKET

4.3 EUROPE BRAZE ALLOYS MARKET: SUPPLY CHAIN ANALYSIS

4.3.1 RAW MATERIAL PROCUREMENT

4.3.2 MANUFACTURING

4.3.3 MARKETING AND DISTRIBUTION

4.3.4 END USERS

4.4 EUROPE BRAZE ALLOYS MARKET: REGULATIONS

4.4.1 REGULATIONS BY U.K. GOVERNMENT

4.4.2 FDA REGULATIONS

4.4.3 OSHA (OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION) STANDARDS

4.4.4 ISO STANDARDS

4.5 EUROPE BRAZE ALLOYS MARKET-RAW MATERIAL PRODUCTION COVERAGE

4.6 EUROPE BRAZE ALLOYS MARKET, PORTER’S FIVE FORCES ANALYSIS

4.6.1 BUYER POWER

4.6.2 SUPPLIER POWER

4.6.3 THE THREAT OF NEW ENTRANTS

4.6.4 THREAT OF SUBSTITUTES

4.6.5 RIVALRY AMONG EXISTING COMPETITORS

4.7 PESTEL ANALYSIS: EUROPE BRAZE ALLOYS MARKET

4.7.1 POLITICS:

4.7.2 ECONOMY:

4.7.3 SOCIAL:

4.7.4 TECHNOLOGY:

4.7.5 ENVIRONMENTAL:

4.7.6 LEGAL:

4.8 CLIMATE CHANGE-

4.9 ALLOY PRICES AFFECT MARKET GROWTH BY REGIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN USAGE OF BRAZE ALLOYS IN THE AUTOMOTIVE AND AVIATION INDUSTRY

