Marché européen de la fabrication additive, par type de matériau (métal, plastique, alliages et céramique ), technologie (stéréolithographie (SLA), modélisation par disposition en fusion (FDM), frittage laser (LS), impression par jet de liant, impression Polyjet, fusion par faisceau d'électrons (EBM), fabrication d'objets laminés (LOM) et autres), applications (automobile, santé, aérospatiale, biens de consommation, industrie, défense, architecture et autres) Tendances du marché et prévisions jusqu'en 2030.

Analyse et taille du marché de la fabrication additive en Europe

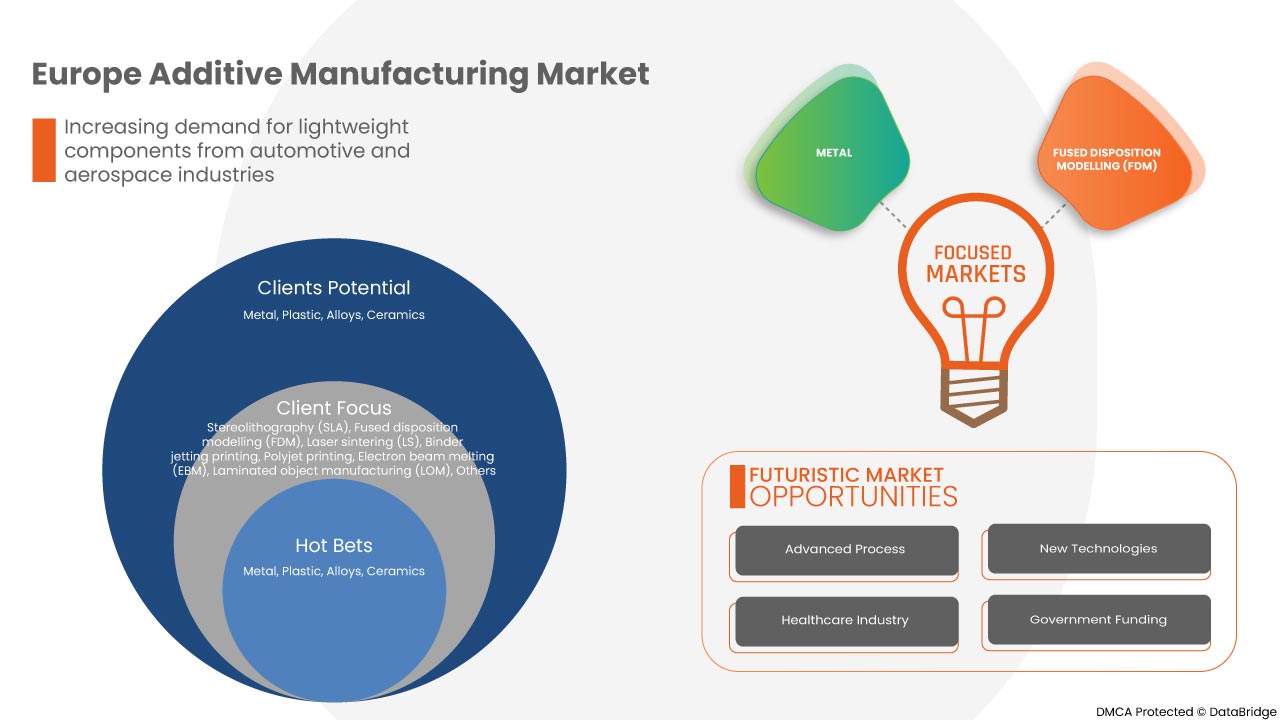

Le marché de la fabrication additive concerne la conception, la production et la distribution de fils, de tissus, de vêtements et d'accessoires. La matière première peut être du métal, du plastique, des alliages et de la céramique. Les industries de fabrication additive contribuent de manière significative à l'économie nationale de nombreux pays. La demande croissante de composants légers des secteurs de l'automobile et de l'aérospatiale et les progrès des technologies d'impression 3D en métal ont considérablement accru la demande sur le marché européen de la fabrication additive.

Le rapport sur le marché européen de la fabrication additive fournit des détails sur les parts de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

