Europe And Us Recycled Solid Board Market

Taille du marché en milliards USD

TCAC :

%

USD

9.26 Billion

USD

11.46 Billion

2024

2032

USD

9.26 Billion

USD

11.46 Billion

2024

2032

| 2025 –2032 | |

| USD 9.26 Billion | |

| USD 11.46 Billion | |

|

|

|

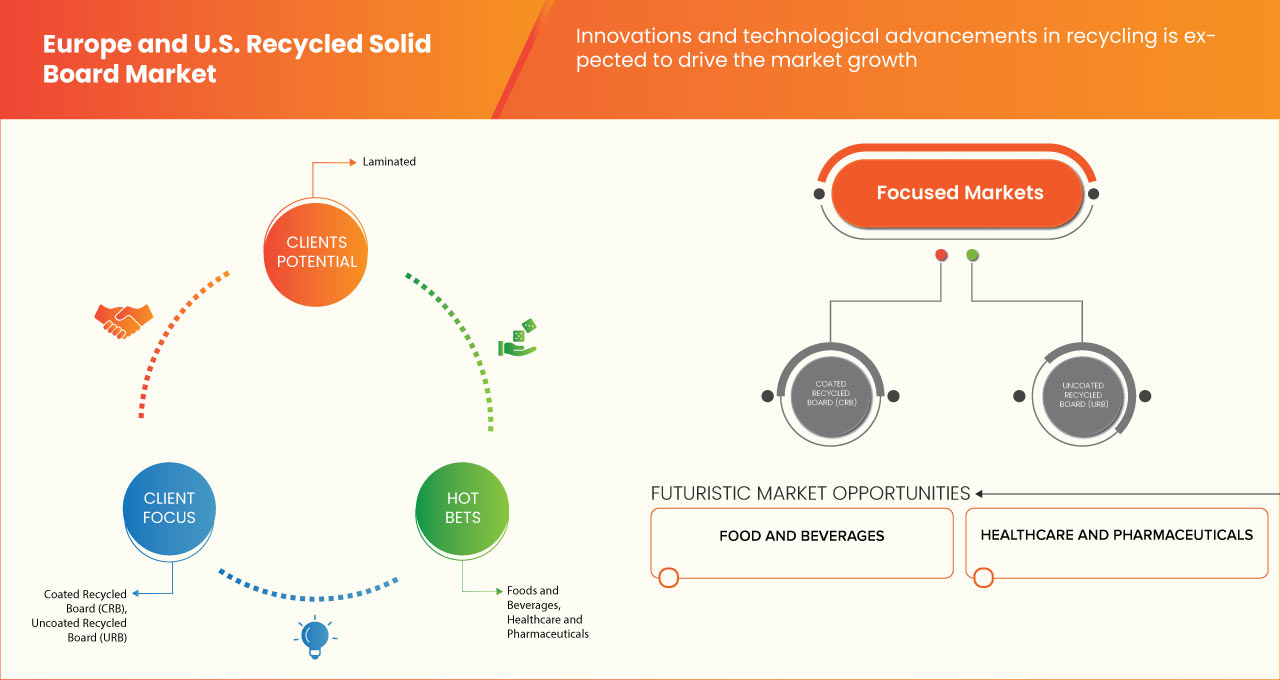

Marché des panneaux solides recyclés en Europe et aux États-Unis, par type de produit (carton recyclé enduit (CRB) et carton recyclé non enduit (URB)), catégorie (laminé et non laminé), poids (300-600 GSM, 601-800 GSM, 801-1200 GSM et plus de 1200 GSM), application (boîtes, présentoirs POP, plateaux, intercalaires, protecteurs de bord et autres), utilisation finale (alimentation et boissons, soins de santé et produits pharmaceutiques, cosmétiques et soins personnels, électricité et électronique, bâtiment et construction, emballage industriel, emballage de tabac et autres) - Tendances et prévisions de l'industrie jusqu'en 2031.

