Marché des voitures d'occasion en Europe et en Amérique du Sud, par type de fournisseur (organisé, non organisé), type de propulsion (essence, diesel, électrique, GPL et GNC), cylindrée (petite (moins de 1 499 CC), moyenne (1 500-2 499 CC) et pleine grandeur (plus de 2 500 CC)), concessionnaire (franchisé, indépendant), transmission (manuelle, automatique), type de véhicule (SUV, berline, crossover, coupé, hayon, monospace, cabriolet, voitures de sport et autres), catégorie de prix (élevé (plus de 20 000 USD), moyen (5 501 USD-20 000 USD) et bas (moins de 5 500 USD), canal de vente (hors ligne, en ligne) - Tendances et prévisions du secteur jusqu'en 2030.

Analyse et taille du marché des voitures d'occasion en Europe et en Amérique du Sud

Le secteur englobe l'achat et la vente de véhicules d'occasion dans divers pays de ces régions. Ce marché comprend le commerce de voitures d'occasion par l'intermédiaire de concessionnaires, de plateformes en ligne, de ventes aux enchères et de ventes privées, impliquant des véhicules qui ont déjà été possédés et conduits. Il concerne divers segments, notamment les voitures particulières, les SUV, les camions et les véhicules utilitaires, et englobe à la fois les consommateurs individuels et les entreprises impliquées dans les processus d'achat et de vente. Les facteurs qui influencent ce marché comprennent la dynamique de l'offre et de la demande, les conditions économiques, les politiques réglementaires, les avancées technologiques et les préférences des consommateurs.

Selon les analyses de Data Bridge Market Research, le marché européen des voitures d'occasion devrait atteindre une valeur de 639 011,39 millions USD d'ici 2030, à un TCAC de 6,4 % au cours de la période de prévision. Le marché sud-américain des voitures d'occasion devrait atteindre une valeur de 99 146,78 millions USD d'ici 2030, à un TCAC de 4,1 % au cours de la période de prévision. Le rapport sur le marché des voitures d'occasion en Europe et en Amérique du Sud couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type de fournisseur (organisé, non organisé), type de propulsion (essence, diesel, électrique, GPL et GNC), cylindrée (petite (moins de 1 499 cc), moyenne (1 500 à 2 499 cc) et grande taille (plus de 2 500 cc)), concessionnaire (franchisé, indépendant), transmission (manuelle, automatique), type de véhicule (SUV, berline, crossover, coupé, berline à hayon, monospace, cabriolet, voitures de sport et autres), catégorie de prix (élevée (plus de 20 000 USD), moyenne (5 501 à 20 000 USD) et basse (moins de 5 500 USD), canal de vente (hors ligne, en ligne) |

|

Pays couverts |

Allemagne, Royaume-Uni, France, Italie, Espagne, Russie, Pologne, Pays-Bas, Belgique, Suisse, Danemark, Finlande, Suède, Norvège, Turquie et reste de l'Europe, Brésil, Argentine et reste de l'Amérique du Sud |

|

Acteurs du marché couverts |

AUTO1 Group, Penske Automotive Group, Inc., Lookers PLC, PENDRAGON, Emil Frey AG, Group1 Automotive, Inc., Arnold Clark Automobiles Limited, Gottfried Schultz Automobile Trading SE, Alibaba Group Holding Limited, OLX GROUP, Auto Trader Group plc., KAVAK, HELLMAN & FRIEDMAN LLC, leboncoin, mobile.de GmbH, Gumtree.com Limited, Webmotors SA, AUTONIZA, Seminuevos.com, SALFA, Unidas, Grupo Sinal entre autres |

Définition du marché

Le marché des voitures d'occasion est un secteur dynamique impliquant le commerce de véhicules d'occasion dans plusieurs pays de ces régions. Il englobe une large gamme de types de véhicules, tels que les voitures particulières, les SUV, les camions et les véhicules utilitaires, qui ont déjà appartenu à des particuliers ou à des entreprises. Ce marché fonctionne via différents canaux, notamment les réseaux de concessionnaires, les plateformes en ligne, les enchères et les transactions directes de personne à personne.