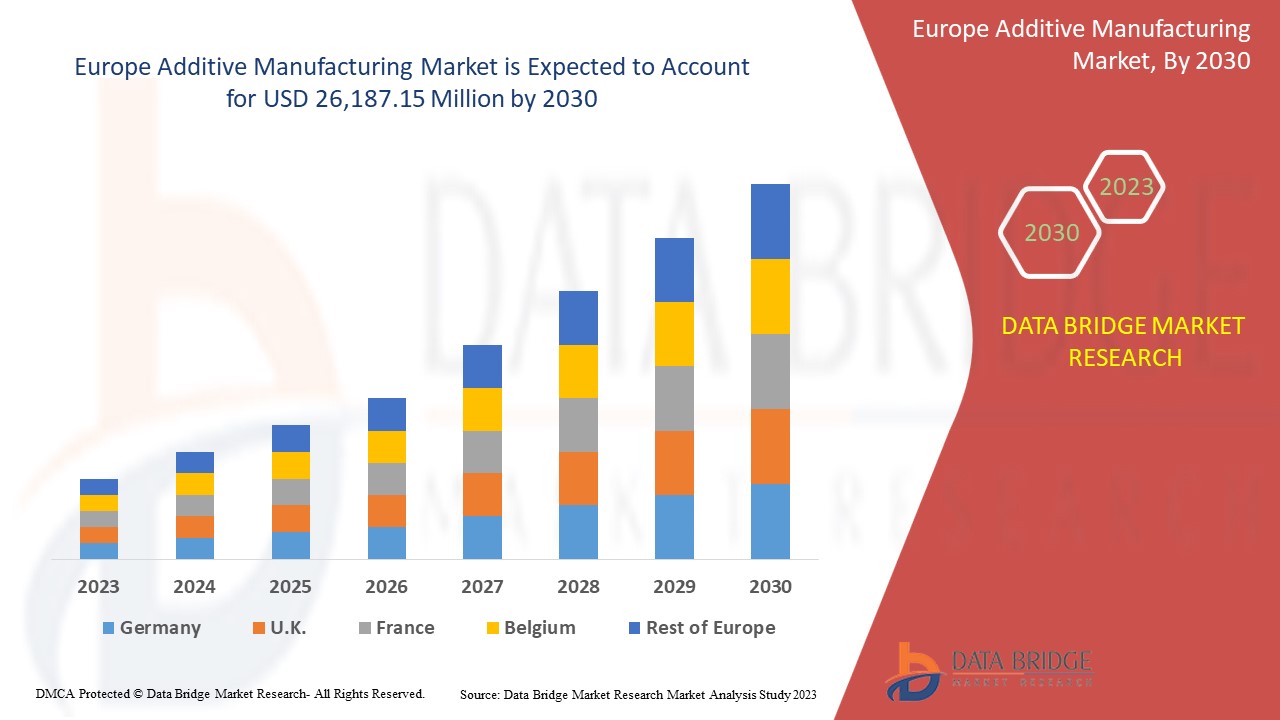

Le marché européen de la fabrication additive devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 20,7 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 26 187,15 millions USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché de la fabrication additive est la demande croissante de composants légers des industries automobile et aérospatiale.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de matériau (métal, plastique, alliages et céramique), technologie (stéréolithographie (SLA), modélisation par disposition en fil fondu (FDM), frittage laser (LS), impression par jet de liant, impression Polyjet, fusion par faisceau d'électrons (EBM), fabrication d'objets laminés (LOM) et autres), application (automobile, santé, aérospatiale, biens de consommation, industrie, défense, architecture et autres). |

|

Pays couverts |

Royaume-Uni, Russie, France, Espagne, Italie, Allemagne, Turquie, Pays-Bas, Suisse, Belgique, reste de l'Europe. |

|

Acteurs du marché couverts |

ANSYS, Inc., Höganäs AB, EOS, ARBURG GmbH + Co KG, Stratasys, Renishaw plc., YAMAZAKI MAZAK CORPORATION, Materialise, Markforged, Titomic Limited., SLM Solutions, Proto Labs, ENVISIONTEC US LLC, Ultimaker BV, American Additive Manufacturing LLC, Optomec, Inc., 3D system Inc. et ExOne. (Une filiale de Desktop Metal, Inc.), entre autres. |

Définition du marché

La fabrication additive (FA) diffère de la méthode de production soustractive, qui consiste à extraire les matériaux inutiles d'un bloc de matériau. L'utilisation de la fabrication additive dans les applications industrielles fait généralement référence à l'impression 3D. La fabrication additive implique l'ajout de matériaux couche par couche pour former un objet tout en se référant à un fichier tridimensionnel à l'aide d'une imprimante 3D et d'un logiciel d'impression 3D. Une technologie de fabrication additive appropriée est sélectionnée parmi l'ensemble des technologies disponibles en fonction de l'application.

Dynamique du marché de la fabrication additive en Europe

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de composants légers de la part des industries automobile et aérospatiale

Le secteur automobile et aérospatial exige de nombreux objectifs techniques et économiques interactifs en matière de performances fonctionnelles, de réduction des délais de livraison, de légèreté, de gestion des coûts et de livraison de composants critiques pour la sécurité. Pour répondre à la demande et compenser la consommation de carburant et la gestion des coûts, il faut améliorer les performances techniques et permettre de fabriquer une structure plus légère qui est directement liée à l'amélioration des performances économiques et techniques et qui aidera l'industrie aérienne à transporter plus de charge utile, ce qui améliorera directement ses revenus. Les technologies de fabrication additive, contrairement à la fabrication traditionnelle conventionnelle, utilisent une fabrication couche par couche à base de poudre ou de fil typique et de matériaux comme le polymère plastique, qui est léger.

