Marché européen des algicides, par type (sulfate de cuivre, composés d'ammonium quaternaire, cuivre chélaté, acide peracétique et dioxyde d'hydrogène, colorants et colorants, autres), forme (liquide et sec), mode d'action (non sélectif et sélectif), application (traitement des eaux de surface, aquaculture , centres sportifs et récréatifs, agriculture, autres), canal de distribution (direct et indirect) - Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché

Les algicides sont largement utilisés pour tuer les algues et empêcher leur croissance. Ils sont utilisés pour tuer le phytoplancton et également pour prévenir ou réduire les grandes proliférations. Ils sont disponibles sur le marché sous différentes formes telles que liquide, granulaire et palettes. Ils sont injectés ou pulvérisés sur les eaux de surface. La demande croissante d'algicides dans diverses applications finales telles que l'aquaculture et le traitement des eaux de surface et une augmentation de la demande de systèmes de climatisation sont des moteurs du marché européen des algicides.

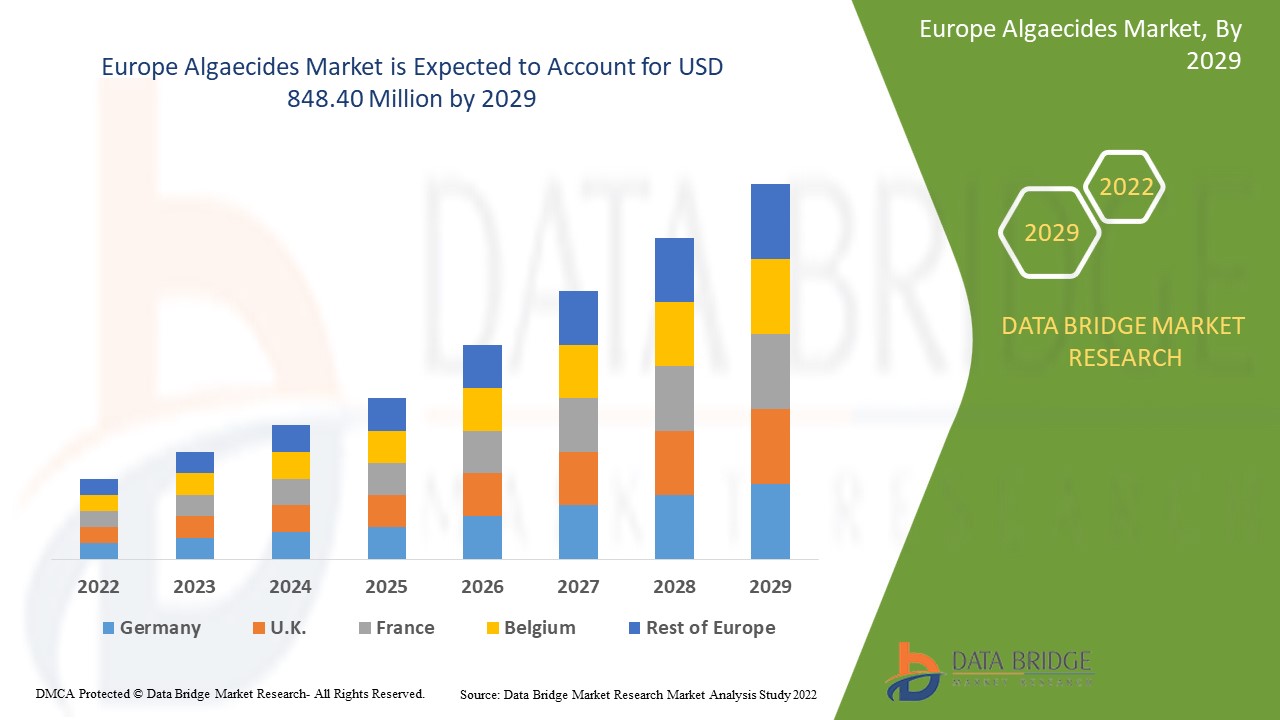

Ces algicides sont utilisés pour empêcher la photosynthèse et la récolte des macrophytes qui participent à la formation de proliférations ou réduisent les proliférations lorsqu'elles se produisent. Data Bridge Market Research analyse que le marché des algicides devrait atteindre la valeur de 848,40 millions USD d'ici 2029, à un TCAC de 6,6 % au cours de la période de prévision. « L'aquaculture » représente le segment d'application le plus important sur le marché respectif en raison de l'augmentation des algicides dans les champs aquatiques. Le rapport de marché organisé par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Type (sulfate de cuivre, composés d'ammonium quaternaire, cuivre chélaté, acide peracétique et dioxyde d'hydrogène, colorants et colorants, autres), forme (liquide et sec), mode d'action (non sélectif et sélectif), application (traitement des eaux de surface, aquaculture, centres sportifs et récréatifs, agriculture, autres), canal de distribution (direct et indirect) |