Les éléments clés de ce marché comprennent l’évaluation et la tarification des véhicules d’occasion, les vérifications de l’historique des véhicules, les options de financement, les services d’entretien et de remise à neuf et l’expérience globale du client. Les conditions économiques, le pouvoir d’achat des consommateurs, les préférences culturelles, les réglementations environnementales et les progrès technologiques jouent un rôle important dans la dynamique du marché. La croissance des plateformes en ligne a également transformé la façon dont les voitures d’occasion sont achetées et vendues, offrant aux consommateurs un accès plus facile à l’information et un plus large choix d’options.

Dynamique du marché des voitures d'occasion en Europe et en Amérique du Sud

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Émergence de différentes plateformes de commerce électronique en Europe et en Amérique du Sud

Les plateformes de commerce électronique ont fondamentalement changé le marché de la vente au détail automobile dans une plus large mesure. La pénétration croissante d'Internet a également facilité la création d'un marché en ligne dans le monde entier. Grâce à cela, les consommateurs ont plusieurs choix, notamment des variétés illimitées, des fonctionnalités de comparaison de styles, de prix et de modèles dans les portails en ligne. La plupart des concessionnaires répertorient les détails des voitures neuves et d'occasion en ligne afin que les clients puissent trouver des informations ainsi que des photos sur presque tous les véhicules qui les intéressent. De plus, si les informations sur les prix et les incitations ne sont pas disponibles, l'utilisateur peut simplement appeler et contacter de nombreux concessionnaires disponibles en ligne et obtenir les informations requises sur le modèle de voiture. En outre, divers sites Web de vente de voitures d'occasion en ligne proposent des forfaits de service après-vente gratuits ou à prix réduit qui couvrent divers types de coûts d'entretien associés au véhicule après l'achat.

- Augmentation de la transparence et de la symétrie des informations entre les concessionnaires et les clients

Les achats en ligne influencent la façon dont les consommateurs envisagent l'achat de voitures d'occasion. Les consommateurs veulent pouvoir configurer un véhicule selon leurs besoins plutôt que d'accepter ce qui se trouve sur le terrain comme la seule option disponible. La confiance entre les consommateurs et les concessionnaires est donc nécessaire pour leur processus de décision afin d'éviter tout conflit ou désaccord. Comme pour les ventes de voitures neuves, la relation entre le concessionnaire et le client devra être basée sur le respect et la facilité d'achat. Une telle relation asymétrique supposera que les acheteurs et les vendeurs disposent des mêmes informations pour déterminer la qualité d'un produit. En outre, Internet devient de plus en plus la source d'information privilégiée des acheteurs de véhicules d'occasion. Grâce à cela, les clients sont aujourd'hui de mieux en mieux informés sur les voitures, leur qualité, leur valeur résiduelle, les prix appliqués, les frais de financement, la disponibilité et, plus fréquemment, la marge bénéficiaire exacte que le concessionnaire réalise en concluant une affaire. La technologie permet également aux concessionnaires de trouver de nouvelles façons de s'approvisionner en stocks et de vendre les unités de gros plus rapidement. Des améliorations telles que celles-ci dans le secteur des voitures d'occasion aident encore plus les concessionnaires à gérer leur processus de vente plus efficacement tout en améliorant le contrôle des flux de stocks.

