>Marché européen des acides aminés, par type d'acide aminé (acide glutamique, méthionine, cystéine, lysine, arginine, tyrosine, alanine, leucine, histidine, phénylalanine, valine, proline, tryptophane, glycine, sérine, isoleucine thréonine, glutamine, acide aspartique, asparagine et autres), niveau de pureté (acide aminé 99 %, acide aminé plus de 99 %, acide aminé 90 %, acide aminé 80 %, acide aminé 70 % et acide aminé moins de 60 %), forme (poudre, granulés, liquide, granulés et autres), catégorie de produit (acide aminé microbien, acide aminé d'origine végétale et acide aminé synthétique), fonction (fortification, booster d'énergie, exhausteur de goût, conservateur, croissance musculaire, booster d'immunité et autres), application ( alimentation animale , aliments et boissons), Tendances et prévisions de l'industrie des produits pharmaceutiques, des compléments alimentaires , de la nutrition sportive, des milieux de culture cellulaire, des cosmétiques et des soins personnels, des canaux de distribution (directs et indirects) jusqu'en 2029

Analyse et perspectives du marché

Le marché européen des acides aminés connaît une croissance significative en raison de la croissance de l'industrie agroalimentaire et de la hausse de la demande de produits alimentaires sains et nutritifs. L'augmentation de la demande d'acides aminés dans l'industrie de l'alimentation animale stimule également la croissance du marché européen des acides aminés. Cependant, les réglementations gouvernementales strictes associées aux acides aminés devraient freiner la croissance de la demande du marché des acides aminés au cours de la période de prévision.

Data Bridge Market Research analyse que le marché européen des acides aminés connaîtra un TCAC de 6,6 % entre 2022 et 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type d'acide aminé (acide glutamique, méthionine, cystéine, lysine, arginine, tyrosine, alanine, leucine, histidine, phénylalanine, valine, proline, tryptophane, glycine, sérine, isoleucine, thréonine, glutamine, acide aspartique, asparagine et autres), niveau de pureté (acide aminé 99 %, acide aminé plus de 99 %, acide aminé 90 %, acide aminé 80 %, acide aminé 70 % et acide aminé moins de 60 %), forme (poudre, granulés, liquide, granulés et autres), catégorie de produit (acide aminé microbien, acide aminé d'origine végétale et acide aminé synthétique), fonction (fortification, booster d'énergie, exhausteur de goût, conservateur, croissance musculaire, booster d'immunité et autres), application (alimentation animale, aliments et boissons, produits pharmaceutiques, diététique Suppléments, nutrition sportive, milieux de culture cellulaire, cosmétiques et soins personnels), canal de distribution (direct et indirect) |

|

Pays couverts |

Allemagne, Espagne, France, Italie, Royaume-Uni, Pays-Bas, Belgique, Suisse, Russie, Belgique, Turquie et reste de l'Europe |

|

Acteurs du marché couverts |

Merck KGaA, Ajinomoto Co., Inc. , KYOWA HAKKO BIO CO.,LTD. , Evonik Industries AG , ADM, Prinova Group LLC., Daesang, Adisseo ,CJ CheilJedang Corp. , Global Bio-chem Technology Group Company Limited. , Sunrise Nutrachem Group Co.,LTD, Sichuan Tongsheng Amino acid Co., Ltd , FUFENG GROUP , Asiamerica Group, Inc. and Sumitomo Chemical Co., Ltd. |

Market Definition

Amino acids are molecules that combine to form proteins. Amino acids and proteins are the building blocks of life. Amino acids form a substantial part of both animal and human nutrition. In the human body, they are necessary for vital processes such as synthesizing neurotransmitters and hormones. They are advantageous for nourishing the immune system, fighting arthritis and cancer, and treating rectal diseases and tinnitus. Nowadays, the demand for amino acids is increasing as they assist in improving conditions such as depression, sleep disorders, premenstrual dysphoric disorder (PMDD), smoking cessation, bruxism, and attention deficit-hyperactivity disorder (ADHD). Amino acids are also abundant in red meat, seafood, eggs, dairy products, and soy.

Europe amino acids market Dynamics

Drivers

-

Increasing demand for amino acids in various industries

The rising demand for amino acids from food, pharmaceutical, nutraceutical, animal feed chemical, and other industries is expected to drive the amino acid market. This demand is due to the health benefits associated with various amino acids.

