Europe Acrylic Monomers Market

Taille du marché en milliards USD

TCAC :

%

| 2023 –2030 | |

| USD 1,901,459.57 Thousand | |

| USD 2,718,142.83 Thousand | |

|

|

|

>Marché européen des monomères acryliques, par produit (acrylamide et méthacrylamide, acrylate, acides et sels acryliques, acrylonitrile, acryliques bisphénoliques, monomères glucidiques, acryliques fluorés, malémide, acryliques polyfonctionnels et autres), application (plastique, adhésifs et produits d'étanchéité, résines synthétiques, fibres acryliques, matériaux de construction, tissus, caoutchouc acrylique et autres), utilisation finale ( peintures et revêtements , bâtiment et construction, automobile, biens de consommation, emballage, traitement de l'eau, marine, aérospatiale et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des monomères acryliques en Europe

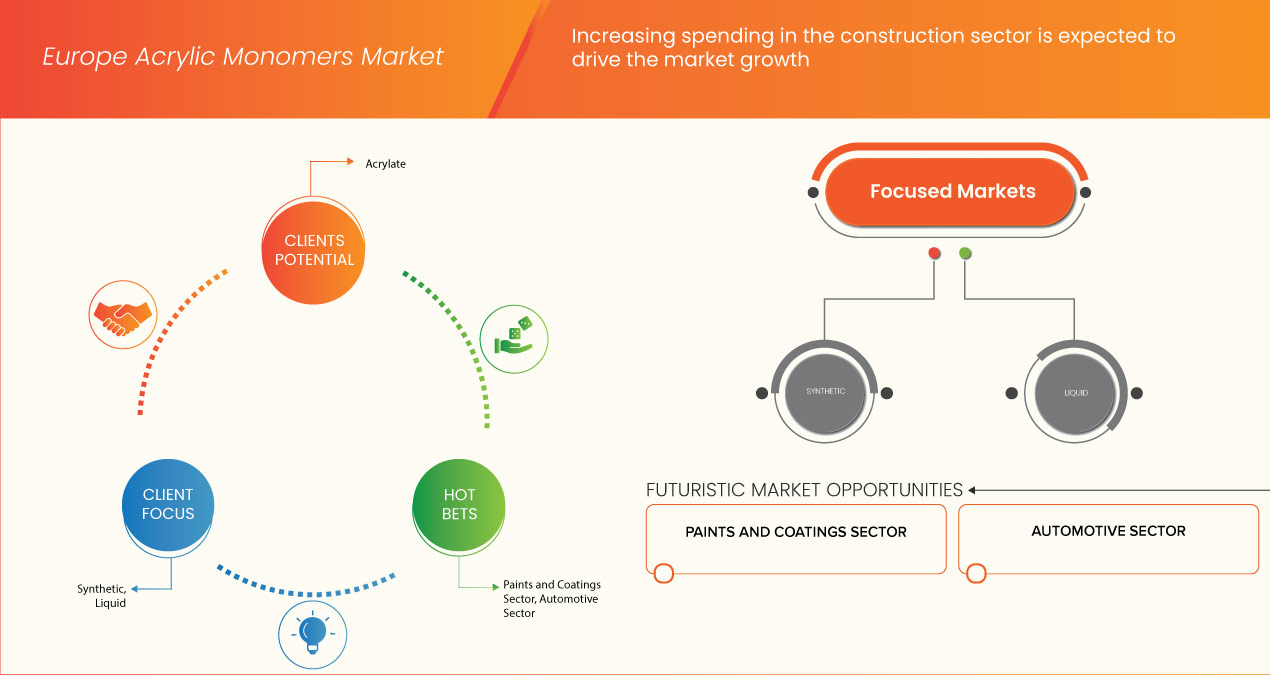

Le marché européen des monomères acryliques est stimulé par l'augmentation des dépenses dans le secteur de la construction. En outre, les perspectives positives concernant l'industrie des peintures et des revêtements constituent un moteur important pour le marché. De plus, l'orientation des fabricants vers les monomères acryliques respectueux de l'environnement devrait stimuler la croissance du marché. Cependant, le respect de normes réglementaires complexes et en constante évolution devrait freiner la croissance du marché.