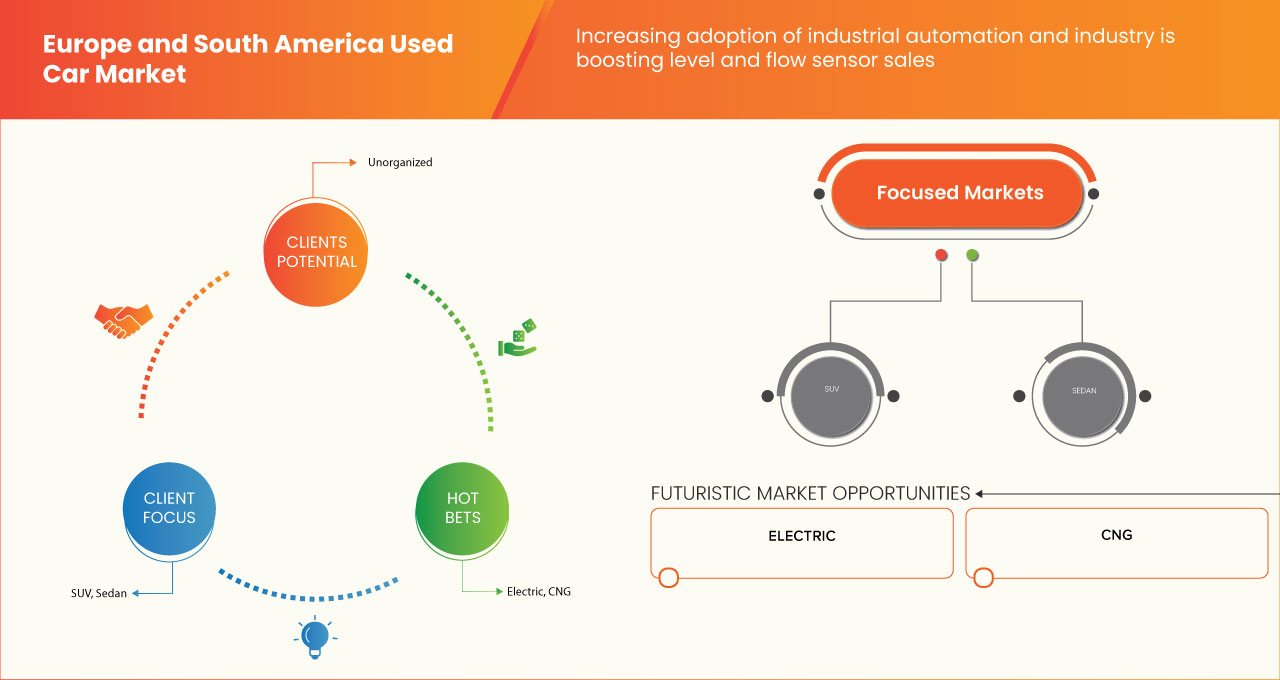

Opportunité

- Augmentation des partenariats stratégiques et des acquisitions entre deux entreprises

La coordination et l'intégration de diverses technologies sont essentielles pour obtenir des améliorations durables dans le secteur automobile. Pour cette raison, le gouvernement s'efforce également, par le biais de partenariats et d'acquisitions, d'accélérer l'utilisation appropriée des technologies existantes sur le marché des voitures d'occasion. Cela permet non seulement de faire connaître et de tirer profit de l'organisation, mais aussi de créer un espace pour une nouvelle invention. De plus, grâce à des partenariats, l'entreprise peut fournir toutes les facilités, y compris des promotions en ligne et de bonnes offres pour attirer les acheteurs sur le marché. En outre, cela aide les deux entreprises à se faire connaître sur le marché haut de gamme. Ainsi, l'augmentation des fusions et acquisitions dans le secteur automobile crée de nombreuses opportunités pour que le marché des voitures d'occasion se développe considérablement.

Retenue/Défi

- Manque de services après-vente pour les voitures d'occasion

Il ne fait aucun doute que la satisfaction du client est l'un des objectifs essentiels de toute entreprise, non seulement pour sa survie, mais aussi pour sa subsistance. Malheureusement, cela n'est pas facile à atteindre dans la réalité en raison de la concurrence intense et de la complexité des clients. La satisfaction du client sans les caractéristiques d'amélioration de la qualité appréciées par les clients ne peut être obtenue. L'appréciation de la qualité par les clients via les rencontres de service et les évaluations après-achat, si elle n'est pas satisfaite, finira par faire baisser la demande de voitures d'occasion. Cependant, la qualité du service est devenue un aspect crucial du produit de chaque fournisseur de services sur le marché, et le secteur automobile n'est pas différent, les clients recherchant de meilleurs services après-vente pour un meilleur rapport qualité-prix. Il ne fait aucun doute que les services après-vente sont devenus un aspect important des stratégies marketing des entreprises automobiles en raison des avantages et des récompenses qu'ils offrent à court et à long terme.

Développements récents

- En avril 2023, AUTO1 Group a lancé l'Auto1 Group Price Index, le premier indice européen des prix des voitures d'occasion basé sur les données des transactions de gros, révélant une hausse record de 25,7 % des prix des voitures d'occasion en juillet 2022, attribuée aux perturbations liées à la pandémie, aux pénuries de semi-conducteurs et aux tensions géopolitiques. Dans un contexte de fluctuations, l'indice a rebondi de 1,2 % en mars 2023, mais a baissé de 5,9 % en glissement annuel. Cet indice complet offre des informations précieuses sur la dynamique des prix au sein du marché européen de gros des voitures d'occasion.