The rising health consciousness of consumers has raised the demand for healthier food products. This has encouraged food and beverage manufacturers to produce products infused with essential nutrients such as amino acids, which has resulted in a rise in demand. Furthermore, bodybuilders and athletes are turning to protein-rich foods to improve their performance and muscle building. Among these items are sports supplements such as energy drinks, nutrition bars, reduced carbohydrate meals, and nutrition supplements. Several amino acids are employed in muscle development and bodybuilding supplements. It is necessary to consume protein and amino acids in order to grow muscle.

Hence, the use of amino acids in various industries is boosting the growth of the amino acid market. As amino acids play an important role in manufacturing different products, including food, beverages, and chemicals.

-

Advancements in biotechnology used for the production of amino acids

To manufacture amino acids, biotechnological approaches are commonly used. It is important in the synthesis of amino acids. Modern biotechnology is used to boost output yield. For example, genetic and metabolic engineering are employed to enhance strains. However, enzyme catalysis will likely continue to be the primary approach for producing amino acids and their derivatives.

For instance,

-

In January 2022, according to the article in Springer Nature, biosensors that are genetically encoded have been developed to monitor the microbial manufacture of certain BCAAs and BCAA-derived compounds. The endogenous Leu3p regulator of BCAA metabolism can be used to create genetically encoded biosensors for BCAA-derived products like isobutanol and isopentenyl

Hence, the technological advancement for the production of amino acids has made the production of amino acids quite easier and more efficient which has led to more manufacturers entering the market as well as helping in increasing the production capacity of already existing market players due to which the market growth of amino acids is increasing.

Opportunity

- Growing demand for amino acids for dietary supplements

The amino acids are widely popular as dietary supplements among athletes and physically-active individuals because they can treat a sprain, muscle soreness, and mental fatigue. The demand for amino acid supplements is increasing as it helps enhance performance and nitrogen retention, increasing enhance performance and enhance nitrogen retention, increase muscle mass, prevent sports anemia by promoting an increased synthesis of hemoglobin, oxidative enzymes, and myoglobin during aerobic training. The factor as mentioned above is expected to boost the demand for amino acid supplements and will provide lucrative opportunities for amino acids in the market. Moreover, increase awareness regarding the health benefits of amino acids for dietary supplements such as enhancing the musculoskeletal system, regulating digestion, maintaining body weight, supporting the immune system, enforcing a healthy sleep cycle, and others among consumers are increasing the demand for amino acids supplements, which in turn increases the demand for amino acids among dietary supplement manufacturer. The rising demand for amino acid supplements among consumers to lead the desired lifestyle enables manufacturers to launch new products in the market.

Restraint/Challenge

- High competition among the market players

The high competition among the already existing market players poses a significant challenge for the new players who wish to enter the market as several players are offering high-quality amino acids products for different end-users including food & beverages manufacturers, the pharmaceutical industry, dietary supplements manufacturers, and others. The existing players in the market, such as AJINOMOTO CO., INC., EVONIK INDUSTRIES, ADM, Sichuan Tongsheng Amino acid Co., Ltd, and others, offer a large number of different amino acids product for different applications and are constantly engaged in launching new products with high-quality, therefore, causing major competition in the market. Moreover, some local players and small-scale manufacturers, which some local players and small-scale manufacturers offer low-quality products or counterfeit products at cheaper prices, affecting the global amino acids market. In addition, an increase in the number of manufacturers offering a wide range of amino acids for different applications will cause tough competition for the other players in the market.

Post COVID-19 Impact Europe Amino Acids Market

Post the pandemic, the demand for amino acids has increased as there won't be any more restrictions on movement; hence, the supply of products would be easy. In addition, the growing demand for amino acids in various industries such as food, feed, pharmaceutical, sports nutrition, and others are expected to drive the market's growth.

For instance,

- In April 2021, CJ CheilJedang Corp. Has launched FlavorNrich Master C. It is the 'world's first natural cysteine in response to market needs for plant-based, transparent and natural flavor ingredients. This has helped the company to widen its amino acid portfolio.

Recent Developments

- In January 2022, Merck KGaA collaborated with Absci to deploy its Bionic Protein non-standard amino acid technology to produce enzymes tailored for 'Merck's bio manufacturing applications. This will help the company to extend its research work.

