Marché européen des emballages en papier et plastique biodégradables, par type d'emballage (plastique et papier), produit (sacs, plaques à pâtisserie, assiettes en papier, contenants à sandwich à clapet, gobelets, plateaux, couverts, bols, pochettes et sachets, à couvercle et autres), utilisation (à usage unique et réutilisable), canal de distribution (commerce électronique, supermarchés/hypermarchés, supérettes, magasins spécialisés et autres), application (emballage alimentaire, emballage de boissons, emballage de produits pharmaceutiques, emballage de soins personnels et ménagers, emballage d'appareils électroniques et autres), couche d'emballage (emballage primaire, emballage secondaire et emballage tertiaire), utilisateur final (restaurants, hôtels, salons de thé et de café, confiseries et snacks, cafétérias et autres), pays (Allemagne, Royaume-Uni, Italie, France, Espagne, Suisse, Russie, Turquie, Belgique, Pays-Bas et reste de l'Europe), tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché : Marché européen des emballages en papier et plastique biodégradables

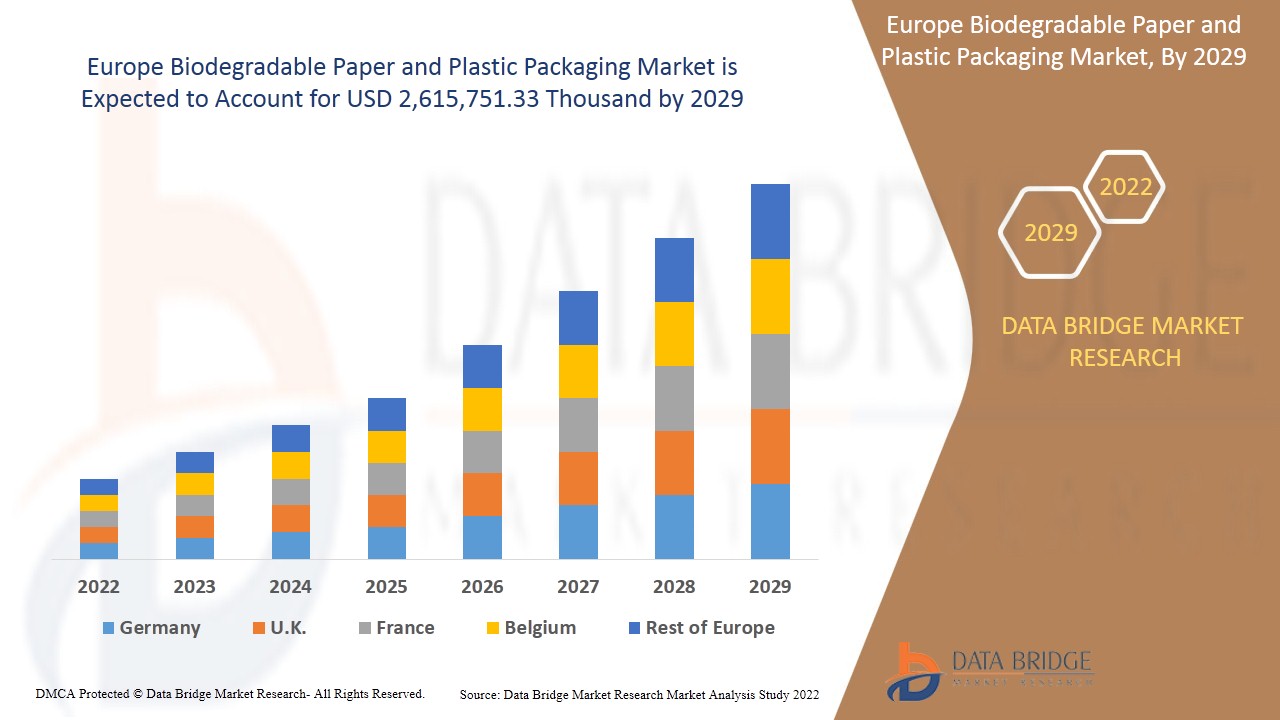

Le marché européen des emballages en papier et plastique biodégradables devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît à un TCAC de 7,8 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 2 615 751,33 milliers de dollars d’ici 2029. L’un des principaux moteurs associés au marché européen des emballages en papier et plastique biodégradables pourrait être le renforcement des réglementations gouvernementales liées aux emballages.