5.1.2 INCREASING PREFERENCE TOWARD BRAZING PROCESS OVER SOLDERING, AND WELDING, AMONG OTHERS

5.1.3 INCREASING DEMAND FOR COPPER & ALUMINUM BRAZES ALLOYS

5.1.4 RISING ELECTRICAL & ELECTRONICS MARKET EUROPELY

5.2 RESTRAINTS

5.2.1 FLUCTUATING PRICES OF BRAZE METALS

5.2.2 COMPLEXITIES IN THE MANUFACTURING PROCESS OF BRAZE ALLOYS

5.2.3 AVAILABILITY OF SUBSTITUTES FOR BRAZE ALLOYS

5.3 OPPORTUNITIES

5.3.1 WIDE APPLICATIONS OF BRAZING ALLOYS IN VARIOUS INDUSTRIES

5.3.2 COST-EFFECTIVENESS OF BRAZE ALLOYS

5.3.3 RISING NUMBER OF INNOVATIONS IN THE BRAZING INDUSTRY

5.3.4 STRATEGIC DECISIONS BY KEY PLAYERS

5.4 CHALLENGES

5.4.1 SUPPLY CHAIN DISRUPTION DUE TO COVID -19

5.4.2 ADVERSE EFFECT OF BRAZING ON THE ENVIRONMENT

6 EUROPE BRAZE ALLOYS MARKET, BY METAL

6.1 OVERVIEW

6.2 SILVER

6.3 COPPER

6.4 NICKEL

6.5 GOLD

6.6 TITANIUM

6.7 STEEL

6.7.1 STAINLESS STEEL

6.7.2 CARBON STEEL

6.7.3 LOW ALLOY STEEL

6.7.4 OTHERS

6.8 ALUMINUM

6.9 COBALT

6.1 IRON

6.11 MAGNESIUM

6.12 OTHERS

7 EUROPE BRAZE ALLOYS MARKET, BY FILLER MATERIAL

7.1 OVERVIEW

7.2 BRAZE PASTE

7.3 BRAZE ROD AND WIRE

7.4 BRAZE POWDER

7.5 BRAZE PREFORM

7.6 BRAZE FOIL

7.7 BRAZE TAPE

8 EUROPE BRAZE ALLOYS MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 TORCH BRAZING

8.3 FURNACE BRAZING

8.4 RESISTANCE BRAZING

8.5 INDUCTION BRAZING

8.6 DIP BRAZING

8.7 INFRARED BRAZING

8.8 VACUUM BRAZING

8.9 ELECTRON BEAM/LASER BRAZING

8.1 EXOTHERMIC BRAZING

8.11 BRAZE WELDING

8.12 HYDROGEN BRAZING

8.13 BLANKET BRAZING

8.14 DISSOCIATED AMMONIA

8.15 FUEL GAS BRAZING

8.16 OTHERS

9 EUROPE BRAZE ALLOYS MARKET, BY FORM

9.1 OVERVIEW

9.2 WIRE

9.3 STRIP

9.4 BAR

9.5 PIPE

9.6 TUBE

9.7 FLAT

9.8 SHEET

9.9 PLATE

9.1 ROUND BAR

9.11 OTHERS

10 EUROPE BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE

10.1 OVERVIEW

10.2 1001 °C TO 1200 °C

10.3 LESS THAN 900 °C

10.4 901 °C TO 1000 °C

10.5 ABOVE 1200 °C

11 EUROPE BRAZE ALLOYS MARKET, BY END USER

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.2.1 SILVER

11.2.2 COPPER

11.2.3 NICKEL

11.2.4 GOLD

11.2.5 TITANIUM

11.2.6 STEEL

11.2.7 ALUMINUM

11.2.8 COBALT

11.2.9 IRON

11.2.10 MAGNESIUM

11.2.11 OTHERS

11.3 AEROSPACE AND DEFENSE

11.3.1 SILVER

11.3.2 COPPER

11.3.3 NICKEL

11.3.4 GOLD

11.3.5 TITANIUM

11.3.6 STEEL

11.3.7 ALUMINUM

11.3.8 COBALT

11.3.9 IRON

11.3.10 MAGNESIUM

11.3.11 OTHERS

11.4 ELECTRONICS AND ELECTRICAL

11.4.1 SILVER

11.4.2 COPPER

11.4.3 NICKEL

11.4.4 GOLD

11.4.5 TITANIUM

11.4.6 STEEL

11.4.7 ALUMINUM

11.4.8 COBALT

11.4.9 IRON

11.4.10 MAGNESIUM

11.4.11 OTHERS

11.5 BUILDING AND CONSTRUCTION

11.5.1 SILVER

11.5.2 COPPER

11.5.3 NICKEL

11.5.4 GOLD

11.5.5 TITANIUM

11.5.6 STEEL

11.5.7 ALUMINUM

11.5.8 COBALT

11.5.9 IRON

11.5.10 MAGNESIUM

11.5.11 OTHERS

11.6 CHEMICALS

11.6.1 SILVER

11.6.2 COPPER

11.6.3 NICKEL

11.6.4 GOLD

11.6.5 TITANIUM

11.6.6 STEEL

11.6.7 ALUMINUM

11.6.8 COBALT

11.6.9 IRON

11.6.10 MAGNESIUM

11.6.11 OTHERS

11.7 MARINE

11.7.1 SILVER

11.7.2 COPPER

11.7.3 NICKEL

11.7.4 GOLD

11.7.5 TITANIUM

11.7.6 STEEL

11.7.7 ALUMINUM

11.7.8 COBALT

11.7.9 IRON

11.7.10 MAGNESIUM

11.7.11 OTHERS

11.8 OTHERS

11.8.1 SILVER

11.8.2 COPPER

11.8.3 NICKEL

11.8.4 GOLD

11.8.5 TITANIUM

11.8.6 STEEL

11.8.7 ALUMINUM

11.8.8 COBALT

11.8.9 IRON

11.8.10 MAGNESIUM

11.8.11 OTHERS

12 EUROPE BRAZE ALLOYS MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 U.K.

12.1.3 FRANCE

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 NETHERLANDS

12.1.7 BELGIUM

12.1.8 SWITZERLAND

12.1.9 RUSSIA

12.1.10 TURKEY

12.1.11 REST OF EUROPE

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ESAB

15.1.1 COMPANY SANPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSYS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 OC OERLIKON MANAGEMENT AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 UMICORE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 AMETEK.INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 JOHNSON MATTHEY

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSI

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 AIMTEK

15.6.1 COMPANY SANPSHOT

15.6.2 COMPANY SHARE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BELMONT METALS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CUPRO ALLOYS CORPORATION.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ESPRIX TECHNOLOGIES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 HARRIS PRODUCTS GROUP.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 INDIAN SOLDER AND BRAZING ALLOYS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 INDIUM CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 KRANTI METALLURGY PVT LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 LUCAS-MILHAUPT, INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 MORGAN ADVANCED MATERIALS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PRINCE IZANT COMPANY.

15.16.1 COMPANY SANPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SARU SILVER ALLOY PRIV ATE LIMITED.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SAXONIA EDELMETALLE GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 S. K. METAL