Analyse et taille du marché des panneaux solides recyclés en Europe et aux États-Unis

Le marché européen et américain du carton recyclé connaît une croissance constante, tirée par une augmentation de la demande de la part de diverses industries d'utilisation finale. La sensibilisation croissante à la durabilité et les préoccupations environnementales croissantes propulsent le marché vers l'avant. Cependant, l'offre limitée de matières premières pourrait entraver dans une certaine mesure l'expansion du marché.

Data Bridge Market Research analyse que le marché européen et américain des panneaux solides recyclés devrait atteindre 11,19 milliards USD d'ici 2031, contre 9,02 milliards USD en 2023, avec un TCAC de 2,7 % au cours de la période de prévision 2024-2031.

|

Rapport métrique |

Détails |

|

Période de prévision |

2024 à 2031 |

|

Année de base |

2023 |

|

Années historiques |

2022 (personnalisable pour 2016-2021) |

|

Unités quantitatives |

Chiffre d'affaires en milliards USD |

|

Segments couverts |

Type de produit (carton recyclé couché (CRB) et carton recyclé non couché (URB)), catégorie (laminé et non laminé), poids (300-600 g/m², 601-800 g/m², 801-1200 g/m² et plus de 1200 g/m²), application (boîtes, présentoirs, plateaux, intercalaires, protecteurs de bord et autres), utilisation finale (alimentation et boissons, soins de santé et produits pharmaceutiques, cosmétiques et soins personnels, électricité et électronique, bâtiment et construction, emballage industriel, emballage de tabac et autres) |

|

Pays couverts |

États-Unis, Allemagne, Italie, Royaume-Uni, France, Pologne, Russie, Espagne, Turquie, Pays-Bas, Belgique, Suède, Finlande, Suisse, Danemark, Norvège et reste de l'Europe |

|

Acteurs du marché couverts |

Smurfit Kappa, Reno De Medici SpA, DS Smith, VPK Group NV, Schumacher Packaging, Solidus, Koehler Paper, LEIPA GROUP, Guangzhou bmpaper, Cartiera San Martino, Cartiera Fornaci spa., Cartiera Marchigiana, Kartonfabrik Porstendorf, Preston Board & Packaging Ltd. , Groupe Magnia, GROUPE PREMIER PAPER, Cartiera Cama, SEVEROČESKÁ PAPÍRNA, sro, Advanced Packaging Ltd., KAPAG Karton + Papier AG et Merckens entre autres |

Définition du marché

Le carton compact recyclé est un type de matériau fabriqué à partir de fibres de papier recyclé. Il est couramment utilisé dans les emballages et divers produits à base de papier. Le processus consiste à collecter du papier et du carton usagés, à les décomposer en fibres, puis à les recombiner en un matériau en carton compact. Ce matériau est souvent recherché pour ses avantages environnementaux, car il réduit le besoin de fibres de papier vierges et aide à détourner les déchets des décharges. De plus, il est généralement robuste et polyvalent, ce qui le rend adapté à une gamme d'applications.

Dynamique du marché des panneaux composites recyclés en Europe et aux États-Unis

Conducteurs

- Augmentation de la demande de diverses industries d'utilisation finale

L'augmentation de la demande de diverses industries d'utilisation finale découle d'une reconnaissance croissante des avantages environnementaux associés au carton compact recyclé. Des industries telles que l'alimentation et les boissons, la vente au détail, le commerce électronique , les cosmétiques et l'électronique recherchent de plus en plus des matériaux d'emballage qui correspondent à leurs objectifs de durabilité et répondent aux attentes des consommateurs soucieux de l'environnement. Le carton compact recyclé offre une solution convaincante, offrant une alternative renouvelable et recyclable aux matériaux d'emballage traditionnels comme le carton vierge ou le plastique. De plus, la polyvalence et l'adaptabilité du carton compact recyclé le rendent adapté à une large gamme d'applications, notamment les boîtes en carton ondulé, les cartons, les présentoirs et les encarts, répondant aux divers besoins des industries d'utilisation finale. Alors que les entreprises de tous les secteurs accordent la priorité à la durabilité et à la gestion de l'environnement, la demande de carton compact recyclé devrait poursuivre sa trajectoire ascendante, stimulant la croissance du marché et l'innovation en Europe et aux États-Unis .