Les emballages en papier et en plastique biodégradables sont des produits respectueux de l'environnement qui n'émettent pas de carbone pendant le processus de production. En raison de la sensibilisation croissante de la population aux emballages respectueux de l'environnement, la demande d'emballages en papier et en plastique biodégradables a augmenté. Elle s'applique à plusieurs industries telles que les industries pharmaceutiques, alimentaires, de la santé et environnementales. Avec différents types de plastiques, l'industrie alimentaire et des boissons est fortement dépendante des matériaux d'emballage.

La sensibilisation croissante des consommateurs aux emballages écologiques devrait stimuler la croissance du marché. Le besoin de matériaux à faible empreinte carbone pourrait agir comme un moteur potentiel du marché. De plus, l'élimination progressive des plastiques à usage unique augmenterait les ventes et les bénéfices des acteurs opérant sur le marché.

Le principal obstacle qui pèse sur le marché européen des emballages en papier et en plastique biodégradables est l’investissement limité dans la production de plastique biodégradable. En outre, une forte concentration sur la production de plastique recyclable et non biodégradable d’origine biologique peut également freiner la croissance du marché. La production d’ acide polylactique (PLA) à partir de la canne à sucre et du maïs devrait créer des opportunités pour le marché européen des emballages en papier et en plastique biodégradables. La disponibilité limitée des machines et des équipements pour les matériaux biosourcés est susceptible de constituer un défi pour la croissance du marché.

Ce rapport sur le marché européen des emballages en papier et plastique biodégradables fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des emballages en papier et en plastique biodégradables en Europe

Le marché européen des emballages en papier et plastique biodégradables est segmenté en fonction du type d'emballage, du produit, de l'utilisation, du canal de distribution, de l'application, de la couche d'emballage et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