- In 2020 FUFENG GROUP won the honor of the national top 100 agricultural product processing industry This selection was conducted by the China Association of Leading Agricultural Industrialization Enterprises released the "Top 100 Enterprises in the National Agricultural Products Processing Industry in 2019", This development increased the goodwill of the company.

Europe Amino Acids Market Scope

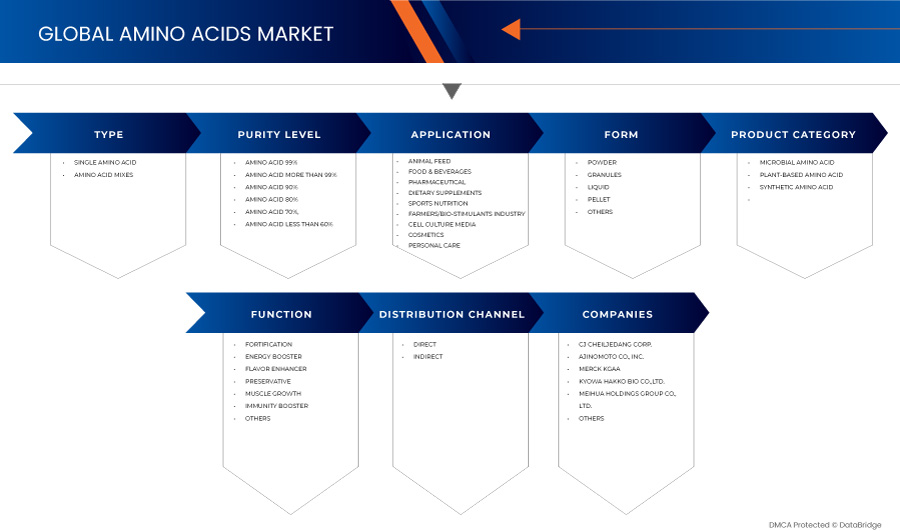

The Europe amino acids market is segmented into seven notable segments based on types of amino acids, purity level, form, product category, function, application, and distribution channel.

The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type of amino acid

- Alanine

- Arginine

- Aspartic acid

- Cysteine

- Glutamic acid

- Glutamine

- Glycine

- Histadine

- Isoleucine

- Leucine

- Lysine

- Methionine

- Phenyalanine

- Proline

- Serine

- Asparagine

- Threonine

- Tyrosine

- Tryptophan

- Valine

- Others

On the basis of type of, the Europe amino acids market is segmented into glutamic acid, methionine, cysteine, lysine, arginine, tyrosine, alanine, leucine, histidine, phenylalanine, valine, proline, tryptophan, glycine, serine, isoleucine threonine, glutamine, aspartic acid, asparagine, and others.

Purity level

- Amino acid less than 60%

- Amino acid 70%

- Amino acid 80%

- Amino acid 90%

- Amino acid 99%

- Amino acid more than 99%

On the basis of purity level, the Europe amino acids market is segmented into amino acid 99%, amino acid more than 99%, amino acid 90%, amino acid 80%, amino acid 70%, and amino acid less than 60%.

Form

- Liquid

- Granules

- Powder

- Pellet

- Others (if any)

On the basis of fat content, the Europe amino acids market is segmented into powder, granules, liquid, pellet, and others.

Product Category

- Plant-based amino acid

- Microbial amino acid

- Synthetic amino acid

On the basis of product category, the Europe amino acids market is segmented into microbial amino acid, plant-based amino acid, and synthetic amino acid.

Function

- Immunity booster

- Preservative

- Flavor enhancer

- Fortification

- Muscle growth

- Energy booster

- Others

On the basis of function, the Europe amino acids market is segmented into fortification, energy booster, flavor enhancer, preservative, muscle growth, immunity booster, and others.

Application

- Food & beverages

- Dietary supplements

- Pharmaceutical

- Sports nutrition

- Animal feed

- Personal care

- Cosmetic

- Cell culture media

On the basis of application, the Europe amino acids market is segmented into animal feed, food & beverages, pharmaceutical, dietary supplements, sports nutrition, cell culture media, cosmetic, personal, and care.

Distribution Channel

- Direct

- Indirect

On the basis of distribution channel, the Europe amino acids market is segmented into direct and indirect.