- Avantages offerts par la fabrication additive dans diverses industries utilisatrices finales

Les industries comme l'aérospatiale font partie des industries qui utilisent la fabrication additive pour leurs performances. Les pièces d'avion sont utilisées par des produits de fabrication additive qui sont légers et peuvent résister à des conditions environnementales difficiles, en raison de la réduction de la quantité de matériaux requise et du processus de formation des matériaux couche par couche. Les industries aérospatiales l'utilisent comme un avantage pour la réduction du poids et la réduction des déchets, ce qui est très important pour la fabrication de pièces aérospatiales pour les grandes entreprises.

Dans le secteur médical en pleine innovation, l'utilisation de produits fabriqués par fabrication additive présente un grand avantage pour les médecins, les patients et les instituts de recherche. Grâce à la conception de prototypes fonctionnels fournis par les technologies de fabrication additive, il est très avantageux de créer une conception flexible de divers outils de sauvetage nécessaires à des fins chirurgicales et d'étude, d'outils utilisés dans les procédures dentaires, de modèles préopératoires pour les tomodensitogrammes, de guides de scie et de forage personnalisés, de boîtiers et d'instruments spécialisés.

- Personnalisation facile et production en masse grâce à la fabrication additive

La personnalisation par fabrication additive, contrairement à la fabrication traditionnelle, n'ajoute pas de coût supplémentaire pour la personnalisation et ne nécessite aucun moule ou outil spécifique pour la conception. Il suffit d'un prototype de conception 3D et peut être créé par le client lui-même en raison de la personnalisation facile et de la production rapide. La demande est élevée et nous pouvons produire en masse n'importe quel design unique sans entraver le coût et le temps lors de l'utilisation des imprimantes 3D. Non seulement elle permet une production personnalisée en masse, mais elle offre également au consommateur une expérience d'achat et de consommation unique qui lui donne le sentiment d'appartenance et de satisfaction du consommateur par rapport à son homologue qui ne propose pas de conception personnalisée. Elle permet également au consommateur d'acheter le design de son choix. Par exemple, NIKE, un fabricant de chaussures, vend des chaussures sur son site Web avec un design 3D sur lequel le consommateur peut ajouter lui-même son choix de couleur sans trop d'hésitation. Cela ajoutera un avantage à la concurrence sur le marché car, grâce à ce système, il permet au fabricant de connaître son client.