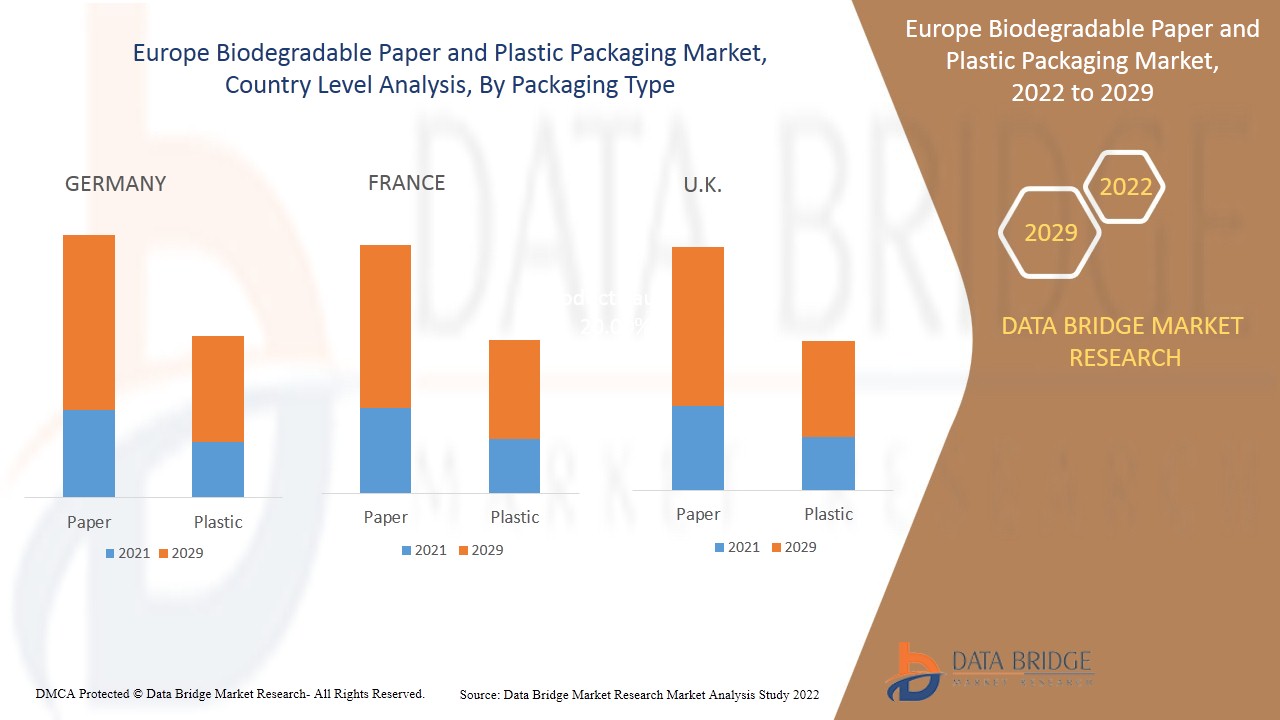

- En fonction du type d'emballage, le marché européen des emballages en papier et en plastique biodégradables est segmenté en papier et en plastique. En 2022, le segment du papier devrait dominer le marché européen des emballages en papier et en plastique biodégradables, car le processus de fabrication du papier nécessite une main-d'œuvre moins qualifiée avec une disponibilité facile des ressources ou des matières premières, ce qui augmente sa demande.

- Sur la base du produit, le marché européen des emballages en papier et plastique biodégradables est segmenté en pailles, sacs, plaques de cuisson, assiettes en papier, boîtes à sandwich à clapet, gobelets, plateaux, couverts, bols, pochettes et sachets, avec couvercle, etc. En 2022, le segment des sacs devrait dominer le marché européen des emballages en papier et plastique biodégradables car il est durable et peut être utilisé à des fins multiples, ce qui augmente sa demande.

- En fonction de leur utilisation, le marché européen des emballages en papier et en plastique biodégradables est segmenté en emballages à usage unique et réutilisables. En 2022, le segment réutilisable devrait dominer le marché européen des emballages en papier et en plastique biodégradables, car il évite l'exploitation inutile des ressources et empêche les déchets, augmentant ainsi sa demande au cours de la période de prévision.

- En fonction du canal de distribution, le marché européen des emballages en papier et plastique biodégradables est segmenté en commerce électronique , supermarchés/hypermarchés, magasins de proximité, magasins spécialisés et autres. En 2022, le segment des supermarchés/hypermarchés devrait dominer le marché européen des emballages en papier et plastique biodégradables, car les clients peuvent bénéficier d'une totale liberté de sélection, ce qui augmente sa demande au cours de la période de prévision.

- En fonction des applications, le marché européen des emballages en papier et plastique biodégradables est segmenté en emballages alimentaires, emballages de boissons, emballages de produits pharmaceutiques, emballages de produits de soins personnels et ménagers, emballages d'appareils électroniques, etc. En 2022, le segment des emballages alimentaires devrait dominer le marché européen des emballages en papier et plastique biodégradables, car il rend les aliments plus sûrs et moins vulnérables à la contamination, ce qui augmente sa demande.

- Sur la base de la couche d'emballage, le marché européen des emballages en papier et plastique biodégradables est segmenté en emballages primaires, emballages secondaires et emballages tertiaires. En 2022, le segment des emballages primaires devrait dominer le marché européen des emballages en papier et plastique biodégradables car il est peu coûteux et conçu pour les utilisateurs finaux qui ont imprimé des informations sur le produit, augmentant ainsi sa demande au cours de la période de prévision.

- Sur la base de l'utilisateur final, le marché européen des emballages en papier et plastique biodégradables est segmenté en restaurants, hôtels, salons de thé et de café, confiseries et snacks, cafétérias et autres. En 2022, le segment des restaurants devrait dominer le marché européen des emballages en papier et plastique biodégradables, car il permet aux convives de découvrir différentes cultures à travers les aliments et leurs emballages, ce qui augmente sa demande au cours de la période de prévision.