|

Pays couverts |

Royaume-Uni, Russie, France, Espagne, Italie, Allemagne, Turquie, Pays-Bas, Suisse, Belgique, reste de l'Europe. |

|

Acteurs du marché couverts |

BASF SE (Allemagne), Lonza (Suisse), UPL (Inde), Weifang Maochen Chemical Co., Ltd. (Chine), Airmax (États-Unis) |

Définition du marché

L'algicide est utilisé pour tuer et empêcher la croissance des algues ou des cyanobactéries. Il existe deux types d'algicides, qui comprennent les algicides naturels et synthétiques. Ils sont généralement utilisés pour empêcher les algues filamenteuses, ramifiées et planctoniques. L'algicide dépend de certains facteurs tels que les quantités d'application, la chimie de l'eau et la formulation du produit, entre autres. Il existe différents types d'algicides

Sulfate de cuivre : (CuSO4) est un composé inorganique et est largement utilisé pour prévenir les algues bleu-vert car les algues bleu-vert sont plus sensibles aux effets du cuivre que les autres algues.

Cuivre chélaté : Il fonctionne mieux que les algicides au sulfate de cuivre car il prévient les algues filamenteuses et planctoniques.

Composés d'ammonium quaternaire : ils sont plus efficaces contre les algues vertes car ils détruisent leur membrane cellulaire. Ils ne sont pas chers et sont largement utilisés pour les piscines.

Acide peracétique et dioxyde d'hydrogène : c'est un algicide non toxique qui oxyde les champignons (y compris les spores), les bactéries et les virus. Il agit sur les organismes phytopathogènes.

Colorants et colorants : il s'agit d'un type d'algicide qui améliore l'apparence des plans d'eau grâce à un colorant tel que le bleu. Il contrôle également la croissance de plusieurs types de mauvaises herbes et d'algues aquatiques.

Le COVID-19 a eu un impact minimal sur le marché des algicides

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, aucun impact significatif n'a été constaté sur leurs opérations et leur chaîne d'approvisionnement en algicides en Europe, car l'importation et l'exportation de vaccins et de biens essentiels ont entraîné une augmentation de la demande d'algicides. Avec cette prise de conscience croissante et l'impulsion gouvernementale en faveur de la recherche et du développement et l'introduction de nouveaux types d'algicides, la croissance du marché des algicides a augmenté.

La dynamique du marché des algicides comprend :

Facteurs moteurs/opportunités pour le marché des algicides

- Augmentation de la préoccupation et de la sensibilisation à la préservation de l'environnement et de l'écosystème

La sensibilisation croissante aux effets nocifs de la formation d'algues pousse les consommateurs à utiliser des algicides. Les algues nuisent à la santé des marins et de l'homme. Pour prévenir ou arrêter la formation d'algues, de nombreux organismes gouvernementaux et fabricants s'efforcent de sensibiliser les gens et les clients aux algicides. Par conséquent, la préoccupation et la sensibilisation croissantes concernant la conservation de l'environnement et de l'écosystème conduisent à la croissance du marché.

- Augmentation de la demande d'algicides dans diverses applications finales telles que l'aquaculture et le traitement des eaux de surface

Les algicides sont largement utilisés dans l'aquaculture et le traitement des eaux de surface. De nombreuses entreprises et fabricants fournissent des algicides pour empêcher la croissance des algues et contribuer au bon fonctionnement de l'aquaculture et du traitement des eaux de surface. Ainsi, la demande croissante d'algicides dans diverses applications finales telles que l'aquaculture et le traitement des eaux de surface entraîne la croissance du marché.

- Hausse de la demande de systèmes de climatisation

Les algicides sont largement utilisés pour traiter et nettoyer la formation d'algues dans les climatiseurs. Avec la demande croissante de climatiseurs à travers le monde, la demande d'algicides devrait augmenter à l'avenir. Ainsi, la hausse de la demande de systèmes de climatisation entraînera la croissance du marché.