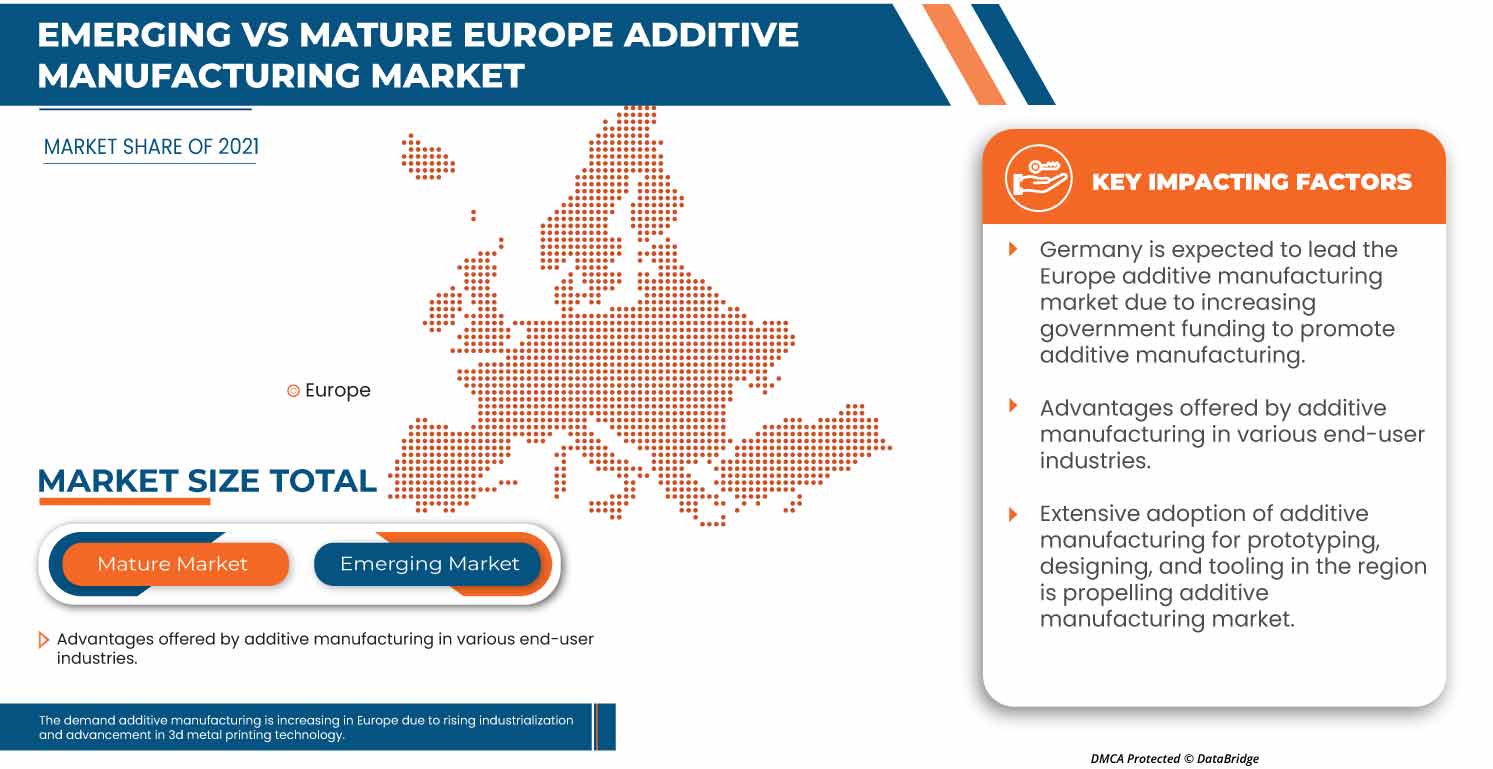

- Augmentation de l'industrialisation et progrès de la technologie d'impression 3D en métal

Avec l'essor de l'industrialisation, il existe une demande énorme de produits d'impression 3D en métal dans des secteurs tels que l'aérospatiale, l'automobile, la santé et d'autres industries. Avec la demande de divers domaines pour des pièces dans l'aérospatiale pour leurs moteurs à réaction et d'autres pièces structurelles pour personnaliser les pièces dans l'industrie automobile afin de personnaliser la conception des chaussures et autres gadgets électroniques, il existe une demande pour le développement rigoureux des technologies d'impression 3D, qui fonctionneront plus efficacement et pourront produire le produit à un rythme beaucoup plus rapide et avec plus de précision. Ainsi, la demande d'avancées et de commodité des technologies de fabrication additive conduit à une augmentation de la demande de technologies d'impression 3D en métal.

Opportunités

- Progrès dans le secteur de la santé

Dans le domaine médical, chaque patient est unique et la fabrication additive a donc un fort potentiel d'utilisation pour des applications médicales personnalisées et sur mesure. Les applications cliniques médicales les plus courantes sont les implants personnalisés et les guides de scies pour modèles médicaux. Dans le domaine dentaire, les produits de fabrication additive sont utilisés dans les attelles, les appareils orthodontiques, les modèles dentaires et les guides de forage. Cependant, les produits de fabrication additive sont également utilisés pour fabriquer des tissus et des organes artificiels, qui peuvent être utilisés à des fins d'étude dans un institut de recherche ou entre les consultations entre médecins et patients. Le développement de la numérisation de l'imagerie médicale permet la reconstruction de modèles 3D à partir de l'anatomie des patients. Le flux de travail typique des dispositifs médicaux personnalisés commence par l'imagerie ou la capture de la géométrie de l'anatomie du patient à l'aide de méthodes de numérisation 3D informatisée. Ces données peuvent être utilisées pour imprimer des modèles 3D de l'anatomie d'un patient ou peuvent être utilisées pour créer des dispositifs ou des implants personnalisés.

- Augmenter le financement gouvernemental pour promouvoir la fabrication additive

La fabrication additive a un immense potentiel pour révolutionner le paysage de la fabrication et de la production industrielle grâce aux processus numériques, à la communication et à l'imagerie. La fabrication additive est une activité tendance qui bénéficie d'une forte demande de la part de diverses industries telles que l'aérospatiale, l'automobile, le secteur médical, l'électronique, la mode, etc. Voyant le potentiel de la contribution possible de ce secteur à l'économie nationale, les gouvernements de différents pays élaborent une stratégie différente pour soutenir et promouvoir cette industrie.

Contraintes/Défis

- Coûts élevés des équipements, des machines et manque de professionnels qualifiés

Les avantages de la fabrication additive ont ouvert de vastes horizons pour la création de formes et de composants 3D. Mais toutes les entreprises n’ont pas la capacité d’intégrer ce type d’activité à leurs processus commerciaux à moindre coût. Parmi les causes les plus courantes qui entravent l’avenir de la fabrication additive figurent le coût élevé des équipements et le manque de professionnels dans ce secteur.