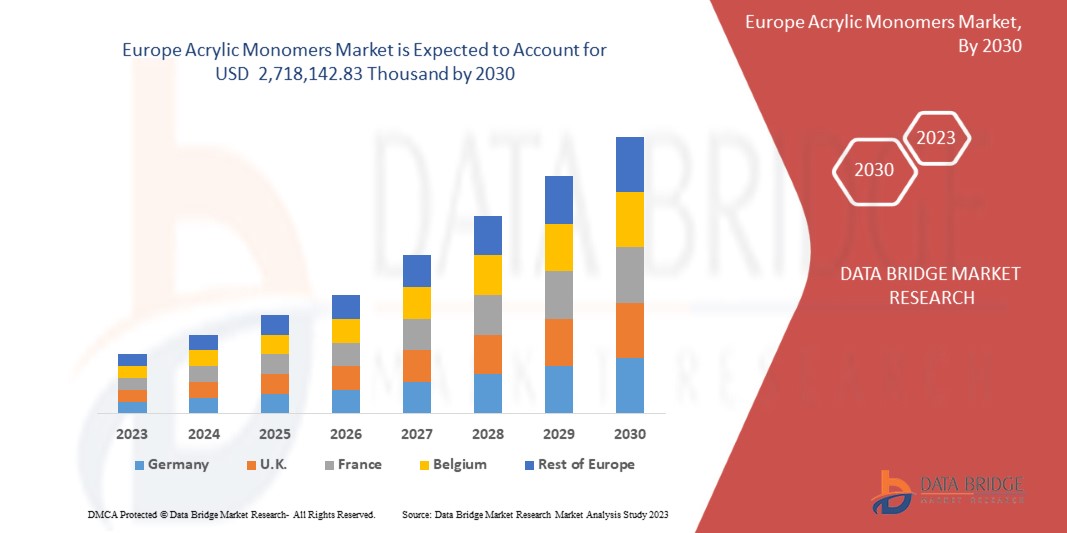

Data Bridge Market Research analyse que le marché européen des monomères acryliques devrait atteindre la valeur de 2 718 142,83 milliers USD d'ici 2030, contre 1 901 459,57 milliers USD en 2022, à un TCAC de 4,7 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (Personnalisable 2015-2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Produit (acrylamide et méthacrylamide, acrylate, acides et sels acryliques, acrylonitrile , acryliques bisphénoliques, monomères glucidiques, acryliques fluorés, malémide, acryliques polyfonctionnels et autres), application (plastique, adhésifs et produits d'étanchéité , résines synthétiques, fibres acryliques, matériaux de construction, tissus, caoutchouc acrylique et autres), utilisation finale (peintures et revêtements, bâtiment et construction, automobile, biens de consommation, emballage, traitement de l'eau, marine, aérospatiale et autres) |

|

Pays couverts |

Allemagne, Royaume-Uni, Italie, France, Espagne, Suisse, Russie, Turquie, Belgique, Pays-Bas et reste de l'Europe |

|

Acteurs du marché couverts |

BASF SE, Arkema, Mitsubishi Chemical Group Corporation, DOW, LG Chem, Evonik Industries AG, NIPPON SHOKUBAI CO., LTD, LobaChemie Pv.t Ltd., Solventis, Tokyo Chemical Industries CO., Ltd. et entre autres |

Définition du marché européen des monomères acryliques

Les monomères acryliques sont des composés qui contiennent de l'acide acrylique et des composés apparentés appelés acrylates. Le composé appelé acrylique est principalement un acrylate ou un acide acrylique ou un polymère. Les monomères acryliques sont des produits chimiques hautement réactifs. Les liquides monomères acryliques sont généralement utilisés avec de la poudre polymère pour produire des ongles en acrylique durables. Les monomères acryliques contiennent du méthacrylate d'éthyle (EMA), en raison de leur résistance maximale, de leur mise en œuvre rapide et de leurs propriétés d'adhérence supérieures.