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SULZER LTD

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

15.21 TSI TECHNOLOGIES

15.21.1 COMPANY SANPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 CHINA'S AVERAGE PRICE FOR BRAZING ALLOYS TYPES

TABLE 2 INDIA'S AVERAGE PRICE FOR BRAZING ALLOYS TYPES

TABLE 3 U.S. AVERAGE PRICE FOR BRAZING ALLOYS TYPES

TABLE 4 EUROPE BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 5 EUROPE BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 6 EUROPE SILVER IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 7 EUROPE COPPER IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 8 EUROPE NICKEL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 9 EUROPE GOLD IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 10 EUROPE TITANIUM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 11 EUROPE STEEL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 12 EUROPE STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 13 EUROPE ALUMINUM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 14 EUROPE COBALT IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 15 EUROPE IRON IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 16 EUROPE MAGNESIUM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 17 EUROPE OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 18 EUROPE BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 19 EUROPE BRAZE PASTE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 20 EUROPE BRAZE ROD AND WIRE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 21 EUROPE BRAZE POWDER IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 22 EUROPE BRAZE PREFORM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 23 EUROPE BRAZE FOIL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 24 EUROPE BRAZE TAPE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 25 EUROPE BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 26 EUROPE TORCH BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 27 EUROPE FURNACE BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 28 EUROPE RESISTANCE BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 29 EUROPE INDUCTION BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 30 EUROPE DIP BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 31 EUROPE INFRARED BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 32 EUROPE VACUUM BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 33 EUROPE ELECTRON BEAM/LASER BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 34 EUROPE EXOTHERMIC BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 35 EUROPE BRAZE WELDING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 36 EUROPE HYDROGEN BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 37 EUROPE BLANKET BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 38 EUROPE DISSOCIATED AMMONIA IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 39 EUROPE FUEL GAS BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 40 EUROPE OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 41 EUROPE BRAZE ALLOYS MARKET, BY FORM, 2014-2029 (USD MILLION)

TABLE 42 EUROPE WIRE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 43 EUROPE STRIP IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 44 EUROPE BAR IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 45 EUROPE PIPE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 46 EUROPE TUBE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 47 EUROPE FLAT IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 48 EUROPE SHEET IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 49 EUROPE PLATE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 50 EUROPE ROUND BAR IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 51 EUROPE OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 52 EUROPE BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 53 EUROPE 1001 °C TO 1200 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 54 EUROPE LESS THAN 900 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 55 EUROPE 901 °C TO 1000 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 56 EUROPE ABOVE 1200 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 57 EUROPE BRAZE ALLOYS MARKET, BY END-USER, 2014-2029 (USD MILLION)

TABLE 58 EUROPE AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 59 EUROPE AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 60 EUROPE AEROSPACE AND DEFENSE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 61 EUROPE AEROSPACE AND DEFENSE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 62 EUROPE ELECTRONICS AND ELECTRICAL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 63 EUROPE ELECTRONICS AND ELECTRICAL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 64 EUROPE BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 65 EUROPE BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 66 EUROPE CHEMICALS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 67 EUROPE CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 68 EUROPE MARINE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 69 EUROPE MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 70 EUROPE OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 71 EUROPE OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 72 EUROPE BRAZE ALLOYS MARKET, BY COUNTRY, 2014-2029 (USD MILLION)

TABLE 73 EUROPE BRAZE ALLOYS MARKET, BY COUNTRY, 2014-2029 (TONS)