Europe Amino Acids Market Regional Analysis/Insights

The Europe amino acids markets analyzed and market size insights and trends are provided based on as referenced above.

The countries covered in the Europe amino acids markets report are Germany, Spain, France, Italy, U.K., Netherlands, Belgium, Switzerland, Russia, Turkey and the Rest of Europe.

Germany dominates the Europe amino acids market. This is due to the growing demand for amino acids in various industries such as food, feed, agriculture, pharmaceuticals.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des acides aminés en Europe

Le paysage concurrentiel du marché européen des acides aminés fournit des détails par concurrents. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché européen des acides aminés.

Français Certains des acteurs du marché sont Merck KGaA, Ajinomoto Co., Inc., KYOWA HAKKO BIO CO., LTD., Evonik Industries AG, ADM, Prinova Group LLC., Daesang, Adisseo, CJ CheilJedang Corp., Global Bio-chem Technology Group Company Limited., Sunrise Nutrachem Group Co., LTD, Sichuan Tongsheng Amino acid Co., Ltd, FUFENG GROUP, Asiamerica Group, Inc. et Sumitomo Chemical Co., Ltd.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché Europe vs région et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE AMINO ACIDS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 RAW MATERIAL PROCUREMENT

4.1.2 MANUFACTURING PROCESS

4.1.3 MARKETING AND DISTRIBUTION

4.1.4 END USERS

4.2 SUPPLY SHORTAGE

4.3 TECHNOLOGICAL ADVANCEMENT

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5.1 MANUFACTURERS ARE DOING EXPANSIONS TO CATER TO THE DEMAND

4.5.2 LAUNCH OF DIFFERENT AMINO ACIDS BY MANUFACTURERS

4.5.3 MANUFACTURERS LAUNCHING NATURAL INGREDIENT BASED/PLANT-BASED AMINO ACIDS

4.5.4 FUTURE PERSPECTIVE

4.6 FACTOR INFLUENCING PURCHASE DECISION (B2B)

4.6.1 HIGH NUTRITIONAL VALUE

4.6.2 PRICING OF THE AMINO ACIDS

4.6.3 HIGH QUALITY

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR AMINO ACIDS IN VARIOUS INDUSTRIES

6.1.2 ADVANCEMENTS IN BIOTECHNOLOGY USED FOR THE PRODUCTION OF AMINO ACIDS

6.1.3 AVAILABILITY OF DIFFERENT TYPES OF AMINO ACIDS IN THE MARKET

6.1.4 STRONG SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 COMPLICATED MANUFACTURING PROCESS

6.2.2 STRICT GOVERNMENT REGULATIONS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR AMINO ACIDS FOR DIETARY SUPPLEMENTS