Dynamique du marché des monomères acryliques en Europe

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of these are discussed in detail below:

Drivers

- Positive Outlook toward the Paints and Coating Industry

The paints and coatings industry holds a positive outlook concerning the market, driven by various factors and applications that contribute to its growth. One of the primary drivers behind the positive outlook for the paints and coatings industry is the extensive use of acrylic monomers, specifically N-butyl acrylate. These monomers serve as essential building blocks for copolymers used in the formulation of paints and coatings. These properties include the ability to form hydrophobic polymers, which are crucial for creating coatings that provide protection and durability. This property makes them particularly valuable in the formulation of coatings, where water resistance and durability are essential. Methacrylate, another essential acrylic monomer derived from methacrylic acid, enjoys widespread usage in diverse applications, including computer screens and paints.

The demand for high-performance coatings with exceptional durability, weather resistance, and clarity has been on the rise. Acrylic monomers, with their hydrophobic nature and ability to form tough polymers, meet these demands effectively. Manufacturers in the paints and coatings industry increasingly turn to acrylic copolymers to enhance the quality and longevity of their products. The expansion of construction and infrastructure projects worldwide has generated significant demand for paints and coatings, which is expected to drive market growth.

- Increasing Spending in the Construction Sector

The construction sector stands as a vital pillar of economic development, shaping the skylines of cities and laying the foundation for infrastructure growth. The surge in construction spending is primarily attributed to the growing urbanization and population expansion. With more people moving to cities, there is an escalating demand for residential, commercial, and infrastructure development. Governments and private investors are pouring substantial funds into construction projects to meet these demands. This surge in construction activity catalyzes the market.

Acrylic monomers, with their ability to fortify concrete, are the ideal solution. They reinforce the concrete matrix, reducing the risk of cracks and fractures. This increased durability ensures that structures can withstand the test of time, aligning perfectly with the long-term goals of construction projects. Acrylic monomers play a pivotal role in this endeavor by improving the workability and flowability of concrete. With optimized water-cement ratios and enhanced fluidity, construction teams can efficiently pour and consolidate concrete, enabling the realization of intricate and daring designs. This not only saves time but also reduces labor costs, making it an economically attractive choice for construction projects. Acrylic monomers provide the required adhesion, water resistance, and durability, making them an indispensable component in the construction of these monumental structures, which is expected to drive market growth.

Opportunities

- Shifting the Focus of Manufacturers toward Eco-friendly Acrylic Monomers

The acrylic monomer market is currently witnessing a significant shift in focus, with manufacturers increasingly turning their attention towards eco-friendly acrylic monomers. One key driver behind this shift is the increasing concern for the environment. In recent years, there has been a growing awareness of the environmental impact of traditional acrylic monomers, which are often derived from fossil fuels and can release harmful emissions during their production. This has led to a heightened demand for more environmentally friendly alternatives. Manufacturers are now investing in research and development to create acrylic monomers that are derived from renewable resources and have a reduced environmental impact.

Furthermore, stringent government regulations and policies aimed at reducing greenhouse gas emissions are pushing manufacturers to adopt more sustainable practices. This regulatory pressure is driving the development and adoption of eco-friendly acrylic monomers as a means to comply with environmental standards. As a result, manufacturers who embrace this shift in focus are likely to gain a competitive edge in the market. The shift towards eco-friendly acrylic monomers also aligns with changing consumer preferences. Today's consumers are more environmentally conscious and are increasingly seeking products that are produced using sustainable and eco-friendly processes thus providing the opportunity for the growth of the market.