Le prix moyen d’un équipement de fabrication additive se situe entre 300 000 et 1,5 million de dollars. Le coût des consommables industriels varie entre 100 et 150 dollars par pièce. Cependant, le prix final dépend du matériau choisi, comme le plastique, qui est considéré comme l’option la plus économique parmi tous les autres matériaux disponibles. Le temps nécessaire est également assez élevé, car il faut plus d’une heure pour imprimer un objet de 40 cm.

- Manque d'efficacité du logiciel

La fabrication additive utilisant le procédé de fusion laser sur lit de poudre (PBF) permet de créer des formes complexes et élaborées ainsi que des structures organiques qui étaient auparavant trop coûteuses ou complexes à réaliser à l'aide d'opérations de fabrication traditionnelles. Par exemple, les libertés de conception obtenues par la PBF laser pourraient être exploitées pour des composants légers afin de créer les structures en treillis les plus complexes pour une utilisation plus efficace des matériaux. Mais la PBF laser a ses inconvénients. Elle comprend des pièces à parois minces/à rapport hauteur/largeur élevé qui peuvent se briser pendant la fabrication, des structures de support difficiles à retirer, des effets de superposition sur la rugosité de la surface et différents paramètres de processus tels que les réglages laser pour les surfaces en surface par rapport aux surfaces en surface.

Développement récent

- En février, SLM Solutions a lancé SLM.Quality. Il s'agit d'une solution logicielle d'assurance qualité qui permet aux clients d'effectuer des évaluations de tâches de fabrication, des qualifications de processus et des certifications de pièces plus efficacement. Qu'il s'agisse de production de pièces uniques ou de production en série, les solutions SLM.Quality peuvent assister les clients industriels pendant le processus de qualification, en améliorant la traçabilité et la documentation des données de processus clés. Ce développement aidera l'entreprise à attirer davantage de clients.

- En février, SLM Solutions et Assembrix ont annoncé conjointement l’intégration réussie du logiciel Assembrix VMS avec les machines SLM Solutions du monde entier. Ce nouveau partenariat répondra à la demande croissante des équipementiers pour une fabrication additive distribuée sécurisée et permettra la création d’un écosystème de fabrication additive international fiable.