- En mars 2023, Emil Frey AG a collaboré avec iptiQ, la filiale d'assurance numérique de Swiss Re, pour lancer une solution d'assurance numérique révolutionnaire appelée « Emil Frey Protect ». Ce partenariat stratégique s'appuie sur l'approche centrée sur le client d'Emil Frey dans le secteur automobile et sur l'expertise d'iptiQ dans l'intégration transparente de l'assurance numérique dans les chaînes de valeur des marques grand public. Disponible pour les clients suisses lors de l'achat et de l'entretien d'une voiture, Emil Frey Protect est entièrement intégré à la plateforme de vente et de mobilité numérique d'Emil Frey, offrant une expérience 100 % sans papier. Cette solution d'assurance innovante améliore l'offre de services d'Emil Frey, en fournissant aux clients une assurance automobile complète et personnalisée en toute simplicité, renforçant ainsi la position de l'entreprise sur les marchés européens et sud-américains des voitures d'occasion.

Portée du marché des voitures d'occasion en Europe et en Amérique du Sud

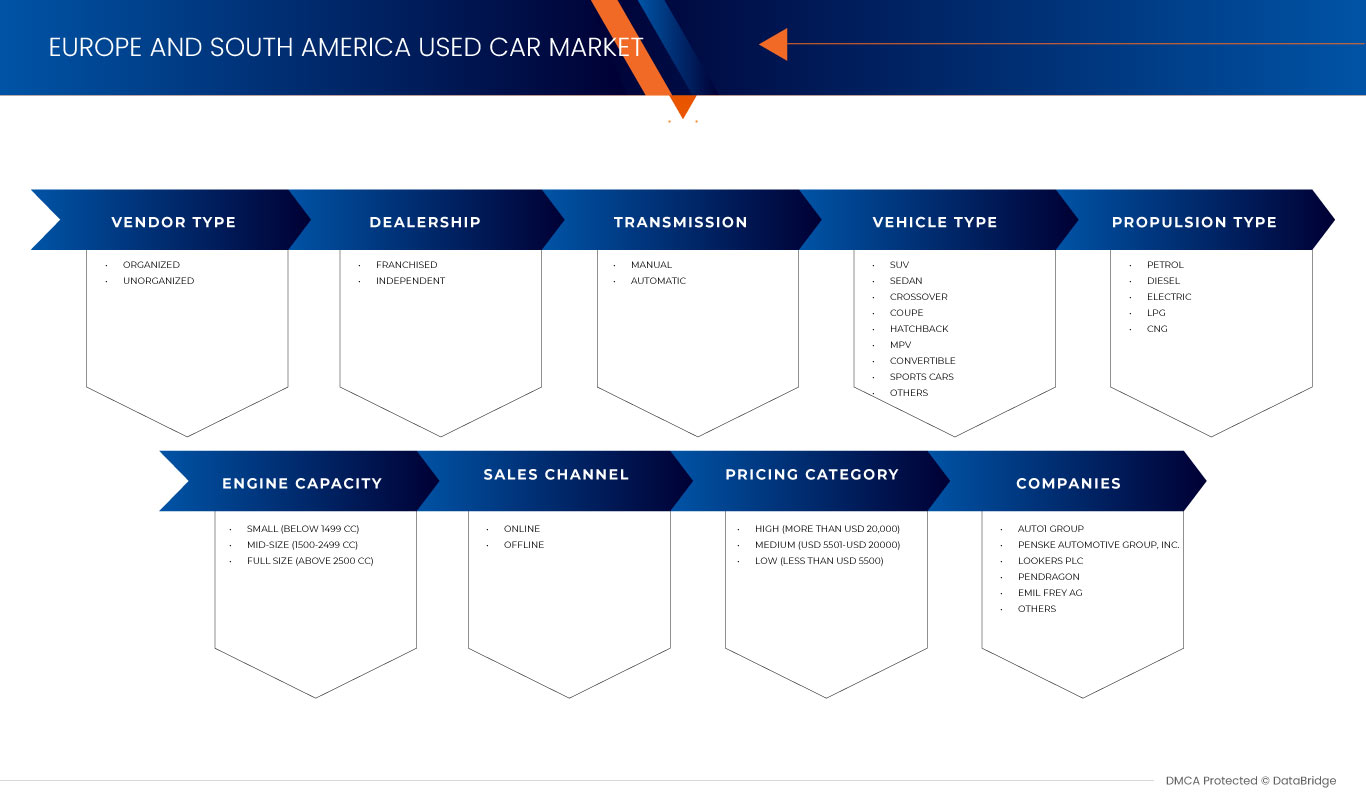

Le marché des voitures d'occasion en Europe et en Amérique du Sud est segmenté en fonction du type de fournisseur, du type de propulsion, de la cylindrée, du type de véhicule, du concessionnaire, de la transmission, de la catégorie de prix et du canal de vente. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de fournisseur

- Organisé

- Non organisé

Sur la base du type de fournisseur, le marché des voitures d'occasion en Europe et en Amérique du Sud est segmenté en organisé et non organisé.