- Immense Potential in the Water Treatment Industry

The water treatment industry is currently witnessing immense potential, creating a promising opportunity for the acrylic monomer market. In recent years, concerns about water pollution and scarcity have grown significantly, driving the need for effective water treatment solutions. Acrylic monomers, particularly glacial acrylic acid, play a crucial role in this industry as they are used as flocculent polymers. These polymers aid in the removal of impurities and contaminants from water, making it safer and more suitable for various applications.

One of the key applications of acrylic monomers, such as glacial acrylic acid, is their role as flocculent polymers. In water treatment processes, flocculants are substances that help in the agglomeration and precipitation of suspended particles. Glacial acrylic acid can serve as a monomer for the production of these flocculent polymers. When added to water, these polymers bind to impurities and contaminants, causing them to form agglomerated flakes. This process is critical in the removal of pollutants, including organic matter, chemicals, and heavy metals, from water sources. The agglomerated flakes formed with the help of acrylic monomers can be easily filtered out, resulting in cleaner water. This is particularly valuable in industries where the quality of water is of utmost importance, such as municipal water treatment plants, industrial processes, and even in the production of drinking water. The ability of acrylic monomers to enhance the efficiency of water treatment processes by facilitating the removal of impurities is a significant factor contributing to their relevance in the water treatment industry.

Restraints/ Challenges

- Fluctuations in the Prices of Raw Materials

Fluctuations in raw material prices can act as a restraint in the market. Similarly, acrylic monomers are made using ingredients such as propylene and isobutylene, and their prices can be like a rollercoaster. When these raw material prices suddenly rise, it can make producing acrylic monomers more expensive. Manufacturers might have to charge more for their products or see their profits shrink.

Now, think of businesses that use acrylic monomers to make paints, adhesives, or coatings. They rely on a stable supply and cost of these monomers to plan their budgets and prices. When raw material prices jump, it can disrupt these plans, causing uncertainty in the market.

In addition, these price fluctuations can affect smaller companies and start-ups more, as they might not have the resources to handle sudden cost increases. It can make it harder for them to compete in the market.

Moreover, industries that use acrylic monomers, such as construction or automotive and paint & coatings, also feel the impact. Unpredictable costs can affect their projects and budgets, potentially leading to delays or increased expenses.

- Meeting Complex and Evolving Regulatory Standards

The complex and ever-changing rules and regulations can be a major challenge in the market. In the acrylic monomers industry, there are rules set by governments and environmental agencies around the globe. These rules are there to ensure the safety of workers, consumers, and the environment. They might include limits on the use of certain chemicals or guidelines on how waste should be managed.

Complying with these regulations often requires significant investments in R&D. Companies may need to reformulate their products, change their production processes, or invest in new equipment to meet these standards. The paperwork and documentation required for compliance can also be overwhelming. This can slow down product development and increase costs.

Moreover, non-compliance can lead to fines, legal troubles, and damage to a company's reputation, which is expected to challenge market growth.

Recent Development

- In September 2023, Arkema announced it will implement a new patented purification technology by 2026 at its production site in Carling, France, to improve the site’s operational efficiency and environmental footprint toward the highest standard. This investment will enable to reduce the site’s CO2 emissions by 20 %, thus contributing to the Group’s ambitious climate plan validated by SBTi on a 1.5°C trajectory by 2030

- In January 2023, Mitsubishi Chemical Group and Mitsui Chemicals have initiated collaborative research to standardize and optimize chemical logistics, which underlie both society and industry. The corporations want to gradually roll out activities across a variety of key subjects, with those that can be immediately executed expected to begin this fiscal year. Mitsubishi Chemical Group and Mitsui Chemicals will work together to develop stronger, more sustainable chemical logistics

Europe Acrylic Monomers Market Scope

Europe acrylic monomers market is categorized into three segments based on product, application, and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Acrylamide and Methacrylamide

- Acrylate

- Acrylic Acids and Salts

- Acrylonitrile

- Bisphenol Acrylics

- Carbohydrate monomers

- Fluorinated Acrylics

- Malemide

- Polyfunctional Acrylics

- Others

On the basis of product, the market is segmented into acrylamide and methacrylamide, acrylate, acrylic acids and salts, acrylonitrile, bisphenol acrylics, carbohydrate monomers, fluorinated acrylics, malemide, polyfunctional acrylics, and others.