Portée du marché européen de la fabrication additive

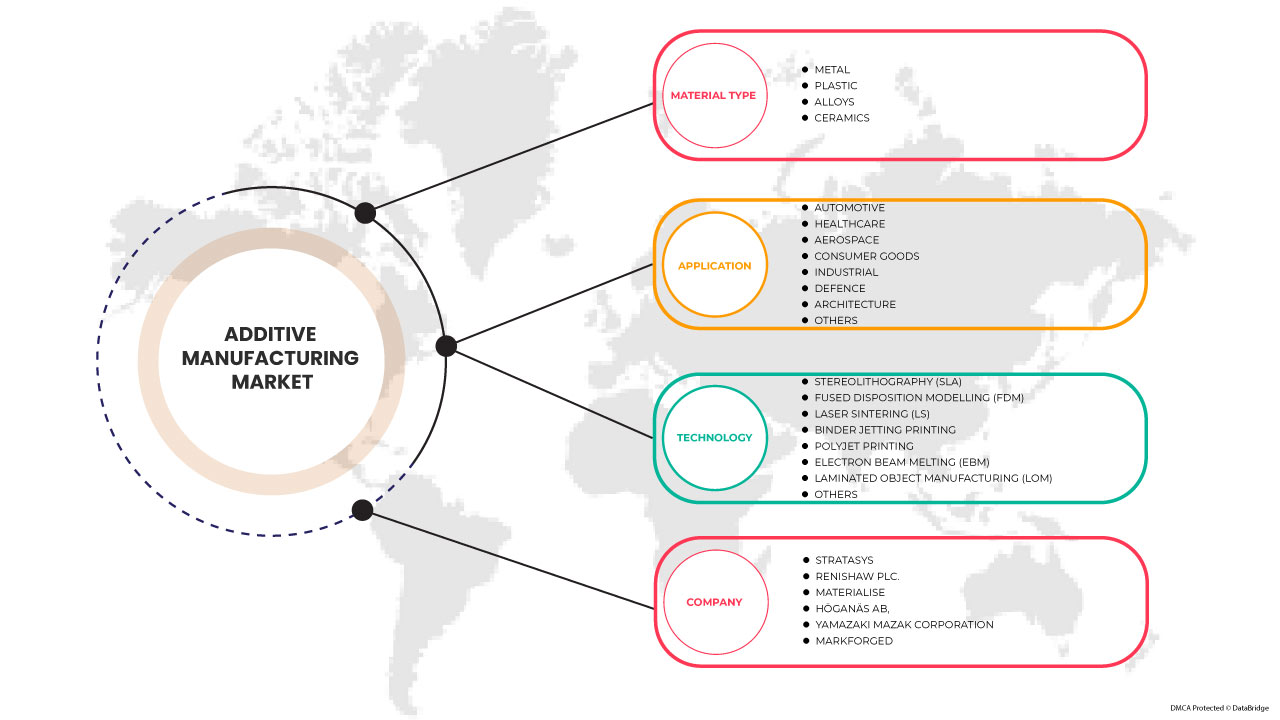

Le marché européen de la fabrication additive est classé en fonction du type de matériau, de la technologie et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de matériau

- Métaux

- Plastiques

- Alliages

- Céramique

Sur la base du type de matériau, le marché européen de la fabrication additive est classé en cinq segments : métaux, plastiques, alliages et céramiques.

Technologie

- Stéréolithographie (SLA)

- Modélisation de la disposition fusionnée (FDM)

- Frittage au laser (LS)

- Impression par jet de liant

- Impression Polyjet

- Fusion par faisceau d'électrons (EBM)

- Fabrication d'objets laminés (LOM)

- Autres

Sur la base de la technologie, le marché européen de la fabrication additive est classé en huit segments : stéréolithographie (SLA), modélisation par disposition fondue (FDM), frittage laser (LS), impression par jet de liant, impression Polyjet, fusion par faisceau d'électrons (EBM), fabrication d'objets laminés (LOM) et autres.

Application

- Automobile

- Soins de santé

- Aérospatial

- Biens de consommation

- Industriel

- Défense

- Architecture

- Autres

Sur la base des applications, le marché européen de la fabrication additive est classé en huit segments : automobile, santé, aérospatiale, biens de consommation, industrie, défense, architecture et autres.

Analyse/perspectives régionales du marché de la fabrication additive en Europe

Le marché européen de la fabrication additive est segmenté en fonction du type de matériau, de la technologie et des applications.

Les pays du marché européen de la fabrication additive sont le Royaume-Uni, la Russie, la France, l’Espagne, l’Italie, l’Allemagne, la Turquie, les Pays-Bas, la Suisse, la Belgique et le reste de l’Europe.

L’Allemagne domine le marché européen de la fabrication additive en raison du développement avancé des technologies.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis rencontrés en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la fabrication additive en Europe

Le paysage concurrentiel du marché européen de la fabrication additive fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché européen de la fabrication additive.

Français Certains des principaux acteurs opérant sur le marché européen de la fabrication additive sont SLM Solutions, Proto Labs, Stratasys, Renishaw plc., Materialise, Titomic Limited., Höganäs AB, YAMAZAKI MAZAK CORPORATION, Markforged, Ultimaker BV, Optomec, Inc., ExOne. (Une filiale de Desktop Metal, Inc.), American Additive Manufacturing LLC, ANSYS, Inc., ARBURG GmbH + Co KG, ENVISIONTEC US LLC, EOS et 3D Systems, Inc., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE ADDITIVE MANUFACTURING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4 SUPPLY CHAIN ANALYSIS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR LIGHTWEIGHT COMPONENTS FROM THE AUTOMOTIVE AND AEROSPACE INDUSTRIES

6.1.2 ADVANTAGES OFFERED BY ADDITIVE MANUFACTURING IN VARIOUS END-USER INDUSTRIES

6.1.3 EASY CUSTOMIZATION AND BULK PRODUCTION USING ADDITIVE MANUFACTURING

6.1.4 RISE IN INDUSTRIALIZATION AND ADVANCEMENT IN 3D METAL PRINTING TECHNOLOGY

6.2 RESTRAINTS

6.2.1 HIGH COSTS OF EQUIPMENT, MACHINERY AND LACK OF SKILLED PROFESSIONAL

6.2.2 LACK OF SOFTWARE EFFICIENCY

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENT IN THE HEALTHCARE SECTOR