- Expansion dans le commerce électronique

Les consommateurs se tournent de plus en plus vers les achats en ligne pour des raisons de commodité et d’accessibilité. La demande de matériaux d’emballage garantissant une livraison sûre et efficace des marchandises a donc augmenté. Le carton compact recyclé apparaît comme une solution favorable pour les emballages de commerce électronique en raison de ses propriétés écologiques, offrant à la fois des capacités de protection et des références en matière de durabilité. Avec l’essor des plateformes de vente au détail en ligne, il existe un besoin croissant de matériaux d’emballage robustes et fiables capables de résister aux rigueurs de l’expédition et de la manutention tout en minimisant l’impact environnemental. Le carton compact recyclé répond à cette exigence en offrant une alternative durable aux matériaux d’emballage traditionnels comme le plastique ou le carton vierge, en accord avec les valeurs écologiques des consommateurs et des entreprises. De plus, comme les réglementations et les préférences des consommateurs accordent de plus en plus d’importance à la durabilité, les entreprises de commerce électronique sont sous pression pour adopter des solutions d’emballage respectueuses de l’environnement. Cela crée un environnement de marché favorable au carton compact recyclé, stimulant la demande et la croissance du marché.

Opportunités

- Innovation produit et expansion sur de nouveaux marchés

L’innovation dans le développement de produits permet aux fabricants de surmonter les limitations techniques et d’améliorer les performances, la fonctionnalité et l’attrait esthétique du carton compact recyclé. Par exemple, les progrès des technologies de recyclage et de fabrication permettent de produire du carton compact recyclé avec une résistance, une durabilité et une imprimabilité améliorées, ce qui le rend adapté à une gamme plus large d’applications, notamment les emballages haut de gamme, les présentoirs sur le lieu de vente et les supports promotionnels. De plus, les innovations dans les traitements de surface, les revêtements et les stratifiés améliorent l’apparence et la fonctionnalité du carton compact recyclé, répondant aux divers besoins et préférences des clients de différents secteurs. En outre, l’expansion sur de nouveaux marchés offre des opportunités de croissance et de diversification. En ciblant des secteurs tels que l’alimentation et les boissons, les cosmétiques, l’électronique et la vente au détail, où la durabilité et les emballages respectueux de l’environnement sont de plus en plus valorisés, les fabricants peuvent exploiter de nouvelles sources de revenus et élargir leur clientèle. En outre, l’exploration des marchés internationaux offre des opportunités d’exportation de produits en carton compact recyclé vers des régions où la demande de solutions d’emballage durables augmente, ce qui stimule encore davantage l’expansion du marché .

- Prise de conscience croissante concernant la durabilité et préoccupations environnementales croissantes

Les consommateurs et les entreprises étant de plus en plus conscients de l’impact environnemental de leurs décisions d’achat, la demande de solutions d’emballage respectueuses de l’environnement qui minimisent l’épuisement des ressources, la pollution et les déchets augmente. Le carton compact recyclé offre une alternative durable aux matériaux d’emballage conventionnels, car il est fabriqué à partir de fibres recyclées post-consommation ou post-industrielles, réduisant ainsi le besoin de ressources vierges et détournant les déchets des décharges. De plus, le carton compact recyclé s’aligne sur les principes de l’économie circulaire en favorisant la réutilisation et le recyclage des matériaux, contribuant ainsi à une chaîne d’approvisionnement plus durable et plus économe en ressources.