Type de propulsion

- Essence

- Diesel

- GNC

- GPL

- Électrique

Sur la base du type de propulsion, le marché des voitures d'occasion en Europe et en Amérique du Sud est segmenté en essence, diesel, GNC, GPL et électrique.

Capacité du moteur

- Taille réelle (plus de 2500 cc)

- Taille moyenne (entre 1500 et 2499 cc)

- Petit (moins de 1499 cc)

Sur la base de la cylindrée du moteur, le marché des voitures d'occasion en Europe et en Amérique du Sud est segmenté en grande taille (au-dessus de 2 500 cm3), moyenne taille (entre 1 500 et 2 499 cm3) et petite taille (en dessous de 1 499 cm3).

Concession

- Franchisé

- Indépendant

Sur la base des concessionnaires, le marché des voitures d'occasion en Europe et en Amérique du Sud est segmenté en franchisés et indépendants.

Transmission

- Automatique

- Manuel

Sur la base de la transmission, le marché des voitures d'occasion en Europe et en Amérique du Sud est segmenté en automatique et manuel.

Catégorie de prix

- Élevé (plus de 20 000 USD)

- Moyen (5 501 USD – 20 000 USD)

- Faible (moins de 5 500 USD)

Sur la base de la catégorie de prix, le marché des voitures d'occasion en Europe et en Amérique du Sud est segmenté en haut (plus de 20 000 USD), moyen (5 501 USD - 20 000 USD) et bas (moins de 5 500 USD).

Canal de vente

- En ligne

- Hors ligne

Sur la base du canal de vente, le marché des voitures d'occasion en Europe et en Amérique du Sud est segmenté en en ligne et hors ligne.

Type de véhicule

- VUS

- Sedan

- Berline à hayon

- Convertible

- Croisement

- Monospace

- Coupé

- Voiture de sport

- Autres

Sur la base du type de véhicule, le marché des voitures d'occasion en Europe et en Amérique du Sud est segmenté en SUV, berline, hayon, cabriolet, crossover, monospace, coupé, voiture de sport et autres.

Analyse/perspectives du marché des voitures d'occasion en Europe et en Amérique du Sud

Le marché des voitures d'occasion en Europe et en Amérique du Sud est segmenté en fonction du type de fournisseur, du type de propulsion, de la capacité du moteur, du type de véhicule, du concessionnaire, de la transmission, de la catégorie de prix et du canal de vente.

Les pays couverts dans le rapport sur le marché des voitures d'occasion en Europe et en Amérique du Sud sont l'Allemagne, le Royaume-Uni, la France, l'Italie, l'Espagne, la Russie, la Pologne, les Pays-Bas, la Belgique, la Suisse, le Danemark, la Finlande, la Suède, la Norvège, la Turquie et le reste de l'Europe, le Brésil, l'Argentine et le reste de l'Amérique du Sud.

Le Royaume-Uni domine la région Europe car il possède l'une des économies et des populations les plus importantes d'Europe, ce qui se traduit naturellement par un marché automobile plus vaste, y compris le segment des voitures d'occasion. Le Brésil domine la région Amérique du Sud car de nombreuses personnes préfèrent acheter des voitures d'occasion en raison des économies de coûts par rapport à l'achat de véhicules neufs.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques européennes et sud-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des voitures d'occasion en Europe et en Amérique du Sud

Le paysage concurrentiel du marché des voitures d'occasion en Europe et en Amérique du Sud fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe et en Amérique du Sud, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des voitures d'occasion en Europe et en Amérique du Sud.