6.3.2 INCREASING GOVERNMENT FUNDING TO PROMOTE ADDITIVE MANUFACTURING

6.4 CHALLENGES

6.4.1 ISSUES RELATED TO MATERIAL AVAILABILITY, DEVELOPMENT, VALIDATION, AND STANDARDIZATION

6.4.2 MISCONCEPTIONS AMONG SMALL AND MEDIUM-SCALE MANUFACTURERS ABOUT THE PROTOTYPING PROCESS

7 EUROPE ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 METAL

7.2.1 METAL, BY MATERIAL TYPE

7.2.1.1 STEEL

7.2.1.2 ALUMINUM (ALUMIDE)

7.2.1.3 TITANIUM

7.2.1.4 SILVER

7.2.1.5 GOLD

7.2.1.6 OTHERS

7.3 PLASTIC

7.3.1 PLASTIC, BY MATERIAL TYPE

7.3.1.1 ACRYLONITRILE BUTADIENE STYRENE

7.3.1.2 POLYLACTIC ACID (PLA)

7.3.1.3 NYLON

7.3.1.4 PHOTOPOLYMERS

7.3.1.5 OTHERS

7.3.2 OTHERS, BY MATERIAL TYPE

7.3.2.1 POLYPROPYLENE

7.3.2.2 HIGH DENSITY POLYETHYLENE

7.3.2.3 POLYCARBONATE

7.3.2.4 POLYVINYL ALCOHOL

7.4 ALLOYS

7.4.1 ALLOYS, BY MATERIAL TYPE

7.4.1.1 TOOL STEELS AND MARAGING STEELS

7.4.1.2 COMMERCIALLY PURE TITANIUM AND ALLOYS

7.4.1.3 ALUMINUM ALLOYS

7.4.1.4 NICKEL-BASED ALLOYS

7.4.1.5 COBALT-CHROMIUM ALLOYS

7.4.1.6 COPPER-BASED ALLOYS

7.5 CERAMICS

7.5.1 CERAMICS, BY MATERIAL TYPE

7.5.1.1 GLASS

7.5.1.2 SILICA

7.5.1.3 QUARTZ

7.5.1.4 OTHERS

8 EUROPE ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 STEREOLITHOGRAPHY (SLA)

8.3 FUSED DISPOSITION MODELLING (FDM)

8.4 LASER SINTERING (LS)

8.4.1 LASER SINTERING (LS), BY TECHNOLOGY

8.4.1.1 SELECTIVE LASER MELTING (SLM)

8.4.1.2 SELECTIVE LASER SINTERING (SLS)

8.4.1.3 DIRECT METAL LASER SINTERING

8.5 BINDER JETTING PRINTING

8.6 POLYJET PRINTING

8.7 ELECTRON BEAM MELTING (EBM)

8.8 LAMINATED OBJECT MANUFACTURING (LOM)

8.9 OTHERS

9 EUROPE ADDITIVE MANUFACTURING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 AUTOMOTIVE

9.3 HEALTHCARE

9.4 AEROSPACE

9.5 CONSUMER GOODS

9.6 INDUSTRIAL

9.7 DEFENCE

9.8 ARCHITECTURE

9.9 OTHERS

10 EUROPE ADDITIVE MANUFACTURING MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 ITALY

10.1.3 U.K.

10.1.4 FRANCE

10.1.5 SPAIN

10.1.6 TURKEY

10.1.7 RUSSIA

10.1.8 SWITZERLAND

10.1.9 BELGIUM

10.1.10 NETHERLANDS

10.1.11 REST OF EUROPE

11 EUROPE ADDITIVE MANUFACTURING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.2 CERTIFICATION

11.3 ACHIEVEMENT

11.4 LAUNCH

11.5 MERGER

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ANSYS, INC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 HÖGANÄS AB