Marché européen des emballages en papier et en plastique biodégradables, analyse au niveau des pays

Le marché européen des emballages en papier et plastique biodégradables est segmenté en fonction du type d’emballage, du produit, de l’utilisation, du canal de distribution, de l’application, de la couche d’emballage et de l’utilisateur final.

Les pays couverts par le rapport sur le marché européen des emballages en papier et plastique biodégradables sont l’Allemagne, le Royaume-Uni, l’Italie, la France, l’Espagne, la Suisse, la Russie, la Turquie, la Belgique, les Pays-Bas et le reste de l’Europe.

L'Allemagne devrait dominer le marché européen des emballages en papier et en plastique biodégradables en raison du besoin croissant de matériaux à faible empreinte carbone. En France, la sensibilisation croissante des consommateurs à l'égard des emballages respectueux de l'environnement a stimulé la demande d'emballages en papier et en plastique biodégradables dans tous les secteurs. Au Royaume-Uni, le renforcement des réglementations gouvernementales relatives aux emballages devrait stimuler la demande d'emballages en papier et en plastique biodégradables parmi les utilisateurs finaux.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Croissance de l' industrie des emballages en papier et en plastique biodégradables

Le marché européen des emballages en papier et plastique biodégradables vous fournit également une analyse détaillée du marché pour chaque pays, la croissance d'une base installée de différents types de produits pour le marché des emballages en papier et plastique biodégradables, l'impact de la technologie utilisant des courbes de survie et les changements dans les scénarios réglementaires des préparations pour nourrissons et leur impact sur le marché européen des emballages en papier et plastique biodégradables. Les données sont disponibles pour la période historique de 2012 à 2020.

Paysage concurrentiel et analyse des parts de marché des emballages en papier et en plastique biodégradables en Europe

Le paysage concurrentiel du marché européen des emballages en papier et plastique biodégradables fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que l'orientation de l'entreprise vers le marché européen des emballages en papier et plastique biodégradables.

Français Certains des principaux acteurs couverts dans le rapport sont Smurfit Kappa, DS Smith, Tetra Pak, Mondi, International Paper, VPK Group, Sonoco Products Company, STOROPACK HANS REICHENECKER GMBH, WestRock Company, Stora Enso, Eurocell srl, Novamont SpA, OSQ, BIO-LUTIONS International AG, TIPA LTD, Robert Cullen Ltd., BioApply, CPS Paper Products, The Biodegradable Bag Company Ltd., Hosgör Plastik parmi d'autres acteurs nationaux et régionaux. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

Par exemple,

- En octobre 2021, le Groupe VPK a transformé le site industriel DA Alizay, situé en Normandie, en pôle de développement durable dans l'économie circulaire. Le Groupe VPK annonce réaliser la reconstruction de la machine à papier avec Valmet Oyj

- En novembre 2021, Mondi a investi 20 millions d'euros pour améliorer la durabilité de sa production de pâte à papier à l'usine de Frantschach en Autriche. Ce nouvel équipement d'usine rendra la production de pâte à papier de Mondi encore plus efficace et durable. Cela contribuera à élargir encore davantage la clientèle

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 USAGE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 CUSTOMER BARGAINING POWER

4.1.4 SUPPLIER BARGAINING POWER

4.1.5 INTERNAL COMPETITION (RIVALRY)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 NEED FOR LOWER CARBON FOOTPRINT MATERIALS