Contraintes/Défis

- Manque de sensibilisation aux solutions d'emballage recyclé

Malgré une prise de conscience croissante de l’environnement, de nombreux consommateurs et entreprises ne comprennent pas pleinement les avantages ou la disponibilité du carton compact recyclé comme option d’emballage durable. Ce manque de sensibilisation peut provenir de divers facteurs, notamment des idées fausses sur la qualité et les performances des matériaux recyclés, une éducation limitée sur les processus de recyclage et une promotion insuffisante du carton compact recyclé par les fabricants et les détaillants. En conséquence, les consommateurs peuvent se tourner par défaut vers des options d’emballage traditionnelles fabriquées à partir de matériaux vierges, en supposant qu’elles offrent une qualité ou une fiabilité supérieure. De même, les entreprises peuvent privilégier des matériaux d’emballage familiers sans pleinement tenir compte de l’impact environnemental de leurs choix ou de la disponibilité d’alternatives recyclées. Pour relever ce défi, il faut des campagnes d’éducation et de sensibilisation complètes pour mettre en avant les avantages du carton compact recyclé, notamment son empreinte environnementale plus faible, sa consommation de ressources réduite et sa contribution à une économie circulaire.

- Des investissements importants dans le développement des infrastructures

Le développement d’infrastructures de recyclage robustes, notamment des installations de collecte, de tri, de traitement et de fabrication, nécessite des investissements substantiels en équipements, en technologies et en personnel. De plus, la nature fragmentée du secteur du recyclage et les réglementations variables selon les régions peuvent compliquer la planification et la mise en œuvre des projets d’infrastructure, entraînant des retards et des dépassements de coûts. De plus, le retour sur investissement des projets d’infrastructure de recyclage peut être incertain ou prolongé, car les flux de revenus des matériaux recyclés et des produits finis sont influencés par la dynamique du marché, les prix des matières premières et les fluctuations de la demande. Des coûts initiaux élevés et des rendements financiers incertains peuvent dissuader les investisseurs privés et limiter le financement public des infrastructures de recyclage, limitant ainsi l’expansion et la modernisation des installations nécessaires pour soutenir la croissance du marché des panneaux solides recyclés. En outre, les obstacles réglementaires, les processus d’autorisation et l’opposition de la communauté peuvent encore compliquer les efforts de développement des infrastructures, retardant les projets et augmentant les coûts. Pour surmonter ces défis, il faut des efforts coordonnés de la part des agences gouvernementales, des acteurs de l’industrie et des institutions financières pour rationaliser les processus d’autorisation, offrir des incitations à l’investissement privé et faciliter les partenariats public-privé

Développements récents

- En juillet 2019, selon un article de la National Library of Medicine, l’utilisation généralisée du papier et du carton sur le marché mondial de l’emballage, qui représente 31 %, est motivée par sa polyvalence et sa réputation écologique. Particulièrement présent dans les emballages alimentaires, il offre confinement, protection et communication pratique des informations aux consommateurs. Près de la moitié du papier et du carton produits en 2000 était destiné aux applications d’emballage. Avec son image respectueuse de l’environnement, le papier est privilégié par l’industrie alimentaire, en particulier pour le contact direct avec les aliments et à des fins de transport/stockage. Les exemples incluent les pots de crème glacée, les sacs de pop-corn pour micro-ondes, les cartons de lait et les conteneurs de restauration rapide, ce qui met en évidence ses diverses applications et stimule la demande de carton solide recyclé comme alternative durable

- En septembre 2023, l'utilisation de carton compact recyclé dans l'industrie pharmaceutique offre des avantages significatifs par rapport aux matériaux d'emballage traditionnels en raison de sa recyclabilité. Cette option d'emballage écologique, dérivée de fibres de papier recyclées, offre une résistance microbienne et une facilité de recyclage, répondant ainsi au besoin de l'industrie de solutions respectueuses de l'environnement. En utilisant cela, les produits pharmaceutiques peuvent être emballés dans des matériaux qui minimisent la perturbation de l'écosystème et sont biodégradables

- En juin 2020, selon un article de Springer Nature, l’adoption croissante du commerce électronique et l’augmentation des niveaux socioéconomiques ont considérablement stimulé la demande de matériaux d’emballage en carton, entraînant une augmentation du recyclage et de la production de déchets. Par conséquent, les déchets de boues de papier recyclés apparaissent comme une ressource précieuse pour les applications de traitement de l’énergie et de l’eau, contribuant à améliorer la durabilité et les pratiques d’économie circulaire dans le secteur du recyclage du papier et du carton