6.3.2 RISING DEMAND FOR NUTRITIOUS AND HEALTHY PRODUCTS

6.3.3 INCREASING NUMBER OF INITIATIVES TAKEN BY AMINO ACID MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

6.4.2 RISING AWARENESS REGARDING THE SIDE EFFECTS OF AMINO ACIDS

7 EUROPE AMINO ACIDS MARKET, BY TYPE OF AMINO ACID

7.1 OVERVIEW

7.2 GLUTAMIC ACID

7.3 METHIONINE

7.4 CYSTEINE

7.5 LYSINE

7.6 ARGININE

7.7 TYROSINE

7.8 ALANINE

7.9 LEUCINE

7.1 HISTIDINE

7.11 PHENYLALANINE

7.12 VALINE

7.13 PROLINE

7.14 TRYPTOPHAN

7.15 GLYCINE

7.16 SERINE

7.17 ISOLEUCINE

7.18 THREONINE

7.19 GLUTAMINE

7.2 ASPARTIC ACID

7.21 ASPARAGINE

7.22 OTHERS

8 EUROPE AMINO ACIDS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ANIMAL FEED

8.2.1 ANIMAL FEED, BY ANIMAL TYPE

8.2.1.1 POULTRY FEED

8.2.1.1.1 BROILERS

8.2.1.1.2 BREEDERS

8.2.1.1.3 LAYERS

8.2.1.2 RUMINANT FEED

8.2.1.2.1 CALVES

8.2.1.2.2 DAIRY CATTLE

8.2.1.2.3 BEEF CATTLE

8.2.1.2.4 OTHERS

8.2.1.3 SWINE FEED

8.2.1.3.1 STARTER

8.2.1.3.2 GROWER

8.2.1.3.3 SOW

8.2.1.4 PET FOOD

8.2.1.4.1 DOGS

8.2.1.4.2 CATS

8.2.1.4.3 BIRDS

8.2.1.4.4 RABBIT

8.2.1.4.5 OTHERS

8.2.1.5 AQUACULTURE

8.2.1.5.1 FISH

8.2.1.5.2 CRUSTACEANS

8.2.1.5.3 MOLLUSKS

8.2.1.5.4 OTHERS

8.2.1.6 OTHERS

8.2.2 ANIMAL FEED, BY PRODUCT CATEGORY

8.2.2.1 PLANT-BASED AMINO ACID

8.2.2.2 MICROBIAL AMINO ACID

8.2.2.3 SYNTHETIC AMINO ACID

8.3 FOOD & BEVERAGES

8.3.1 FOOD & BEVERAGES, BY TYPE

8.3.1.1 BEVERAGES

8.3.1.1.1 BEVERAGES, BY TYPE

8.3.1.1.1.1 JUICES

8.3.1.1.1.2 SPORTS DRINKS

8.3.1.1.1.3 ENERGY DRINKS

8.3.1.1.1.4 DAIRY BASED DRINKS

8.3.1.1.1.4.1 REGULAR PROCESSED MILK

8.3.1.1.1.4.2 FLAVOURED MILK

8.3.1.1.1.4.3 MILK SHAKES

8.3.1.1.1.5 PLANT-BASED BEVERAGES

8.3.1.1.1.5.1 SOY MILK

8.3.1.1.1.5.2 ALMOND MILK

8.3.1.1.1.5.3 OAT MILK

8.3.1.1.1.5.4 CASHEW MILK

8.3.1.1.1.5.5 COCONUT MILK

8.3.1.1.1.5.6 OTHERS

8.3.1.1.1.6 SMOOTHIES

8.3.1.2 PROCESSED FOOD

8.3.1.2.1 PROCESSED FOOD, BY TYPE

8.3.1.2.1.1 SAUCES, DRESSINGS AND CONDIMENTS

8.3.1.2.1.2 JAMS, PRESERVES & MARMALADES

8.3.1.2.1.3 READY MEALS

8.3.1.2.1.4 SOUPS

8.3.1.2.1.5 OTHERS

8.3.1.3 BAKERY

8.3.1.3.1 BAKERY, BY TYPE

8.3.1.3.1.1 BREAD & ROLLS

8.3.1.3.1.2 BISCUIT, COOKIES & CRACKERS

8.3.1.3.1.3 CAKES, PASTRIES & TRUFFLE

8.3.1.3.1.4 TART & PIES

8.3.1.3.1.5 BROWNIES

8.3.1.3.1.6 OTHER

8.3.1.4 DAIRY PRODUCTS

8.3.1.4.1 DAIRY PRODUCTS, BY TYPE

8.3.1.4.1.1 ICE CREAM

8.3.1.4.1.2 CHEESE

8.3.1.4.1.3 YOGURT

8.3.1.4.1.4 OTHERS

8.3.1.5 CONVENIENCE FOOD

8.3.1.5.1 CONVENIENCE FOOD, BY TYPE

8.3.1.5.1.1 SNACKS & EXTRUDED SNACKS

8.3.1.5.1.2 PIZZA & PASTA

8.3.1.5.1.3 INSTANT NOODLES

8.3.1.5.1.4 OTHERS

8.3.1.6 FUNCTIONAL FOOD

8.3.1.7 FROZEN DESSERTS

8.3.1.7.1 FROZEN DESSERTS, BY TYPE

8.3.1.7.1.1 GELATO

8.3.1.7.1.2 CUSTARD

8.3.1.7.1.3 OTHERS

8.3.1.8 CONFECTIONERY

8.3.1.8.1 CONFECTIONARY, BY TYPE

8.3.1.8.1.1 GUMS & JELLIES

8.3.1.8.1.2 HARD-BOILED SWEETS

8.3.1.8.1.3 CHOCOLATE

8.3.1.8.1.4 CHOCOLATE SYRUPS

8.3.1.8.1.5 CARAMELS & TOFFEES

8.3.1.8.1.6 MINTS

8.3.1.8.1.7 OTHERS