5.1.2 GROWING CONSUMER AWARENESS RELATED TO ECO-FRIENDLY PACKAGING

5.1.3 STRENGHTHENING OF GOVERNMENT REGULATIONS RELATED TO PACKAGING

5.1.4 PHASE OUT OF SINGLE USE PLASTICS

5.2 RESTRAINTS

5.2.1 HIGH COST OF BIODEGRADABLE PACKAGING PRODUCTS

5.2.2 LOW PRODUCTION OF POLYHYDROXYBUTYRATE ACID (PHB)

5.2.3 LIMITED INVESTMENT IN BIODEGRADABLE PLASTIC PRODUCTION

5.2.4 HIGH FOCUS ON RECYCLABLE AND BIO-BASED NON-BIODEGRADABLE PLASTIC PRODUCTION

5.3 OPPORTUNITIES

5.3.1 PRODUCTION OF COST-EFFECTIVE BIODEGRADABLE PACKAGING PRODUCTS

5.3.2 PRODUCTION OF POLYLACTIC ACID (PLA) FROM SUGARCANE AND CORN

5.3.3 BIODEGRADABLE PACKAGING PRODUCTION FOR HEALTHCARE INDUSTRY

5.4 CHALLENGES

5.4.1 HIGH FLUCTUATION IN RAW MATERIAL PRICES

5.4.2 LIMITED AVAILABILITY OF MACHINES AND EQUIPMENT FOR PRODUCTION OF BIO-BASED MATERIALS

5.4.3 LOW YIELD IN PRODUCTION OF BIO-BASED PLASTIC RESINS

6 IMPACT OF COVID-19 ON EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE EUROPE BIODEGRADABLE PLASTIC & PAPER PACKAGING MARKET