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATE

13.3 EOS

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 ARBURG GMBH + CO KG

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATE

13.5 STRATASYS

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATES

13.6 AMERICAN ADDITIVE MANUFACTURING LLC

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATE

13.7 ENVISIONTEC US LLC

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATE

13.8 EXONE. (A SUBSIDIARY OF DESKTOP METAL, INC.)

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 MATERIALISE

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 MARKFORGED

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATES

13.11 OPTOMEC, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 PROTO LABS

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 ANNUAL REPORTS, AND SEC FILINGRECENT UPDATES

13.13 RENISHAW PLC.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATES

13.14 SLM SOLUTIONS

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT UPDATES

13.15 TITOMIC LIMITED.

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT UPDATES

13.16 ULTIMAKER BV

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT UPDATE

13.17 YAMAZAKI MAZAK CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATES

13.18 3D SYSTEM, INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 EUROPE ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 3 EUROPE METAL IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 EUROPE METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 5 EUROPE PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 EUROPE PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 7 EUROPE OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 8 EUROPE ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 10 EUROPE CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 EUROPE CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 12 EUROPE ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 13 EUROPE STEREOLITHOGRAPHY (SLA) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 EUROPE FUSED DISPOSITION MODELLING (FDM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 EUROPE LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 17 EUROPE BINDER JETTING PRINTING IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 EUROPE POLYJET PRINTING IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 EUROPE ELECTRON BEAM MELTING (EBM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 EUROPE LAMINATED OBJECT MANUFACTURING (LOM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 EUROPE OTHERS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 EUROPE ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 23 EUROPE AUTOMOTIVE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 EUROPE HEALTHCARE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 EUROPE AEROSPACE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 EUROPE CONSUMER GOODS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 EUROPE INDUSTRIAL IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 EUROPE DEFENCE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 EUROPE ARCHITECTURE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 EUROPE OTHERS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 EUROPE ADDITIVE MANUFACTURING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 EUROPE ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 33 EUROPE METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 34 EUROPE PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 35 EUROPE OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 36 EUROPE ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 37 EUROPE CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 38 EUROPE ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 39 EUROPE LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 40 EUROPE ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 GERMANY ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 42 GERMANY METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 43 GERMANY PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 44 GERMANY OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 45 GERMANY ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 46 GERMANY CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 47 GERMANY ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 48 GERMANY LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 49 GERMANY ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 50 ITALY ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 51 ITALY METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 52 ITALY PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 53 ITALY OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 54 ITALY ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 55 ITALY CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 56 ITALY ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 57 ITALY LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 58 ITALY ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 59 U.K. ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 60 U.K. METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 61 U.K. PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 62 U.K. OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 63 U.K. ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.K. CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.K. ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 66 U.K. LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 67 U.K. ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 FRANCE ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 69 FRANCE METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 70 FRANCE PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 71 FRANCE OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 72 FRANCE ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 73 FRANCE CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 74 FRANCE ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 75 FRANCE LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 76 FRANCE ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 77 SPAIN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 78 SPAIN METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 79 SPAIN PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 80 SPAIN OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 81 SPAIN ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 82 SPAIN CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 83 SPAIN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 84 SPAIN LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 85 SPAIN ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 86 TURKEY ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 87 TURKEY METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 88 TURKEY PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 89 TURKEY OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 90 TURKEY ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 91 TURKEY CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 92 TURKEY ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 93 TURKEY LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 94 TURKEY ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 95 RUSSIA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 96 RUSSIA METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 97 RUSSIA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 98 RUSSIA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 99 RUSSIA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 100 RUSSIA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 101 RUSSIA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 102 FRANCE LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 103 RUSSIA ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 104 SWITZERLAND ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 105 SWITZERLAND METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 106 SWITZERLAND PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 107 SWITZERLAND OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 108 SWITZERLAND ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 109 SWITZERLAND CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 110 SWITZERLAND ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 111 SWITZERLAND LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 112 SWITZERLAND ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 113 BELGIUM ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 114 BELGIUM METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 115 BELGIUM PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 116 BELGIUM OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 117 BELGIUM ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 118 BELGIUM CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 119 BELGIUM ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 120 BELGIUM LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 121 BELGIUM ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 122 NETHERLANDS ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 123 NETHERLANDS METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 124 NETHERLANDS PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 125 NETHERLANDS OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 126 NETHERLANDS ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 127 NETHERLANDS CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 128 NETHERLANDS ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 129 BELGIUM LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 130 NETHERLANDS ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 131 REST OF EUROPE ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE ADDITIVE MANUFACTURING MARKET

FIGURE 2 EUROPE ADDITIVE MANUFACTURING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ADDITIVE MANUFACTURING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ADDITIVE MANUFACTURING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ADDITIVE MANUFACTURING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ADDITIVE MANUFACTURING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 EUROPE ADDITIVE MANUFACTURING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE ADDITIVE MANUFACTURING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE ADDITIVE MANUFACTURING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE ADDITIVE MANUFACTURING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 EUROPE ADDITIVE MANUFACTURING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE ADDITIVE MANUFACTURING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE ADDITIVE MANUFACTURING MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR LIGHTWEIGHT COMPONENTS FROM THE AUTOMOTIVE AND AEROSPACE INDUSTRIES IS EXPECTED TO DRIVE THE EUROPE ADDITIVE MANUFACTURING MARKET IN THE FORECAST PERIOD

FIGURE 15 THE METAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ADDITIVE MANUFACTURING MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE ADDITIVE MANUFACTURING MARKET

FIGURE 17 EUROPE ADDITIVE MANUFACTURING MARKET: BY MATERIAL TYPE, 2022

FIGURE 18 EUROPE ADDITIVE MANUFACTURING MARKET: BY TECHNOLOGY, 2022

FIGURE 19 EUROPE ADDITIVE MANUFACTURING MARKET: BY APPLICATION, 2022

FIGURE 20 EUROPE ADDITIVE MANUFACTURING MARKET: SNAPSHOT (2022)

FIGURE 21 EUROPE ADDITIVE MANUFACTURING MARKET : BY COUNTRY (2022)

FIGURE 22 EUROPE ADDITIVE MANUFACTURING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 EUROPE ADDITIVE MANUFACTURING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 EUROPE ADDITIVE MANUFACTURING MARKET: BY MATERIAL TYPE (2023-2030)

FIGURE 25 EUROPE ADDITIVE MANUFACTURING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.