8.3.1.9 INFANT FORMULA

8.3.1.9.1 INFANT FORMULA, BY TYPE

8.3.1.9.1.1 FIRST INFANT FORMULA

8.3.1.9.1.2 ANTI-REFLUX (STAY DOWN) FORMULA

8.3.1.9.1.3 COMFORT FORMULA

8.3.1.9.1.4 HYPOALLERGENIC FORMULA

8.3.1.9.1.5 FOLLOW-ON FORMULA

8.3.1.9.1.6 OTHERS

8.3.2 FOOD AND BEVERAGES, BY PRODUCT CATEGORY

8.3.2.1 PLANT-BASED AMINO ACID

8.3.2.2 MICROBIAL AMINO ACID

8.3.2.3 SYNTHETIC AMINO ACID

8.4 PHARMACEUTICAL

8.4.1 PHARMACEUTICAL, BY PRODUCT CATEGORY

8.4.1.1 PLANT-BASED AMINO ACID

8.4.1.2 MICROBIAL AMINO ACID

8.4.1.3 SYNTHETIC AMINO ACID

8.4.2 PHARMACEUTICAL, BY TYPE OF AMINO ACID

8.4.2.1 GLUTAMIC ACID

8.4.2.2 METHIONINE

8.4.2.3 CYSTEINE

8.4.2.4 LYSINE

8.4.2.5 ARGININE

8.4.2.6 TYROSINE

8.4.2.7 ALANINE

8.4.2.8 LEUCINE

8.4.2.9 HISTIDINE

8.4.2.10 PHENYLALANINE

8.4.2.11 VALINE

8.4.2.12 PROLINE

8.4.2.13 TRYPTOPHAN

8.4.2.14 GLYCINE

8.4.2.15 SERINE

8.4.2.16 ISOLEUCINE

8.4.2.17 THREONINE

8.4.2.18 GLUTAMINE

8.4.2.19 ASPARTIC ACID

8.4.2.20 ASPARAGINE

8.4.2.21 OTHERS

8.5 DIETARY SUPPLEMENTS

8.5.1 DIETARY SUPPLEMENTS, BY TYPE

8.5.1.1 IMMUNITY SUPPLEMENTS

8.5.1.2 BONE AND JOINT HEALTH SUPPLEMENTS

8.5.1.3 OVERALL WELLBEING SUPPLEMENTS

8.5.1.4 BRAIN HEALTH SUPPLEMENTS

8.5.1.5 SKIN HEALTH SUPPLEMENTS

8.5.1.6 OTHERS

8.5.2 DIETARY SUPPLEMENTS, BY PRODUCT CATEGORY

8.5.2.1 PLANT-BASED AMINO ACID

8.5.2.2 MICROBIAL AMINO ACID

8.5.2.3 SYNTHETIC AMINO ACID

8.5.3 DIETARY SUPPLEMENTS, BY TYPE OF AMINO ACID

8.5.3.1 GLUTAMIC ACID

8.5.3.2 METHIONINE

8.5.3.3 CYSTEINE

8.5.3.4 LYSINE

8.5.3.5 ARGININE

8.5.3.6 TYROSINE

8.5.3.7 ALANINE

8.5.3.8 LEUCINE

8.5.3.9 HISTIDINE

8.5.3.10 PHENYLALANINE

8.5.3.11 VALINE

8.5.3.12 PROLINE

8.5.3.13 TRYPTOPHAN

8.5.3.14 GLYCINE

8.5.3.15 SERINE

8.5.3.16 ISOLEUCINE

8.5.3.17 THREONINE

8.5.3.18 GLUTAMINE

8.5.3.19 ASPARTIC ACID

8.5.3.20 ASPARAGINE

8.5.3.21 OTHERS

8.6 SPORTS NUTRITION

8.6.1 SPORTS NUTRITION, BY TYPE

8.6.1.1 SPORT DRINK MIXES

8.6.1.2 ENERGY GELS

8.6.1.3 SPORTS NUTRITION BARS

8.6.1.4 PROTEIN POWDERS

8.6.1.5 OTHERS

8.6.2 SPORTS NUTRITION, BY PRODUCT CATEGORY

8.6.2.1 PLANT-BASED AMINO ACID

8.6.2.2 MICROBIAL AMINO ACID

8.6.2.3 SYNTHETIC AMINO ACID

8.6.3 SPORTS NUTRITION, BY TYPE OF AMINO ACID

8.6.3.1 GLUTAMIC ACID

8.6.3.2 METHIONINE

8.6.3.3 CYSTEINE

8.6.3.4 LYSINE

8.6.3.5 ARGININE

8.6.3.6 TYROSINE

8.6.3.7 ALANINE

8.6.3.8 LEUCINE

8.6.3.9 HISTIDINE

8.6.3.10 PHENYLALANINE

8.6.3.11 VALINE

8.6.3.12 PROLINE

8.6.3.13 TRYPTOPHAN

8.6.3.14 GLYCINE

8.6.3.15 SERINE

8.6.3.16 ISOLEUCINE

8.6.3.17 THREONINE

8.6.3.18 GLUTAMINE

8.6.3.19 ASPARTIC ACID

8.6.3.20 ASPARAGINE

8.6.3.21 OTHERS

8.7 CELL CULTURE MEDIA

8.7.1 CELL CULTURE MEDIA, BY PRODUCT CATEGORY

8.7.1.1 PLANT-BASED AMINO ACID

8.7.1.2 MICROBIAL AMINO ACID

8.7.1.3 SYNTHETIC AMINO ACID

8.7.2 CELL CULTURE MEDIA, BY TYPE OF AMINO ACID

8.7.2.1 GLUTAMIC ACID

8.7.2.2 METHIONINE

8.7.2.3 CYSTEINE

8.7.2.4 LYSINE

8.7.2.5 ARGININE

8.7.2.6 TYROSINE

8.7.2.7 ALANINE

8.7.2.8 LEUCINE

8.7.2.9 HISTIDINE