6.2 STRATERGIC DECISIONS BY MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 PRICE IMPACT

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 BAGS

7.2.1 STANDARD CARRY BAGS

7.2.2 STAND UP BAGS

7.2.2.1 ROUND BOTTOM GUSSET TYPE

7.2.2.2 SEAL BOTTOM TYPE

7.2.2.3 PLOW BOTTOM TYPE

7.2.2.4 SIDE GUSSET TYPE

7.2.2.5 THREE SIDE SEALED

7.2.2.6 FOUR SIDE SEALED

7.2.2.7 OTHERS

7.2.3 T-SHIRT PLASTIC BAGS

7.2.4 SELF-OPENING STYLE BAGS

7.2.5 ZIPPER BAGS

7.2.6 FOOD SAFE BARRIER BAGS

7.2.7 SMELL PROOF BAGS

7.2.8 PINCH BOTTOM BAGS

7.2.9 OTHERS

7.3 TRAYS

7.4 PAPER PLATES

7.5 BOWLS

7.6 CLAMSHELL SANDWICH CONTAINERS

7.7 POUCHES AND SACHETS

7.8 PORTION CUPS

7.9 STRAWS

7.1 CUTLERY

7.11 LIDDED

7.12 BAKING SHEETS

7.13 OTHERS

8 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE

8.1 OVERVIEW

8.2 PAPER

8.2.1 CORRUGATED BOARD

8.2.2 BOXBOARD

8.2.3 FLEXIBLE PAPER

8.2.4 OTHERS

8.3 PLASTIC

8.3.1 PLA

8.3.2 STARCH BASED PLASTIC

8.3.3 PBS

8.3.4 PHA

8.3.5 PCL

8.3.6 OTHERS

9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE

9.1 OVERVIEW

9.2 REUSABLE

9.3 SINGLE-USE

10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SUPERMARKETS/HYPERMARKETS

10.3 CONVENIENCE STORES

10.4 SPECIALTY STORES

10.5 E-COMMERCE

10.6 OTHERS

11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER

11.1 OVERVIEW

11.2 PRIMARY PACKAGING

11.3 SECONDARY PACKAGING

11.4 TERTIARY PACKAGING

12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD PACKAGING

12.2.1 FOOD PACKAGING, BY APPLICATION

12.2.1.1 FRUITS

12.2.1.2 VEGETABLE

12.2.1.3 BAKERY PRODUCTS

12.2.1.3.1 CAKES

12.2.1.3.2 PASTRIES

12.2.1.3.3 BISCUITS

12.2.1.3.4 BREAD

12.2.1.3.5 OTHERS

12.2.1.4 COOKED FOOD

12.2.1.4.1 PIZZA

12.2.1.4.2 SANDWICH

12.2.1.4.3 BURGER

12.2.1.4.4 OTHERS

12.2.1.5 MEAT, SEAFOOD AND POULTRY

12.2.1.6 DAIRY PRODUCTS

12.2.1.6.1 EGGS

12.2.1.6.2 CHEESE

12.2.1.6.3 OTHERS

12.2.1.7 OTHERS

12.3 BEVERAGE PACKAGING

12.4 ELECTRONIC APPLIANCE PACKAGING

12.5 PERSONAL & HOME CARE PACKAGING

12.6 PHARMACEUTICALS PACKAGING

12.7 OTHERS

13 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER

13.1 OVERVIEW

13.2 RESTAURANTS

13.2.1 RESTAURANTS, BY PRODUCT

13.2.1.1 BAGS

13.2.1.2 TRAYS

13.2.1.3 PAPER PLATES

13.2.1.4 BOWLS

13.2.1.5 CLAMSHELL SANDWICH CONTAINERS

13.2.1.6 POUCHES AND SACHETS

13.2.1.7 PORTION CUPS

13.2.1.8 STRAWS

13.2.1.9 CUTLERY

13.2.1.10 LIDDED

13.2.1.11 BAKING SHEETS

13.2.1.12 OTHERS

13.3 SWEETS & SNACKS STORES

13.3.1 SWEETS & SNACKS STORES, BY PRODUCT

13.3.1.1 BAGS

13.3.1.2 TRAYS

13.3.1.3 PAPER PLATES

13.3.1.4 BOWLS

13.3.1.5 CLAMSHELL SANDWICH CONTAINERS

13.3.1.6 POUCHES AND SACHETS

13.3.1.7 PORTION CUPS

13.3.1.8 STRAWS

13.3.1.9 CUTLERY

13.3.1.10 LIDDED

13.3.1.11 BAKING SHEETS

13.3.1.12 OTHERS

13.4 CAFETERIA

13.4.1 CAFETERIA, BY PRODUCT

13.4.1.1 BAGS

13.4.1.2 TRAYS

13.4.1.3 PAPER PLATES

13.4.1.4 BOWLS

13.4.1.5 CLAMSHELL SANDWICH CONTAINERS

13.4.1.6 POUCHES AND SACHETS

13.4.1.7 PORTION CUPS

13.4.1.8 STRAWS

13.4.1.9 CUTLERY

13.4.1.10 LIDDED

13.4.1.11 BAKING SHEETS

13.4.1.12 OTHERS

13.5 TEA AND COFFEE SHOPS