- Augmentation du revenu disponible des consommateurs

De nos jours, les gens préfèrent vivre un style de vie luxueux. Même les appartements dans les métropoles sont dotés de mini-piscines sur balcon, ce qui a également augmenté la demande d'algicides à usage domestique. Le revenu disponible joue un rôle important dans la croissance du marché des algicides, car l'augmentation du revenu disponible permet aux individus de vivre un style de vie de qualité. L'augmentation du revenu disponible des consommateurs du monde entier a augmenté le pouvoir d'achat des clients et amélioré leur qualité de vie, offrant ainsi de grandes opportunités de croissance au marché européen des algicides.

Contraintes/défis rencontrés par le marché des algicides

- Réglementation gouvernementale stricte sur les algicides

Diverses associations telles que l'EPA et l'UE ont mis en place des réglementations ou des directives pour l'application, l'utilisation et le transport des algicides. La Commission européenne a confirmé que certains composés d'argent ne seront pas approuvés pour une utilisation dans les produits biocides (tels que les produits antimicrobiens). Cela pourrait avoir des implications au sein de l'UE et au-delà, y compris aux États-Unis et sur les autres marchés où divers produits « traités à l'argent » sont fabriqués pour être distribués dans le monde entier. Par conséquent, des réglementations et des directives gouvernementales strictes pour l'utilisation et l'application directe d'algicides qui peuvent être nocifs pour tout être vivant, comme les humains ou les animaux, devraient freiner la croissance du marché des algicides

- Perturbation de la chaîne d'approvisionnement

La pandémie de COVID-19 a provoqué un confinement soudain dans de nombreuses régions du monde pour empêcher la propagation du virus, ce qui a entraîné la fermeture rapide d'usines et de magasins, entre autres. Les problèmes rencontrés par les travailleurs, les ouvriers, les salariés et les fabricants du monde entier, ainsi que la perturbation de la chaîne d'approvisionnement à travers le monde en raison de l'épidémie de COVID-19 et de la guerre entre la Russie et l'Ukraine, devraient constituer un défi pour la croissance du marché européen des algicides.

Ce rapport sur le marché européen des algicides fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des algicides, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développements récents

- En mai 2022, Lonza et ALSA Ventures ont collaboré pour fournir des services de développement et de fabrication aux entreprises de biotechnologie. Lonza soutiendra les sociétés du portefeuille d'ALSA Ventures avec des services de soutien à la réduction des risques, au développement précoce et à la fabrication de modalités de nouvelle génération. Cela aidera l'entreprise à développer ses activités.

- En novembre 2021, Lonza a acquis l'usine de fabrication d'exosomes de Codiak BioSciences à Lexington, dans le Massachusetts (États-Unis). Cela a permis à l'entreprise d'accéder aux droits mondiaux, exclusifs et sous-licenciables de la technologie de fabrication d'exosomes à haut débit de Codiak.

Portée du marché européen des algicides

Le marché européen des algicides est segmenté en fonction du type, du mode d'action, de la forme, de l'application et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Sulfate de cuivre

- Cuivre chélaté

- Composés d'ammonium quaternaire

- Acide peracétique et dioxyde d'hydrogène

- Teintures et colorants

- Autres

Sur la base du type, le marché européen des algicides est segmenté en sulfate de cuivre, composés d'ammonium quaternaire, cuivre chélaté, acide peracétique et dioxyde d'hydrogène, colorants et autres.

Mode d'action

- Non sélectif

- Sélectif

Sur la base du mode d’action, le marché européen des algicides est segmenté en non sélectif et sélectif.

Formulaire

- Liquide

- Sec

Sur la base de la forme, le marché européen des algicides est segmenté en liquide et sec.

Application

- Traitement des eaux de surface

- Aquaculture

- Centres sportifs et récréatifs

- Agriculture

- Autres

Sur la base des applications, le marché européen des algicides est segmenté en traitement des eaux de surface, aquaculture, centres sportifs et récréatifs, agriculture et autres.

Canal de distribution

- Indirect

- Direct

Sur la base du canal de distribution, le marché européen des algicides est segmenté en indirect et direct.

Analyse/perspectives régionales du marché des algicides en Europe

Le marché européen des algicides est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type, mode d’action, forme, application et canal de distribution comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché européen des algicides sont le Royaume-Uni, la Russie, la France, l'Espagne, l'Italie, l'Allemagne, la Turquie, les Pays-Bas, la Suisse, la Belgique et le reste de l'Europe.

Le Royaume-Uni domine le marché en raison des activités croissantes des programmes de traitement de l’eau dans la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des algicides

Le paysage concurrentiel du marché européen des algicides fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché européen des algicides.