Application

- Plastic

- Adhesives and Sealants

- Synthetic Resins

- Acrylic Fibers

- Building materials

- Fabrics

- Acrylic Rubber

- Others

On the basis of application, the market is segmented into plastic, adhesives and sealants, synthetic resins, acrylic fibers, building materials, fabrics, acrylic rubber, and others.

End-Use

- Paints and Coatings

- Bâtiment et construction

- Automobile

- Biens de consommation

- Conditionnement

- Traitement de l'eau

- Marin

- Aérospatial

- Autres

Sur la base de l'utilisation finale, le marché est segmenté en peintures et revêtements, bâtiment et construction, automobile, biens de consommation, emballage, traitement de l'eau, marine, aérospatiale et autres.

Analyse/perspectives régionales : marché européen des monomères acryliques

Le marché européen des monomères acryliques est analysé et des informations sur la taille du marché et les tendances sont fournies par produit, application et utilisation finale, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché européen des monomères acryliques sont l’Allemagne, le Royaume-Uni, l’Italie, la France, l’Espagne, la Suisse, la Russie, la Turquie, la Belgique, les Pays-Bas et le reste de l’Europe.

L'Allemagne devrait dominer le marché en termes de parts de marché en raison de l'utilisation intensive de monomères acryliques, en particulier l'acrylate de N-butyle. Ces monomères servent de composants essentiels pour les copolymères utilisés dans la formulation de peintures et de revêtements.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Marché européen des monomères acryliques : paysage concurrentiel et analyse des parts de marché

Le paysage concurrentiel du marché européen des monomères acryliques fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché.

Certains des principaux acteurs opérant sur le marché européen des monomères acryliques sont BASF SE, Arkema, Mitsubishi Chemical Group Corporation, DOW, LG Chem, Evonik Industries AG, NIPPON SHOKUBAI CO., LTD, LobaChemie Pv.t Ltd., Solventis, Tokyo Chemical Industries CO., Ltd. et entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 MARKET APPLICATION COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR MARKET POSITION GRID

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 VENDOR SELECTION CRITERIA

4.4 RAW MATERIAL COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 POSITIVE OUTLOOK TOWARD PAINTS AND COATINGS INDUSTRY