- En juillet 2023, selon un article de flinder, à mesure que le commerce électronique continue de croître, la demande de solutions d’emballage durables telles que le carton compact recyclé augmente. Pour parvenir à la durabilité dans le commerce électronique, il faut des approches sur mesure qui tiennent compte des besoins uniques des entreprises, des attentes des consommateurs et des ressources disponibles. Un aspect crucial est l’évaluation des cycles de vie des produits et des pratiques d’approvisionnement afin de minimiser l’impact environnemental. Cela implique de prolonger les cycles de vie des produits, de proposer des réparations et de mettre en œuvre des programmes de reprise ou de vente d’articles d’occasion. En outre, il est essentiel d’évaluer l’empreinte écologique de la chaîne d’approvisionnement et de s’approvisionner auprès de fournisseurs engagés dans des pratiques éthiques et durables. Les entreprises peuvent également explorer des solutions d’emballage innovantes, telles que des options minimales, réutilisables, recyclables ou compostables

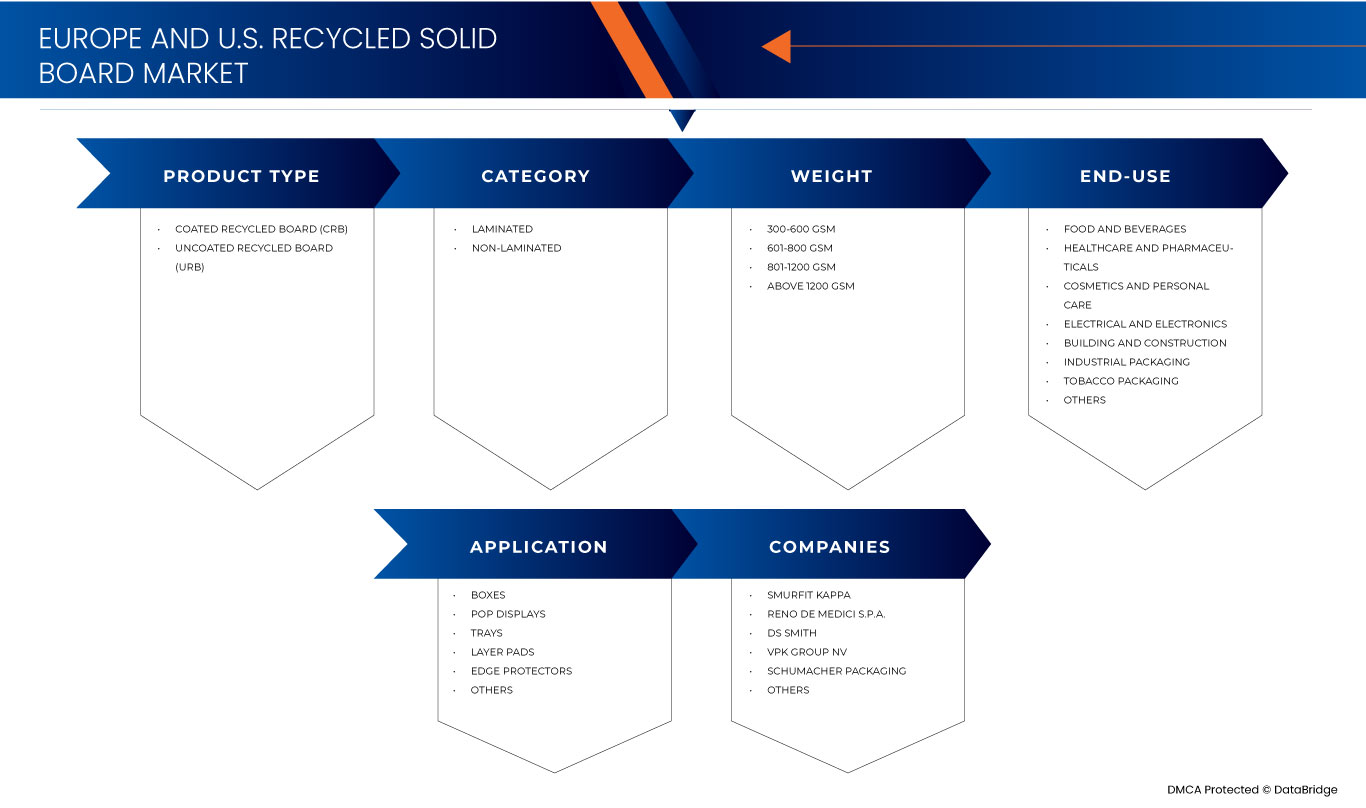

Portée du marché des panneaux solides recyclés en Europe et aux États-Unis

Le marché européen et américain du carton recyclé est divisé en cinq segments notables en fonction du type de produit, de la catégorie, du poids, de l'application et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Carton recyclé couché (CRB)

- Panneau recyclé non couché (URB)

Sur la base du type de produit, le marché est segmenté en carton recyclé enduit (CRB) et en carton recyclé non enduit (URB).

Catégorie

- Feuilleté

- Non laminé

Sur la base de la catégorie, le marché est segmenté en laminé et non laminé.

Poids

- 300-600 GSM

- 601-800 GSM

- 801-1200 GSM

- Au-dessus de 1200 GSM

Sur la base du poids, le marché est segmenté en 300-600 GSM, 601-800 GSM, 801-1200 GSM et plus de 1200 GSM.

Application

- Boîtes

- Présentoirs pop-up

- Plateaux

- Tampons de couches

- Protecteurs de bord

- Autres

Sur la base de l'application, le marché est segmenté en boîtes, présentoirs pop, plateaux, intercalaires, protecteurs de bords et autres.

Utilisation finale