Certains des principaux acteurs opérant sur le marché des voitures d'occasion en Europe et en Amérique du Sud sont : AUTO1 Group, Penske Automotive Group, Inc., Lookers PLC, PENDRAGON, Emil Frey AG, Group1 Automotive, Inc., Arnold Clark Automobiles Limited, Gottfried Schultz Automobile Trading SE, Alibaba Group Holding Limited, OLX GROUP, Auto Trader Group plc., KAVAK, HELLMAN & FRIEDMAN LLC, leboncoin, mobile.de GmbH, Gumtree.com Limited, Webmotors SA, AUTONIZA, Seminuevos.com, SALFA, Unidas, Grupo Sinal entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE AND SOUTH AMERICA USED CAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 VENDOR TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EMERGENCE OF DIFFERENT E-COMMERCE PLATFORM IN EUROPE AND SOUTH AMERICA REGIONS

5.1.1.1 GERMANY

5.1.1.1.1 AUTOSCOUT24

5.1.1.1.2 MOBILE.DE

5.1.1.2 U.K.

5.1.1.2.1 MOTORS. CO.UK.

5.1.1.2.2 AUTOTRADER

5.1.1.3 FRANCE

5.1.1.3.1 LEBONCOIN

5.1.1.4 BRAZIL

5.1.1.4.1 VOLANTY

5.1.2 INCREASE IN TRANSPARENCY AND SYMMETRY OF INFORMATION BETWEEN DEALERS AND CUSTOMERS

5.1.3 RISE IN DEMAND FOR OFF-LEASE CARS & SUBSCRIPTION SERVICE BY THE FRANCHISE

5.1.4 RISE IN DEMAND FOR THE PERSONAL TRANSPORT MOBILITY

5.1.5 UPSURGE DEMAND FOR THE VEHICLE WITH GREATER VALUE AT LOWER COST

5.2 RESTRAINTS

5.2.1 EVER INCREASE IN COST OF OWNERSHIP

5.2.2 STRINGENT GOVERNMENT REGULATIONS FOR CAR DEALERS

5.2.3 HIGHER MAINTENANCE AND SERVICE COST

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC PARTNERSHIP AND ACQUISITIONS BETWEEN TWO COMPANIES

5.3.2 ORIGINAL EQUIPMENT MANUFACTURERS (OEMS) INVOLVEMENT IN CERTIFICATION AND MARKETING PROGRAMS

5.3.3 RISE IN THE INVESTMENT BY THE GOVERNMENT IN THE AUTOMOBILE SECTOR

5.3.4 AVAILABILITY OF THE REIMBURSED POLICY FOR THE USED CAR

5.4 CHALLENGES

5.4.1 LACK OF POST-SALE SERVICES FOR USED CAR

5.4.2 INCLINATION OF OEMS (ORIGINAL EQUIPMENT MANUFACTURERS) IN SALE OF ONLY NEW CAR

6 EUROPE & SOUTH AMERICA USED CAR MARKET, BY VENDOR TYPE

6.1 OVERVIEW

6.2 ORGANIZED

6.3 UNORGANIZED

7 EUROPE & SOUTH AMERICA USED CAR MARKET, BY PROPULSION TYPE

7.1 OVERVIEW

7.2 PETROL

7.3 DIESEL

7.4 ELECTRIC

7.4.1 BATTERY OPERATED VEHICLES (BEV)

7.4.2 PLUGIN VEHICLES (PEV)

7.4.3 HYBRID VEHICLES (HEVS)

7.5 LPG

7.6 CNG

8 EUROPE & SOUTH AMERICA USED CAR MARKET, BY ENGINE CAPACITY

8.1 OVERVIEW

8.2 SMALL (BELOW 1499 CC)

8.3 MID-SIZE (BETWEEN 1500-2499 CC)

8.4 FULL SIZE (ABOVE 2500 CC)

9 EUROPE & SOUTH AMERICA USED CAR MARKET, BY DEALERSHIP

9.1 OVERVIEW

9.2 FRANCHIASED

9.3 INDEPENDENT

10 EUROPE & SOUTH AMERICA USED CAR MARKET, BY TRANSMISSION

10.1 OVERVIEW

10.2 MANUAL

10.3 AUTOMATIC

11 EUROPE & SOUTH AMERICA USED CAR MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 SUV

11.3 SEDAN

11.4 CROSSOVER

11.5 COUPE

11.6 HATCHBACK

11.7 MPV

11.8 CONVERTIBLE

11.9 SPORTS CARS

11.1 OTHERS

12 EUROPE & SOUTH AMERICA USED CAR MARKET, BY PRICING CATEGORY

12.1 OVERVIEW

12.2 HIGH (MORE THAN USD 20,000)

12.3 MEDIUM (USD 5501-USD 20000)

12.4 LOW (LESS THAN USD 5500)

13 EUROPE & SOUTH AMERICA USED CAR MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OFFLINE

13.3 ONLINE

14 EUROPE AND SOUTH AMERICA USED CAR MARKET BY REGION

14.1 EUROPE

14.1.1 U.K.

14.1.2 GERMANY

14.1.3 FRANCE

14.1.4 ITALY

14.1.5 RUSSIA

14.1.6 SPAIN

14.1.7 TURKEY

14.1.8 NETHERLANDS

14.1.9 BELGIUM

14.1.10 SWITZERLAND

14.1.11 DENMARK

14.1.12 SWEDEN

14.1.13 POLAND

14.1.14 NORWAY

14.1.15 FINLAND

14.1.16 REST OF EUROPE