Certains des principaux acteurs opérant sur le marché des algicides sont BASF SE, Lonza, UPL, Weifang Maochen Chemical Co., Ltd. et Airmax, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ALGAECIDES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN CONCERN AND AWARENESS REGARDING THE CONSERVATION OF THE ENVIRONMENT AND ECOSYSTEM

5.1.2 RISE IN DEMAND FOR ALGAECIDES IN VARIOUS END USE APPLICATIONS SUCH AS AQUACULTURE AND SURFACE WATER TREATMENT

5.1.3 SPIKE IN DEMAND FOR AIR CONDITIONING SYSTEMS

5.2 RESTRAINT

5.2.1 STRINGENT GOVERNMENT REGULATION ON ALGAECIDES

5.3 OPPORTUNITY

5.3.1 INCREASE IN DISPOSABLE INCOME OF CONSUMERS

5.4 CHALLENGE

5.4.1 SUPPLY CHAIN DISRUPTION

6 EUROPE ALGAECIDES MARKET, BY TYPE

6.1 OVERVIEW

6.2 COPPER SULFATE

6.3 QUATERNARY AMMONIUM COMPOUNDS

6.4 CHELATED COPPER

6.5 PEROXYACETIC ACID & HYDROGEN DIOXIDE

6.6 DYES & COLORANTS

6.7 OTHERS

7 EUROPE ALGAECIDES MARKET, BY MODE OF ACTION

7.1 OVERVIEW

7.2 SELECTIVE

7.3 NON-SELECTIVE

8 EUROPE ALGAECIDES MARKET, BY FORM

8.1 OVERVIEW

8.2 LIQUID

8.3 DRY

9 EUROPE ALGAECIDES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 AQUACULTURE

9.3 SURFACE WATER TREATMENT

9.4 SPORTS & RECREATIONAL CENTERS

9.5 AGRICULTURE

9.6 OTHERS

10 EUROPE ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

11 EUROPE ALGAECIDES MARKET, BY REGION

11.1 EUROPE

11.1.1 U.K.

11.1.2 RUSSIA

11.1.3 FRANCE

11.1.4 SPAIN

11.1.5 ITALY

11.1.6 GERMANY

11.1.7 TURKEY

11.1.8 NETHERLAND

11.1.9 SWITZERLAND

11.1.10 BELGIUM

11.1.11 REST OF EUROPE

12 EUROPE ALGAECIDES MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

12.2 MERGER & ACQUISITIONS

12.3 COLLABORATION

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BASF SE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 LONZA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATES

14.3 UPL

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATE

14.4 AIRMAX

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 BIOSAFE SYSTEMS, LLC

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT UPDATES

14.6 N. JONAS & COMPANY, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 OREQ

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 PHOENIX PRODUCTS CO.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 SEPRO CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 WEIFANG MAOCHEN CHEMICAL CO., LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF INSECTICIDES, RODENTICIDES, FUNGICIDES, HERBICIDES, ANTI-SPROUTING PRODUCTS, PLANT-GROWTH REGULATORS, DISINFECTANTS, AND SIMILAR PRODUCTS, PUT UP FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES, FOR INSTANCE, SULPHUR-TREATED BANDS, WICKS AND CANDLES, AND FLY-PAPERS; HS CODE - 3808 (USD MILLION)

TABLE 2 EXPORT DATA OF INSECTICIDES, RODENTICIDES, FUNGICIDES, HERBICIDES, ANTI-SPROUTING PRODUCTS, PLANT-GROWTH REGULATORS, DISINFECTANTS, AND SIMILAR PRODUCTS, PUT UP FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES, FOR INSTANCE, SULPHUR-TREATED BANDS, WICKS AND CANDLES, AND FLY-PAPERS; HS CODE - 3808 (USD MILLION)

TABLE 3 EUROPE ALGAECIDES MARKET, BY TYPE, 2017-2029 (USD MILLION)

TABLE 4 EUROPE COPPER SULFATE IN ALGAECIDES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE QUATERNARY AMMONIUM COMPOUNDS IN ALGAECIDES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE CHELATED COPPER IN ALGAECIDES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE PEROXYACETIC ACID & HYDROGEN DIOXIDE IN ALGAECIDES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE DYES & COLORANTS IN ALGAECIDES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE OTHERS IN ALGAECIDES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 11 EUROPE SELECTIVE IN ALGAECIDES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE NON-SELECTIVE IN ALGAECIDES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 14 EUROPE LIQUID IN ALGAECIDES MARKET, BY REGION, 2017-2029 (USD MILLION)

TABLE 15 EUROPE DRY IN ALGAECIDES MARKET, BY REGION, 2017-2029 (USD MILLION)