5.1.2 INCREASING SPENDING IN THE CONSTRUCTION SECTOR

5.1.3 HIGH ADOPTION IN DEVELOPMENT OF ADHESIVES AND SEALANTS

5.2 RESTRAINTS

5.2.1 FLUCTUATIONS IN THE PRICES OF RAW MATERIALS

5.2.2 AVAILABILITY OF ALTERNATIVE MATERIALS AND TECHNOLOGIES

5.3 OPPORTUNITIES

5.3.1 SHIFTING FOCUS OF MANUFACTURERS TOWARD ECO-FRIENDLY ACRYLIC MONOMERS

5.3.2 IMMENSE POTENTIAL IN THE WATER TREATMENT INDUSTRY

5.4 CHALLENGES

5.4.1 MEETING COMPLEX AND EVOLVING REGULATORY STANDARDS

5.4.2 INTERNAL COMPETITION IN THE MARKET

6 EUROPE ACRYLIC MONOMERS MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 PLASTIC

6.3 ADHESIVES AND SEALANTS

6.4 SYNTHETIC RESINS

6.5 ACRYLIC FIBERS

6.6 BUILDING MATERIALS

6.7 FABRICS

6.8 ACRYLIC RUBBER

6.9 OTHERS

7 EUROPE ACRYLIC MONOMERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 ACRYLATE

7.3 ACRYLIC ACIDS AND SALTS

7.4 BISPHENOL ACRYLICS

7.5 POLYFUNCTIONAL ACRYLICS

7.6 FLUORINATED ACRYLICS

7.7 ACRYLONITRILE

7.8 ACRYLAMIDE AND METHACRYLAMIDE

7.9 MALEMIDE

7.1 CARBOHYDRATE MONOMERS

7.11 OTHERS

8 EUROPE ACRYLIC MONOMERS MARKET, BY END-USE

8.1 OVERVIEW

8.2 PAINTS AND COATINGS

8.3 BUILDING AND CONSTRUCTION

8.4 AUTOMOTIVE

8.5 CONSUMER GOODS

8.6 PACKAGING

8.7 AEROSPACE

8.8 MARINE

8.9 WATER TREATMENT

8.1 OTHERS

9 EUROPE ACRYLIC MONOMERS MARKET, BY COUNTRY

9.1 EUROPE

9.1.1 GERMANY

9.1.2 U.K.

9.1.3 ITALY

9.1.4 FRANCE

9.1.5 SPAIN

9.1.6 SWITZERLAND

9.1.7 RUSSIA

9.1.8 TURKEY

9.1.9 BELGIUM

9.1.10 NETHERLANDS

9.1.11 REST OF EUROPE

10 EUROPE ACRYLIC MONOMERS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 BASF SE

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 ARKEMA

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 EVONIK INDUSTRIES AG

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 NIPPON SHOKUBAI CO., LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 MITSUBISHI CHEMICAL GROUP CORPORATION

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 DOW

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 LG CHEM

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 LOBACHEMIE PVT. LTD.

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 SOLVENTIS

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 TOKYO CHEMICAL INDUSTRY CO., LTD.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 2 EUROPE PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 EUROPE FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 EUROPE ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 5 EUROPE ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 6 EUROPE ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 EUROPE ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 8 EUROPE PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 9 EUROPE BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 10 EUROPE AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 11 EUROPE CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 12 EUROPE PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 EUROPE AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 14 EUROPE MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 EUROPE WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 16 EUROPE OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 17 EUROPE ACRYLIC MONOMERS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 18 EUROPE ACRYLIC MONOMERS MARKET, BY COUNTRY, 2021-2030 (THOUSAND LITERS)