- Alimentation et boissons

- Santé et produits pharmaceutiques

- Cosmétiques et soins personnels

- Électricité et électronique

- Bâtiment et construction

- Emballage industriel

- Emballage du tabac

- Autres

Sur la base de l'utilisation finale, le marché est segmenté en aliments et boissons, soins de santé et produits pharmaceutiques, cosmétiques et soins personnels, électricité et électronique, bâtiment et construction, emballage industriel, emballage de tabac et autres.

Analyse/perspectives régionales du marché des panneaux solides recyclés en Europe et aux États-Unis

Le marché européen et américain du carton recyclé est segmenté en cinq segments notables en fonction du type de produit, de la catégorie, du poids, de l'application et de l'utilisation finale.

Les pays couverts par le rapport sur le marché des panneaux solides recyclés en Europe et aux États-Unis sont les États-Unis, l'Allemagne, l'Italie, le Royaume-Uni, la France, la Pologne, la Russie, l'Espagne, la Turquie, les Pays-Bas, la Belgique, la Suède, la Finlande, la Suisse, le Danemark, la Norvège et le reste de l'Europe.

L'Allemagne devrait dominer l'Europe en raison de l'utilisation et de la demande croissantes de carton compact recyclé provenant de diverses industries d'utilisation finale, notamment les cosmétiques et les soins personnels.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du carton recyclé en Europe et aux États-Unis

Le paysage concurrentiel du marché du carton recyclé en Europe et aux États-Unis fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché du carton recyclé en Europe et aux États-Unis

Français Certains des principaux acteurs opérant sur le marché du carton compact recyclé en Europe et aux États-Unis sont Smurfit Kappa, Reno De Medici SpA, DS Smith, VPK Group NV, Schumacher Packaging, Solidus, Koehler Paper, LEIPA GROUP, Guangzhou bmpaper, Cartiera San Martino, Cartiera Fornaci spa., Cartiera Marchigiana, Kartonfabrik Porstendorf, Preston Board & Packaging Ltd., Magnia Group, PREMIER PAPER GROUP, Cartiera Cama, SEVEROČESKÁ PAPÍRNA, sro, Advanced Packaging Ltd., KAPAG Karton + Papier AG et Merckens, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.