8.7.2.10 PHENYLALANINE

8.7.2.11 VALINE

8.7.2.12 PROLINE

8.7.2.13 TRYPTOPHAN

8.7.2.14 GLYCINE

8.7.2.15 SERINE

8.7.2.16 ISOLEUCINE

8.7.2.17 THREONINE

8.7.2.18 GLUTAMINE

8.7.2.19 ASPARTIC ACID

8.7.2.20 ASPARAGINE

8.7.2.21 OTHERS

8.8 COSMETIC

8.8.1 COSMETIC, BY TYPE

8.8.1.1 FACE SERUMS

8.8.1.2 FACE CREAM

8.8.1.3 LIP CARE AND LIPSTICK PRODUCTS

8.8.1.4 OTHERS

8.8.2 COSMETIC, BY PRODUCT CATEGORY

8.8.2.1 PLANT-BASED AMINO ACID

8.8.2.2 MICROBIAL AMINO ACID

8.8.2.3 SYNTHETIC AMINO ACID

8.8.3 COSMETIC, BY TYPE OF AMINO ACID

8.8.3.1 GLUTAMIC ACID

8.8.3.2 METHIONINE

8.8.3.3 CYSTEINE

8.8.3.4 LYSINE

8.8.3.5 ARGININE

8.8.3.6 TYROSINE

8.8.3.7 ALANINE

8.8.3.8 LEUCINE

8.8.3.9 HISTIDINE

8.8.3.10 PHENYLALANINE

8.8.3.11 VALINE

8.8.3.12 PROLINE

8.8.3.13 TRYPTOPHAN

8.8.3.14 GLYCINE

8.8.3.15 SERINE

8.8.3.16 ISOLEUCINE

8.8.3.17 THREONINE

8.8.3.18 GLUTAMINE

8.8.3.19 ASPARTIC ACID

8.8.3.20 ASPARAGINE

8.8.3.21 OTHERS

8.9 PERSONAL CARE

8.9.1 PERSONAL CARE, BY TYPE

8.9.1.1 SKIN CARE

8.9.1.2 HAIR CARE

8.9.2 PERSONAL CARE, BY PRODUCT CATEGORY

8.9.2.1 PLANT-BASED AMINO ACID

8.9.2.2 MICROBIAL AMINO ACID

8.9.2.3 SYNTHETIC AMINO ACID

9 EUROPE AMINO ACIDS MARKET, BY PURITY LEVEL

9.1 OVERVIEW

9.2 AMINO ACID 99%

9.3 AMINO ACID MORE THAN 99%

9.4 AMINO ACID 90%

9.5 AMINO ACID 80%

9.6 AMINO ACID 70%

9.7 AMINO ACID LESS THAN 60%

10 EUROPE AMINO ACIDS MARKET, BY FORM

10.1 OVERVIEW

10.2 POWDER

10.2.1 POWDER, BY TYPE

10.2.1.1 FINE POWDER

10.2.1.2 CRYSTALLINE POWDER

10.2.1.3 GRANULAR POWDER

10.3 GRANULES

10.4 LIQUID

10.5 PELLET

10.6 OTHERS

11 EUROPE AMINO ACIDS MARKET, BY PRODUCT CATEGORY

11.1 OVERVIEW

11.2 MICROBIAL AMINO ACID

11.2.1 MICROBIAL AMINO ACID, BY TYPE

11.2.1.1 BACTERIA

11.2.1.2 FUNGI

11.2.1.3 YEAST

11.3 PLANT-BASED AMINO ACID

11.4 SYNTHETIC AMINO ACID

12 EUROPE AMINO ACIDS MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 FORTIFICATION

12.3 ENERGY BOOSTER

12.4 FLAVOR ENHANCER

12.5 PRESERVATIVE

12.6 MUSCLE GROWTH

12.7 IMMUNITY BOOSTER

12.8 OTHERS

13 EUROPE AMINO ACIDS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

14 EUROPE AMINO ACIDS MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 SPAIN

14.1.3 FRANCE

14.1.4 ITALY

14.1.5 U.K.

14.1.6 NETHERLANDS

14.1.7 BELGIUM

14.1.8 SWITZERLAND

14.1.9 RUSSIA

14.1.10 TURKEY

14.1.11 REST OF EUROPE

15 COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 AJINOMOTO CO., INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CJ CHEILJEDANG CORP.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 MERCK KGAA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 FUFENG GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 DAESANG

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 KYOWA HAKKO BIO CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 COMPANY SHARE ANALYSIS

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 ADISSEO

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 ADM