TABLE 74 EUROPE BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 75 EUROPE BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 76 EUROPE STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 77 EUROPE BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 78 EUROPE BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 79 EUROPE BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 80 EUROPE BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 81 EUROPE BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 82 EUROPE AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 83 EUROPE AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 84 EUROPE ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 85 EUROPE BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 86 EUROPE CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 87 EUROPE MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 88 EUROPE OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 89 GERMANY BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 90 GERMANY BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 91 GERMANY STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 92 GERMANY BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 93 GERMANY BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 94 GERMANY BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 95 GERMANY BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 96 GERMANY BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 97 GERMANY AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 98 GERMANY AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 99 GERMANY ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 100 GERMANY BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 101 GERMANY CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 102 GERMANY MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 103 GERMANY OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 104 U.K. BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 105 U.K. BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 106 U.K. STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 107 U.K. BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 108 U.K. BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 109 U.K. BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 110 U.K. BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 111 U.K. BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 112 U.K. AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 113 U.K. AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 114 U.K. ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 115 U.K. BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 116 U.K. CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 117 U.K. MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 118 U.K. OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 119 FRANCE BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 120 FRANCE BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 121 FRANCE STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 122 FRANCE BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 123 FRANCE BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 124 FRANCE BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 125 FRANCE BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 126 FRANCE BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 127 FRANCE AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 128 FRANCE AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 129 FRANCE ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 130 FRANCE BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 131 FRANCE CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 132 FRANCE MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 133 FRANCE OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 134 ITALY BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 135 ITALY BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 136 ITALY STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 137 ITALY BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 138 ITALY BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 139 ITALY BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 140 ITALY BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 141 ITALY BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 142 ITALY AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 143 ITALY AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 144 ITALY ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 145 ITALY BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 146 ITALY CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 147 ITALY MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 148 ITALY OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 149 SPAIN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 150 SPAIN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 151 SPAIN STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 152 SPAIN BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 153 SPAIN BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 154 SPAIN BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 155 SPAIN BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 156 SPAIN BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 157 SPAIN AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 158 SPAIN AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 159 SPAIN ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 160 SPAIN BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 161 SPAIN CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 162 SPAIN MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 163 SPAIN OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 164 NETHERLANDS BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 165 NETHERLANDS BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 166 NETHERLANDS STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 167 NETHERLANDS BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 168 NETHERLANDS BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 169 NETHERLANDS BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 170 NETHERLANDS BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 171 NETHERLANDS BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 172 NETHERLANDS AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 173 NETHERLANDS AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 174 NETHERLANDS ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 175 NETHERLANDS BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 176 NETHERLANDS CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 177 NETHERLANDS MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 178 NETHERLANDS OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 179 BELGIUM BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 180 BELGIUM BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 181 BELGIUM STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 182 BELGIUM BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 183 BELGIUM BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 184 BELGIUM BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 185 BELGIUM BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 186 BELGIUM BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 187 BELGIUM AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 188 BELGIUM AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 189 BELGIUM ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 190 BELGIUM BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 191 BELGIUM CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 192 BELGIUM MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 193 BELGIUM OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 194 SWITZERLAND BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 195 SWITZERLAND BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 196 SWITZERLAND STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 197 SWITZERLAND BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 198 SWITZERLAND BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 199 SWITZERLAND BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 200 SWITZERLAND BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 201 SWITZERLAND BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 202 SWITZERLAND AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 203 SWITZERLAND AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 204 SWITZERLAND ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 205 SWITZERLAND BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 206 SWITZERLAND CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 207 SWITZERLAND MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 208 SWITZERLAND OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 209 RUSSIA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 210 RUSSIA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 211 RUSSIA STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 212 RUSSIA BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 213 RUSSIA BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 214 RUSSIA BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 215 RUSSIA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 216 RUSSIA BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 217 RUSSIA AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 218 RUSSIA AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 219 RUSSIA ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 220 RUSSIA BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 221 RUSSIA CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 222 RUSSIA MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 223 RUSSIA OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 224 TURKEY BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 225 TURKEY BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 226 TURKEY STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 227 TURKEY BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 228 TURKEY BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 229 TURKEY BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 230 TURKEY BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 231 TURKEY BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 232 TURKEY AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 233 TURKEY AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 234 TURKEY ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 235 TURKEY BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 236 TURKEY CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 237 TURKEY MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 238 TURKEY OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 239 REST OF EUROPE BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 240 REST OF EUROPE BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

Liste des figures

FIGURE 1 EUROPE BRAZE ALLOYS MARKET: SEGMENTATION

FIGURE 2 EUROPE BRAZE ALLOYS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE BRAZE ALLOYS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE BRAZE ALLOYS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE BRAZE ALLOYS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BRAZE ALLOYS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE BRAZE ALLOYS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE BRAZE ALLOYS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE BRAZE ALLOY MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE EUROPE CONDENSING UNIT MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASE IN USAGE OF BRAZE ALLOYS IN THE AUTOMOTIVE AND AVIATION IS A MAJOR DRIVER FOR THE GROWTH OF EUROPE BRAZE ALLOYS MARKET IN THE FORECAST PERIOD OF 2022-2029

FIGURE 12 METAL IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BRAZE ALLOYS MARKET IN 2021 AND 2029

FIGURE 13 VENDOR SELECTION CRITERIA:

FIGURE 14 SUPPLY CHAIN OF EUROPE BRAZE ALLOYS MARKET

FIGURE 15 VARIOUS CLASSES OF BRAZING FILLERS ACCORDING TO ISO 17672:2016

FIGURE 16 THE FOLLOWING GRAPH SHOWCASES THE DIFFERENT PRICES RANGE IN DIFFERENT REGIONS IN USD MILLION PER TON.

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE BRAZE ALLOYS MARKET

FIGURE 18 PRICE GRAPH OF SOME OF THE METALS USED IN BRAZE ALLOYS

FIGURE 19 EUROPE BRAZE ALLOYS MARKET: BY METAL, 2021

FIGURE 20 EUROPE BRAZE ALLOYS MARKET: BY FILLER MATERIAL, 2021

FIGURE 21 EUROPE BRAZE ALLOYS MARKET: BY TECHNOLOGY, 2021

FIGURE 22 EUROPE BRAZE ALLOYS MARKET: BY FORM, 2021

FIGURE 23 EUROPE BRAZE ALLOYS MARKET: BY PRODUCTION TEMPERATURE, 2021

FIGURE 24 EUROPE BRAZE ALLOYS MARKET: BY END USER, 2021

FIGURE 25 EUROPE BRAZE ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 26 EUROPE BRAZE ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 27 EUROPE BRAZE ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 EUROPE BRAZE ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 EUROPE BRAZE ALLOYS MARKET: BY METAL (2022 & 2029)

FIGURE 30 EUROPE BRAZE ALLOY MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.