TABLE 16 EUROPE ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 17 EUROPE AQUACULTURE IN ALGAECIDES MARKET, BY REGION, 2017-2029 (USD MILLION)

TABLE 18 EUROPE SURFACE WATER TREATMENT IN ALGAECIDES MARKET, BY REGION, 2017-2029 (USD MILLION)

TABLE 19 EUROPE SPORTS & RECREATIONAL CENTERS IN ALGAECIDES MARKET, BY REGION, 2017-2029 (USD MILLION)

TABLE 20 EUROPE AGRICULTURE IN ALGAECIDES MARKET, BY REGION, 2017-2029 (USD MILLION)

TABLE 21 EUROPE OTHERS IN ALGAECIDES MARKET, BY REGION, 2017-2029 (USD MILLION)

TABLE 22 EUROPE ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 23 EUROPE DIRECT IN ALGAECIDES MARKET, BY REGION, 2017-2029 (USD MILLION)

TABLE 24 EUROPE INDIRECT IN ALGAECIDES MARKET, BY REGION, 2017-2029 (USD MILLION)

TABLE 25 EUROPE ALGAECIDES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 26 EUROPE ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 28 EUROPE ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 29 EUROPE ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 30 EUROPE ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 31 U.K. ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.K. ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 33 U.K. ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 34 U.K. ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 35 U.K. ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 36 RUSSIA ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 RUSSIA ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 38 RUSSIA ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 39 RUSSIA ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 40 RUSSIA ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 41 FRANCE ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 FRANCE ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 43 FRANCE ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 44 FRANCE ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 45 FRANCE ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 46 SPAIN ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SPAIN ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 48 SPAIN ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 49 SPAIN ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 50 SPAIN ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 51 ITALY ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 ITALY ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 53 ITALY ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 54 ITALY ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 55 ITALY ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 56 GERMANY ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 58 GERMANY ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 59 GERMANY ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 60 GERMANY ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 61 TURKEY ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 TURKEY ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 63 TURKEY ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 64 TURKEY ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 65 TURKEY ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 66 NETHERLAND ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 NETHERLAND ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 68 NETHERLAND ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 69 NETHERLAND ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 70 NETHERLAND ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 71 SWITZERLAND ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SWITZERLAND ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 73 SWITZERLAND ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 74 SWITZERLAND ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 75 SWITZERLAND ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 76 BELGIUM ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 BELGIUM ALGAECIDES MARKET, BY MODE OF ACTION, 2017-2029 (USD MILLION)

TABLE 78 BELGIUM ALGAECIDES MARKET, BY FORM, 2017-2029 (USD MILLION)

TABLE 79 BELGIUM ALGAECIDES MARKET, BY APPLICATION, 2017-2029 (USD MILLION)

TABLE 80 BELGIUM ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2017-2029 (USD MILLION)

TABLE 81 REST OF EUROPE ALGAECIDES MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE ALGAECIDES MARKET: SEGMENTATION

FIGURE 2 EUROPE ALGAECIDES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ALGAECIDES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ALGAECIDES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ALGAECIDES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ALGAECIDES MARKET: TYPE LIFE LINE CURVE

FIGURE 7 EUROPE ALGAECIDES MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE ALGAECIDES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE ALGAECIDES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE ALGAECIDES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE ALGAECIDES MARKET: CHALLENGE MATRIX

FIGURE 12 EUROPE ALGAECIDES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE ALGAECIDES MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE EUROPE ALGAECIDES MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 RISING DEMAND FOR ALGAECIDES IN VARIOUS END-USE APPLICATIONS SUCH AS AQUACULTURE AND SURFACE WATER TREATMENT IS DRIVING THE EUROPE ALGAECIDES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 COPPER SULFATE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ALGAECIDES MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINT, OPPORTUNITY, AND CHALLENGE OF THE EUROPE ALGAECIDES MARKET

FIGURE 18 EUROPE ALGAECIDES MARKET, BY TYPE, 2021

FIGURE 19 EUROPE ALGAECIDES MARKET, BY MODE OF ACTION, 2021

FIGURE 20 EUROPE ALGAECIDES MARKET, BY FORM, 2021

FIGURE 21 EUROPE ALGAECIDES MARKET, BY APPLICATION, 2021

FIGURE 22 EUROPE ALGAECIDES MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 EUROPE ALGAECIDES MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE ALGAECIDES MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE ALGAECIDES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE ALGAECIDES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE ALGAECIDES MARKET: BY TYPE (2022& 2029)

FIGURE 28 EUROPE ALGAECIDES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.