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 AMINO GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ASIAMERICA GROUP, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 EVONIK INDUSTRIES AG

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 EUROPE BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 KINGCHEM LIFE SCIENCE LLC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 NIPPON RIKA CO., LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 NOVUS INTERNATIONAL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 PANGAEA SCIENCES.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 PACIFIC RAINBOW INTERNATIONAL, INC.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PRINOVA GROUP LLC.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 QINGDAO SAMIN CHEMICAL CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SICHUAN TONGSHENG AMINO ACID CO., LTD

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 SUMITOMO CHEMICAL.

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 SUNRISE NUTRACHEM GROUP CO.,LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des figures

FIGURE 1 EUROPE AMINO ACIDS MARKET: SEGMENTATION

FIGURE 2 EUROPE AMINO ACIDS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AMINO ACIDS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE AMINO ACIDS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE AMINO ACIDS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE AMINO ACIDS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE AMINO ACIDS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 EUROPE AMINO ACIDS MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE AMINO ACIDS MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE AMINO ACIDS MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASING USE OF AMINO ACIDS IN FOOD AND BEVERAGES, PERSONAL CARE, COSMETIC PRODUCTS, ANIMAL FEED AND PHARMACEUTICAL DRUGS IS LEADING THE GROWTH OF THE EUROPE AMINO ACIDS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE OF AMINO ACID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE AMINO ACIDS MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE AMINO ACIDS MARKET

FIGURE 15 EUROPE AMINO ACIDS MARKET: BY TYPE OF AMINO ACID, 2021

FIGURE 16 EUROPE AMINO ACIDS MARKET, BY APPLICATION

FIGURE 17 EUROPE AMINO ACIDS MARKET: BY PURITY LEVEL, 2021

FIGURE 18 EUROPE AMINO ACIDS MARKET: BY FORM, 2021

FIGURE 19 EUROPE AMINO ACIDS MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 20 EUROPE AMINO ACIDS MARKET: BY FUNCTION, 2021

FIGURE 21 EUROPE AMINO ACIDS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 EUROPE AMINO ACIDS MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE AMINO ACIDS MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE AMINO ACIDS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE AMINO ACIDS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE AMINO ACIDS MARKET: BY TYPE OF AMINO ACID (2022 & 2029)

FIGURE 27 EUROPE AMINO ACIDS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.