13.5.1 TEA AND COFFEE SHOPS, BY PRODUCT

13.5.1.1 BAGS

13.5.1.2 TRAYS

13.5.1.3 PAPER PLATES

13.5.1.4 BOWLS

13.5.1.5 CLAMSHELL SANDWICH CONTAINERS

13.5.1.6 POUCHES AND SACHETS

13.5.1.7 PORTION CUPS

13.5.1.8 STRAWS

13.5.1.9 CUTLERY

13.5.1.10 LIDDED

13.5.1.11 BAKING SHEETS

13.5.1.12 OTHERS

13.6 HOTELS

13.6.1 HOTELS, BY PRODUCT

13.6.1.1 BAGS

13.6.1.2 TRAYS

13.6.1.3 PAPER PLATES

13.6.1.4 BOWLS

13.6.1.5 CLAMSHELL SANDWICH CONTAINERS

13.6.1.6 POUCHES AND SACHETS

13.6.1.7 PORTION CUPS

13.6.1.8 STRAWS

13.6.1.9 CUTLERY

13.6.1.10 LIDDED

13.6.1.11 BAKING SHEETS

13.6.1.12 OTHERS

13.7 OTHERS

13.7.1 OTHERS, BY PRODUCT

13.7.1.1 BAGS

13.7.1.2 TRAYS

13.7.1.3 PAPER PLATES

13.7.1.4 BOWLS

13.7.1.5 CLAMSHELL SANDWICH CONTAINERS

13.7.1.6 POUCHES AND SACHETS

13.7.1.7 PORTION CUPS

13.7.1.8 STRAWS

13.7.1.9 CUTLERY

13.7.1.10 LIDDED

13.7.1.11 BAKING SHEETS

13.7.1.12 OTHERS

14 EUROPE

14.1 GERMANY

14.2 FRANCE

14.3 U.K.

14.4 ITALY

14.5 SPAIN

14.6 RUSSIA

14.7 BELGIUM

14.8 NETHERLANDS

14.9 SWITZERLAND

14.1 TURKEY

14.11 REST OF EUROPE

15 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 MERGERS & ACQUISITIONS

15.3 EXPANSIONS

15.4 NEW PRODUCT DEVELOPMENT

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SMURFIT KAPPA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 DS SMITH

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 TETRA PAK

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT UPDATES

17.4 MONDI

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 INTERNATIONAL PAPER

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 VPK GROUP

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 SONOCO PRODUCTS COMPANY

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT UPDATE

17.8 STOROPACK HANS REICHENECKER GMBH

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 BIOAPPLY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATE

17.1 BIO-LUTIONS INTERNATIONAL AG

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATES

17.11 CPS PAPER PRODUCTS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATE

17.12 EUROCELL SRL

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT UPDATE

17.13 HOŞGÖR PLASTIK

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 NOVAMONT S.P.A.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT UPDATE

17.15 OSQ

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT UPDATE

17.16 ROBERT CULLEN LTD

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATE

17.17 STORA ENZO

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT UPDATE

17.18 THE BIODEGRADABLE BAG COMPANY LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT UPDATE

17.19 TIPA LTD

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT UPDATES

17.2 WEST ROCK COMPANY

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT UPDATES

18 QUESTIONNAIRES

19 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER CLOSURE OF PLASTICS.; HS CODE - 3923 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER CLOSURE OF PLASTICS .; HS CODE - 3923 (USD THOUSAND)

TABLE 3 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND )

TABLE 13 EUROPE FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE DAIRY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 26 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 28 GERMANY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 29 GERMANY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 30 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 GERMANY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 32 GERMANY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 34 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 35 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 36 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 GERMANY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 38 GERMANY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 GERMANY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 GERMANY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 42 GERMANY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 GERMANY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 44 GERMANY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 GERMANY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 46 GERMANY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 GERMANY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 48 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 50 FRANCE BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 FRANCE STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 FRANCE PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 FRANCE PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 56 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 57 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 58 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 FRANCE FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 60 FRANCE BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 FRANCE COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 FRANCE DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 64 FRANCE RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 65 FRANCE SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 66 FRANCE CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 FRANCE TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 FRANCE HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 FRANCE OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 70 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 72 U.K. BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 U.K. STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 74 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 U.K. PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 U.K. PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 78 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 79 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 80 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 U.K. FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 82 U.K. BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 83 U.K. COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 U.K. DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 86 U.K. RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 U.K. SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 88 U.K. CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 U.K. TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 90 U.K. HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 91 U.K. OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 92 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 93 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 94 ITALY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 95 ITALY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 96 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 ITALY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 ITALY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 100 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 101 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 102 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 ITALY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 104 ITALY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 105 ITALY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 ITALY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 108 ITALY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 109 ITALY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 110 ITALY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 111 ITALY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 112 ITALY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 ITALY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 114 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 116 SPAIN BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 117 SPAIN STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 118 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 SPAIN PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 SPAIN PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 122 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 123 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 124 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 SPAIN FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 126 SPAIN BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 127 SPAIN COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 128 SPAIN DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 130 SPAIN RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 131 SPAIN SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 132 SPAIN CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 133 SPAIN TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 134 SPAIN HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 135 SPAIN OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 136 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 137 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 138 RUSSIA BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 139 RUSSIA STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 140 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 RUSSIA PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 RUSSIA PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 144 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 145 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 146 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 RUSSIA FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 148 RUSSIA BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 RUSSIA COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 150 RUSSIA DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 152 RUSSIA RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 153 RUSSIA SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 154 RUSSIA CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 155 RUSSIA TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 156 RUSSIA HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 157 RUSSIA OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 158 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 159 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 160 BELGIUM BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 161 BELGIUM STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 162 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 BELGIUM PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 BELGIUM PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 166 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 167 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 168 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 BELGIUM FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 170 BELGIUM BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 171 BELGIUM COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 172 BELGIUM DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 173 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 174 BELGIUM RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 175 BELGIUM SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 176 BELGIUM CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 177 BELGIUM TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 178 BELGIUM HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 179 BELGIUM OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 180 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 181 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 182 NETHERLANDS BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 183 NETHERLANDS STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 184 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 NETHERLANDS PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 NETHERLANDS PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 188 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 189 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 190 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 191 NETHERLANDS FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 192 NETHERLANDS BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 193 NETHERLANDS COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 194 NETHERLANDS DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 196 NETHERLANDS RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 197 NETHERLANDS SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 198 NETHERLANDS CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 199 NETHERLANDS TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 200 NETHERLANDS HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 201 NETHERLANDS OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 202 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 203 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 204 SWITZERLAND BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 205 SWITZERLAND STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 206 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 207 SWITZERLAND PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 208 SWITZERLAND PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 210 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 211 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 212 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 213 SWITZERLAND FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 214 SWITZERLAND BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 215 SWITZERLAND COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 216 SWITZERLAND DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 217 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 218 SWITZERLAND RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 219 SWITZERLAND SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 220 SWITZERLAND CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 221 SWITZERLAND TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 222 SWITZERLAND HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 223 SWITZERLAND OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 224 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 225 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 226 TURKEY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 227 TURKEY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 228 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 229 TURKEY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 230 TURKEY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 231 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 232 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 233 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 234 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 235 TURKEY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 236 TURKEY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 237 TURKEY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 238 TURKEY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 239 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 240 TURKEY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 241 TURKEY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 242 TURKEY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 243 TURKEY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 244 TURKEY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 245 TURKEY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 246 REST OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 247 REST OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

Liste des figures

FIGURE 1 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: GLOBAL VS. REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: THE USAGE LIFE LINE CURVE

FIGURE 7 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 14 GROWING CONSUMER AWARENESS RELATED TO ECOFRIENDLY PACKAGING IS DRIVING THE EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET IN 2022 TO 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

FIGURE 17 VOLUME OF PLASTIC POLYMERS USE IN THE EUROPEAN UNION (MILLION TONS), 2018

FIGURE 18 EUROPE BIOPLASTICS MARKET, BY TYPE (IN EUROPE), 2018

FIGURE 19 PRODUCTION CAPACITY OF BIOPLASTICS, BY MATERIAL TYPE, 2019

FIGURE 20 TYPES OF NATIONAL RESTRICTIONS OR BANS IN THE WORLD (%)

FIGURE 21 BANS ON SPECIFIC PRODUCTS (N) ASSOCIATED WITH FOOD SERVICE AND DELIVERY

FIGURE 22 PRODUCTION COST OF PLA, BY OPERATING EXPENDITURE (%)

FIGURE 23 FEEDSTOCK EFFICIENCY SCORE, 2016

FIGURE 24 LAND USE PER TON OF BIOBASED PLA, BIOBASED PE AND BIOETHANOL

FIGURE 25 PRODUCER PRICE INDEX BY INDUSTRY: PLASTICS MATERIAL AND RESINS MANUFACTURING

FIGURE 26 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2021

FIGURE 27 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2021

FIGURE 28 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2021

FIGURE 29 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 30 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2021

FIGURE 31 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 32 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2021

FIGURE 33 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 34 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 35 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 36 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 37 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY PRODUCT (2022-2029)

FIGURE 38 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY SHARE 2021(%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.