TABLE 19 GERMANY ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 20 GERMANY ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 21 GERMANY ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 GERMANY ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 23 GERMANY PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 GERMANY FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 GERMANY ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 26 GERMANY PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 GERMANY BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 28 GERMANY AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 29 GERMANY CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 30 GERMANY PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 GERMANY AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 32 GERMANY MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 33 GERMANY WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 34 GERMANY OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 35 U.K. ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 U.K. ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 37 U.K. ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 U.K. ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 39 U.K. PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 U.K. FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 U.K. ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 42 U.K. PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 43 U.K. BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 44 U.K. AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 45 U.K. CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 46 U.K. PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 47 U.K. AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 U.K. MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 U.K. WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 50 U.K. OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 ITALY ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 52 ITALY ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 53 ITALY ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 ITALY ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 55 ITALY PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 ITALY FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 ITALY ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 58 ITALY PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 ITALY BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 60 ITALY AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 61 ITALY CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 62 ITALY PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 63 ITALY AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 64 ITALY MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 65 ITALY WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 66 ITALY OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 67 FRANCE ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 68 FRANCE ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 69 FRANCE ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 FRANCE ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 71 FRANCE PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 FRANCE FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 FRANCE ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 74 FRANCE PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 75 FRANCE BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 76 FRANCE AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 77 FRANCE CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 78 FRANCE PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 79 FRANCE AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 80 FRANCE MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 81 FRANCE WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 82 FRANCE OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 83 SPAIN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 84 SPAIN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 85 SPAIN ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 SPAIN ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 87 SPAIN PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 SPAIN FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 SPAIN ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 90 SPAIN PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 91 SPAIN BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 92 SPAIN AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 93 SPAIN CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 94 SPAIN PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 95 SPAIN AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 96 SPAIN MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 97 SPAIN WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 98 SPAIN OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 99 SWITZERLAND ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 100 SWITZERLAND ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 101 SWITZERLAND ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 SWITZERLAND ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 103 SWITZERLAND PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 SWITZERLAND FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 SWITZERLAND ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 106 SWITZERLAND PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 107 SWITZERLAND BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 108 SWITZERLAND AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 109 SWITZERLAND CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 110 SWITZERLAND PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 111 SWITZERLAND AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 112 SWITZERLAND MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 113 SWITZERLAND WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 114 SWITZERLAND OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 115 RUSSIA ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 116 RUSSIA ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 117 RUSSIA ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 118 RUSSIA ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 119 RUSSIA PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 RUSSIA FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 RUSSIA ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 122 RUSSIA PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 123 RUSSIA BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 124 RUSSIA AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 125 RUSSIA CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 126 RUSSIA PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 127 RUSSIA AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 128 RUSSIA MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 129 RUSSIA WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 130 RUSSIA OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 131 TURKEY ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 132 TURKEY ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 133 TURKEY ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 TURKEY ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 135 TURKEY PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 TURKEY FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 137 TURKEY ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 138 TURKEY PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 139 TURKEY BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 140 TURKEY AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 141 TURKEY CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 142 TURKEY PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 143 TURKEY AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 144 TURKEY MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 145 TURKEY WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 146 TURKEY OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 147 BELGIUM ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 148 BELGIUM ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 149 BELGIUM ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 BELGIUM ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 151 BELGIUM PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 152 BELGIUM FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 BELGIUM ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 154 BELGIUM PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 155 BELGIUM BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 156 BELGIUM AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 157 BELGIUM CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 158 BELGIUM PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 159 BELGIUM AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 160 BELGIUM MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 161 BELGIUM WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 162 BELGIUM OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 163 NETHERLANDS ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 164 NETHERLANDS ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 165 NETHERLANDS ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 NETHERLANDS ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 167 NETHERLANDS PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 NETHERLANDS FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 NETHERLANDS ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 170 NETHERLANDS PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 171 NETHERLANDS BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 172 NETHERLANDS AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 173 NETHERLANDS CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 174 NETHERLANDS PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 175 NETHERLANDS AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 176 NETHERLANDS MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 177 NETHERLANDS WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 178 NETHERLANDS OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 179 REST OF EUROPE ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 EUROPE ACRYLIC MONOMERS MARKET: SEGMENTATION

FIGURE 2 EUROPE ACRYLIC MONOMERS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ACRYLIC MONOMERS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ACRYLIC MONOMERS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE ACRYLIC MONOMERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ACRYLIC MONOMERS MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 EUROPE ACRYLIC MONOMERS MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE ACRYLIC MONOMERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE ACRYLIC MONOMERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 EUROPE ACRYLIC MONOMERS MARKET: DBMR MARKET CHALLENGE MATRIX

FIGURE 11 EUROPE ACRYLIC MONOMERS MARKET: DBMR MARKET POSITION GRID

FIGURE 12 EUROPE ACRYLIC MONOMERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE ACRYLIC MONOMERS MARKET: SEGMENTATION

FIGURE 14 INCREASING SPENDING IN THE CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE GROWTH OF THE EUROPE ACRYLIC MONOMERS MARKET IN THE FORECAST PERIOD

FIGURE 15 THE ACRYLATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE EUROPE ACRYLIC MONOMERS MARKET IN 2023 AND 2030

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE ACRYLIC MONOMERS MARKET

FIGURE 18 EUROPE ACRYLIC MONOMERS MARKET: BY APPLICATION, 2022

FIGURE 19 EUROPE ACRYLIC MONOMERS MARKET: BY PRODUCT, 2022

FIGURE 20 EUROPE ACRYLIC MONOMERS MARKET: BY END-USE, 2022

FIGURE 21 EUROPE ACRYLIC MONOMERS MARKET: SNAPSHOT (2022)

FIGURE 22 EUROPE ACRYLIC MONOMERS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.