14.2 SOUTH AMERICA

14.2.1 BRAZIL

14.2.2 ARGENTINA

14.2.3 REST OF SOUTH AMERICA

15 EUROPE AND SOUTH AMERICA USED CAR MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 COMPANY SHARE ANALYSIS: SOUTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 AUTO1 GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 BRAND PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 PENSKE AUTOMOTIVE GROUP, INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 LOOKERS PLC

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 PENDRAGON

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 EMIL FREY AG

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 ALIBABA GROUP HOLDING LIMITED

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ARNOLD CLARK AUTOMOBILES LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 AUTO TRADER GROUP PLC

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 AUTONIZA

17.9.1 COMPANY SNAPSHOT

17.9.2 BRAND PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 GOTTFRIED SCHULTZ AUTOMOBILE TRADING SE

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 GROUP1 AUTOMOTIVE, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 GRUPO SINAL

17.12.1 COMPANY SNAPSHOT

17.12.2 SOLUTION PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 GUMTREE.COM LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 HELLMAN & FRIEDMAN LLC

17.14.1 COMPANY SNAPSHOT

17.14.2 BRAND PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 KAVAK

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 LEBONCOIN

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 MOBILE.DE GMBH

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 OLX GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 SALFA

17.19.1 COMPANY SNAPSHOT

17.19.2 BRAND PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SEMINUEVOS.COM

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 UNIDAS

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 WEBMOTORS SA

17.22.1 COMPANY SNAPSHOT

17.22.2 SOLUTION PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 SCALE OF USED VEHICLE EXPORTS IN THE YEAR 2017 (USD MILLION)

TABLE 2 COMPARISON OF THE BRAND AND ESTIMATED MAINTENANCE COST OVER 10 YEARS (APPROX.)

TABLE 3 ROUTINE AND BASIC MAINTENANCE COST OF USED CARS (APPROX. IN USD)

TABLE 4 EUROPE USED CAR MARKET, BY VENDOR TYPE, 2021-2030 (UD MILLION)

TABLE 5 SOUTH AMERICA USED CAR MARKET, BY VENDOR TYPE, 2021-2030 (UD MILLION)

TABLE 6 EUROPE USED CAR MARKET, BY PROPULSION TYPE, 2021-2030 (UD MILLION)

TABLE 7 SOUTH AMERICA USED CAR MARKET, BY PROPULSION TYPE, 2021-2030 (UD MILLION)

TABLE 8 EUROPE ELECTRIC IN USED CAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 SOUTH AMERICA ELECTRIC IN USED CAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 EUROPE USED CAR MARKET, BY ENGINE CAPACITY, 2021-2030 (USD MILLION)

TABLE 11 SOUTH AMERICA USED CAR MARKET, BY ENGINE CAPACITY, 2021-2030 (USD MILLION)

TABLE 12 EUROPE USED CAR MARKET, BY DEALERSHIP, 2021-2030 (USD MILLION)

TABLE 13 SOUTH AMERICA USED CAR MARKET, BY DEALERSHIP, 2021-2030 (USD MILLION)

TABLE 14 EUROPE USED CAR MARKET, BY TRANSMISSION, 2021-2030 (USD MILLION)

TABLE 15 SOUTH AMERICA USED CAR MARKET, BY TRANSMISSION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE USED CAR MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 17 SOUTH AMERICA USED CAR MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 18 EUROPE USED CAR MARKET, BY PRICING CATEGORY, 2021-2030 (USD MILLION)

TABLE 19 SOUTH AMERICA USED CAR MARKET, BY PRICING CATEGORY, 2021-2030 (USD MILLION)

TABLE 20 EUROPE USED CAR MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 21 SOUTH AMERICA USED CAR MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE AND SOUTH AMERICA USED CAR MARKET SEGMENTATION

FIGURE 2 EUROPE AND SOUTH AMERICA USED CAR MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AND SOUTH AMERICA USED CAR MARKET: DROC ANALYSIS

FIGURE 4 EUROPE USED CAR MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 5 SOUTH AMERICA USED CAR MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 6 EUROPE AND SOUTH AMERICA USED CAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 EUROPE AND SOUTH AMERICA USED CAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE USED CAR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SOUTH AMERICA USED CAR MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE AND SOUTH AMERICA USED CAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE AND SOUTH AMERICA USED CAR MARKET: MULTIVARIATE MODELING

FIGURE 12 EUROPE USED CAR MARKET: VENDOR TYPE TIMELINE CURVE

FIGURE 13 SOUTH AMERICA USED CAR MARKET: VENDOR TYPE TIMELINE CURVE

FIGURE 14 EUROPE AND SOUTH AMERICA USED CAR MARKET SEGMENTATION

FIGURE 15 EMERGENCE OF DIFFERENT ECOMMERCE PLATFORMS IS EXPECTED TO DRIVE THE EUROPE USED CAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 RISE IN DEMAND FOR OFF-LEASE CARS & AND SUBSCRIPTION SERVICE BY THE FRANCHISE IS EXPECTED TO DRIVE THE SOUTH AMERICA USED CAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 17 ORGANIZED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE USED CAR MARKET IN 2023 & 2030

FIGURE 18 ORGANIZED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SOUTH AMERICA USED CAR MARKET IN 2023 & 2030

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE AND SOUTH AMERICA USED CAR MARKET

FIGURE 20 MONTHLY PASSENGER CAR SALES IN EUROPE BETWEEN AUGUST 2020 AND JUNE 2021 (1,000 UNITS)

FIGURE 21 CAR RENTAL PRICES FOR POPULAR CITIES IN SOUTH AMERICA

FIGURE 22 VARIOUS GOVERNMENT INITIATIVES

FIGURE 23 EUROPE USED CAR MARKET: BY VENDOR TYPE, 2022

FIGURE 24 SOUTH AMERICA USED CAR MARKET: BY VENDOR TYPE, 2022

FIGURE 25 EUROPE USED CAR MARKET: BY PROPULSION TYPE, 2022

FIGURE 26 SOUTH AMERICA USED CAR MARKET: BY PROPULSION TYPE, 2022

FIGURE 27 EUROPE USED CAR MARKET: BY ENGINE CAPACITY, 2022

FIGURE 28 SOUTH AMERICA USED CAR MARKET: BY ENGINE CAPACITY, 2022

FIGURE 29 EUROPE USED CAR MARKET: BY DEALERSHIP, 2022

FIGURE 30 SOUTH AMERICA USED CAR MARKET: BY DEALERSHIP, 2022

FIGURE 31 EUROPE USED CAR MARKET: BY TRANSMISSION, 2022

FIGURE 32 SOUTH AMERICA USED CAR MARKET: BY TRANSMISSION, 2022

FIGURE 33 EUROPE USED CAR MARKET: BY VEHCLE TYPE, 2022

FIGURE 34 SOUTH AMERICA USED CAR MARKET: BY VEHCLE TYPE, 2022

FIGURE 35 EUROPE USED CAR MARKET: BY PRICING CATEGORY, 2022

FIGURE 36 SOUTH AMERICA USED CAR MARKET: BY PRICING CATEGORY, 2022

FIGURE 37 EUROPE USED CAR MARKET: BY SALES CHANNEL, 2022

FIGURE 38 SOUTH AMERICA USED CAR MARKET: BY SALES CHANNEL, 2022

FIGURE 39 EUROPE USED CAR MARKET: SNAPSHOT (2022)

FIGURE 40 SOUTH AMERICA USED CAR MARKET: SNAPSHOT (2022)

FIGURE 41 EUROPE USED CAR MARKET: COMPANY SHARE 2022 (%)

FIGURE 42 SOUTH AMERICA USED CAR MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.